5G Infrastructure Market by Communication Infrastructure (Small Cell & Macro Cell), Core Network (SDN & NFV), Network Architecture (Standalone & Non-standalone), Operational Frequency (Sub 6GHz & Above 6GHz), End User & Geography - Global Forecast to 2025-2035

The global 5G Infrastructure market was valued at USD 14.34 billion in 2025 and is estimated to reach USD 155.32 billion by 2035, at a CAGR of 26.9% between 2025 and 2035.

The global 5G infrastructure market is driven by the increasing demand for high-speed connectivity, low-latency communication, and support for next-generation applications such as autonomous vehicles, smart cities, and industrial IoT. Continuous advancements in network equipment, including small cells, massive MIMO, and edge computing solutions, are enhancing network performance and capacity. Additionally, telecom operators are investing heavily in spectrum acquisition, network densification, and virtualization to support seamless 5G deployment. The market is witnessing intense competition, with vendors focusing on technological innovation, strategic partnerships, and regional expansion to meet diverse customer requirements and accelerate global 5G adoption.

5G infrastructure comprises the network equipment, technologies, and systems that enable the deployment and operation of fifth-generation (5G) mobile networks. It includes components such as base stations, small cells, massive MIMO antennas, network routers, and edge computing nodes that collectively deliver high-speed, low-latency, and high-capacity connectivity. 5G infrastructure supports a wide range of applications, including enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications for IoT. It also integrates with existing network architectures and virtualization technologies to optimize performance, scalability, and efficiency, enabling seamless connectivity for both consumers and enterprises.

Market by Communication Infrastructure

Small Cell

Small cells dominate the 5G infrastructure market due to their ability to efficiently enhance network coverage, capacity, and performance across diverse environments, including homes, enterprises, public spaces, and rural areas. Unlike traditional macro cells, small cells are low-power, cost-effective, and can be rapidly deployed in both licensed and unlicensed spectra, supporting multiple air interfaces such as LTE and 5G. With rising demand for high-speed, low-latency, and reliable connectivity, small cells help operators address coverage gaps, manage network congestion, and deliver consistent service quality. Their seamless integration of indoor and outdoor networks ensures superior end-user experience, making them a critical solution for large-scale 5G adoption. This combination of efficiency, scalability, and performance positions small cells as a key driver in the market.

Micro Cell

Macro cells are projected to experience the fastest growth in the 5G infrastructure market during the forecast period, driven by the escalating demand for extensive coverage and high-capacity networks. These cells can cover distances up to 30 km and support over 2,000 users, making them ideal for urban and suburban deployments. The integration of massive MIMO (Multiple Input, Multiple Output) technology enhances spectral efficiency by enabling simultaneous data transmission and reception across multiple antennas. Despite challenges such as thermal management, high energy consumption, and design complexity, advancements in antenna design, cooling solutions, and signal processing are mitigating these issues. As a result, macro cells remain a cornerstone for large-scale 5G deployments, ensuring robust network performance and meeting the growing connectivity demands.

Market by End USer

Industrial

The industrial end-user segment is expected to record the fastest growth in the 5G infrastructure market due to the rising adoption of Industry 4.0 technologies, smart factories, and automation across manufacturing, logistics, and energy sectors. 5G enables ultra-reliable low-latency communication (URLLC) and massive machine-type communication (mMTC), supporting real-time monitoring, predictive maintenance, and autonomous machinery. Industrial applications demand high-speed, low-latency networks for enhanced operational efficiency, safety, and productivity. Additionally, the integration of IoT devices, robotics, and AI-driven analytics in industrial environments further drives demand for 5G infrastructure. Governments and enterprises are increasingly investing in private 5G networks to optimize industrial processes, boosting growth in this segment faster than in consumer or telecom verticals.

Commercial

The commercial end-user segment dominates the 5G infrastructure market due to the extensive deployment of 5G networks in urban and metropolitan areas to support high-speed mobile broadband and enhanced connectivity for businesses. Sectors such as retail, healthcare, banking, and hospitality rely on 5G to enable seamless digital services, cloud computing, virtual and augmented reality applications, and real-time data analytics. The rising demand for smart offices, connected devices, and improved customer experiences further fuels adoption. Additionally, telecom operators prioritize commercial deployments to cater to large user bases and generate higher revenue, making the commercial segment the largest contributor to 5G infrastructure investments globally.

