Acoustic Wave Sensor Market by Type (Surface Acoustic Wave, Bulk Acoustic Wave), Device (Resonator, Delay Line), Sensing Parameter (Temperature, Pressure, Humidity), Vertical (Military, Automotive, Industrial) and Geography - Global Forecast to 2023

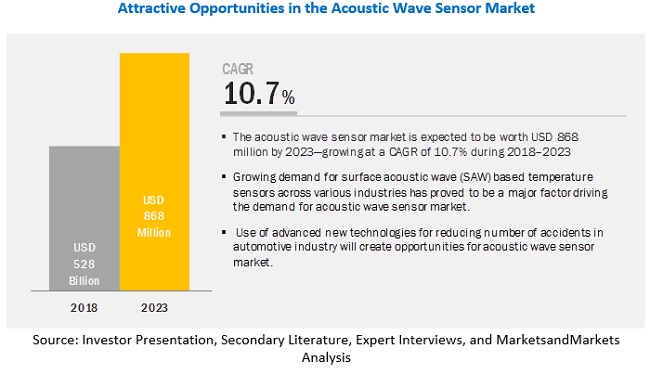

The acoustic wave sensor market to grow from USD 528 million in 2018 to USD 868 million by 2023, at a Compound Annual Growth Rate (CAGR) of 10.7% during the forecast period. The major factors that are expected to be driving the acoustic wave sensor market are high demand for surface acoustic wave (SAW) based temperature sensors among industrial end users and growing concern toward security and surveillance. The objective of the report is to define, describe, and forecast the Acoustic Wave Sensor market size based on type, device, sensing parameter, vertical and region.

Impact of AI Acoustic Wave Sensor Market

The integration of artificial intelligence (AI) into the acoustic wave sensor market is catalyzing significant advancements across various industries. AI enhances these sensors' capabilities by enabling sophisticated signal processing, allowing for more accurate detection and analysis of acoustic patterns. This is particularly impactful in sectors like healthcare, where AI-powered acoustic sensors facilitate non-invasive monitoring of physiological parameters such as heart rate and respiratory functions, thereby improving patient diagnostics and care . In industrial applications, AI aids in predictive maintenance by analyzing acoustic emissions to detect equipment anomalies before failures occur, optimizing operational efficiency . Moreover, the automotive industry benefits from AI-enhanced acoustic sensors through improved vehicle safety systems and in-cabin noise management . Despite challenges like environmental interference and high manufacturing costs, the fusion of AI with acoustic wave sensing technology is unlocking new potentials, driving innovation, and expanding the market's reach into emerging areas such as smart infrastructure and environmental monitoring.

By type, the surface acoustic wave sensor segment is expected to grow at the highest growth rate during the forecast period

Among the type segment, the surface acoustic wave sensor segment is expected to grow at the highest CAGR during the forecast period. Surface acoustic wave (SAW) sensors are used to sense the occurrence of any change in frequency of various parameters such as temperature, pressure, torque, chemical vapors, and so on. When the acoustic wave created due to these parameters are subjected to pass parallel to the piezoelectric substrate of SAW sensor from one electrode to another electrode. The variation in their frequency, velocity and attenuation of the SAW is sensed by the molecules present in the substrate coating. Therefore, SAW sensors are used to sense and indicate the change in the concentration of a specific chemical in the environment.

By devices, the resonator holds the largest share of the acoustic wave sensor market

The resonator segment is expected to hold the largest market share. Acoustic wave resonator uses the vibration of piezoelectric material and it employs acoustic waves generated to high frequency circuit. These resonators have applications such as automotive keyless entry, tire pressure monitoring, and many more.

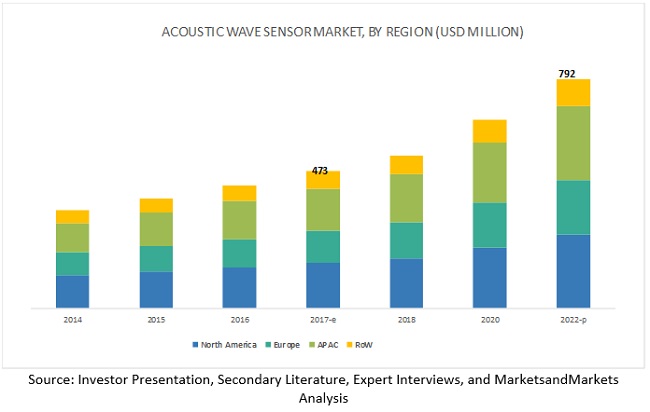

North America to account for the largest market size during the forecast period.

