Electric Vehicle Plastics Market by Type (ABS, PU, PA, PC, PVB, PP, PVC, PMMA), Application & Component (Dashboard, Seat, Trim, Bumper, Body, Battery, Engine, Lighting, Wiring), Battery Type & Material, Vehicle Type and Region - Global Forecast to 2027

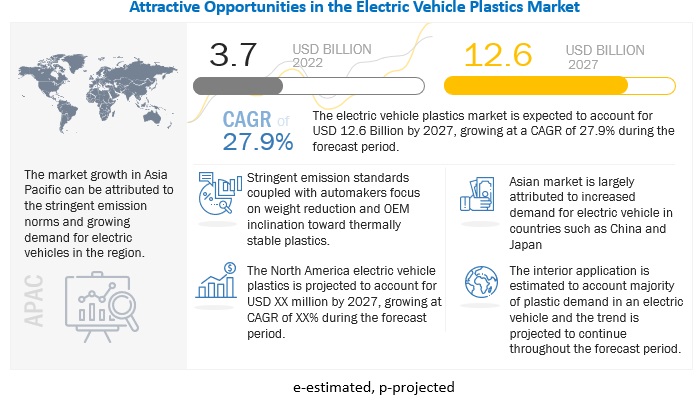

The electric vehicle plastics market size is expected to grow from USD 3.7 billion in 2022 and is projected to reach USD 12.6 billion in 2027, at a CAGR of 27.9% during the forecast period. Race to reduce the vehicle's overall weight to increase driving range and emissions, along with increasing demand for superior quality vehicle interiors, are driving the plastics market in electric vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

The most likely scenario taken into consideration is the gradual resumption of global production volumes, wherein global vehicle sales are recovering from the impacts of the pandemic. As the lockdowns are lifted, challenges related to the supply chain, availability of labor, and government preventive guidelines will be reduced. In this scenario, the Electric Vehicle Plastics market will have a moderate impact and witness steady growth.

Electric Vehicle Plastics Market Dynamics

Driver: OEMs' inclination toward thermally stable plastics in heat-sensitive applications

The new-generation electric and hybrid vehicles must be lighter and stronger to increase vehicle range. Automotive OEMs focus more on specific application segments of electric vehicles, such as electric motors, battery thermal management, and chassis. Numerous applications for metal replacement in various underhood components using high-performance plastic materials, mainly polyamide-based materials, make these conversions possible, with high tensile strength, high-temperature resistance, and light-weighting benefits.

Thermally conductive plastics in LED enclosures and electric battery housings in electric vehicles can allow higher voltages with safety. Also, they offer greater light weighting options, are more customizable, and can create more uniform thermal management systems.

Polyamides have great opportunities in battery trays and connectors in electric vehicles, as electric cars have many sensors, cameras, and radars. The connectors are molded from polyamide due to their temperature resistance property. Manufacturers such as BASF use special polyamide and polybutylene terephthalate grades that meet the demands for flame retardancy, color stability, and electrical isolation. This allows BASF to save weight and installation space around the battery pack and improve the vehicle's safety. Thus, the demand for thermally stable plastics is increasing in the electric & hybrid vehicle segment.

Restraint: Recycling of plastic materials used in electric vehicles

Plastics play an important role in making vehicles lightweight and fuel-efficient and reducing their environmental impact. Sustainability has become a central driver for innovation and the future of the automotive industry. The sales of electric vehicles are increasing owing to their lower impact on the environment compared to ICE-powered vehicles. However, according to few leading OEMs approximately 30% of the vehicle’s lifetime CO2 emissions are generated due to the materials and their production. Hence, the automotive industry must focus on the sustainability of the materials used in these vehicles and make the production process more environmentally friendly.

To effectively achieve this, the manufacturers should consider the circular pathways for automotive plastics and how materials can be integrated from end-of-life vehicles into new models to make them more sustainable. Hence, the manufacturers are investing in the newest ways to recycle end-of-life automotive materials so that the materials can be reused without hampering the quality of the product. Hence, this factor hinders the growth of the electric vehicle plastics market.

Opportunities: Use of anti-microbial plastics/additives in electric vehicles to keep occupants safe and healthy

Anti-microbial plastics are plastics with anti-microbial capabilities that inhibit the growth of microorganisms such as bacteria or fungi. Antibacterial plastic is expected to gain popularity in the automotive industry because of COVID-19. Also, considering this as an opportunity, several car care product suppliers have introduced products such as anti-microbial surface protection treatments for cars.

Hong Kong University of Science and Technology researchers have developed a multilevel anti-microbial polymer (MAP-1) coating that can effectively kill viruses, bacteria, and even hard-to-kill spores and may also be effective against COVID-19. The researchers developed the new MAP-1 coating using a special blend of anti-microbial polymers, which is highly versatile with an effective period of up to 90 days. The coating is designed for use on different surfaces, including metals, concrete, wood, glass, and plastics, as well as fabrics, leather, and textiles, without changing the material's appearance and tactile feel. Therefore, due to rising concerns over hygiene factors related to the vehicle interior and most-touched vehicle parts, anti-microbial plastics are likely to be adopted by electric vehicle manufacturers in the near future.

Furthermore, most interior and exterior modern vehicle parts are made of plastics. Most commonly used plastics are polyurethanes, polypropylene, polyethylene, and engineering plastics (acrylonitrile butadiene styrene, acrylic-styrene-acrylonitrile, polybutylene terephthalate, polyoxymethylene, and polyamide). Anti-microbial additives are mainly used in dashboards, steering wheels, loudspeaker grills, carpets, door linings, seat belts, and airbags. Therefore, their wide application in interiors and exteriors makes them compatible with future vehicles in terms of hygiene perspective.

Challenges: High cost of capital and infrastructure for re-engineering plastics

One of the key challenges for re-engineering plastics is the relatively high cost of capital and infrastructure required. The obstacles include manufacturers' lack of awareness about recycling these plastics and lack of infrastructure. Moreover, from a component manufacturer's point of view, there is a knowledge gap about the recyclability of certain plastic types used in component design. The recycling of plastics and composites from complex, durable products are limited by technological and economic restraints.

For instance, thermosets are mostly used in automotive applications. Thermoset materials cure into a given shape through the application of heat. Curing results in permanent cross-links that lead to a high degree of rigidity and change the material permanently. Thermoset materials will not regain their original form. The thermoplastic materials become pliable when heated, allowing them to be molded, but they do not set. These materials typically begin in pellet form and are heated and molded. As the material cools, it will harden, but no curing occurs. This allows thermoplastic materials to be reprocessed many times, although continual recycling will result in degradation. In addition, there are additional hindrances in recycling plastics, such as a lack of technology, infrastructure, and a small market for recyclates. It is generally found that plastics and other materials are difficult to separate. Also, the absence of major infrastructure investments and new technology makes the recycling process costly.

The recycling process of plastics requires state-of-the-art technology facilities that are more advanced than car-crushing compactors. These facilities require heavy investments and plastic separation technologies such as magnetic separation, eddy current separators, float-sink tanks, and laser and infrared systems, which differentiate and separate plastics based on color.

Therefore, lack of infrastructure, economics, knowledge gap, and heterogeneous mixes of plastics make recycling challenge.

