US Neonatal (Preterm) Infant Care Market (2010-2015)

‘Preterm’ birth, as the name suggests, means delivery before 37 weeks of gestation or 259 days. Preterm births form a serious pediatric health problem in the U.S., forming one of the leading causes of infant mortality in the country. Preterm births account for nearly 13% of all the births and 17% of all the infant deaths occurring in the nation and this phenomenon costs the country more than $25 billion annually. The condition is on an alarming rise due to factors such as labor treatments, induced fertility, poor prenatal care, inappropriate maternal age, obesity, and smoking. Preterm infant care products (equipment, drugs, and formulae) can thus be life-critical as they provide the respiratory, nutritional, and thermal support necessary for the survival of pre-term babies.

The U.S. Neonatal (Preterm) Infant Care Market is studied by Equipment/Products, Services, Drugs and Formula The U.S. preterm infant care market is expected to decline from $17.41 billion in 2010 to $14.85 billion in 2015, declining at an negative CAGR of -3.13% from 2010 to 2015. The services segment accounted for the largest share of the overall preterm infant care market at $15 billion in 2010. New product launches and technology upgradation are the two main strategies adopted by the players to stay competitive in this market.

The U.S. market for preterm care devices is mature and fragmented, with numerous players offering both basic and sophisticated equipments at affordable rates. However local manufacturers offer similar products at around $3,000 - $9,000. The availability of low-cost, locally manufactured devices is driving market growth, as these generate enormous revenues by widening consumer base to tier II and tier III healthcare providers.

However, the decreasing incidence of preterm births is the major factor inhibiting the growth of the U.S. market for preterm infant care products and services. Also, the U.S. government initiatives to lower preterm birth incidence rate are expected to significantly reduce the number of preterm births in the country. For instance, the government campaign “Healthy People 2010” aimed to reduce the country’s preterm birth rate from 12.7% in 2007 to 7.6% in 2010. According to the National Center for Health, 1 in 8 U.S. births are preterm and preterm birth rates in the U.S. have declined from 12.8% in 2006 to 12.3% in 2008.

Maturity of the market and the relatively high penetration levels of distribution channels pose high entry barriers and challenges to market growth. Therefore, companies such as Philips Respironics, Masimo Corporation, and Covidien are strengthening their regular distribution channels by deploying direct sales force and increasing technical support staff to stay competitive in this market.

Scope of the report

This research report categorizes the U.S. neonatal (preterm) infant care market (2010 – 2015) on the basis of preterm infant care services market, preterm infant care products market, preterm infant formula market, and preterm infant care drugs; forecasting revenues and analyzing trends in each of the following submarkets:

Preterm infant care equipment:

Diagnosis, Therapy and Monitoring

Preterm infant formula:

For use in hospitals, after discharge, iron fortified cow’s milk formulae, hydrolyzed whey based formulae, casein hydrolysate formulae, amino acid formulae

Preterm infant care drugs:

Antibiotics, Bronchodilators, Analgesics, Diuretics, Vassopressors, Hematologic Agents

Preterm infant care services market:

Diagnosis, Therapy and Monitoring

In addition to market data on the submarkets of the U.S. preterm infant care market, each section of the report will identify and analyze the market trends, opportunities, and the factors driving or inhibiting market growth. The report will also draw a competitive landscape, wherein it will profile the top 35 market players.

U.S. Neonatal (Preterm) Infant Care Market (2010 – 2015)

‘Preterm’ birth refers to delivery prior to 37 weeks of gestation or 259 days. This generally occurs due to poor prenatal care, high maternal age, induced fertility, labor treatments, and lifestyle choices such as obesity and smoking. The U.S. preterm infant care market is broadly classified under products and services. The products market covers the revenues generated from equipment sales, upgradation, replacement, and the sales of infant formulae and drugs. The services market consists of the revenues generated from diagnosis, therapy/monitoring, and the other services such as milk banking. The equipment segment of overall preterm infant care market covers respiratory assistance devices, delivery systems, thermal control equipment, monitoring and diagnostic devices, and bili lights. This market is relatively mature with numerous players offering both basic and sophisticated equipment at affordable costs. However, the sales of replacement units generate the most market revenues.

The U.S. preterm infant care market is expected to decline from $17.4 billion in 2010 to $14.85 billion in 2015 at a CAGR of -3.13% from 2010 to 2015. The major factor that affects the U.S. preterm infant care market is the preterm birth rate that is seen to be on a decline; thus the affecting the market.

