Veterinary Sutures Market - Global Forecast to 2030

The Global Veterinary Sutures Market is projected to grow exponentially by 2032, growing at a high CAGR from 2024 to 2032. Growth in the market can be attributed to factors such as the rising incidences of veterinary surgeries, along with growing awareness of animal health. Growing demand for pet insurances and rising animal health expenditures are also contributing to this trend. However, the rising pet care costs may pose a significant challenge to the veterinary sutures market's expansion. Moreover, as the number of pets is increasing among individuals for companionships, the need for veterinary care and surgical treatments will also rise.

Driver: Increasing incidences of veterinary surgeries

The increasing incidences of surgeries in pets is one of the key factors driving the growth of the veterinary sutures market. Pet owners are seeking advanced veterinary care for their animals. Because of this, veterinary practices like spaying and neutering, orthopedic surgeries, tumor removals, and the management of wounds are becoming very common treatments. For instance, as per the Mars State of Pet Homelessness Report (2024) for the United States, 74% of the 94.7 million owned dogs and 77% of the 91.8 million owned cats have been spayed or neutered. This increase in surgical procedures directly demands the use of the veterinary sutures required for wound closure and tissue repair in animals. Moreover, the growing awareness of pet health and wellness, has also increased the consumption of sutures for various tissues and healing needs. According to the APPA, the veterinary care and product sales segment accounted for USD 39.1 billion in 2024.

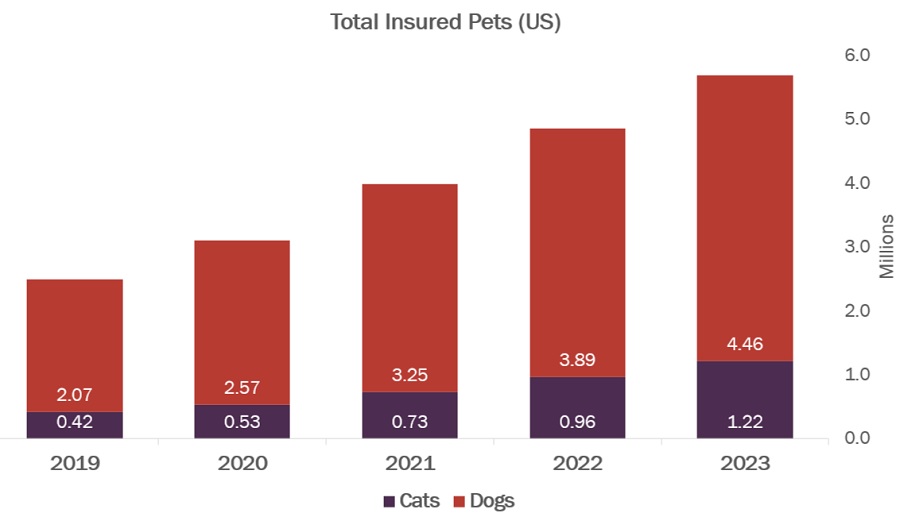

Furthermore, the increasing expenditure by pet owners is on rise. As many pets have started suffering because of conditions like broken bones, ligament tears, and gastrointestinal disorders, the reliance on veterinary care and treatments has increased, thereby fueling the market growth. Additionally, the increased penetration by pet insurance companies has further made veterinary procedures more affordable and accessible for pet owners. This further increases the demand for advanced veterinary sutures. Therefore, as the pet surgeries are on rise, the veterinary sutures market will continue to grow, worldwide.

