5G Fixed Wireless Access Market Size, Share, Statistics and Industry Growth Analysis Report By Offering (Hardware, Service), Operating Frequency (Sub 6GHz, 24-39 GHz, Above 39 GHz), Demography (Urban, Semi-urban, Rural), Application and Region (North America, Europe, APAC, RoW) - Size, Share, Statistics and Industry Growth Analysis Report

Updated on : October 22, 2024

5G Fixed Wireless Access Market Size & Growth

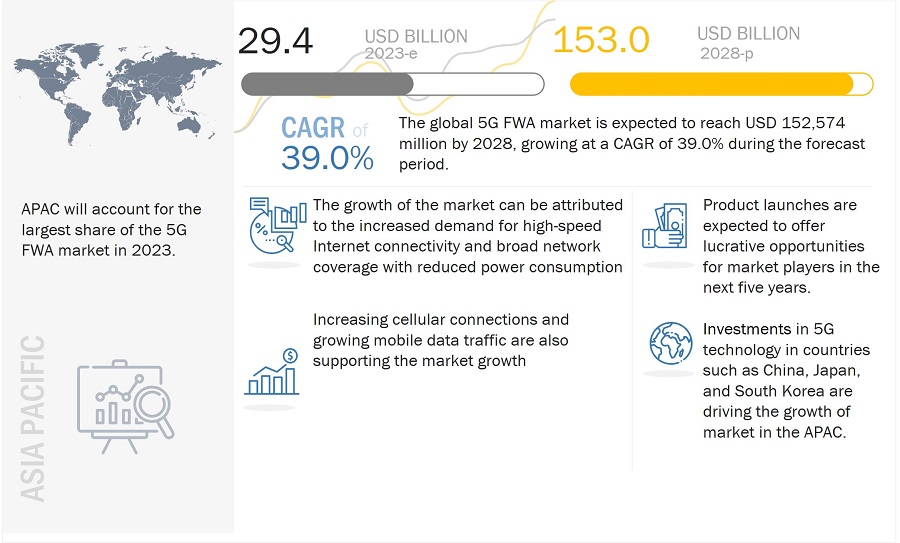

The global 5G fixed wireless access market size is expected to be valued at USD 29.4 billion in 2023 and is projected to reach USD 153.0 billion by 2028; growing at a CAGR of 39.0% during the forecast period from 2023 to 2028.

The market for fixed wireless access is flourishing globally owing to technological advancements ranging from LTE to 5G. The use of fixed wireless access enables the offering of broadband services to residential customers and small and medium-sized enterprises (SMEs) on a large scale with low connection latency.

Fixed Wireless Access Market Insights and Growth Prospects:

The fixed wireless access market is poised for significant growth, fueled by the increasing demand for high-speed internet connectivity and the widespread deployment of 5G networks. FWA leverages wireless technology to deliver broadband services to homes and businesses, especially in areas where traditional wired infrastructure is costly or impractical. With the advent of 5G, FWA offers faster speeds, lower latency, and greater reliability, making it a key solution for providing high-quality internet access in underserved and rural regions. The market is driven by major telecommunications players, such as Verizon, T-Mobile, and AT&T, who are expanding their 5G fixed wireless access offerings to meet the evolving connectivity needs of residential, commercial, and industrial customers worldwide.

5G Fixed Wireless Access Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

5G Fixed Wireless Access fwa market

The 5G FWA market includes major Tier I and II players like Nokia (Finland), Samsung Electronics (South Korea), Huawei Technologies (China), Ericsson (Sweden), Inseego (US), and others.

5G Fixed Wireless Access Market Trends and Dynamics

Driver: Surging demand for high-speed Internet connectivity and broad network coverage with reduced latency and power consumption

The evolution of 5G is projected to take fixed wireless access to a new level using a wide range of radio spectrum. This is expected to enable consumers to achieve major capacity gains and low-latency connectivity. Thus, 5G fixed wireless access is anticipated to enhance network performance capabilities and offer more high-speed network coverage than existing connectivity networks.

