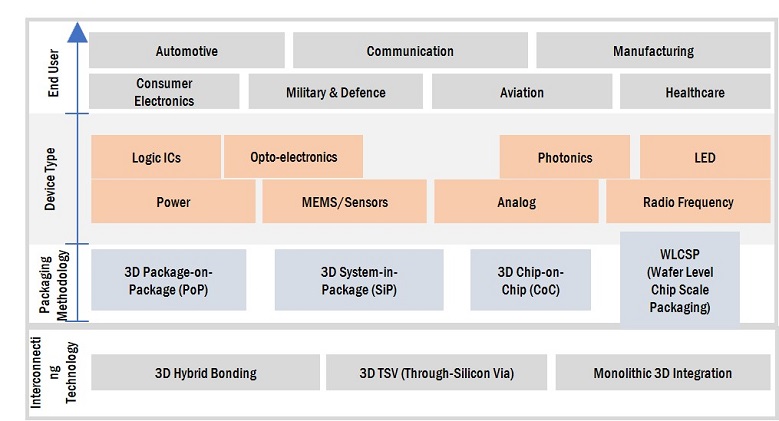

3D Stacking Market by Method (Die-to-Die, Die-to-Wafer, Wafer-to-Wafer, Chip-to-Chip, Chip-to-Wafer), Technology (Through-Silicon Via, Hybrid Bonding, Monolithic 3D Integration), Device (Logic ICs, Optoelectronics, Memory, MEMS) - Global Forecast to 2028

Updated on : October 22, 2024

3D Stacking Market Size & Growth

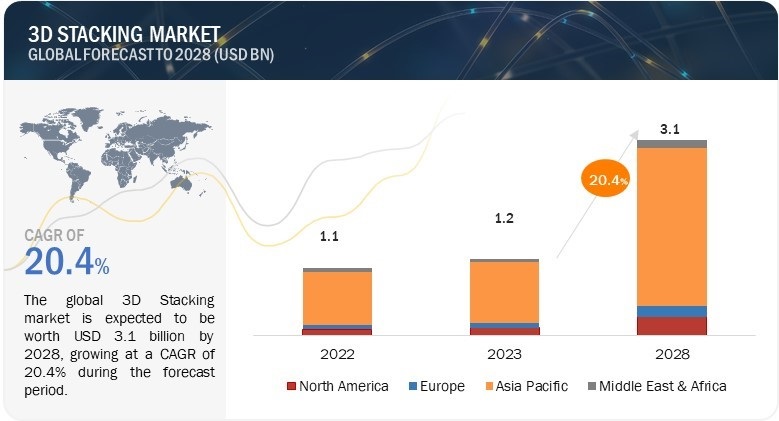

The 3D stacking market size is estimated to be worth USD 1.2 billion in 2023 and is projected to reach USD 3.1 billion by 2028, growing at a CAGR of 20.4% between 2023 to 2028.

Rapid expansion of semiconductor applications across various industries and integration of advanced electronics within the automotive industry the major opportunities that lie ahead for the 3D stacking market.

3D Stacking Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

3D Stacking Market Trends:

Driver: Heterogeneous integration and component optimization to improve manufacturing of electronic components

3D stacking technology facilitates heterogeneous integration by allowing the creation of circuit layers with different processes and on different types of wafers. This exceptional flexibility empowers manufacturers to optimize individual components to a remarkable degree compared to traditional single-wafer fabrication. In practical terms, it means that electronic components can be fine-tuned to meet specific requirements with a level of precision and customization that was previously unattainable.

Restraint: High cost of 3D stacking technology to limit adoption

One of the most significant hurdles in the 3D stacking market is the substantial financial commitment required for implementing 3D stacking technology. This transformative technology demands considerable investments in specialized equipment, materials, and expertise. The costs associated with acquiring and setting up the necessary machinery, including advanced semiconductor manufacturing equipment and precision tools for vertical stacking, can be exorbitant. Moreover, specialized materials required for 3D stacking often come at a premium. These initial expenses can be particularly daunting for smaller manufacturers or startups operating with limited financial resources.

Opportunity: Rapid expansion of semiconductor applications across various industries

Surge in semiconductor use is driven by emerging technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), 5G telecommunications, and high-performance computing. These technologies demand increasingly powerful and efficient semiconductor solutions. As the capabilities of these applications continue to evolve, there is an escalating need for innovative approaches to enhance semiconductor performance and functionality. The 3D stacking technology offers a compelling solution to meet these escalating demands. It enables the creation of vertically integrated components, allowing for improved performance, reduced power consumption, and enhanced functionality.

