3D Printing Plastics Market

3D Printing Plastics Market by Type (Photopolymer, ABS, Polyamide, PLA, PETG), Form (Filament, Liquid, Powder), Application (Prototyping, Manufacturing, Tooling), End-use Industry (Healthcare, Aerospace & Defense, Automotive, Consumer Goods), and Region- Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

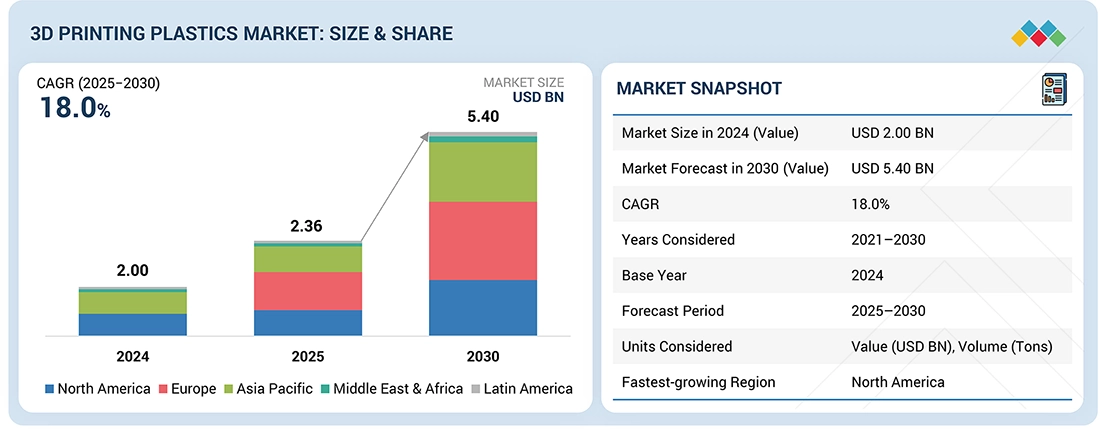

The 3D printing plastics market is projected to grow from USD 2.36 billion in 2025 to USD 5.39 billion by 2030, at a CAGR of 18.0% in terms of value. During the forecast period, it is projected that the global market for 3D printing plastics will experience high growth, as there is an increasing demand for 3D printing plastics across various industries due to their unique characteristics and expanding applications in various sectors, such as automotive, aerospace & defense, healthcare, and consumer goods. Additionally, the market is expected to benefit from advancements in the manufacturing processes of 3D printing plastics. Increased investments in the 3D printing plastics market, especially in regions like Europe, North America, and Asia Pacific, further drive demand for the market.