The increasing adoption of connected devices, such as smartphones, laptops, and smart devices, in several commercial and residential applications, such as distance learning, autonomous driving, multiuser gaming, videoconferencing, and live streaming, as well as in telemedicine and augmented reality, is expected to support the demand for 5G fixed wireless access solutions to achieve extended coverage.

Restraint: Environmental impact of millimeter-wave frequency circuitries

The millimeter-wave spectrum faces several challenges, such as the high costs of components. Manufacturing small components requires high precision, which increases their manufacturing costs and results in non-line-of-sight issues. Millimeter waves are blocked by physical objects such as trees and buildings, resulting in loss of signals and reduced range. These disadvantages may lead telecommunication operators to increase the number of towers and use equipment based on new technologies.

Opportunity: Partnerships among platform and hardware providers, mobile operators, and system integrators in emerging economies

The 5G ecosystem comprises 5G component and product manufacturers, network infrastructure and platform providers, system integrators, and end users. Presently, partnerships/collaborations between hardware manufacturers and mobile network operators in the context of 5G are limited to the US, China, Japan, and some European countries. 5G application platform providers, hardware vendors, and mobile operators have established strategic partnerships with the leading system integrators to accelerate the development and commercialization of 5G products and technologies. The stakeholders in the 5g fwa market are increasingly investing in the development of fixed wireless access-related components and equipment to harness the market potential of fixed wireless access. They are forming strategic partnerships with other key players.

Challenge: Compatibility issues between traditional and 5G networks

The seamless shift from traditional networks to 5G fronthaul and backhaul networks is difficult to achieve. Usually, traditional fronthaul/backhaul networks are incompatible with the new, advanced fronthaul/backhaul equipment. This creates compatibility issues leading to increasing infrastructure-related costs and results in the reluctance of organizations to employ advanced technologies. However, startup companies who are vendors for OEMs and established players in 5G FWA industry are using highly efficient advanced fronthaul/backhaul solutions to design and develop new systems based on the requirements of their customers.

Global 5G Fixed Wireless Access Market Segmentation

5G fixed wireless access market for services to hold the highest market share during the forecast period

5G FWA services are predicted to be a game-changer in the global telecommunication industry. These services have been made available to households in 2022 across major countries like the US, Canada, China, South Korea, etc. For instance, Samsung and T3 broadband collaborated on 5G-ready Citizens Broadband Radio Service (CBRS) network solutions to Mercury Broadband, a leading provider of high-speed Internet across rural markets in the US. The collaboration will enable Mercury to leverage CBRS to deliver FWA broadband connectivity and enhanced customer services in hard-to-reach, remote areas across several states. Verizon has also increased the number of cities where it offers 5G fixed wireless for business customers from 3 to 24. Previously, the FWA 5G service was only available in select parts of Chicago, Houston, and Los Angeles. The new additions include parts of 21 cities where its 5G Ultra-Wideband service using mmWave spectrum is available.

24-39 GHz operating frequency for 5G fixed wireless access to hold the highest market share in 2028

The game-changing breakthrough of 5G mmWave extended range increases the capacity of 5G fixed wireless access (FWA) solutions by making it possible to employ mmWave spectrum to serve a far greater number of residences than previously conceivable. By using this strategy, it is possible to reach semi-urban and rural areas by providing high-end "wireless fiber" services. Verizon, AT&T, T-Mobile, and US Cellular operators use the mmWave spectrum in their 5G network infrastructures. Though the mmWave spectrum can transmit massive volumes of data at high speed, this band's signals can only travel a few thousand feet. As a result, mmWave 5G infrastructures have mostly been confined to crowded downtown areas and are not expected to reach suburban or rural areas anytime soon.

Semi-urban demography for 5G FWA to hold the highest market share from 2023 to 2028

In semi-urban areas, the density of the population is sparse. Hence, these areas require significantly high investments to connect subscribers with a network through wireline infrastructures. With high-power transmissions/reception and advanced antenna technologies, wireless links can effectively reach rural areas without any major construction work required, as only base stations and customer premises equipment require installation. Nokia is one of the key players making efforts to offer FWA solutions to users, along with the hardware components necessary to connect new rural and suburban areas.