Challenge: Maintaining effective supply chain in 3D stacking

The challenge of ensuring an effective supply chain in the 3D stacking market is magnified by the specialized nature of materials and equipment required. These include unique semiconductor substrates, precision tools, and adhesives necessary for the 3D stacking process. Disruptions or shortages in the supply chain for these critical components can lead to production delays and increased costs, hampering market growth. Moreover, the global reach of the supply chain, involving numerous suppliers and manufacturers across different regions, introduces complexity and logistical challenges, with customs regulations and export controls adding to the intricacy.

3D Stacking Market Ecosystem

The 3D stacking market is marked by the presence of a few tier-1 companies, such as Samsung Electronics Co. Ltd (South Korea), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Intel Corporation (US), ASE Technology Holding Co., Ltd. (Taiwan), Amkor Technology (US), Broadcom (US), and many more. These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable 3D stacking solutions.

3D Stacking Market Segmentation

Consumer electronics to hold largest market share in 3D stacking market during forecast period

3D stacking addresses this demand by enabling the integration of diverse functionalities and components in a compact three-dimensional structure. This integration results in more efficient devices with optimized power consumption, faster processing, and improved thermal management. As a result, manufacturers in the consumer electronics industry are increasingly turning to 3D stacking to meet consumer expectations for advanced, yet portable and energy-efficient, electronic products.

Memory Devices to hold largest market share by Device Type

Memory devices in the context of 3D stacking refer to electronic components responsible for data storage and retrieval. The memory devices market is experiencing sustained growth due to the rising need for high-performance memory and storage in various applications, such as artificial intelligence, machine learning, and storage processing. 3D stacking is also used in memory applications in specialized AI and ML hardware, such as graphics processing units (GPUs) and tensor processing units (TPUs).

3D TSV to hold larget market during forecast period

Through-Silicon Via (TSV) technology is at the forefront of the 3D chip stacking revolution, serving as a crucial process for achieving vertical integration in semiconductor devices. TSVs act as a vertical interconnect technique, enabling the creation of 3D packages and integrated circuits. They are employed in building 3D packages that house multiple semiconductor dies, eliminating the need for traditional edge wiring or wirebonding that was previously utilized in stacked packages on organic substrates. TSVs are highly favored in the development of advanced 3D ICs and interposer stacks.

3D Stacking Industry Regional Analysis

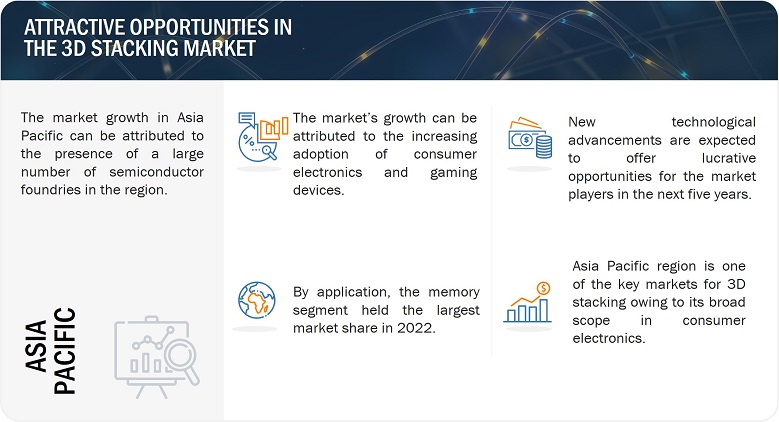

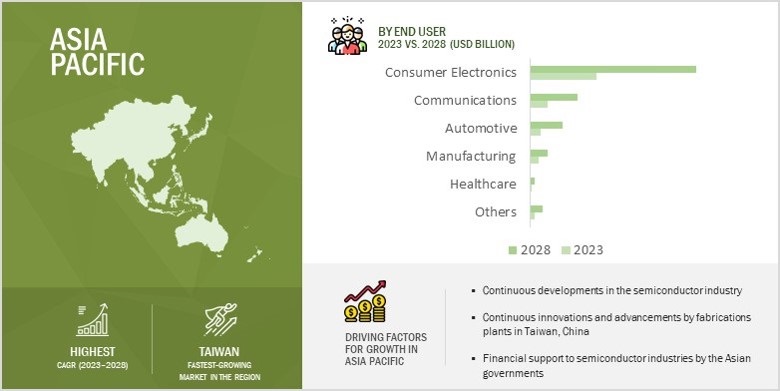

Asia Pacific held to register highest CAGR and market share in the 3D stacking market during forecast period