North America is expected to hold the largest market size in the acoustic wave sensor market during the forecast period, followed by the APAC region. Technological advancements, low manufacturing cost, and wireless and passive nature of the products are the major drivers of the lucrative growth of acoustic wave sensors. The use of acoustic wave sensors in military segment is a major factor responsible for the growth of the region. The US military runs laboratories to provide superior technologies to its militants. The labs include the U.S. Army Medical Research Unit in Nairobi, Kenya; the Armed Forces Research Institute of Medical Sciences in Bangkok; the U.S. Naval Medical Research Unit 3 in Cairo; NAMRU-6 in Lima, Peru; and NAMRU-2 Pacific, temporarily headquartered at Pearl Harbor, Hawaii and several others. The automotive industry is a major growth driver of the acoustic wave sensor in North American region. The National Highway Traffic Safety Administration (NHTSA) has mandated from 2008 that all newly manufactured or imported US cars will be fitted with tire pressure monitoring systems (TPMS), which has further assisted the growth of the acoustic wave sensor market in the North American region. The target of a TPMS is avoiding traffic accidents, poor fuel economy, and increased tire wear due to under-inflated tires through early recognition of a hazardous state of the tires.

Acoustic Wave Sensor Market Dynamics

Driver: High demand for SAW based temperature sensors among industrial end users

The continuous demand for temperature sensors from the industry end users is expected to fuel the growth of the acoustic wave based temperature sensor market. Temperature sensor products are increasingly used by various industry end users to integrate sensing technologies in their products such as automotive, medical, industrial, and chemical industries. This helps to reduce replacement costs of the components, reduce wear and tear of the products, increase the safety of the products, and meet stringent reliability requirements.

There is a growing demand for SAW based temperature sensors across various industries owing to their various benefits such as accuracy, wide temperature range, fast response rate, low cost, and repeatability. Since temperature measurement is the most common parameter in many industries, industrial end users are adopting the temperature sensor technology that provides durable and accurate temperature measurements and defects if any.

For instance, there is a growing demand for accurate SAW based temperature sensors system for applications such as engine coolant temperature management, outside air temperature management, active in-vehicle temperature management, and cylinder heat temperature management in the automobile industry. Moreover, advanced temperature sensors are increasingly being preferred by various end-user industries.

Restraint: Technical issues related to size, energy consumption, and sensitivity

Gas sensor devices, although having growing demand, face certain problems that are yet to be addressed. Some of the major problems of the gas sensor devices are high energy consumption; small size; sensitivity to environmental factors; and the size of the sensor, important in case of portable gas detector devices that are used in few applications such as in building automation. Energy consumption of a gas sensor device plays an important role as it contributes to the overall power consumption of the system. Devices built on metal-oxide-semiconductor technology consume more power as compared to an electrochemical device. It is difficult for gas sensors to maintain high level of sensitivity to detect different gases under high humidity conditions. Various sensors have different sensitivity and work for specific atmospheric condition. There are variety of SAW base gas sensors used for gas sensing, the oscillators is considered to be the key unit of SAW gas sensor. The sensitive substrate will absorb certain kind of gases and on the other will not absorb other gases; this will allow us to obtain the content of gas by measuring its change in oscillation frequency. These SAW based gas sensor are being used in application such as food security, environmental monitoring, and many more.

Opportunity: Immense growth opportunities in automotive industry

The automotive industry is well known for developing new application and development of sensor technologies for automotive safety systems. This system has become advanced, sophisticated and efficient over a period of time. Now a day’s automotive industry is more prone to the use of advanced new technologies for reducing number of accidents and decreases the impact of accidents. Acoustic wave sensors have played an important role in achieving these targets, where these systems have made vehicles safer for the occupants. The new awareness of the governments and consumers towards safety of vehicles is one of the major drivers for the acoustic wave sensor market. The increasing demand of micro electro-mechanical sensor (MEMS) technology that uses new sensor technologies for applications like pressure sensing in tire pressure monitoring system (TPMS). The MEMS technology plays an important role in automotive industry as it reduces cost and space as compared to other technologies. SAW sensors are mainly deployed in this industry to sense the modulation occurred in a physical phenomenon. These sensors have limited applications in automotive industry like for torque sensing in electronic power steering, TPMS, and the monitoring of combustion engine but with the increasing advancement in technology many applications is expected to emerge.

