Cardiac Monitoring and Cardiac Rhythm Management Devices Market Size, Growth, Share & Trends Analysis

Cardiac Monitoring & Rhythm Management Devices Market by Type [Cardiac Monitoring (ECG, Ambulatory Monitors), Cardiac Rhythm Management [Pacemaker (Single, Leadless), Defibrillator (AED)], Application [Arrhythmia], End User [Hospital] - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global cardiac monitoring and cardiac rhythm management devices market, valued at USD 26.33 billion in 2025, stood at USD 27.90 billion in 2026 and is projected to advance at a resilient CAGR of 6.3% from 2026 to 2031, culminating in a forecasted valuation of USD 37.88 billion by the end of the period. The rising incidence of cardiovascular diseases and arrhythmias, driven by aging and lifestyle risk factors such as obesity and diabetes, is leading to significant expansion of the cardiac monitoring and rhythm management device market. The market is further driven by innovations in minimally invasive and remote monitoring technologies, growing focus on home healthcare and telemedicine, and increased awareness and early detection of cardiac conditions. Additional factors supporting steady growth include favorable reimbursement policies in developed regions and greater access to cardiac care in emerging markets.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific was the fastest regional market for cardiac monitoring and cardiac rhythm management devices market.

-

BY TYPE (Cardiac Monitoring Devices)By type, the non-invasive cardiac monitoring devices segment accounted for the largest share of 83.9%.

-

BY TYPE (Rhythm Management Devices)By type, the pacemakers segment accounted for the largest share of 45.8%.

-

BY ApplicationBy application, in 2025, the arryhtmia segment accounted for the largest share of 64.7% .

-

BY End userBy end user, the home care settings is projected to register highest CAGR during forecast period.

-

COMPETITIVE LANDSCAPEGE HealthCare, Koninklijke Philips N.V., Boston Scientific Corporation, Baxter are identified as STAR players in the market. These industry leaders have very broad product portfolios, large-scale manufacturing, strong R&D, and global distribution

-

COMPETITIVE LANDSCAPEBiotronik , Bittium, and Edan Instruments, Inc. are identified as high-growth innovators/SMEs, these companies are carving out niches through regional specialization, novel technologies, and growing presence in emerging markets

The cardiac monitoring and cardiac rhythm management devices market is growing overall due to the rising prevalence of cardiovascular diseases and arrhythmias, driven largely by an aging global population and increasing lifestyle-related risk factors such as obesity and diabetes. Growth is further supported by technological advancements in minimally invasive and remote monitoring devices, expanding adoption of home healthcare and telemedicine, and improved awareness and early diagnosis of cardiac conditions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The cardiac monitoring and rhythm management landscape is rapidly evolving as hospitals, cardiac centers, primary care facilities, ambulatory surgical centers, and home care settings face a rising cardiovascular disease burden and growing demand for continuous, remote, and early-detection solutions. These shifts are pushing providers to adopt advanced, connected, and patient-centric monitoring technologies. As a result, patients increasingly expect faster diagnosis, uninterrupted monitoring, personalized therapy, and improved long-term cardiac outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Increasing incidence of lifestyle and cardiovascular diseases

-

§Development of wireless monitoring and wearable cardiac devices

Level

-

§High costs of cardiac monitoring and rhythm management devices

Level

-

§Untapped growth potential in emerging markets

-

§Expanding access to advanced cardiac diagnostics with AI and CMS support

Level

-

§Frequent product recalls

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CARDIAC MONITORING & CARDIAC RHYTHM MANAGEMENT DEVICES MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implantable cardiac rhythm management devices (pacemakers, ICDs, CRT), remote cardiac monitoring systems | Improved arrhythmia management, reduced sudden cardiac death risk, advanced remote patient monitoring |

|

Pacemakers, implantable loop recorders, cardiac monitors, and CRM systems | Long device longevity, continuous rhythm monitoring, enhanced diagnostic accuracy |

|

Pacemakers, ICDs, CRT devices, wearable and implantable cardiac monitors | Reliable rhythm control, improved heart failure outcomes, strong physician adoption |

|

Ambulatory ECG monitoring, cardiac telemetry, patient monitoring systems | Continuous cardiac surveillance, early arrhythmia detection, integrated hospital workflows |

