Wet Pet Food Market by Pet (Dogs and Cats), Source (Animal-Based, Plant Derivatives, and Synthetic), Distribution Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, and Online) and Region - Global Forecast to 2028

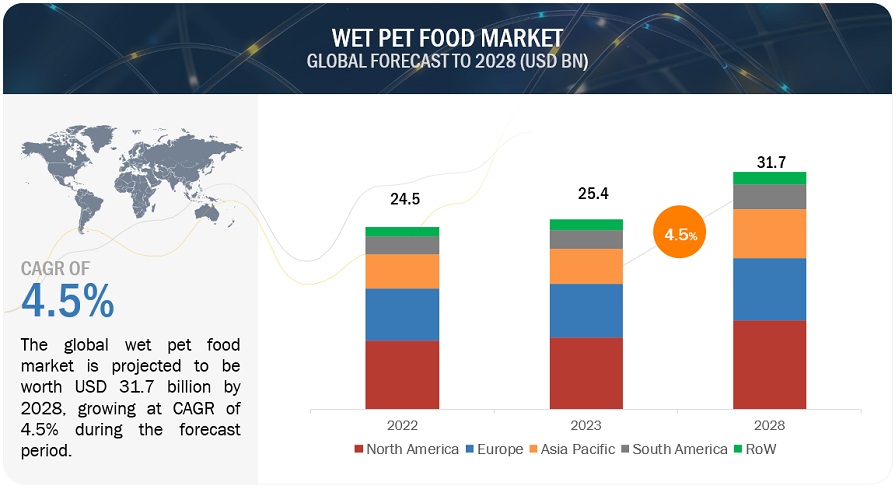

The Wet Pet Food Market is estimated at USD 25.4 billion in 2023 and is projected to reach USD 31.7 billion by 2028, at a CAGR of 4.5% from 2023 to 2028.

The pet industry has seen significant growth in recent years, offering a wide range of products, from specialized toys to advanced grooming solutions. Pet food is available in various forms, including wet pet food, which has gained popularity due to its higher moisture content, resembling traditional stews and gravies. This moisture not only enhances palatability but also addresses concerns about hydration, which is crucial for pet health. Wet pet food also offers a wider nutritional spectrum, allowing for the inclusion of essential proteins, vitamins, and minerals. This versatility is valuable for pets with specific dietary restrictions or health considerations. As consumers become more health-conscious, wet pet food has become an appealing choice to cater to these evolving demands. This growth is driven by increasing disposable incomes, changing perceptions of pets as integral family members, and a growing awareness of the influence of nutrition on overall pet well-being.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Increasing influence of pet-centric social media and trends

Social media platforms tailored to pet lovers have significantly shaped contemporary perceptions of pet ownership. These platforms have created a virtual space where individuals can share their affection for their pets, exchange experiences, and gather insights from like-minded individuals, fostering a sense of community and camaraderie. Pet-centric social media has played a key role in the rise in pet ownership by presenting a compelling narrative of the joys and rewards associated with having pets. This collective sharing of positive experiences has made pet ownership appear aspirational, deeply rewarding, and fulfilling.

Moreover, pet-centric social media has emerged as a powerful tool for disseminating information, fostering community engagement, and facilitating peer-to-peer recommendations among pet owners. Platforms such as Instagram, TikTok, and Facebook have facilitated the creation of a vibrant ecosystem where pet owners share their experiences, nutritional choices, and overall well-being.

The visual appeal of these platforms, combined with the emotional connection that pet owners forge with their animals, has created a unique avenue for pet food manufacturers to showcase their products in an engaging and relatable manner. The persuasive influence of pet-centric social media is accentuated by endorsements and collaborations between pet influencers and pet food brands. The relatability of these influencers, who are seen as genuine advocates for their pets, bolsters the credibility and desirability of pet food products.Their endorsements serve as a bridge between the brand and the consumer, fostering a sense of trust and authenticity that traditional advertising methods may struggle to achieve..

Restraints: Price sensitivity among consumers

The wet pet food market often commands a premium price compared to its dry counterpart. This is primarily due to the higher moisture content, perceived freshness, and potentially better taste and texture offered by wet pet food. However, this higher price can make price-sensitive consumers choose more affordable alternatives, such as dry pet food. Economic factors play a crucial role in shaping consumer decisions, particularly in a context where pet ownership involves food expenses and other costs related to veterinary care, accessories, and toys. The overall cost of living, disposable income, and economic stability influence consumer’s willingness to spend on premium products like wet pet food. During economic uncertainty or financial strain, consumers prioritize spending on essential items over discretionary purchases like premium pet food products. This tendency to economize often leads consumers to choose more affordable alternatives, limiting the growth potential of higher-priced wet pet food options.

Opportunities: Rise in pet-friendly travel and pet rental

Over the last ten years, the concept of pet ownership has transformed from simple companionship to become a deeply integrated lifestyle choice. This shift has led to the growth of trends such as pet-friendly travel and the emergence of pet rentals, reflecting the increasing humanization of pets. This change in pet care and companionship has been driven by societal changes, where pets are now seen as valued family members deserving of experiences and amenities previously reserved for humans. Pet owners are increasingly seeking ways to include their furry companions in their travel experiences, be it on planes, trains, or at vacation destinations. The concept of pet rental has emerged as an innovative solution, particularly in urban areas where individuals desire the companionship of a pet without the lifelong commitment of ownership.