BEV Vehicle type likely to drive demand due to its growing popularity and zero CO2 emissions

The BEV segment is estimated to showcase the fastest growth during the forecast period due to faster adoption than other EV segments due to stringent air pollution regulations and shifting towards electric mobility to reduce CO2 emissions. With advancements in weight reduction and improved range, the demand for electric vehicles is expected to increase in the coming years, thus driving the demand for lightweight plastics such as polypropylene. The focus on weight reduction to increase the driving range of BEVs is likely to create new opportunities for plastics as they are lighter and comparatively less expensive than their metal counterparts. Polyurethanes (PU) have excellent manufacturability and are preferred material options for automotive seating solutions. Higher demand for interior comfort drives PU demand in EVs. Polypropylene (PP) has a lower density than other plastic materials; hence it has opened new opportunities to reduce vehicle weight. PP also has good recyclability, allowing it to be reused as raw material and reducing plastic waste. Thus, increased adoption of BEV vehicles amongst other EV vehicle types is likely to drive the demand for plastic components used in these vehicles.

Polypropylene is the new favorite material amongst OEMs for low-weight plastic components

Polypropylene is a thermoplastic formed from a combination of propylene monomers. Polypropylene is often used as a binder for thermoplastic components for composites made from natural fiber. Polypropylene is a bad conductor of electricity, making it a suitable material for making electronic components for interior applications. It is also one of the lightest plastic materials commercially available, with a density of 0.905 g/cm3, making it ideal for making lightweight components. PP is also extremely weather resistant and has good chemical resistant properties, making it an attractive option for exterior vehicle applications such as bumpers. These mechanical properties allow for significant overall vehicle weight reduction when components from polypropylene materials are used. Reducing a vehicle's weight improves fuel efficiency and driving range, thus reducing overall vehicular CO2 emissions. Reducing CO2 emissions is a top priority for many nations, making propylene a very attractive material to be used in electric vehicles, which have seen a tremendous rise in adoption globally. Thus, it is expected to have the fastest growth rate among other plastic materials.

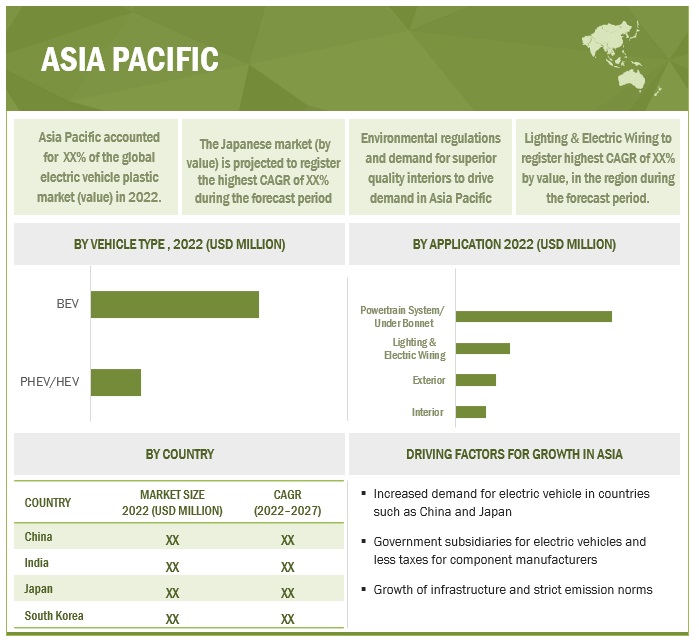

Asia Pacific region to establish dominance in the global Electric Vehicle Plastics market

The Asia Pacific is expected to hold a market share of 54.7% in 2022. The electric vehicle market in China is booming. According to IEA, sales were highest in China, where they tripled relative to 2020 to 3.3 million units after several years of relative stagnation, and in Europe, which increased by two-thirds year-on-year to 2.3 million units. The demand for plastic from the BEV segment in the country is anticipated to remain the most attractive throughout the forecast period owing to their popularity and zero emission characteristics compared to PHEVs. Additionally, investments from companies like Tesla in the country are further anticipated to boost the demand for electric vehicles thus the plastic components. The government in India is pushing the deployment of EV charging stations by providing capital subsidies through Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India, (FAME) India Scheme Phase II and state level initiatives.

Further, the government has delicensed the activity of setting up EV charging stations to increase private sector investments and facilitate market adoption. There is a higher demand for PHEVs than BEVs in Japan, as PHEVs and HEVs are exempted from ‘automobile acquisition tax’, i.e., registration tax and tonnage tax which has shifted the consumer preference to PHEVs as opposed to BEVs. Due to this, the demand for plastics in PHEVs is anticipated to create lucrative growth opportunities for EV plastic component manufacturers in Japan.

Thus, the Electric Vehicle Plastics Market in Asia Pacific is driven due to the increasing concerns over carbon footprint of automobile industry, reduction in the overall weight of vehicles to improve fuel efficiency, and government mandates to promote the adoption of electric mobility.

Asia pacific: Electric Vehicle Plastics Market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Electric Vehicle Plastics market is dominated by global players and comprises several regional players as well. The key players in the Electric Vehicle Plastics market are BASF SE(Germany), Lyondellbasell Industries Holdings B.V. (Netherlands), Sabic (Saudi Arabia), Dow (US) & Dupont (US).

Scope of the Report

|

Report Metric |

Details |

|

Base Year for Estimation |

2021 |

|

Forecast Period |

2022–2027 |

|

Market Growth and Revenue Forecast |

USD (Million/Billion) |

|

Top Players |

|

|

Fastest Growing Market |

Lighting and Electric Wiring |

|

Largest Market |

Asia Pacific |

|

Segments Covered |

|

|

By Plastic Type |

PA, PP, PC, PVB, PU, PVC, PBT, ABS, PMMA, HDPE, LDPE, Others |

|

ICE By Plastic Type |

PA, PP, PC, PVB, PU, PVC, PBT, ABS, PMMA, HDPE, LDPE, Others |

|

By Application |

Interior, Exterior, Powertrain/Underhood, Lighting & Electric Wiring |

|

By Components |

Dashboard, Seats, Interior Trim, Car Upholstery, Bumper, Body, Exterior Trim, Battery, Auxiliary Battery, Engine, Engine Top Cover, Engine Encapsulation, Fuel Tank, Lighting, Electric Wiring, Floor Insulator, Fender Insulator, Wheel Arc Liner, Other Components |

|

ICE By Components |

Dashboard, Seats, Interior Trim, Car Upholstery, Bumper, Body, Exterior Trim, Battery, Engine, Engine Top Cover, Engine Encapsulation, Fuel Tank, Lighting, Electric Wiring, Floor Insulator, Fender Insulator, Wheel Arc Liner, Other Components |

|

EV Battery By Material |

PA, PC, PE, PP, Others |

|

EV Battery By Type |

Drive Battery |

|

EV Battery By Vehicle type |

BEV, PHEV/HEV, FCEV |

|

By Vehicle Type |

BEV, PHEV/HEV |

|

EV Polypropylene By Component |

Dashboard, Seats, Interior Trim, Car Upholstery, Bumper, Body, Exterior Trim, Battery, Engine, Engine Encapsulation, Lighting, Electric Wiring, Floor Insulator, Fender Insulator, Wheel Arc Liner |

|

ICE Polypropylene By Component |

Dashboard, Seats, Interior Trim, Car Upholstery, Bumper, Body, Exterior Trim, Battery, Engine, Engine Encapsulation, Lighting, Electric Wiring, Floor Insulator, Fender Insulator, Wheel Arc Liner, Other Components |

|

By Region |

Asia Pacific – China, India, Japan, South Korea, |

|

Additional Customization to be offered |

|

Recent Developments

- In June 2022, BASF SE launched Ultradur an engineering plastic product that is equipped with highly effective additives that delays hydrolytic degradation. This makes the material resistant to damage by water at elevated temperatures. This material can provide safety for sensitive electronics in extremely challenging environments.

- In June 2022, Sabic launched NORYL. This resin is a product well suited for insulation film used in electric vehicle (EV) battery modules to help improve protection against short circuits and fire propagation. Resin’s ability to meet the UL94 V0 standard at 0.25 mm means it can provide a high level of flame retardance at a thinner film gauge than PC or PP, potentially freeing up valuable space in the battery pack.

