Traffic Camera Market by Component (Hardware, Software, Services), Type (Fixed Camera, Mobile Speed Camera, Red Light Camera, Surveillance Camera), Product (Analog, IP Camera), Application, Resolution and Region – Global Forecast to 2030

Traffic camera is a device which is equipped with sophisticated smart electronic hardware component capable of delivering high quality image and videos in challenging condition and short exposure time. Traffic cameras are installed on expressways, highways, freeways, tunnels, and arterial roads for surveillance and are interlinked with optical fibers. These traffic cameras contain a sensing device that collects real-time information by recording a video and transmitting it to a network node that is then passed to a monitoring center in a compressed format. Different types of traffic cameras are available in the market which includes traffic violation cameras, surveillance camera, average speed cameras, speed detection cameras, and red-light cameras.

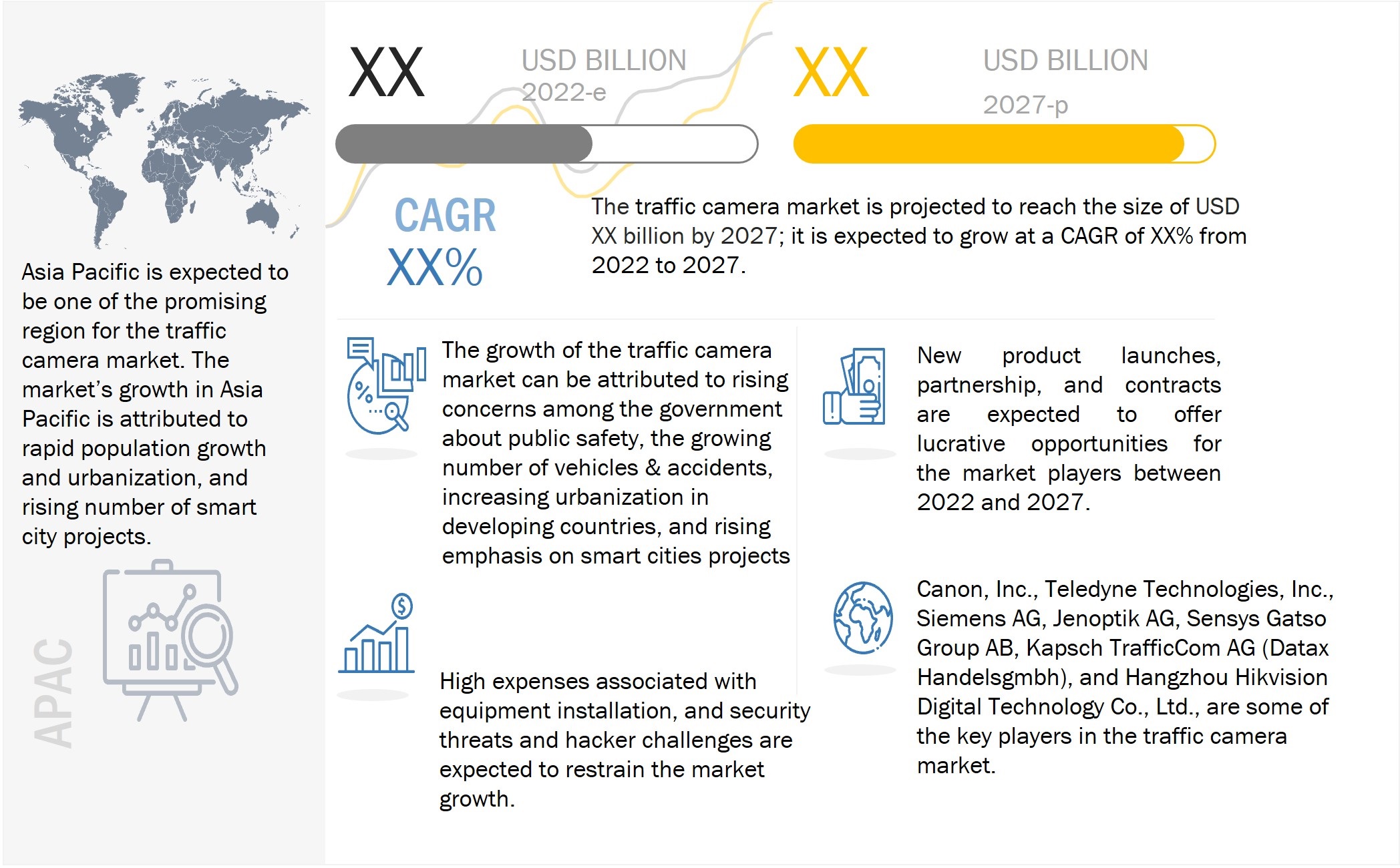

The global traffic camera market size is expected to grow from USD XX billion in 2024 to USD XX billion by 2030, at a CAGR of XX%. are the key factors boosting the growth of the market. Some of the key factors propelling the market growth includes increasing number of smart city project in developing economies, concerns among the government related to public safety and rise in number of vehicles coupled with insufficient infrastructure. Moreover, an increase in the penetration of analytics software is expected to offer remunerative opportunities for the expansion of the market during the forecast period. High expenses associated with equipment installation, and security threats and hacker challenges are expected to restrain the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Several benefits and advantages associated with deploying traffic camera