The 5G fixed wireless access market is expected to grow according to different spectrums used across different areas. For example, the higher spectrum would be favored in suburban and urban areas, while rural areas can use lower frequencies for FWA services. In semi-urban areas, "high band" millimeter wave (mmWave) spectrum such as 26GHz and 28GHz is mostly favored. 5G FWA will enable telecom operators to easily deliver high-speed mobile broadband services in semi-urban and rural areas. Laying fiber at every corner of the country can be a daunting task for telecom operators as it would take time and money. However, this can be avoided with 5G FWA.

Urban: Second largest demography of 5G fixed wireless access market

The urban areas represent densely developed territory and encompass residential, commercial, and nonresidential urban land uses. In general, upgrading or deploying the foundation infrastructures in densely populated urban areas is challenging owing to the high costs of civil work projects and complexities associated with the construction of high-rise buildings. FWA is expected to overcome this challenge by providing wireless connections with high throughput and low latency everywhere, whether in the aging wireline infrastructures or new network nodes.

Commercial application to hold the highest share of the 5G fixed wireless access market during the forecast period.

The commercial sector is one of the key targets for mobile service providers. Several vendors offer 5G FWA solutions to commercial users by launching commercial 5G networks and carrying out research and development activities to upgrade these commercial network solutions. For instance, in September 2022, Nokia and Telia partnered to launch the world's first commercial 5G SA network with network slicing for FWA. Telia introduced 5G SA to commercial FWA broadband services, with Nokia being its sole vendor of 5G standalone (SA) cores. Also, in August 2021, Verizon partnered with Corning to launch commercial in-building 5G millimeter-wave cell sites (indoor 5G) for enterprise customers. These in-building cell sites are being deployed in Verizon retail store locations and are set to be installed at WeWork locations across the US.

The adoption of 5G fixed wireless access is expected to increase with millimeter-wave (mmWave) bands such as 28 GHz and 39 GHz in applications that require a large, continuous, and readily available spectrum. Moreover, advanced antenna technologies such as massive MIMO are expected to enable the simultaneous delivery of high-speed services. Thus, the ability of 5G FWA to provide advanced connectivity and services to customers, along with its capability to serve IoT use cases, is driving investments to develop FWA networks across commercial areas.

5G Fixed Wireless Access Industry Regional Analysis

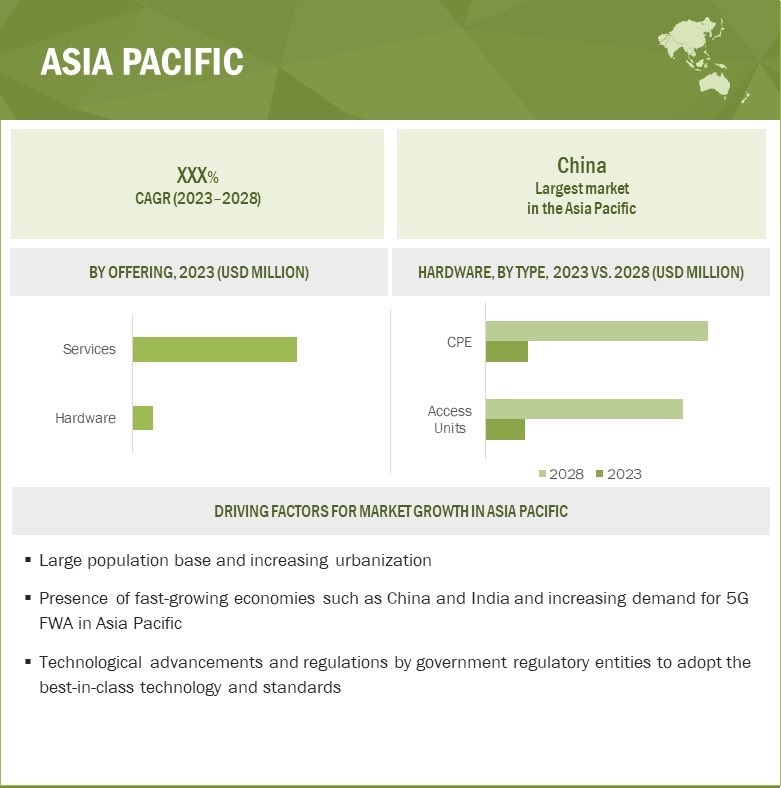

5G fixed wireless access market in Asia Pacific to hold the highest CAGR during the forecast period

