Diagnostic Electrocardiograph Market / Diagnostic ECG Market Size, Share & Trends by Product (Resting ECG, Stress, Mobile Cardiac Telemetry Device, Implantable Loop Recorder) and Service, Lead Type (12-lead, 6-lead, 5- lead), End User, and Region - Global Forecast to 2028

Diagnostic Electrocardiograph Market Size, Share & Trends

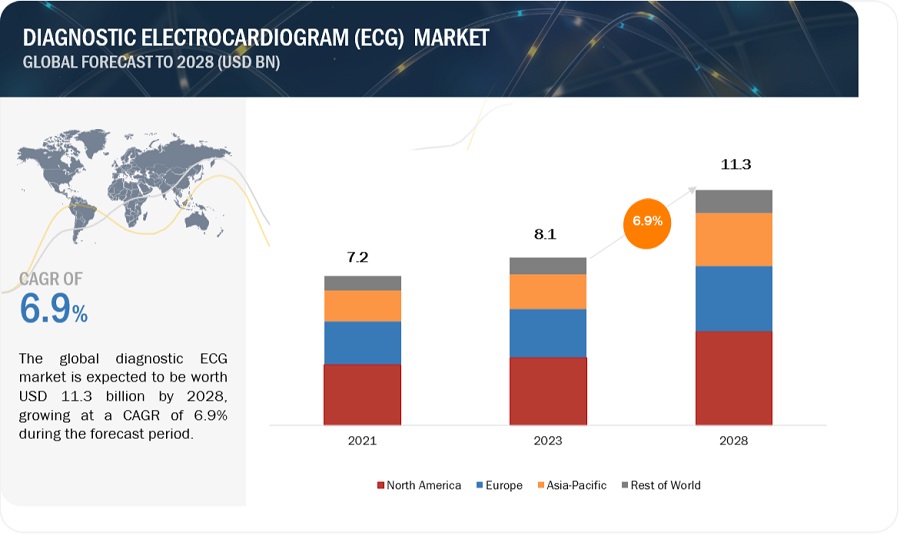

The size of global diagnostic electrocardiograph market in terms of revenue was estimated to be worth $8.1 billion in 2023 and is poised to reach $11.3 billion by 2028, growing at a CAGR of 6.9% from 2023 to 2028. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Rising number of patients suffering from cardiovascular disease (CVD) and the growing demand for early diagnosis of cardiac diseases are driving the growth of this market. Moreover, the rapid rise in geriatric population diagnosed with heart diseases and technological advancements in the wearable ECG devices are anticipated to support the diagnostic ECG market growth. However, the shortage of skilled professionals to monitor diagnostic ECG reports with accuracy is likely to hamper the growth of the Diagnostic ECG market.

Diagnostic Electrocardiograph Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Diagnostic ECG Market Dynamics

DRIVER: Increasing prevalence of lifestyle and cardiovascular disease

Increasing adoption of Sedentary lifestyles has led to an increase in lifestyle diseases such as hypertension, obesity, dyslipidemia, diabetes which has increased the prevalence of cardiovascular disease (CVD) across globe. According to CDC, an estimated 12.1 million population in US are expected to have atrial fibrillation by 2030. According to the report published by World Heart Vision, with the rising the burden of CVD, it is estimated that CVD deaths is projected to from 18.9 million in 2020 to around 22.,2 million in 2030 globally. Diagnosis ECG devices enables early diagnose and provides real-time insights of heart conditions, such as arrhythmias, myocardial infarctions. The ability to monitor the CVD progression and timely diagnosis are likely to boost the adoption of diagnostic ECG devices.

RESTRAINT: Dearth of skilled professionals

In most countries, there is a shortage of physicians and healthcare professionals with the expertise and know-how to handle cardiac monitoring devices, such as diagnostic CG devices.

Globally, there is a shortage of 4.3 million physicians (Source: WHO). According to a survey on the latest business conditions conducted by the National Association for Business Economics (NABE), 35% of participants reported that there is a shortage of skilled professionals in the US. According to the Association of American Medical Colleges (AAMC), the US will face a shortage of approximately 122,000 physicians by 2032. This shortage of skilled professionals and physicians in healthcare will have an impact on the diagnostic ECG market.

