Wastewater Reverse Osmosis Membrane Market by Type (Cellulose Acetate, Thin Film Composite), Application (Residential,Commercial, Industrial), And Region (North America, Europe, APAC, South America, Middle East & Africa) - Global Forecast to 2028

Updated on : March 20, 2024

Wastewater Reverse Osmosis Market

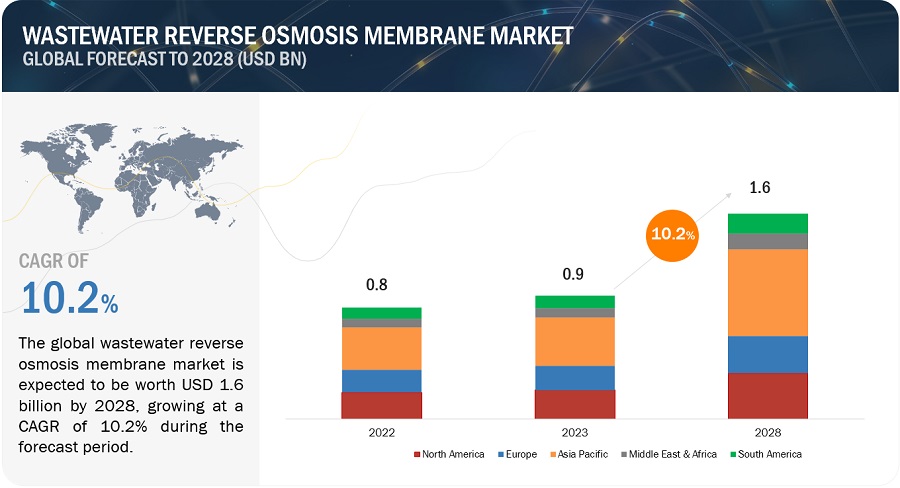

The global wastewater reverse osmosis membrane market was valued at USD 0.9 billion in 2023 and is projected to reach USD 1.6 billion by 2028, growing at 10.2% cagr from 2023 to 2028. The wastewater reverse osmosis membrane market is projected to grow significantly in the coming years. RO is a highly effective and versatile technology for removing a wide range of contaminants from water, making it particularly well-suited for treating wastewater from various industrial and municipal sources. The increasing awareness of water scarcity and the need for sustainable water management practices have led to a growing emphasis on recycling and reusing wastewater.

Global Wastewater Reverse Osmosis Membrane Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Wastewater Reverse Osmosis Membrane Market Dynamics

Driver: Rapid decline of freshwater resources

As traditional freshwater sources face depletion due to factors such as population growth, industrialization, and climate change, there is a growing urgency to find alternative water supplies. In response to this scarcity, there has been a paradigm shift towards the sustainable management of water resources, with a particular emphasis on recycling and reusing wastewater. Industries, agriculture, and municipalities are increasingly turning to RO as a solution to alleviate the stress on freshwater sources. By treating wastewater through RO processes, not only are valuable water resources recovered, but the environmental impact of discharging untreated or poorly treated wastewater is also minimized. The technology's efficiency, coupled with advancements in membrane technology and system design, makes RO a practical and cost-effective option for addressing water scarcity challenges.

Restraint: Fouling in RO membrane

Fouling in RO membranes is a critical phenomenon that can significantly impact the efficiency and effectiveness of water treatment processes. It occurs when unwanted substances accumulate on the surface of RO membranes, impeding their performance and diminishing overall efficiency. Fouling occurs in both cellulose-based and thin film composite membranes. The multifaceted nature of fouling encompasses various types, with particulate fouling, scaling, organic fouling, and biological fouling being primary culprits.

Opportunity: Increasing demand for water treatment due to rapid industrialization and urbanization

Rapid population growth, urbanization, and expanding industrial activities generate an unprecedented volume of wastewater that necessitates sophisticated treatment solutions. RO, renowned for its efficacy in removing diverse contaminants, has become pivotal in addressing stringent environmental standards and regulations. Additionally, the growing awareness of water scarcity, coupled with climate change concerns, underscores the urgency to optimize water usage and embrace sustainable practices. Ongoing advancements in RO technology, including improvements in membrane materials, energy efficiency, and system design, enhance the effectiveness and cost-efficiency of the process. This makes RO more attractive for a broader range of applications.

