Upcycled Ingredients Market - Global Forecast to 2030

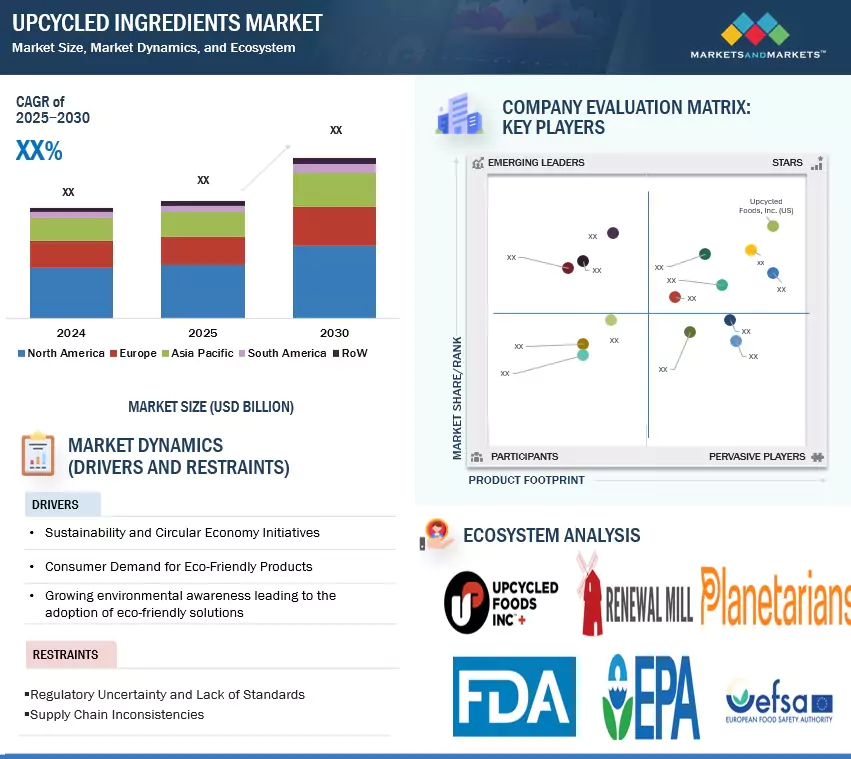

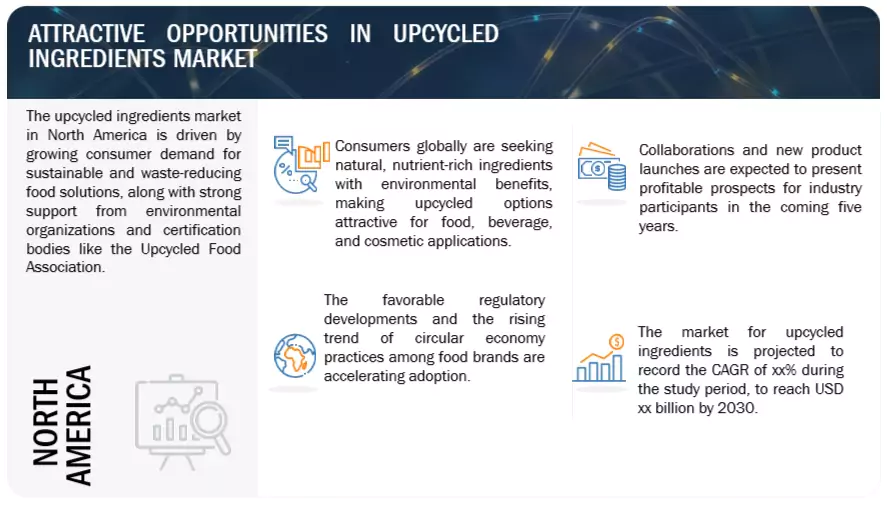

The upcycled ingredients market is estimated at USD xx billion in 2025; it is projected to grow at a CAGR of xx % to reach USD xx billion by 2030. The upcycled ingredients market is driven by growing consumer demand for sustainable and clean-label products, coupled with rising awareness about food waste and environmental impact. Increasing adoption of circular economy practices, supportive government regulations, and innovations in food processing technologies are further propelling the market. Manufacturers are leveraging food byproducts to create value-added ingredients for applications in food, cosmetics, and animal feed, aligning with global sustainability goals. Additionally, partnerships and investments by key industry players are accelerating product development and commercialization, enhancing the appeal of upcycled ingredients as both eco-friendly and economically viable solutions across multiple industries.