- In October 2021, Lyondellbasell launched CirculenRenew. CirculenRenew polymers offer a variety of polypropylene (PP) and polyethylene (HDPE and LDPE) grades that are equivalent to virgin resin quality while reducing fossil feedstock use and helping to reduce CO2 over the product life cycle. These renewable-based polymers offer the same properties in terms of product performance and regulatory approvals. This product helps the company reduce its raw material cost of engineering plastic products.

- In December 2021, SABIC, announced that the company has selected Bamberger Polymers – a global market leader in plastics distribution – as an authorized SABIC distributor in the Americas to provide customers with its engineering thermoplastics (ETP) and polyolefins. This strategic collaboration will further expand SABIC’s market presence for these products and utilize Bamberger’s successful marketing and distribution network in the Americas.

- In June 2021, Dow announced plans to build an integrated MDI distillation and prepolymers facility at its world-scale manufacturing site in Freeport, Texas, US. This investment supports the increasing demand for downstream polyurethane systems products. The new Freeport MDI facility will replace Dow’s current North America capacity in La Porte, Texas. It will also be capable of supplying an additional 30 percent of products to Dow’s customers.

Frequently Asked Questions (FAQ):

What is the current size of the Electric Vehicle Plastics market?

The global Electric Vehicle Plastics market is expected to grow from USD 3.7 billion in 2022 and is projected to reach USD 12.6 billion in 2027, at a CAGR of 27.9% during the forecast period.

Who are the top key players in the electric vehicle plastics market?

The Electric Vehicle Plastics market is dominated by global players and comprises several regional players. The key players in the electric vehicle plastics market are BASF SE(Germany), Lyondellbasell Industries Holdings B.V. (Netherlands), Sabic (Saudi Arabia), Dow (US) & Dupont (US). Moreover, these companies develop new products as per market demands and concentrates of supply contracts to capture market share. Such advantages give these companies an edge over other companies that are component providers.

What are the trends in the Electric Vehicle Plastics market?

Interior segment is expected to be the largest market of the Electric Vehicle Plastics market by application.

BEVs to lead the market for Electric Vehicle Plastics system adoption by vehicle segment.

Polyurethane and Polypropylene to hold large market share by plastic type

Which are the most prominent factors driving the Electric Vehicle Plastics market?

Rapidly rising global electric vehicle sales

Demand for metal component alternatives that have lower weight .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 61)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 ELECTRIC VEHICLE PLASTICS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 67)

2.1 RESEARCH DATA

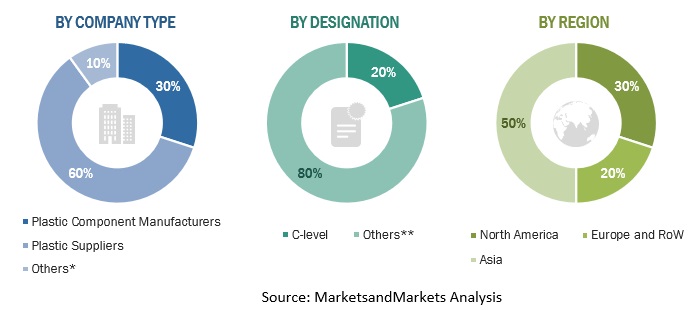

FIGURE 2 ELECTRIC VEHICLE PLASTICS MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR VEHICLE SALES/PRODUCTION

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.2.1 Key data from secondary sources

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

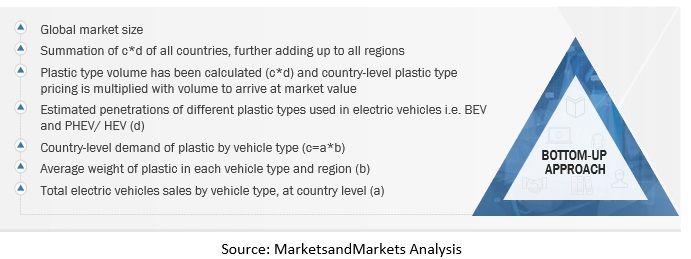

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

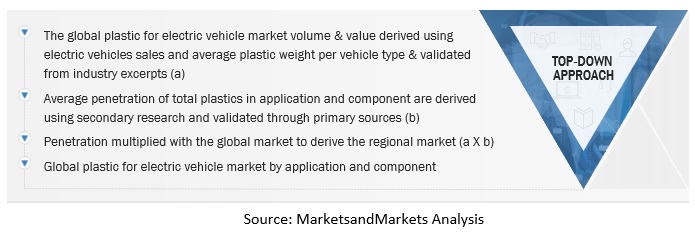

2.4.2 TOP-DOWN APPROACH

2.5 FACTOR ANALYSIS

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.7 ASSUMPTIONS & ASSOCIATED RISKS

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 78)

3.1 REPORT SUMMARY

FIGURE 6 ELECTRIC VEHICLE PLASTICS MARKET OUTLOOK

FIGURE 7 ELECTRIC VEHICLE PLASTICS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 80)

4.1 OPPORTUNITIES IN ELECTRIC VEHICLE PLASTICS MARKET

FIGURE 8 STRINGENT EMISSION NORMS, RISING DEMAND FOR ELECTRIC VEHICLES, AND LOWER MANUFACTURING COSTS TO DRIVE MARKET

4.2 MARKET, BY PLASTIC TYPE

FIGURE 9 POLYURETHANE TO HOLD LARGEST MARKET SHARE IN MARKET

4.3 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE

FIGURE 10 POLYURETHANE TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 MARKET, BY VEHICLE TYPE

FIGURE 11 BEV SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET BY 2027

4.5 MARKET, BY COMPONENT

FIGURE 12 INTERIOR TRIM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.6 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT

FIGURE 13 INTERIOR TRIM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.7 MARKET, BY APPLICATION

FIGURE 14 INTERIOR SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

4.8 ELECTRIC PASSENGER CAR BATTERY PLASTICS MARKET, BY VEHICLE TYPE

FIGURE 15 BEV SEGMENT TO HOLD LARGEST SHARE IN ELECTRIC PASSENGER CAR BATTERY PLASTICS MARKET

4.9 ELECTRIC PASSENGER CAR BATTERY PLASTICS MARKET, BY BATTERY TYPE

FIGURE 16 DRIVE BATTERY SEGMENT TO DOMINATE ELECTRIC PASSENGER CAR BATTERY PLASTICS MARKET

4.10 ELECTRIC PASSENGER CAR BATTERY PLASTICS MARKET, BY PLASTIC TYPE

FIGURE 17 POLYAMIDE SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.11 ELECTRIC PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT

FIGURE 18 INTERIOR TRIM SEGMENT TO COMMAND LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.12 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT

FIGURE 19 INTERIOR TRIM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.13 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO HOLD LARGEST SHARE IN MARKET

5 MARKET OVERVIEW (Page No. - 90)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 ELECTRIC VEHICLE PLASTICS MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent emission standards to drive electrification as well as weight reduction

TABLE 1 EMISSION NORM SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

TABLE 2 EURO 5 VS. EURO 6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

TABLE 3 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016–2021

FIGURE 22 EMISSION REGULATIONS: 2015–2025

5.2.1.2 OEM inclination toward thermally stable plastics in heat-sensitive applications

5.2.2 RESTRAINTS

5.2.2.1 Recycling of plastic materials used in electric vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Use of bioplastics in electric vehicles provides most efficient and environment-friendly lightweighting solution