Restraint: Rising pet care costs

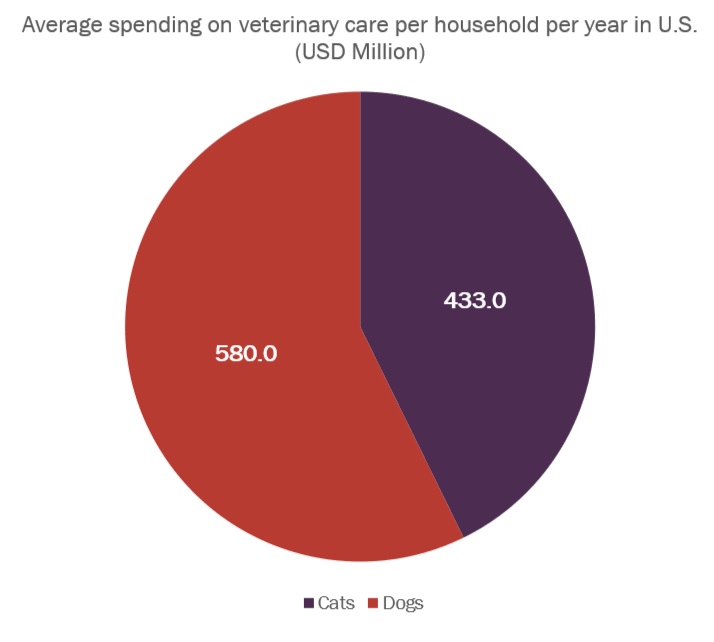

The cost of pet care has been steadily rising, presenting a growing financial challenge for pet owners worldwide. Several factors contribute to this trend. Advances in veterinary suture materials and technology have expanded the range of available treatments, offering pets a level of healthcare previously reserved for humans. While these advancements improve outcomes, they also come with higher costs. For instance, according to the American Veterinary Medical Association (AVMA), the average annual spending on pets (excluding adoption or purchase costs) was USD 1,515 in 2023 and USD 1,516 in 2024. Dog owners spent over USD 1,700 annually on average, and cat owners spent under USD 1,350 annually. Thus, veterinary expenses accounted for about one-third of total pet spending, while the remaining two-thirds were allocated to food, medication, and other non-veterinary costs. Moreover, as pets are increasingly viewed as family members, there is a greater willingness among owners to invest in premium services and products, further driving up costs. Also, high pet care costs directly impact the number of visits by pet owners to veterinary facilities, thereby restraining the growth of this market.

Opportunity: Growing demand for pet insurance and rising animal health expenditure

The spending on pet healthcare including pet food, supplies/over-the-counter medications, veterinary care, pet insurance policies, and other services has increased significantly in recent years. Many pet owners, especially in major markets across North America and Europe, are purchasing pet insurance because of the significant growth in pet care expenditure in recent years. Moreover, the adoption of pet insurance is also on the rise as insurance helps pet owners manage preventive care, acute and chronic illnesses, and emergency medical care costs for their respective pets. As pets are increasingly viewed as family members, their healthcare is becoming a priority for pet owners. This shift toward more comprehensive and preventive care, including regular veterinary visits and treatments has led to a substantial increase in spending on pet healthcare.

Moreover, in emerging countries such as India and China, the pet insurance industry is in the nascent stage. The increasing disposable incomes and rising pet expenditure are expected to increase the adoption of pet insurance policies and support the veterinary health industry. All these factors are propelling the growth and demand of veterinary sutures market.

Challenge: Limited number of veterinarians in developing countries

A major challenge to the growth of the veterinary sutures market is the scarcity of qualified veterinarians in emerging markets. In the Asia Pacific and Latin American regions, a lack of veterinary professionals severely limits acceptability to quality veterinary care, which is a major factor in the adoption of veterinary sutures. For instance, by 2030, the U.S. will require 41,000 veterinarians to meet pet care demands, but the profession is projected to face a shortfall of 15,000, according to a study by Mars Veterinary Health. This gap in the workforce limits the usage of veterinary infrastructure, which leads to delayed diagnoses and treatment of companion animals. Therefore, any shortage or limitations of veterinary practitioners directly affects animal healthcare, thereby hampering the growth of the market.