KEY TAKEAWAYS

-

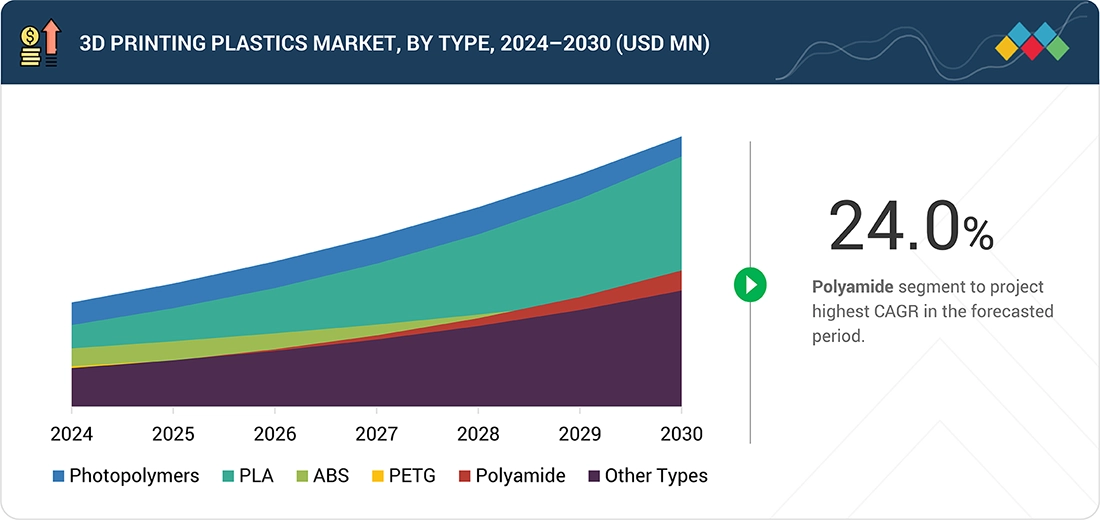

BY TYPEThe type segment of 3D printing plastics include photopolymers, PLA, ABS, polyamide, PETG, and others. Rising adoption in 3D printing and rapid prototyping is driving the demand for photopolymers, giving them the largest market share.

-

BY FORMThe 3D printing plastic is available in powder, liquid, and filament form. The rising adoption of powder-form 3D printing plastics for industrial prototyping and end-use part production is driving its CAGR.

-

BY APPLICATIONThe application segment of 3d printing plastics include prototyping, manufacturing, and Tooling. Expanding use of 3D printing plastics in large-scale industrial manufacturing and customized component production is driving the highest CAGR in the application segment.

-

BY END-USE INDUSTRYThe end-use industry includes aerospace & defense, automotive, healthcare, consumer goods, and other end-use industries. The automotive sector is witnessing the highest CAGR in the 3D printing plastics market as manufacturers increasingly adopt additive manufacturing for lightweight components, rapid prototyping, and design optimization.