The overall APAC region is home to a few of the fastest-growing and leading industrialized economies, such as China, South Korea, and Japan. It is witnessing dynamic changes in the adoption of recent technologies and advancements across industries. According to GSMA, there will be 400 million 5G connections in the Asia Pacific by 2025. 5G adoption, as a percentage of total connections, is set to accelerate in Asia Pacific as the technology's footprint expands across the region. 5G is now commercially available in 14 countries, with several others, including India and Vietnam, expected to come on board in the coming years. These new networks and the expansion of existing ones in pioneer markets will drive the transition to 5G FWA.

5G Fixed Wireless Access Market by Region

To know about the assumptions considered for the study, download the pdf brochure

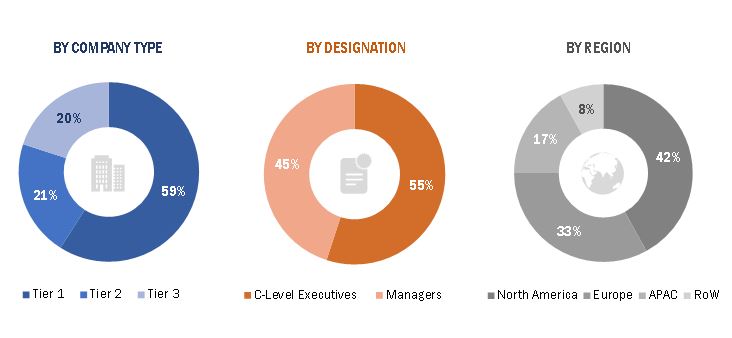

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 – 40%, Tier 2 – 25%, and Tier 3 – 35%

- By Designation: C-level Executives – 35%, Directors – 28%, and Others – 37%

- By Region: North America – 42%, Europe – 33%, Asia Pacific – 17%, RoW – 8%

5G Fixed Wireless Access Companies - Key Market Players

The 5G fixed wireless access companies such as

- Nokia (Finland),

- Samsung Electronics (South Korea),

- Huawei Technologies (China),

- Ericsson (Sweden),

- Inseego (US) and others.

5G Fixed Wireless Access Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 29.4 Billion in 2023 |

| Projected Market Size | USD 153.0 Billion by 2028 |

| Growth Rate | CAGR of 39.0% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Offering, Demography, Operating Frequency, Application |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

The major market players include Nokia (Finland), Samsung Electronics (South Korea), Huawei Technologies (China), Ericsson (Sweden), Inseego (US), Verizon Communications (US), Siklu Communication (Israel), Vodafone (UK), CableFree (UK), and CommScope (US) (Total 25 players are profiled) |

5G Fixed Wireless Access Market Highlights

The study categorizes the 5G fixed wireless access market share based on the following segments:

|

Aspect |

Details |

|

5G FWA market, by offering |

|

|

5G FWA market, by demography |

|

|

5G FWA market, by operating frequency |

|

|

5G FWA market, by application |

|

|

5G FWA market, By region |

|

Recent Developments in 5G Fixed Wireless Access Industry

- In November 2022, NBN, a major network provider in Australia, partnered with Ericsson to boost the FWA infrastructure in the country. The partnership made Ericsson the sole supplier of 4G and 5G radio access and microwave transport solutions. Deployed solutions will include Ericsson's 4G and 5G antenna-integrated radios across NBN's current and future spectrum bands and the latest Massive MIMO solutions.