This study involves the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2032 |

|

Base year considered |

2024 |

|

Forecast period |

2025–2032 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type, Suture Structure, Material, and Application |

|

Geographies covered |

North America (US & Canada), Europe (Germany, the UK, France, Italy, Spain, and RoE), APAC (Japan, China, Australia, South Korea, India, and the RoAPAC), LATAM (Brazil, Mexico, and RoLATAM), and MEA (GCC Countries, and RoMEA) |

|

Companies covered |

Ethicon, Medtronic, B. Braun SE, Vitrex Medical A/S, AIP Medical SA, KATSAN Katgüt Sanayi VE Tic. A.S., Amerisourcebergen Corporation, Unisur Lifecare, Orion Sutures, Lotus Surgicals Pvt Ltd, CP Medical, Vetersut, Neogen Corporation, and Jorgen Kruuse A/S |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

7 VETERINARY SUTURES MARKET, BY Suture Structure, 2023 - 2030 (USD MILLION)

7.1 INTRODUCTION

7.2 FILAMENT SUTURES

7.2.1 MONOFILAMENT SUTURES

7.2.2 MULTI-FILAMENT SUTURES

7.3 BRAIDED SUTURES

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Centres for Disease Control and Prevention (CDC), American Veterinary Medical Association (AVMA), Animal Health Institute (AHI), National Animal Health Laboratory Network (NAHLN) And Food and Agriculture Organization of the United Nations (FAO)were referred to identify and collect information for the global veterinary sutures market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the veterinary sutures market. The primary sources from the demand side include hospitals & clinics, physiotherapy clinics and home care settings. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

Market Estimation Methodology

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global veterinary sutures market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 70-75% of the market share at the global level). Also, the global veterinary sutures market was split into various segments based on:

- List of major players operating in the veterinary sutures market at the regional and/or country level

- Mapping of annual revenue generated by listed major players from veterinary sutures (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 70-75% of the global market share as of 2023

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global veterinary sutures market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-Up approach & Top-down approach)

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the global veterinary sutures market through the above-mentioned methodology, this market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Report Objectives

- To define, measure, and describe the global veterinary sutures market by type, suture structure, application, material, and end user

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze the regulatory scenario, pricing, value chain analysis, supply chain analysis, ecosystem analysis, technology analysis, Porter’s Five Forces analysis, pipeline analysis, and patent analysis

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure, profile the key players in the global veterinary suture market, and comprehensively analyze their core competencies

- To track and analyze company developments such as mergers and acquisitions, partnerships, expansions, and product launches and approvals in the veterinary suture market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Europe veterinary suture market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific veterinary suture market into Taiwan, and others

- Further breakdown of the Rest of Latin America veterinary suture market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia veterinary suture market into Malaysia, Singapore, Australia, and others

COMPETITIVE LANDSCAPE ASSESSMENT

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3-5 key players in the veterinary suture market

- Competitive leadership mapping for established players in the US

Recent Developments

- In July 2024, CP Medical (Georgia), a leading manufacturer of medical sutures and a subsidiary of Theragenics Corporation, has been acquired by Riverpoint Medical. CP Medical specializes in surgical and wound closure products, primarily serving the veterinary market with some distribution in dental and dermatology. Riverpoint Medical, backed by Arlington Capital Partners, focuses on regenerative technologies and advanced surgical fiber solutions.

- In August 2024, Dolphin Sutures (India) expanded its veterinary product portfolio with two innovative solutions: fluorescent sutures and cassette sutures. These advancements reinforce Dolphin Sutures’ commitment to empowering veterinary professionals with cutting-edge surgical solutions for optimal animal care.

- In August 2024, CASCO Pet (UK) announced an exclusive U.S. distribution agreement with MWI Animal Health (US) for its WELLKennels product range. This partnership aimed to enhance CASCO Pet’s presence in the veterinary market by improving pet accommodation solutions.

Growth opportunities and latent adjacency in Veterinary Sutures Market