OPPORTUNITY: Emerging markets to offer high-growth opportunities

Emerging countries offer significant growth opportunities for cardiac diagnostics owing to rising prevalence of cardiovascular diseases , rapid growth in aging population in the emerging countries and ongoing investments in healthcare infrastructure. Moreover, there is an increasing awareness in the emerging countries about preventive care and early diagnosis of CVD. Moreover, Countries like India, Thailand, Singapore have gained popularity as a distinguished destinations for medical tourism owing to lower treatment cost, thus increasing the influx of patients seeking advanced diagnosis and treatment. Moreover, increasing government initiative in improving the healthcare accessibility and rising partnerships & collaborations among manufactures and public & private hospitals and cardiac centers are anticipated to accelerate the demand for advanced diagnosis ECG devices

CHALLENGE: Stringent regulatory requirements delaying approval of cardiac devices

Regulatory barriers can significantly impact the approval procedure of ECG devices resulting in delayed market entry of these devices. The establishment of stringent regulatory framework, rigorous clinical trial, adherence to standard, and the need of additional scrutiny in ECG devices integrated with AI algorithms or wireless connectivity are some of the factors that may lead to delay in the approval of diagnostic ECG devices, further leading to limited timely patient care and early diagnosis of disease. . These delay can also become hinderance for manufactures to expand the diagnostic ECG devices in new market, limiting the market growth opportunity.

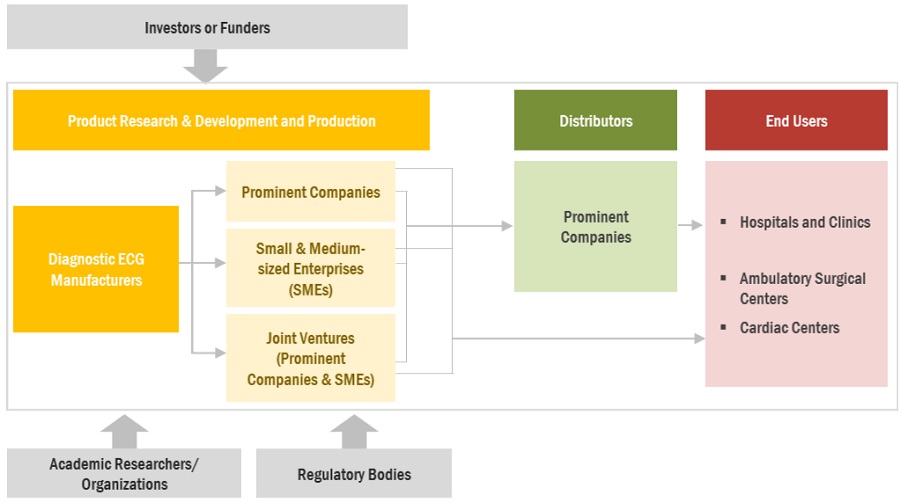

Diagnostic ECG Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of diagnostic ECG devices. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Nihon Kohden Corporation (Japan), OSI Systems, Inc. (US), and Hill-Rom Holdings, Inc. (Baxter International Inc.) (US).

By product type segment, the restring ECG devices to observe the highest market growth rate in the diagnostic electrocardiograph industry

Based on product type, the diagnostic electrocardiograph market is segmented into devices and software and services. The devices segment is categorized into resting ECG devices, stress ECG devices, Holter monitors, event monitors, implantable loop recorders, mobile cardiac telemetry devices, and smart ECG devices. The resting ECG devices segment captured the larger share of diagnostic ECG market in 2022. The large share of this segment is attributed to the wide applications of these devices in CVD management and the low cost of these devices. Moreover, these devices are simple, easy to use, and come with a space-efficient structure.