The wet pet food market has found a unique opportunity to thrive amid the rise of pet-friendly travel and the popularity of pet cafes. The increase in pet-friendly travel can be attributed to evolving societal attitudes towards pets, considering them as valued family members rather than mere animals. Many transportation services and hospitality establishments have adapted their policies to accommodate pets, recognizing the economic potential of catering to this growing demographic of pet owners. Airlines like Emirates Airlines (Dubai), Air Canada (Canada), Virgin Australia (Australia), British Airways (UK), Qatar Airways (Qatar), etc., have allowed pets while traveling, enabling pet owners to bring their pets along on vacations, business trips, and other travel endeavors, thus enhancing the overall travel experience.

As pets accompany their owners on these journeys, the demand for convenient and nutritious pet food solutions becomes essential. Wet pet food helps maintain the dietary routine of pets while traveling, especially in unfamiliar surroundings. It offers a practical and hassle-free solution, providing a complete, balanced, and nutritionally rich meal in a ready-to-serve format. This eliminates the need for carrying and measuring dry kibble, making feeding seamless and efficient in a hotel room or during a long journey

Challenges: Localization of flavors to match regional preferences

The strategy of tailoring flavors to match regional preferences has become crucial in the wet pet food market. This is driven by the need to cater to diverse consumer demands and cultural nuances. The practice involves customizing the taste profiles of pet food products to align with the specific preferences of different regions. Manufacturers have recognized that pets, like humans, have distinct taste preferences influenced by their geographical and cultural environments. Therefore, companies have been actively formulating and offering various flavors that resonate with local palates in order to enhance customer satisfaction and market penetration. For example, Wiggles (India) launched wet pet food containing Chicken, Chicken Liver, Pumpkin, Carrots, and Green Peas, as well as beneficial herbs such as Brahmi, Ashwagandha, Rosemary, Moringa, and Chicory Root Extract, known for their healing properties in India. While localizing flavors seems like a logical step to capture a wider customer base, it also presents several complex challenges within the wet pet food market. One prominent issue is the complexity associated with sourcing, formulating, and producing a diverse range of flavors.

The culinary traditions and cultural norms of every region influence preferred flavors and ingredients, necessitating meticulous research and development efforts. This demand for an expansive flavor portfolio places a considerable burden on manufacturers in terms of resources, time, and expertise. To address this, companies need to leverage advanced data analytics and market research to gain insights into regional flavor preferences, which can guide informed decisions on flavor localization. Collaborations with local partners, suppliers, and culinary experts can also offer a deeper understanding of local tastes and ingredients, facilitating the formulation of authentic and appealing flavors. Moreover, implementing modular and flexible production processes can enhance the ability to efficiently produce a diverse range of flavors without compromising quality. Companies can reduce costs, minimize waste, and streamline the introduction of new flavors to the market by optimizing supply chain management and production workflows..

Market Ecosystem

Based on the pet, dogs is estimated to account for the largest market share of the wet pet food market.

In the past few decades, there has been a significant increase in dog adoption rates. Whether rescued from shelters or adopted from breeders, more dogs have found their way into homes. This rise in dog ownership has been driven by various factors, including a better understanding of the emotional and psychological benefits that dogs bring to human lives. Developed countries such as the US, Australia, Germany, and the Netherlands have traditionally been attractive markets for dog food due to the increasing adoption of pets in these regions and the rising spending on pet food products. However, in recent years, developing countries have also become significant markets for dog foods due to a steady rise in pet adoptions, increased awareness regarding dog health, and the humanization of pets.

Countries like India, China, and Brazil are now attractive markets for dog food, as they have large populations of stray dogs that are adopted by several people. According to data from PetSecure (Australia), a pet insurance company, China, Japan, the Philippines, and India are among the countries with the highest pet dog populations. India, in particular, has the fastest-growing dog population in the world.

Based on the distribution channel, online mode is anticipated to have the highest growth rate in the wet pet food market.

Online platforms are driving the expansion of the wet pet food market by overcoming the limitations of traditional shopping. The convenience of browsing and purchasing goods online removes the need for in-person store visits. This accessibility encourages pet owners to explore a broader range of wet pet food options and make informed decisions based on the unique requirements of their pets. The global impact of the pandemic has reshaped consumer behavior, triggering a significant shift toward online shopping. E-commerce platforms experienced an unprecedented surge in demand as people sought safer means of acquiring goods. This trend extended to pet products, including wet pet food, as owners turned to online platforms to access quality products while adhering to safety measures. This surge in demand has highlighted the potential of online platforms to meet evolving consumer needs, positioning them as a pivotal driver of the expansion of the wet pet food market.

