White Spirit Market by Type (Type 0, Type 1, Type 2, Type 3), Flash Point, Application (Thinner & Solvent, Fuels, Cleaning Agent, Degreasing Agent), Region (North America, Europe, APAC, Middle East & Africa, South America ) - Global Forecast to 2024

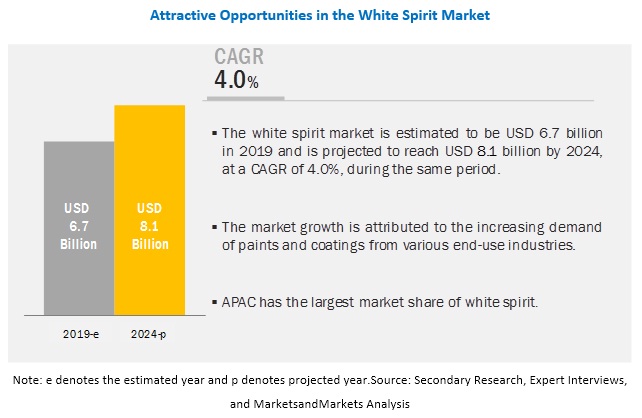

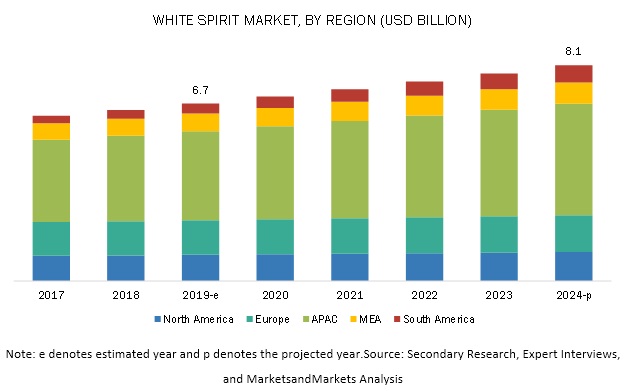

White Spirit Market is projected to grow from the estimated USD 6.7 billion in 2019 to USD 8.1 billion by 2024, at a cagr 4.0%, during the forecast period. White spirit, also known as mineral spirit or mineral turpentine oil (MTO); is a petrochemical solvent, which contains C7 to C12 aliphatic, acyclic, and aromatic hydrocarbons with a boiling range varying between 65-230°C. There are four types of white spirits that are produced as the fractional distillation fractions obtained from naphtha and kerosene cut of crude oil. The composition of these types might vary within some specific limits because of the difference in the raw material used during the production process. White spirits are clear, colorless, and flammable liquids with flash points ranging between 21-68 °C and an aromatic content ranging between 2% to 25%.

Type 2 to be the second-fastest-growing component of the white spirits market

Type 2 white spirit, also known as solvent extracted, is a combination of hydrocarbons, which is obtained as a raffinate from the solvent extraction process. The demand for type 2 white spirit is driven mainly by the growing demand from the paint & coating, adhesives, and cleaning chemical manufacturers. The increasing consumption of these compounds in the various end-use industries such as automotive, construction, composites, and chemicals, is another important factor leading to the high demand for type 2 white spirit.

Thinner & solvent to be the largest application segment of the white spirits market.

White spirit is an essential ingredient in the manufacturing of solvent-based paints & coatings and is used as a thinner. The main purpose of the white spirit as a thinner is to reduce the viscosity of the paint and provide a slower rate of evaporation. Hence, the paints that are thinned with white spirit dry to a smoother surface and form a leveled coat on the surface it is being applied to. The growing demand for new houses due to the rising number of nuclear families has led to the construction of new residential and commercial buildings, and this is expected to increase in the future. The growth of the construction industry is fueling the paints & coatings demand in these regions, which will directly have an impact on the demand for white spirit.

APAC is estimated to account for the largest market share during the forecast period.

The growth of the construction industry in APAC is fueling the paints & coatings demand in these regions, which will directly have an impact on the demand for white spirit. The rapid construction activities in the emerging economies of APAC, Middle East & Africa, and South America is driving the white spirit market. This is supported by the improving standard of living, rising housing construction expenditure, and investments across various industries, such as appliances, automotive, general industrial, architectural, and furniture.