Market by Geography

Geographically, the security camera market is experiencing widespread adoption across North America, Europe, Asia Pacific, and the Middle East & Africa. The Asia Pacific region is expected to record the fastest growth rate in the 5G infrastructure market due to strong government support, large-scale investments, and rapid digitalization across countries such as China, India, Japan, and South Korea. These nations are aggressively expanding 5G networks to support smart cities, industrial automation, and digital services. The presence of major telecom equipment manufacturers, such as Huawei, ZTE, and Samsung, further accelerates infrastructure deployment in the region. Rising demand for high-speed internet, IoT devices, and cloud-based applications across commercial, industrial, and consumer sectors also drives 5G adoption. Additionally, Asia Pacific has a large population with increasing smartphone penetration, creating significant demand for enhanced mobile broadband services. Combined with favorable policies, growing investments in private 5G networks, and strong technological capabilities, these factors position Asia Pacific as the fastest-growing market for 5G infrastructure globally.

Market Dynamics

Driver: Rapid Digitalization and IoT Adoption

The 5G infrastructure market is primarily driven by rapid digitalization and the growing adoption of Internet of Things (IoT) devices across industries. High-speed and low-latency networks are essential for enabling smart factories, connected healthcare systems, autonomous vehicles, and AR/VR applications. Governments and enterprises are investing heavily in 5G to support smart city initiatives, cloud-based services, and AI-driven analytics. This increasing reliance on real-time data, automation, and advanced communication technologies creates a strong demand for robust and scalable 5G infrastructure, positioning the market for continuous growth across commercial, industrial, and residential sectors.

Restraint: High Deployment Cost

High deployment costs remain a key restraint for the 5G infrastructure market. Implementing 5G networks requires significant investment in network equipment, spectrum acquisition, installation, and integration with existing infrastructure. Small-scale operators and developing regions often struggle with the financial and technical burden of deploying these networks. Additionally, ongoing operational and maintenance costs, including upgrades and compliance with regulatory standards, further increase expenses. These high costs can slow adoption, especially in regions with limited budgets or less-developed telecom ecosystems, making affordability and cost-efficiency critical challenges for stakeholders in the global 5G infrastructure market.

Opportunity: Expansion of Private Networks in Manufacturing and Logistics

The expansion of private 5G networks offers significant growth opportunities for the 5G infrastructure market. Industries such as manufacturing, logistics, healthcare, and energy can leverage private networks for secure, reliable, and low-latency communication. Private 5G allows real-time monitoring, predictive maintenance, autonomous operations, and enhanced operational efficiency. Companies can implement customized networks tailored to specific business needs, improving productivity and data management. Collaborations between telecom providers and industrial enterprises further accelerate adoption. As organizations increasingly focus on digital transformation and automation, the demand for private 5G solutions continues to grow, making it a key opportunity for market players.

Challenge: Network Interoperability and Security

Network interoperability and security are major challenges in the 5G infrastructure market. Integrating 5G with existing 4G and legacy networks requires technical expertise to ensure seamless communication and consistent performance. Additionally, the increasing number of connected devices and critical industrial applications raises cybersecurity concerns. Ensuring data privacy, network security, and compliance with evolving regulations remains a complex task for operators. Rural and remote deployments face additional challenges, including technical limitations and lack of skilled personnel. Addressing interoperability, cybersecurity, and regulatory requirements is crucial for the widespread adoption and long-term sustainability of 5G infrastructure globally.

Future Outlook

Between 2025 and 2035, the 5G infrastructure market is poised for significant growth over the coming years, driven by rising demand for high-speed connectivity, smart cities, industrial automation, and IoT adoption. The rollout of private 5G networks across manufacturing, healthcare, logistics, and enterprise sectors is expected to accelerate, providing secure, low-latency communication and enabling advanced applications such as autonomous vehicles, AR/VR, and AI-driven analytics. Asia Pacific is likely to lead growth due to strong government initiatives, large-scale investments, and the presence of major telecom equipment providers. Innovations in network technologies, including massive MIMO, network slicing, and edge computing, will further enhance performance and adoption. Despite challenges related to cost, security, and interoperability, continuous technological advancements, public-private collaborations, and increasing digital transformation initiatives position the market for sustained expansion globally.