Challenges: Dense brine disposal

Brine disposal is a critical aspect of reverse osmosis (RO) in wastewater treatment, as it deals with the concentrated reject stream generated during the RO process. In reverse osmosis, water is pushed through a semi-permeable membrane to remove impurities, but not all water molecules pass through the membrane. The rejected contaminants, along with a concentrated solution of dissolved salts and other substances, form what is known as brine. Managing and disposing of this brine is a significant challenge in the wastewater treatment process. The challenge lies in effectively dealing with this concentrated solution, as improper disposal can have detrimental effects on the environment. One significant concern is the impact on aquatic ecosystems when brine is directly discharged into water bodies. The elevated salinity levels can disrupt the balance of these ecosystems, potentially harming marine life and altering the quality of surrounding soil and vegetation if used for irrigation.

Wastewater Reverse Osmosis Membrane Market Ecosystem

By type, Thin film composite segment will be the fastest growing segment in the wastewater reverse osmosis membrane market during forecast preiod.

The increasing prominence of Thin Film Composite (TFC) membranes in reverse osmosis (RO) reflects a paradigm shift in membrane technology for water treatment. TFC membranes, characterized by a layered structure comprising a robust support layer and a thin polyamide barrier layer, have witnessed growing adoption due to their enhanced performance and versatility. Their design ensures higher salt rejection and improved permeability, making them particularly effective in desalination processes and water purification applications. The reduced susceptibility to fouling and scaling, coupled with enhanced durability, has positioned TFC membranes as a preferred choice in addressing water treatment challenges.

By application, Residential segment will be the third fastest growing segment in the wastewater reverse osmosis membrane market during forecast preiod.

RO membranes, particularly designed for residential applications, play a crucial role in purifying wastewater by using a semi-permeable barrier to separate contaminants from water molecules. The growth of RO membranes in this context can be attributed to their efficiency in removing a wide range of impurities, including salts, bacteria, and pollutants, resulting in high-quality treated water. This technology is especially relevant for households seeking sustainable and independent water solutions, as it allows for the reclamation of water resources that might otherwise be wasted. As the demand for reliable and efficient residential wastewater treatment options continues to rise, the development and adoption of RO membranes are expected to play a pivotal role in addressing water scarcity challenges at the household level.

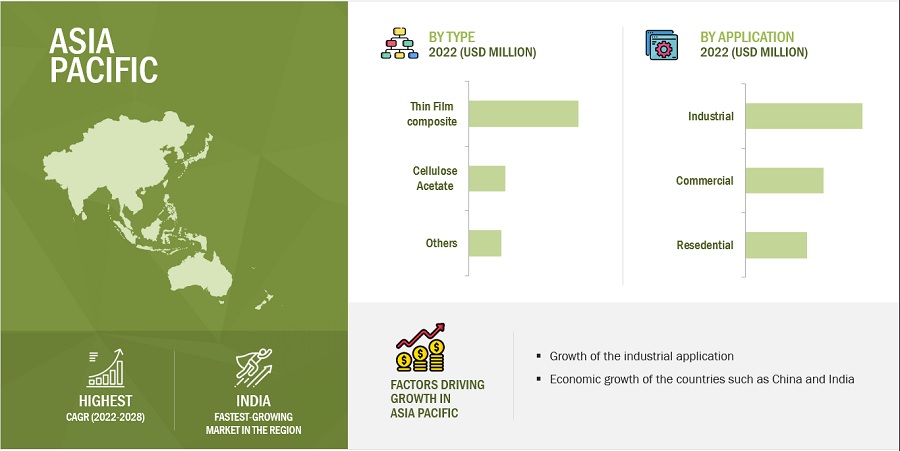

Asia Pacific is projected to be fastest growing amongst other regions in the wastewater reverse osmosis membrane market in terms of value.

