Automotive Acoustic Materials Market by Type (ABS, Fiberglass, PP, PU, PVC & Textile), Component (Arch Liner, Dash, Fender & Floor Insulator, Door, Head & Bonnet Liner, Engine Cover, Trunk Trim, Parcel Tray), ICE & EV, and Region - Forecast to 2027

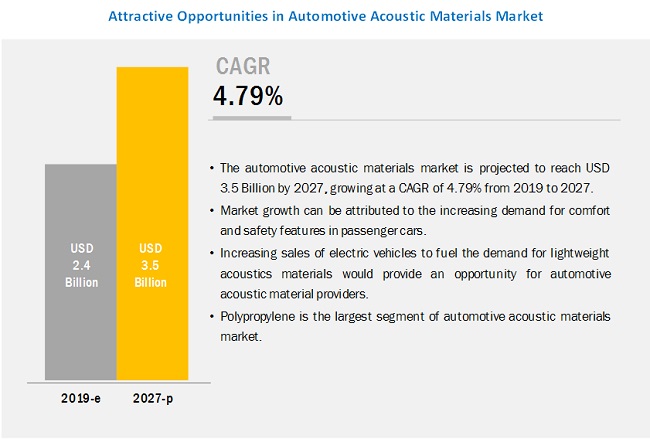

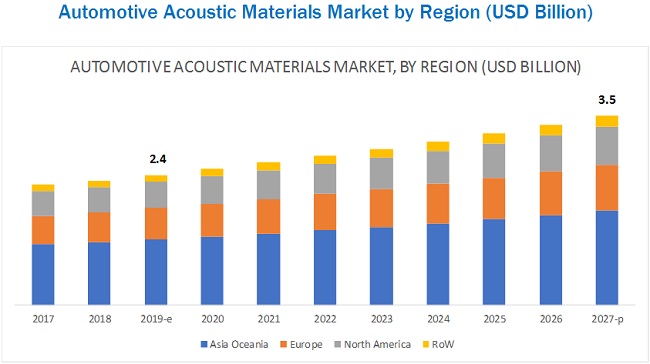

[164 Pages Report] The automotive acoustic materials market is projected to grow at a CAGR of 4.79% from USD 2.4 billion in 2019 to USD 3.5 billion by 2027. The increasing requirement for acoustic efficiency in automobiles for enhanced cabin comfort is the major factor which will drive the acoustic materials market.

BEV is expected to be the fastest growing segment in the automotive acoustic materials market, by electric vehicle type, during the forecast period.

Battery electric vehicle (BEV) is projected to be the fastest growing segment in the market by 2027. The battery used in a BEV is rechargeable and accounts for about 70% weight of the electric vehicle. OEMs are investing heavily in R&D to reduce the noise created through motors in BEVs. With increasing vehicle production and focus on cabin comfort, the demand for acoustic materials will grow in the near future. For instance, Autoneum has expanded its product portfolio for electric vehicles with Hybrid-Acoustics ECO+ for carpet systems, inner dashes, and floor insulators.

HCV segment of the automotive acoustic materials market is estimated to be the fastest during the forecast period.

The global market for automotive acoustic materials has the fastest projection for HCVs in the vehicle type segment. The vehicle industry is segmented into passenger car, HCV, and LCV. According to MarketsandMarkets analysis, the production of HCVs is estimated to grow from 5.1 million units in 2018 to 6.2 million units by 2025. The components covered in HCVs for the automotive acoustic material market are door trim, headliners, cabin rear trim, engine encapsulation, and wheel arch liners. According to industry insights, the demand for acoustic materials in a region follows the trend of vehicle production. Hence, the HCV segment of the market is estimated to be the fastest.

Door trim is projected to be the largest contributor during the forecast period, by component

Door trim is projected to be the largest market when it comes to the component segment. It attracts many suppliers and manufacturers for business investments. This market is exponentially increasing because of its good strength and better aesthetical properties. ABS, polypropylene, and polyurethane are the key materials used for this component.

The door trim is one of the essential interior applications used in all vehicle categories. Thus, OEMs focus on its toughness, higher strength, design flexibility, and cost competitiveness. The mixture of different materials offers significant acoustic performance in automobiles. Hence, it is projected to be the largest contributor to the automotive acoustic materials market.

Market Dynamics

Drivers

Introduction of enhanced comfort and safety features

With the increase in demand for vehicles, especially premium passenger cars, cabin comfort and luxury have become the key focus areas for manufacturers. The key objective is to ensure that the vehicle sound level does not exceed the permissible limit. Material suppliers are deploying strategies of expansion and new product development to cater to the increased focus on automotive acoustics and meet the increased demand for acoustic materials.

Government regulations pertaining to vehicle noise

With CO2 emission limitations, automotive OEMs also need to comply with the regulations regarding exterior and interior noise. The vehicle pass-by noise has been identified as one of the main causes of environmental health problems in Europe, especially in urban areas and those in the proximity of highways.

