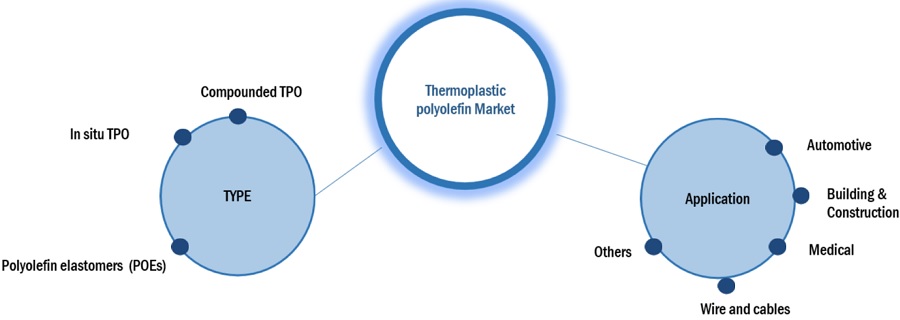

Thermoplastic Polyolefin Market by Type (In Situ TPO, Compounded TPO, POEs), Application (Automotive, Building & Construction, Medical, Wire and Cables), Region (North America, Europe, APAC, MEA, South America) - Global forecast to 2028

Updated on : July 17, 2025

Thermoplastic Polyolefin Market

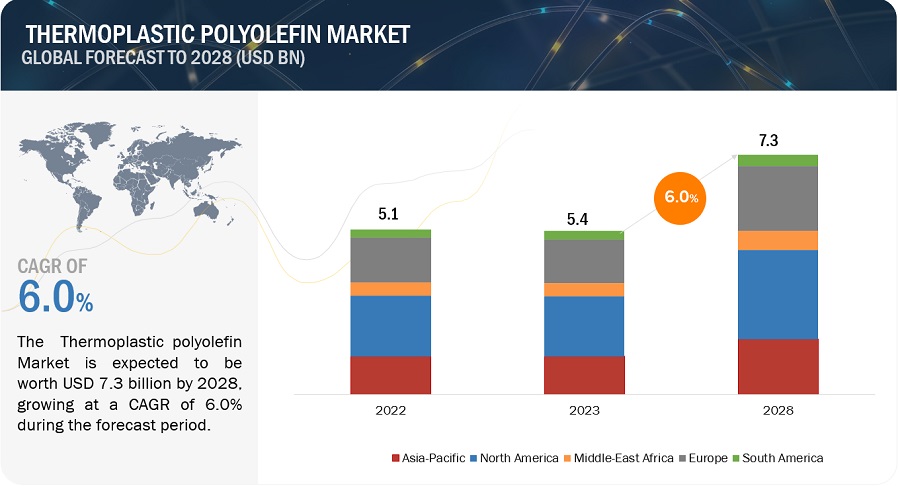

The global thermoplastic polyolefin market was valued at USD 5.4 billion in 2023 and is projected to reach USD 7.3 billion by 2028, growing at 6.0% cagr from 2023 to 2028. The market is mainly led by the significant usage of Thermoplastic polyolefin in various end-use industries. The growing demand from the automotive, construction, rising demand for industrial sector, is driving the market for thermoplastic polyolefin market.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Thermoplastic Polyolefin Market

Market Dynamics

Driver: Increasing demand for lightweight and durable materials in the automotive and construction industry.

The use of thermoplastic polyolefin (TPO) in various industries such as automotive, aerospace, and transportation is driven by its exceptional lightweight characteristics, which bring about several advantages. In the automotive sector, for instance, reducing the weight of vehicles is of paramount importance to meet stringent fuel efficiency standards and reduce carbon emissions. TPO's lightweight nature allows automakers to replace heavier materials like metal in various automotive components, including bumpers, interior trim, and exterior body panels, without compromising safety or performance. As a result, vehicles become lighter and more aerodynamic, which translates to improved fuel economy. Lighter vehicles require less energy to operate, leading to reduced fuel consumption and lower greenhouse gas emissions, aligning with the global push for more environmentally friendly transportation solutions.