The rapid industrialization and urbanization in countries across Asia have resulted in a heightened demand for efficient wastewater treatment solutions. RO membranes, known for their high efficiency in removing contaminants and producing high-quality treated water, have become a preferred technology to address the diverse and complex composition of wastewater in the region. As governments and industries in the Asia-Pacific region increasingly prioritize water quality and environmental sustainability, the cost-effectiveness and reliability of RO membranes make them a compelling choice for wastewater treatment projects.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players operating in the wastewater reverse osmosis membrane market include DuPont (US), Toray Industries, Inc. (Japan), Veolia (France), Alfa Laval (Sweden), LG Chem (South Korea), Hydranautics (US), KOCH Separation Solutions (US), Mann + Hummel Water & Fluid Solutions GmbH (Germany), Membranium (Russia), and Toyobo Co. Ltd (Japan) among others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for reverse osmosis membrane in wastewater treatment from emerging economies.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Million Square Meter) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DuPont Water Solutions (US), Toray Industries, Inc. (Japan), Veolia (France), Alfa Laval (Sweden), LG Chem (South Korea), Hydranautics (US), KOCH Separation Solutions (US), Mann + Hummel Water & Fluid Solutions GmbH (Germany), Membranium (Russia), and Toyobo Co. Ltd (Japan) among others. |

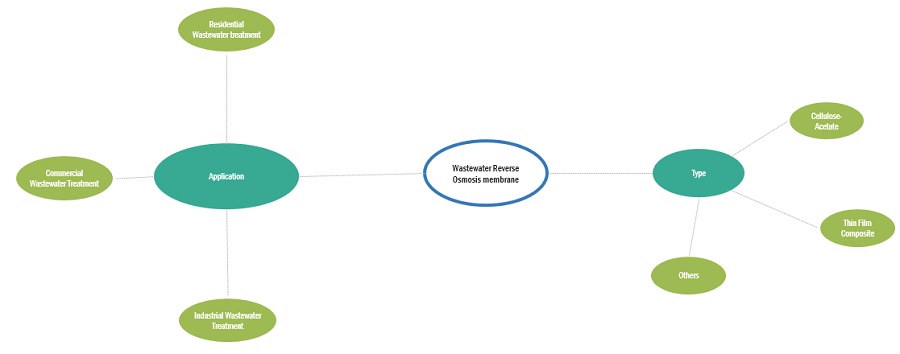

This report categorizes the global wastewater reverse osmosis market based on type, module, application, and region.

On the basis of type, the wastewater reverse osmosis market has been segmented as follows:

- Cellulose Acetate

- Thin Film Composite

- Others

On the basis of application, the wastewater reverse osmosis market has been segmented as follows:

- Residential wastewater treatment

- Commercial wastewater treatment

- Industrial wastewater treatment

On the basis of region, the wastewater reverse osmosis market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The wastewater reverse osmosis market has been further analyzed based on key countries in each of these regions.

Recent Developments

- .In September 2023, LG Chem has opened its first coustmer solution center in Europe. This has helped company to expands and strengthen its presence in Europe.

- In June 2023, Veolia has broadened its fleet of mobile water services in China, encompassing reverse osmosis, ultrafiltration, nanofiltration, and deionization units. This expansion positions the company to serve diverse industries and provide customers with mobile water treatment technologies and expertise at any time and location.

- In January 2023, Koch Separation Solutions (KSS) collaborated with Aqana to provide anaerobic wastewater treatment technology to industrial clients in North America. This strategic partnership has enhanced the company's product portfolio for industrial wastewater treatment.

- In July 2022, Toray Industries, Inc. recently expanded its wastewater treatment plant in China, located in Baoding, Hebei Province. This state-of-the-art facility is one of the largest in China and specializes in manufacturing hollow fiber ultrafiltration membrane modules. With a daily treatment capacity of 315,000 cubic meters, it has significantly contributed to the company's ability to deliver cutting-edge technology and water treatment membrane products of the highest quality.

- In December 2021, DuPont has joined forces with Water.org, a non-profit organization dedicated to providing innovative solutions that eliminate financial obstacles for individuals in poverty to access safe water and sanitation. This collaboration has played a crucial role in expanding global access to safe water, particularly in communities that are most susceptible to the impacts of water scarcity. By combining DuPont's technical expertise in water filtration and purification solutions with Water.org's proficiency in pioneering market-driven financial solutions for the global water crisis, the partnership has made significant strides in addressing water challenges around the world.