5.2.3.2 Use of antimicrobial plastics/additives in electric vehicles to keep occupants safe and healthy

5.2.4 CHALLENGES

5.2.4.1 Shifting demand of OEMs toward advanced materials to adhere to carbon emission targets

5.2.4.2 High cost of capital and infrastructure for re-engineering plastics

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM/MARKET INTERCONNECTION

FIGURE 24 ECOSYSTEM: ELECTRIC VEHICLE PLASTICS MARKET

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS: MARKET

FIGURE 26 MARKET: SUPPLY CHAIN PLAYERS

5.6 AVERAGE SELLING PRICE ANALYSIS

5.6.1 BY PLASTIC TYPE, 2021

TABLE 5 AVERAGE PRICE, BY PLASTIC TYPE, 2021 (USD/TON)

5.7 REVENUE SHIFT DRIVING MARKET GROWTH

5.8 CUSTOMER BUYING BEHAVIOR

5.8.1 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR ELECTRIC VEHICLE PLASTICS

TABLE 6 KEY BUYING CRITERIA FOR ELECTRIC VEHICLE PLASTICS APPLICATIONS

5.8.2 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ELECTRIC VEHICLE PLASTICS APPLICATIONS (%)

5.9 PATENT ANALYSIS

TABLE 8 APPLICATIONS AND PATENTS GRANTED, 2019–2022

5.10 CASE STUDY ANALYSIS

5.10.1 PERFORMANCE PLASTICS, LLC RACES TO SOLUTION WITH THERMOPLASTIC GEAR

5.10.2 SUPPORTING PLASTIC PROCESS QUALITY CONTROL FOR AUTOMOTIVE DASHBOARD MATERIALS

5.10.3 CONVERSION OF METAL ROLLING ELEMENT BEARING TO ONE-PIECE, HIGH-PERFORMANCE PLASTIC BEARING

5.11 TRADE ANALYSIS

5.11.1 AUTOMOTIVE PLASTICS AND PARTS EXPORT TRADE DATA, BY COUNTRY, 2021 (USD)

TABLE 9 EXPORT TRADE DATA, BY COUNTRY, 2021

5.11.2 AUTOMOTIVE PLASTICS AND PARTS IMPORT TRADE DATA, BY COUNTRY, 2021 (USD)

TABLE 10 IMPORT TRADE DATA, BY COUNTRY, 2021

5.12 TECHNOLOGICAL ANALYSIS

5.12.1 OVERVIEW

5.12.2 MATERIAL SUPPLIER PERSPECTIVE

5.12.3 OEM INITIATIVES

TABLE 11 KEY RECYCLED/BIOPLASTIC INITIATIVES BY EV OEMS

5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 12 ELECTRIC VEHICLE PLASTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 113)

6.1 ASIA PACIFIC TO BE PRIORITY MARKET FOR PLASTIC SUPPLIERS

6.2 POLYPROPYLENE HELPS IN WEIGHT REDUCTION AND PROVIDES COST-EFFECTIVE SOLUTION

6.3 CONCLUSION

7 ELECTRIC VEHICLE PLASTICS MARKET, BY PLASTIC TYPE (Page No. - 115)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 28 MARKET, BY PLASTIC TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 13 MARKET, BY PLASTIC TYPE, 2018–2021 (TONS)

TABLE 14 MARKET, BY PLASTIC TYPE, 2022–2027 (TONS)

TABLE 15 MARKET, BY PLASTIC TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY PLASTIC TYPE, 2022–2027 (USD MILLION)

7.2 ACRYLONITRILE BUTADIENE STYRENE (ABS)

7.2.1 LIGHTWEIGHT AND HIGH-STRENGTH APPLICATIONS TO DRIVE DEMAND FOR ABS

TABLE 17 ACRYLONITRILE BUTADIENE STYRENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 18 ACRYLONITRILE BUTADIENE STYRENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 19 ACRYLONITRILE BUTADIENE STYRENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 ACRYLONITRILE BUTADIENE STYRENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.3 POLYAMIDE (PA)

7.3.1 NEW GRADES OF POLYAMIDE 6 TO DRIVE POLYAMIDE-BASED APPLICATIONS IN ELECTRIC VEHICLES

TABLE 21 POLYAMIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 22 POLYAMIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 23 POLYAMIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 POLYAMIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.4 POLYCARBONATE (PC)

7.4.1 FREEDOM IN DESIGN AND SUPERIOR STRUCTURAL INTEGRITY TO DRIVE DEMAND

TABLE 25 POLYCARBONATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 26 POLYCARBONATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 27 POLYCARBONATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 POLYCARBONATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.5 POLYVINYL BUTYRAL (PVB)

7.5.1 PVB SUBSTITUTE ETHYLENE VINYL ACETATE (EVA) LIKELY TO STAGNATE MARKET GROWTH

TABLE 29 POLYVINYL BUTYRAL MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 30 POLYVINYL BUTYRAL MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 31 POLYVINYL BUTYRAL MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 POLYVINYL BUTYRAL MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.6 POLYURETHANE (PU)

7.6.1 HIGH DURABILITY AND EASY-TO-MANUFACTURE CHARACTERISTICS TO DRIVE DEMAND IN INTERIOR APPLICATIONS

TABLE 33 POLYURETHANE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 34 POLYURETHANE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 35 POLYURETHANE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 POLYURETHANE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.7 POLYPROPYLENE (PP)

7.7.1 LIGHTER WEIGHT AND LOW COST OF POLYPROPYLENE TO DRIVE DEMAND

TABLE 37 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 38 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 39 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.8 POLYVINYL CHLORIDE (PVC)

7.8.1 INCREASING ELECTRICAL APPLICATIONS IN EV TO DRIVE DEMAND

TABLE 41 POLYVINYL CHLORIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 42 POLYVINYL CHLORIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 43 POLYVINYL CHLORIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 POLYVINYL CHLORIDE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.9 POLYMETHYL METHACRYLATE (PMMA)

7.9.1 100% RECYCLABILITY MAKES PMMA WIDELY USED MATERIAL

TABLE 45 POLYMETHYL METHACRYLATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 46 POLYMETHYL METHACRYLATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 47 POLYMETHYL METHACRYLATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 POLYMETHYL METHACRYLATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.10 HIGH-DENSITY POLYETHYLENE (HDPE)

7.10.1 WASTE REDUCTION DUE TO LONG SHELF LIFE TO DRIVE DEMAND

TABLE 49 HIGH-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 50 HIGH-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 51 HIGH-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 HIGH-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.11 LOW-DENSITY POLYETHYLENE (LDPE)

7.11.1 EASE OF MANUFACTURING AND FLEXIBILITY TO DRIVE DEMAND

TABLE 53 LOW-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 54 LOW-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 55 LOW-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 LOW-DENSITY POLYETHYLENE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.12 POLYBUTYLENE TEREPHTHALATE (PBT)

7.12.1 HIGHER GEOMETRIC TOLERANCE THAN POLYCARBONATE TO OPEN NEW APPLICATION AREAS

TABLE 57 POLYBUTYLENE TEREPHTHALATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 58 POLYBUTYLENE TEREPHTHALATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 59 POLYBUTYLENE TEREPHTHALATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 POLYBUTYLENE TEREPHTHALATE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

7.13 OTHER PLASTICS

7.13.1 LOW-COST APPLICATIONS IN EV TO DRIVE DEMAND FOR POLYSTYRENE

TABLE 61 OTHER PLASTICS MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (TONS)

TABLE 62 OTHER PLASTICS MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (TONS)

TABLE 63 OTHER PLASTICS MARKET FOR ELECTRIC VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 OTHER PLASTICS MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2027 (USD MILLION)