Restraints

Fluctuating raw material prices

The raw material of an automotive component plays an important role in setting the price of the component. The price of crude oil and raw material varies across the globe. Acrylonitrile, ethylene, rubber, polyurethane, polypropylene, and fiberglass are some of the key raw materials used in the manufacturing of acoustic components.

Opportunities

Increased demand for nonwoven materials

In recent years, OEMs have been focusing on reducing the vehicle weight to meet the stringent regulations for CO2 emission and fuel efficiency. In the current scenario, the usage of nonwoven materials, which have multiple automotive applications, has increased.

Rising sales of electric vehicles

With decreasing limits of tail-pipe emissions and increasing limits of fuel efficiency, OEMs are focusing on technological advancements in engine & exhaust systems. As the existing and upcoming regulations consider fleet level emission limits, OEMs are focusing on the production and sale of battery electric vehicles. This would help them to restrict the country-wise emissions of their fleets. Consequently, the demand for electric vehicles is projected to grow in the near future. Though electric vehicles generate lesser noise than internal combustion engines, there are third order sources such as electric motor, battery, HVAC system, and other several low decibel (dB) noise from the brake, acoustics, wind, and squeaks and rattle sounds from the vehicle.

Challenges

Installation of Active Noise Control (ANC) system

The Active Noise Control (ANC) system is designed to reduce the low-frequency noise generated in the interior cabin of a passenger car. The increasing deployment of the active noise control system may hinder the growth of the acoustic materials market in the future

Recycling of acoustic raw materials and growing demand for natural acoustic materials

The use of acoustic materials is growing in automotive applications such as exterior, interior, powertrain, and other underbody parts. The commonly used acoustic materials in these applications are polyurethane, polypropylene, and fiberglass. However, these acoustic materials are difficult to recycle owing to their complex compositions and the cross-linked nature of several base polymers and resins. Natural and recyclable acoustic materials may pose a serious threat to the acoustic materials made of virgin fibers.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2019–2027 |

|

Forecast Units |

Value (USD) and Volume (Tons) |

|

Segments Covered |

material type, component, application, electric vehicle type, ICE vehicle type, and region |

|

Geographies Covered |

Asia Oceania, Europe, North America, and the RoW |

|

Companies Covered |

The key players in the automotive acoustic materials market are Dow Chemical (US), BASF (Germany), 3M (US), Covestro (Germany), Henkel (Germany), and LyondellBasell (US). Additionally, the report covered 20 major players. |

This research report categorizes the automotive acoustic materials market based on material type, application, electric vehicle type, ICE vehicle type, and region

Market, By Application

- Underbody & engine bay acoustics

- Interior cabin acoustics

- Exterior acoustics

- Trunk panel acoustics

Market, By Material Type

- Acrylonitrile butadiene styrene (ABS)

- Fiberglass

- Polyvinyl chloride (PVC)

- Polyurethane (PU) foam

- Polypropylene

- Textiles

Market, By Components

- Hood liner/bonnet liner

- Engine top cover

- Fender insulator

- Door trims

- Headliners

- Floor insulator

- Wheel arch liner

- Trunk trim

- Inner dash

- Outer dash

- Parcel tray

- Cabin rear trim

- Engine encapsulation

Market, By Electric Vehicle Type

- BEV

- HEV

- PHEV

Market, By Vehicle Type

- Passenger Cars

- LCV

- HCV

Market, By Region

- Asia Oceania

- Europe

- North America

- RoW

Key Market Players

Some of the key players in the automotive acoustic materials market are Dow Chemical (US), BASF (Germany), 3M (US), Covestro (Germany), Henkel (Germany), and LyondellBasell (US). BASF (Germany) is identified as a leading player in the acoustic materials market. The company is one of the established players and globally renowned suppliers of acoustic materials to Tier I, component manufacturers, and OEMs. The company follows the strategy of new product developments to gain a competitive edge in the acoustic materials market. In October 2016, BASF partnered with Hyundai Motor Company (South Korea) to showcase the RN30 concept car in the K Fair organized in Düsseldorf, Germany. Under this collaboration, Hyundai used Cellasto, a microcellular polyurethane elastomer for the manufacturing of bumpers and top mounts. This elastomer enhances the noise, vibrations, and harshness of the car.

Key Questions addressed by the report

- What are the acoustic materials that are expected to have increased demand over the next 5 years?

- What are the different NVH regulations that would affect the acoustic materials market over the next 5 years?

- What would be the trend for acoustic materials over the next 5 years?

- What is the share of major players in the automotive acoustic materials market?

- Which component and application is expected to witness the fastest growth over the next 5 years?