-

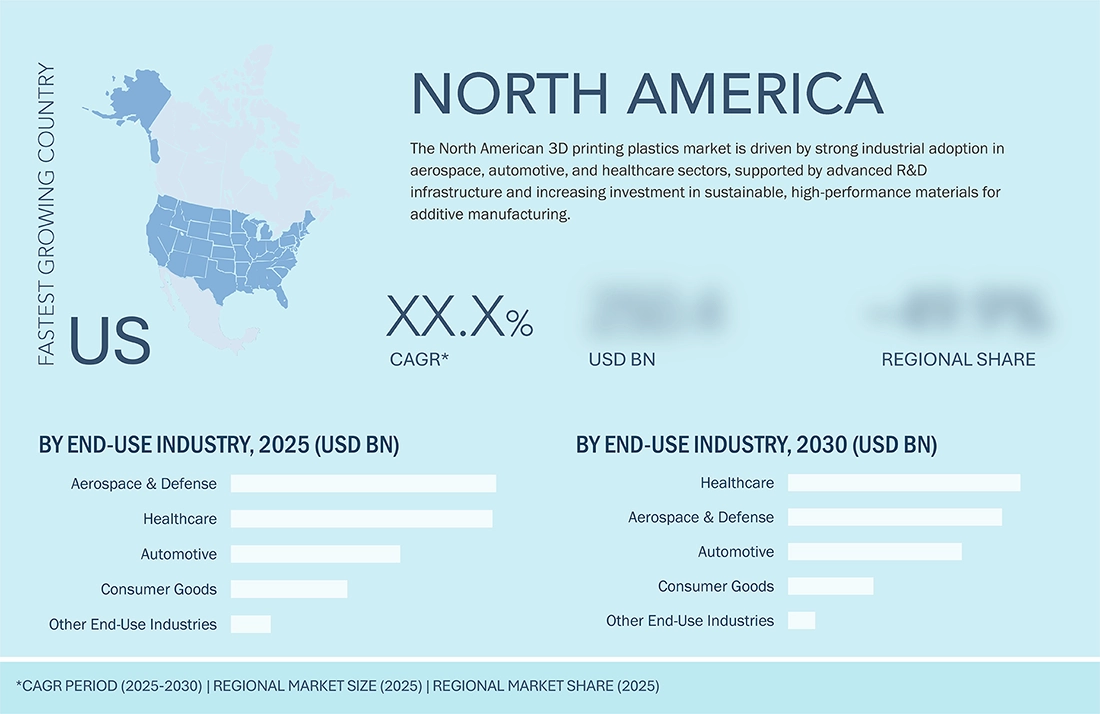

BY REGIONThe 3D prinitng plastics market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. North America is expected to record the highest CAGR in the 3D printing plastics market due to strong adoption of additive manufacturing across aerospace, automotive, and healthcare industries. The presence of major 3D printing companies, rapid technological advancements, and supportive government initiatives for advanced manufacturing are further fueling regional growth.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Stratasys (US), Arkema S.A. (France), and Evonik Industries AG (Germany)have entered into a number of agreements and partnerships to cater to the growing demand for 3D printing plastics across innovative applications.

The global market for 3D printing plastics is experiencing strong growth due to the impact of technology, industry, and economic trends. 3D printing plastics are now being embraced by critical industries, including automotive, aerospace, medical, medical, and consumer electronics. These sectors recognize that 3D printing plastics help accelerate product development, decrease tooling costs, and manufacture on-demand parts. High-performance plastics are now being used by manufacturers for both prototypes as well as final production parts, such as PA (Nylon), ABS, and PLA, because of their performance properties, which include strength-to-weight ratio, thermal stability, and durability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of 3D printing plastics suppliers, which, in turn, affect the revenues of 3D printing plastics manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government Initiatives to surge adoption of 3D printing technologies

-

Increased supply of 3D printing plastics due to forward integration of key polymer companies

Level

-

Environmental concerns regarding disposal of plastic products

-

Lack of mass production

Level

-

Increasing demand for bio-based plastic grades

-

Enhanced performance of composite grades in industrial applications

Level

-

Technological advancements in 3D printing

-

High manufacturing costs of commercial-grade plastics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Government Initiatives to surge adoption of 3D Printing plasticscrease in demand for recyclable materials

Government initiatives are a key driver in accelerating the growth of the 3D printing plastics market globally. Governments worldwide have realized the potential of additive manufacturing to revolutionize the production system, and they are supporting its adoption and expansion through, funding, making favourable tax treatment, and enhancing the infrastructure required for domestic production. These efforts aim to increase the ability to produce goods domestically rather than adopting traditional production practices. The United States government, through organizations like the National Institute of Standards and Technology (NIST) and America Makes, has created many programs focused on advancing additive manufacturing technologies. The German government, widely regarded as a global center of engineering and manufacturing, supports 3D printing via its "Industrie 4.0" initiative purring along the digital transformation path within the manufacturing sector.

Restraint: Environmental concerns regarding disposal of plastic products

One of the restraints on growth of the 3D printing plastics market is increasing global environmentalism when it comes to disposing of plastic-based products. 3D printing does have some benefits of decreasing waste material and on demand producing. However, the most common materials used, including ABS, PLA, and other thermoplastics, still contribute to environmental degradation at the end of their life cycle. Many of these plastics are non-biodegradable and could last in the environment indefinitely, particularly in situations where they are only used as prototypes, which can have extremely short lives before disposal, or as products that have very short lifespans. Although some 3D printing plastics, like PLA, are marketed as biodegradable, their decomposition typically requires industrial composting conditions that are not widely accessible.

Opportunity: Increasing demand for bio-based plastic grades

The global push for sustainability and environmental stewardship is opening up an important opportunity for the 3D printing plastics market in the form of increased demand for bio-based plastic grades. Bio-based plastics use renewable resources such as corn starch, sugarcane, or cellulose in contrast to traditional petroleum based polymers. As industries and consumers begin to understand the impacts of plastic waste on the environment, the demand for biodegradable and recyclable material for 3D printing is quickly increasing. Bio-based or compostable materials such as Polylactic Acid (PLA) are currently being used in 3D printing applications such as prototyping and consumables, in part, that they are user-friendly, and have minimal impact to the environment during their production and use. In addition, ongoing research and development is advancing the use of bio-based materials with the goal of developing more durable high-performance plastics that can be used in functional components of products in categories such as automotive, medical, and electronics.