Asia Pacific is expected to hold the largest share of the 3D stacking market owing to the availability of low-cost labor in China, innovations and advancements by fabrications plants in Taiwan, manufacturing capabilities of Japanese companies, and the establishment of new fabs in China, Taiwan, Japan, and South Korea. These factors are some of the cutting-edge advantages for the Asian semiconductor industry.

3D Stacking Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top 3D Stacking Companies - Key Market Players

The major players in the 3D stacking companies include key players such

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan),

- Intel Corporation (US),

- Samsung (South Korea),

- Advanced Micro Devices, Inc. (US),

- ASE (Taiwan), and many more.

These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

3D Stacking Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 1.2 billion in 2023 |

|

Expected Value |

USD 3.1 billion by 2028 |

|

Growth Rate |

CAGR of 20.4% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Method, Interconnecting Technology, Device Type, End User and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the 3D stacking market are Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Intel Corporation (US), Samsung (South Korea), Advanced Micro Devices, Inc. (US), ASE (Taiwan), GlobalFoundries Inc. (US) and many more. |

3D Stacking Market Highlights

|

Segment |

Subsegment |

|

By Method |

|

|

By Interconnecting Technology |

|

|

By Device Type |

|

|

By End User Industry |

|

|

By Region |

|

Recent Developments in 3D Stacking Industry

- In June 2023, Cadence Design Systems, Inc. has expanded its collaboration with Samsung Foundry to accelerate 3D-IC design development for emerging technologies like hyperscale computing, 5G, AI, IoT, and mobile applications. This partnership enhances multi-die planning and implementation through reference flows and package design kits based on the Cadence Integrity 3D-IC platform, which uniquely integrates system planning, packaging, and system-level analysis.

- In February 2023, UMC (Taiwan) and Cadence (US) collaborated on 3D-IC Hybrid Bonding Reference Flow. This technology supports the integration across a broad range of technology nodes suitable for edge AI, image processing, and wireless communication applications. Cost-effectiveness and design reliability are the pillars of UMC’s hybrid bonding technologies, and this collaboration with Cadence provides mutual customers with both, helping them reap the benefits of 3D structures while also accelerating the time needed to complete their integrated designs.

- In February 2022, Advanced Micro Devices, Inc. (US) has completed acquisition of Xilinx, This union establishes a powerhouse in high-performance and adaptive computing, boasting an expanded product portfolio covering computing, graphics, and adaptive System-on-Chip products. The acquisition is projected to enhance non-GAAP margins, non-GAAP EPS, and free cash flow generation in the first year, while also bolstering AMD’s prowess in advanced technology domains such as die stacking, chiplet technology, AI, and software platforms..

Frequently Asked Questions (FAQs):

What is the current size of the global 3D stacking market?

The 3D stacking market is estimated to be worth USD 1.1 billion in 2022 and is projected to reach USD 3.1 billion by 2028, at a CAGR of 20.4% during the forecast period.

Who are the winners in the global 3D stacking market size?

Samsung (South Korea), SK HYNIX INC. (South Korea), Intel Corporation (US), ASE Technology Holding Co., Ltd. (Taiwan), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), and Amkor Technology (US) are the star companies in the 3D stacking market.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the 3D stacking market during forecast period owing to the manufacturing capabilities of Japanese companies, innovations and advancements by fabrications plants in Taiwan, availability of low-cost labor in China, and the establishment of new fabs in China, Taiwan, Japan, and South Korea.

What are the major opportunities related to 3D stacking market share?

Growing adoption of high-bandwidth memory (HBM) devices; Rapid expansion of semiconductor applications across various industries; integration of advanced electronics within the automotive industry are major opportunities related to 3D stacking market.

What are the major strategies adopted by market players?