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Acoustic materials market, By Application and Material Type

- ABS

- Fiberglass

- PP

- PU

- PVC

- Textiles

- Others

Acoustic materials market, By Vehicle and Material Type

- Sedan

- Hatchback

- SUV

- Minivan

- Pickup

- Pickup Truck

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Sampling Techniques & Data Collection Methods

2.1.2 Primary Participants

2.2 Market Estimation

2.2.1 Bottom-Up Approach

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Automotive Acoustic Materials Market

4.2 Market in Asia Oceania, By Vehicle Type and Country

4.3 Market, By Country

4.4 Market, By Material Type

4.5 Market, By Component

4.6 Market, By Application

4.7 Market, By Ice Vehicle Type

4.8 Market, By Electric & Hybrid Vehicle Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Introduction of Enhanced Comfort and Safety Features

5.2.1.2 Government Regulations Pertaining to Vehicle Noise

5.2.2 Restraints

5.2.2.1 Fluctuating Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Increased Demand for Nonwoven Materials

5.2.3.2 Rising Sales of Electric Vehicles

5.2.3.3 Increasing Vehicle Emission Regulations Provide Acoustic Material Manufacturers an Opportunity to Develop New Acoustic Materials

5.2.4 Challenges

5.2.4.1 Installation of Active Noise Control (ANC) System

5.2.4.2 Recycling of Acoustic Raw Materials and Growing Demand for Natural Acoustic Materials

6 Automotive Acoustic Materials Market, By Material Type (Page No. - 47)

This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions/Limitations

6.1.3 Industry Insights

6.2 Polyurethane

6.2.1 Asia Oceania is the Largest Market for Polyurethane Acoustic Materials

6.3 Polypropylene

6.3.1 Asia Oceania is the Fastest Growing Market for Polypropylene Acoustic Materials

6.4 Textile

6.4.1 Asia Oceania is the Largest Market for Textiles Acoustic Materials

6.5 Polyvinyl Chloride

6.5.1 Asia Oceania is the Largest Market for Polyvinyl Chloride Acoustic Materials

6.6 Fiberglass

6.6.1 North America is the Fastest Growing Market for Fiberglass Acoustic Materials

6.7 Acrylonitrile Butadiene Styrene (ABS)

6.7.1 Asia Oceania is the Largest Market for Acrylonitrile Butadiene Styrene Acoustic Materials

6.8 Others

6.8.1 Asia Oceania is the Largest Market for Other Acoustic Materials

7 Automotive Acoustic Materials Market, By Component (Page No. - 58)

This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions/Limitations

7.1.3 Industry Insights

7.2 Bonnet Liner

7.2.1 Asia Oceania is the Largest Market for Bonnet Liner Acoustic Materials

7.3 Cabin Rear Trim

7.3.1 North America is the Fastest Growing Market for Cabin Rear Trim Acoustic Materials

7.4 Door Trim

7.4.1 Europe is the Fastest Growing Market for Door Trim Acoustic Materials

7.5 Engine Top Cover

7.5.1 Asia Oceania is the Largest Market for Engine Top Cover Acoustic Materials

7.6 Engine Encapsulation

7.6.1 Europe is the Fastest Growing Market for Engine Encapsulation Due to Nvh Regulations

7.7 Fender Insulator

7.7.1 Europe is the Fastest Growing Market for Fender Insulator Acoustic Materials

7.8 Floor Insulator

7.8.1 Asia Oceania is the Largest Market for Floor Insulator Acoustic Materials

7.9 Headliner

7.9.1 Europe is the Fastest Growing Market for Headline Acoustic Materials Due to Nvh Regulation

7.1 Inner Dash Insulator

7.10.1 Asia Oceania is the Largest Market for Inner Dash Insulator Acoustic Materials

7.11 Outer Dash Insulator

7.11.1 Europe is the Fastest Growing Market for Outer Dash Insulator Acoustic Materials

7.12 Parcel Tray Insulator

7.12.1 Asia Oceania is the Largest Market for Parcel Tray Insulator Acoustic Materials

7.13 Trunk Trim

7.13.1 Asia Oceania is the Fastest Growing Market for Trunk Trim Acoustic Materials

7.14 Wheel Arch Liner

7.14.1 Asia Oceania is the Largest Market for Wheel Arch Liner Acoustic Materials

8 Automotive Acoustic Materials Market, By Application (Page No. - 70)

This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Industry Insights

8.2 Underbody & Engine Bay Acoustics

8.2.1 Europe is the Second Largest Market for Underbody & Engine Bay Acoustic Materials

8.3 Interior Cabin Acoustics

8.3.1 Asia Oceania is the Largest Market for Interior Cabin Acoustic Materials

8.4 Exterior Acoustics

8.4.1 Europe is the Second Largest Market for Exterior Acoustic Materials

8.5 Trunk Panel Acoustics