Key Market Players

The leading players in the white spirits market are Royal Dutch Shell (The Netherlands), Total SA (France), ExxonMobil (US), Idemitsu Kosan Co. Ltd (Japan), Bharat Petroleum Corporation Limited (India), Indian Oil Corporation Limited (India), and ThaiOil Company (Japan). Most of these leading players operate globally and have a widespread distribution network.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Unit considered |

Value (USD Billion and USD Thousand) and Volume (Kiloton and Ton) |

|

Segments |

Type, Flash Point, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

Royal Dutch Shell (The Netherlands), Total SA (France), ExxonMobil (US), Idemitsu Kosan Co. Ltd (Japan), Bharat Petroleum Corporation Limited (India), Indian Oil Corporation Limited (India), and ThaiOil Company (Japan). |

This research report categorizes the global white spirits market based on type, flash point, application, and region.

Based on type:

- Type 0

- Type 1

- Type 2

- Type 3

Based on Flash Point:

- Low

- Medium

- High

Based on application:

- Thinner & Solvent

- Fuels

- Cleaning Agent

- Degreasing Agent

- Others

Based on region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is analyzed further for key countries in each of these regions.

Key questions addressed by the report

- What are the different types of white spirits being used globally?

- What are the regulations on the use of white spirit, globally?

- What are the most prominent applications of white spirit? Which is the largest application that is expected to drive the market in the near future?

- What are the global trends in demand for white spirit? Will the market witness an increase or decline in demand in the near future?

- Is there any substitute for white spirit?

- Who are the key players in the white spirits market, globally?

- What are the attractive revenue pockets for suppliers of white spirit?

- What are the winning imperatives for companies in this market?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth white spirits market?

How many types of white spirits are there in the market?

Which flashpoint is preferred for storing the white spirit?

What are applications for white spirits?

What is the biggest restrain for the white spirits market?

How is the market consolidated for white spirits?

Who are the major manufacturers of white spirits?

What is the white spirits market size in terms of volume?

What is the future outlook of each segment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Supply Side

2.2.4 Demand Side

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the White Spirit Market

4.2 APAC White Spirit Market, By Application and Country

4.3 White Spirit Market, By Type

4.4 White Spirit Market, By Flash Point

4.5 White Spirit Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Paints and Coatings From Growing Economies

5.2.2 Restraints

5.2.2.1 Environmental Regulations Boosting the Demand for VOC-Free Products

5.2.3 Opportunities

5.2.3.1 Growing Production Capacities of Paints and Coatings in Developing Countries

5.2.4 Challenges

5.2.4.1 Handling and Storage of White Spirit

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Yc, Ycc Shift

5.4.1 Yc Shift

5.4.2 Ycc Shift

6 White Spirit Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Type 0

6.2.1 Stringent Regulations in Developed Economies is Declining the Demand for Type 0 White Spirit Across the Globe

6.3 Type 1

6.3.1 APAC is Expected to have A High Demand for Type 1 White Spirit During the Forecast Period

6.4 Type 2

6.4.1 Low Aromatic Content is Increasing the Demand for Type 2 White Spirit in Paints & Coatings, Cleaning, and Deagrasing Applications

6.5 Type 3

6.5.1 Robust Growth in Demand for De-Aromatic Solvent in the Paints & Coatings Industry Will Drive the Market

7 White Spirit Market, By Flash Point (Page No. - 49)

7.1 Introduction

7.2 Low Flash Point

7.2.1 Risk Associated With the Low Flash Point White Spirits During Storage & Transportation is Decreasing Their Demand

7.3 Medium Flash Point

7.3.1 The Medium Flash Point Segment is Expected to Register Steady Growth During the Forecast Period

7.4 High Flash Point

7.4.1 Owing to High Stability and Low VOC Content, the High Flash Point White Spirit is Gaining Traction in the End-Use Industry

