Wireless Charging Market

Wireless Charging Market for Electric Vehicles by Charging System (Inductive and Magnetic Power Transfer), Propulsion, Charging Type (Stationary and Dynamic Wireless Charger), Component, Power Supply, and Vehicle Type - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global wireless charging market for electric vehicles is projected to grow from USD 0.09 billion in 2025 to USD 1.12 billion by 2032, at a CAGR of 43.8%. Wireless EV charging supports efficient and user-friendly mobility by removing cable hassles and enabling contactless power transfer. It meets consumer demand for convenience, integrates with smart vehicles and homes, and aligns with smart parking systems. Its ability to cut downtime, reduce wear, and fit into urban energy platforms positions it as a strong enabler of next-generation electrification.

KEY TAKEAWAYS

-

BY CHARGING TYPEStationary wireless charging systems are seeing wider integration in residential and workplace environments, driven by lower infrastructure requirements and increasing compatibility with current EV models.

-

BY COMPONENTPower control units are evolving with embedded diagnostics and real-time communication to optimize wireless energy transfer.

-

BY POWER SUPPLY RANGEHigh-power wireless systems (above 11?kW) are actively integrated into bus and fleet depots across China and South Korea. Passenger use is still mainly led by 7–11 kW chargers.

-

BY PROPULSIONService-based pricing would help commercial clients adopt wireless charging without heavy upfront investment, ensuring providers generate stable, recurring revenue.

-

BY REGIONWireless EV charging is gaining traction across regions, driven by different factors. In the US, fleet pilots, government grants, and OEM–supplier partnerships are key enablers. Europe is advancing through smart city policies, public transport pilots, and EU-backed standardization. China benefits from high EV adoption, large state-led projects, and integration with smart urban platforms.

-

COMPETITIVE LANDSCAPECompetition in wireless EV charging is driven by OEM partnerships with tech providers, as early integrations decide market share. Patents around inductive charging and alignment systems are creating strong entry barriers. Efficiency, scalability, and proven business models are now the key differentiators.

The wireless charging market for electric vehicles is rapidly developing, driven by the increasing adoption of BEVs, advancements in essential wireless charging technologies, and a growing focus on interoperability standards. With governments promoting zero-emission mobility and OEMs providing new features for user convenience, wireless charging is expected to emerge as a key enabler for future electric transportation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

This illustrates how companies operating in the wireless charging market for EVs are shifting their focus as technology and customer needs evolve. With the increasing adoption of electric cars and the rise of autonomous vehicles, the market is moving toward new opportunities, especially wireless charging systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Redefining EV charging with automation and operational efficiency

-

Increased involvement of OEMs in the wireless charging market

Level

-

Lower energy transfer efficiency than conventional wired systems

-

High cost and complexity of integrating in-vehicle charger systems

Level

-

Rapid adoption of wireless charging in smart city infrastructure

-

Increased investments in dynamic wireless charging technology

Level

-

Lack of standardized vehicle integration

-

Substantial setup and installation costs of public AC wireless charging

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Redefining EV charging with automation and operational efficiency

Wireless EV charging systems provide a compelling dual benefit: enhanced user convenience and simplified infrastructure upkeep. By removing the need for physical connectors, these systems enable fully automated, hands-free charging, a major advantage for residential users, urban commuters, and fleet operators.

Restraint: Lower energy transfer efficiency than conventional wired systems

While wired charging typically achieves efficiency levels between 90% and 95%, wireless charging systems often operate around 80%. This lower efficiency results in higher energy loss, leading to increased charging costs and reduced overall energy effectiveness. However, with a shift in technology, wireless charging efficiency is growing.

Opportunity: Rapid adoption of wireless charging in smart city infrastructure

The adoption of wireless EV charging into smart city infrastructure offers a major growth opportunity for the market. As governments and cities worldwide invest in creating smarter urban environments, there is an increasing focus on integrating advanced transportation technologies into roads, parking areas, and public transit systems.