8.5.1 Asia Oceania is the Largest Market for Trunk Panel Acoustic Materials

9 Automotive Acoustic Materials Market, By Ice Vehicle Type (Page No. - 79)

This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Industry Insights

9.2 Passenger Car

9.2.1 Asia Oceania is Expected to Remain the Largest Market Due to Increasing Passenger Car Production

9.3 Light Commercial Vehicle (LCV)

9.3.1 North America is the Fastest Growing LCV Acoustic Materials Market

9.4 Heavy Commercial Vehicle (HCV)

9.4.1 With Stringent Nvh Regulations, Europe is the Fastest Growing HCV Acoustic Materials Market

10 Automotive Acoustic Materials Market, By Electric and Hybrid Vehicle Type (Page No. - 86)

This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and Row

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Industry Insights

10.2 BEV

10.2.1 Asia Oceania is the Largest BEV Acoustic Materials Market

10.3 PHEV

10.3.1 Europe is the Second Largest PHEV Acoustic Materials Market

10.4 HEV

10.4.1 Asia Oceania is the Largest HEV Acoustic Materials Market

11 Automotive Acoustic Materials Market, By Region (Page No. - 93)

This Chapter has Been Further Segmented By Material Type (ABS, Fiberglass, PP, PU, PVC, Textiles and Others)

11.1 Introduction

11.1.1 Research Methodology

11.1.2 Assumptions/Limitations

11.1.3 Industry Insights

11.2 Asia Oceania

11.2.1 China

11.2.1.1 Polypropylene is the Largest Segment in China

11.2.2 India

11.2.2.1 Acrylonitrile Butadiene Styrene is the Fastest Growing Segment in India

11.2.3 Japan

11.2.3.1 Polypropylene is the Largest Segment in Japan

11.2.4 South Korea

11.2.4.1 Acrylonitrile Butadiene Styrene is the Fastest Growing Segment in South Korea

11.2.5 Thailand

11.2.5.1 Polypropylene is the Largest Segment in Thailand

11.2.6 Rest of Asia Oceania

11.2.6.1 Textiles is the Second Fastest Growing Segment in South Korea

11.3 Europe

11.3.1 France

11.3.1.1 Polyurethane is the Second Largest Segment in France

11.3.2 Germany

11.3.2.1 Polypropylene is the Largest Segment in Germany

11.3.3 Russia

11.3.3.1 Acrylonitrile Butadiene Styrene is the Fastest Growing Segment in Russia

11.3.4 Spain

11.3.4.1 Fiberglass is the Second Fastest Growing Segment in Spain

11.3.5 Turkey

11.3.5.1 Polypropylene is the Largest Segment in Turkey

11.3.6 UK

11.3.6.1 Acrylonitrile Butadiene Styrene is the Fastest Growing Segment in UK

11.3.7 Rest of Europe

11.3.7.1 Fiberglass is the Second Fastest Growing Segment in Rest of Europe

11.4 North America

11.4.1 Canada

11.4.1.1 Fiberglass is the Fastest Growing Segment in Canada

11.4.2 Mexico

11.4.2.1 Acrylonitrile Butadiene Styrene is the Second Fastest Growing Segment in Mexico

11.4.3 US

11.4.3.1 Polypropylene is the Largest Segment in the US

11.5 Rest of the Word (RoW)

11.5.1 Brazil

11.5.1.1 Polypropylene is the Largest Segment in Brazil

11.5.2 Iran

11.5.2.1 Acrylonitrile Butadiene Styrene is the Fastest Growing Segment in Iran

11.5.3 Rest of RoW

11.5.3.1 Fiberglass is the Fastest Growing Segment in Rest of RoW

12 Competitive Landscape (Page No. - 125)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Leadership Mapping

12.3.1 Terminology

12.3.1.1 Visionary Leaders

12.3.1.2 Innovators

12.3.1.3 Dynamic Differentiators

12.3.1.4 Emerging Companies

12.4 Competitive Leadership Mapping: Material Manufacturers

12.4.1 Strength of Product Portfolio

12.4.2 Business Strategy Excellence

12.5 Competitive Leadership Mapping: Acoustic Component Manufacturers

12.5.1 Strength of Product Portfolio

12.5.2 Business Strategy Excellence

12.6 Competitive Scenario

12.6.1 New Product Developments

12.6.2 Expansions

12.6.3 Mergers & Acquisitions

12.6.4 Partnerships/Agreements/Supply Contracts/ Collaborations/Joint Ventures

13 Company Profiles (Page No. - 138)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

13.1 Dowdupont

13.2 BASF

13.3 3M

13.4 Covestro

13.5 Henkel

13.6 Huntsman

13.7 Lyondellbasell

13.8 Toray Industries

13.9 Sika

13.10 Sumitomo Riko

13.11 Additional Companies

13.11.1 North America

13.11.1.1 UFP Technologies

13.11.1.2 Johns Manville

13.11.1.3 CTA Acoustics

13.11.1.4 Roush

13.11.2 Europe

13.11.2.1 Tecman Speciality Materials

13.11.2.2 Borealis

13.11.2.3 Jh Ziegler

13.11.2.4 Autoneum

13.11.3 Asia Oceania

13.11.3.1 Nihon Tokushu Toryo

13.11.3.2 Nichias Corporation

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 164)