The key players have adopted acquisitions, product launches, and partnerships to strengthen their position in the 3D stacking market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing focus on miniaturization and efficient space utilization in electronic devices- Cost advantage offered by 3D stacking technology- Growing demand for consumer electronics and gaming devices- Unparalleled flexibility and customization benefits offered by 3D stacking in electronic component manufacturing- Reduced power consumption and operational costs over 2D stackingRESTRAINTS- Need for substantial upfront investment- Lack of standardization governing 3D stacking technologyOPPORTUNITIES- Growing adoption of high-bandwidth memory (HBM) devices- Rapid expansion of semiconductor applications across various industries- Integration of advanced electronics into automobilesCHALLENGES- Maintaining effective supply chain in 3D stacking- Designing complexities associated with 3D stacking technology

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.7 TECHNOLOGY TRENDSFAN-OUT WAFER-LEVEL PACKAGINGFAN-OUT PANEL-LEVEL PACKAGINGADVANCED MATERIALSMONOLITHIC 3D INTEGRATION

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISSEMICONDUCTOR WAFER PRODUCER REDUCED WAFER REJECTIONS THROUGH CLOSED-LOOP MONITORINGSPTS’S DRIE TECHNOLOGY STRENGTHENED IMEC’S SILICON ETCH PLATFORM

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2025

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY REGULATIONS AND STANDARDS- Regulations- Standards

- 6.1 INTRODUCTION

-

6.2 3D PACKAGE-ON-PACKAGE (POP)GROWING DEMAND FOR COMPACT AND FEATURE-RICH ELECTRONIC DEVICES TO PROPEL SEGMENTAL GROWTH

-

6.3 3D SYSTEM-IN-PACKAGE (SIP)NEED FOR MINIATURIZED AND POWER-EFFICIENT DEVICES ACROSS DIVERSE APPLICATIONS TO DRIVE SEGMENT

-

6.4 3D CHIP-ON-CHIP (COC)NEED FOR COMPACT SOLUTIONS IN HIGH-PERFORMANCE COMPUTING APPLICATIONS TO FUEL SEGMENTAL GROWTH

-

6.5 WAFER LEVEL CHIP SCALE PACKAGING (WLCSP)NEED TO REDUCE CONSUMPTION OF PACKAGING MATERIAL TO PROPEL ADOPTION OF WLCSP TECHNOLOGY

- 7.1 INTRODUCTION

-

7.2 DIE-TO-DIERISING NEED FOR COMPACT AND EFFICIENT DEVICE STRUCTURES TO BOOST ADOPTION OF DIE-TO-DIE STACKING

-

7.3 DIE-TO-WAFERINCREASING FOCUS ON DEVICE PERFORMANCE ENHANCEMENT TO FUEL ADOPTION OF DIE-TO-WAFER INTEGRATION IN 3D STACKING

-

7.4 WAFER-TO-WAFERGROWING DEMAND FOR ADVANCED COMPACT PACKAGING SOLUTIONS TO FUEL SEGMENTAL GROWTH

-

7.5 WAFER-TO-CHIPRISING NEED FOR COMPACT AND EFFICIENT PACKAGING SOLUTIONS IN AUTOMOTIVE ELECTRONICS TO DRIVE SEGMENT

-

7.6 CHIP-TO-CHIPGROWING NEED FOR HIGH-PERFORMANCE AND POWER-EFFICIENT ELECTRONIC DEVICES TO PROPEL SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 3D HYBRID BONDINGADOPTION OF 3D HYBRID BONDING IN HIGH-PERFORMANCE COMPUTING AND DATA-INTENSIVE APPLICATIONS TO DRIVE MARKET

-

8.3 3D THROUGH-SILICON VIA (TSV)VIA-FIRST TSV- Increasing adoption of via-first TSV in applications requiring early-stage integration to drive marketVIA-MIDDLE TSV- Need for flexibility in vertical connections in semiconductor design to increase demand for via-middle TSV technologyVIA-LAST TSV- Growing adoption of via-last TSV technology in applications requiring late-stage interconnection to drive marketHYBRID TSV- Ability to meet specific design and performance requirements to fuel adoption of hybrid TSVDEEP TRENCH TSV- Rising demand for enhanced electrical performance in advanced microprocessors and memory devices to drive marketMICROBUMP TSV- Rising demand for miniaturized and densely interconnected semiconductor devices to fuel market growthTHROUGH GLASS VIA (TGV)- Rising adoption of TGV technique in applications requiring transparent and hermetic packaging to drive market