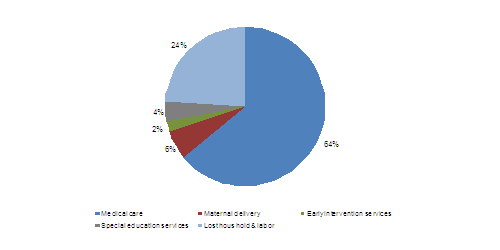

Preterm births not only incur the risk of infant mortality, but also have a high socioeconomic impact. On an average, infant care per preterm birth costs around $50,000; with medical expenses accounting for a major part of this sum. The lost labor hours (with respect to the parents of preterm infants) account for a quarter of the total expenditure involved in preterm infant care.

SOCIOECONOMIC COSTS

Source: MarketsandMarkets

The absence of diagnosis to detect the possibility of preterm birth increases the cost of delivery and accounts for about 6% of the total costs. The service market for preterm infant care includes the expenditures incurred due to the need for neonatal intensive care units (NICUs) with high-end medical equipment such as incubators, radiant warmers, and ventilators. The service market also includes inpatient diagnostic/monitoring and therapeutic services, medical services needed by preterm infants after discharge, and the developmental care services offered by healthcare providers.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKET ESTIMATES AND FORECASTS

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

2 SUMMARY

3 MARKET OVERVIEW

3.1 SOCIOECONOMIC IMPACT & COST ANALYSIS

3.2 DRIVERS

3.2.1 AVAILABILITY OF LOW-COST EQUIPMENT

3.2.2 GENETIC PREDISPOSITION

3.2.3 OBESITY, DIABETES, SMOKING

3.3 RESTRAINTS & OPPORTUNITIES

3.3.1 DECREASING INCIDENCE OF PRETERM BIRTHS

3.3.2 GOVERNMENT INITIATIVES

3.3.3 HIGH ENTRY BARRIERS

3.3.4 TECHNOLOGY DEVELOPMENTS IN PREVENTING PRETERM BIRTHS

3.4 NOVEL APPROACHES TO PRETERM INFANT CARE

3.4.1 DEVELOPMENTAL CARE

3.4.2 NEONATAL INFORMATION SYSTEMS

3.5 KEY FINDINGS

4 PRETERM INFANT CARE SERVICES MARKET

4.1 OVERVIEW

4.2 THERAPY & MONITORING SERVICES

4.3 DIAGNOSIS

5 U.S. PRETERM INFANT CARE, PRODUCTS MARKET

5.1 OVERVIEW

5.2 DELIVERY SYSTEMS

5.2.1 DRIVERS

5.2.1.1

5.2.2 RESTRAINTS

5.2.2.1

5.2.2.2

5.2.3 OPPORTUNITY

5.2.3.1

5.2.4 FEEDING TUBES

5.2.5 INTRAVENOUS LINES

5.2.6 UMBILICAL CATHETER

5.2.7 PERIPHERALLY INSERTED CENTRAL CATHETER LINE

5.3 BILI LIGHTS

5.4 RESPIRATORY ASSISTANCE DEVICES

5.4.1 DRIVERS

5.4.1.1

5.4.1.2

5.4.2 OPPORTUNITIES

5.4.2.1

5.4.2.2

5.5 THERMAL CONTROL EQUIPMENTS

5.5.1 DRIVERS

5.5.1.1

5.5.1.2

5.5.2 RESTRAINT

5.5.2.1

5.5.3 OPPORTUNITY

5.5.3.1

5.6 MONITORING DEVICES

5.6.1 DRIVERS

5.6.1.1

5.6.1.2

5.6.2 RESTRAINTS

5.6.2.1

5.6.3 OPPORTUNITY

5.6.3.1

5.6.3.2

5.7 DIAGNOSTIC EQUIPMENT

5.7.1 DRIVERS

5.7.1.1

5.7.2 RESTRAINTS

5.7.2.1

5.7.2.2

5.7.3 OPPORTUNITY

5.7.3.1

5.7.4 IMAGING EQUIPMENT

5.8 PRE TERM INFANT FORMULA