Challenge:High manufacturing costs of commercial-grade plastics

The major obstacle for the 3D printing plastics market is the high production cost of commercial grade plastic materials thus discouraging their extensive use in various end-use industries. These high-performance plastics, which include PEEK, polyamide, polycarbonate (PC) and carbon-fiber-reinforced thermoplastics have been developed for the most challenging applications across aerospace, automotive, medical and industrial markets. But making these products at commercial-quality standards comes with complex and energy-consuming methods (such as high-temperature polymerization, advanced compounding, and rigorous material conditioning) that will greatly influence costs of production. The commercial-grade plastics generally need much testing and certification to satisfy the industrial standards (such as for aerospace and medical applications), resulting in more development and compliance expenses.

3D Printing Plastics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufacturing of cabin spacer panels and structural components for commercial aircraft (A320, A350) using FDM technology with Ultem 9085 and high-performance polyamide compounds. These bionic-designed panels replace traditionally injection-molded components in aircraft interior retrofitting and cabin upgrades, requiring small-batch production and tight lead times. | 15% weight reduction compared to traditional metal or plastic panels through optimized bionic lattice designs; drastically reduced lead time for small-batch customized parts by eliminating complex tooling requirements |

|

Production of custom-fitted prosthetic limbs and hands for patients with limb loss using FDM and resin-based 3D printing with biocompatible polymers. Personalized prosthetics are manufactured from patient anatomical scans, with each device tailored to individual patient measurements and functional requirements. | Highly customized fit for each patient, dramatically improving comfort and functionality; production time reduced from weeks/months to just a few days |

|

Manufacturing of complex bearing cage assemblies and seals for industrial split roller bearings using HP Multi Jet Fusion (MJF) technology with PA11 nylon. These high-performance bearing components feature intricate interlocking geometries that were previously impossible to produce using traditional manufacturing methods like injection molding or CNC machining. | 70% increased load-bearing capacity and up to 500% extended working life compared to traditionally manufactured bearings; patent-pending design innovations enabled by 3D printing's geometric freedom |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The 3D printing plastics market ecosystem consists of raw material suppliers (Nature Work, Avient Corporation), 3D printing plastics manufacturers (Evonik Industries AG, Stratasys, Arkema S.A. ), distributor (Slice Engineering, Channel Prime Allaince) and end users (General Motors, Boeing). Raw material suppliers provide essential polymers to 3D Printing plastics manufacturers. Distributors and suppliers establish contact between manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

3D Printing Plastics Market, By Type

Photopolymers are expected to have the largest market share in the 3D printing plastics market, both in terms of value and volume, due to their outstanding print quality, increasing use in various industries, and wide compatibility with advanced 3D printing technologies. These light-sensitive resins are mainly utilized in vat photopolymerization techniques like Stereolithography, Digital Light Processing, and LCD printing, which are favored for creating highly detailed, smooth, and dimensionally precise parts. Their excellent capability to produce fine details makes them the preferred choice for applications such as dental models, hearing aids, jewelry molds, consumer product prototypes, and surgical guides, among others.

3D Printing Plastics Market, By Form

The powders form segment is expected to grow the fastest of the segments in the 3D printing plastics industry, reflecting its integral role in powder bed fusion (PBF) technologies such as Selective Laser Sintering (SLS) and Multi Jet Fusion (MJF), which continue to gain traction in high-performance industrial target applications that use polymer powders, specifically nylon (PA11, PA12), TPU, and composite-filled powders, because they are capable of produce parts with high mechanical strength, functional durability and complex geometries without support structures, all significant advantages over traditional methods.

3D Printing Plastics Market, By Application

The manufacturing segment is expected to represent the highest CAGR in the 3D printing plastics market during the forecasted period in terms of value. Many end-use industries have begun to implement 3D printing in the mass production of components, which include components for automotive, healthcare, and aerospace & defense. 3D printing technology can create automotive components, mobile cases, wing mirrors, toys, etc. End-use industries are shifting toward bulk manufacturing of products and components that are manufactured through 3D printing due to their manufacturing cost-effectiveness, lead-time, and unique abilities to design complex structured objects. 3D printing technology can develop personalized parts and products tailored to a specific client's requirements and preferences.