In 2022, 12-lead segment to dominate the Diagnostic electrocardiograph industry, by lead type

Based on lead type, the diagnostic electrocardiograph market is segmented into patch type 12-lead, 5-lead, 3-lead, 6-lead, single lead, and other lead types (such as 13 lead, 18-lead). In 2022, the 12-lead segment accounted for the largest share of the diagnostic ECG. 12-lead ECG devices are chiefly used by paramedics to diagnose acute myocardial infarction (AMI) and reduce treatment time. These devices have numerous potential clinical uses and serve as the standard for the noninvasive diagnosis of arrhythmias and conduction disturbances. Moreover, the rising usage of 12-lead ECG devices hospital & pre-hospital settings are likely to support the segment growth

In 2022, hospitals, Clinics, and Cardiac Centers segment to dominate the diagnostic electrocardiograph industry

Based on end user, the diagnostic electrocardiograph market is segmented into hospitals, cardiac centers, & clinics; ambulatory surgical centers; and other end users. This is attributed to the growing burden of cardiovascular diseases, which, in turn, is increasing the need for quality cardiology care, government initiatives to strengthen hospital infrastructure, establishment of new cardiac centers, and growing patient volume undergoing cardiac testing in hospital settings.

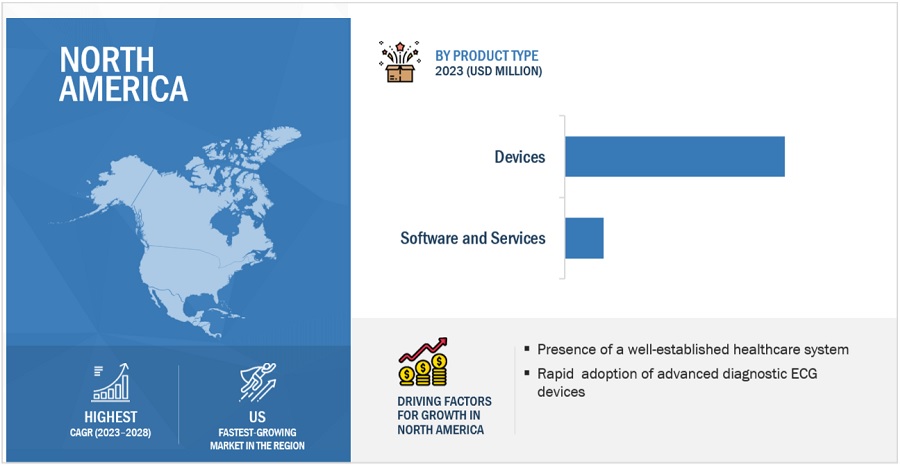

In 2022, North America to dominate in diagnostic electrocardiograph industry

The diagnostic electrocardiograph market is segmented into North America, Europe, Asia Pacific, Latin America and Middle-East Africa. North America is expected to dominate during the forecast period, primarily due increasing prevalence of cardiovascular disease, well establish healthcare infrastructe, growing aging population, and the raoid adoption of remote monitoring devices

To know about the assumptions considered for the study, download the pdf brochure

The Diagnostic electrocardiograph market is dominated by players such as GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Nihon Kohden Corporation (Japan), OSI Systems, Inc. (US), and Hill-Rom Holdings, Inc. (Baxter International Inc.) (US).

Scope of the Diagnostic Electrocardiograph Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

USD 8.1 billion |

|

Projected Revenue Size by 2028 |

USD 11.3 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.9% |

|

Market Driver |

Increasing prevalence of lifestyle and cardiovascular disease |

|

Market Opportunity |

Emerging markets to offer high-growth opportunities |

This report has segmented the global diagnostic electrocardiograph market to forecast revenue and analyze trends in each of the following submarkets:

By Product Type

-

Devices

- Resting ECG Devices

- Stress ECG Devices

- Holter Monitors

- Event Monitors

- Implantable Loop Recorders

- Mobile Cardiac Telemetry Devices

- Smart ECG Devices

- Software and Services

By Lead Type

- 12-lead

- 5-lead

- 3-lead

- 6-lead

- Sigle lead

- other lead types

By End User

- Hospitals, Clinics, and Cardiac Centers

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle-East Africa

Recent Developments Diagnostic Electrocardiograph Industry

- In April 2022, GE Healthcare signed an agreement with Deep Cardio to develop AI based ECG diagnostic technology and ECG data analysis program.

- In 2021, Royal Philips (Netherlands) acquired BioTelemetry, Inc. & Capsule Technologies (US) to strengthen Philips’ cardiac care portfolio, cardiac diagnostics, and monitoring services, which are included in the Connected Care segment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global diagnostic electrocardiograph market?