5.9 CHANGING TRENDS IN THE PRETERM INFANT FORMULA INDUSTRY

5.10 PRETERM FORMULAS FOR USE IN HOSPITALS

5.11 PRETERM FOLLOW-UP FORMULAS AFTER DISCHARGE

5.12 DRUGS

6 COMPETITIVE LANDSCAPE

6.1 OVERVIEW

7 GEOGRAPHIC ANALYSIS

7.1 OVERVIEW

7.2 OPPORTUNITIES

7.3 MISSISSIPPI

7.3.1 QUICK FACTS

7.3.2 RISK FACTOR ANALYSIS

7.4 ALABAMA

7.4.1 QUICK FACTS

7.4.2 RISK FACTOR ANALYSIS

7.5 DISTRICT OF COLUMBIA

7.5.1 QUICK FACTS

7.5.2 RISK FACTOR ANALYSIS

7.6 LOUISIANA

7.6.1 QUICK FACTS

7.6.2 RISK FACTOR ANALYSIS

7.7 KENTUCKY

7.7.1 QUICK FACTS

7.7.2 RISK FACTOR ANALYSIS

7.8 SOUTH CAROLINA

7.8.1 RISK FACTOR ANALYSIS

7.9 TENNESSEE

7.9.1 RISK FACTOR ANALYSIS

7.10 NEVADA

7.10.1 RISK FACTOR ANALYSIS

7.11 NEW MEXICO

7.11.1 RISK FACTOR ANALYSIS

7.12 GEORGIA

7.12.1 RISK FACTOR ANALYSIS

7.13 WEST VIRGINIA

7.13.1 RISK FACTOR ANALYSIS

7.14 OKLAHOMA

7.14.1 RISK FACTOR ANALYSIS

7.15 FLORIDA

7.15.1 RISK FACTOR ANALYSIS

7.16 TEXAS

7.16.1 RISK FACTOR ANALYSIS

7.17 ARKANSAS

7.17.1 RISK FACTOR ANALYSIS

7.18 CALIFORNIA

7.18.1 RISK FACTOR ANALYSIS

7.19 NEW YORK

7.19.1 RISK FACTOR ANALYSIS

7.20 OHIO

7.20.1 RISK FACTOR ANALYSIS

7.21 ILLINOIS

7.21.1 RISK FACTOR ANALYSIS

7.22 PENNSYLVANIA

7.22.1 RISK FACTOR ANALYSIS

8 PATENT ANALYSIS

8.1 PATENT ANALYSIS BY ASSIGNEE

8.2 PATENT ANALYSIS BY PRODUCTS

8.3 PATENT ANALYSIS BY EQUIPMENT

9 COMPANY PROFILES

9.1 ABBOTT NUTRITION

9.2 ANALOGIC CORP

9.3 ATOM MEDICAL INTERNATIONAL CORP.

9.4 ARJOHUNTLEIGH

9.5 CAREFUSION INC

9.6 CAS MEDICAL SYSTEMS INC

9.7 CHILDREN'S HOSPITAL OF PHILADELPHIA

9.8 CHILDREN'S NATIONAL MEDICAL CENTER

9.9 CLINICAL INNOVATIONS

9.10 COVIDIEN LTD.

9.11 CRITICARE SYSTEMS, INC.

9.12 DRAEGERWERK AG & CO. KGAA

9.13 EDAN INSTRUMENTS, INC

9.14 FISHER & PAYKEL HEALTHCARE CORP.

9.15 FUKUDA DENSHI CO. LTD.

9.16 GE HEALTHCARE

9.17 HAMILTON MEDICAL AG

9.18 KCBIOMEDIX, INC

9.19 MASIMO CORP.

9.20 MEAD JOHNSON NUTRITION CO

9.21 MEDELA INC.

9.22 MEDIX I.C.S.A

9.23 NATUS MEDICAL INC.

9.24 NESTLE NUTRITION

9.25 NEWYORK-PRESBYTERIAN MORGAN STANLEY CHILDREN'S HOSPITAL

9.26 NIHON KOHDEN CORP.

9.27 NONIN MEDICAL INC.

9.28 ORIDION SYSTEMS LTD

9.29 PEDIATRIX MEDICAL GROUP

9.30 PHOENIX MEDICAL SYSTEMS PVT LTD

9.31 PHILIPS RESPIRONICS INC

9.32 SPACELABS MEDICAL, INC

9.33 UTAH MEDICAL PRODUCTS, INC.

9.34 WELCH ALLYN INC.

9.35 WYETH NUTRITION CORP

APPENDIX

PATENTS

LIST OF TABLES

1 U.S. PRETERM INFANT CARE MARKET, 2007 – 2015 ($MILLION)

2 U.S. PRETERM INFANT CARE MARKET, BY SEGMENTS 2007 – 2015 ($MILLION)

3 U.S. PRETERM INFANT CARE SERVICES MARKET, 2007 – 2015 ($MILLION)