Drivers: Sustainability and Circular Economy Initiatives

Sustainability and circular economy efforts are at the core of fueling industry growth for upcycled ingredients. With food waste becoming a world issue, nearly one-third of the world's food being wasted each year, governments, industries, and consumers are now looking to upcycle. Upcycled ingredients take by-products and excess foods and agriculture materials from the food and agriculture industry and transform them into high-value food, nutraceutical, or cosmetic ingredients with reduced environmental footprint toward contributing to zero-waste goals.

In the European Union, the Farm to Fork Strategy and European Green Deal promote circular food production and waste minimization for a more sustainable food system. The EU also provides support in financing through programs like Horizon Europe and EIT Food and aids startups in innovation with upcycled ingredients. National circular bioeconomy strategies have been launched in Netherlands and Germany that facilitate industrial symbiosis and ingredient valorization.

Increased urbanization and food security concerns within the Asia-Pacific region are driving innovation. Upcycled applications are driven by Japan's Food Loss Reduction Promotion Act and South Korea's waste-to-value tax incentives. Singapore's 30 by 30 vision promotes food innovation hubs like the Food Innovation and Resource Centre (FIRC), where collaboration with upcycling companies occurs. Regional efforts are driving scalable solutions, and upcycled ingredients become the central point of sustainable development.

Restraints: Supply chain inconsistencies

Supply chain uncertainty is a major limitation in the upcycled ingredients sector. Unpredictable and fragmented availability of food side streams, which are the primary raw materials for upcycling, is one of the key issues. These fruit peels, spent grains, or vegetable pulp side streams are most frequently variable in quality, quantity, and seasonality, making it difficult to establish a scalable and reliable supply chain. With no robust sourcing networks and cold chain facilities, large-scale production of upcycled ingredients is problematic. These supply chain deficiency's reduced reliability, deter investment, and decelerate upcycled ingredients' induction into conventional food, nutraceutical, and cosmetic applications. Small and medium-sized food manufacturers, especially in developing economies, can have insufficient infrastructure or collaborations to separate, warehouse, and transport waste products in hygienic and trackable conditions.

Further, the lack of standard sourcing procedures and limited coordination between ingredient manufacturers and upstream processors inhibit effective raw material consolidation. This leads to input cost volatility and jeopardizes production timelines for manufacturers producing downstream with upcycled inputs. Logistics limitations, particularly in rural geographies, aggravate the recovery of perishable byproducts prior to spoilage. Further, geographical variations in waste composition necessitate tailored processing strategies, which add operational complexity.

Opportunities: Growing demand for sustainable and clean-label products

The growing demand for sustainable and clean-label products presents a significant opportunity in the upcycled ingredients market. As consumers become more environmentally conscious, there is a heightened interest in food and personal care products that minimize waste and promote circular economy principles. Upcycled ingredients align perfectly with this shift, as they utilize food byproducts that would otherwise be discarded, turning them into high-value components for use in food, beverages, cosmetics, and nutraceuticals. Additionally, clean-label trends—characterized by simple, recognizable ingredients and transparent sourcing—further boost the appeal of upcycled products. These ingredients are often rich in nutrients, fiber, and functional properties, making them attractive to health-focused consumers seeking natural and wholesome alternatives. Brands are increasingly incorporating upcycled inputs to differentiate themselves, enhance sustainability credentials, and meet corporate ESG goals. The rise of eco-conscious millennials and Gen Z consumers, combined with growing pressure on brands to reduce their environmental footprint, is expected to drive innovation and investment in the upcycled space. This market shift not only helps reduce food waste and resource consumption but also unlocks new revenue streams for manufacturers and processors. As demand for sustainable, ethical, and clean-label products continues to rise, upcycled ingredients are well-positioned for accelerated growth.