Restraint: Limited high temperature resistance

Thermoplastic polyolefin (TPO) materials exhibit certain limitations when it comes to high-temperature applications. This is primarily due to the inherent nature of TPO as a thermoplastic, which means that it softens and becomes pliable when exposed to elevated temperatures. Typically softening in the range of 160°C to 180°C (320°F to 356°F), TPO materials can lose their structural integrity and mechanical properties beyond this threshold. Consequently, TPO is not suitable for environments requiring resistance to extreme heat, such as engine components in the automotive industry or industrial processes with high-temperature conditions. In these cases, alternative materials with higher heat resistance, like polyamide (nylon) or polyphenylene sulfide (PPS), are preferred choices. While TPO offers numerous advantages, including cost-effectiveness and durability, careful consideration of its thermal limitations is essential for selecting the appropriate material for applications subject to high temperatures.

Opportunity: Utilization of automotive lightweight materials

As automotive manufacturers intensify their efforts to enhance fuel efficiency and decrease carbon emissions, the adoption of thermoplastic polyolefin (TPO) becomes increasingly attractive for lightweighting initiatives. TPO's lightweight characteristics offer several advantages in this context. First, by replacing heavier materials like metal in automotive components such as bumpers, interior trim, and exterior body panels, TPO helps reduce the overall weight of vehicles. This weight reduction translates into improved fuel economy, as vehicles require less energy to operate, thereby consuming less fuel and emitting fewer greenhouse gases. Additionally, lighter vehicles often exhibit better handling and agility, enhancing the overall driving experience. The pursuit of sustainability and regulatory compliance with stringent emission standards further reinforces the demand for TPO in the automotive industry, positioning it as a crucial solution in the drive towards more fuel-efficient and eco-friendly vehicles.

Challenge: UV stability factor.

While thermoplastic polyolefin (TPO) materials offer commendable weather resistance, their vulnerability to long-term exposure to ultraviolet (UV) radiation is a notable challenge. UV radiation from sunlight can lead to the degradation of TPOs over time, causing them to become more brittle and less durable. This degradation process may manifest as cracking, chalking, or surface roughness, ultimately compromising the material's structural integrity and long-term performance. Additionally, UV exposure can result in discoloration of TPOs, altering their appearance. To address this limitation, UV stabilizers or coatings are often incorporated into TPO formulations in applications where prolonged exposure to sunlight is expected. These additives help mitigate the effects of UV radiation, prolonging the life and appearance of TPO-based products and ensuring they maintain their structural and aesthetic integrity in outdoor environments.

Market Ecosystem

The market ecosystem for thermoplastic polyolefin is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of thermoplastic polyolefin materials. At the core of this ecosystem are material providers who focus on research, development, and manufacturing of polyurethane catalysts and systems. They continuously innovate and produce novel materials and their applications to meet the evolving demands of the market.

DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US).

Thermoplastic Polyolefin: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Polyolefin elastomers (POEs) is the largest type thermoplastic polyolefin market in 2023, in terms of value."

Polyolefin elastomers (POEs) stand as the largest segment within the thermoplastic polyolefin (TPO) market, primarily due to their remarkable versatility and unique properties. POEs are prized for their exceptional elasticity and flexibility, which closely resemble rubber-like characteristics. This intrinsic elasticity makes POEs highly desirable in applications that necessitate materials capable of stretching and recovering their original shape, enduring repetitive stress, or accommodating dynamic movements. Furthermore, POEs offer outstanding impact resistance, a pivotal attribute for a wide array of applications, especially in the automotive industry where they are extensively employed in bumper fascia and various interior components. Their ability to absorb and dissipate energy upon impact not only enhances safety but also contributes to the overall durability and longevity of the end products. This combination of elasticity and impact resistance positions POEs as a leading choice in the TPO market, facilitating their extensive use across industries that require resilient and dependable materials.

“Automotive accounted for the largest material share of the thermoplastic polyolefin market in 2023” in terms of value.