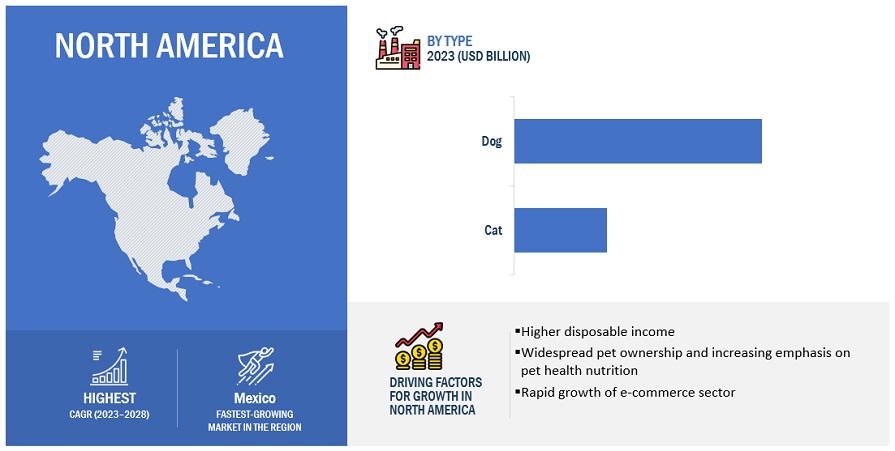

The North America market is projected to contribute the largest share of the global wet pet food market.

In North America, especially in the US, the bond between pets and their owners has strengthened over the years. According to a 2021 report from the No Kill Advocacy Center, 96% of the US population feels morally obliged to protect pets and animals. This sentiment is evident in spending habits, with veterinary care being the second-highest priority after daily essentials. The high value placed on pets, along with the region's significant disposable income, has led to a growing wet pet food market. Canada and Mexico, alongside the US, have seen an increase in pet adoption rates and higher spending on pet food due to the growth of the middle-class population and urbanization. This trend has significantly contributed to the expansion of the wet pet food market in North America. Major industry players such as Mars, Incorporated, Colgate-Palmolive Company, General Mills Inc., and The JM Smucker Company are active in this market. Their presence in North America enhances market competitiveness and benefits consumers through product availability, quality, and pricing. As the trend of pet adoption continues to rise and there is growing emphasis on pet well-being, these key players are strategically expanding their footprint in the North American market.

Key Market Players

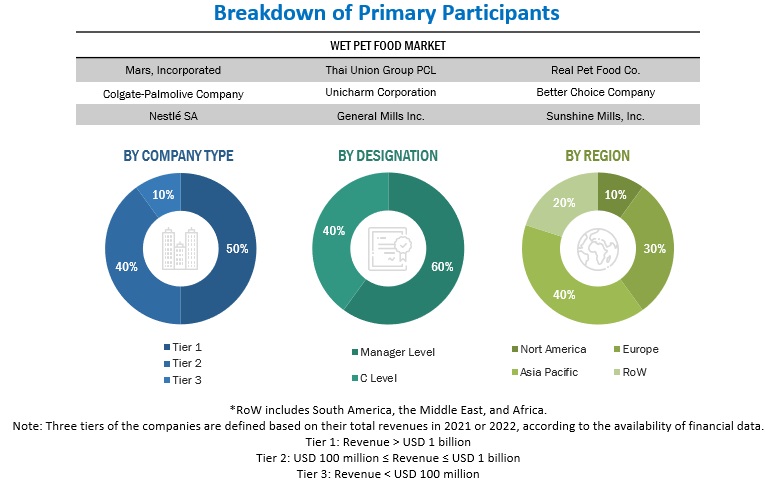

Nestlé (Switzerland), Mars, Incorporated (US), Colgate-Palmolive Company (US), Unicharm Corporation (Japan), Thai Union Group PCL (Thailand), Charoen Pokphand Foods PCL (Thailand), General Mills Inc. (US), The J.M. Smucker Company (US), Better Choice Company (US), Real Pet Food Co. (Australia), MONGE SPA P.IVA (Italy), Schell & Kampeter, Inc. (US), Inaba-Petfood Co., Ltd. (Japan), Sunshine Mills, Inc. (US), and Farmina Pet Foods (Italy). These players in this market are focusing on increasing their presence through expansion and collaboration. These companies have a strong presence in North America, Asia Pacific, and Europe.

Scope of the report<

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

)Segments Covered |

By Pet, By Source, By Distribution Channel, and By Region. |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

Key stakeholders

- Key Manufacturers of Pet Nutrition Products

- Key Companies Engaged in Pet Food Processing

- Key Manufacturers of Wet Pet Food

- Traders, Distributors, and Suppliers in Wet Pet Food Market

- Traders and Suppliers of Raw Materials to Wet Pet Food Industry

- Associations, Regulatory Bodies, and Other Industry-related Bodies:

- The Association of American Feed Control Officials (AAFCO)

- Pet Food Manufacturers Association (PFMA)

- The Pet Food Industry Association of Australia

- American Pet Products Association, Inc. (APPA)

- Canadian Association of Raw Pet Food Manufacturers

Wet Pet Food Market:

By Pet

- Dogs

- Cats

By Distribution Channel

- Pet Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

By Source

- Animal-based

- Plant Derivatives

- Synthetic

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Development

- In July 2023, Champion Petfoods, under Mars, Incorporated, introduced its ACANA PREMIUM PÂTÉ wet cat food line, aligning with feline natural diets focused on preybased nutrition and hydration. The product includes 3- and 5.5-oz cans in six diverse recipes, catering to various tastes and nutritional needs, such as Omega 3 support for skin and coat health. This strategic product launch enhances its position in the wet pet food market by offering a tailored and nutritious option that satisfies the dietary preferences of cats and supports their overall health.