Challenge: Lack of standardized vehicle integration

One major obstacle to the wider adoption of wireless EV charging is the lack of standardized integration across different vehicle models. Currently, only a small number of EVs come with factory-installed wireless charging receivers. Aftermarket retrofitting increases cost, adds complexity, and introduces logistical challenges, especially for fleet operators.

Wireless Charging Market for Electric Vehicles: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Magnetic resonance-based wireless charging solutions for passenger cars and light commercial vehicles | Convenient hands-free charging, high efficiency transfer up to 11 kW, supports interoperability across multiple EV models |

|

Dynamic wireless charging infrastructure enabling charging while vehicles are in motion, focused on buses and commercial fleets | Extended driving range, reduced downtime for fleet vehicles, supports high utilization in public transit systems |

|

Road-embedded wireless charging systems for public transport and logistic vehicles | Continuous energy supply during travel, smaller onboard battery requirement, lower vehicle weight and cost |

|

Smart wireless charging platforms integrated with mobile apps and grid services | Compact design for urban environments, enhanced user experience with app-based monitoring, potential for V2G integration |

|

Aftermarket wireless charging kits for popular EV models | Easy retrofit installation, improved user convenience, reduced wear and tear on charging connectors |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the wireless charging market for the electric vehicle’s ecosystem, which is primarily represented by OEMs, wireless EV charging system providers, and end-users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wireless Charging Market for Electric Vehicles, By Charging Type

Inductive power transfer remains the most commercially adopted system, leveraging electromagnetic induction to deliver safe and efficient energy transfer. Magnetic power transfer, particularly through magnetic resonance and dynamic coupling, has gained significant traction, especially in dynamic (in-motion) charging applications.

Wireless Charging Market for Electric Vehicles, By Component

A wireless charging system consists of a charging pad (primary coil) fixed on the ground, a receiver pad (secondary coil) fitted under the vehicle, and a power control unit (PCU) that controls power transfer to the base charging pad. The current flowing through the primary coil creates an electromagnetic field, which is picked up by the secondary coil.

Wireless Charging Market for Electric Vehicles, By Power Supply Range

7–11 kW chargers are currently the main use case of wireless charging, allowing basic L2 charging in parking lots for fleets, and private parking spaces. This will be mainly driven by key partnerships between OEMs and wireless charger providers planning to provide this feature along with luxury EVs.

Wireless Charging Market for Electric Vehicles, By Propulsion

Wireless charging is more critical for BEVs due to their larger batteries and higher energy demand, making frequent, hassle-free charging essential. Urban and fleet BEVs benefit from automated, space-efficient charging without human intervention. Advances in efficiency and standardization will make wireless systems practical for BEVs due to their larger battery size and electric first propulsion demand.

REGION

Europe to be the fastest-growing market for wireless charging for EVs

The European wireless charging market for EVs, consisting of France, Germany, the Netherlands, Norway, Spain, Sweden, Switzerland, and the UK, is projected to be the fastest-growing market during the forecast period. The increasing sales of electric vehicles, coupled with the development of charging infrastructure facilities, are expected to facilitate the rapid development of the market in this region.

Wireless Charging Market for Electric Vehicles: COMPANY EVALUATION MATRIX

In the wireless charging market for electric vehicles, WiTricity (Star) leads with cutting-edge magnetic resonance technology, a robust patent portfolio, and numerous global partnerships. Their innovation and extensive licensing model accelerate adoption across automakers, Tier 1 suppliers, and infrastructure providers, establishing WiTricity as a pioneer in this space. ZTE Corporation (Emerging Leader) is rapidly expanding, leveraging its telecommunications expertise to deliver innovative wireless charging hardware and smart infrastructure solutions, particularly in the Asia-Pacific region. While WiTricity leads in technology and market presence, ZTE's strong regional growth and product development position it well to compete for leadership in the near future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.09 BN |

| Market Forecast in 2032 (Value) | USD 1.12 BN |

| Growth Rate | CAGR of 48.3% from 2025 to 2032 |

| Years Considered | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Units), Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, and North America |