Key Market Players

Top security cameras companies Telefonaktiebolaget LM Ericsson (Sweden), Huawei Technologies Co., Ltd. (China), Nokia (Finland), SAMSUNG (South Korea), and ZTE Corporation (China)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Secondary Sources

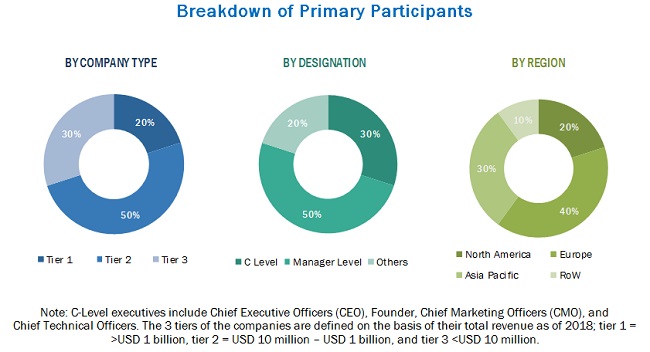

2.1.3 Primary Data

2.1.3.1 Breakdown of Primaries

2.1.3.2 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in 5G Infrastructure Market

4.2 Market, By Communication Infrastructure

4.3 Market, By Core Network Technology

4.4 Market, By Network Architecture

4.5 Market for Commercial, By Type & Region

4.6 Market, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Lower Latency in 5G

5.2.1.2 Growth in Mobile Data Traffic

5.2.1.3 Growing Adoption of Virtual Networking Architecture in Telecommunications

5.2.1.4 Increasing M2M Connections Across Various Industries

5.2.2 Restraints

5.2.2.1 Delay in Standardization of Spectrum Allocation

5.2.3 Opportunities

5.2.3.1 Growing Demand From Different Business Verticals

5.2.3.2 Growth of IoT Technology Would Offer New Opportunities for 5G Infrastructure

5.2.4 Challenges

5.2.4.1 Technological Design Challenges

5.2.4.1.1 Heat Dissipation in Massive Multiple Input and Multiple Output (Mimo)

5.2.4.1.2 Inter-Cell Interference Management

5.2.4.2 Deployment and Coverage

5.3 Value Chain Analysis

5.4 5G Trial Spectrum

5.5 5G Use Cases

5.5.1 Connected Transportation

5.5.2 Connected Health

5.5.3 Smart Manufacturing

5.5.4 Ar/Vr

6 5G Infrastructure Market, By Communication Infrastructure (Page No. - 50)

6.1 Introduction

6.2 Small Cell

6.2.1 Micro Cell

6.2.1.1 Micro Cells have A Greater Coverage Area Than Femtocells and Pico Cells

6.2.2 Femtocell

6.2.2.1 Femtocells are Usually Deployed in Homes Or Small Businesses Because of Its Short Range Small Cell Types

6.2.3 Pico Cell

6.2.3.1 Pico Cells are Usually Installed in Larger Indoor Areas Such as Shopping Malls, Offices, Or Train Stations.

6.3 Macro Cell (5G Radio Base Station)

6.3.1 A Macro Cell in Wireless Cellular Networks Provides Radio Access Coverage to A Large Area of Mobile Network

7 5G Infrastructure Market, By Core Network Technology (Page No. - 66)

7.1 Introduction

7.2 SDN

7.2.1 SDN Allows Network/Cloud Operators to Make Instant Changes in Their Network Through A Centralized Control System

7.3 NFV

7.3.1 NFV is an Advanced Network Technology That Employs Virtualized Network Services

8 5G Infrastructure Market, By Network Architecture (Page No. - 78)

8.1 Introduction

8.2 5G Nr Non-Standalone (LTE Combined)

8.2.1 5G Non-Standalone Architecture Operates in Master–Slave Configuration

8.3 5G Standalone (NR + Core)

8.3.1 5G Standalone Network Provides an End-To-End 5G Experience to Users

9 5G Infrastructure Market, By Operational Frequency (Page No. - 81)

9.1 Introduction

9.2 Sub 6 GHz

9.2.1 Sub 6 GHz Band Offers an Amalgamation of Coverage and Capacity Benefits

9.3 Above 6 GHz

9.3.1 Above 6 GHz Band is Essential to Meet Ultra-High Broadband Speeds Projected for 5G

10 5G Infrastructure Market, By End User (Page No. - 85)