Frequently Asked Questions (FAQ):

What is the current size of the global wastewater reverse osmosis membrane market?

The global wastewater reverse osmosis membrane market size is estimated to reach USD 1.6 billion by 2028 from USD 0.9 billion in 2023, at a CAGR of 9.9% during the forecast period.

Who are the winners in the global wastewater reverse osmosis membrane market?

Companies such as include DuPont (US), Toray Industries, Inc. (Japan), Veolia (France), Alfa Laval (Sweden), LG Chem (South Korea), Hydranautics (US), KOCH Separation Solutions (US), Mann + Hummel Water & Fluid Solutions GmbH (Germany), Membranium (Russia), and Toyobo Co. Ltd (Japan)among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Stringent regulatory and sustainability mandates for protecting the environment, Rapid Declinne of freshwater resources.

What are the various types of RO membranes for wastewater treatment?

Cellulose acetate and Thin film composite are the major types of RO membranes.

What are the various application of RO membranes for wastewater treatment?

Residential, Commercial, Industrial wastewater treatment are the major applications of RO membranes .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapid decline of freshwater resources- Stringent regulatory and sustainability mandates for environmental protection- Increasing public awareness about wastewater treatmentRESTRAINTS- Fouling in RO membrane- High operational pressure in wastewater RO processOPPORTUNITIES- Increased demand for water treatment due to industrialization and urbanization- Increasing awareness for water reuse and recyclingCHALLENGES- Dense brine disposal- High energy consumption

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TRENDS, BY REGIONAVERAGE SELLING PRICE TRENDS, BY TYPE

-

6.5 RAW MATERIAL ANALYSISPOLYAMIDEPOLYSULFONE & POLYETHERSULFONECELLULOSE ACETATE

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS (2012–2022)INSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

6.7 ECOSYSTEM/MARKET MAP

- 6.8 TECHNOLOGY ANALYSIS

-

6.9 TARIFF AND REGULATORY LANDSCAPEREGULATIONSNORTH AMERICA- Clean Water Act (CWA)- Safe Drinking Water Act (SDWA)EUROPE- The Urban Wastewater Treatment Directive (1991)- The Drinking Water Directive (1998)- The Water Framework Directive (2000)ASIA PACIFIC- CHINA- India- JapanSTANDARDS- NSF/ANSI Standard 58- ASTM D4195- ISO 9001- Water Reuse GuidelinesREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.10 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

6.11 CASE STUDY ANALYSISDUPONT RO MEMBRANE FOR CALIFORNIA WASTEWATER TREATMENTSEAWATER DESALINATION USING TORAY'S RO MEMBRANES TO SUPPORT ALMERÍA'S THRIVING AGRICULTURAL ECONOMY

-

6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- 6.13 KEY CONFERENCES & EVENTS, 2023–2024

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS- Municipalities and water utilities- Industrial users- Engineering and consulting firms- Environmental agencies- Contractors and installers- RO membrane manufacturers- R&D entities- End-users and facility operators- Financiers and procurement managers- Third-party testing and certification organizationsBUYING CRITERIA- Quality- Service

-

6.15 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

- 7.1 INTRODUCTION

-

7.2 THIN-FILM COMPOSITE MEMBRANESIDEAL FOR PURIFICATION OF FEED STREAMS CONTAINING DISSOLVED CONTAMINANTS

-

7.3 CELLULOSE ACETATE MEMBRANESOLDEST FORM OF RO MEMBRANE USED COMMERCIALLY

- 7.4 OTHER MATERIAL TYPES

- 8.1 INTRODUCTION

-

8.2 INDUSTRIAL WASTEWATER TREATMENTRAPID INDUSTRIALIZATION IN EMERGING COUNTRIES TO DRIVE MARKET

-

8.3 COMMERCIAL WASTEWATER TREATMENTWATER REUSE INITIATIVES AND SUSTAINABLE PRACTICES TO SUPPORT MARKET GROWTH

-

8.4 RESIDENTIAL WASTEWATER TREATMENTINCREASING NEED FOR TREATED WATER TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICIMPACT OF RECESSIONCHINA- Increasing awareness of wastewater treatment to drive marketJAPAN- Development of advanced technologies to support market growthINDIA- Increasing awareness of water and wastewater treatment to propel marketSOUTH KOREA- Increasing laws and regulations for water treatment to drive marketAUSTRALIA- Construction of new water infrastructure to support market growthREST OF ASIA PACIFIC