8 ELECTRIC VEHICLE PLASTICS MARKET, BY APPLICATION (Page No. - 139)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 29 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 65 MARKET, BY APPLICATION, 2018–2021 (TONS)

TABLE 66 MARKET, BY APPLICATION, 2022–2027 (TONS)

TABLE 67 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 68 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 POWERTRAIN SYSTEM/UNDER BONNET

8.2.1 LIGHTWEIGHT BATTERY CASINGS TO DRIVE PLASTIC DEMAND IN POWERTRAIN SYSTEMS

TABLE 69 POWERTRAIN SYSTEM/UNDER BONNET: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 70 POWERTRAIN SYSTEM/UNDER BONNET: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 71 POWERTRAIN SYSTEM/UNDER BONNET: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 POWERTRAIN SYSTEM/UNDER BONNET: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 EXTERIOR

8.3.1 BETTER SAFETY FEATURES TO DRIVE DEMAND FOR PLASTICS IN EXTERIOR APPLICATIONS

TABLE 73 EXTERIOR: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 74 EXTERIOR: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 75 EXTERIOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 EXTERIOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 INTERIOR

8.4.1 CUSTOMER PREFERENCE FOR BETTER AESTHETICS AND HIGHER COMFORT TO DRIVE DEMAND

TABLE 77 INTERIOR: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 78 INTERIOR: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 79 INTERIOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 INTERIOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 LIGHTING & ELECTRIC WIRING

8.5.1 ADVANCED SAFETY FEATURES TO DRIVE DEMAND FOR PLASTICS IN LIGHTING & ELECTRIC WIRING

TABLE 81 LIGHTING & ELECTRIC WIRING: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 82 LIGHTING & ELECTRIC WIRING: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 83 LIGHTING & ELECTRIC WIRING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 LIGHTING & ELECTRIC WIRING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ELECTRIC VEHICLE PLASTICS MARKET, BY COMPONENT (Page No. - 150)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 30 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 85 MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 86 MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 87 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 88 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

9.2 DASHBOARD

9.2.1 BETTER SAFETY AND SUPERIOR COMFORT FEATURES TO DRIVE DEMAND

TABLE 89 DASHBOARD: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 90 DASHBOARD: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 91 DASHBOARD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 DASHBOARD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SEATS

9.3.1 VEHICLE WEIGHT REDUCTION AND AESTHETIC SEAT DESIGN TO DRIVE DEMAND

TABLE 93 SEATS: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 94 SEATS: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 95 SEATS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 SEATS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 INTERIOR TRIM

9.4.1 QUALITY AESTHETIC LOOK AND DESIGN FLEXIBILITY TO DRIVE DEMAND

TABLE 97 INTERIOR TRIM: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 98 INTERIOR TRIM: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 99 INTERIOR TRIM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 INTERIOR TRIM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 CAR UPHOLSTERY

9.5.1 BETTER INTERIOR CUSTOMIZATION OF UPHOLSTERY FOR AESTHETICS TO DRIVE DEMAND

TABLE 101 CAR UPHOLSTERY: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 102 CAR UPHOLSTERY: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 103 CAR UPHOLSTERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 CAR UPHOLSTERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 BUMPER

9.6.1 SMART DRIVING ASSIST SYSTEMS ALONG WITH BETTER SAFETY FEATURES TO DRIVE DEMAND

TABLE 105 BUMPER: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 106 BUMPER: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 107 BUMPER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 BUMPER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 BODY

9.7.1 IMPROVED AERODYNAMICS DUE TO DESIGN FLEXIBILITY OF PLASTICS TO DRIVE DEMAND

TABLE 109 BODY: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 110 BODY: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 111 BODY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 BODY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 EXTERIOR TRIM

9.8.1 DURABLE LIGHTWEIGHT EXTERIOR PARTS TO DRIVE DEMAND FOR PLASTIC COMPONENTS

TABLE 113 EXTERIOR TRIM: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 114 EXTERIOR TRIM: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 115 EXTERIOR TRIM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 EXTERIOR TRIM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 BATTERY

9.9.1 REDUCTION OF BATTERY WEIGHT TO INCREASE DRIVING RANGE SUPPORTING ADOPTION OF BATTERY PLASTICS

9.9.1.1 Battery casing

TABLE 117 BATTERY CASING: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 118 BATTERY CASING: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 119 BATTERY CASING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 BATTERY CASING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9.1.2 Battery pack

TABLE 121 BATTERY PACK: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 122 BATTERY PACK: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 123 BATTERY PACK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 BATTERY PACK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9.1.3 Battery separator

TABLE 125 BATTERY SEPARATOR: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 126 BATTERY SEPARATOR: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 127 BATTERY SEPARATOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 128 BATTERY SEPARATOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9.1.4 Battery (other components)

TABLE 129 BATTERY (OTHER COMPONENTS): MARKET, BY REGION, 2018–2021 (TONS)

TABLE 130 BATTERY (OTHER COMPONENTS): MARKET, BY REGION, 2022–2027 (TONS)

TABLE 131 BATTERY (OTHER COMPONENTS): MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 132 BATTERY (OTHER COMPONENTS): MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 AUXILIARY BATTERY

9.10.1 RISING ADOPTION OF LI-ION BATTERIES EXPECTED TO DRIVE ADOPTION OF PLASTICS IN AUXILIARY BATTERIES

TABLE 133 AUXILIARY BATTERY: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 134 AUXILIARY BATTERY: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 135 AUXILIARY BATTERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 136 AUXILIARY BATTERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 ENGINE

9.11.1 HIGH-PERFORMANCE PLASTICS FOR ELEVATED TEMPERATURE APPLICATIONS IN PHEVS TO DRIVE DEMAND

TABLE 137 ENGINE: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 138 ENGINE: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 139 ENGINE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 140 ENGINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.12 ENGINE TOP COVER

9.12.1 HIGH-TEMPERATURE RESISTANCE AND LOW-WEIGHT APPLICATIONS TO DRIVE DEMAND

TABLE 141 ENGINE TOP COVER: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 142 ENGINE TOP COVER: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 143 ENGINE TOP COVER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 144 ENGINE TOP COVER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.13 ENGINE ENCAPSULATION

9.13.1 LIGHTWEIGHT PLASTIC ENCAPSULATIONS TO BOOST DRIVING RANGE

TABLE 145 ENGINE ENCAPSULATION: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 146 ENGINE ENCAPSULATION: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 147 ENGINE ENCAPSULATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 148 ENGINE ENCAPSULATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.14 FUEL TANK

9.14.1 LIGHTWEIGHT FUEL TANKS TO IMPROVE EV DRIVING RANGE

TABLE 149 FUEL TANK: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 150 FUEL TANK: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 151 FUEL TANK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 152 FUEL TANK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.15 LIGHTING

9.15.1 ADVANCED LIGHTING SOLUTIONS FOR BETTER VISIBILITY TO BOOST DEMAND

TABLE 153 LIGHTING: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 154 LIGHTING: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 155 LIGHTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 156 LIGHTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.16 ELECTRIC WIRING

9.16.1 INCREASED ELECTRONIC COMPONENTS IN ELECTRIC VEHICLES TO DRIVE DEMAND

TABLE 157 ELECTRIC WIRING: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 158 ELECTRIC WIRING: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 159 ELECTRIC WIRING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 160 ELECTRIC WIRING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.17 FLOOR INSULATOR

9.17.1 SMOOTHER RIDE EXPERIENCE AND BETTER VIBRATIONAL CONTROL TO DRIVE DEMAND

TABLE 161 FLOOR INSULATOR: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 162 FLOOR INSULATOR: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 163 FLOOR INSULATOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 164 FLOOR INSULATOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.18 FENDER INSULATOR