10.1 Introduction

10.2 Residential

10.2.1 Smart Home, Synchronized Watches, Smartphones, and Fitness Apps are Gaining Traction and Expected to Grow at High Rate Due to Performance Capabilities of 5G

10.3 Commercial

10.3.1 Commercial is A Major Sector That Mobile Service Providers Target

10.4 Industrial

10.4.1 IoT and M2M Communication are Key Technologies Employing Industrial Automation

10.5 Government

10.5.1 Several Governments Across the World Would Play Major Role in Growth of 5G Market By Deploying 5G Networks at Government Schools and Colleges

11 Geographic Analysis (Page No. - 96)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US Being in Forefront of Adoption of IoT, Wearable Technology to Drive Growth of 5G Market

11.2.2 Canada

11.2.2.1 Adoption of Advanced Technologies, Particularly Forthcoming 5G and the Proliferating IoT, to Rise in Canada

11.2.3 Mexico

11.2.3.1 Mexico to Exhibit Highest Growth in North American 5G Infrastructure Market During 2019–2027

11.3 Europe

11.3.1 UK

11.3.1.1 UK Government is Heavily Investing in 5G Infrastructure for Quick Deployment of 5G Networks in Various Parts of Europe

11.3.2 Germany

11.3.2.1 Germany is Powerhouse of Industrial and Automobile Electronics Manufacturing Within Europe

11.3.3 France

11.3.3.1 IoT Would Catalyze 5G Market in France as IoT Implementation Requires Large Number of Interconnected and Communicating Devices

11.3.4 Italy

11.3.4.1 IoT Italian 5G Infrastructure Market Growth Will Be Propelled By Heavy Investments in Establishing High-Speed and Robust Networks

11.3.5 Rest of Europe

11.3.5.1 Advanced Network Equipment That Can Establish Seamless Connectivity Plays A Vital Role in Automation

11.4 APAC

11.4.1 China

11.4.1.1 China is Among Fast-Growing Economies Involved in 5G Network Infrastructure Development

11.4.2 Japan

11.4.2.1 Companies in Japan have Made Significant Investments in R&D to Gain Competitive Edge in the Market

11.4.3 South Korea

11.4.3.1 South Korea is Home to Various Large-Scale Manufacturing Companies Operating in Semiconductor Displays, Transport, and Logistics Verticals

11.4.4 India

11.4.4.1 Widespread Proliferation of Broadband Connectivity and Penetration of Advanced Technologies Across Indian Organizations to Drive Demand for 5G Network in India

11.4.5 Rest of APAC

11.4.5.1 Countries Such as Singapore and Australia are Likely to Launch 5G Networks Because of Active Participation of Government Bodies

11.5 RoW

11.5.1 Middle East and Africa

11.5.1.1 Companies Conduct Research on 5G and M2M Communication Technologies for IoT and Smart City Applications, Which Would Surge Demand for 5G Networks

11.5.2 South America

11.5.2.1 Growing Internet Users in South America to Drive Growth of 5G Infrastructure Market

12 Competitive Landscape (Page No. - 133)

12.1 Overview

12.2 Market Ranking Analysis, 2019

12.3 Competitive Situation and Trends

12.3.1 Partnerships, Collaborations, and Agreements

12.3.2 Product Launches

12.3.3 Expansions

12.3.4 Acquisitions

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

13 Company Profiles (Page No. - 151)

13.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1.1 Ericsson

13.1.2 Huawei

13.1.3 Nokia Networks

13.1.4 Samsung

13.1.5 ZTE

13.1.6 NEC

13.1.7 Cisco

13.1.8 Commscope

13.1.9 Comba Telecom Systems

13.1.10 Alpha Networks

13.1.11 Siklu Communication

13.1.12 Mavenir

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13.2 Other Key Players

13.2.1 Airspan Networks

13.2.2 VMware

13.2.3 Extreme Networks

13.2.4 American Tower

13.2.5 Fujitsu

13.2.6 Verizon Communications

13.2.7 AT&T

13.2.8 SK Telecom

13.2.9 T-Mobile

13.2.10 Hewlett Packard Enterprise

13.2.11 Korea Telecom

13.2.12 China Mobile

14 Appendix (Page No. - 203)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Report

14.6 Author Details

List of Tables (108 Tables)

Table 1 Market, By Communication Infrastructure, 2018–2027 (USD Million)