14.1 Insights of Industry Experts

14.2 Secondary Data

14.3 Primary Data

14.4 Automotive Acoustic Materials Market Breakdown & Data Triangulation

14.5 Assumptions

14.6 Discussion Guide

14.7 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.8 Available Customizations

14.8.1 Automotive Acoustic Materials Market, By Application, By Material Type

14.8.1.1 ABS

14.8.1.2 Fiberglass

14.8.1.3 PP

14.8.1.4 PU

14.8.1.5 PVC

14.8.1.6 Textiles

14.8.1.7 Others

14.8.2 Automotive Acoustic Materials Market, By Component, By Vehicle Type

14.8.2.1 Sedan

14.8.2.2 Hatchback

14.8.2.3 SUV

14.8.2.4 Minivans

14.8.2.5 Pickup Truck

14.9 Related Reports

14.10 Author Details

List of Tables (114 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Recent Expansions By Acoustic Material Manufacturers

Table 3 Different Government Associations Responsible for Vehicle Noise Limits

Table 4 Overview of Emission Regulation Specifications for Passenger Cars

Table 5 Emission Norm Specifications in Key Countries for Passenger Cars

Table 6 Passenger Car Models Equipped With Active Noise Control System

Table 7 Automotive Acoustic Materials Market, By Material Type, 2017–2027 (Tons)

Table 8 Market, By Material Type, 2017–2027 (‘000 USD)

Table 9 Polyurethane: Market, By Region, 2017–2027 (Tons)

Table 10 Polyurethane: Market, By Region, 2017–2027 (‘000 USD)

Table 11 Polypropylene: Market, By Region, 2017–2027 (Tons)

Table 12 Polypropylene: Market, By Region, 2017–2027 (‘000 USD)

Table 13 Textiles: Market, By Region, 2017–2027 (Tons)

Table 14 Textiles: Market, By Region, 2017–2027 (‘000 USD)

Table 15 Polyvinyl Chloride: Market, By Region, 2017–2027 (Tons)

Table 16 Polyvinyl Chloride: Market, By Region, 2017–2027 (‘000 USD)

Table 17 Fiberglass: Market, By Region, 2017–2027 (Tons)

Table 18 Fiberglass: Market, By Region, 2017–2027 (‘000 USD)

Table 19 Acrylonitrile Butadiene Styrene: Market, By Region, 2017–2027 (Tons)

Table 20 Acrylonitrile Butadiene Styrene: Automotive Acoustic Materials Market, By Region, 2017–2027 (‘000 USD)

Table 21 Others: Market, By Region, 2017–2027 (Tons)

Table 22 Others: Market, By Region, 2017–2027 (‘000 USD)

Table 23 Market, By Component, 2017–2027 (Tons)

Table 24 Bonnet Liner: Market, By Region, 2017–2027 (Tons)

Table 25 Cabin Rear Trim: Market, By Region, 2017–2027 (Tons)

Table 26 Door Trim: Market, By Region, 2017–2027 (Tons)

Table 27 Engine Top Cover: Market, By Region, 2017–2027 (Tons)

Table 28 Engine Encapsulation: Market, By Region, 2017–2027 (Tons)

Table 29 Fender Insulator: Market, By Region, 2017–2027 (Tons)

Table 30 Floor Insulator: Market, By Region, 2017–2027 (Tons)

Table 31 Headliner: Market, By Region, 2017–2027 (Tons)

Table 32 Inner Dash Insulator: Automotive Acoustic Materials Market, By Region, 2017–2027 (Tons)

Table 33 Outer Dash Insulator: Market, By Region, 2017–2027 (Tons)

Table 34 Parcel Tray Insulator: Market, By Region, 2017–2027 (Tons)

Table 35 Trunk Trim: Market, By Region, 2017–2027 (Tons)

Table 36 Wheel Arch Liner: Market, By Region, 2017–2027 (Tons)

Table 37 Market, By Application, 2017–2027 (‘000 Tons)

Table 38 Market, By Application, 2017–2027 (USD Thousand)

Table 39 Underbody & Engine Bay Acoustics: Market, By Region, 2017–2027 (‘000 Tons)

Table 40 Underbody & Engine Bay Acoustics: Market, By Region, 2017–2027 (USD Thousand)

Table 41 Interior Cabin Acoustics: Automotive Acoustic Materials Market, By Region, 2017–2027 (‘000 Tons)

Table 42 Interior Cabin Acoustics: Market, By Region, 2017–2027 (USD Thousand)