-

8.4 MONOLITHIC 3DABILITY TO ADDRESS LIMITATIONS OF ADVANCED CMOS SCALING TO FUEL DEMAND FOR MONOLITHIC 3D INTEGRATION

- 9.1 INTRODUCTION

-

9.2 LOGIC ICSRISING NEED FOR HIGH COMPUTATIONAL EFFICIENCY TO INDUCE DEMAND FOR LOGIC ICS

-

9.3 IMAGING & OPTOELECTRONICSPOTENTIAL TO IMPROVE IMAGE PROCESSING AND OPTICAL FUNCTIONALITIES TO SPUR ADOPTION OF 3D STACKING

-

9.4 MEMORY DEVICESSURGING DEMAND FOR HIGH-BANDWIDTH MEMORY TO FOSTER MARKET GROWTH

-

9.5 MEMS/SENSORSGROWING REQUIREMENT FOR COMPACT AND ACCURATE SENSING TECHNOLOGIES TO FUEL UPTAKE OF 3D STACKING

-

9.6 LIGHT EMITTING DIODES (LEDS)RISING DEMAND FOR INNOVATIVE DESIGNS AND IMPROVED LUMINOSITY IN LEDS TO FUEL SEGMENTAL GROWTH

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 CONSUMER ELECTRONICSINCREASING TECHNOLOGICAL ADVANCEMENTS IN CONSUMER ELECTRONICS TO DRIVE ADOPTION OF 3D STACKING

-

10.3 MANUFACTURINGINCREASING SHIFT TOWARD SMART FACTORIES AND INDUSTRY 4.0 TO FUEL ADOPTION OF 3D STACKING

-

10.4 COMMUNICATIONSINTEGRATION OF ADVANCED FUNCTIONALITIES IN HIGH-PERFORMANCE COMPUTING APPLICATIONS TO DRIVE MARKET

-

10.5 AUTOMOTIVERISING DEMAND FOR COMPACT AND POWERFUL AUTOMOTIVE ELECTRONIC SYSTEMS TO PROPEL MARKET GROWTH

-

10.6 HEALTHCARESURGING DEMAND FOR ADVANCED MEDICAL EQUIPMENT FOR HIGH PERFORMANCE AND EFFICIENCY TO FUEL MARKET GROWTH

- 10.7 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Presence of fabrication business giants to support market growthCANADA- Increasing focus on innovation and technological advancements to foster market growthMEXICO- Government-led initiatives to develop semiconductor industry to fuel market growthNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Growing production of automobiles to create demand for 3D stackingFRANCE- Increasing R&D in 3D stacking to drive marketUK- 5G implementation to create conducive environment for market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICCHINA- Increasing investments in semiconductor industry to drive marketJAPAN- Increasing focus on precision engineering to boost adoption of 3D stackingSOUTH KOREA- Growing focus on innovation and research to contribute to market growthTAIWAN- Rising demand for compact, efficient, and high-performing chips to support market growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 REST OF THE WORLD (ROW)MIDDLE EAST & AFRICA- Government initiatives to strengthen semiconductor industry to favor market growthSOUTH AMERICA- Growing demand for advanced architecture and high-end computing to contribute to market growthROW: RECESSION IMPACT

- 12.1 INTRODUCTION

-

12.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 12.3 MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS IN 3D STACKING MARKET

-

12.5 KEY COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT, BY INTERCONNECTING METHODCOMPANY FOOTPRINT, BY DEVICE TYPECOMPANY FOOTPRINT, BY END USERCOMPANY FOOTPRINT, BY REGIONOVERALL COMPANY FOOTPRINT

-

12.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES & DEVELOPMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSTAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAMSUNG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewINTEL CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewSK HYNIX INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewADVANCED MICRO DEVICES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewASE TECHNOLOGY HOLDING CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAMKOR TECHNOLOGY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJIANGSU CHANGDIAN TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsTEXAS INSTRUMENTS INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developmentsUNITED MICROELECTRONICS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsPOWERTECH TECHNOLOGY INC- Business overview- Products/Services/Solutions offeredCADENCE DESIGN SYSTEMS, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsBROADCOM- Business overview- Products/Services/Solutions offered- Recent developmentsTOWER SEMICONDUCTOR- Business overview- Products/Services/Solutions offered- Recent developmentsIBM- Business overview- Products/Services/Solutions offered- Recent developmentsTOKYO ELECTRON LIMITED- Business overview- Products/Services/Solutions offered- Recent developmentsCEA-LETI- Business overview- Products/Services/Solutions offered

