Turbogenerator Market by Capacity (10 - 175 MVA, 175 MVA - 550 MVA, 550 MVA & Above), by End-User (Coal Power Plants, Gas Power Plants, Nuclear Power Plants, Others), by Cooling (Air Cooled, Hydrogen Cooled, Water Hydrogen Cooled) & Geography (Asia-Pacific, Europe, Middle East & Africa, North America, South America) - Global Trends and Forecasts to 2019

Power is an inevitable requirement for sustaining growth across the globe. The requirement of electricity throughout the globe will drive many developing and developed countries to install power plants across the globe. Since fossil fuels still constitute a huge portion of our primary fuel required for electricity generation and no substitute in near future to replace them completely, high capacity power plants will be the key sources for electricity. Turbogenertor is major equipment installed in hydrocarbons fuelled power plants and other renewable plants like geothermal plants. These are the high speed electrical equipments rotating at 3000rpm or 1500rpm, converting mechanical energy of turbine into electrical energy.

In most of the developing economies, a rapid growth in need of electricity required per capita to raise the living standards and to meet the industrial demand are the major drivers for installations of power plants. Hydrocarbons being the only source providing energy security for most of the developing and developed countries in near future, it is inevitable that they can be soon replaced by other renewable sources of energy.

The global turbogenerator market is segmented on the basis of the end-user power plants which include coal, gas, nuclear and others (Biomass, Geothermal, co-generation, Combined Heat & Power). Further classification is done based on the capacity of the turbogenerators 10-175 MVA, 175 MVA to 550 MVA, 550 MVA & above. The market is again segmented by types of cooling arrangement made in these generators i.e. air cooled, hydrogen cooled, water hydrogen cooled. The market is further segmented on the basis of regions such as Asia-Pacific, Europe, Middle East & Africa, North America and South America. Each segment has been analyzed with respect to its market trends, growth trends, and future prospects. The data has been analyzed from 2011 to 2019, and all quantitative data regarding segmentation is mentioned in terms of value ($Million).

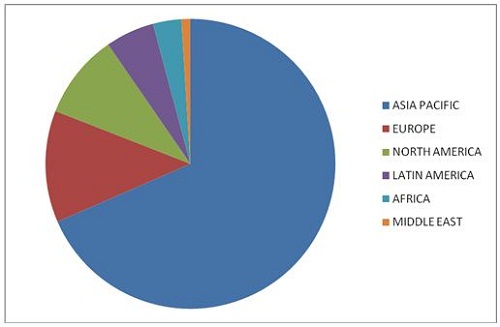

Asia-Pacific expected to witness highest demand

The global turbogenerator market is expected to cross $10 billion mark by 2019, growing at a CAGR of 0.7% from 2014 to 2019. In terms of market size, Asia-Pacific stood first followed by Europe and North America in 2013. Rapid industrialization in the emerging countries of Asia-Pacific has led to increased demand for power, thus creating demands for new power plants. Between 2014 and 2019, the region is expected to witness the highest capacity additions though to reach $6.62 billion by 2019.

Turbogenerator Market Share (Value), by Geography, 2013

Source: MarketsandMarkets Analysis

The turbogenerator market is also analyzed with respect to Porter's Five Force model. Different market forces such as suppliers’ power, buyers’ power, degree of competition, threat from substitutes, and threat from new entrants, are analyzed with respect to the turbogenerator industry. The report also provides a competitive landscape of major market players that includes developments, mergers & acquisition, expansion & investments, agreements & contracts, new technologies developments, and others. A number of these developments are spotted by key industry players that suggest the growth strategy of these companies as well as of the overall industry.

The report also provides a comprehensive review of major market drivers, restraints, opportunities, winning imperatives, and key burning issues in the turbogenerator market. Key players in the industry are profiled in detail with their recent developments. Some of these include companies such as Alstom SA (France), General Electric (the U.S.), Siemens AG (Germany), Mitsubishi Hitachi Power Systems (Japan), Andritz AG (Austria), BHEL (India) and Harbin Electric Company (China).

The global turbogenerator market is expected to be a 10.36 billion dollar industry by 2019, with a projected CAGR of 0.7%, signifying a high demand for turbogenerators in developing countries and market saturation in developed countries.