- In April 2023, Mars Petcare's SHEBA brand has introduced its first line of kitten nutrition products, PERFECT PORTIONS Wet Kitten Food, complementing its existing range of nutritional offerings for cats of all ages. It is designed to provide comprehensive nutrition, featuring high-quality proteins that support immune system health, bone strength, and brain development. Enriched with essential nutrients, DHA, vitamins, and minerals, the diets are available in two flavors, Savory Chicken and Delicate Salmon, in 2.64-oz trays in physical stores and online via major retailers such as Amazon, Chewy, Walmart, and PetSmart.

- On March 2023,. Hill’s Pet Nutrition, a division of ColgatePalmolive, unveiled Prescription Diet ONC Care, a specialized line of prescription diets aimed at supporting pets diagnosed with cancer. This range includes dry and wet formulas, catering to the dietary needs of cats and dogs facing this disease. The launch holds a broader significance for the company, especially in the wet pet food market. By introducing a specialized prescription range for pets with cancer, Hill’s strengthens its foothold in the pet food industry and extends its commitment to the well-being of animals. As the Prescription Diet ONC Care range graduallyrolls out across different continents in the coming years, starting from North America and progressing to regions such as Europe, Middle East, Africa, Latin America, Australia, New Zealand, and Asia, the company demonstrates its strategic approach to catering to global demand and enhancing its presence in veterinary clinics and pet specialty stores.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the wet pet food market?

The North American region accounted for the largest share in terms of value at USD 9.6 billion in 2023 and is expected to grow at a CAGR of 4.3% during the forecast period.

What is the current size of the global wet pet food market?

The wet pet food market is estimated at USD 25.4 billion in 2023 and is projected to reach USD 31.7 billion by 2028, at a CAGR of 4.5% from 2023 to 2028.

Which are the major key players in the wet pet food market?

Nestlé (Switzerland), Mars, Incorporated (US), Colgate-Palmolive Company (US), Unicharm Corporation (Japan), Thai Union Group PCL (Thailand), Charoen Pokphand Foods PCL (Thailand), General Mills Inc. (US), The J.M. Smucker Company (US), Better Choice Company (US), and Real Pet Food Co. (Australia).

What are the factors driving the wet pet food market?

Surge in pet adoption

Focus on enhancing palatability and digestibility of wet pet foods

Increasing influence of pet-centric social media and trends

Which segment by type accounted for the largest wet pet food market share?

By type, dog wet pet food dominated the market for wet pet food and was valued the largest at USD 13 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING TREND OF PET HUMANIZATIONURBANIZATION AND EVOLVING LIFESTYLESGROWING AWARENESS OF PET HEALTH AND NUTRITION

-

5.3 MARKET DYNAMICSDRIVERS- Surge in pet adoption- Focus on enhancing palatability and digestibility of wet pet foods- Increasing influence of pet-centric social media and trendsRESTRAINTS- Limited shelf life and storage issues- Price sensitivity among consumers- Cultural preferences favoring homemade pet dietsOPPORTUNITIES- Growing e-commerce and online platforms- Rise in pet-friendly travel and pet rental- Growing demand for premium pet foodsCHALLENGES- Volatility in raw material prices- Localization of flavors to match regional preferences- Sustainability and environmental issues

- 6.1 INTRODUCTION

- 6.2 TARIFF AND REGULATORY LANDSCAPE

-

6.3 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPEAN UNION (EU)ASIA PACIFIC- China- Japan- IndiaSOUTH AMERICA- Brazil- ArgentinaREST OF THE WORLD- South Africa- Pet Food Industry Association of Southern Africa (PFI)INTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.4 PATENT ANALYSIS

- 6.5 TRADE ANALYSIS

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PETAVERAGE SELLING PRICE TREND, BY REGION

-

6.7 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTSOURCINGMANUFACTURINGPACKAGING AND STORAGEDISTRIBUTION AND LOGISTICSMARKETING AND SALESEND USERS

- 6.8 SUPPLY CHAIN ANALYSIS

-

6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.10 ECOSYSTEM ANALYSIS

- 6.11 CASE STUDY ANALYSIS

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.13 TECHNOLOGY ANALYSISNEXT-GENERATION PROTEIN FOR PET FOOD INGREDIENTSWATER IMMERSION RETORT TECHNOLOGY FOR CANNED FOODSTERILIZING WET PET FOOD WITH STEAM

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.15 KEY CONFERENCES AND EVENTS (2023–2024)

- 7.1 INTRODUCTION

-

7.2 DOGSHIGH ADOPTION RATE TO DRIVE MARKET

-

7.3 CATSINCREASING DEMAND FOR HIGHER NUTRITIONAL REQUIREMENTS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 PET SPECIALTY STORESHIGH-QUALITY PRODUCTS AND PERSONALIZED CUSTOMER SERVICE TO DRIVE MARKET

-

8.3 SUPERMARKETS/HYPERMARKETSVAST FOOT TRAFFIC AND BROAD CONSUMER DEMOGRAPHY TO DRIVE MARKET

-

8.4 CONVENIENCE STORESEASY ACCESSIBILITY AND CONVENIENCE TO DRIVE MARKET

-

8.5 ONLINEGROWTH OF E-COMMERCE TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 ANIMAL-BASEDSUPERIOR PALATABILITY AND AROMA TO DRIVE MARKET