8 White Spirit Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Paints & Coatings

8.2.1 Steller Growth in Demand for Low Aromatic Content Solvent is Witnessed in the Paints & Coatings Industry

8.3 Cleaning

8.3.1 Increasing Demand for Cleaning Solvent in Developing Countries Will Spur the White Spirit Market Growth

8.4 Degreasing

8.4.1 Developing Manufacturing and Fabrication Sectors Across the Globe Will Provide an Impetus for the Growth of the Market

8.5 Fuel

8.5.1 Changing Government Regulations and Norms on Fuel Blending Will Hamper the Market Growth

8.6 Others

9 White Spirit Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Crude Oil Production Capacity and Growing Paints & Coatings and Fabrication Industries are Driving the Market Growth

9.2.2 Canada

9.2.2.1 Expected Growth in Paints & Coatings Production Will Help the Market to Grow

9.2.3 Mexico

9.2.3.1 The Steady Growth of the Manufacturing Sector Will Drive the Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Slow Demand for Solvent-Borne Coatings Will Hamper the Growth of the Market in the Country

9.3.2 UK

9.3.2.1 Government Initiatives in Infrastructure Projects to Increase the Demand for White Spirit

9.3.3 France

9.3.3.1 Increasing Manufacturing Activities are Contributing to the Market Growth

9.3.4 Russia

9.3.4.1 Growing Infrastructure Development Will Boost the Demand for White Spirit

9.3.5 Spain

9.3.5.1 Increasing Focus on Aerospace and Industrial Sectors is Boosting the Demand for White Spirit

9.3.6 Finland

9.3.6.1 White Spirit Market is Expected to Register Slow Growth in the Country During the Forecast Period

9.3.7 Poland

9.3.7.1 Steady Growth of the Paints & Coatings Industry Will Boost the Demand for White Spirit

9.3.8 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Amendment in Regulation and Policies Will Trigger the Demand for Type 3 White Spirit in Several Applications

9.4.2 Australia

9.4.2.1 Expected Growth in the Paints & Coatings Industry Will Boost the Demand for White Spirits in the Country

9.4.3 Japan

9.4.3.1 Strong Production Capacity is Expected to Drive the Market

9.4.4 India

9.4.4.1 Healthy Growth of the Paints & Coatings Industry Will Boost the Market Growth

9.4.5 South Korea

9.4.5.1 Strong Production Capacity and Rising Demand for Eco-Friendly Chemicals Will Propel the White Spirit Market Growth

9.4.6 Rest of APAC

9.5 Middle East & Africa

9.5.1 Iran

9.5.1.1 Healthy Growth of the Solvent-Borne Paints & Coatings Sector in Iran Will Propel the Demand for White Spirit

9.5.2 South Africa

9.5.2.1 Thriving Demand for Thinners is Witnessed From the Paints & Coatings Industry

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Slow Growth of the Solvent-Borne Coatings Sector Will Hamper the White Spirit Market in the Country

9.6.2 Argentina

9.6.2.1 White Spirit has High Demand From the Paints & Coatings Industry of the Country

9.6.3 Bolivia

9.6.3.1 The White Spirit Market is Expected to Register 1.2 Times Growth, in Terms of Value, During the Forecast Period

9.6.4 Rest of South America

10 Competitive Landscape (Page No. - 129)

10.1 Introduction

10.2 Market Shares of Key Players

10.2.1 Royal Dutch Shell PLC.

10.2.2 Exxonmobil Corporation

10.2.3 Total SA

10.3 Competitive Scenario

10.3.1 Expansion

11 Company Profiles (Page No. - 132)

(Business Overview, Products & Products Offered, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 Royal Dutch Shell PLC

11.2 Total SA

11.3 Exxonmobil Corporation

11.4 ThaiOil Group

11.5 Idemitsu Kosan Co., LTD

11.6 Türkiye Petrol Rafinerileri A.S.

11.7 DHC Solvent Chemie GmbH

11.8 Neste OYJ

11.9 Bharat Petroleum Corporation Limited (BPCL)

11.10 Indian Oil Corporation Limited (IOCL)

11.11 Eagle Petroleum

11.12 AL Sanea Chemical Products

11.13 Haltermann Carless Deutschland GmbH

11.14 Kuwait International Factory

11.15 AL-Oga Factory for Manufacturing White Spirit

11.16 K H Chemicals

11.17 Gulf Factory for White Solvent

11.18 Brenntag AG (Distributer)

11.19 Banner Chemicals Limited (Distributer)

11.20 Pon Pure Chemicals Group

*Details on Business Overview, Offered, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 158)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (226 Tables)