Global turbogenerator market is at very much dependent on regulatory policy of country and opportunities are diverse across regions. In the emerging economies such as China and India, the market is tied to the rapid industrialization and urbanization activities leading to high growth in power demands. Government and regulatory bodies in these regions are implementing growth plans to meet the energy requirements in future. However, the matured markets of Europe and Americas, are striving towards stagnation with rarely any more fossil fuel power generations coming up, thereby reducing the consumption of fresh natural resources.

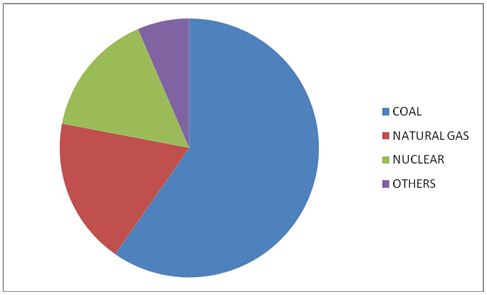

Coal Fired power plants dominates the demand in market

Coal Fired power plants with big capacities are rapidly coming up in China and India accounting for almost 55% share of the total market in 2013. This segment is expected to witness stagnation at these levels on account of the increased environmental awareness and stringent regulations put in place by the regulatory bodies.

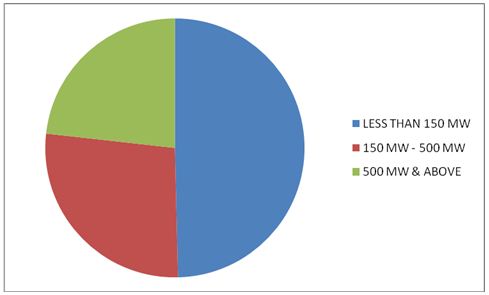

Turbogenerator Units above Capacity of 550 MVA are rapidly coming up in China, India and some other countries accounting for almost 48% share of the total market in 2013. This segment is expected to witness high growth on account of the increased larger units being installed throughout the world for better efficiencies.

Turbogenerator: Market Share, by Capacity (Value), by End-User, 2013

Source: MarketsandMarkets Analysis

Turbogenerator: Market Share, by Capacity (Value),by End-User, 2013

Source: MarketsandMarkets Analysis

Key companies in the turbo generators market are Alstom SA (France), General Electric (the U.S.), Siemens AG (Germany), Mitsubishi Hitachi Power Systems (Japan), Andritz AG (Austria), BHEL (India), Harbin Electric Company (China), Toshiba (Japan), Dongfang Electric Corporation (China), L&T MHI (India).

Mergers and Acquisitions: Key strategy

The leading companies Turbogenerator market focus on the growth of their mergers & acquisitions with the key objective of serving various industry sectors with wide geographic presence. The leading companies have been able to enter in to partnerships and JVs with local players in order to expand their range of operations. They are constantly focusing on the emerging regions to establish themselves as leading technology providers.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives

1.2 Analyst Insights

1.3 Report Description

1.4 Market Definitions

1.5 Market Segmentation & Aspects Covered

1.6 Stakeholders

1.7 Research Methodology

1.7.1 Approach

1.7.2 Market Size Estimation

1.7.3 Market Crackdown & Data Triangulation

1.7.4 Key Data Taken From Secondary Sources

1.7.5 Key Secondary Sources Used

1.7.6 Key Data Taken From Primary Sources

1.7.7 Assumptions Made for Turbogenerator Report

2 Executive Summary (Page No. - 29)

3 Premium Insights (Page No. - 32)

3.1 Asia-Pacific Dominates the Global Market

3.2 550 MVA & Above Capacity Turbogenerators Dominate the Global Turbogenerator Market