-

9.3 PLANT DERIVATIVESINCREASING SHIFT TOWARD VEGANISM TO DRIVE MARKET

-

9.4 SYNTHETICINCREASED SPEDNING ON HEALTHY PET FOOD TO DRIVE MARKET

- 10.1 INTRODUCTION

- 10.2 RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Booming e-commerce sector and global export opportunities to drive marketCANADA- High disposable incomes and health-conscious trends to drive marketMEXICO- Socio-economic changes to drive market

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Booming pet ownership and online sales to drive marketINDIA- Rising pet humanization and growing middle class population to drive marketJAPAN- Aging population and busy lifestyles to drive marketINDONESIA- Increasing disposable income and pet wellness to drive marketPAKISTAN- Rising demand for premium nutrition to drive marketPHILIPPINES- Urban lifestyles and health consciousness to drive marketVIETNAM- Larger young population and pet humanization to drive marketTHAILAND- Global trade opportunities and growing demand for cat food to drive marketSOUTH KOREA- Government support and rising pet ownership to drive marketMALAYSIA- Expanding e-commerce to drive marketMYANMAR- Rising pet ownership and presence of international brands to drive marketBANGLADESH- Rising adoption of foreign breeds and e-commerce platforms to drive marketAFGHANISTAN- Responsible pet care and awareness to drive marketNEPAL- Evolving pet culture and shifting lifestyles to drive marketTAIWAN- Shifting preferences and regulatory initiatives to drive marketSRI LANKA- E-commerce accessibility and pet welfare awareness to drive marketREST OF ASIA PACIFIC

-

10.5 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Substantial pet population to drive marketFRANCE- Health-conscious pet owners to drive marketUK- Strategic investments by major companies to drive marketITALY- Rising pet ownership and health-conscious trends to drive marketSPAIN- Export-oriented approach to drive marketREST OF EUROPE

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rising pet ownership and presence of startups to drive marketARGENTINA- Growing expenditure on pet-related products to drive marketREST OF SOUTH AMERICA

-

10.7 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISMIDDLE EAST- Increasing pet humanization trend among middle- and higher middle-class families to drive marketAFRICA- Strategic expansion of pet food companies to drive market

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.5 ANNUAL REVENUE VS. GROWTH OF KEY PLAYERS

- 11.6 EBITDA OF KEY PLAYERS

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

11.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSNESTLÉ (NESTLÉ PURINA PETCARE COMPANY)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMARS, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOLGATE-PALMOLIVE COMPANY (HILL'S PET NUTRITION, INC.)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUNICHARM CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHAI UNION GROUP PCL.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHAROEN POKPHAND FOODS PCL (PERFECT COMPANION GROUP)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL MILLS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE J.M. SMUCKER COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBETTER CHOICE COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewREAL PET FOOD CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMONGE SPA P.IVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHELL & KAMPETER, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINABA-PETFOOD CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUNSHINE MILLS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFARMINA PET FOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 STARTUPS/SMESNIPPON PET FOOD CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHANGHAI BIRUIJI PET PRODUCTS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLITTLE BIGPAW- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPETLINE NATURAL ANIMAL NUTRITION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYARRAH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTIKI PETS (WHITEBRIDGE PET BRANDS)AMÌ PLANET SRLZIWI PETSGRANATAPET GMBH & CO. KGNULO

- 13.1 INTRODUCTION

- 13.2 RESEARCH LIMITATIONS

-

13.3 PROBIOTICS IN ANIMAL FEED MARKETMARKET DEFINITIONMARKET OVERVIEWPROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCKPROBIOTICS IN ANIMAL FEED MARKET, BY REGION

-

13.4 PET FOOD INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEWPET FOOD INGREDIENTS MARKET, BY INGREDIENTPET FOOD INGREDIENTS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 WET PET FOOD MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF MAJOR PATENTS IN WET PET FOOD MARKET, 2013–2022

- TABLE 9 IMPORT VALUE OF WET PET FOOD, 2022 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF WET PET FOOD, 2022 (USD THOUSAND)

- TABLE 11 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PET, 2022 (USD/TON)

- TABLE 12 WET PET FOOD MARKET: AVERAGE SELLING PRICE FOR DOGS, BY REGION, 2020–2022 (USD/TON)

- TABLE 13 WET PET FOOD MARKET: AVERAGE SELLING PRICE FOR CATS, BY REGION, 2020–2022 (USD/TON)

- TABLE 14 WET PET FOOD MARKET ECOSYSTEM

- TABLE 15 OPTIMIZING PET FOOD PRODUCTION USING SOLUTIONS FROM PRECISION AUTOMATION

- TABLE 16 ENHANCING EFFICIENCY USING LIQUID PRODUCT RECOVERY SYSTEMS AT MARS PET CARE

- TABLE 17 STREAMLINING PET FOOD DISTRIBUTION USING ROTOMATRIX SOLUTION

- TABLE 18 WET PET FOOD MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR WET PET FOOD, BY PET (%)

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 21 KEY CONFERENCES AND EVENTS IN WET PET FOOD MARKET, 2023–2024

- TABLE 22 TOP 20 PET POPULATION, BY COUNTRY, 2022

- TABLE 23 WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 24 WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 25 WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 26 WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 27 DOGS: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 DOGS: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 DOGS: WET PET FOOD MARKET, BY REGION, 2019–2022 (KT)