Table 43 Exterior Acoustics: Market, By Region, 2017–2027 (‘000 Tons)

Table 44 Exterior Acoustics: Market, By Region, 2017–2027 (USD Thousand)

Table 45 Trunk Panel Acoustics: Market, By Region, 2017–2027 (‘000 Tons)

Table 46 Trunk Panel Acoustics: Market, By Region, 2017–2027 (USD Thousand)

Table 47 Market, By Vehicle Type, 2017–2027 (Tons)

Table 48 Market, By Vehicle Type, 2017–2027 (‘000 USD)

Table 49 Passenger Car: Materials Market, By Region, 2017–2027 (Tons)

Table 50 Passenger Car: Market, By Region, 2017–2027 (‘000 USD)

Table 51 Light Commercial Vehicle: Automotive Acoustic Materials Market, By Region, 2017–2027 (Tons)

Table 52 Light Commercial Vehicle: Market, By Region, 2017–2027 (‘000 USD)

Table 53 Heavy Commercial Vehicle: Market, By Region, 2017–2027 (Tons)

Table 54 Heavy Commercial Vehicle: Market, By Region, 2017–2027 (‘000 USD)

Table 55 Market, By Electric Vehicle Type, 2017–2027 (Tons)

Table 56 Market, By Electric Vehicle Type, 2017–2027 (‘000 USD)

Table 57 BEV: Market, By Region, 2017–2027 (Tons)

Table 58 BEV: Market, By Region, 2017–2027 (‘000 USD)

Table 59 PHEV: Market, By Region, 2017–2027 (Tons)

Table 60 PHEV: Market, By Region, 2017–2027 (‘000 USD)

Table 61 HEV: Automotive Acoustic Materials Market, By Region, 2017–2027 (Tons)

Table 62 HEV: Market, By Region, 2017–2027 (‘000 USD)

Table 63 Market, By Region, 2017–2027 (Tons)

Table 64 Market, By Region, 2017–2027 (‘000 USD)

Table 65 Asia Oceania: Market, By Country, 2017–2027 (Tons)

Table 66 Asia Oceania: Market, By Country, 2017–2027 (‘000 USD)

Table 67 China: Market, By Material Type, 2017–2027 (Tons)

Table 68 China: Market, By Material Type, 2017–2027 (‘000 USD)

Table 69 India: Market, By Material Type, 2017–2027 (Tons)

Table 70 India: Market, By Material Type, 2017–2027 (‘000 USD)

Table 71 Japan: Market, By Material Type, 2017–2027 (Tons)

Table 72 Japan: Market, By Material Type, 2017–2027 (‘000 USD)

Table 73 South Korea: Market, By Material Type, 2017–2027 (Tons)

Table 74 South Korea: Market, By Material Type, 2017–2027 (‘000 USD)

Table 75 Thailand: Market, By Material Type, 2017–2027 (Tons)

Table 76 Thailand: Market, By Material Type, 2017–2027 (‘000 USD)

Table 77 Rest of Asia Oceania: Market, By Material Type, 2017–2027 (Tons)

Table 78 Rest of Asia Oceania: Automotive Acoustic Materials Market, By Material Type, 2017–2027 (‘000 USD)

Table 79 Europe: Market, By Country, 2017–2027 (Tons)

Table 80 Europe: Market, By Country, 2017–2027 (‘000 USD)

Table 81 France: Market, By Material Type, 2017–2027 (Tons)

Table 82 France: Market, By Material Type, 2017–2027 (‘000 USD)

Table 83 Germany: Market, By Material Type, 2017–2027 (Tons)

Table 84 Germany: Market, By Material Type, 2017–2027 (‘000 USD)

Table 85 Russia: Market, By Material Type, 2017–2027 (Tons)

Table 86 Russia: Market, By Material Type, 2017–2027 (‘000 USD)

Table 87 Spain: Market, By Material Type, 2017–2027 (Tons)

Table 88 Spain: Market, By Material Type, 2017–2027 (‘000 USD)

Table 89 Turkey: Automotive Acoustic Materials Market, By Material Type, 2017–2027 (Tons)

Table 90 Turkey: Market, By Material Type, 2017–2027 (‘000 USD)

Table 91 UK: Market, By Material Type, 2017–2027 (Tons)

Table 92 UK: Market, By Material Type, 2017–2027 (‘000 USD)

Table 93 Rest of Europe: Market, By Material Type, 2017–2027 (Tons)

Table 94 Rest of Europe: Market, By Material Type, 2017–2027 (‘000 USD)

Table 95 North America: Market, By Country, 2017–2027 (Tons)

Table 96 North America: Market, By Country, 2017–2027 (‘000 USD)

Table 97 Canada: Market, By Material Type, 2017–2027 (Tons)

Table 98 Canada: Market, By Material Type, 2017–2027 (‘000 USD)