Table 1 Difference in the Requirement of Paint By Changing the Binder and Solvent Type

Table 2 Regulations on the Use of Solvent-Based Chemicals in Different Regions

Table 3 White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 4 White Spirit Market Size, By Type, 2017–2024 (USD Million)

Table 5 Type 0 White Spirit Market Size, By Region, 2017–2024 (Kiloton)

Table 6 Type 0 Market Size, By Region, 2017–2024 (USD Million)

Table 7 Type 1 White Spirit on the Basis of Flash Point Range

Table 8 Type 1 Market Size, By Region, 2017–2024 (Kiloton)

Table 9 Type 1 Market Size, By Region, 2017–2024 (USD Million)

Table 10 Type 2 Market Size, By Region, 2017–2024 (Kiloton)

Table 11 Type 2 Market Size, By Region, 2017–2024 (USD Million)

Table 12 Type 3 On the Basis of Flash Point Range

Table 13 Type 3 Market Size, By Region, 2017–2024 (Kiloton)

Table 14 Type 3 Market Size, By Region, 2017–2024 (USD Million)

Table 15 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 16 Market Size, By Flash Point, 2017-2024 (USD Million)

Table 17 Low Flash Point White Spirit Market Size, By Region, 2017–2024 (Kiloton)

Table 18 Market Size, By Region, 2017–2024 (USD Million)

Table 19 Medium Flash Point White Spirit Market Size, By Region, 2017–2024 (Kiloton)

Table 20 Market Size, By Region, 2017–2024 (USD Million)

Table 21 High Flash Point White Spirit Market Size, By Region, 2017–2024 (Kiloton)

Table 22 HMarket Size, By Region, 2017–2024 (USD Million)

Table 23 White Spirit Market Size, By Application, 2017–2024 (Kiloton)

Table 24 Market Size, By Application, 2017–2024 (USD Million)

Table 25 White Spirit Market Size in Paints & Coatings, By Region, 2017–2024 (Kiloton)

Table 26 Market Size in Paints & Coatings, By Region, 2017–2024 (USD Million)

Table 27 Market Size in Cleaning Solvent, By Region, 2017–2024 (Kiloton)

Table 28 Market Size in Cleaning Solvent, By Region, 2017–2024 (USD Million)

Table 29 Market Size in Degreasing, By Region, 2017–2024 (Kiloton)

Table 30 Market Size in Degreasing, By Region, 2017–2024 (USD Million)

Table 31 Market Size in Fuel, By Region, 2017–2024 (Kiloton)

Table 32 Market Size in Fuel, By Region, 2017–2024 (USD Million)

Table 33 Market Size in Others, By Region, 2017–2024 (Kiloton)

Table 34 Market Size in Others, By Region, 2017–2024 (USD Million)

Table 35 Market Size, By Region, 2017–2024 (Kiloton)

Table 36 Market Size, By Region, 2017–2024 (USD Million)

Table 37 North America: White Spirit Market Size, By Country, 2017–2024 (Kiloton)

Table 38 Market Size, By Country, 2017–2024 (USD Million)

Table 39 North America: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 40 Market Size, By Type, 2017–2024 (USD Million)

Table 41 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 42 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 43 Market Size, By Application, 2017–2024 (Kiloton)

Table 44 Market Size, By Application, 2017–2024 (USD Million)

Table 45 Regulations on the Use of Solvent-Borne Paints and Coatings

Table 46 US: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 47 Market Size, By Type, 2017–2024 (USD Million)

Table 48 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 49 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 50 Market Size, By Application, 2017–2024 (Kiloton)

Table 51 Market Size, By Application, 2017–2024 (USD Million)

Table 52 VOC Content Limits in Canada

Table 53 Canada: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 54 Market Size, By Type, 2017–2024 (USD Million)