The global diagnostic electrocardiograph market boasts a total revenue value of USD 11.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global diagnostic electrocardiograph market?

The global diagnostic electrocardiograph market has an estimated compound annual growth rate (CAGR) of 6.9% and a revenue size in the region of USD 8.1 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing incidence of lifestyle and cardiovascular diseases- Rapidly expanding global geriatric population and subsequent surge in heart conditions- Development of wireless monitoring and wearable cardiac devices- Increasing investments, funds, and grants for research on cardiac diagnosisRESTRAINTS- Stringent regulatory requirements delaying approval of cardiac devicesOPPORTUNITIES- Emerging markets to offer high-growth opportunitiesCHALLENGES- Dearth of skilled professionals

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 REIMBURSEMENT SCENARIO

-

5.10 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- Brazil- MexicoMIDDLE EASTAFRICA

-

5.11 TRADE ANALYSISTRADE ANALYSIS FOR DIAGNOSTIC ECG PRODUCTS

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2023–2024

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND REVENUE POCKETS FOR DIAGNOSTIC ECG MONITOR MANUFACTURERS

-

5.15 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 DEVICESRESTING ECG DEVICES- Wide availability of resting ECG devices to support market growthSTRESS ECG DEVICES- High cost of stress ECG devices to limit adoptionHOLTER MONITORS- Growing demand for continuous monitoring to fuel growthEVENT MONITORS- Increasing outsourcing of monitoring devices to propel market growthIMPLANTABLE LOOP RECORDERS- Introduction of technologically advanced implantable loop recorders to support market growthMOBILE CARDIAC TELEMETRY DEVICES- Increasing demand for cardiac monitoring solutions in home care settings to propel marketSMART ECG MONITORS- Rising need to reduce treatment costs to drive adoption of smart/wearable ECG monitors

-

6.3 SOFTWARE & SERVICESSHIFT TOWARDS AI-ENABLED ECG SOFTWARE TO SUPPORT GROWTH

- 7.1 INTRODUCTION

-

7.2 12-LEAD ECG DEVICESGROWING USE IN PRE-HOSPITAL AND CLINIC SETTINGS TO DRIVE MARKET GROWTH

-

7.3 5-LEAD ECG DEVICESGROWING IMPORTANCE OF PATIENT MONITORING TO BOOST ADOPTION

-

7.4 3-LEAD ECG DEVICESABILITY TO MEET NEEDS OF MULTIPLE DIAGNOSTIC TESTS SIMULTANEOUSLY TO SUPPORT MARKET

-

7.5 6-LEAD ECG DEVICESGROWING USE OF 6-LEAD ECG DEVICES IN REMOTE PATIENT MONITORING TO FAVOR MARKET GROWTH

-

7.6 SINGLE-LEAD ECG DEVICESEASE OF USE FOR DIAGNOSIS AND QUICK RESULTS TO INCREASE USE OF SINGLE-LEAD ECG DEVICES

- 7.7 OTHER ECG LEAD DEVICES

- 8.1 INTRODUCTION

-

8.2 HOSPITALS, CLINICS, AND CARDIAC CENTERSINCREASING UTILIZATION OF ECG DEVICES IN HOSPITALS & CARDIAC CENTERS TO ACCELERATE MARKET GROWTH

-

8.3 AMBULATORY SURGERY CENTERSGROWING ADOPTION OF OUTPATIENT SURGERIES TO SUPPORT GROWTH

- 8.4 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Growing number of FDA approvals for ECG devices to support market growthCANADA- Growing focus of government and private organizations on providing funding for research to drive market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate diagnostic ECG market in Europe during forecast periodFRANCE- Rising prevalence of heart failure to drive adoption of diagnostic ECG devicesUK- Rising demand for home-based smart ECG devices to support market growth.ITALY- Rising incidence of heart diseases to increase use of diagnostic ECG devicesSPAIN- Rising geriatric population to support market growth in SpainREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- High healthcare expenditure and favorable reimbursement and insurance coverage to support market growth in JapanCHINA- Government support for infrastructural improvement to drive market growthINDIA- Government initiatives to propel market growthAUSTRALIA- Growing adoption of telemedicine and remote patient monitoring to boost marketSOUTH KOREA- Rising geriatric population to propel market growthREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Improving access to diagnostic services to drive growthMEXICO- Government support for infrastructural improvement to drive market growthREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAGROWING MEDICAL COVERAGE IN REGION TO SUPPORT GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