Table 99 Mexico: Market, By Material Type, 2017–2027 (Tons)

Table 100 Mexico: Market, By Material Type, 2017–2027 (‘000 USD)

Table 101 US: Market, By Material Type, 2017–2027 (Tons)

Table 102 US: Market, By Material Type, 2017–2027 (‘000 USD)

Table 103 RoW: Market, By Country, 2017–2027 (Tons)

Table 104 RoW: Market, By Country, 2017–2027 (‘000)

Table 105 Brazil: Market, By Material Type, 2017–2027 (Tons)

Table 106 Brazil: Automotive Acoustic Materials Market, By Material Type, 2017–2027 (‘000 USD)

Table 107 Iran: Market, By Material Type, 2017–2027 (Tons)

Table 108 Iran: Market, By Material Type, 2017–2027 (‘000 USD)

Table 109 Rest of RoW: Market, By Material Type, 2017–2027 (Tons)

Table 110 Rest of RoW: Market, By Material Type, 2017–2027 (‘000 USD)

Table 111 New Product Developments, 2017

Table 112 Expansions, 2017-2019

Table 113 Mergers & Acquisitions, 2015–2017

Table 114 Partnerships/Agreements/Supply Contracts/Collaborations/ Joint Ventures, 2015–2017

List of Figures (48 Figures)

Figure 1 Acoustic Materials Market - Market Segmentation

Figure 2 Acoustic Materials Market: Research Design

Figure 3 Research Design Model

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Automotive Acoustic Materials Market: Market Outlook

Figure 6 Market, By Region, 2019 vs. 2027 (USD Million)

Figure 7 Increasing Vehicle Production to Drive the Market

Figure 8 Passenger Car and China Accounted for the Largest Shares in the Asia Oceania Market, By Vehicle Type and Country, Respectively, in 2019 (USD Million)

Figure 9 Mexico, India, Turkey, and Russia are Expected to Grow at the Highest Rates During the Forecast Period

Figure 10 Polyurethane is Expected to Hold the Largest Share of the Market, By Material Type, 2019 vs. 2027 (USD Million)

Figure 11 Door Trim is Expected to Lead the Automotive Acoustic Materials Market, By Component, 2019 vs. 2027 (Thousand Tons)

Figure 12 Interior Application to Hold the Largest Share in the Market, By Application, 2019 vs. 2027 (USD Million)

Figure 13 Passenger Car to Hold the Largest Share in the Market, By Ice Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 14 BEV to Hold the Largest Share in the Market, By Electric and Hybrid Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 15 Automotive Acoustics: Market Dynamics

Figure 16 Polypropylene Prices (2014–2019)

Figure 17 Percentage Breakup of Automotive Nonwoven Applications (Square Meter)

Figure 18 Electric Vehicle Sales and Forecast, 2018 vs 2025

Figure 19 Market, By Material Type, 2019 vs. 2027 (USD Million)

Figure 20 Market, By Component, 2019 vs. 2027 (‘000 Tons)

Figure 21 Market, By Application, 2019 vs. 2027 (USD Thousand)

Figure 22 Market, By Vehicle Type, By Region, 2019 vs. 2027 (USD Million)

Figure 23 Market, By Electric Vehicle, 2019 vs. 2027 (‘000 USD)

Figure 24 Market, By Region, 2019 vs. 2027 (USD Million)

Figure 25 Asia Oceania: Market, By Country, 2019 vs 2027

Figure 26 Europe: Automotive Acoustic Market By Country 2019 vs 2027

Figure 27 North America: Automotive Acoustic Materials Market, By Country, 2019 vs 2027, (USD Million)

Figure 28 RoW: Market, By Country, 2019 vs 2027, (USD Million)

Figure 29 Market Share, By Material Suppliers, 2018

Figure 30 Automotive Acoustic Materials Suppliers (Global) Competitive Leadership Mapping (2018)

Figure 31 Company-Wise Product Offering Analysis

Figure 32 Company-Wise Business Strategy Analysis

Figure 33 Automotive Acoustic Component Manufacturers (Global) Competitive Leadership Mapping (2018)

Figure 34 Company-Wise Product Offering Analysis

Figure 35 Company-Wise Business Strategy Analysis

Figure 36 Companies Adopted Partnerships and Supply Contracts as A Key Growth Strategy