Table 55 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 56 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 57 Market Size, By Application, 2017–2024 (Kiloton)

Table 58 Market Size, By Application, 2017–2024 (USD Million)

Table 59 Mexico: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 60 Market Size, By Type, 2017–2024 (USD Million)

Table 61 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 62 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 63 Market Size, By Application, 2017–2024 (Kiloton)

Table 64 Market Size, By Application, 2017–2024 (USD Million)

Table 65 VOC Regulations on Products in Europe

Table 66 Europe: White Spirit Market Size, By Country, 2017–2024 (Kiloton)

Table 67 Market Size, By Country, 2017–2024 (USD Million)

Table 68 Market Size, By Type, 2017–2024 (Kiloton)

Table 69 Market Size, By Type, 2017–2024 (USD Million)

Table 70 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 71 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 72 Market Size, By Application, 2017–2024 (Kiloton)

Table 73 Market Size, By Application, 2017–2024 (USD Million)

Table 74 Germany: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 75 Market Size, By Type, 2017–2024 (USD Million)

Table 76 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 77 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 78 Market Size, By Application, 2017–2024 (Kiloton)

Table 79 Market Size, By Application, 2017–2024 (USD Million)

Table 80 UK: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 81 Market Size, By Type, 2017–2024 (USD Million)

Table 82 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 83 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 84 Market Size, By Application, 2017–2024 (Kiloton)

Table 85 Market Size, By Application, 2017–2024 (USD Million)

Table 86 France: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 87 Market Size, By Type, 2017–2024 (USD Million)

Table 88 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 89 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 90 Market Size, By Application, 2017–2024 (Kiloton)

Table 91 Market Size, By Application, 2017–2024 (USD Million)

Table 92 Russia: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 93 Market Size, By Type, 2017–2024 (USD Million)

Table 94 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 95 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 96 Market Size, By Application, 2017–2024 (Kiloton)

Table 97 Market Size, By Application, 2017–2024 (USD Million)

Table 98 Spain: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 99 Market Size, By Type, 2017–2024 (USD Million)

Table 100 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 101 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 102 Market Size, By Application, 2017–2024 (Kiloton)

Table 103 Market Size, By Application, 2017–2024 (USD Million)

Table 104 Finland: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 105 Market Size, By Type, 2017–2024 (USD Million)

Table 106 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 107 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 108 Market Size, By Application, 2017–2024 (Kiloton)

Table 109 Market Size, By Application, 2017–2024 (USD Million)

Table 110 Poland: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 111 Market Size, By Type, 2017–2024 (USD Million)

Table 112 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 113 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 114 Market Size, By Application, 2017–2024 (Kiloton)

Table 115 Market Size, By Application, 2017–2024 (USD Million)

Table 116 Rest of Europe: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 117 Market Size, By Type, 2017–2024 (USD Million)

Table 118 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 119 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 120 Market Size, By Application, 2017–2024 (Kiloton)

Table 121 Market Size, By Application, 2017–2024 (USD Million)

Table 122 APAC: White Spirit Market Size, By Country, 2017–2024 (Kiloton)

Table 123 Market Size, By Country, 2017–2024 (USD Million)

Table 124 Market Size, By Type, 2017–2024 (Kiloton)

Table 125 Market Size, By Type, 2017–2024 (USD Million)

Table 126 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 127 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 128 Market Size, By Application, 2017–2024 (Kiloton)

Table 129 Market Size, By Application, 2017–2024 (USD Million)

Table 130 China: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 131 Market Size, By Type, 2017–2024 (USD Million)

Table 132 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 133 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 134 Market Size, By Application, 2017–2024 (Kiloton)

Table 135 Market Size, By Application, 2017–2024 (USD Million)

Table 136 Australia: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 137 Market Size, By Type, 2017–2024 (USD Million)

Table 138 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 139 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 140 Market Size, By Application, 2017–2024 (Kiloton)

Table 141 Market Size, By Application, 2017–2024 (USD Million)

Table 142 Japan Paints Production and Sale, 2018 (Ton)

Table 143 Market Size, By Type, 2017–2024 (Kiloton)