3.3 Market Estimation and Growth Analysis, By End-User

3.4 Market Estimation and Growth Analysis, By Geography

3.5 Regional Market Lifecycle

4 Market Overview (Page No. - 38)

4.1 Introduction

4.2 Classification of Turbogeneraotr

4.2.1 Based on Cooling

4.2.1.1 Air-Cooled Turbogenerator

4.2.1.2 Hydrogen-Cooled Turbogenerator

4.2.1.3 Water-Hydrogen Cooled Turbogenerator

4.2.2 Based on Capacity

4.2.3 Based on End-User

4.3 Market Segmentation

4.3.1 Turbogenerator By Geography

4.3.2 By End-Users

4.3.3 By Capacity

4.4 Value Chain Analysis

4.4.1 Original Equipment Manufacturers

4.4.2 Operators

4.5 Market Dynamics

4.5.1 Drivers

4.5.1.1 Growth in Coal-Fired Power Plants in Developing Countries

4.5.1.2 Growth in Gas-Fired Power Plants

4.5.1.3 Industrial Expansion in Asia-Pacific Region

4.5.1.4 Increase in Power Demand

4.5.1.5 Insufficient Generation Capacity, Especially in African Countries

4.5.2 Restraints

4.5.2.1 Emergence of Alternate and Renewable Sources of Energy

4.5.2.2 Weak Growth in Developed Markets

4.5.3 Opportunities

4.5.3.1 Requirement of Higher Capacity and Higher Efficiency Turbogenerator

4.6 Burning Issues

4.6.1 Project Financing Problems in Under-Developed Countries

4.7 Winning Imperative

4.8 Porter’s Five forces Analysis

4.8.1 Bargaining Power of Suppliers

4.8.2 Bargaining Power of Buyers

4.8.3 Threat of New Entrants

4.8.4 Threat of Substitutes

4.8.5 Degree of Competittion

5 Turbogenerator Market, By Geography (Page No. - 60)

5.1 Introduction

5.2 Turbogenerator Market by Geography

5.2.1 Market by Installed Power Capacity, By Geography, 2013

5.2.2 Market Size (Value), By Geography

5.3 North America Turbogenerator Market

5.3.1 Introduction

5.3.2 Market by Country

5.3.3 U.S. Market

5.3.3.1 Introduction

5.3.3.2 Market By Capacity

5.3.3.3 Market By End-User

5.3.4 Canada Market

5.3.4.1 Introduction

5.3.4.2 Market By Capacity

5.3.4.3 Market By End-User

5.4 Latin America Turbogenerator Market

5.4.1 Introduction

5.4.2 Latin America: Market, By Country

5.4.3 Mexico Market

5.4.3.1 Introduction

5.4.3.2 Market By Capacity

5.4.3.3 Market By End-User

5.4.4 Brazil Market

5.4.4.1 Introduction

5.4.4.2 Market By Capacity

5.4.4.3 Market By End-User

5.4.5 Chile Turbogenerator Market

5.4.5.1 Introduction

5.4.5.2 Market By Capacity

5.4.5.3 Market By End-User

5.4.6 Argentina Turbogenerator Market

5.4.6.1 Introduction

5.4.6.2 Market By Capacity

5.4.6.3 Market By End-User

5.4.7 Rest of Latin America Turbogenerator Market.

5.4.7.1 Introduction

5.4.7.2 Market By Capacity

5.4.7.3 Market By End-User

5.5 Europe Turbogenerator Market

5.5.1 Introduction

5.5.2 Market By Country

5.5.3 U.K. Market

5.5.3.1 Introduction

5.5.3.2 Market By Capacity

5.5.3.3 Market By End-User

5.5.4 Germany TurbogeneratorMarket

5.5.4.1 Introduction

5.5.4.2 Market By Capacity

5.5.4.3 Market By End-User

5.5.5 Italy Turbogenerator Market

5.5.5.1 Introduction

5.5.5.2 Market By Capacity

5.5.5.3 Market By End-User

5.5.6 France: Market.

5.5.6.1 Introduction

5.5.6.2 Market By Capacity

5.5.6.3 Market By End-User

5.5.7 Russia Turbogenerator Market

5.5.7.1 Introduction

5.5.7.2 Market By Capacity

5.5.7.3 Market By End-User

5.5.8 Rest of Europe Turbogenerator Market.

5.5.8.1 Introduction

5.5.8.2 Market By Capacity

5.5.8.3 Market By End-User