Automotive manufacturers widely use thermoplastic polyolefin (TPO) for a multitude of reasons, making it a preferred material for various applications within vehicles. One of its primary advantages lies in its exceptional lightweight properties, significantly lighter than traditional materials like metal. This attribute is pivotal in the automotive industry's ongoing pursuit of improved fuel efficiency and reduced carbon emissions, as lighter vehicles consume less fuel and emit fewer greenhouse gases. Moreover, TPO's cost-effectiveness makes it an attractive choice for automakers, contributing to overall cost savings in vehicle production. Its durability, with resistance to UV radiation, moisture, and chemicals, makes TPO suitable for exterior components that must endure harsh environmental conditions. Additionally, TPO's design flexibility allows for the creation of intricate and aerodynamic automotive designs, promoting both aesthetics and performance. Furthermore, its impact resistance is crucial for components like bumpers, enhancing vehicle safety by absorbing and dissipating energy during collisions. In interior applications, TPO aids in noise reduction, contributing to a quieter and more comfortable driving experience. All these attributes collectively position TPO as a versatile and indispensable material in the automotive sector, playing a pivotal role in shaping the vehicles of today and tomorrow.

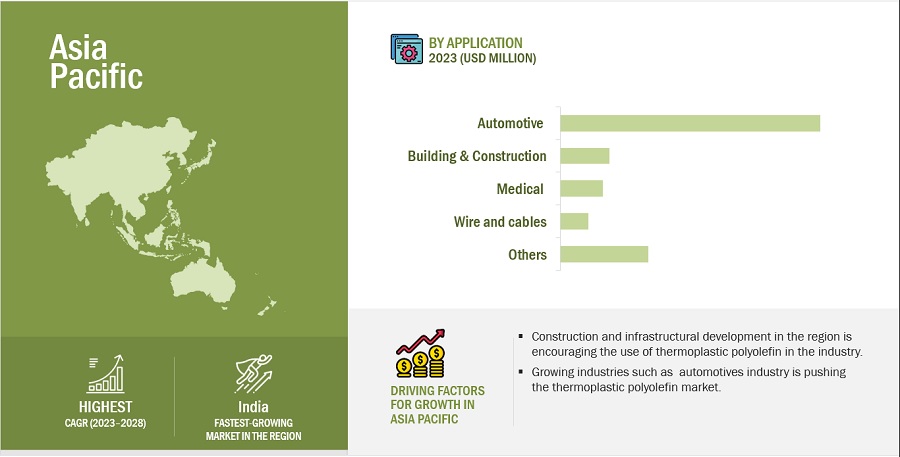

" Asia pacific is the largest market for thermoplastic polyolefin Market in 2023, in terms of value."

The Asia-Pacific region has emerged as the largest market for thermoplastic polyolefin (TPO) primarily due to a convergence of significant factors. Rapid expansion in the automotive sector, particularly in countries like China and India, has led to a substantial demand for TPO, which is extensively utilized in manufacturing automotive components for lightweight and improved fuel efficiency. Simultaneously, the region is experiencing a construction boom driven by urbanization, population growth, and economic development, making TPO a preferred choice for roofing membranes and waterproofing materials. Additionally, the Asia-Pacific region serves as a major manufacturing center for consumer goods like luggage, toys, and sports equipment, all of which benefit from TPO's cost-effectiveness and impact resistance. TPO's versatile properties, coupled with its cost competitiveness, have fueled its widespread adoption across industries, establishing Asia-Pacific as the leading market for TPO materials.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of thermoplastic polyolefin have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2023-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

type, application and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US). |

Segmentation

This report categorizes the global Thermoplastic polyolefin market based on IR Range, Material type, functions, end use industry and region.

On the basis of type the market has been segmented as follows:

- In situ TPO

- Compounded TPO

- Polyolefin elastomers (POEs)

On the basis of application, the market has been segmented as follows:

- Automotive

- Building & Construction

- Medical

- Wire and cables

- Others

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In 2023, Dow and Avery Dennison co-developed an innovative and sustainable new hotmelt label adhesive solution.

- ExxonMobil, a leading petrochemical company, acquired the global Vistalon EPDM (ethylene propylene diene monomer) rubber business from ExxonMobil Chemical Company. While not exclusively focused on TPO, this acquisition was part of ExxonMobil's broader strategy in the polymer industry.