- In November 2022, Vodafone announced the launch of 5G FWA services for homes and businesses across Spain. The company added that its 5G network would be available in 1,000 municipalities across Spain by the end of the year, reaching 46% of the population.

- In October 2022, Ericsson partnered with Jio to build India's first 5G Standalone network. As a part of this partnership, the company will deploy its 5G RAN products and solutions, and E-band microwave mobile transport solutions will be deployed in the 5G network for Jio to push FWA for home broadband users and businesses.

- In October 2022, Verizon added 5G Home and LTE Home FWA services to its Verizon Forward Program, extending that offer to customers nationwide via its LTE and 5G wireless network instead of limiting it to just those within its Fios' fiber footprint.

- In October 2022, Singtel partnered with Ericsson to deploy the Ericsson AIR 3268 to its 5G network, which is part of its net-zero emissions initiative. The partnership will help Singtel expand its 5G FWA coverage.

- In September 2022, Ericsson launched its new 5G radio solution, which offers a highly compact and flexible solution to expand 5G coverage cost-efficiently. Radio 6646 will expand the wide-area reach and outside-in coverage from rooftops and towers to indoor locations such as offices, basements, stores, and homes. It will also increase the capacity of 5G networks, especially when combined with mid-band TDD over Carrier Aggregation and 5G Standalone (5G SA).

Frequently Asked Questions (FAQ):

What is the market size for the 5G fixed wireless access market?

The global 5G FWA market is expected to be valued at USD 29.4 billion in 2023 and is projected to reach USD 153.0 billion by 2028; it is expected to grow at a CAGR of 39.0% from 2023 to 2028.

What are the major driving factors and opportunities in the 5G fixed wireless access market?

Some of the major driving factors for the growth of this market include surging demand for high-speed Internet connectivity and broad network coverage with reduced latency and power consumption, increased adoption of advanced technologies such as M2M and IoT, and growing use of millimeter-wave technology in 5G FWA. Moreover, increased demand for 5G fixed wireless access networks from different industries and rising demand for IoT and cloud-based services to create opportunities for market players.

Who are the leading players in the global 5G fixed wireless access market share?

Companies such as Nokia (Finland), Samsung Electronics (South Korea), Huawei Technologies (China), Ericsson (Sweden), and Inseego (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the recession's impact on the global 5G fixed wireless access market share?

Demand for components such as 5G FWA in end-use markets depends primarily on CAPEX by operators/organizations for constructing, rebuilding, or upgrading their networking systems. The recession affects the amount of CAPEX spending and the company's sales and profitability, there can be no assurance that existing capital spending will continue or that spending will not decrease during the economic downturn. This will harm the growth of 5G FWA equipment like CPE, antennas, access units, etc., used in domestic and commercial environments.

What are some of the technological advancements in the 5G fixed wireless access market?

With the continuously increasing number of connected devices, high-speed Internet connectivity has become one of the most important requirements in digitally advanced workplaces. With 4G rapidly expanding its prospects across automotive, industrial, and healthcare applications, the industry focus has shifted toward developing 5G technology. 5G offers high data throughput rates, reduced latency, high energy savings, maximum cost reduction, excellent capacity, and massive simultaneous device connectivity that led to the large-scale adoption of cloud computing. This, in turn, is expected to be the next development phase in the highly dynamic broadband industry. As speculated by leading network providers, 5G network infrastructures are expected to offer connectivity of ≥1 Gbps. Moreover, 5G technology is expected to enable a fully connected world, having a fully heterogeneous network.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the 5G FWA market. Primary sources were several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of the value chain of the 5G FWA ecosystem.