5.6 Aisa-Pacific Turbogenerator Market

5.6.1 Introduction

5.6.2 Asia-Pacific Market, By Country

5.6.3 Japan Market

5.6.3.1 Introduction

5.6.3.2 Market By Capacity

5.6.3.3 Market By End-User

5.6.4 South Korea: Turbogenerator Market

5.6.4.1 Introduction

5.6.4.2 Market By Capacity

5.6.4.3 Market By End-User

5.6.5 Australia Market,

5.6.5.1 Introduction

5.6.5.2 Market By Capacity

5.6.5.3 Market By End-User

5.6.6 China Turbogenerator Market

5.6.6.1 Introduction

5.6.6.2 Market By Capacity

5.6.6.3 Market By End-User

5.6.7 India Turbogenerator Market

5.6.7.1 Introduction

5.6.7.2 Market By Capacity

5.6.7.3 Market By End-User

5.6.8 Rest of Asia-Pacific Turbogenerator Market

5.6.8.1 Introduction

5.6.8.2 Market By Capacity

5.6.8.3 Market By End-User

5.7 Middle East Turbogenerator Market

5.7.1 Introduction

5.7.2 Middle East Market, By Country

5.7.3 SAudi Arabia: Market

5.7.3.1 Introduction

5.7.3.2 Market By Capacity

5.7.3.3 Market By End-User

5.7.4 U.A.E. Turbogenerator Market

5.7.4.1 Introduction

5.7.4.2 U.A.E., By Capacity

5.7.4.3 U.A.E., By End-User

5.7.5 Rest of Middle East Turbogenerator Market

5.7.5.1 Introduction

5.7.5.2 Market By Capacity

5.7.5.3 Market By End-User

5.8 Africa Turbogenerator Market

5.8.1 Introduction

5.8.2 Africa Market, By Value

5.8.2.1 Introduction

5.8.2.2 Market By Capacity

5.8.2.3 Market By End-User

6 Turbogenerator Market, By Capacity (Page No. - 130)

6.1 Introduction

6.2 Market By Capacity

6.2.1 Introduction

6.2.2 Market By Capacity, By Installed Power Capacity

6.2.3 Turbogenerator Market By Capacity

6.3 Market By Capacity Rating (10 MVA to 175 MVA)

6.3.1 Introduction

6.3.2 Market By Capacity (10 MVA to 175 MVA), , By Geography

6.3.3 Market Capacity Rating: 10 MVA to 175 MVA, By Value, By Geography

6.3.3.1 Introduction

6.4 Market By Capacity Rating (175 MVA to 550 MVA)

6.4.1 Introduction

6.4.2 Turbogenerator Market, Capacity Rating: 175 MVA to 550 MVA, By Installed Power Capacity, By Geography

6.4.3 Market Capacity Rating: 175 MVA to 550 MVA, By Value, By Geography

6.5 Turbogenerator Market Capacity Rating (550 MVA & Above)

6.5.1 Introduction

6.5.2 Market Capacity Rating: 550 MVA and Above, By Installed Power Capacity, By Geography

6.5.3 Market Value for Capacity Rating: 10 MVA to 175 MVA, By Geography

6.5.3.1 Introduction

7 Turbogenerator Market, By End-User (Page No. - 151)

7.1 Introduction

7.2 Turbogenerator Market, By End-User

7.2.1 Market By Installed Power Capacity, By End-User, 2013

7.2.2 Market By Value, By End-User

7.3 Turbogenerator Market, Coal-Fired Power Plants

7.3.1 Introduction

7.3.2 Market, Coal-Fired Power Plants, By Capacity

7.3.2.1 Market Coal-Fired Power Plants, By Capacity, By Installed Power Capacity

7.3.2.2 Market, Coal-Fired Power Plants, By Capacity, By Value

7.3.3 Market Coal-Fired Power Plants, By Geography

7.3.3.1 Market Coal-Fired Power Plants, By Geography, By Installed Power Capacity

7.3.3.2 Market Coal-Fired Power Plants, By Geography, By Value

7.4 Turbogenerator Market for Gas-Based Power Plants

7.4.1 Introduction

7.4.2 Market Gas-Based Power Plants, By Capacity

7.4.2.1 Market, Gas-Based Power Plants, By Capacity, By Installed Power Capacity

7.4.2.2 Market for Gas-Based Power Plants, By Capacity, By Value

7.4.3 Gas-Based Power Plants, By Geography