- DOW announced on December 2021 the launch of LUXSENSE a silicone synthetic leather, the worlds first high end silicone based synthetic leather material.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the thermoplastic polyolefin market?

This study's forecast period for the thermoplastic polyolefin market is 2023-2028. The market is expected to grow at a CAGR of 6.0% in terms of value, during the forecast period.

Who are the major key players in the thermoplastic polyolefin market?

DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US). are the leading manufacturers and service provider of thermoplastic polyolefin market.

What are the emerging trends in the Thermoplastic polyolefin market?

Increasing environmental concerns have driven the demand for greener and more sustainable solutions across industries. In the thermoplastic polyolefin market, there has been a growing interest in eco-friendly materials that minimize the environmental impact of thermoplastics.

What are the drivers and opportunities for the thermoplastic polyolefin market?

The Increasing demand for advanced technologies in the thermoplastic polyolefin drives the thermoplastic polyolefin market. The growing energy efficiency sector presents significant opportunities for the utilization and advancement of polyurethane catalysts.

What are the restraining factors in the thermoplastic polyolefin market?

Strict regulatory frameworks serve as restraints to the widespread adoption and implementation of polyurethane catalysts. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing usage of thermoplastic polyolefins in exterior and interior parts of automobiles- Steady growth in building & construction industry- Increasing usage of thermoplastic polyolefin waterproofing membrane in repair and maintenance activitiesRESTRAINTS- Raw material price volatility- Limited temperature applications of thermoplastic polyolefinOPPORTUNITIES- Intra replacement of other thermoplastic polymers with thermoplastic polyolefins- Growing penetration of EVs worldwide- Rising demand from emerging applications- Increasing demand from the packaging industryCHALLENGES- Growing trend of plastic recycling

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 RECESSION IMPACT

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSTHERMOPLASTIC POLYOLEFIN MANUFACTURERSDISTRIBUTORSEND USER

-

6.3 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.4 THERMOPLASTIC POLYOLEFIN MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document type- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

6.7 TRENDS/DISRUPTIONS IMPACTING BUSINESSESREVENUE SHIFTS & NEW REVENUE POCKETS FOR THERMOPLASTIC POLYOLEFIN MARKET

-

6.8 ECOSYSTEM

-

6.9 TECHNOLOGY ANALYSISEXTRUSIONINJECTION MOLDING

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.11 AVERAGE PRICE ANALYSIS

- 6.12 CASE STUDY

- 7.1 INTRODUCTION

-

7.2 IN-SITU THERMOPLASTIC POLYOLEFININCREASING APPLICATION IN AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE DEMAND

-

7.3 COMPOUNDED THERMOPLASTIC POLYOLEFINPHYSICOCHEMICAL CHARACTERISTICS TO DRIVE DEMAND IN AUTOMOTIVE INDUSTRY

-

7.4 POLYOLEFIN ELASTOMERS (POES)INCREASING USAGE AS ALTERNATIVE TO RUBBER TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVEINCREASING PENETRATION OF EVS TO DRIVE MARKET

-

8.3 BUILDING & CONSTRUCTIONWATERPROOFING THERMOPLASTIC POLYOLEFIN MEMBRANES TO SUPPORT MARKET GROWTH

-

8.4 WIRE & CABLEGROWING DEMAND FOR WIRES & CABLES THERMOPLASTIC POLYOLEFIN TO DRIVE MARKET

-

8.5 MEDICALCOMPLIANCE WITH MEDICAL & HEALTHCARE STANDARDS TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

-

9.3 RECESSION IMPACTCHINA- Growing automotive and building & construction sectors and upcoming government policies to drive growthINDIA- Increasing FDI investment in industrial sector to drive marketJAPAN- High usage rate of thermoplastic polyolefin in automotive industry to drive growthSOUTH KOREA- Building & construction sector to drive marketREST OF ASIA PACIFIC