Challenges: Lack of standardized regulations

The lack of standardized regulations is a significant challenge hindering the growth of the upcycled ingredients market. Currently, there is no globally harmonized definition of what qualifies as an “upcycled ingredient,” leading to confusion among producers, retailers, and consumers. While organizations like the Upcycled Food Association have introduced certification frameworks, these are not universally recognized, which limits their influence in international markets. This regulatory ambiguity creates uncertainty for businesses regarding labeling, safety, and marketing claims, making it difficult to scale operations or enter new geographic regions. Moreover, differing food safety standards and approval processes across countries complicate the commercialization of upcycled ingredients. For instance, what is approved as a food-grade ingredient in one market may require additional testing or may be completely restricted in another. This fragmentation discourages innovation and delays product launches, especially for startups and SMEs with limited resources. Without clear guidelines from government agencies or global food safety authorities, many companies remain hesitant to fully invest in upcycled ingredient development. Addressing this challenge requires coordinated efforts from regulators, industry groups, and scientific bodies to establish clear, science-based policies that can support the responsible and transparent use of upcycled ingredients across borders.

UPCYCLED INGREDIENTS MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of upcycled ingredients products. These companies have been operating in the market for several years and possess a diversified product portfolio, and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), Rentokil Initial Plc (UK), Anticimex (Sweden), and Ecolab (US).

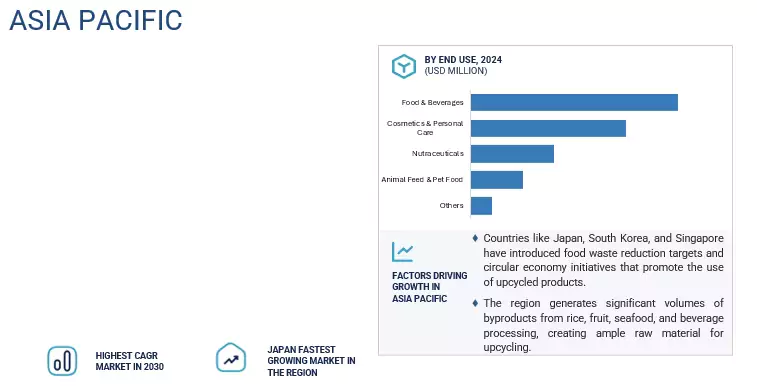

Based on end use, food & beverages segment to hold largest market share during forecast period

The food and beverage segment holds the largest market share in the global upcycled ingredients market, driven by increasing consumer demand for sustainable and functional food options. As food waste reduction becomes a growing priority, manufacturers are turning to upcycled ingredients as a solution to transform byproducts into high-value food components. Ingredients such as upcycled flour from spent grains, fiber-rich peels, and fruit pulp are now widely incorporated into snacks, baked goods, beverages, and plant-based alternatives. These innovations not only support sustainability goals but also enhance product nutrition, texture, and flavor.

The growing adoption of clean-label and circular economy principles has further accelerated the use of upcycled ingredients in food and beverage formulations. Consumers are increasingly looking for eco-conscious brands that demonstrate transparency and environmental responsibility. As a result, numerous startups and major food companies alike are introducing product lines that feature upcycled components. Regulatory advancements and certifications, such as the Upcycled Certified label, have also boosted consumer trust and market penetration. With strong retail and food service demand, favorable regulations, and innovation in food processing technologies, the food and beverage sector is expected to continue dominating the upcycled ingredients market, making it a key driver of growth and sustainability in the years ahead.

Upcycled starch segment to hold significant market share during forecast period

Upcycled starch holds a significant share in the ingredient type segment of the global upcycled ingredients market, driven by its wide applicability, functional benefits, and sustainability appeal. Derived from byproducts such as potato peels, cassava waste, or corn residues, upcycled starch serves as a versatile ingredient used in numerous applications across food, beverage, nutraceutical, and personal care industries. It functions as a thickener, stabilizer, binder, or texture enhancer, offering both economic and environmental advantages by reducing raw material waste. In the food and beverage sector, upcycled starch is increasingly utilized in bakery, sauces, soups, plant-based meats, and ready-to-eat meals, where clean-label and sustainable attributes are gaining traction. Moreover, its growing use in biodegradable packaging and personal care products further supports its market growth, especially as consumers and manufacturers seek alternatives to synthetic and non-renewable ingredients.