7.4.3.1 Market Gas-Based Power Plants, By Geography, By Installed Power Capacity

7.4.3.2 Market Gas-Based Power Plants, By Geography, By Value

7.5 Turbogenerator Market for Nuclear Power Plants

7.5.1 Introduction

7.5.2 Market Nuclear Power Plants, By Capacity

7.5.2.1 Market Nuclear Power Plants, By Capacity, By Installed Power Capacity

7.5.2.2 Market for Nuclear Power Plants, By Capacity, By Value

7.5.3 Market Nuclear Power Plants, By Geography

7.5.3.1 Market, Nuclear Power Plants, By Geography, By Installed Power Capacity

7.5.3.2 Market Nuclear Power Plants, By Geography, By Value

7.6 Turbogenerator Market for Other Power Plants

7.6.1 Introduction

7.6.2 Market, Other Power Plants, By Capacity

7.6.2.1 Market Other Power Plants, By Capacity, By Installed Power Capacity

7.6.2.2 Market for Other Power Plants, By Capacity, By Value

7.6.3 Turbogenerator Market, Other Power Plants, By Geography

7.6.3.1 Market Other Power Plants, By Geography, By Installed Power Capacity

7.6.3.2 Market Nuclear Power Plants, By Geography, By Value

8 Turbogenrator Market, By Cooling Type (Page No. - 195)

8.1 Introduction

8.1.1 Air Cooled Turbogenerator

8.1.2 Hydrogen Cooled Turbo Generator

8.1.3 Water-Hydrogen Cooled Turbogenerator

9 Competitive Landscape (Page No. - 198)

Key Findings

9.1 Introduction

9.2 Key Players of the Turbogenerator Market

9.2.1 List of Key Players

9.3 Contracts & Agreements Lead the Way

9.4 Contracts and Agreements

9.5 Mergers & Acquisitions

9.6 Other Developments

10 Company Profiles (Page No. - 212)

10.1 Alstom S.A.

10.1.1 Introduction

10.1.2 Products

10.1.3 Developments

10.1.4 Strategy & Insights

10.1.5 SWOT Analysis

10.1.6 MNM View

10.2 andritz AG

10.2.1 Introduction

10.2.2 Products

10.2.3 Developments

10.2.4 Strategy & Insights

10.3 Bharat Heavy Electricals Ltd.

10.3.1 Introduction

10.3.2 Products

10.3.3 Developments

10.3.4 Strategy & Insights

10.4 Brush Turbogenerator

10.4.1 Introduction

10.4.2 Products & Services

10.4.3 Developments

10.4.4 Strategy & Insights

10.5 Dongfang Electric Corporation Ltd.

10.5.1 Introduction

10.5.2 Products

10.5.3 Developments

10.5.4 Strategy & Insights

10.6 General Electric

10.6.1 Introduction

10.6.2 Products

10.6.3 Developments

10.6.4 Strategy & Insights

10.6.5 SWOT Analysis

10.6.6 MNM View

10.7 Harbin Electric Company

10.7.1 Introduction

10.7.2 Products

10.7.3 Developments

10.7.4 Strategy & Insights

10.8 Mitsubishi Heavy Indutries

10.8.1 Introduction

10.8.2 Products & Services

10.8.3 Developments

10.8.4 Strategy & Insights

10.8.5 SWOT Analysis

10.8.6 MNM View

10.9 Siemens AG

10.9.1 Introduction

10.9.2 Products & Services

10.9.3 Developments

10.9.4 Strategy & Insights

10.9.5 SWOT Analysis

10.9.6 MNM View

10.10 Toshiba

10.10.1 Introduction

10.10.2 Products

10.10.3 Developments

10.10.4 Strategy & Insights

10.10.5 SWOT Analysis

10.10.6 MNM View

Appendix (Page No. - 258)

List of Tables (95 Tables)

Table 1 Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 2 World Energy Consumption, By Country Grouping, 2010–2040 (Quadrillion Btu)

Table 3 Africa: Power Generation Capacity

Table 4 Market Size (Installed Power Capacity), By Geography, 2013 (MW)

Table 5 Market Size, By Geography, 2012-2019 ($Million)

Table 6 North America: Market Share, By Country, 2013 ($Million)