3D Printing Plastics Market, By End-use Industry

Given the early adoption of additive manufacturing technology and increased demand for lightweight, high-performance, and mission-critical components, the aerospace and defense segment is expected to have the highest market share in the 3D printing plastics industry in 2024. Advanced 3D printing plastics such PEEK, ULTEM (PEI), and other high-temperature thermoplastics can effectively help the aerospace sector constantly under pressure, to lower the overall weight of aircraft, improve fuel performance, and reduce CO2 emissions. High temperature thermoplastics like PEEK and ULTEM (PEI) ultimately have a better strength-to-weight ratio, thermal resistance, flame and high heat resistance, and chemical stability, all required for many uses in the aerospace industry, including cabin interiors, ducting systems, structural brackets, and engine components.

REGION

North America to be fastest-growing region in global 3D printing plastics market during forecast period

North America is projected to be the fastest growing region in 3D printing plastics market. North America is home to various 3D printing plastic companies, such as 3D Systems, Inc., Stratasys, Huntsman International LLC, and many more. They are the leading companies in the 3D printing plastics market and have adopted various technologies like MJF, and FDM, serving various industries, such as automotive, aerospace & defense, and medical, making it a highly valuable industry. Various factors, such as advanced infrastructure, increasing government funding, material diversity, and shift in manufacturing capacities, make North America a prominent region in the 3D printing plastics market.