- 9.4 NORTH AMERICA

-

9.5 RECESSION IMPACTUS- Increasing usage thermoplastic polyolefin in vehicles due to low weight to drive marketCANADA- Increasing vehicle production to drive demandMEXICO- Rise in automobile production to surge demand

- 9.6 EUROPE

-

9.7 RECESSION IMPACTGERMANY- Government support for boosting automotive industry to drive marketUK- Increase in automobile registrations and construction industry output to drive marketFRANCE- Rising automobile production and output from construction industry to drive marketSPAIN- Rise in automobile production to drive demandITALY- Growth of automotive sector to drive marketREST OF EUROPE

- 9.8 MIDDLE EAST & AFRICA

-

9.9 RECESSION IMPACTSOUTH AFRICA- Steady recovery of several end-use industries from COVID-19 impact to drive marketGCC COUNTRIES- Investment in automotive and construction industries to drive marketREST OF MIDDLE EAST & AFRICA

- 9.10 SOUTH AMERICA

-

9.11 RECESSION IMPACTBRAZIL- Rising demand from automotive sector to drive marketARGENTINA- Sluggish growth of manufacturing sector to drive marketREST OF SOUTH AMERICA

- 10.1 INTRODUCTION

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY THERMOPLASTIC POLYOLEFIN MANUFACTURERS

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- SABIC- Sumitomo Chemical CO., LTD.- ExxonMobil Corporation- DOW- Mitsui Chemicals, Inc

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKINGTHERMOPLASTIC POLYOLEFIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.7 STARTUP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

10.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSDOW- Business overview- Products/Services/Solutions offered- Recent development- MnM view Key strategiesMITSUI CHEMICALS, INC.- Business overview- Products/Services/Solutions offered- MnM view- Strategic choices- Weaknesses and competitive threatsEXXONMOBIL CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- Exxonmobil corporation: Product launches- MnM viewSABIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSUMITOMO CHEMICAL CO., LTD.- Business overview- Products/Services/Solutions offered- MnM view- Strategic choices- Weaknesses and competitive threatsLYONDELLBASELL INDUSTRIES N.V.- Business overview- Products/Services/Solutions offered- MnM view- Strategic choices- Weaknesses and competitive threatsINEOS GROUP HOLDING SA- Products/Services/Solutions offeredRECENT DEVELOPMENTS- MnM view- Strategic choices- Weaknesses and competitive threatsBOREALIS AG- Business overview- Products/Services/Solutions offered- MnM view- Strategic overview- Weaknesses and competitive threatsFORMOSA PLASTIC CORPORATION- Business overviewPRODUCTS/SERVICES/SOLUTIONS OFFEREDRECENT DEVELOPMENTS- MnM viewRTP COMPANY- Business overview- Products/Services/Solutions offered- MnM view

-

11.2 OTHER PLAYERSPOLYONE CORPORATIONMITSUBISHI CHEMICAL HOLDING CORPORATIONELASTRONGAFTEKNOR APEX COMPANYRAIGH REFINING AND PETROCHEMICAL COMPANYNOBLE POLYMERSHEXPOL ABWASHINGTON PENNALPHAGARY LIMITEDSAUDI ARAMCOKRATON CORPORATIONADELL PLASTICS, INC. INCORPORATIONASAHI KASEIZEON CORPORATION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2027 (USD MILLION)

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 GRANTED PATENTS ACCOUNTED FOR 37% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 6 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2027

- TABLE 7 ADVANTAGES OF CATALYST DEVELOPMENT FOR THERMOPLASTIC POLYOLEFINS

- TABLE 8 INFLUENCE OF INSTITUTIONAL BUYERS IN BUYING PROCESS FOR TOP 5 APPLICATIONS

- TABLE 9 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- TABLE 10 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 11 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 12 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2026 (USD MILLION)

- TABLE 13 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 14 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 15 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 16 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 17 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 18 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2019-2022 (TON)

- TABLE 19 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2023–2028 (TON)

- TABLE 20 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 23 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 24 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 29 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 30 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 31 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 32 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

- TABLE 33 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 35 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 36 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 39 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 40 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 43 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 44 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019–2022 (TON)

- TABLE 47 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023–2028 (TON)