Table 7 North America: Market Size, By Country, 2012-2019 ($Million)

Table 8 U.S.: Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 9 U.S.: Market Size, By End-User, 2012-2019 ($Million)

Table 10 Canada: Market Size, By Capacity, 2012-2019 ($Million)

Table 11 Canada: Market Size , By End-User, 2012-2019 ($Million)

Table 12 $$ Latin America: Market Size, By Country, 2012-2019 ($Million)

Table 13 Mexico: Market Size, By Capacity, 2012-2019 ($Million)

Table 14 Mexico:Market Size, By End-User, 2012-2019 ($Million)

Table 15 Brazil: Market Size, By Capacity, 2012-2019 ($Million)

Table 16 Brazil: Turbogenerator Market Size, By End-User, 2012-2019 ($Million)

Table 17 Chile: Market Size, By Capacity, 2012-2019 ($Million)

Table 18 Chile: Market Size, By End-User, 2012-2019 ($Million)

Table 19 Argentina: Market Size, By Capacity, 2012-2019 ($Million)

Table 20 Argentina: Market Size , By End-User, 2012-2019 ($Million)

Table 21 Rest of Latin America: Market Size, By Capacity, 2012-2019 ($Million)

Table 22 Rest of Latin America: Market Size, By End-User, 2012-2019 ($Million)

Table 23 Europe: Market Size, By Country, 2012-2019 ($Million)

Table 24 U.K. Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 25 U.K. Market Size, By End-User, 2012-2019 ($Million)

Table 26 Germany Market Size, By Capacity, 2012-2019 ($Million)

Table 27 Germany: Market Size, By End-User, 2012-2019 ($Million)

Table 28 Italy: Market Size, By Capacity, 2012-2019 ($Million)

Table 29 Italy: Market Size, By End-User, 2012-2019 ($Million)

Table 30 France: Market Size, By Capacity, 2012-2019 ($Million)

Table 31 France: Market Size, By End-User, 2012-2019 ($Million)

Table 32 Russia: Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 33 Russia: Market Size, By End-User, 2012-2019 ($Million)

Table 34 Rest of Europe:Market Size, By Capacity, 2012-2019 ($Million)

Table 35 Rest of Europe: Market Size, By End-User, 2012-2019 ($Million)

Table 36 Asia-Pacific: Market Size, By Country, 2012-2019 ($Million)

Table 37 Japan: Market Size, By Capacity, 2012-2019 ($Million)

Table 38 Japan: Turbogenerator Market Size, By End-User, 2012-2019 ($Million)

Table 39 Market: South Korea, Market Size (Value), By Capacity, 2012-2019 ($Million)

Table 40 South Korea: Market Size,By End-User, 2012-2019 ($Million)

Table 41 Australia: Market Size, By Capacity, 2012-2019 ($Million)

Table 42 Australia: Turbogenerator Market Size, By End-User, 2012-2019 ($Million)

Table 43 China: Market Size, By Capacity, 2012-2019 ($Million)

Table 44 China: Market Size, By End-User, 2012-2019 ($Million)

Table 45 India: Market Size, By Capacity, 2012-2019 ($Million)

Table 46 India: Turbogenerator Market Size, By End-User, 2012-2019 ($Million)

Table 47 Rest of Asia-Pacific: Market Size, By Capacity, 2012-2019 ($Million)

Table 48 Rest of Asia-Pacific: Market Size, By End-User, 2012-2019 ($Million)

Table 49 Middle East: Market Size, By Country, 2012-2019 ($Million)

Table 50 Saudi Arabia: Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 51 Turbogenerator Market: Saudi Arabia, Market Size (Value), By End-User, 2012-2019 ($Million)

Table 52 U.A.E.: Market Size, By Capacity, 2012-2019 ($Million)

Table 53 U.A.E.: Market Size, By End-User, 2012-2019 ($Million)

Table 54 Market: Rest of the Middle-East, Market Size (Value), By Capacity, 2012-2019 ($Million)

Table 55 Rest of Middle East: Turbogenerator Market Size, By End-User, 2012-2019 ($Million)

Table 56 Africa: Market Size, By Capacity, 2012-2019 ($Million)

Table 57 Africa: Market Size, By End-User, 2012-2019 ($Million)