10.7 COMPETITIVE BENCHMARKINGOVERALL COMPANY FOOTPRINTCOMPANY PRODUCT FOOTPRINTCOMPANY REGIONAL FOOTPRINT

-

10.8 COMPETITIVE SCENARIO (2020–2023)PRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSGE HEALTHCARE- Business overview- Products offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Products offered- Recent developments- MnM viewHILL-ROM HOLDINGS, INC. (BAXTER INTERNATIONAL INC.)- Business overview- Products offered- Recent developments- MnM viewFUKUDA DENSHI- Business overview- Products offeredMINDRAY MEDICAL INTERNATIONAL LIMITED- Business overview- Products offered- Recent developmentsNIHON KOHDEN CORPORATION- Business overview- Products offeredOSI SYSTEMS, INC.- Business overview- Products offered- Recent developmentsBPL MEDICAL TECHNOLOGIES- Business overview- Products offeredSCHILLER AG- Business overview- Products offered- Recent developmentsBITTIUM- Business overview- Products offered- Recent developmentsACS DIAGNOSTICS- Business overview- Products offeredALLENGERS MEDICAL SYSTEMS LTD.- Business overview- Products offeredBIONET- Business overview- Products offeredCARDIAC INSIGHT, INC.- Business overview- Products offeredBTL- Business overview- Products offered

-

11.2 OTHER PLAYERSMEDITECH EQUIPMENT CO. LTD.MIDMARK CORPORATIONALIVECOR, INC.VITALCONNECTIRHYTHM TECHNOLOGIES, INC.BORSAM BIOMEDICAL INSTRUMENTS CO., LTD.NASIFF ASSOCIATES, INC.VECTRACORBIOMEDICAL INSTRUMENTS CO. LTD.LIFESIGNALS, INC.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 AVERAGE SELLING PRICE OF DIAGNOSTIC ECG MONITORING PRODUCTS (2022)

- TABLE 3 DIAGNOSTIC ECG MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 CPT CODES FOR ECG PROCEDURES

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT DATA FOR DIAGNOSTIC ECG PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 EXPORT DATA FOR DIAGNOSTIC ECG PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 12 DIAGNOSTIC ECG MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIAGNOSTIC ECG PRODUCTS

- TABLE 14 KEY BUYING CRITERIA FOR DIAGNOSTIC ECG PRODUCTS

- TABLE 15 DIAGNOSTIC ECG MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 16 DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 RESTING ECG DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 STRESS ECG DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 HOLTER MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 EVENT MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 IMPLANTABLE LOOP RECORDERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 MOBILE CARDIAC TELEMETRY DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 SMART ECG MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 DIAGNOSTIC ECG SOFTWARE & SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028(USD MILLION)

- TABLE 26 12-LEAD ECG DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 27 5-LEAD ECG DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 28 3-LEAD ECG DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 29 6-LEAD ECG DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 30 SINGLE-LEAD ECG DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 31 OTHER ECG LEAD DEVICES MARKET, BY REGION, 2021–2028(USD MILLION)

- TABLE 32 DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 33 DIAGNOSTIC ECG MARKET FOR HOSPITALS, CLINICS, AND CARDIAC CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 DIAGNOSTIC ECG MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 DIAGNOSTIC ECG MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 DIAGNOSTIC ECG MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 41 US: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 43 EUROPE: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 47 GERMANY: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 48 FRANCE: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 UK: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 ITALY: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 SPAIN: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 REST OF EUROPE: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 JAPAN: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 CHINA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 INDIA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 AUSTRALIA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 SOUTH KOREA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 LATIN AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028 (USD MILLION)

- TABLE 66 LATIN AMERICA: DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 BRAZIL: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 MEXICO: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 REST OF LATIN AMERICA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2021–2028 (USD MILLION)

- TABLE 72 MIDDLE EAST & AFRICA: DIAGNOSTIC ECG MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 73 PRODUCT FOOTPRINT ANALYSIS: DIAGNOSTIC ECG MARKET