- TABLE 30 DOGS: WET PET FOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 31 CATS: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 CATS: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 CATS: WET PET FOOD MARKET, BY REGION, 2019–2022 (KT)

- TABLE 34 CATS: WET PET FOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 35 WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 36 WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 37 PET SPECIALTY STORES: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 PET SPECIALTY STORES: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 SUPERMARKETS/HYPERMARKETS: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 SUPERMARKETS/HYPERMARKETS: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 CONVENIENCE STORES: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 CONVENIENCE STORES: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 ONLINE: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 ONLINE: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 46 WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 47 ANIMAL-BASED: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 ANIMAL-BASED: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 PLANT DERIVATIVES: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 PLANT DERIVATIVES: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SYNTHETIC: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 SYNTHETIC: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 WET PET FOOD MARKET, BY REGION, 2019–2022 (KT)

- TABLE 56 WET PET FOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 57 NORTH AMERICA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 60 NORTH AMERICA: WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 61 NORTH AMERICA: WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: WET PET FOOD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: WET PET FOOD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 US: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 68 US: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 69 CANADA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 70 CANADA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 71 MEXICO: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 72 MEXICO: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 76 ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 77 ASIA PACIFIC: WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: WET PET FOOD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: WET PET FOOD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 CHINA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 84 CHINA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 85 INDIA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 86 INDIA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 87 JAPAN: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 88 JAPAN: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 89 INDONESIA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 90 INDONESIA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 91 PAKISTAN: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 92 PAKISTAN: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 93 PHILIPPINES: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 94 PHILIPPINES: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 95 VIETNAM: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 96 VIETNAM: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 97 THAILAND: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 98 THAILAND: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 99 SOUTH KOREA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 101 MALAYSIA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 102 MALAYSIA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 103 MYANMAR: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 104 MYANMAR: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 105 BANGLADESH: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 106 BANGLADESH: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 107 AFGHANISTAN: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 108 AFGHANISTAN: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 109 NEPAL: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 110 NEPAL: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 111 TAIWAN: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 112 TAIWAN: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 113 SRI LANKA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 114 SRI LANKA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 118 EUROPE: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 120 EUROPE: WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 121 EUROPE: WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 122 EUROPE: WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 124 EUROPE: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: WET PET FOOD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 EUROPE: WET PET FOOD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 GERMANY: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 128 GERMANY: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 129 FRANCE: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 130 FRANCE: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 131 UK: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 132 UK: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 133 ITALY: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 134 ITALY: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 135 SPAIN: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 136 SPAIN: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 140 SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 142 SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 143 SOUTH AMERICA: WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 144 SOUTH AMERICA: WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH AMERICA: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 146 SOUTH AMERICA: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH AMERICA: WET PET FOOD MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 148 SOUTH AMERICA: WET PET FOOD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 BRAZIL: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 150 BRAZIL: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 151 ARGENTINA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 152 ARGENTINA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 156 REST OF THE WORLD: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: WET PET FOOD MARKET, BY PET, 2019–2022 (KT)

- TABLE 158 REST OF THE WORLD: WET PET FOOD MARKET, BY PET, 2023–2028 (KT)

- TABLE 159 REST OF THE WORLD: WET PET FOOD MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 160 REST OF THE WORLD: WET PET FOOD MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 161 REST OF THE WORLD: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 162 REST OF THE WORLD: WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 163 REST OF THE WORLD: WET PET FOOD MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 164 REST OF THE WORLD: WET PET FOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 167 AFRICA: WET PET FOOD MARKET, BY PET, 2019–2022 (USD MILLION)

- TABLE 168 AFRICA: WET PET FOOD MARKET, BY PET, 2023–2028 (USD MILLION)

- TABLE 169 WET PET FOOD MARKET: DEGREE OF COMPETITION, 2022

- TABLE 170 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 171 COMPANY FOOTPRINT, BY PET

- TABLE 172 COMPANY FOOTPRINT, BY SOURCE

- TABLE 173 COMPANY FOOTPRINT, BY REGION

- TABLE 174 OVERALL COMPANY FOOTPRINT

- TABLE 175 WET PET FOOD MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 176 WET PET FOOD MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 177 PRODUCT LAUNCHES, 2019–2023