The increased adoption of circular economy models and growing partnerships between food processors and ingredient innovators have supported the commercialization of upcycled starch. Additionally, rising awareness of food loss and waste has prompted companies to invest in technologies that convert agricultural and food processing byproducts into value-added starches. As sustainability becomes a central pillar of product development, upcycled starch is well-positioned for continued market expansion.

Asia Pacific region to grow at highest CAGR during forecast period

Asia Pacific is projected to grow at the highest rate in the global upcycled ingredients market, driven by rapid urbanization, rising awareness of food waste, and growing demand for sustainable food solutions. Countries such as China, India, Japan, and South Korea are witnessing increased focus on circular economy practices and resource-efficient food systems. As environmental concerns intensify, governments and private sectors across the region are promoting initiatives to reduce food loss and convert agricultural byproducts into value-added ingredients. The region’s strong agricultural base generates substantial volumes of food processing waste, creating ample opportunities for upcycled ingredient production. Local startups and global players are collaborating to tap into these resources, developing innovative food, beverage, and cosmetic products featuring upcycled starches, fibers, proteins, and oils. Additionally, the rising middle class in Asia Pacific is driving demand for functional and clean-label ingredients that align with sustainability values.

Supportive government policies, growing investments in food-tech and biotech innovation, and an expanding consumer base with increasing environmental consciousness are further accelerating the growth of the upcycled ingredients market in Asia Pacific. With a blend of resource availability, technological innovation, and shifting consumer preferences, the region is poised to emerge as a major growth hub for upcycled ingredient solutions in the coming years.

Key Market Players

- Upcycled Foods, Inc. (US)

- AgriFiber Solutions, LLC (US)

- Outcast Foods (Canada)

- Planetarians (US)

- NETZRO, SBC (US)

- KAFFE BUENO (Denmark)

- SunOpta (Canada)

- American River Ag (US)

- CLARIANT (Switzerland)

- Bake Me Healthy (US)

- ÄIO (Estonia)

- Ecovert (Canada)

- Fauna & Flora International (UK)

- UpCircle (UK)

- Givaudan (Switzerland)

- Symrise (Germany)

- Seppic (France)

- Barry Callebaut (Switzerland)

- Chippin (US)

- RAHN AG (Switzerland)

- Lignopure GmbH (Germany)

- P2 Science, Inc (US)

- SOPHIM (France)

- Mibelle AG (Switzerland)

- OLVEA (France)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

Recent Developments

- In February 2025, Upcycled Foods, Inc. (UP, Inc.) partnered with Misfits Market to launch the retailer’s first line of upcycled breads under its Odds & Ends private label. Developed from scratch, the new product line offers consumers a sustainable, nutritious, and flavorful bread option, aligning with the rising demand for environmentally responsible food choices.

- In January 2025, UpSnack Brands expanded its sustainable snack portfolio through the acquisition of Pipcorn, known for its heirloom corn snacks, and Spudsy, a leading brand in upcycled sweet potato products. The move aims to enhance both brands’ market presence while reinforcing UpSnack’s commitment to sustainability in the snack industry.

- In July 2024, global specialty ingredients provider Barentz entered into a distribution partnership with CrushDynamics, a company focused on advanced fermentation technology and upcycled ingredients. This collaboration aims to expand market access for CrushDynamics’ sustainable ingredient solutions while strengthening Barentz’s portfolio in the upcycled and functional ingredients space.

- In June 2024, Apparo Inc. entered a joint development agreement with global natural ingredients provider Döhler to co-develop upcycled ingredients for the food and beverage market. This partnership aims to introduce innovative, sustainable ingredient solutions derived from food byproducts.

- In November 2023, Gudrun introduced its new Cacaofruit Bites, developed with a focus on upcycling to minimize waste streams. The launch reflects the company's commitment to sustainability by transforming cacao side streams into high-value ingredients, turning what is typically discarded into a flavorful and nutritious product.

Frequently Asked Questions (FAQ):

What is the current size of the upcycled ingredients market?

The upcycled ingredients control market is estimated at USD xx billion in 2025 and is projected to reach USD xx billion by 2030, at a CAGR of xx% during the same period.

Which are the key players in the market, and how intense is the competition?

Upcycled Foods, Inc. (US), Planetarians (US), NetZro (US), and ReGrained US).

The market for upcycled ingredients is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the upcycled ingredients market?