- TABLE 48 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

- TABLE 49 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 51 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 52 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 55 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 56 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

- TABLE 57 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 59 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 60 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 63 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 64 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

- TABLE 65 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 67 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 68 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 71 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 72 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 75 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 77 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 78 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 79 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 81 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 82 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 83 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 85 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 86 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2019–2026 (TON)

- TABLE 89 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2023–2028 (TON)

- TABLE 90 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 91 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 92 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 95 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 96 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 99 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 101 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 102 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 105 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 106 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 109 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 110 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 111 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 113 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 114 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 115 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 117 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 118 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 121 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 122 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 123 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 124 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2019–2026 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019–2022 (TON)

- TABLE 127 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023–2028 (TON)

- TABLE 128 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 131 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 132 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 135 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 136 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 139 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 140 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019–2022 (TON)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023–2028 (TON)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 147 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 148 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

- TABLE 149 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 151 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 152 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 155 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 156 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 159 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 160 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 163 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 164 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 165 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019–2022 (TON)

- TABLE 167 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023–2028 (TON)

- TABLE 168 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 THERMOPLASTIC POLYOLEFIN: DEGREE OF COMPETITION

- TABLE 171 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 172 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 173 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 174 THERMOPLASTIC POLYOLEFIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 175 SME PLAYERS APPLICATION FOOTPRINT

- TABLE 176 SME PLAYERS TYPE FOOTPRINT

- TABLE 177 THERMOPLASTIC POLYOLEFIN MARKET: SME PLAYERS REGION FOOTPRINT

- TABLE 178 THERMOPLASTIC POLYOLEFIN MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 179 THERMOPLASTIC POLYOLEFIN MARKET: DEALS (2020–2023)

- TABLE 180 THERMOPLASTIC POLYOLEFIN OTHER DEVELOPMENTS (2021–2023)

- TABLE 181 DOW: COMPANY OVERVIEW

- TABLE 182 DOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 DOW : OTHER DEVELOPMENTS

- TABLE 184 DOW: PRODUCT LAUNCHES

- TABLE 185 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 186 MITSUI CHEMICALS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 EXXONMOBIL CORPORATION: BUSINESS OVERVIEW

- TABLE 188 EXXONMOBIL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 189 SABIC: COMPANY OVERVIEW

- TABLE 190 SABIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 SABIC: DEAL

- TABLE 192 SABIC: DEALS

- TABLE 193 SABIC: PRODUCT LAUNCHES

- TABLE 194 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 195 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 LYONDELLBASELL INDUSTRIES N.V.: COMPANY OVERVIEW

- TABLE 197 LYONDELLBASELL INDUSTRIES N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 INEOS GROUP HOLDINGS S.A.: COMPANY OVERVIEW

- TABLE 199 INEOS GROUP HOLDING SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 200 INEOS GROUP HOLDINGS S.A.: DEALS

- TABLE 201 INEOS GROUP HOLDINGS S.A.: PRODUCT LAUNCH

- TABLE 202 BOREALIS AG: BUSINESS OVERVIEW

- TABLE 203 BOREALIS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 BOREALIS AG: DEALS

- TABLE 205 FORMOSA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 206 FORMOSA PLASTICS CORPORATION: PRODUCT OFFERINGS

- TABLE 207 FORMOSA PLASTICS CORPORATION: PRODUCT LAUNCH

- TABLE 208 RTP COMPANY: COMPANY OVERVIEW

- TABLE 209 RTP COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 RTP COMPANY: DEALS

- TABLE 211 POLYONE CORPORATION: COMPANY OVERVIEW

- TABLE 212 • MITSUBISHI CHEMICAL HOLDING CORPORATION: COMPANY OVERVIEW

- TABLE 213 ELASTRON: COMPANY OVERVIEW

- TABLE 214 GAF: COMPANY OVERVIEW

- TABLE 215 TEKNOR APEX COMPANY : COMPANY OVERVIEW

- TABLE 216 RAIGH REFINING AND PETROCHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 217 NOBLE POLYMERS: COMPANY OVERVIEW