-

9.3 EUROPEIMPACT OF RECESSIONGERMANY- Presence of well-developed sewage water treatment infrastructure to propel marketUK- Growing demand for treated water in commercial, domestic, and municipality segments to drive marketFRANCE- Advancements in water treatment infrastructure to support market growthITALY- Increasing investments in wastewater treatment to propel marketSPAIN- Population growth and industrialization to drive marketNETHERLANDS- Well-organized system of water supply and sewage collection & treatment to support market growthBELGIUM- Growing urban wastewater discharge to significantly impact water qualityREST OF EUROPE

-

9.4 NORTH AMERICAIMPACT OF RECESSIONUS- Growing focus on various plans and initiatives related to wastewater treatment to drive growthCANADA- Strong state-level and national-level municipal regulations to boost marketMEXICO- Government initiatives and growth in manufacturing sector to support market growth

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONSAUDI ARABIA- Large network of desalination projects to favor market growthUAE- Improving wastewater treatment infrastructure to fuel growthSOUTH AFRICA- Growing demand for freshwater and R&D in desalination to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICAIMPACT OF RECESSIONBRAZIL- High demand for safe drinking water to boost marketARGENTINA- Increasing foreign investments to boost market developmentREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS

-

10.4 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS- DuPont- Hydranautics- Toray Industries- LG Chem- VeoliaMARKET SHARE OF KEY PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY COMPANIESDUPONT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHYDRANAUTICS (NITTO DENKO GROUP COMPANY)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLG CHEM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVEOLIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALFA LAVAL- Business overview- Products/Solutions/Services offered- Recent developmentsKOCH SEPARATION SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsMANN+HUMMEL WATER & FLUID SOLUTIONS GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsMEMBRANIUM (RM NANOTECH)- Business overview- Products/Solutions/Services offered- Recent developmentsTOYOBO CO. LTD.- Business overview- Products/Solutions/Services offeredGEA GROUP- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSAPPLIED MEMBRANES, INC.AXEON WATER TECHNOLOGIESHYDRAMEMHUNAN KEENSEN TECHNOLOGY CO., LTD.LENNTECH B.V.MERCK KGAAMEMBRACON (UK) LTD.OSMOTECH MEMBRANES PVT. LTD.PALL CORPORATIONPARKER HANNIFIN CORPORATIONPERMIONICSSHANGHAI RECSUN MEMBRANCE TECHNOLOGY CO., LTD.VONTRON TECHNOLOGY CO., LTD.AQUAPORIN A/SWATTS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PATENT SCENARIO

- TABLE 2 LIST OF PATENTS BY KURITA WATER INDUSTRIES LTD., 2020–2022

- TABLE 3 LIST OF PATENTS BY MASSACHUSETTS INSTITUTE OF TECHNOLOGY, 2020–2022

- TABLE 4 LIST OF PATENTS BY ECOLAB USA INC., 2020–2021

- TABLE 5 US: TOP 10 PATENT OWNERS, 2012–2022

- TABLE 6 ROLE IN ECOSYSTEM: WASTEWATER RO MEMBRANES MARKET

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REGION-WISE IMPORT TRADE, 2018–2022 (USD MILLION)

- TABLE 11 REGION-WISE EXPORT TRADE, 2018–2022 (USD MILLION)

- TABLE 12 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 13 TRENDS OF PER CAPITA GDP (USD), 2020–2022