9.18.1 REDUCING VIBRATIONAL NOISE FOR BETTER RIDE EXPERIENCE TO BOOST DEMAND

TABLE 165 FENDER INSULATOR: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 166 FENDER INSULATOR: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 167 FENDER INSULATOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 168 FENDER INSULATOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.19 WHEEL ARC LINER

9.19.1 WEIGHT REDUCTION FOR ACOUSTIC APPLICATIONS TO DRIVE DEMAND

TABLE 169 WHEEL ARC LINER: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 170 WHEEL ARC LINER: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 171 WHEEL ARC LINER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 172 WHEEL ARC LINER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 OTHER COMPONENTS

9.20.1 LOWER WEIGHT RESERVOIR TANKS TO BOOST DEMAND

TABLE 173 OTHER COMPONENTS: MARKET, BY REGION, 2018–2021 (TONS)

TABLE 174 OTHER COMPONENTS: MARKET, BY REGION, 2022–2027 (TONS)

TABLE 175 OTHER COMPONENTS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 176 OTHER COMPONENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRIC VEHICLE PLASTICS MARKET, BY VEHICLE TYPE (Page No. - 188)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 31 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 177 MARKET, BY VEHICLE TYPE, 2018–2021 (TONS)

TABLE 178 MARKET, BY VEHICLE TYPE, 2022–2027 (TONS)

TABLE 179 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 180 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

10.2 BEV

10.2.1 FOCUS ON INCREASING VEHICLE DRIVING RANGE TO DRIVE DEMAND FOR PLASTICS

TABLE 181 BEV PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (TONS)

TABLE 182 BEV PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (TONS)

TABLE 183 BEV PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (USD MILLION)

TABLE 184 BEV PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (USD MILLION)

10.3 PHEV/HEV

10.3.1 HIGHER NUMBER OF PLASTIC COMPONENTS TO DRIVE DEMAND

TABLE 185 PHEV/HEV PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (TONS)

TABLE 186 PHEV/HEV PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (TONS)

TABLE 187 PHEV/HEV PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (USD MILLION)

TABLE 188 PHEV/HEV PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (USD MILLION)

11 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT (Page No. - 197)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 32 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 189 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 190 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 191 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 192 ICE PASSENGER CAR PLASTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.2 DASHBOARD

TABLE 193 DASHBOARD: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 194 DASHBOARD: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 195 DASHBOARD: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 196 DASHBOARD: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 SEATS

TABLE 197 SEATS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 198 SEATS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 199 SEATS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 200 SEATS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 INTERIOR TRIM

TABLE 201 INTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 202 INTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 203 INTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 204 INTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 CAR UPHOLSTERY

TABLE 205 CAR UPHOLSTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 206 CAR UPHOLSTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 207 CAR UPHOLSTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 208 CAR UPHOLSTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 BUMPER

TABLE 209 BUMPER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 210 BUMPER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 211 BUMPER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 212 BUMPER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 BODY

TABLE 213 BODY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 214 BODY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 215 BODY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 216 BODY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 EXTERIOR TRIM

TABLE 217 EXTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 218 EXTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 219 EXTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 220 EXTERIOR TRIM: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 BATTERY

TABLE 221 BATTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 222 BATTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 223 BATTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 224 BATTERY: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.10 ENGINE

TABLE 225 ENGINE: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 226 ENGINE: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 227 ENGINE: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 228 ENGINE: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.11 ENGINE TOP COVER

TABLE 229 ENGINE TOP COVER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 230 ENGINE TOP COVER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 231 ENGINE TOP COVER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 232 ENGINE TOP COVER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.12 ENGINE ENCAPSULATION

TABLE 233 ENGINE ENCAPSULATION: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 234 ENGINE ENCAPSULATION: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 235 ENGINE ENCAPSULATION: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 236 ENGINE ENCAPSULATION: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.13 FUEL TANK

TABLE 237 FUEL TANK: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 238 FUEL TANK: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 239 FUEL TANK: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 240 FUEL TANK: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.14 LIGHTING

TABLE 241 LIGHTING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 242 LIGHTING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 243 LIGHTING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 244 LIGHTING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.15 ELECTRIC WIRING

TABLE 245 ELECTRIC WIRING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 246 ELECTRIC WIRING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 247 ELECTRIC WIRING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 248 ELECTRIC WIRING: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.16 FLOOR INSULATOR

TABLE 249 FLOOR INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 250 FLOOR INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 251 FLOOR INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 252 FLOOR INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.17 FENDER INSULATOR

TABLE 253 FENDER INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 254 FENDER INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 255 FENDER INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 256 FENDER INSULATOR: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.18 WHEEL ARC LINER

TABLE 257 WHEEL ARC LINER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 258 WHEEL ARC LINER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 259 WHEEL ARC LINER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 260 WHEEL ARC LINER: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.19 OTHER COMPONENTS

TABLE 261 OTHER COMPONENTS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 262 OTHER COMPONENTS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 263 OTHER COMPONENTS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 264 OTHER COMPONENTS: ICE PASSENGER CAR PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

12 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL (Page No. - 227)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

FIGURE 33 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

TABLE 265 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL, 2018–2021 (TONS)

TABLE 266 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL, 2022–2027 (TONS)

TABLE 267 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 268 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

12.2 POLYAMIDE (PA)

12.2.1 ADVANCEMENTS IN NEW GRADES OF POLYAMIDE TO DRIVE ITS DEMAND IN ELECTRIC VEHICLE BATTERIES

TABLE 269 POLYAMIDE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (TONS)

TABLE 270 POLYAMIDE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (TONS)

TABLE 271 POLYAMIDE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (USD MILLION)

TABLE 272 POLYAMIDE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (USD MILLION)

12.3 POLYCARBONATE (PC)

12.3.1 LIGHTWEIGHT PROPERTIES EXPECTED TO BOOST POLYCARBONATE ADOPTION

TABLE 273 POLYCARBONATE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (TONS)

TABLE 274 POLYCARBONATE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (TONS)

TABLE 275 POLYCARBONATE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (USD MILLION)

TABLE 276 POLYCARBONATE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (USD MILLION)

12.4 POLYPROPYLENE (PP)

12.4.1 EXCELLENT MOLDABILITY AND MECHANICAL PROPERTIES EXPECTED TO DRIVE ADOPTION

TABLE 277 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (TONS)

TABLE 278 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (TONS)

TABLE 279 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (USD MILLION)

TABLE 280 POLYPROPYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (USD MILLION)

12.5 POLYETHYLENE (PE)

12.5.1 HIGH TENSILE STRENGTH AND CHEMICAL RESISTANCE EXPECTED TO DRIVE MARKET GROWTH

TABLE 281 POLYETHYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (TONS)

TABLE 282 POLYETHYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (TONS)

TABLE 283 POLYETHYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (USD MILLION)

TABLE 284 POLYETHYLENE MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (USD MILLION)

12.6 OTHER PLASTIC MATERIALS

12.6.1 INCREASING ADOPTION OF PC AND PU IN EV BATTERIES TO DRIVE MARKET GROWTH

TABLE 285 OTHER PLASTIC MATERIALS MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (TONS)

TABLE 286 OTHER PLASTIC MATERIALS MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (TONS)

TABLE 287 OTHER PLASTIC MATERIALS MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2018–2021 (USD MILLION)

TABLE 288 OTHER PLASTIC MATERIALS MARKET FOR ELECTRIC VEHICLE BATTERY, BY REGION, 2022–2027 (USD MILLION)

13 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE (Page No. - 239)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

FIGURE 34 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 289 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE, 2018–2021 (TONS)

TABLE 290 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 291 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 292 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.2 DRIVE BATTERY