- TABLE 74 REGIONAL FOOTPRINT ANALYSIS: DIAGNOSTIC ECG MARKET

- TABLE 75 DIAGNOSTIC ECG MARKET: KEY PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–AUGUST 2023)

- TABLE 76 DIAGNOSTIC ECG MARKET: KEY DEALS (JANUARY 2020–AUGUST 2023)

- TABLE 77 DIAGNOSTIC ECG MARKET: OTHER DEVELOPMENTS (JANUARY 2020–AUGUST 2023)

- TABLE 78 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 79 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 80 HILL-ROM HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 81 FUKUDA DENSHI: BUSINESS OVERVIEW

- TABLE 82 MINDRAY MEDICAL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- TABLE 83 NIHON KOHDEN CORPORATION: COMPANY OVERVIEW

- TABLE 84 OSI SYSTEMS, INC: BUSINESS OVERVIEW

- TABLE 85 BPL MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 86 SCHILLER AG: BUSINESS OVERVIEW

- TABLE 87 BITTIUM: BUSINESS OVERVIEW

- TABLE 88 ACS DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 89 ALLENGERS MEDICAL SYSTEMS LTD: BUSINESS OVERVIEW

- TABLE 90 BIONET: BUSINESS OVERVIEW

- TABLE 91 CARDIAC INSIGHT, INC.: BUSINESS OVERVIEW

- TABLE 92 BTL: BUSINESS OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 DIAGNOSTIC ECG MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION: DIAGNOSTIC ECG MARKET

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 DIAGNOSTIC ECG MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 DIAGNOSTIC ECG MARKET, BY LEAD TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 DIAGNOSTIC ECG MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF DIAGNOSTIC ECG MARKET

- FIGURE 12 INCREASING PREVALENCE OF CVD GLOBALLY TO DRIVE MARKET GROWTH

- FIGURE 13 DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN DIAGNOSTIC ECG MARKET IN 2022

- FIGURE 14 RESTING ECG DEVICES TO CAPTURE LARGEST SHARE OF DIAGNOSTIC ECG DEVICES MARKET IN 2022

- FIGURE 15 12-LEAD ECG DEVICES SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2028

- FIGURE 16 HOSPITALS, CLINICS, AND CARDIAC CENTERS SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH IN DIAGNOSTIC ECG MARKET FROM 2023 TO 2028

- FIGURE 18 DIAGNOSTIC ECG MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PATENT ANALYSIS FOR DIAGNOSTIC ECG MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS OF DIAGNOSTIC ECG MARKET: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 21 DIAGNOSTIC ECG MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 DIAGNOSTIC ECG MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 REVENUE SHIFT IN DIAGNOSTIC ECG MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIAGNOSTIC ECG PRODUCTS

- FIGURE 25 KEY BUYING CRITERIA FOR DIAGNOSTIC ECG PRODUCTS

- FIGURE 26 NORTH AMERICA: DIAGNOSTIC ECG MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: DIAGNOSTIC ECG MARKET SNAPSHOT

- FIGURE 28 KEY DEVELOPMENTS IN DIAGNOSTIC ECG MARKET (2020–2023)

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS (2019–2022)

- FIGURE 30 DIAGNOSTIC ECG MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 31 DIAGNOSTIC ECG MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 32 DIAGNOSTIC ECG MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 33 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 34 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 35 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 FUKUDA DENSHI: COMPANY SNAPSHOT (2022)

- FIGURE 37 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT (2021)

- FIGURE 38 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 39 OSI SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 BITTIUM: COMPANY SNAPSHOT (2022)