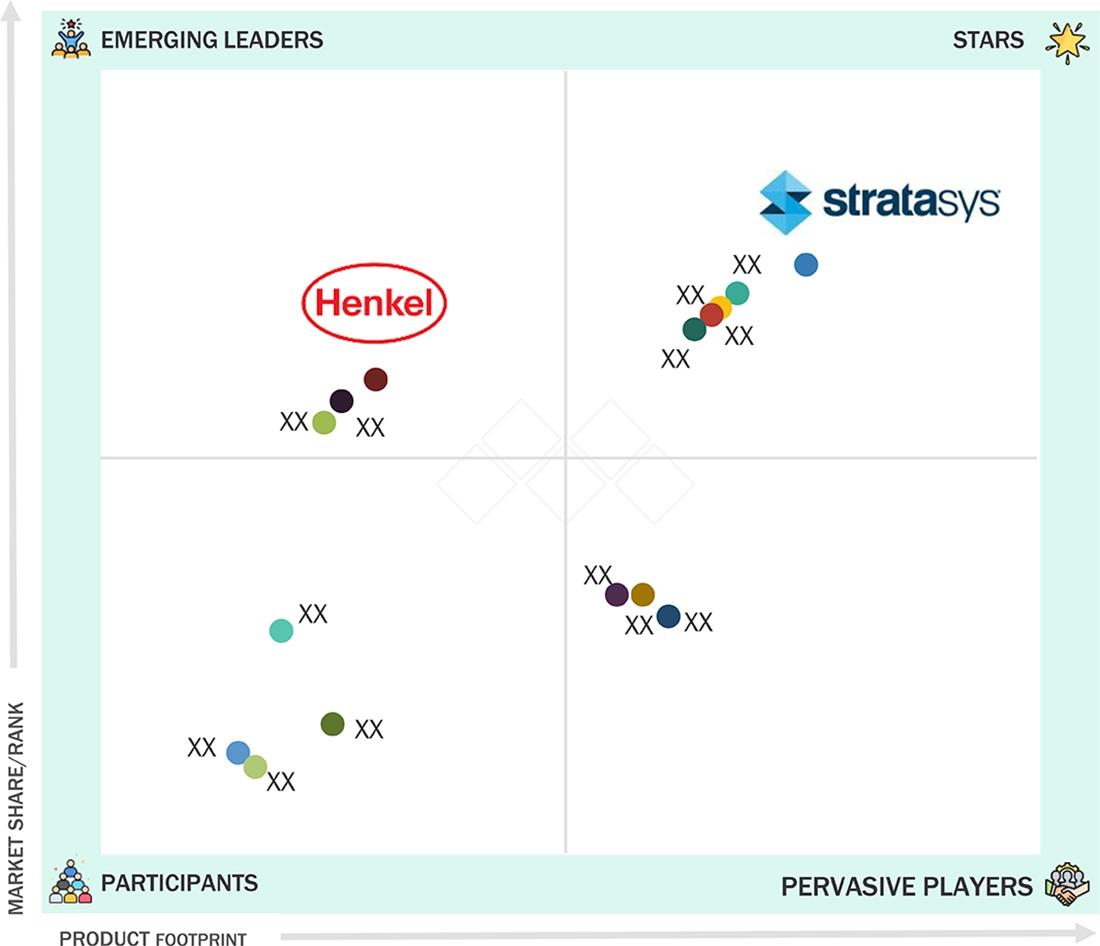

3D Printing Plastics Market: COMPANY EVALUATION MATRIX

In the 3D Printing Plastics market matrix, Stratasys (Star) leads due to its robust market share and expansive product range, leveraging its established global presence and consistently strong record in delivering advanced materials across multiple applications. Henkel AG & Co. KGaA (Emerging Leader) is increasingly gaining market momentum through strategic regional initiatives and innovative product developments. While Stratasys dominates through scale and a diverse portfolio, Henkel AG & Co. KGaA shows significant potential to move toward the leaders’ quadrant as demand for 3D printing plastics continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.00 Billion |

| Market Forecast in 2030 (Value) | USD 5.40 Billion |

| Growth Rate | CAGR of 18.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

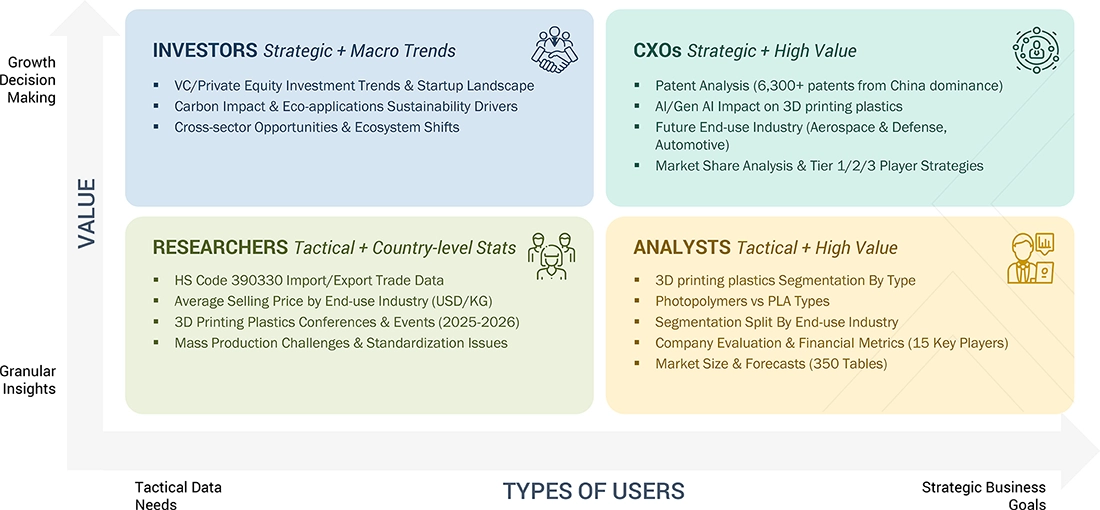

WHAT IS IN IT FOR YOU: 3D Printing Plastics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier |

|

|

| 3D Printer OEMs |

|

|

| 3D Printed Parts Manufacturers (Service Providers) |

|

|

| End-user Industries (Aerospace, Automotive, Healthcare, Consumer Goods) |

|

|

RECENT DEVELOPMENTS

- April 2025 : 3D Systems, Inc. partnered with University Hospital Basel to enable the world’s first in-hospital manufacturing of 3D printed facial implants using PEEK material. The solution involves 3D Systems’ EXT 220 MED printer and software to design and produce implants directly at the hospital, reducing lead time, enhancing patient customization, and complying with EU MDR medical regulations.