4 U.S. PRETERM INFANT CARE EQUIPMENT MARKET, BY SEGMENTS 2007 – 2015 ($MILLION)

5 U.S. PRETERM INFANT CARE THERAPY & MONITORING EQUIPMENT MARKET, 2007 – 2015 ($MILLION)

6 PREMATURE DIAGNOSTIC DEVICES

7 THERMAL CONTROL DEVICES

8 MONITORING DEVICES

9 DIAGNOSTIC EQUIPMENT

10 U.S. PRETERM INFANT FORMULA MARKET, BY PRODUCTS 2007 – 2015 ($MILLIONS)

11 AGREEMENTS & COLLABORATIONS IN THE PRETERM INFANT CARE MARKET (2007 – 2009)

12 NEW PRODUCT LAUNCHES IN THE PRETERM INFANT CARE MARKET (2007 – 2009)

13 MERGERS & ACQUISITIONS IN THE PRETERM INFANT CARE MARKET (2006 – 2009)

14 PRETERM BIRTH RATE IN ETHNICITIES - MISSISSIPPI

15 PRETERM BIRTH RATE IN ETHNICITIES - ALABAMA

16 PRETERM BIRTH RATE IN ETHNICITIES - DISTRICT OF COLUMBIA

17 PRETERM BIRTH RATE IN ETHNICITIES - LOUISIANA

18 PRETERM BIRTH RATE IN ETHNICITIES - KENTUCKY

19 PRETERM BIRTH RATE IN ETHNICITIES - SOUTH CAROLINA

20 PRETERM BIRTH RATE IN ETHNICITIES - TENNESSEE

21 PRETERM BIRTH RATE IN ETHNICITIES - NEVADA

22 PRETERM BIRTH RATE IN ETHNICITIES - NEW MEXICO

23 PRETERM BIRTH RATE IN ETHNICITIES - GEORGIA

24 PRETERM BIRTH RATE IN ETHNICITIES - WEST VIRGINIA

25 PRETERM BIRTH RATE IN ETHNICITIES - OKLAHOMA

26 PRETERM BIRTH RATE IN ETHNICITIES - FLORIDA

27 PRETERM BIRTH RATE IN ETHNICITIES - TEXAS

28 PRETERM BIRTH RATE IN ETHNICITIES - ARKANSAS

29 PRETERM BIRTH RATE IN ETHNICITIES - CALIFORNIA

30 PRETERM BIRTH RATE IN ETHNICITIES - NEW YORK

31 PRETERM BIRTH RATE IN ETHNICITIES - OHIO

32 PRETERM BIRTH RATE IN ETHNICITIES - ILLINOIS

33 PRETERM BIRTH RATE IN ETHNICITIES - PENNSYLVANIA

LIST OF FIGURES

1 CURRENT PRETERM BIRTH RATE IN THE U.S.

2 SOCIOECONOMIC COSTS

3 DECREASING RATES OF PRETERM BIRTHS IN THE U.S.

4 DEVELOPMENTAL CARE

5 UTILIZATION RATES OF RESPIRATORY ASSISTANCE DEVICES IN PRETERM INFANT CARE

6 TECHNOLOGY TRENDS IN THE RESPIRATORY ASSISTANCE DEVICES MARKET

7 PERCENT UTILIZATION RATES OF THERMAL CONTROL EQUIPMENT

8 TECHNOLOGY TRENDS IN THE MONITORING DEVICES MARKET

9 TECHNOLOGY DEVELOPMENT IN THE DIAGNOSTIC EQUIPMENT MARKET

10 UTILIZATION RATES OF DIAGNOSTIC EQUIPMENT IN PRETERM INFANT CARE

11 PRODUCT DEVELOPMENT IN THE PRETERM INFANT CARE MARKET

12 PRODUCT DEVELOPMENTS IN MEDICAL DEVICES

13 NEW PRODUCT LAUNCHES

14 AGREEMENTS AND COLLABORATIONS

15 PRETERM BIRTH RATES, BY STATES

16 PATENT ANALYSIS, BY ASSIGNEE (2000 – 2009)

17 PATENTS ANALYSIS, BY PRODUCTS (2000 – 2009)

18 PATENTS ANALYSIS, BY EQUIPMENT (2000 – 2009)

19 PATENT ANALYSIS, BY THERAPY & MONITORING EQUIPMENT (2000 – 2009)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in US Neonatal (Preterm) Infant Care Market