-

13.3 OTHER PLAYERSSILICONWARE PRECISION INDUSTRIES CO., LTD.GLOBALFOUNDRIES INC.NHANCED SEMICONDUCTORSDECA TECHNOLOGIESTEZZARONTELEDYNE TECHNOLOGIES INCORPORATEDHUAWEI TECHNOLOGIES CO. LTD.QUALCOMM TECHNOLOGIES, INC.3MAYAR LABS, INC.APPLIED MATERIALS, INC.MONOLITHIC 3D INC.MOLDEX3DCEREBRASXPERI INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 AVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS, 2022 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS, 2018–2022 (USD/THOUSAND UNITS)

- TABLE 4 3D STACKING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 6 KEY BUYING CRITERIA, BY END USER

- TABLE 7 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 381800, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 381800, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 PATENTS RELATED TO MARKET, 2020–2023

- TABLE 10 NUMBER OF PATENTS RELATED TO 3D STACKING REGISTERED IN LAST 10 YEARS

- TABLE 11 3D STACKING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MARKET, BY METHOD, 2019–2022 (USD MILLION)

- TABLE 16 MARKET, BY METHOD, 2023–2028 (USD MILLION)

- TABLE 17 DIE-TO-DIE: MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 18 DIE-TO-DIE: MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 19 DIE-TO-WAFER: MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 20 DIE-TO-WAFER: MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 21 WAFER-TO-WAFER: MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 22 WAFER-TO-WAFER: MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 23 WAFER-TO-CHIP: MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 24 WAFER-TO-CHIP: MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 25 CHIP-TO-CHIP: MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 26 CHIP-TO-CHIP: MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 27 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY INTERCONNECTING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 29 3D HYBRID BONDING: MARKET, BY METHOD, 2019–2022 (USD MILLION)

- TABLE 30 3D HYBRID BONDING: MARKET, BY METHOD, 2023–2028 (USD MILLION)

- TABLE 31 3D TSV: MARKET, BY METHOD, 2019–2022 (USD MILLION)

- TABLE 32 3D TSV: MARKET, BY METHOD, 2023–2028 (USD MILLION)

- TABLE 33 MONOLITHIC 3D INTEGRATION: MARKET, BY METHOD, 2019–2022 (USD MILLION)

- TABLE 34 MONOLITHIC 3D INTEGRATION: MARKET, BY METHOD, 2023–2028 (USD MILLION)

- TABLE 35 MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 36 MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 37 LOGIC ICS: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 38 LOGIC ICS: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 39 IMAGING & OPTOELECTRONICS: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 40 IMAGING & OPTOELECTRONICS: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 41 MEMORY DEVICES: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 42 MEMORY DEVICES: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 43 MEMS/SENSORS: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 44 MEMS/SENSORS: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 45 LEDS: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 46 LEDS: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 47 OTHERS: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 48 OTHERS: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 49 MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 50 3D STACKING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MANUFACTURING: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 56 MANUFACTURING: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 57 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 COMMUNICATIONS: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 60 COMMUNICATIONS: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 61 COMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 COMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 AUTOMOTIVE: 3D STACKING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 64 AUTOMOTIVE: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 HEALTHCARE: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 68 HEALTHCARE: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 69 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 OTHERS: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 72 OTHERS: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 73 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 81 US: 3D STACKING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 84 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 85 MEXICO: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 86 MEXICO: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 91 GERMANY: 3D STACKING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 92 GERMANY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 93 FRANCE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 94 FRANCE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 95 UK: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 96 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 97 REST OF EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 REST OF EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 104 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 JAPAN: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 106 JAPAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 107 SOUTH KOREA: 3D STACKING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 SOUTH KOREA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 TAIWAN: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 110 TAIWAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 ROW: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 116 ROW: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 120 SOUTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 121 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN 3D STACKING MARKET

- TABLE 122 MARKET: MARKET SHARE ANALYSIS, 2022

- TABLE 123 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 124 COMPANY FOOTPRINT, BY INTERCONNECTING METHODS

- TABLE 125 COMPANY FOOTPRINT, BY DEVICE TYPE

- TABLE 126 COMPANY FOOTPRINT, BY END USER INDUSTRY

- TABLE 127 COMPANY FOOTPRINT, BY REGION

- TABLE 128 MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2023

- TABLE 129 3D STACKING MARKET: DEALS, 2020–2023

- TABLE 130 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 131 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCT LAUNCHES