|

Holter monitors, ECG systems, cardiac telemetry and patient monitoring platforms | High-quality signal acquisition, scalable monitoring solutions, broad hospital adoption |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The trend in the cardiac monitoring and rhythm management devices market is toward an integrated ecosystem in which device manufacturers produce ECG monitors, Holter systems, implantable recorders, pacemakers, and defibrillators, supported by component suppliers, contract manufacturers, and OEM partners. The devices must comply with safety, performance, and cybersecurity standards set by regulatory authorities. These include the remarkable things created by digital health innovators such as Al-driven analytics, cloud connectivity, and remote monitoring. It all gets to the hospitals, cardiac centers, ahome care settings through distributors and logistics partners, with clinicians and biomedical teams now at the end of the chain,ain throwing the major adoption impetus. There are, however, new and continued trends such as miniaturization, wireless technologies, advanced arrhythmia detection, and digitally integrated care pathways that increasingly shape the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CARDIAC MONITORING DEVICES MARKET, BY TYPE

Non-invasive cardiac monitoring devices hold a large market share because of their ease of use, patient comfort, and lower procedural risk compared with implantable solutions. They enable continuous or intermittent monitoring without surgery, making them suitable for a broad patient population across hospitals, clinics, and homecare settings. Lower costs, faster deployment, minimal regulatory and reimbursement barriers, and growing adoption of wearable and wireless technologies further drive their widespread use. Additionally, rising demand for remote patient monitoring and early arrhythmia detection supports the strong preference for non-invasive solutions.

CARDIAC RHYTHM MANAGEMENT DEVICES MARKET, BY TYPE

Defibrillators hold a large share of the cardiac rhythm management market due to their critical, life-saving role in treating sudden cardiac arrest and life-threatening ventricular arrhythmias. Their widespread adoption across hospitals, emergency medical services, public-access settings, and home care is supported by strong clinical guidelines and government initiatives promoting automated external defibrillator (AED) deployment. Rising cardiovascular disease prevalence, growing awareness of sudden cardiac death, and technological advances, including portable, wearable, and implantable defibrillators, further contribute to their strong market share.

CARDIAC MONITORING AND RHYTHM MANAGEMENT DEVICES MARKET, BY APPLICATION

Arrhythmia is a major segment of the cardiac monitoring and rhythm management market due to its high prevalence, association with serious outcomes such as stroke and sudden cardiac death, and the need for continuous or long-term monitoring. The rising incidence of atrial fibrillation and other rhythm disorders, driven by aging populations and lifestyle-related risk factors, has increased demand for accurate detection and management solutions. Advances in non-invasive monitoring, implantable devices, and AI-enabled rhythm analysis further underscore the importance of arrhythmia diagnosis and treatment.

CARDIAC MONITORING AND RHYTHM MANAGEMENT DEVICES MARKET, BY End user

Hospitals account for a significant share of the cardiac monitoring and rhythm management devices market because they serve as primary centers for diagnosis, acute care, and complex cardiac interventions. They house advanced infrastructure, including intensive care units, electrophysiology labs, and catheterization centers, enabling the use of both non-invasive and implantable devices. High patient volume, availability of skilled cardiologists and electrophysiologists, and access to reimbursement and emergency care services further drive strong adoption of cardiac monitoring and rhythm management technologies in hospital settings.

REGION

Asia Pacific to be fastest-growing region in global cardiac monitoring and rhythm management devices market during forecast period

The Asia Pacific region is expected to post the highest growth rate in the cardiac monitoring and rhythm management devices market, driven by a rapidly expanding elderly population and rising prevalence of cardiovascular diseases. Improving healthcare infrastructure, greater access to advanced cardiac care, and growing government and private-sector investments are accelerating adoption. Additionally, expanding medical tourism, rising awareness of early diagnosis, and the entry of cost-effective devices and local manufacturers further support strong market growth across the region.

CARDIAC MONITORING & CARDIAC RHYTHM MANAGEMENT DEVICES MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the cardiac monitoring and rhythm management devices market matrix, GE Healthcare (Star) leads globally with a broad portfolio, a strong international presence, and advanced digital cardiac monitoring technologies that drive widespread adoption across care settings. OSI Systems Inc. (Emerging Leader) is expanding through specialized, cost-effective solutions focused on niche applications, emerging markets, and ambulatory and home-based cardiac care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- GE HealthCare (US)

- Koninklijke Philips N.V. (Netherlands)

- Boston Scientific Corporation (US)

- Baxter (US)

- Medtronic (Ireland)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Abbott (US)

- Stryker (US)