Table 144 Market Size, By Type, 2017–2024 (USD Million)

Table 145 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 146 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 147 Market Size, By Application, 2017–2024 (Kiloton)

Table 148 Market Size, By Application, 2017–2024 (USD Million)

Table 149 Key Paints and Coatings Manufacturers in India

Table 150 Market Size, By Type, 2017–2024 (Kiloton)

Table 151 Market Size, By Type, 2017–2024 (USD Million)

Table 152 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 153 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 154 Market Size, By Application, 2017–2024 (Kiloton)

Table 155 Market Size, By Application, 2017–2024 (USD Million)

Table 156 South Korea: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 157 Market Size, By Type, 2017–2024 (USD Million)

Table 158 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 159 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 160 Market Size, By Application, 2017–2024 (Kiloton)

Table 161 Market Size, By Application, 2017–2024 (USD Million)

Table 162 Rest of APAC: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 163 Market Size, By Type, 2017–2024 (USD Million)

Table 164 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 165 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 166 Market Size, By Application, 2017–2024 (Kiloton)

Table 167 Market Size, By Application, 2017–2024 (USD Million)

Table 168 Middle East & Africa: White Spirit Market Size, By Country, 2017–2024 (Kiloton)

Table 169 Market Size, By Country, 2017–2024 (USD Million)

Table 170 Market Size, By Type, 2017–2024 (Kiloton)

Table 171 Market Size, By Type, 2017–2024 (USD Million)

Table 172 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 173 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 174 Market Size, By Application, 2017–2024 (Kiloton)

Table 175 Market Size, By Application, 2017–2024 (USD Million)

Table 176 Iran: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 177 Market Size, By Type, 2017–2024 (USD Million)

Table 178 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 179 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 180 Market Size, By Application, 2017–2024 (Kiloton)

Table 181 Market Size, By Application, 2017–2024 (USD Million)

Table 182 South Africa: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 183 Market Size, By Type, 2017–2024 (USD Million)

Table 184 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 185 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 186 Market Size, By Application, 2017–2024 (Kiloton)

Table 187 Market Size, By Application, 2017–2024 (USD Million)

Table 188 Rest of Middle East & Africa: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 189 Market Size, By Type, 2017–2024 (USD Million)

Table 190 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 191 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 192 Market Size, By Application, 2017–2024 (Kiloton)

Table 193 Market Size, By Application, 2017–2024 (USD Million)

Table 194 South America: White Spirit Market Size, By Country, 2017–2024 (Kiloton)

Table 195 Market Size, By Country, 2017–2024 (USD Million)

Table 196 Market Size, By Type, 2017–2024 (Kiloton)

Table 197 Market Size, By Type, 2017–2024 (USD Million)

Table 198 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 199 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 200 Market Size, By Application, 2017–2024 (Kiloton)

Table 201 Market Size, By Application, 2017–2024 (USD Million)

Table 202 Brazil: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 203 Market Size, By Type, 2017–2024 (USD Million)

Table 204 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 205 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 206 Market Size, By Application, 2017–2024 (Kiloton)

Table 207 Market Size, By Application, 2017–2024 (USD Million)

Table 208 Argentina: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 209 Market Size, By Type, 2017–2024 (USD Million)

Table 210 Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 211 Market Size, By Flash Point, 2017–2024 (USD Million)

Table 212 Market Size, By Application, 2017–2024 (Kiloton)

Table 213 Market Size, By Application, 2017–2024 (USD Million)

Table 214 Bolivia: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 215 Bolivia: White Spirit Market Size, By Type, 2017–2024 (USD Million)

Table 216 Bolivia: White Spirit Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 217 Bolivia: White Spirit Market Size, By Flash Point, 2017–2024 (USD Million)

Table 218 Bolivia: White Spirit Market Size, By Application, 2017–2024 (Kiloton)

Table 219 Bolivia: White Spirit Market Size, By Application, 2017–2024 (USD Million)

Table 220 Rest of South America: White Spirit Market Size, By Type, 2017–2024 (Kiloton)

Table 221 Rest of South America: White Spirit Market Size, By Type, 2017–2024 (USD Million)