- April 2025 : Syensqo Introduces Medical-grade White PPSU, that offers high impact strength, sterilization stability, and broad processing versatility for injection molding, extrusion, and 3D printing.

- June 2024 : Arkema granted SEQENS an exclusive license to produce PEKK (under the Kepstan trademark) specifically for long-term medical implantable applications. This builds on a 15-year collaboration, enabling SEQENS to market “IMPEKK” materials potential alternatives to titanium and PEEK—via its global distributor and manufacturing network.

Table of Contents

Methodology

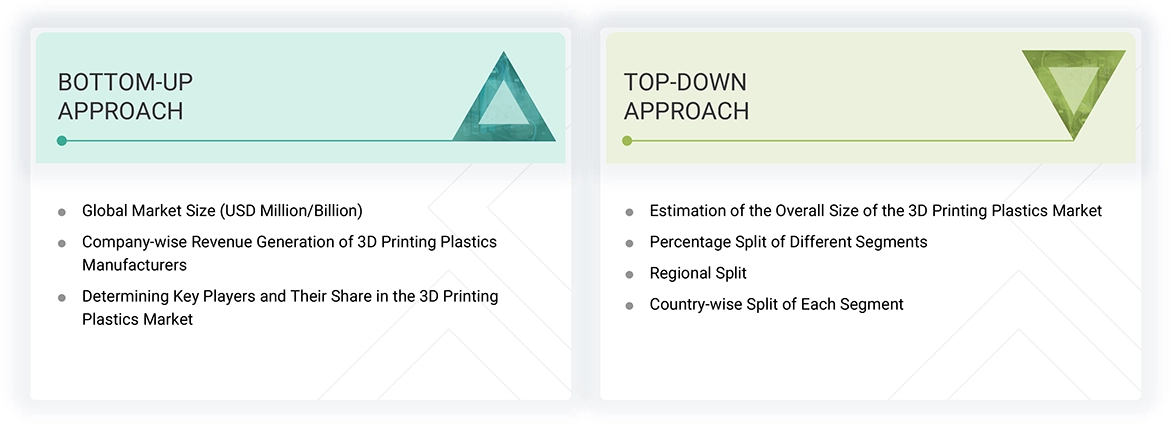

The study involves two major activities in estimating the current market size for the 3D printing plastics market. Exhaustive secondary research was done to collect information on the market and the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering 3D printing plastics and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the 3D Printing plastics market, which was validated through interviews with experts.

Primary Research

Extensive primary research was conducted after obtaining information regarding the 3D printing plastics market scenario through secondary research. Several interviews were conducted with market experts from both the demand and supply sides across the major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, e-mails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the 3D printing plastics industry, system integrators, component providers, distributors, and key opinion leaders. Interviews with experts were conducted to gather insights, such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research helped in understanding the various trends related to type, form, end use industry, application, and region. Stakeholders from the demand side (CIOs, CTOs, CSOs, and installation teams of the customers/end users who are 3D printing plastics services) were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of 3D printing plastics and future outlook of their business which will affect the overall market.