- NIHON KOHDEN CORPORATION (Japan)

- MicroPort Scientific Corporation (China)

- FUKUDA DENSHI (Japan)

- OSI Systems, Inc. (US)

- iRhythm Inc. (US)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- AliveCor, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 26.33 Billion |

| Revenue Forecast in 2031 | USD 37.88 Billion |

| Growth Rate | CAGR of 6.3% from 2026-2031 |

| Years Considered | 2024-2031 |

| Base year | 2025 |

| Forecast period | 2026–2031 |

| Units considered | Value (USD million/billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of cardiac monitoring and rhythm management devices by product type (ECG machines, Holter monitors, event monitors, mobile cardiac telemetry, implantable loop recorders, pacemakers, implantable cardioverter defibrillators [ICDs], cardiac resynchronization therapy [CRT] devices), technology (wired, wireless, wearable, implantable), and end user (hospitals, cardiology clinics, ambulatory centers, home monitoring). | Analysis of emerging trends such as AI-enabled arrhythmia detection, wearable and patch-based monitors, remote patient monitoring (RPM), cloud-based data analytics, miniaturized implantable devices, and extended battery-life technologies improving early diagnosis and long-term disease management. |

| Company Information | Comprehensive profiles of leading global players such as Medtronic, Abbott, Boston Scientific, Philips, GE HealthCare, Biotronik, and other regional and emerging manufacturers. | Identification of strategic partnerships, digital health collaborations, regulatory approvals, product launches, pipeline developments, and mergers & acquisitions shaping innovation and competition in the cardiac monitoring and rhythm management landscape. |

| Geographic Analysis | Region- and country-level demand mapping across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa; evaluation of regulatory pathways, reimbursement policies, healthcare infrastructure, and technology adoption rates. | Regional market outlook highlighting growth opportunities driven by rising cardiovascular disease prevalence, aging populations, increasing adoption of remote cardiac monitoring, expansion of home-based care models, and favorable reimbursement frameworks for digital and implantable cardiac devices. |

RECENT DEVELOPMENTS

- October 2025 : Abbott launched AVEIR DR Dual-Chamber Leadless Pacemaker System in India, the world’s first dual-chamber leadless pacemaker that enables wireless, beat-by-beat synchronisation between two miniaturised devices without traditional leads or a chest pocket. The system is intended to reduce complications associated with lead-based pacemakers and extend leadless pacing options to a broader patient cohort in India needing dual-chamber support.

- January 2025 : Sutter Health and GE Healthcare entered a seven-year Care Alliance partnership to expand access to AI-powered imaging across California, improving patient care and clinician efficiency. The partnership includes upgrading technology like PET/CT, MRI, and ultrasound across Sutter’s facilities and supports new care sites and specialty centers.

- June 2024 : Philips launched the Cardiac Workstation in EMEA to transform diagnostic cardiology by using advanced algorithms that streamline ECG data collection and analysis. The platform helps clinicians prioritize at-risk patients and reduces administrative burdens, enabling faster, more efficient care.

- September 2024 : Boston Scientific received U.S. Food & Drug Administration (FDA) approval to expand the indication for its INGEVITY™+ Pacing Leads to include conduction-system pacing (CSP) and sensing of the left bundle branch area (LBBA) when connected to single- or dual-chamber pacemakers. This expanded indication supports an alternative pacing strategy aimed at enhancing ventricular synchrony and potentially reducing the long-term risk of heart failure compared to traditional right-ventricular pacing