Table 222 Rest of South America: White Spirit Market Size, By Flash Point, 2017–2024 (Kiloton)

Table 223 Rest of South America: White Spirit Market Size, By Flash Point, 2017–2024 (USD Million)

Table 224 Rest of South America: White Spirit Market Size, By Application, 2017–2024 (Kiloton)

Table 225 Rest of South America: White Spirit Market Size, By Application, 2017–2024 (USD Million)

Table 226 Expansion, 2017

List of Figures (32 Figures)

Figure 1 White Spirit Market: Research Design

Figure 2 White Spirit Market: Bottom-Up Approach

Figure 3 White Spirit Market: Top-Down Approach

Figure 4 Market Size Estimation: Supply Side Analysis

Figure 5 White Spirit Market: Data Triangulation

Figure 6 Type 3 Was the Dominating Type Segment in the White Spirit Market in 2018

Figure 7 High Flash Point White Spirit Accounted for the Largest Market Share in 2018

Figure 8 Paints & Coatings to Be the Fastest-Growing Application of White Spirit

Figure 9 APAC to Be the Fastest-Growing White Spirit Market During the Forecast Period

Figure 10 Increasing Demand From the Paints & Coatings Industry to Drive the Market

Figure 11 China Accounted for the Largest Market Share in APAC in 2018

Figure 12 Type 3 Segment to Maintain Ascendency Throughout the Forecast Period

Figure 13 High Flash Point Segment to Register the Highest CAGR During the Forecast Period

Figure 14 India to Be the Fastest-Growing Market for White Spirit

Figure 15 Drivers, Restraints, Opportunities, and Challenges: White Spirit Market

Figure 16 White Spirit Market: Porter’s Five Forces Analysis

Figure 17 India to Be the Fastest-Growing White Spirit Market

Figure 18 North America: White Spirit Market Snapshot

Figure 19 Europe: White Spirit Market Snapshot

Figure 20 APAC: White Spirit Market Snapshot

Figure 21 South America: White Spirit Market Snapshot

Figure 22 Companies Majorly Adopted Expansion Growth Strategy Between 2017 and 2019

Figure 23 Royal Dutch Shell PLC Led the White Spirit Market in 2018

Figure 24 Royal Dutch Shell PLC: Company Snapshot

Figure 25 Total SA: Company Snapshot

Figure 26 Exxonmobil Corporation: Company Snapshot

Figure 27 ThaiOil Group: Company Snapshot

Figure 28 Idemitsu Kosan Co., LTD: Company Snapshot

Figure 29 Türkiye Petrol Rafinerileri A.S.: Company Snapshot

Figure 30 Neste OYJ.: Company Snapshot

Figure 31 Bharat Petroleum Corporation Limited.: Company Snapshot

Figure 32 Indian Oil Corporation Limited: Company Snapshot

The study involves four major activities in estimating the current market size of white spirit, also known as mineral spirit or mineral turpentine oil (MTO). Exhaustive secondary research was done to collect information related to the white spirit market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The white spirit market comprises several stakeholders, such as raw material suppliers, technology developers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the construction and transportation industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

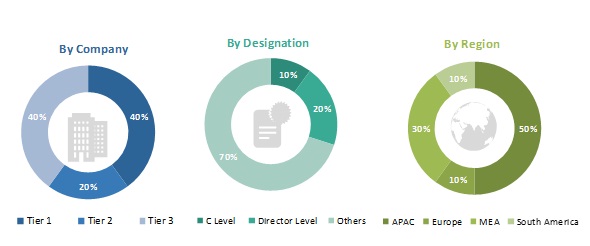

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global white spirit market and estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there are three sources-top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the market size of white spirits, in terms of value

- To define, describe, and forecast the market size of white spirits, in terms of volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the white spirits market size based on type

- To analyze and forecast the white spirits market size based on the flash point

- To analyze and forecast the white spirits market size based on application

- To forecast the market size of different segments with respect to five regions, namely, APAC, Europe, North America, Middle East & Africa, and South America

- To forecast the white spirits market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansion, acquisition, and new product development, in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to ten)

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in White Spirit Market