Traffic cameras provides highly accurate automated reading of vehicles’ plates, limit human manual review, and automate the processing of traffic monitoring tasks. Traffic monitoring cameras can be used for many purposes such as tracking the movement of criminals (as a crime deterrent), preventing dangerous situations, collecting data for activities like vehicle insurance control, vehicle tracking, and traffic analysis among others. Traffic monitoring cameras are equipped with Automatic Number Plate Recognition (ANPR) which is an AI-based technology capable of reading and recording vehicle license plates without the need for human assistance. ANPR solutions are used for traffic big data collection, tolling management, enforcement, access control, security, and traffic management including plate reading, vehicle identification & classification.

Opportunities: Innovative red light camera systems for combined speed and red-light enforcement

The red-light camera systems are based on state-of-the-art radar technology and induction loops combined with high-resolution cameras. The systems enable multiple lanes to be monitored simultaneously. Different speed limits can also be set for different vehicle types, e.g., cars and trucks. Manufacturers are offering devices that can be used flexibly for various purposes and at different types of location.

Red light violations, illegal turning, driving in the wrong lanes and speeding are the main causes of fatal road traffic accidents, especially at junctions. By deploying innovative and individually adapted red light camera systems, traffic can be monitored efficiently, and infringements can be prosecuted while saving on resources. Intelligent red light camera systems are being increasingly deployed for speed enforcement and increasing traffic safety.

Challenges: High upfront cost of advanced traffic camera systems

Modern traffic cameras are integrated with artificial intelligence technology, various sensors, and various other advanced technologies. These sensors and technologies allow the camera to capture and record images and videos with more clarity. The sensors integrated into these cameras can even detect motion and automatically turn towards the source of the movement. Due to integration of number of smart devices in traffic camera for real time monitoring and analysis the upfront cost of installation is on higher side. This in turn is expected to act as a restraining factor for the growth of traffic camera market in short to medium term.

Key Market Players

The traffic camera market is highly competitive, with the presence of several giant companies, and small and startup companies. Major players operating in the traffic camera market have witnessed consistent revenue growth from 2016 to 2021. Various companies are deploying different strategies to excel in the traffic camera market. They are trying to broaden their revenue stream by adopting organic and inorganic business strategies such as product launches, acquisitions, collaborations, contracts, and agreements, which have helped companies enhance their products and expand their geographic reach.

Canon, Inc., Teledyne Technologies, Inc., Siemens AG, Jenoptik AG, Sensys Gatso Group AB, Kapsch TrafficCom AG (Datax Handelsgmbh), Hangzhou Hikvision Digital Technology Co., Ltd., IDEMIA SAS (Advent International, Inc.), Tattile, E Com Systems, and Allied Vision Technologies GmbH. are some of the key players in the traffic camera market globally.

Recent Developments

- In August 2022, IDIS has enhanced its line-up of video security solutions with the launch of a new, NDAA-compliant license plate capture camera. The newest addition to the IDIS suite enables users to accurately capture the license plates of vehicles worldwide traveling up to 50mph (80 km/h). The 2MP DC-T6224HRXL has a detection range of over 325 yards (100m) in full light and advanced IR to capture flawless images at up to 66 feet (20m).

- In February 2021, Hikvision Launches new ITS camera for improvement of road safety and traffic flow. The camera encompasses different skills and abilities, boasting speed detection, traffic violation detection, automated plate recognition, and vehicle attribute analysis in one housing.

- In October 2020, Axis Communications has launched the new AXIS Q1615 Mk III Network Camera to further strengthen its broad portfolio of traffic products. With the proprietary Axis ARTPEC chip, this top-of-the-line camera combines exceptional image quality with powerful AI-accelerator processing capabilities.