- TABLE 178 DEALS, 2019–2023

- TABLE 179 OTHERS, 2019–2023

- TABLE 180 NESTLÉ: COMPANY OVERVIEW

- TABLE 181 NESTLÉ: DEALS

- TABLE 182 NESTLÉ: OTHERS

- TABLE 183 MARS, INCORPORATED: COMPANY OVERVIEW

- TABLE 184 MARS, INCORPORATED: PRODUCT LAUNCHES

- TABLE 185 MARS, INCORPORATED: DEALS

- TABLE 186 MARS, INCORPORATED: OTHERS

- TABLE 187 COLGATE-PALMOLIVE COMPANY: COMPANY OVERVIEW

- TABLE 188 COLGATE-PALMOLIVE COMPANY: PRODUCT LAUNCHES

- TABLE 189 COLGATE-PALMOLIVE COMPANY: DEALS

- TABLE 190 COLGATE-PALMOLIVE COMPANY: OTHERS

- TABLE 191 UNICHARM CORPORATION: COMPANY OVERVIEW

- TABLE 192 UNICHARM CORPORATION: PRODUCT LAUNCHES

- TABLE 193 THAI UNION GROUP PCL.: COMPANY OVERVIEW

- TABLE 194 THAI UNION GROUP PCL.: DEALS

- TABLE 195 THAI UNION GROUP PCL.: OTHERS

- TABLE 196 CHAROEN POKPHAND FOODS PCL: COMPANY OVERVIEW

- TABLE 197 GENERAL MILLS INC.: COMPANY OVERVIEW

- TABLE 198 GENERAL MILLS INC.: OTHERS

- TABLE 199 THE J.M. SMUCKER COMPANY: COMPANY OVERVIEW

- TABLE 200 BETTER CHOICE COMPANY: COMPANY OVERVIEW

- TABLE 201 BETTER CHOICE COMPANY: DEALS

- TABLE 202 REAL PET FOOD CO.: COMPANY OVERVIEW

- TABLE 203 MONGE SPA P.IVA: COMPANY OVERVIEW

- TABLE 204 SCHELL & KAMPETER, INC.: COMPANY OVERVIEW

- TABLE 205 SCHELL & KAMPETER, INC.: OTHERS

- TABLE 206 INABA-PETFOOD CO., LTD.: COMPANY OVERVIEW

- TABLE 207 SUNSHINE MILLS, INC.: COMPANY OVERVIEW

- TABLE 208 FARMINA PET FOODS: COMPANY OVERVIEW

- TABLE 209 NIPPON PET FOOD CO., LTD.: COMPANY OVERVIEW

- TABLE 210 SHANGHAI BIRUIJI PET PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 211 LITTLE BIGPAW: COMPANY OVERVIEW

- TABLE 212 PETLINE NATURAL ANIMAL NUTRITION: COMPANY OVERVIEW

- TABLE 213 YARRAH: COMPANY OVERVIEW

- TABLE 214 TIKI PETS: COMPANY OVERVIEW

- TABLE 215 AMÌ PLANET SRL: COMPANY OVERVIEW

- TABLE 216 ZIWI PETS: COMPANY OVERVIEW

- TABLE 217 GRANATAPET GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 218 NULO: COMPANY OVERVIEW

- TABLE 219 ADJACENT MARKETS TO WET PET FOOD MARKET

- TABLE 220 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019–2022 (USD MILLION)

- TABLE 221 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023–2028 (USD MILLION)

- TABLE 222 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 223 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 224 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019–2022 (KT)

- TABLE 225 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023–2028 (KT)

- TABLE 226 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019–2021 (USD MILLION)

- TABLE 227 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2022–2027 (USD MILLION)

- TABLE 228 PET FOOD INGREDIENTS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 229 PET FOOD INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 WET PET FOOD MARKET: RESEARCH DESIGN

- FIGURE 3 SUPPLY-SIDE INDICATORS

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 WET PET FOOD MARKET, BY PET, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 WET PET FOOD MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 WET PET FOOD MARKET, BY REGION, 2022

- FIGURE 9 RISING RATE OF PET ADOPTION TO DRIVE WET PET FOOD MARKET

- FIGURE 10 ANIMAL-BASED SEGMENT AND US ACCOUNTED FOR SIGNIFICANT SHARES IN 2022

- FIGURE 11 PET SPECIALTY STORES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 DOGS SEGMENT TO LEAD MARKET BY 2028

- FIGURE 13 ANIMAL-BASED SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES DURING FORECAST PERIOD

- FIGURE 14 US TO ACCOUNT FOR LARGEST SHARE OF WET PET FOOD MARKET IN 2023

- FIGURE 15 WET PET FOOD MARKET DYNAMICS

- FIGURE 16 NUMBER OF PATENTS GRANTED FOR WET PET FOOD PRODUCTS, 2013–2022

- FIGURE 17 REGIONAL ANALYSIS OF PATENTS GRANTED IN WET PET FOOD MARKET, 2022

- FIGURE 18 WET PET FOOD MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 WET PET FOOD MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS FOR WET PET FOOD MANUFACTURERS

- FIGURE 21 WET PET FOOD MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR WET PET FOOD, BY PET

- FIGURE 23 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 24 WET PET FOOD MARKET, BY PET, 2023 VS. 2028 (USD MILLION)

- FIGURE 25 WET PET FOOD MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 26 WET PET FOOD MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 27 WET PET FOOD MARKET: GEOGRAPHIC SNAPSHOT, 2023–2028 (USD MILLION)

- FIGURE 28 RECESSION INDICATORS

- FIGURE 29 GLOBAL INFLATION RATE, 2011–2022

- FIGURE 30 GLOBAL GDP, 2011–2022 (USD TRILLION)

- FIGURE 31 RECESSION INDICATORS AND THEIR IMPACT ON WET PET FOOD MARKET

- FIGURE 32 GLOBAL WET PET FOOD MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 33 NORTH AMERICA: WET PET FOOD MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 35 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 36 ASIA PACIFIC: WET PET FOOD MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 38 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 39 EUROPE: COUNTRY-LEVEL INFLATION DATA (2017–2022)

- FIGURE 40 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 41 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 42 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 43 REST OF THE WORLD: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 44 REST OF THE WORLD: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 45 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- FIGURE 46 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 47 EBITDA, 2022 (USD BILLION)