13.2.1 TREND TOWARD REDUCING OVERALL BATTERY WEIGHT TO DRIVE ADOPTION OF BATTERY PLASTICS

TABLE 293 DRIVE BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 294 DRIVE BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 295 DRIVE BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 296 DRIVE BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 AUXILIARY BATTERY

13.3.1 TRANSITION FROM LEAD ACID TO LI-ION BATTERIES TO DRIVE ADOPTION OF PLASTICS IN AUXILIARY BATTERIES

TABLE 297 AUXILIARY BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 298 AUXILIARY BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 299 AUXILIARY BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 300 AUXILIARY BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

14 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE (Page No. - 246)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

FIGURE 35 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 301 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE, 2018–2021 (TONS)

TABLE 302 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE, 2022–2027 (TONS)

TABLE 303 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 304 ELECTRIC VEHICLE BATTERY PLASTICS MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2 BEV

14.2.1 INCREASING FOCUS ON REDUCING VEHICLE WEIGHT TO DRIVE DEMAND FOR PLASTICS IN BEV BATTERIES

TABLE 305 BEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 306 BEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 307 BEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 308 BEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 PHEV

14.3.1 DEVELOPMENTS IN BATTERY PLASTIC MATERIALS FOR HOUSINGS/CASINGS EXPECTED TO DRIVE DEMAND

TABLE 309 PHEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 310 PHEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 311 PHEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 312 PHEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

14.4 FCEV

14.4.1 CONTINUOUS DEVELOPMENTS IN FCEV TECHNOLOGY AND LAUNCH OF VARIOUS MODELS TO DRIVE MARKET

TABLE 313 FCEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (TONS)

TABLE 314 FCEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (TONS)

TABLE 315 FCEV BATTERY PLASTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 316 FCEV BATTERY PLASTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

15 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE (Page No. - 254)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS/LIMITATIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 36 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 317 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (TONS)

TABLE 318 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (TONS)

TABLE 319 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE, 2018–2021 (USD MILLION)

TABLE 320 ICE PASSENGER CAR PLASTICS MARKET, BY PLASTIC TYPE, 2022–2027 (USD MILLION)

15.2 ACRYLONITRILE BUTADIENE STYRENE (ABS)

15.2.1 DEMAND FOR HIGH-QUALITY INTERIORS TO DRIVE GROWTH

TABLE 321 ACRYLONITRILE BUTADIENE STYRENE (ABS) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 322 ACRYLONITRILE-BUTADIENE-STYRENE (ABS) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 323 ACRYLONITRILE BUTADIENE STYRENE (ABS) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 324 ACRYLONITRILE-BUTADIENE-STYRENE (ABS) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.3 POLYAMIDE (PA)

15.3.1 NEW GRADES OF POLYAMIDE FOR UNDER-THE-HOOD APPLICATIONS TO DRIVE DEMAND

TABLE 325 POLYAMIDE (PA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 326 POLYAMIDE (PA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 327 POLYAMIDE (PA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 328 POLYAMIDE (PA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.4 POLYCARBONATE (PC)

15.4.1 PC PROVIDES A SUBSTITUTE FOR GLASS IN EXTERIOR APPLICATIONS AND ALLOWS DESIGN FLEXIBILITY—KEY DEMAND DRIVERS

TABLE 329 POLYCARBONATE (PC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 330 POLYCARBONATE (PC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 331 POLYCARBONATE (PC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 332 POLYCARBONATE (PC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.5 POLYVINYL BUTYRAL (PVB)

15.5.1 DEMAND FOR LAMINATED GLASS TO BOOST GROWTH

TABLE 333 POLYVINYL BUTYRAL (PVB) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 334 POLYVINYL BUTYRAL (PVB) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 335 POLYVINYL BUTYRAL (PVB) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 336 POLYVINYL BUTYRAL (PVB) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.6 POLYURETHANE (PU)

15.6.1 WIDE RANGE OF FIRMNESS TO DRIVE PU DEMAND FOR INTERIOR AND EXTERIOR APPLICATIONS

TABLE 337 POLYURETHANE (PU) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 338 POLYURETHANE (PU) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 339 POLYURETHANE (PU) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 340 POLYURETHANE (PU) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.7 POLYPROPYLENE (PP)

15.7.1 EXCELLENT MECHANICAL PROPERTIES AND RELATIVELY LOW COST TO DRIVE DEMAND

TABLE 341 POLYPROPYLENE (PP) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 342 POLYPROPYLENE (PP) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 343 POLYPROPYLENE (PP) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 344 POLYPROPYLENE (PP) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.8 POLYVINYL CHLORIDE (PVC)

15.8.1 HIGH DURABILITY AND COST-PERFORMANCE ADVANTAGES TO DRIVE DEMAND

TABLE 345 POLYVINYL CHLORIDE (PVC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 346 POLYVINYL CHLORIDE (PVC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 347 POLYVINYL CHLORIDE (PVC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 348 POLYVINYL CHLORIDE (PVC) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.9 POLYMETHYL METHACRYLATE (PMMA)

15.9.1 EXCELLENT OPTICAL QUALITY AND LIGHT DIFFUSION TO DRIVE DEMAND

TABLE 349 POLYMETHYL METHACRYLATE (PMMA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 350 POLYMETHYL METHACRYLATE (PMMA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 351 POLYMETHYL METHACRYLATE (PMMA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 352 POLYMETHYL METHACRYLATE (PMMA) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.10 HIGH-DENSITY POLYETHYLENE (HDPE)

15.10.1 LOWER WEIGHT AND COST-EFFECTIVE MANUFACTURING TO DRIVE DEMAND

TABLE 353 HDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 354 HDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 355 HDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 356 HDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.11 LOW-DENSITY POLYETHYLENE (LDPE)

15.11.1 EASE OF MANUFACTURING AND HIGH-PERFORMANCE TO DRIVE DEMAND

TABLE 357 LDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 358 LDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 359 LDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 360 LDPE MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.12 POLYBUTYLENE TEREPHTHALATE (PBT)

15.12.1 HIGH DIMENSIONAL STABILITY TO DRIVE DEMAND

TABLE 361 POLYBUTYLENE TEREPHTHALATE (PBT) FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 362 POLYBUTYLENE TEREPHTHALATE (PBT) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 363 POLYBUTYLENE TEREPHTHALATE (PBT) MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 364 POLYBUTYLENE TEREPHTHALATE (PBT) MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

15.13 OTHER PLASTICS

TABLE 365 OTHER PLASTICS MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (TONS)

TABLE 366 OTHER PLASTICS MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (TONS)

TABLE 367 OTHER PLASTICS MARKET FOR ICE PASSENGER CAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 368 OTHER PLASTICS MARKET FOR ICE PASSENGER CAR, BY REGION, 2022–2027 (USD MILLION)

16 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT (Page No. - 280)

16.1 INTRODUCTION

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS/LIMITATIONS

16.1.3 INDUSTRY INSIGHTS

FIGURE 37 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 369 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 370 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 371 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 372 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

16.2 ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT

16.2.1 DASHBOARD

16.2.2 SEATS

16.2.3 INTERIOR TRIM

16.2.4 CAR UPHOLSTERY

16.2.5 BUMPER

16.2.6 BODY

16.2.7 EXTERIOR TRIM

16.2.8 BATTERY

16.2.9 ENGINE

16.2.10 FUEL TANK

16.2.11 LIGHTING

16.2.12 FLOOR INSULATOR

16.2.13 FENDER INSULATOR

16.2.14 ENGINE TOP COVER

16.2.15 WHEEL ARC LINER

16.2.16 ENGINE ENCAPSULATION

TABLE 373 ASIA PACIFIC: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 374 ASIA PACIFIC: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 375 ASIA PACIFIC: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 376 ASIA PACIFIC: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 377 EUROPE: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 378 EUROPE: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 379 EUROPE: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 380 EUROPE: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 381 NORTH AMERICA: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 382 NORTH AMERICA: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 383 NORTH AMERICA: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 384 NORTH AMERICA: ELECTRIC VEHICLE POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