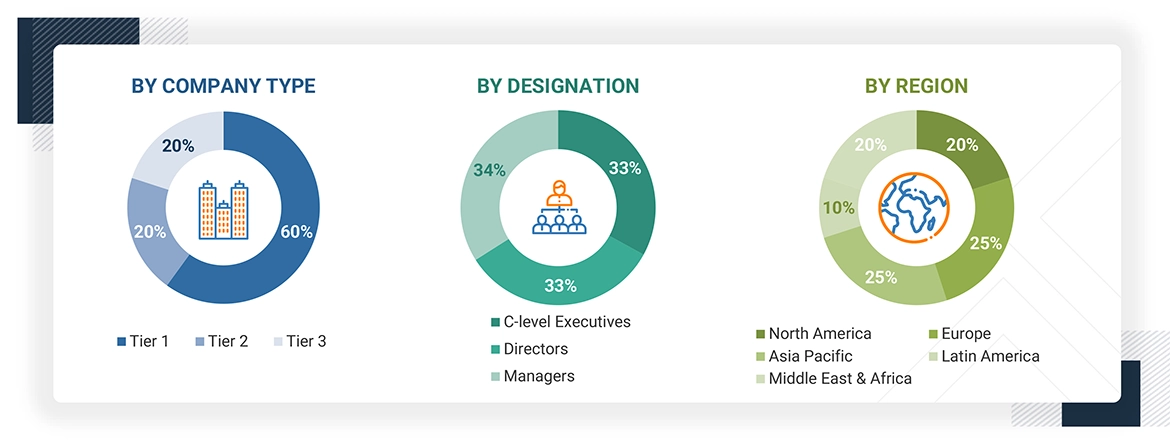

Breakup of Interviews with Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the 3D printing plastics market size includes the following details. The market sizing was undertaken from the demand side. The market was estimated based on the demand for 3D printing plastics in different applications at the regional level. Such procurements provide information on the demand aspects of the 3D printing plastics industry for each application. All possible segments of the 3D printing plastics market for each application were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

3D printing plastics refer to a diverse range of materials made from synthetic or semi-synthetic compounds that are used in the 3D printing process. These materials are malleable and can be used to create three-dimensional objects through various 3D printing technologies, such as Fused Deposition Modeling (FDM), Stereolithography (SLA), and Digital Light Synthesis (DLS). 3D printing plastics are modified polymers used to create objects using 3D printing technology. With developments in composite grades, 3D printing plastics have been increasingly used to manufacture high-end components for the aerospace & defense and healthcare industries. 3D printing plastics are generally available in filament, powder, and liquid forms. They can be classified into different types, such as photopolymer, acrylonitrile butadiene styrene (ABS), polylactic acid (PLA), and polyamide.

Stakeholders

- 3D printing plastics manufacturers

- 3D printer manufacturers

- Universities, governments, and research organizations

- 3D printing plastics and composite associations and industrial bodies

- Research and consulting firms

- Investment banks and private equity firms, universities, governments, and research organizations

- Associations and industrial bodies

- R&D institutes

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the 3D printing plastics market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global 3D printing plastics market by type, form, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which are the major companies in the 3D printing plastics market? What key strategies have market players adopted to strengthen their market presence?

Major companies include 3D Systems (US), Arkema (France), Materialise (Belgium), Stratasys (US), Syensqo (Belgium), Shenzhen Esun (China), Evonik Industries (Germany), EOS GmbH (Germany), Formlabs (US), SABIC (Saudi Arabia), CRP Technology (Italy), Henkel (Germany), Huntsman (US), Ensinger (Germany), and Zortrax (Poland). Key strategies include product launches, acquisitions, and expansions to boost market presence.

What are the drivers and opportunities for the 3D printing plastics market?

Forward integration by major polymer companies increasing supply, and government initiatives supporting 3D printing adoption, are major drivers. These factors are creating lucrative growth opportunities for players.

Which region is expected to hold the largest market share?

North America is expected to hold the largest market share, driven by strong demand from the automotive, aerospace, and renewable energy sectors.

What is the projected growth rate of the 3D printing plastics market over the next 5 years?

The market is projected to grow at a CAGR of 18% over the next five years in terms of value.

How is the 3D printing plastics market aligned for future growth?

The market is growing rapidly, with high future potential. Many manufacturers are planning capacity expansions to meet rising demand.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the 3D Printing Plastics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in 3D Printing Plastics Market

Stephanie

Nov, 2018

Market trends on global 3D printing aerospce market.

Dmitry

Aug, 2019

3D printing plastics market, potential by application.

Gary

Jan, 2018

Specific detail on 3-D printing market.

Anika

Jan, 2019

Specific information for clients about 3D-Printing markets and filament markets.

Uri

Jun, 2019

General information on 3D Printing Plastics Market.