- TABLE 133 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: DEALS

- TABLE 134 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: OTHERS

- TABLE 135 SAMSUNG: COMPANY OVERVIEW

- TABLE 136 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 137 SAMSUNG: PRODUCT LAUNCHES

- TABLE 138 SAMSUNG: DEALS

- TABLE 139 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 140 INTEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 142 SK HYNIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 SK HYNIX INC.: DEALS

- TABLE 144 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 145 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 146 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 147 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 148 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 149 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCT LAUNCHES

- TABLE 150 AMKOR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 151 AMKOR TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 AMKOR TECHNOLOGY: DEALS

- TABLE 153 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 154 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 155 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: DEALS

- TABLE 157 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 158 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 160 UNITED MICROELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 161 UNITED MICROELECTRONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 UNITED MICROELECTRONICS CORPORATION: DEALS

- TABLE 163 POWERTECH TECHNOLOGY INC: COMPANY OVERVIEW

- TABLE 164 POWERTECH TECHNOLOGY INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 CADENCE DESIGN SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 166 CADENCE DESIGN SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 CADENCE DESIGN SYSTEMS, INC.: DEALS

- TABLE 168 BROADCOM: COMPANY OVERVIEW

- TABLE 169 BROADCOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 BROADCOM: DEALS

- TABLE 171 TOWER SEMICONDUCTOR: COMPANY OVERVIEW

- TABLE 172 TOWER SEMICONDUCTOR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 TOWER SEMICONDUCTOR: DEALS

- TABLE 174 IBM: COMPANY OVERVIEW

- TABLE 175 IBM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 IBM: PRODUCT LAUNCHES

- TABLE 177 TOKYO ELECTRON LIMITED: COMPANY OVERVIEW

- TABLE 178 TOKYO ELECTRON LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 TOKYO ELECTRON LIMITED: PRODUCT LAUNCHES

- TABLE 180 CEA-LETI: COMPANY OVERVIEW

- TABLE 181 CEA-LETI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 3D STACKING MARKET: MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY SIDE)—REVENUE GENERATED FROM 3D STACKING SOLUTIONS AND SERVICES

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 CONSUMER ELECTRONICS SEGMENT TO CAPTURE LARGEST SHARE OF MARKET IN 2028

- FIGURE 9 MEMORY DEVICES SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 10 3D TSV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 3D STACKING MARKET TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 12 INCREASING FOCUS ON MINIATURIZATION AND EFFICIENT SPACE UTILIZATION IN ELECTRONIC DEVICES TO BOOST MARKET GROWTH

- FIGURE 13 DIE-TO-DIE SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 14 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 15 3D TSV SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 16 MEMORY DEVICES SEGMENT TO HOLD LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT AND CHINA HELD LARGEST SHARE OF MARKET IN ASIA PACIFIC IN 2022

- FIGURE 18 TAIWAN TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR 3D STACKING DURING FORECAST PERIOD

- FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ANALYSIS OF IMPACT OF DRIVERS ON MARKET

- FIGURE 21 NUMBER OF SMARTPHONE AND MOBILE PHONE USERS GLOBALLY, 2020–2025

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON MARKET

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON MARKET

- FIGURE 25 3D STACKING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 3D STACKING ECOSYSTEM

- FIGURE 27 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 28 AVERAGE SELLING PRICE OF 12-INCH WAFERS EQUIVALENT OFFERED BY KEY PLAYERS

- FIGURE 29 AVERAGE SELLING PRICE OF WAFERS, 2018–2022

- FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 WAFER-TO-CHIP SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 36 3D TSV SEGMENT TO CAPTURE LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 37 MEMS/SENSORS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 38 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: 3D STACKING MARKET SNAPSHOT

- FIGURE 41 EUROPE: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

- FIGURE 44 MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 3D STACKING MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 46 TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD: COMPANY SNAPSHOT

- FIGURE 47 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 48 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 SK HYNIX INC.: COMPANY SNAPSHOT

- FIGURE 50 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 51 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 AMKOR TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 53 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 UNITED MICROELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 POWERTECH TECHNOLOGY INC: COMPANY SNAPSHOT