Figure 37 Dowdupont: Company Snapshot

Figure 38 BASF: Company Snapshot

Figure 39 3M: Company Snapshot

Figure 40 Covestro: Company Snapshot

Figure 41 Henkel: Company Snapshot

Figure 42 Huntsman: Company Snapshot

Figure 43 Lyondellbasell: Company Snapshot

Figure 44 Toray Industries: Company Snapshot

Figure 45 Sika: Company Snapshot

Figure 46 Sumitomo Riko: Company Snapshot

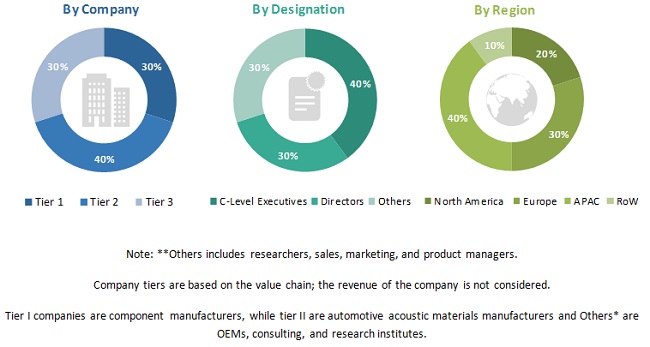

Figure 47 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 48 Data Triangulation

The study involves 4 main activities to estimate the current size of the automotive acoustic materials market. Exhaustive secondary research was done to collect information on the market, such as acoustic material types, regulations, and upcoming acoustic material trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A bottom-up approach was employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Crunchbase, Bloomberg, and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive acoustic materials market through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (acoustic material manufacturers) across major regions, namely, North America, Europe, Asia Oceania, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approach

The bottom-up approach has been used to estimate and validate the size of the global acoustic materials market, by application and vehicle type. To determine the acoustic materials market size, in terms of volume, by component and vehicle type, the regional-level production numbers of each vehicle type (passenger car, LCV, and HCV) have been multiplied by regional-level penetration of different acoustic materials [acrylonitrile butadiene styrene (ABS), fiberglass, polyvinyl chloride (PVC), polypropylene (PP), polyurethane foam, polyethylene terephthalate (PET), and automotive textiles)] consumption under each component (bonnet liner, engine top covers, engine encapsulation, inner dash, outer dash, fender insulator, door trims, instrument panels, headliners, floor insulator, cabin trunk trim, parcel tray, and wheel arch liners) for each vehicle type. The regional-level market size, in terms of volume, of each vehicle type, is added to derive the global acoustic materials market, by region. The components are categorized into 4 applications (interior cabin, exterior, trunk panel, and underbody). Country-level production is used to find the acoustic materials market, by material, in terms of volume. The country-level market is then multiplied with the country-level average selling price of each material consumed under different applications, which results in the country-level market size, by value. The further summation of regional-level markets gives the global acoustic materials market. A similar kind of approach has been followed to derive the acoustic materials market, by components and electric vehicle type (BEV, PHEV, and HEV).

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive acoustic materials market.

Report Objectives

- To define, segment, analyze, and forecast (2019–2027) the acoustic materials market size, in terms of volume (ton) and value (USD million/thousand)

- To segment the acoustic materials market and forecast the market size, by volume and value, based on material type [acrylonitrile butadiene styrene (ABS), fiberglass, polyvinyl chloride (PVC), polypropylene (PP), polyurethane foam, polyethylene terephthalate (PET), and automotive textiles)]

- To segment the acoustic materials market and forecast the market size, by volume and value, based on application (under hood & engine bay, interior, exterior, and trunk panel)

- To segment the acoustic materials market and forecast the market size, by volume and value, based on component (bonnet liner, engine top covers, engine encapsulation, inner dash, outer dash, fender insulator, door trims, instrument panels, headliners, floor insulator, cabin trunk trim, parcel tray and wheel arch liners)

- To segment the acoustic materials market and forecast the market size, by volume and value, based on ICE vehicle type (passenger car, LCV, and HCV)

- To segment the acoustic materials market and forecast the market size, by volume and value, based on electric vehicle type (BEV, HEV, and PHEV)

- To segment the acoustic materials market and forecast the market size, by volume and value, based on region (North America, Europe, Asia Oceania, and the Rest of the World)

- To analyze the competitive leadership mapping for the key market players based on their product offerings and business strategies to find the dynamic differentiators, innovators, visionary leaders, and emerging companies in the automotive acoustics materials market

- To identify the market dynamics (drivers, restraints, opportunities, and challenges) and analyze their impact on the acoustic materials market

- To track and analyze recent developments, collaborations, joint ventures, product innovations, and mergers & acquisitions in the acoustic materials market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Acoustic materials market, By Application and Material Type

- ABS

- Fiberglass

- PP

- PU

- PVC

- Textiles

- Others

Acoustic materials market, By Vehicle and Material Type

- Sedan

- Hatchback

- SUV

- Minivan

- Pickup

- Pickup Truck

Growth opportunities and latent adjacency in Automotive Acoustic Materials Market

We are interested in Automotive Acoustic Materials Market competitive leadership mapping for the key market players based on their product offerings and business

I am a student at Cattolica University and I am writing my degree thesis, but I am struggling finding some general recent data about the market of acoustic components in the automotive industry. I hope you can help me.