Table 2 Market, By Communication Infrastructure, 2018–2027 (Thousand Units)

Table 3 5G Communication Infrastructure Market, By Region, 2018–2027 (USD Million)

Table 4 5G Communication Infrastructure Market in North America, By Country, 2018–2027 (USD Million)

Table 5 5G Communication Infrastructure Market in Europe, By Country, 2018–2027 (USD Million)

Table 6 5G Communication Infrastructure Market in APAC, By Country, 2018–2027 (USD Million)

Table 7 5G Communication Infrastructure Market in RoW, By Region, 2018–2027 (USD Million)

Table 8 5G Communication Infrastructure Market, By End User, 2018–2027 (USD Million)

Table 9 5G Small Cell Market, By Network Architecture, 2018–2027 (Thousand Units)

Table 10 5G Small Cell Market, By Deployment Type, 2018–2027 (Thousand Units)

Table 11 5G Small Cell Market, By Type, 2018–2027 (Thousand Units)

Table 12 5G Small Cell Market, By Type, 2018–2027 (USD Million)

Table 13 5G Small Cell Market, By Region, 2018–2027 (USD Million)

Table 14 5G Small Cell Market in North America, By Country, 2018–2027 (USD Million)

Table 15 5G Small Cell Market in Europe, By Country, 2018–2027 (USD Million)

Table 16 5G Small Cell Market in APAC, By Country, 2018–2027 (USD Million)

Table 17 5G Small Cell Market in RoW, By Region, 2018–2027 (USD Million)

Table 18 Comparison of Various Types of Cells in 5G Infrastructure Market

Table 19 5G Macro Cell Market, By Region, 2018–2027 (USD Million)

Table 20 5G Macro Cell Market in North America, By Country, 2018–2027 (USD Million)

Table 21 5G Macro Cell Market in Europe, By Country, 2018–2027 (USD Million)

Table 22 5G Macro Cell Market in APAC, By Country, 2018–2027 (USD Million)

Table 23 5G Macro Cell Market in RoW, By Region, 2018–2027 (USD Million)

Table 24 Market, By Core Network Technology, 2018–2027 (USD Million)

Table 25 5G Core Network Technology, By Region, 2018–2027 (USD Million)

Table 26 5G Core Network Technology in North America, By Country, 2018–2027 (USD Million)

Table 27 5G Core Network Technology in Europe, By Country, 2018–2027 (USD Million)

Table 28 5G Core Network Technology in APAC, By Country, 2018–2027 (USD Million)

Table 29 5G Core Network Technology in RoW, By Region, 2018–2027 (USD Million)

Table 30 5G Core Network Technology, By End User, 2018–2027 (USD Million)

Table 31 5G SDN Market, By Region, 2018–2027 (USD Million)

Table 32 5G SDN Market in North America, By Country, 2018–2027 (USD Million)

Table 33 5G SDN Market in Europe, By Country, 2018–2027 (USD Million)

Table 34 5G SDN Market in APAC, By Country, 2018–2027 (USD Million)

Table 35 5G SDN Market in RoW, By Region, 2018–2027 (USD Million)

Table 36 5G NFV Market, By Region, 2018–2027 (USD Million)

Table 37 5G NFV Market in North America, By Country, 2018–2027 (USD Million)

Table 38 5G NFV Market in Europe, By Country, 2018–2027 (USD Million)

Table 39 5G NFV Market in APAC, By Country, 2018–2027 (USD Million)

Table 40 5G NFV Market in RoW, By Region, 2018–2027 (USD Million)

Table 41 Market, By Network Architecture, 2018–2027 (USD Million)

Table 42 Market, By Operational Frequency, 2018–2027 (USD Million)

Table 43 Market for Sub 6 GHz Frequency, By Region, 2018–2027 (USD Million)

Table 44 Market for Above 6 GHz, By Region, 2018–2027 (USD Million)

Table 45 Market, By End User, 2018–2027 (USD Million)

Table 46 Market for Residential, By Region, 2018–2027 (USD Million)

Table 47 Market for Residential, By Type, 2018–2027 (USD Million)

Table 48 Market for Commercial, By Region, 2018–2027 (USD Million)

Table 49 Market for Commercial, By Type, 2018–2027 (USD Million)

Table 50 Market for Industrial, By Region, 2019–2027 (USD Million)

Table 51 Market for Industrial, By Type, 2019–2027 (USD Million)