- TABLE 14 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023–2027

- TABLE 15 WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 16 WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 17 WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 18 WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 19 WASTEWATER RO MEMBRANES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 WASTEWATER RO MEMBRANES MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 21 ASIA PACIFIC WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 23 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 25 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 27 CHINA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 28 CHINA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 29 JAPAN: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 30 JAPAN: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 31 INDIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 32 INDIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 33 SOUTH KOREA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 34 SOUTH KOREA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 35 AUSTRALIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 36 AUSTRALIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 37 REST OF ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 38 REST OF ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 39 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 41 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 43 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 45 GERMANY: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 46 GERMANY: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 47 UK: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 UK: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 49 FRANCE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 FRANCE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 51 ITALY: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 ITALY: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 53 SPAIN: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 SPAIN: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 55 NETHERLANDS: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 NETHERLANDS: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 57 BELGIUM: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 BELGIUM: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 59 REST OF EUROPE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 REST OF EUROPE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 61 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 63 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 65 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 67 US: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 US: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 69 CANADA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 71 MEXICO: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 MEXICO: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 73 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 75 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 76 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 77 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 79 SAUDI ARABIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 SAUDI ARABIA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 81 UAE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 UAE: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 83 SOUTH AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 SOUTH AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 85 REST OF MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 REST OF MIDDLE EAST & AFRICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 87 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 89 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 90 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 91 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 92 SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 93 BRAZIL: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 BRAZIL: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 95 ARGENTINA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 ARGENTINA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 97 REST OF SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 REST OF SOUTH AMERICA: WASTEWATER RO MEMBRANES MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 99 WASTEWATER RO MEMBRANES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 100 MATERIAL TYPE FOOTPRINT (26 COMPANIES)

- TABLE 101 APPLICATION FOOTPRINT (26 COMPANIES)

- TABLE 102 REGIONAL FOOTPRINT (26 COMPANIES)

- TABLE 103 OVERALL COMPANY FOOTPRINT (26 COMPANIES)

- TABLE 104 DETAILED LIST OF COMPANIES

- TABLE 105 WASTEWATER RO MEMBRANES MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 106 WASTEWATER RO MEMBRANES MARKET: DEALS, 2019–2023

- TABLE 107 WASTEWATER RO MEMBRANES MARKET: OTHER DEVELOPMENTS, 2019–2023

- TABLE 108 DUPONT: COMPANY OVERVIEW

- TABLE 109 DUPONT: PRODUCT OFFERINGS

- TABLE 110 DUPONT: PRODUCT LAUNCHES

- TABLE 111 DUPONT: DEALS

- TABLE 112 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 113 HYDRANAUTICS: PRODUCT OFFERINGS

- TABLE 114 HYDRANAUTICS: PRODUCT LAUNCHES

- TABLE 115 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 116 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 117 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 118 TORAY INDUSTRIES, INC.: DEALS

- TABLE 119 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 120 LG CHEM: COMPANY OVERVIEW

- TABLE 121 LG CHEM: PRODUCT OFFERINGS

- TABLE 122 LG CHEM: OTHER DEVELOPMENTS

- TABLE 123 VEOLIA: COMPANY OVERVIEW

- TABLE 124 VEOLIA: PRODUCT OFFERINGS

- TABLE 125 VEOLIA: DEALS

- TABLE 126 VEOLIA: OTHER DEVELOPMENTS

- TABLE 127 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 128 ALFA LAVAL: PRODUCT OFFERINGS