North America holds the largest share in the upcycled ingredients market due to its well-established food and beverage industry, strong consumer demand for sustainable and clean-label products, and advanced technological infrastructure. The region benefits from supportive regulatory frameworks and widespread adoption of circular economy initiatives aimed at reducing food waste. Additionally, numerous startups and major companies are actively innovating and investing in upcycled ingredient development, further driving market growth in North America.

What kind of information is provided in the company profiles section?

The company profiles provided deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to illustrate the company's potential better.

What are the factors driving the upcycled ingredients market?

Major factors driving the upcycled ingredients market include increasing consumer demand for sustainable products, growing food waste awareness, supportive regulations, technological advancements in food processing, and rising adoption of circular economy practices. .

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

-

1.3 STUDY SCOPEMARKET SEGMENTATIONINCLUSIONS & EXCLUSIONSREGIONS COVEREDYEARS CONSIDERED

-

1.4 UNIT CONSIDEREDCURRENCY/ VALUE UNITVOLUME UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

-

2.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key Primary Insights- Breakdown of Primary Interviews

-

2.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

-

2.4 RESEARCH ASSUMPTIONSASSUMPTIONS OF THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

-

5.3 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.4 IMPACT OF AI/GEN AI

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 TRADE ANALYSIS

-

6.4 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Technology 1- Technology 2COMPLEMENTARY TECHNOLOGY- Technology 1ADJACENT TECHNOLOGY- Technology 1

-

6.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY INGREDIENT TYPEAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY INGREDIENT TYPE

-

6.6 ECOSYSTEM ANALYSIS/ MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

-

6.8 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

-

6.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 7.1 INTRODUCTION

- 7.2 UPCYCLED STARCH

- 7.3 UPCYCLED PROTEINS/POWDER

- 7.4 UPCYCLED FLOUR

- 7.5 UPCYCLED DIETARY FIBER

- 7.6 UPCYCLED ETHANOL

- 7.7 UPCYCLED OILS

- 7.8 UPCYCLED VITAMINS

- 7.9 UPCYCLED ELECTROLYTES

- 7.10 UPCYCLED ANTIOXIDANTS

- 7.11 UPCYCLED MINERALS

- 8.1 INTRODUCTION

-

8.2 PLANT-BASEDFRUITS & VEGETABLESCEREALS & GRAINS

-

8.3 ANIMAL-BASEDDAIRY & EGGSMEAT & SEAFOOD

-

8.4 OTHER SOURCESUPCYCLED INGREDIENTS MARKET, BY END-USE

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGES

- 9.3 COSMETICS & PERSONAL CARE

- 9.4 NUTRACEUTICALS & DIETARY SUPPLEMENTS

- 9.5 ANIMAL FEED AND PET FOOD

- 9.6 OTHERS

-

10.1 NORTH AMERICA/USCANADAMEXICO

-

10.2 EUROPEGERMANYFRANCESPAINUKITALYREST OF EUROPE

-

10.3 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

10.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

10.5 REST OF THE WORLDAFRICAMIDDLE EAST

-

11.1 OVERVIEW

-

11.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

-

11.3 REVENUE ANALYSIS (2020 – 2024)

-

11.4 MARKET SHARE ANALYSIS, 2024

-

11.5 COMPANY VALUATION AND FINANCIAL METRICS

-

11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- Ingredient type Footprint- End Use Sector Footprint- Source Footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed list of key start-up/SMEs- Competitive benchmarking of key start-up/SMEs

-

11.9 COMPETITIVE SCENARIO AND TRENDSNEW PRODUCT LAUNCHESDEALSEXPANSIONSOTHERS

-

12.1 KEY PLAYERSUPCYCLED FOODS, INC.AGRIFIBER SOLUTIONS, LLCOUTCAST FOODSPLANETARIANSNETZRO, SBCKAFFE BUENOSUNOPTAAMERICAN RIVER AGCLARIANTECOVERTFAUNA & FLORA INTERNATIONALUPCIRCLEGIVAUDANSYMRISESEPPIC

-

12.2 OTHER PLAYERSBAKE ME HEALTHYÄIOCHIPPINRAHN AGLIGNOPURE GMBHP2 SCIENCE, INCSOPHIMMIBELLE AGOLVEABARRY CALLEBAUT

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Upcycled Ingredients Market