Table 58 Market Size, By Installed Capacity Additions, 2012-2019 (MW)

Table 59 Turbogenerator Market Size, By Capacity, 2012-2019 ($Million)

Table 60 Turbogenerator (10 MVA – 175 MVA) Market Size, By Geography, 2012-2019 ($Million)

Table 61 Turbogenerator (10 MVA – 175 MVA ) Market Size, By Geography, 2012-2019, ($Million)

Table 62 Market: 175 MVA – 550 MVA, Turbogenerator Market Size (MW), By Installed Power Capacity, By Geography, 2012-2019

Table 63 Turbogenerator (175 MVA – 550 MVA ) Market Size, By Geography, 2012-2019 ($Million)

Table 64 Market: 550 MVA and Above, Market Size (MW), By Installed Power Capacity, By Geography, 2012-2019

Table 65 Turbogenerator (550 MVA and Above ) Market Size, By Geography, 2012-2019 ($Million)

Table 66 Market: By Installed Power Capacity (MW), By End-User, 2013

Table 67 Market: Marketsize (Value), By End-User, 2012-2019 ($Million)

Table 68 Market: Coal-Fired Power Plants, By Installed Power Capacity (MW), 2012-2019

Table 69 Market: Size (Value), Coal-Fired Power Plant, By Capacity, 2012-2019 ($Million)

Table 70 Market: Coal-Fired Power Plants, By Installed Power Capacity (MW), By Geography, 2012-2019

Table 71 Market: Turbogenerator Market Size (Value), Coal-Fired Power Plants, By Geography, 2012-2019 ($Million)

Table 72 Gas Capacity Additions, By Capacity (2012-2019): By End-User

Table 73 Market: Market Size (Value), Gas-Based Power Plant, By Capacity, 2012-2019 ($Million)

Table 74 Market: Gas-Based Power Plants, By Installed Power Capacity (MW), By Geography, 2012-2019

Table 75 Market: Market Size (Value), Gas-Based Power Plants, By Geography, 2012-2019 ($Million)

Table 76 Nuclear Capacity Additions, By Capacity (2012-2019): By End-User

Table 77 Market: Turbogenerator Market Size (Value), Nuclear Power Plant, By Capacity, 2012-2019 ($Million)

Table 78 Market: Nuclear Power Plants, By Installed Power Capacity (MW), By Geography, 2012-2019

Table 79 Market: Market Size (Value), Nuclear Power Plants, By Geography, 2012-2019 ($Million)

Table 80 Market: Coal-Fired Power Plants, By Installed Power Capacity (MW), 2012-

Table 81 Market: Turbogenerator Market Size (Value), Other Power Plant, By Capacity, 2012-2019 ($Million)

Table 82 Market: Other Power Plants, By Installed Power Capacity (MW), By Geography, 2012-2019

Table 83 Market: Market Size (Value), Others Power Plants, By Geography, 2012-2019 ($Million)

Table 84 Annual Contracts & Agreements

Table 85 Annual Mergers & Acquisitions

Table 86 Annual Other Developments

Table 87 Alstom SA : Products & Description

Table 88 andritz: Products & Description

Table 89 BHEL: Products & Description

Table 90 Brush: Products & Description

Table 91 Dong Fang Electric Corporation: Products & Description

Table 92 General Electric: Products & Description

Table 93 Harbin Electric Company: Products & Description

Table 94 Mitsubishi Electric Corporation: Products & Description

Table 95 Toshiba: Products & Description

List of Figures (58 Figures)

Figure 1 Research Methodology

Figure 2 Data Triangulation Methodology

Figure 3 Turbogenerator Market Share (Value), By Capacity, 2013

Figure 4 Market Share (Value) Comparision, 2014 & 2019

Figure 5 Turbogenerator Market Share (Value): By Technology, 2014–2019

Figure 6 Market Size: Estimation and Growth Analysis, By Technology, 2014-2019 ($Million)

Figure 7 Market Size: Estimation and Growth Analysis, By Geography, 2014-2019 ($Million)