WHAT IS IN IT FOR YOU: Wireless Charging Market for Electric Vehicles REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Tier-1 Automotive Supplier (Europe/US) | Competitive intelligence and market strategies Technology roadmap and integration feasibility for wireless charging modules Partnership and pilot project mapping across passenger and commercial vehicles | Identify white space opportunities for wireless systems in future EV platforms Map M&A and collaboration targets in the wireless technology ecosystem Optimize go-to-market strategies for differentiating new vehicle launches |

| Electric Vehicle OEM (Asia Pacific) | Adoption forecasts for wireless charging across luxury, mass, and fleet segments Integration requirements for in-vehicle installation vs. aftermarket Regulatory impact analysis for wireless charging mandates in smart cities | Inform product planning for factory-fitted vs. retrofit offerings Support compliance planning for emerging global wireless charging standards Enable positioning as early adopters in next-gen mobility |

| Automotive Electronics Supplier | Technology due diligence on induction and resonance wireless charging System integration requirements for OEM and Tier-1 vehicles Patent landscape and licensing risks assessment | Map OEM solution fit for wireless-ready modules Position as critical supplier in the wireless charging value chain |

RECENT DEVELOPMENTS

- May 2025 : InductEV partnered with ENRC to provide wireless charging across ENRCs fleet across North America.

- March 2025 : ENRX launched ENRMOVE, which is a wireless charging platform designed for opportunity charging during routine stops.

- March 2025 : WiTricity partnered with International Transportation Service (ITS) to launch a six-month program for the Ford E Transit outfitted with WiTricity's Halo wireless charging system.

- April 2025 : WiTricity established WiTricity Japan KK in Tokyo to strengthen ties with Japanese OEMs and infrastructure developers to simplify EV charging, support fleets, enable automated parking solutions, and integrate V2G.

Table of Contents

Methodology

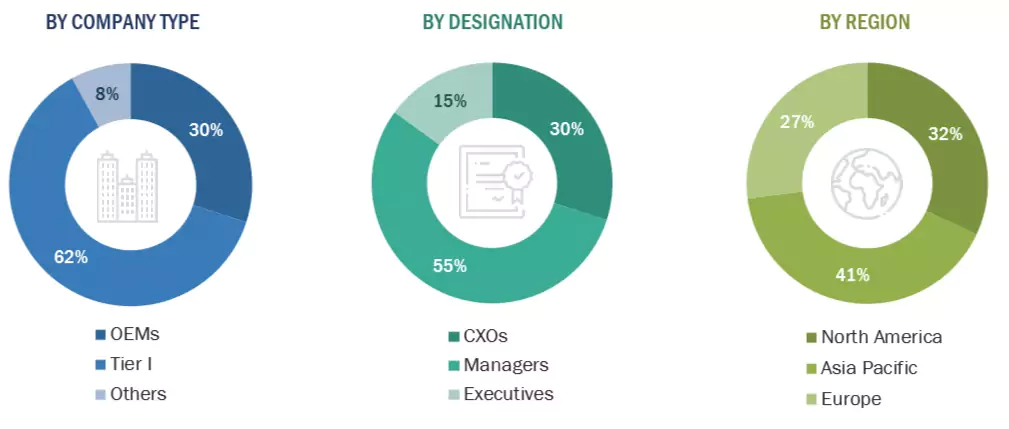

This research study involves the extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the wireless charging market for electric vehicles. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players (wireless EV charger manufacturers and OEMs), and industry consultants, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study on the wireless charging market for electric vehicles. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

After understanding the wireless charging market for electric vehicles scenario through secondary research, extensive primary research was conducted. Primary interviews were conducted with market experts from both demand and supply sides across North America, Europe, and Asia Pacific. Approximately 35% of interviews were conducted from the demand side, while 65% of primary interviews were conducted from the supply side. The primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies.