Table 52 Market for Government, By Region, 2019–2027 (USD Million)

Table 53 Market for Government, By Type, 2019–2027 (USD Million)

Table 54 Market, By Region, 2018–2027 (USD Million)

Table 55 Market in North America, By Country, 2018–2027 (USD Million)

Table 56 Market in North America, By Communication Infrastructure, 2018–2027 (USD Million)

Table 57 Market in North America, By Operational Frequency, 2018–2027 (USD Million)

Table 58 Market in North America, By End User, 2018–2027 (USD Million)

Table 59 Market in North America, By Core Network Technology, 2018–2027 (USD Million)

Table 60 Market in US, By Communication Infrastructure, 2018–2027 (USD Million)

Table 61 Market in US, By Core Network Technology, 2018–2027 (USD Million)

Table 62 Market in Canada, By Communication Infrastructure, 2020–2027 (USD Million)

Table 63 Market in Canada, By Core Network Technology, 2020–2027 (USD Million)

Table 64 Market in Mexico, By Communication Infrastructure, 2020–2027 (USD Million)

Table 65 Market in Mexico, By Core Network Technology, 2020–2027 (USD Million)

Table 66 Market in Europe, By Country, 2018–2027 (USD Million)

Table 67 Market in Europe, By Communication Infrastructure, 2018–2027 (USD Million)

Table 68 Market in Europe, By Operational Frequency, 2018–2027 (USD Million)

Table 69 Market in Europe, By End User, 2018–2027 (USD Million)

Table 70 Market in Europe, By Core Network Technology, 2018–2027 (USD Million)

Table 71 Market in UK, By Communication Infrastructure, 2019–2027 (USD Million)

Table 72 Market in UK, By Core Network Technology, 2019–2027 (USD Million)

Table 73 Market in Germany, By Communication Infrastructure, 2019–2027 (USD Million)

Table 74 Market in Germany, By Core Network Technology, 2019–2027 (USD Million)

Table 75 Market in France, By Communication Infrastructure, 2019–2027 (USD Million)

Table 76 Market in France, By Core Network Technology, 2019–2027 (USD Million)

Table 77 Market in Italy, By Communication Infrastructure, 2019–2027 (USD Million)

Table 78 Market in Italy, By Core Network Technology, 2019–2027 (USD Million)

Table 79 Market in Rest of Europe, By Communication Infrastructure, 2018–2027 (USD Million)

Table 80 Market in Rest of Europe, By Core Network Technology, 2018–2027 (USD Million)

Table 81 Market in APAC, By Country, 2018–2027 (USD Million)

Table 82 Market in APAC, By Communication Infrastructure, 2018–2027 (USD Million)

Table 83 Market in APAC, By Operational Frequency, 2018–2027 (USD Million)

Table 84 Market in APAC, By End User, 2018–2027 (USD Million)

Table 85 Market in APAC, By Core Network Technology, 2018–2027 (USD Million)

Table 86 Market in China, By Communication Infrastructure, 2019–2027 (USD Million)

Table 87 Market in China, By Core Network Technology, 2019–2027 (USD Million)

Table 88 Market in Japan, By Communication Infrastructure, 2019–2027 (USD Million)

Table 89 Market in Japan, By Core Network Technology, 2019–2027 (USD Million)

Table 90 Market in South Korea, By Communication Infrastructure, 2018–2027 (USD Million)

Table 91 Market in South Korea, By Core Network Technology, 2018–2027 (USD Million)

Table 92 Market in India, By Communication Infrastructure, 2021–2027 (USD Million)

Table 93 Market in India, By Core Network Technology, 2021–2027 (USD Million)

Table 94 Market in Rest of APAC, By Communication Infrastructure, 2019–2027 (USD Million)

Table 95 Market in Rest of APAC, By Core Network Technology, 2019–2027 (USD Million)

Table 96 Market in RoW, By Region, 2018–2027 (USD Million)

Table 97 Market in RoW, By Communication Infrastructure, 2018–2027 (USD Million)

Table 98 Market in RoW, By Operational Frequency, 2018–2027 (USD Million)

Table 99 Market in RoW, By End User, 2018–2027 (USD Million)

Table 100 Market in RoW, By Core Network Technology, 2018–2027 (USD Million)

Table 101 Market in Middle East and Africa, By Communication Infrastructure, 2018–2027 (USD Million)