- FIGURE 48 WET PET FOOD MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 49 WET PET FOOD MARKET: COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- FIGURE 50 WET PET FOOD MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 51 NESTLÉ: COMPANY SNAPSHOT

- FIGURE 52 COLGATE-PALMOLIVE COMPANY: COMPANY SNAPSHOT

- FIGURE 53 UNICHARM CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 THAI UNION GROUP PCL.: COMPANY SNAPSHOT

- FIGURE 55 CHAROEN POKPHAND FOODS PCL: COMPANY SNAPSHOT

- FIGURE 56 GENERAL MILLS INC.: COMPANY SNAPSHOT

- FIGURE 57 THE J.M. SMUCKER COMPANY: COMPANY SNAPSHOT

- FIGURE 58 BETTER CHOICE COMPANY: COMPANY SNAPSHOT

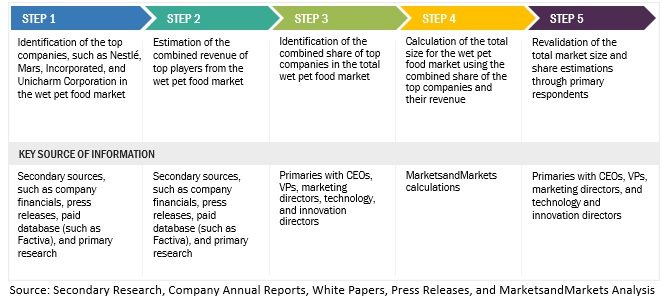

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the wet pet food market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, the EU Commission, the European Food Safety Authority, the German Federal Institute of Risk Assessment, the Food Safety and Standards Authority of India (FSSAI), and the Japanese Ministry of Health, Labor and Welfare have referred to, to identify and collect information for this study. The secondary sources also included wet pet food manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The wet pet food market comprises multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of wet pet food from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

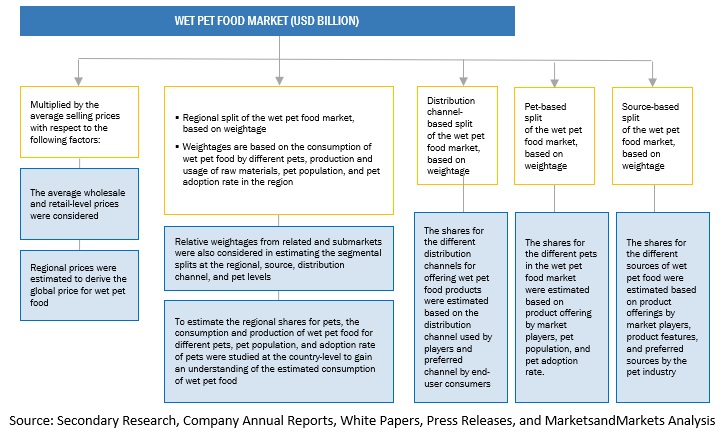

Wet Pet Food Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major wet pet food manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the wet pet food market has been arrived at.

Wet Pet Food Market Size Estimation By Type (Supply Side)

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up approach:

Based on the share of wet pet food for each site at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the site at the country level, the global market for wet pet food was estimated.

Based on the demand for pets, offerings of key players, and the region-wise market share of major players, the global market for food tested was estimated.

Other factors considered include the penetration rate of wet pet food, the demand for consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the wet pet food market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Wet Pet Food Market Size Estimation (Demand Side)

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the wet pet food market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Wet pet food refers to a category of commercial pet food products that are typically sold in cans, pouches, or other airtight containers and have a high moisture content compared to dry pet food. Wet pet food is also often referred to as canned pet food or moist pet food. It is formulated to have a higher water content, often around 70-85% moisture, which can help provide hydration to pets and is particularly beneficial for animals that may have difficulty drinking sufficient water.

American Association of Feed Control Officials (AAFCO) defines wet pet food as "a type of pet food characterized with at least 65% moisture and typically packaged in cans, pouches, trays, or other similar containers."

Stakeholders

- Key manufacturers of animal nutrition products

- Key companies engaged in pet food processing

- Key manufacturers of wet pet food

- Traders, distributors, and suppliers in the wet pet food market

- Traders and suppliers of raw materials to the wet pet food industry

-

Related government authorities, commercial R&D institutions, and other regulatory bodies

- The Association of American Feed Control Officials (AAFCO)

- Pet Food Manufacturers Association (PFMA)

- The Pet Food Industry Association of Australia

- American Pet Products Association, Inc. (APPA)

- Canadian Association of Raw Pet Food Manufacturers

Report Objectives

Market Intelligence

- Determining and projecting the size of the wet pet food market with respect to product type, source, pet, and region.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework and market entry process related to the market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

Identifying and profiling the key players in the wet pet food market.

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

Analyzing the value chain and products across the key regions and their impact on the prominent market players

Providing insights on key product innovations and investments in the global wet pet food market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the rest of Asia Pacific wet pet food market into Australia, New Zealand, Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenia.

- Further breakdown of rest of Europe market into Belgium, Netherlands, other EU, and non-EU countries.

- Further breakdown of the rest of South America's market into Chile, Venezuela, Peru, Columbia, Paraguay, and Uruguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Wet Pet Food Market