Note: Tiers of companies are based on the value chain of the wireless charging market for electric vehicles; the revenues of companies were not

considered. Tier 1 companies include wireless charging providers and wired EV charging station manufacturers. Others include charging network

providers, software solution providers, and charging component providers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global wireless charging market for electric vehicles. In these approaches, the penetration of electric vehicles equipped with wireless charging at a country level was considered.

Data Triangulation

After arriving at the overall size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

The wireless charging encompasses technologies that enable the transfer of electrical power without physical connectors, using methods such as inductive, resonant, or radio frequency charging. It includes hardware, systems, and integration charging solutions.

Stakeholders

- Associations, forums, and alliances related to wireless charging for electric vehicles

- Automobile manufacturers

- Battery distributors

- Battery manufacturers

- Charging infrastructure providers

- Charging service providers

- EV charging pole manufacturers

- EV charging station service providers

- EV distributors and retailers

- EV manufacturers

- Government agencies and policymakers

- Oil & gas companies

- Utility companies

- Wireless EV charging providers

- Wireless EV component manufacturers

Report Objectives

-

To define, segment, and forecast the wireless charging market for electric vehicles

(2025–2032) in terms of volume (units) and value (USD thousand) - To segment the market and forecast its size by charging type, component, application, charging system, propulsion type, power supply range, vehicle type, and region

- To segment the market based on application and estimate the home charging unit subsegment by volume and the commercial charging station subsegment by qualitative insights

- To segment the market based on charging type and estimate the stationary wireless charging system subsegment by volume and the dynamic wireless charging system subsegment by qualitative insights

- To segment the market and forecast its size based on vehicle type—passenger car and commercial vehicle

- To segment the market and forecast its size, by value, based on component: base charging pad (BCP), power control unit (PCU), and vehicle charging pad (VCP)

- To segment the market and forecast its size, by volume and value, based on power supply range: up to 3.7 kW, above 3.7-7.7 kW, above 7.7 -11 kW, and above 11 kW

- To segment the market and forecast its size, by volume, based on propulsion: battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV)

- To segment the market and forecast its size, by volume, based on charging system: inductive power transfer and magnetic power transfer

- To forecast the market size with respect to key regions: North America, Europe, and Asia Pacific

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, product launches, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

-

Wireless Charging Market for Electric Vehicles, By Power Supply at Country Level

(For countries covered in the report) -

Wireless Charging Market for Electric Vehicles, By Vehicle Type at Country Level

(For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Key Questions Addressed by the Report

What is the current size of the wireless charging market for electric vehicles in terms of value?

The size of the wireless charging market for electric vehicles is estimated at USD 0.09 billion in 2025.

Who are the winners in the wireless charging market for electric vehicles?

The wireless charging market for electric vehicles is dominated by established players such as WiTricity Corporation (US), InductEV Inc. (US), ENRX (Norway), Plugless Power Inc. (US), and HEVO Inc. (US). These companies develop and supply wireless charging solutions for electric vehicles, ranging from factory-integrated systems to high-power fleet infrastructure.

Which region will be the fastest-growing wireless charging market for electric vehicles?

Asia Pacific is projected to be the fastest-growing wireless charging market for electric vehicles, with China leading the global EV sales. China is the leading Asia Pacific wireless charging markets for electric vehicles during the forecast period. The easy availability of electronic equipment or raw materials required to manufacture power control units is expected to reduce the cost of wireless charging systems in China, which will, in turn, drive the market.

What are the new trends impacting the growth of the wireless charging market for electric vehicles?

The key trends impacting the growth of the wireless charging market for electric vehicles are focused on dynamic wireless charging, OEM collaborations, and licensing models.

What countries are covered in the North American region for the wireless charging market for electric vehicles?

The countries covered in the report for the North American wireless charging market for electric vehicles are the US and Canada.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wireless Charging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Wireless Charging Market

Jack

Jun, 2022

Which geography is expected to grow at the highest rate among others in the global Wireless Charging Market for Electric Vehicles from 2022 to 2030?.