- TABLE 218 HEXPOL AB: COMPANY OVERVIEW

- TABLE 219 WASHINGTON PENN: COMPANY OVERVIEW

- TABLE 220 ALPHAGARY LIMITED: COMPANY OVERVIEW

- TABLE 221 SAUDI ARAMCO: COMPANY OVERVIEW

- TABLE 222 KRATON CORPORATION: COMPANY OVERVIEW

- TABLE 223 ADELL PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 224 ASAHI KASEI: COMPANY OVERVIEW

- TABLE 225 ZEON CORPORATION: COMPANY OVERVIEW

- FIGURE 1 THERMOPLASTIC POLYOLEFIN MARKET SEGMENTATION

- FIGURE 2 THERMOPLASTIC POLYOLEFIN MARKET: RESEARCH DESIGN

- FIGURE 3 THERMOPLASTIC POLYOLEFIN MARKET: DATA TRIANGULATION

- FIGURE 4 IN-SITU THERMOPLASTIC POLYOLEFIN TO DOMINATE THERMOPLASTIC POLYOLEFIN MARKET BETWEEN 2023 AND 2028 (USD MILLION)

- FIGURE 5 AUTOMOTIVE APPLICATION TO HOLD MAJOR SHARE IN THERMOPLASTIC POLYOLEFIN MARKET BETWEEN 2023 AND 2028 (USD MILLION)

- FIGURE 6 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF THERMOPLASTIC POLYOLEFIN MARKET IN 2023

- FIGURE 7 INCREASING AWARENESS REGARDING SUSTAINABLE DEVELOPMENT TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 POES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 10 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2028

- FIGURE 11 CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMOPLASTIC POLYOLEFIN MARKET

- FIGURE 13 THERMOPLASTIC POLYOLEFIN: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 14 VALUE CHAIN FOR THERMOPLASTIC POLYOLEFIN MARKET

- FIGURE 15 EXPORT SCENARIO FOR HS CODE 3902300 BY KEY COUNTRIES, (2019 - 2022)

- FIGURE 16 EXPORT SCENARIO FOR HS CODE 3902300 BY KEY COUNTRIES, (2019 - 2022)

- FIGURE 17 IMPORT SCENARIO FOR HS CODE 3902300, BY KEY COUNTRIES, (2019 - 2022)

- FIGURE 18 IMPORT SCENARIO FOR HS CODE 390190, BY KEY COUNTRIES, (2019–2022)

- FIGURE 19 TOP JURISDICTION-BY DOCUMENT

- FIGURE 20 REVENUE SHIFT OF THERMOPLASTIC POLYOLEFIN PROVIDERS

- FIGURE 21 THERMOPLASTIC POLYOLEFIN MARKET: ECOSYSTEM

- FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 5 APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- FIGURE 24 WEIGHTED AVERAGE PRICING ANALYSIS (USD/TON) OF THERMOPLASTIC POLYOLEFIN, BY REGION, 2020

- FIGURE 25 POES WAS LARGEST SEGMENT OF THERMOPLASTIC POLYOLEFINS MARKET IN 2022

- FIGURE 26 AUTOMOTIVE APPLICATION WAS LARGEST SEGMENT OF THERMOPLASTIC POLYOLEFIN MARKET IN 2022

- FIGURE 27 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

- FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- FIGURE 31 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- FIGURE 32 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- FIGURE 33 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN THERMOPLASTIC POLYOLEFIN MARKET, 2022

- FIGURE 35 THERMOPLASTIC POLYOLEFIN MARKET IN 2022

- FIGURE 36 THERMOPLASTIC POLYOLEFIN MARKET COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- FIGURE 37 THERMOPLASTIC POLYOLEFIN MARKET START-UPS/SMES COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 DOW: COMPANY SNAPSHOT

- FIGURE 39 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 SABIC: COMPANY SNAPSHOT