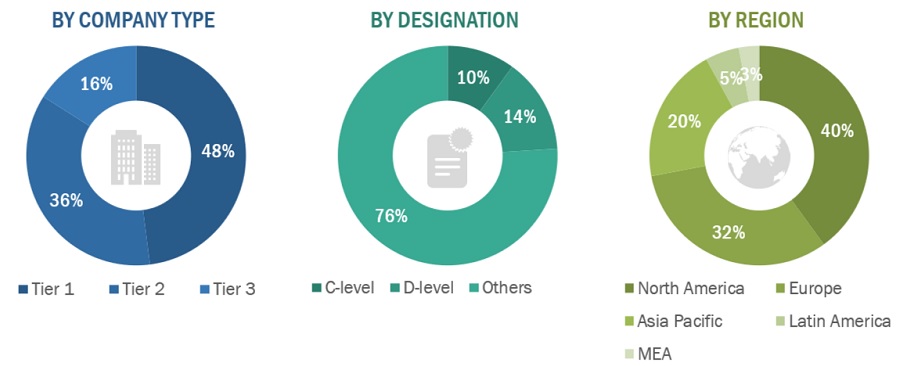

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the diagnostic electrocardiogram (ECG) market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the diagnostic electrocardiogram (ECG) market. The primary sources from the demand side include medical OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

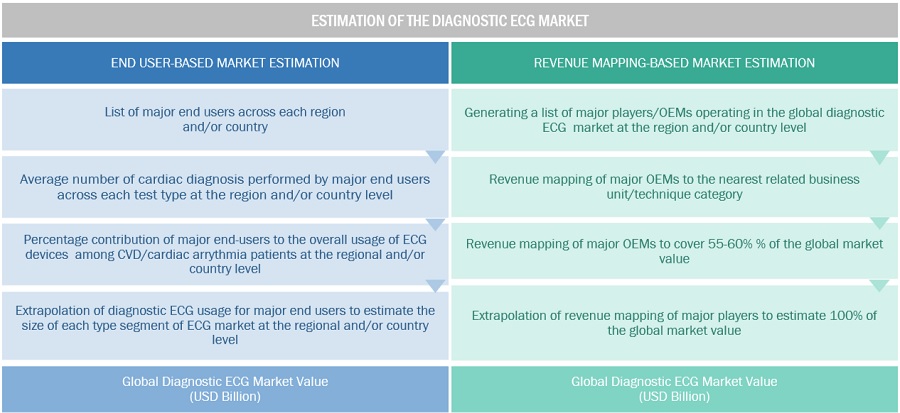

In this report, the global diagnostic electrocardiogram (ECG) market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the diagnostic electrocardiogram (ECG) business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the diagnostic electrocardiogram (ECG) market

- Mapping annual revenues generated by major global players from the diagnostic electrocardiogram (ECG) segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover a major share of the global market as of 2022

- Extrapolating the global value of the diagnostic electrocardiogram (ECG) industry

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global diagnostic electrocardiogram (ECG) market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the diagnostic electrocardiogram (ECG) market was validated using both top-down and bottom-up approaches.

Market Definition

Diagnostic Electrocardiographs (ECG) are used for the detection of electrical signals that are associated with cardiac activities to produce a graphic record of the time versus voltage. These ECG devices are equipped with software that analyze the ECG graph to determine the heart rhythm. Different typed of ECG devices namely, Holter monitors, resting ECG systems, stress ECG systems, implantable loop recorders (ILRs), event monitors, mobile cardiac telemetry (MCT) devices, smart ECG monitors are used by healthcare professional to monitor & diagnosis cardiac conditions, further guiding medical decisions

Key Market Stakeholders

- Diagnostic ECG devices and software manufacturers

- Distributors, suppliers, and commercial service providers

- Healthcare service providers

- Clinical research organizations (CROs)

- Ambulatory Surgical Centers

- Medical research laboratories

- Cardiac centers

- Academic medical centers and universities

- Market research and consulting firms

- Finance/Procurement Department

- Senior Management

Objectives of the Study

- To define, describe, and forecast the diagnostic electrocardiogram (ECG) market on the basis of product type, lead type, , end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global diagnostic electrocardiogram (ECG) market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global diagnostic electrocardiogram (ECG) market.

- To analyze key growth opportunities in the global diagnostic electrocardiogram (ECG) market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to four major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and Rest of the world.

- To profile the key players in the global diagnostic electrocardiogram (ECG) market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global diagnostic electrocardiogram (ECG) market, such as product launches, agreements, expansions, and & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global diagnostic electrocardiogram (ECG) market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe's diagnostic electrocardiogram (ECG) market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among other

- Further breakdown of the Rest of Asia Pacific diagnostic electrocardiogram (ECG) market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diagnostic Electrocardiograph Market