17 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT (Page No. - 301)

17.1 INTRODUCTION

17.1.1 RESEARCH METHODOLOGY

17.1.2 ASSUMPTIONS/LIMITATIONS

17.1.3 INDUSTRY INSIGHTS

FIGURE 38 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 385 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 386 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 387 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 388 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

17.2 ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT

17.2.1 DASHBOARD

17.2.2 SEATS

17.2.3 INTERIOR TRIM

17.2.4 CAR UPHOLSTERY

17.2.5 BUMPER

17.2.6 BODY

17.2.7 EXTERIOR TRIM

17.2.8 BATTERY

17.2.9 ENGINE

17.2.10 FUEL TANK

17.2.11 LIGHTING

17.2.12 FLOOR INSULATOR

17.2.13 FENDER INSULATOR

17.2.14 ENGINE TOP COVER

17.2.15 WHEEL ARC LINER

17.2.16 ENGINE ENCAPSULATION

TABLE 389 ASIA PACIFIC: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 390 ASIA PACIFIC: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 391 ASIA PACIFIC: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 392 ASIA PACIFIC: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 393 EUROPE: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 394 EUROPE: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 395 EUROPE: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 396 EUROPE: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 397 NORTH AMERICA: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (TONS)

TABLE 398 NORTH AMERICA: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (TONS)

TABLE 399 NORTH AMERICA: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 400 NORTH AMERICA: ICE PASSENGER CAR POLYPROPYLENE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

18 ELECTRIC VEHICLE PLASTICS MARKET, BY REGION (Page No. - 322)

18.1 INTRODUCTION

FIGURE 39 MARKET: ASIA PACIFIC IS ESTIMATED TO GROW AT HIGHEST CAGR (2022–2027)

18.1.1 RESEARCH METHODOLOGY

18.1.2 ASSUMPTIONS

18.1.3 INDUSTRY INSIGHTS

FIGURE 40 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 401 MARKET, BY REGION, 2018–2021 (TONS)

TABLE 402 MARKET, BY REGION, 2022–2027 (TONS)

TABLE 403 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 404 MARKET, BY REGION, 2022–2027 (USD MILLION)

18.2 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 405 ASIA PACIFIC: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 406 ASIA PACIFIC: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 407 ASIA PACIFIC: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 408 ASIA PACIFIC: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.2.1 CHINA

18.2.1.1 Improving air quality to drive EV sales and subsequent plastic component demand

TABLE 409 CHINA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 410 CHINA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 411 CHINA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 412 CHINA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.2.2 INDIA

18.2.2.1 Strategic government initiatives and new automotive regulations to boost EV sales

TABLE 413 INDIA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 414 INDIA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 415 INDIA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 416 INDIA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.2.3 JAPAN

18.2.3.1 Increasing PHEV sales projected to drive demand

TABLE 417 JAPAN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 418 JAPAN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 419 JAPAN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 420 JAPAN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.2.4 SOUTH KOREA

18.2.4.1 Technological advancements and improving charging infrastructure expected to drive demand

TABLE 421 SOUTH KOREA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 422 SOUTH KOREA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 423 SOUTH KOREA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 424 SOUTH KOREA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.3 NORTH AMERICA

FIGURE 42 ELECTRIC VEHICLE PLASTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 425 NORTH AMERICA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 426 NORTH AMERICA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 427 NORTH AMERICA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 428 NORTH AMERICA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.3.1 US

18.3.1.1 High demand for low-weight high-performance plastics to drive EV plastics market

TABLE 429 US: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 430 US: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 431 US: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 432 US: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.3.2 CANADA

18.3.2.1 Road safety standards and better customer awareness to drive demand for plastic components

TABLE 433 CANADA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 434 CANADA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 435 CANADA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 436 CANADA: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4 EUROPE

FIGURE 43 EUROPE: MARKET SNAPSHOT

TABLE 437 EUROPE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 438 EUROPE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 439 EUROPE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 440 EUROPE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.1 NORWAY

18.4.1.1 Government EV target for 2025 to boost demand for light-weight plastic components

TABLE 441 NORWAY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 442 NORWAY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 443 NORWAY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 444 NORWAY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.2 GERMANY

18.4.2.1 Customer demand for high-quality interiors in EVs to boost adoption of performance plastics

TABLE 445 GERMANY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 446 GERMANY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 447 GERMANY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 448 GERMANY: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.3 UK

18.4.3.1 BEV powertrain applications in battery and thermal management to drive demand

TABLE 449 UK: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 450 UK: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 451 UK: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 452 UK: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.4 FRANCE

18.4.4.1 Improving charging infrastructure and high aesthetic interiors in EVs to drive demand

TABLE 453 FRANCE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 454 FRANCE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 455 FRANCE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 456 FRANCE: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.5 SWEDEN

18.4.5.1 High incentives on EVs to drive their sales and demand for plastics

TABLE 457 SWEDEN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 458 SWEDEN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 459 SWEDEN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 460 SWEDEN: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

18.4.6 NETHERLANDS

18.4.6.1 Advanced charging infrastructure for EVs to boost EV sales and EV plastic demand

TABLE 461 NETHERLANDS: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (TONS)

TABLE 462 NETHERLANDS: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (TONS)

TABLE 463 NETHERLANDS: MARKET, BY VEHICLE TYPE AND APPLICATION, 2018–2021 (USD MILLION)

TABLE 464 NETHERLANDS: MARKET, BY VEHICLE TYPE AND APPLICATION, 2022–2027 (USD MILLION)

19 COMPETITIVE LANDSCAPE (Page No. - 370)

19.1 OVERVIEW

19.2 ELECTRIC VEHICLE PLASTICS MARKET SHARE ANALYSIS, 2021

TABLE 465 MARKET SHARE ANALYSIS, 2021

FIGURE 44 ELECTRIC VEHICLE PLASTICS MARKET SHARE ANALYSIS, 2021

19.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

19.4 COMPANY EVALUATION QUADRANT

19.4.1 STAR

19.4.2 EMERGING LEADERS

19.4.3 PERVASIVE

19.4.4 PARTICIPANTS

FIGURE 45 COMPETITIVE EVALUATION MATRIX (PLASTICS MANUFACTURERS), 2021

TABLE 466 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

19.5 COMPETITIVE SCENARIO

19.5.1 NEW PRODUCT LAUNCHES

TABLE 467 PRODUCT LAUNCHES, 2019–2022

19.5.2 DEALS

TABLE 468 DEALS, 2019–2022

19.5.3 OTHER DEVELOPMENTS

TABLE 469 OTHER DEVELOPMENTS, 2019–2022

19.6 RIGHT TO WIN

TABLE 470 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019–2022

19.7 COMPETITIVE BENCHMARKING

TABLE 471 ELECTRIC VEHICLE PLASTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 472 ELECTRIC VEHICLE PLASTICS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

20 COMPANY PROFILES (Page No. - 392)

20.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

20.1.1 BASF SE

TABLE 473 BASF SE: BUSINESS OVERVIEW

FIGURE 46 BASF SE: COMPANY SNAPSHOT

TABLE 474 BASF SE: PRODUCTS OFFERED

TABLE 475 BASF SE: NEW PRODUCT DEVELOPMENTS

TABLE 476 BASF SE: DEALS

TABLE 477 BASF SE: OTHER DEVELOPMENTS

20.1.2 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

TABLE 478 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: BUSINESS OVERVIEW