- In March 2020, Taiwanese manufacturer of IP video-based systems Lilin has unveiled and released its new Aida traffic management system along with a range of surveillance cameras and other smart city equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

##### ####

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market Definition and Study Scope

1.3. Currency

1.4. Limitations

1.5. Summary of Changes

1.6. Market Stakeholders

2 Research Methodology

2.1. Research Approach

2.1.1. Secondary Data

2.1.1.1. Major secondary sources

2.1.1.2. Key data from secondary sources

2.1.2. Primary Data

2.1.2.1. Key participants in primary processes across the value chain of traffic camera market

2.1.2.2. Breakdown of primaries

2.1.2.3. Key data from primary sources

2.1.3. Secondary and Primary Research

2.1.3.1. Key Industry Insights

2.2. Market Size Estimation

2.2.1. Bottom-up Approach

2.2.2. Top-down Approach

2.2.3. Factor Analysis

2.2.3.1. Demand-side Analysis

2.2.3.2. Supply-side Analysis

2.2.4. Growth Forecast Assumptions

2.3. Market Breakdown and Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem: Traffic Camera Market

5.5. Technology Analysis

5.6. Pricing Analysis: Average Selling Price

5.7. Patent Analysis

5.8. Case Studies

5.9. Key Conferences and Events in 2022-2023

5.10. Tariff and Regulatory Landscape

5.11. Trade Analysis

5.12. Porter’s Five Forces Analysis

5.13. Trends/Disruptions Impacting Customer’s Business

5.14. Key Stakeholders & Buying Criteria

6 Traffic Camera Market, By Type

6.1. Introduction

6.2. Fixed Camera

6.3. Mobile Speed Camera

6.4. Red Light Camera

6.5. Surveillance Camera

6.6. Others

7 Traffic Camera Market, By Component

7.1. Introduction

7.2. Hardware

7.3. Software

7.4. Services

8 Traffic Camera Market, By Application

8.1. Introduction

8.2. Traffic Monitoring and Transport Network Management

8.3. Automated Number Plate Recognition (ANPR) and Surveillance

8.4. Electronic Road Pricing and Toll Management

8.5. Others

9 Traffic Camera Market, By Product

9.1. Introduction

9.2. Analog

9.3. IP camera

10 Traffic Camera Market, By Resolution

10.1. Introduction

10.2. 2 to 5 MP

10.3. 6 to 8 MP

10.4. Others

11 Geographic Analysis

11.1. Introduction

11.2. Americas

11.2.1. North America

11.2.1.1. US

11.2.1.2. Canada

11.2.1.3. Mexico

11.2.2. South America

11.2.2.1. Brazil

11.2.2.2. Argentina

11.2.2.3. Rest of South America

11.3. Europe

11.3.1. UK

11.3.2. Germany

11.3.3. France

11.3.4. Rest of Europe

11.4. Asia Pacific

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. South Korea

11.4.5. Rest of Asia Pacific

11.5. Rest of the World

11.5.1. Middle East

11.5.2. Africa

12 Competitive Landscape

12.1. Introduction

12.2. Key Players Strategies/Right to Win

12.3. Market Share Analysis

12.4. Revenue Analysis (Top 5 Company)

12.5. Company Evaluation Quadrant, 2021

12.5.1. Stars

12.5.2. Emerging Leaders

12.5.3. Pervasive

12.5.4. Participants

12.6. Company Footprints

12.7. Competitive Benchmarking Tables

12.7.1. Start-up/SME Evaluation Quadrant, 2021

12.7.1.1. Progressive

12.7.1.2. Responsive

12.7.1.3. Dynamic

12.7.1.4. Starting Blocks

12.8. Competitive Scenario and Trends

13 Company Profiles

13.1. Introduction

13.2. Key Players

13.2.1. Sony Corporation

13.2.2. Axis Communication (Canon Inc.)

13.2.3. Teledyne FLIR

13.2.4. Siemens AG

13.2.5. Allied Vision Technologies GmbH

13.2.6. Adaptive Recognition Inc.

13.2.7. Pelco Corporations

13.2.8. Nedap N.V.

13.2.9. Canon

13.2.10. Panasonic Corporation

13.3. Other Players

13.3.1. E Com Systems

13.3.2. Jenoptik

13.3.3. Sensys Gatso Group AB

13.3.4. Kapsch TrafficCom AG

13.3.5. RCE systems s.r.o.

13.3.6. Hangzhou Hikvision Digital Technology Co., Ltd.

13.3.7. Geovision Inc

13.3.8. Suilvision Ltd.

13.3.9. Tattile

13.3.10. VITRONIC

13.3.11. Redflex Holdings

13.3.12. Mobotix

13.3.13. Bosch Security Systems, Inc.

14 Appendix

Growth opportunities and latent adjacency in Traffic Camera Market