Table of Contents

Methodology

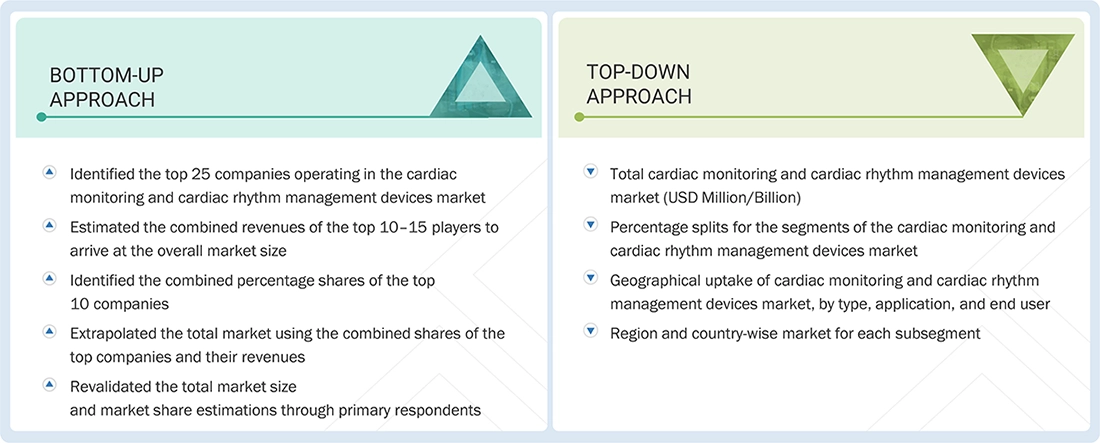

The study involved four major activities in estimating the current size of the cardiac monitoring and cardiac rhythm management devices market. Exhaustive secondary research was conducted to gather information on the market and its subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (cardiologists, Surgeons, Cardiac consultants) and supply sides (cardiac monitoring & cardiac rhythm management devices providers and distributors).

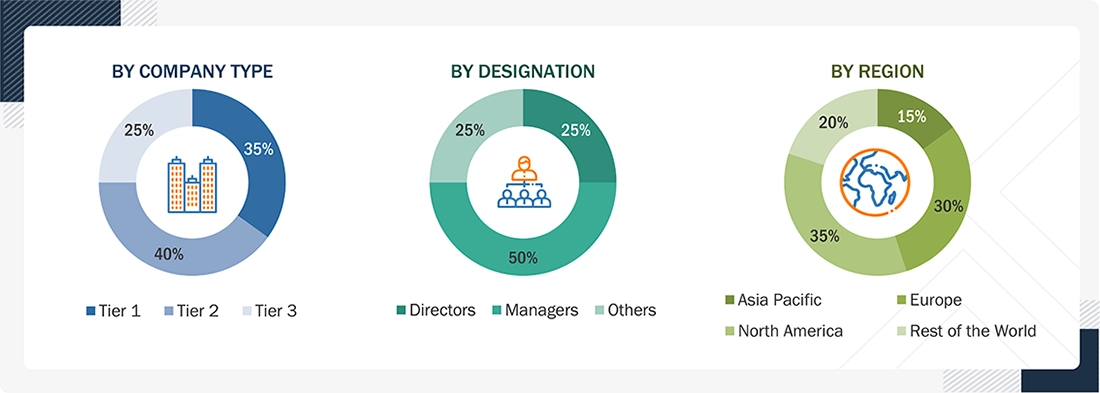

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2025: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cardiac monitoring & cardiac rhythm management devices Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size through market sizing processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by examining various factors and trends on both the demand and supply sides of the cardiac monitoring & cardiac rhythm management devices industry.

Market Definition

Cardiac monitoring is the continuous monitoring of cardiac activity using devices such as electrocardiographs, recording devices, and visual/audible recorders. These devices are used to identify or rule out a cardiac rhythm disorder and determine the appropriate course of treatment. Cardiac rhythm management devices include implantable devices (defibrillators and pacemakers), leads, and external devices used to treat and manage arrhythmia-related diseases. The major end users of implantable pacemakers and defibrillators are hospitals, cardiac centers, clinics, and ambulatory surgery centers.

Stakeholders

- Manufacturers of cardiac monitoring devices and rhythm management devices

- Distributors of cardiac monitoring devices and rhythm management devices

- Hospitals, primary care centers, and cardiac centers

- Ambulatory surgical centers

- Non-government organizations

- Government regulatory authorities

- Contract manufacturers & third-party suppliers

- Research laboratories & academic institutes

- Clinical research organizations (CROs)

- Government & non-governmental regulatory authorities

- Market research & consulting firms

Report Objectives

- To define, describe, segment, and forecast the global cardiac monitoring and cardiac rhythm management devices market, by type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s Five Forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI, case study analysis, unmet needs/end-user expectations, impact of US tariffs, and trends/disruption impacting customers’ business in the market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically analyze the cardiac monitoring and cardiac rhythm management devices market in five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments, including acquisitions, product & service launches, partnerships, and expansions, in the cardiac monitoring and cardiac rhythm management (CM & CRM) devices market.

- To track and analyze competitive developments such as acquisitions, product launches & enhancements, partnerships, agreements, contracts, & collaborations, and R&D activities in the CM & CRM devices market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cardiac Monitoring & Rhythm Management Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cardiac Monitoring & Rhythm Management Devices Market