Table 102 Market in Middle East and Africa, By Core Network Technology, 2018–2027 (USD Million)

Table 103 Market in South America, By Communication Infrastructure, 2020–2027 (USD Million)

Table 104 Market in South America, By Core Network Technology, 2020–2027 (USD Million)

Table 105 Partnership, Collaboration, and Agreement, 2017–2019

Table 106 Product Launch, 2017–2019

Table 107 Expansion, 2018–2019

Table 108 Acquisition, 2018–2019

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, By Communication Infrastructure, 2019 vs 2027 (USD Million)

Figure 7 Market, By Core Network Technology, 2019 vs 2027 (USD Million)

Figure 8 Market, By Network Architecture, 2019 vs 2027 (USD Million)

Figure 9 Market, By Operational Frequency, 2019 vs 2027 (USD Million)

Figure 10 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Lower Latency in 5G and Growth in Mobile Data Traffic to Drive 5G Infrastrucutre Market During 2019–2027

Figure 12 Commercial End-User Segment to Hold Largest Size of 5G Communication Infrastructure Market By 2027

Figure 13 APAC to Lead 5G Core Network Market During Forecast Period

Figure 14 5G Standalone to Dominate Market for Network Architecture During Forecast Period

Figure 15 Communication Infrastructure and APAC Region Likely to Be Largest Shareholders in Overall Market By Commercial End User Industry

Figure 16 China to Grow at Highest CAGR in Market During Forecast Period

Figure 17 Continuous Increase in Demand for Mobile Data Services Drive Market

Figure 18 Mobile Data Traffic, 2017–2022

Figure 19 Cellular IoT Connections, 2018 vs 2024

Figure 20 5G Technology Ecosystem: Value Chain Analysis

Figure 21 5G Trial Spectrum (GHz)

Figure 22 Market, By Communication Infrastructure

Figure 23 APAC to Lead 5G Communication Infrastructure Market By 2027

Figure 24 Commercial to Hold Largest Size End-User Market for 5G Communication Infrastructure During Forecast Period

Figure 25 APAC to Lead 5G Small Cell Market During Forecast Period

Figure 26 Germany to Grow at Highest CAGR for Macro Cell During Forecast Period

Figure 27 Market, By Core Network Technology

Figure 28 Industrial End User to Grow at Highest CAGR for 5G Core Technologies During Forecast Period

Figure 29 APAC to Witness Fastest Growth in 5G NFV Market During Forecast Period

Figure 30 5G Standalone to Lead Network Architecture Market During Forecast Period

Figure 31 Above 6 GHz Frequency to Lead Operational Frequency Market During Forecast Period

Figure 32 Market, By End User

Figure 33 North America Held Largest Market Size for Commercial End User in 2019

Figure 34 Core Network Technology to Witness Higher CAGR for Government End User

Figure 35 Market, By Geography

Figure 36 North America: Snapshot of Market

Figure 37 Europe: Snapshot of Market

Figure 38 APAC: Snapshot of Market

Figure 39 RoW: Snapshot of Market

Figure 40 Companies Adopted Product Launch and Partnerships & Collaborations as the Key Growth Strategies From 2017 to 2019

Figure 41 Ranking of the Key Players in the Market, 2019

Figure 42 Market (Global) Competitive Leadership Mapping, 2018

Figure 43 Ericsson: Company Snapshot

Figure 44 Huawei: Company Snapshot

Figure 45 Nokia Corporation: Company Snapshot

Figure 46 Samsung: Company Snapshot

Figure 47 ZTE: Company Snapshot

Figure 48 NEC: Company Snapshot

Figure 49 Cisco: Company Snapshot

Figure 50 Commscope: Company Snapshot

Figure 51 Comba Telecom Systems: Company Snapshot

Figure 52 Alpha Networks: Company Snapshot

The study involved 4 major activities in estimating the current size of the 5G infrastructure market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the 5G infrastructure market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the 5G infrastructure market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the 5G infrastructure market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the 5G infrastructure market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the 5G infrastructure market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the 5G infrastructure market, in terms of value, by communication infrastructure, core network technology, network architecture, operational frequency, and end user

- To describe and forecast the market size, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the 5G infrastructure market for stakeholders and detail the competitive landscape for market players

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in 5G Infrastructure Market

Need Forecast for 2019-2024, what is driving spending in 5G?