- FIGURE 57 CADENCE DESIGN SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 58 BROADCOM: COMPANY SNAPSHOT

- FIGURE 59 TOWER SEMICONDUCTOR: COMPANY SNAPSHOT

- FIGURE 60 IBM: COMPANY SNAPSHOT

- FIGURE 61 TOKYO ELECTRON LIMITED: COMPANY SNAPSHOT

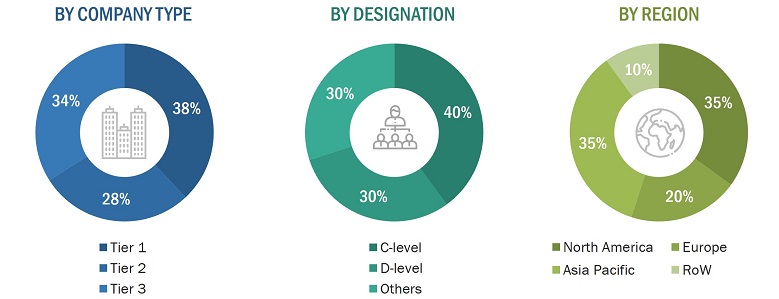

The research study involved 4 major activities in estimating the size of the 3D stacking market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the 3D stacking market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

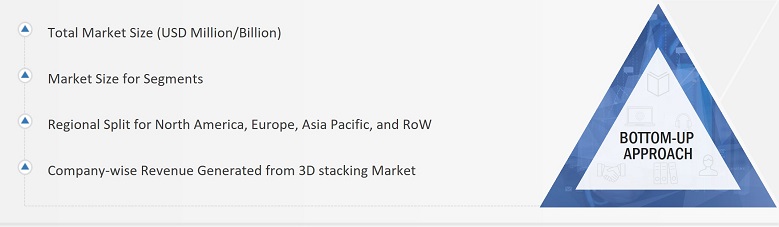

- In the complete market engineering process, both top-down and bottom-up approaches were used along with several data triangulation methods to estimate and forecast the overall market segments and subsegments listed in this report.

Estimating market size by bottom-up approach (demand side)

- Identifying the entities in the semiconductor value chain influencing the entire 3D stacking industry

- Analyzing each type of entity along with related major companies identifying service providers for the implementation of products and services

- Estimating the market for these 3D stacking end users

- Understanding the demand generated by the semiconductor industry-related companies

- Tracking ongoing and upcoming implementation of 3D stacking developments by various companies and forecasting the market based on these developments and other critical parameters

- Arriving at the market size by analyzing 3D stacking companies based on their countries, and then combining it to get the market estimate by region

- Verifying estimates and crosschecking them by a discussion with key opinion leaders, which include CXOs, directors, and operation managers

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, databases, and so on

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained in the previous section, the total market was split into several segments and subsegments. Data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Market Definition

3D stacking is a process of stacking multiple chips, dies or wafers on top of each other and interconnecting them vertically. This can be done using a variety of methods, including through-silicon vias (TSVs), hybrid bonding or monolithic 3D integration. Vertical stacking of components in 3D ICs enables a significantly greater component density compared to conventional 2D ICs. This results in the ability to fit more components into a smaller space, thereby enhancing functionality and improving performance within a given form factor.

Stakeholders

- Suppliers of Raw Materials and Manufacturing Equipment

- Providers and Manufacturers of Components

- Providers of Software Solutions

- Manufacturers and Providers of Semiconductor Devices

- Original Equipment Manufacturers (OEMs)

- ODM and OEM Technology Solution Providers

- Suppliers and Distributors of Semiconductor Manufacturing Devices

- System Integrators

- Middleware Providers

- Assembly, Testing, and Packaging Vendors

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances Related to the Semiconductor Packaging

- Technology Investors

- Governments, Regulatory Bodies, and Financial Institutions

- Venture Capitalists, Private Equity Firms, and Startups

- End Users

The main objectives of this study are as follows:

- To define, describe, and forecast the 3D stacking market, in terms of value, based on method, interconnecting technology, device type and end user

- To forecast the market size, in terms of value, for various segments with respect to four regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the 3D stacking market

- To provide a detailed overview of the value chain of the market and analyze market trends with Porter’s five forces analytical framework

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2 along with detailing the competitive landscape for market leaders

- To analyze strategic developments such as product launches and related developments, acquisitions, expansions, and agreements in the 3D stacking market

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product launches, and other developments in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in 3D Stacking Market