- FIGURE 41 SUMITOMO CHEMICAL CO., LTD: COMPANY SNAPSHOT

- FIGURE 42 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

- FIGURE 43 INEOS GROUP LTD: COMPANY SNAPSHOT

- FIGURE 44 BOREALIS AG: COMPANY SNAPSHOT

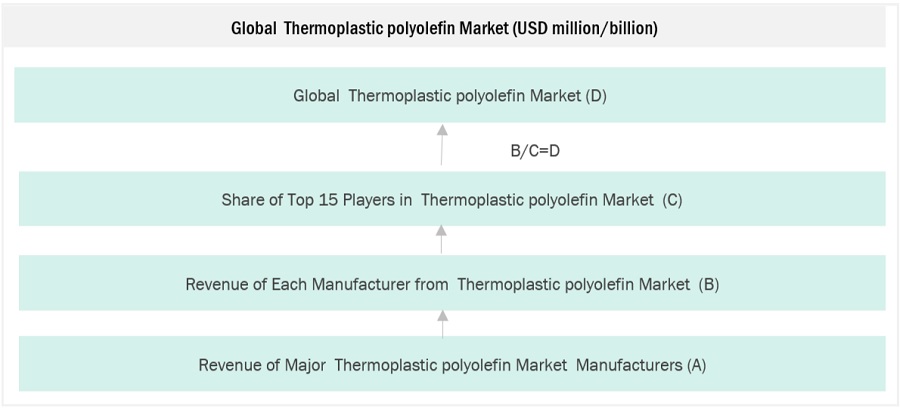

The study involved four major activities in estimating the market size of the Thermoplastic polyolefin market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

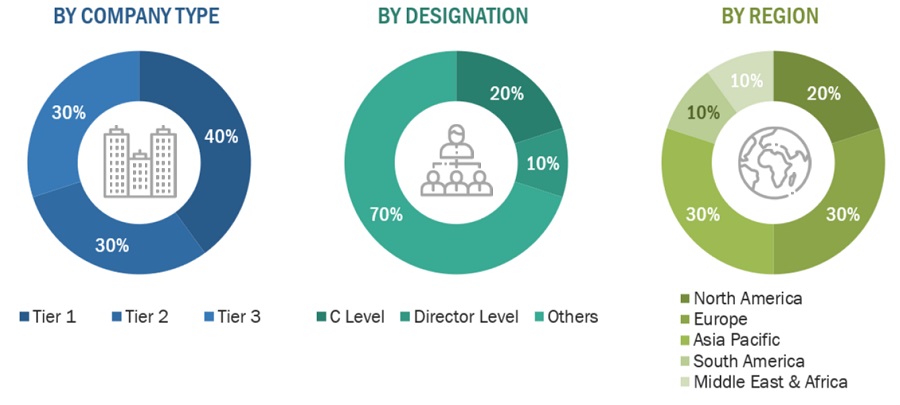

The Thermoplastic polyolefin market comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the Thermoplastic polyolefin market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Polyurethane catalyst industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Polyurethane Catalystand the outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

DOW |

Individual Industry Expert |

|

SABIC |

Sales Manager |

|

Exxon Mobil Corporation |

Manager |

|

Mitsui Chemicals, Inc. |

Marketing Manager |

|

Huntsman International LLC |

Senior Scientist |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the Thermoplastic polyolefin market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Thermoplastic Polyolefin Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Thermoplastic Polyolefin Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Thermoplastic Polyolefin (TPO) is a type of thermoplastic elastomer made from a blend of polypropylene (PP) and ethylene-propylene rubber (EPR/EPDM). It is known for its versatile properties, such as flexibility, durability, and resistance to heat, UV radiation, chemicals, and weathering. In the context of the market, "TPO market" refers to the industry involved in the production, distribution, and utilization of TPO materials and products. This market serves a wide range of applications, including automotive parts (e.g., bumpers, interior trim), construction materials (e.g., roofing membranes, waterproofing), consumer goods, industrial components, and more. The TPO market is driven by factors such as the need for lightweight and durable materials, environmental considerations, and the expansion of industries that benefit from TPO's advantageous properties.

Key Stakeholders

- Raw material suppliers.

- Thermoplastic polyolefin manufacturers.

- Thermoplastic polyolefin traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the Thermoplastic polyolefin market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Polyolefin Market