In-depth interviews with various primary respondents, such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, were conducted to obtain and verify critical qualitative and quantitative information to assess future market prospects.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

List Of Major Secondary Sources

|

NAME OF SOURCES |

WEB LINK |

|

International Telecommunication Union |

https://www.itu.int/en/Pages/default.aspx |

|

3rd Generation Partnership Project (3GPP) |

www.3gpp.org |

|

5G World Alliance |

www.5gworldalliance.org |

|

5G Automotive Association |

www.5gaa.org |

|

International Cooperation on 5G (EU) |

www.ec.europa.eu/digital-single-market/en/5G-international-cooperation |

|

5G-PPP |

www.5g-ppp.eu |

|

5GAmericas |

www.5gamericas.org |

|

Next Generation Mobile Networks (NGMN) Alliance |

www.ngmn.org |

|

5GNOW–5th Generation Non-Orthogonal Waveforms |

www.5gnow.eu |

|

National Institute of Standards and Technology (US Department of Commerce) |

www.nist.gov |

|

Federal Communication Commission (FCC) |

www.fcc.gov |

|

Cellular Telephone Industries Association (CTIA) |

www.ctia.org |

|

Global Mobile Suppliers Association (GSA) |

www.gsacom.com |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the 5G FWA market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the 5G FWA market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the 5G FWA market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

- Analyzing the size of the global 5G FWA market by identifying segment and subsegment revenue related to the market

- Identifying the total number of 5G FWA components shipped globally, which includes CPE and access units

- Estimating the ASP of CPE and access units

- Estimating the ASP of 5G FWA services offered by numerous vendors

- Estimating the size of the 5G FWA market by hardware [(5G FWA CPE shipment * ASP of 5G FWA CPE) + (5G FWA access unit shipment * ASP of 5G FWA access unit)]

- Estimating the size of the 5G FWA market by service (5G FWA subscriber base * ASP of 5G FWA service)

- Estimating the size of the 5G FWA market by offering (5G FWA market by hardware + 5G FWA market by service)

- Estimating the market size of other segments (demography, application, and region)

- Identifying the upcoming projects related to 5G FWA by various companies in different regions and forecasting the market size based on these developments and other important parameters.

Top-Down Approach

In the top-down approach, the overall size of the 5G FWA market that was derived through percentage splits obtained from secondary and primary research was used to estimate the size of the individual markets (mentioned in the market segmentation).

For the calculation of the size of specific market segments, the overall size of the 5G FWA market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each market were determined and confirmed in this study.

- Information related to revenues obtained from key manufacturers and providers of 5G FWA was studied and analyzed to estimate the global size of the 5G FWA market.

- The 5G FWA market is expected to observe a linear growth trend during the forecast period because it is a mature market with many well-established players serving various applications.

- Offerings, geographic presence, and key applications of all identified players in the 5G FWA market were studied to estimate and arrive at the percentage splits of different market segments.

- All major players in each 5G FWA market category were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions with key opinion leaders of all major companies involved in developing the 5G FWA were conducted to validate the market splits based on offering, demography, application, and geography.

- Geographic splits were estimated using secondary sources based on various factors, such as the number of players offering 5G FWA in a specific country or region and the type of 5G FWA equipment offered by these players.

Data Triangulation

After arriving at the overall size of the 5G FWA market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches

Study Objectives

- To describe and forecast the 5G fixed wireless access (FWA) market, in terms of value, based on offering, demography, application, and region.

- To describe and forecast the 5G FWA market in terms of volume based on offering and operating frequency.

-

To describe and forecast the market, in terms of value, with regard to four key regions—

North America, Europe, the Asia Pacific, and the Rest of the World (RoW), along with their respective countries. - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the 5G FWA market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the 5G FWA ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies and provide details of the competitive landscape.

- To analyze strategic approaches such as product launches, collaborations, contracts, acquisitions, agreements, expansions, and partnerships in the 5G FWA market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Fixed Wireless Access Market

We are interested in 5G FWA market by region and applications. Can you please share more details about the countries and type of solutions covered in the report?

Can you please share more information on the scope of 5G FWA market and technologies covered in the report?

I would like to understand 5G FWA in residential for U.S market. I would also like to understand the start-up ecosystem.

I would like to know more about the current status of 5G FWA. Can you provide the use cases of 5G FWA in various industries?

I want to understand the investment scenario in 5G FWA space. Can you please share the current investment trends and which are the key investment area?