- TABLE 129 ALFA LAVAL: DEALS

- TABLE 130 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 131 KOCH SEPARATION SOLUTIONS: PRODUCT OFFERINGS

- TABLE 132 KOCH SEPARATION SOLUTIONS: PRODUCT LAUNCHES

- TABLE 133 KOCH SEPARATION SOLUTIONS: DEALS

- TABLE 134 KOCH SEPARATION SOLUTIONS: OTHER DEVELOPMENTS

- TABLE 135 MANN+HUMMEL WATER & FLUID SOLUTIONS GMBH: COMPANY OVERVIEW

- TABLE 136 MANN+HUMMEL WATER & FLUID SOLUTIONS GMBH: PRODUCT OFFERINGS

- TABLE 137 MANN+HUMMEL WATER & FLUID SOLUTIONS GMBH: DEALS

- TABLE 138 MANN+HUMMEL WATER & FLUID SOLUTIONS GMBH: OTHER DEVELOPMENTS

- TABLE 139 MEMBRANIUM: COMPANY OVERVIEW

- TABLE 140 MEMBRANIUM: PRODUCT OFFERINGS

- TABLE 141 MEMBRANIUM: PRODUCT LAUNCHES

- TABLE 142 TOYOBO CO. LTD.: COMPANY OVERVIEW

- TABLE 143 TOYOBO CO. LTD.: PRODUCT OFFERINGS

- TABLE 144 GEA GROUP: COMPANY OVERVIEW

- TABLE 145 GEA GROUP: PRODUCT OFFERINGS

- TABLE 146 GEA GROUP: PRODUCT LAUNCHES

- TABLE 147 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 148 AXEON WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 149 HYDRAMEM: COMPANY OVERVIEW

- TABLE 150 HUNAN KEENSEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 151 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 152 MERCK KGAA: COMPANY OVERVIEW

- TABLE 153 MEMBRACON (UK) LTD.: COMPANY OVERVIEW

- TABLE 154 OSMOTECH MEMBRANES PVT. LTD.: COMPANY OVERVIEW

- TABLE 155 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 156 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

- TABLE 157 PERMIONICS: COMPANY OVERVIEW

- TABLE 158 SHANGHAI RECSUN MEMBRANCE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 159 VONTRON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 160 AQUAPORIN A/S: COMPANY OVERVIEW

- TABLE 161 WATTS: COMPANY OVERVIEW

- FIGURE 1 WASTEWATER RO MEMBRANES MARKET SEGMENTATION

- FIGURE 2 WASTEWATER RO MEMBRANES MARKET: RESEARCH DESIGN

- FIGURE 3 WASTEWATER RO MEMBRANES MARKET: MARKET SIZE ESTIMATION

- FIGURE 4 WASTEWATER RO MEMBRANES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 WASTEWATER RO MEMBRANES MARKET: TOP-DOWN APPROACH

- FIGURE 6 WASTEWATER RO MEMBRANES MARKET: DATA TRIANGULATION

- FIGURE 7 THIN-FILM COMPOSITE MEMBRANES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 INDUSTRIAL WASTEWATER TREATMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC REGION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 10 GROWING AWARENESS ABOUT WASTEWATER TREATMENT TO DRIVE MARKET

- FIGURE 11 THIN-FILM COMPOSITE MEMBRANES SEGMENT WILL CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 INDUSTRIAL WASTEWATER TREATMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 INDIA—FASTEST-GROWING MARKET FOR WASTEWATER RO MEMBRANES

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WASTEWATER RO MEMBRANES MARKET

- FIGURE 15 VALUE CHAIN ANALYSIS: WASTEWATER RO MEMBRANES MARKET

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: WASTEWATER RO MEMBRANES MARKET

- FIGURE 17 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY APPLICATION (USD/SQUARE METER)

- FIGURE 18 AVERAGE SELLING PRICE TRENDS, BY REGION (USD/SQUARE METER)

- FIGURE 19 AVERAGE SELLING PRICE TRENDS, BY TYPE (USD/SQUARE METER)

- FIGURE 20 PATENTS REGISTERED (2012–2022)

- FIGURE 21 NUMBER OF PATENTS (2012–2022)

- FIGURE 22 TOP JURISDICTIONS (2012–2022)

- FIGURE 23 TOP APPLICANT ANALYSIS

- FIGURE 24 ECOSYSTEM/MARKET MAP: WASTEWATER RO MEMBRANES MARKET

- FIGURE 25 REGION-WISE IMPORT TRADE, 2018–2022 (USD MILLION)

- FIGURE 26 REGION-WISE EXPORT TRADE, 2018–2022 (USD MILLION)

- FIGURE 27 TRENDS IN WASTEWATER RO MEMBRANES MARKET

- FIGURE 28 SUPPLIER SELECTION CRITERION

- FIGURE 29 THIN-FILM COMPOSITE MEMBRANES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 INDUSTRIAL WASTEWATER TREATMENT SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 31 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: WASTEWATER RO MEMBRANES MARKET SNAPSHOT