Figure 8 Turbogenerator: Market Life Cycle

Figure 9 Market Segmentation

Figure 10 Market Share (Value), By Geography, 2013

Figure 11 Market Share (Value), By End-User, 2013

Figure 12 Turbogeneraotr Market Share (Value), By Capacity, 2013

Figure 13 Value Chain Analysis of the Global Turbogenerator Market

Figure 14 World Energy Consumption, By Fuel, 2010-2040

Figure 15 Global Electricity Generation, By Fuel-Type, 2013

Figure 16 Porter’s Five Forces Analysis for the Global Turbogenerator Market

Figure 17 Turbogenerator Market Share (Installed Power Capacity), By Geography, 2013 (MW)

Figure 18 Market Share (Value), By Geography, 2013

Figure 19 Latin America: Turbogenerator Market Share (Value), By Country, 2013

Figure 20 Europe: Share (Value), By Country, 2013

Figure 21 Asia-Pacific: Turbogenerator Market Share (Value), By Country, 2013

Figure 22 Middle East: (Value), By Country, 2013

Figure 23 Market Share (Volume), By Installed Power Capacity, 2013

Figure 24 Market Share (Value), By Capacity, 2013

Figure 25 Turbogenerator(10 MVA – 175 MVA) Market Share, By Installed Power Capacity, By Geography, 2013

Figure 26 Turbogenerator Market: 10 MVA – 175 MVA, Market Share (Value), By Geography, 2013

Figure 27 Market: 175 MVA – 550 MVA, Turbogenerator Market Share, By Installed Power Capacity, By Geography, 2013

Figure 28 Market: 175 MVA – 550 MVA, Market Share (Value), By Geography, 2013

Figure 29 Market: 550 MVA & Above, Market Share, By Installed Power Capacity, By Geography, 2013

Figure 30 Market: 550 MVA and Above, Market Share (Value), By Geography, 2013

Figure 31 Turbogenerator Market Share, By Installed Power Capacity (MW), By End-User , 2013

Figure 32 Market Share (Value), By End-User, 2013

Figure 33 Market Share, Coal-Fired Power Plants, By Installed Power Capacity (MW), 2013

Figure 34 Market Share (Value), Coal-Fired Power Plants, By Capacity, 2013

Figure 35 Market Share, Coal-Fired Power Plants, By Installed Power Capacity (MW), By Geography, 2013

Figure 36 Turbogenerator Market Share (Value), Coal-Fired Power Plants, By Geography, 2013

Figure 37 Market Share, Gas-Based Power Plants, By Installed Power Capacity (MW), 2013

Figure 38 Market Share (Value), Gas-Based Power Plants, By Capacity, 2013

Figure 39 Market Share, Gas-Based Power Plants, By Installed Power Capacity (MW), By Geography, 2013

Figure 40 Market Share (Value), Gas-Based Power Plants, By Geography, 2013

Figure 41 Market Share, Nuclear Power Plants, By Installed Power Capacity (MW), 2013

Figure 42 Market Share Turbogenerator Market (Value), Nuclear Power Plants, By Capacity, 2013

Figure 43 Market Share, Nuclear Power Plants, By Installed Power Capacity (MW), By Geography, 2013

Figure 44 Market Share (Value), Nuclear Power Plants, By Geography, 2013

Figure 45 Market Share, Other Power Plants, By Installed Power Capacity (MW), 2013

Figure 46 Market Share (Value), Other Power Plants, By Capacity, 2013

Figure 47 Market Share, Other Power Plants, By Installed Power Capacity (MW), By Geography, 2013

Figure 48 Market Share (Value), Other Power Plants, By Geography, 2013

Figure 49 Turbogenerator Capacity (2-Pole Generators): By Cooling Type

Figure 50 Turbogenerator Market Activities, By Key Players,2008-2014

Figure 51 Annual Contracts & Agreements Analysis, 2009-2014

Figure 52 Annual Mergers & Acquisitions Analysis, 2010-2013

Figure 53 Annual Other Developments Analysis, 2009-2014

Figure 54 Alstom : SWOT Analysis

Figure 55 General Electric : SWOT Analysis

Figure 56 Mitsubishi Electric Corporation : SWOT Analysis

Figure 57 Siemens AG : SWOT Analysis

Figure 58 Toshiba : SWOT Analysis

Growth opportunities and latent adjacency in Turbogenerator Market