- FIGURE 33 INDUSTRIAL WASTEWATER TREATMENT SEGMENT TO REGISTER HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: WASTEWATER RO MEMBRANES MARKET SNAPSHOT

- FIGURE 35 OVERVIEW OF STRATEGIES DEPLOYED BY WASTEWATER RO MEMBRANE MANUFACTURERS

- FIGURE 36 REVENUE ANALYSIS OF KEY COMPANIES, 2020–2022 (USD MILLION)

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN WASTEWATER RO MEMBRANES MARKET

- FIGURE 38 SHARES OF LEADING COMPANIES IN WASTEWATER RO MEMBRANES MARKET, 2022

- FIGURE 39 WASTEWATER RO MEMBRANES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 WASTEWATER RO MEMBRANES MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 DUPONT: COMPANY SNAPSHOT

- FIGURE 42 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 43 LG CHEM: COMPANY SNAPSHOT

- FIGURE 44 VEOLIA: COMPANY SNAPSHOT

- FIGURE 45 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 46 TOYOBO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 GEA GROUP: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for wastewater reverse osmosis. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The wastewater reverse osmosis market comprises several stakeholders, such as membrane suppliers, distributors of reverse osmosis membranes, system manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of applications such as residential, commercial, and industrial. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to this market. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of wastewater reverse osmosis and the future outlook of their business, which will affect the overall market.

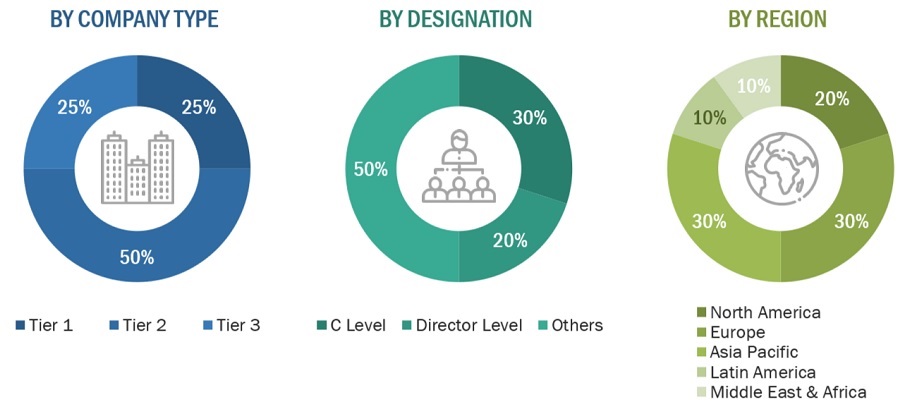

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the wastewater reverse osmosis market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Wastewater Reverse Osmosis Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Wastewater Reverse Osmosis Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply of reverse osmosis membrane for wastewater.

Market Definition

Reverse osmosis (RO) is a vital technology in wastewater treatment, offering an effective solution to reclaim and purify water from various sources. In wastewater treatment, RO plays a critical role in removing contaminants, including dissolved salts, minerals, organic compounds, and other impurities, to produce high-quality treated water. The process involves pressurizing wastewater and passing it through a semi-permeable membrane, that selectively allows water molecules to pass while rejecting larger particles. This molecular-level separation results in purified water, often referred to as permeate, and a concentrated stream of contaminants known as brine or reject water.

The applications of reverse osmosis in wastewater treatment across various sectors, contributing significantly to environmental sustainability and water resource management. In municipal wastewater treatment, RO is utilized to purify wastewater before its discharge into water bodies, ensuring compliance with stringent environmental standards. Industries with complex wastewater streams, such as chemicals, textiles, and electronics, leverage RO to treat and reclaim water for internal processes, reducing their environmental impact and meeting regulatory requirements. The desalination of seawater stands as a critical application, addressing water scarcity in coastal regions by converting seawater into freshwater suitable for drinking and irrigation.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Objectives of the Study:

- To define, describe, and forecast the wastewater reverse osmosis market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type and application.

- To forecast the size of the market for five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments, such as new product launches, acquisitions, and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the wastewater reverse osmosis market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Wastewater Reverse Osmosis Membrane Market