Challenge: SAW sensor are being replaced by other sensors in conventional applications

Acoustic wave sensors are predominantly used in special applications, where the sensors must withstand severe conditions due to heat, radiation, or electromagnetic fields and where the sensors are required to have a long life, free of maintenance. However, these applications cover only a niche market. Besides, in the other conventional applications such as temperature measurement in automotive industries or pressure measurement in healthcare devices, which form a major portion of the market, the working environment for sensors is not that extreme and the other types of sensors (such as piezo resistive, SI-based sensors) are already proving to be more than capable, which limits the penetration of acoustic wave sensors in these markets.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2023 |

|

Base year considered |

2016 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Industry, Sensing Parameter, Device, Type, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW (South America, Middle East, and Africa) |

|

Companies covered |

Vectron International (US), Qualtre Inc. (US), SENSeOR (France), Sensor Technology Ltd. (US), NanoTemper Technologies GmbH (Germany), Althen GmbH (Germany), Transense Technologies (Germany), Pro-micron (Germany), Heinz Messwiderstande (Germany), Hawk Measurement System (Australia), Abracon LLC (US), A D Metro Inc. (US), API Technologies Corp (US). |

The research report categorizes the Acoustic Wave Sensor to forecast the revenues and analyze the trends in each of the following sub-segments:

Acoustic Wave Sensor Market, By Type

- Surface Acoustic Wave (SAW)

- Bulk Acoustic Wave (BAW)

Acoustic Wave Sensor Market, By Devices

- Resonator

- Delay line

Acoustic Wave Sensor Market, By Vertical

- Military

- Industrial

- Automotive

- Food and Beverages

- Healthcare

- Environmental

Acoustic Wave Sensor Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- RoW

Key Market Players

Vectron International (US), Qualtre Inc. (US), SENSeOR (France), Sensor Technology Ltd. (US), NanoTemper Technologies GmbH (Germany), Althen GmbH (Germany), Transense Technologies (Germany), Pro-micron (Germany), Heinz Messwiderstande (Germany), Hawk Measurement System (Australia), Abracon LLC (US), A D Metro Inc. (US), API Technologies Corp (US).

Vectron International held a leading position in the Acoustic Wave Sensor market in 2016. Vectron International is one of the global leaders in designing, manufacturing, and selling of frequency control, sensor, and hybrid product solutions which use of latest techniques based on both bulk acoustic wave (BAW) and surface acoustic wave (SAW) designs. The company is mainly engaged in acquisitions for making strategic investments. The company had acquired businesses and assets which includes patents and technologies. These acquisitions and investments mainly focus in development of existing products and introduction of new products and services. Vectron concentrates on entering the innovation-driven growth markets by designing innovative acoustic wave solutions. The company serves variety of industries such as mobile consumer, medical, aerospace and defense, and telecommunications.

Recent Developments

- In August 2015, SenGenuity developed a wireless temperature sensor using acoustic technology for the measurement of temperatures up to 600°C.

- In June 2015, Qualtre announced its second-generation BAW MEMS gyroscopes. This product offers vibration/shock rejection and stability for a broad frequency range which make it reliable and stable in harsh environments.

- In April 2016, SENSeOR signed a partnership agreement with Clere Electronics Limited (UK), for distributing SENSeOR’s wireless passive SAW sensors and its monitoring solutions for applications in energy and the industrial sector.

- In October 2014, NanoTemper acquired SAW Instruments GmbH (Germany), for expanding its technological portfolio methodology for biomolecular interaction analysis.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Acoustic Wave Sensor market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives Of The Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown Of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary And Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown And Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

6 Acoustic Wave Sensor Market By Type

6.1 Introduction

6.2 Saw Sensors

6.2.1 Rayleigh Surface Wave Sensors

6.2.2 Sh-Saw Sensors

6.2.3 Fpw Sensors

6.3 Baw Sensors

6.3.1 Tsm Sensor

6.3.2 Sh-Apm Sensors

7 Acoustic Wave Sensor Market By Device

7.1 Introduction

7.2 Resonators

7.3 Delay Lines

8 Acoustic Wave Sensor Market By Sensing Parameter

8.1 Introduction

8.2 Temperature

8.3 Pressure.

8.4 Humidity

8.5 Chemical Vapor/Gas

8.6 Torque

8.7 Mass

8.8 Viscosity

8.9 Others

9 Acoustic Wave Sensor Market By Vertical

9.1 Introduction

9.2 Military

9.3 Automotive

9.4 Industrial

9.5 Healthcare

9.6 Food & Beverages

9.7 Environment

9.8 Others

10 Geographic Analysis

10.1 Introduction

10.2 North America

10.2.1 Us

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Uk

10.3.2 France

10.3.3 Germany

10.3.4 Rest Of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest Of Apac

10.5 Rest Of The World (Row)

11 Competitive Landscape

11.1 Overview

11.2 Competitive Scenario

11.2.1 Market Ranking Analysis: Acoustic Wave Sensor Market, 2016

11.3 Acoustic Wave Sensor Dive Chart

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Strength Of Product Portfolio

11.4.2 Business Strategy Excellence

11.5 Competitive Situations And Trends

12 Company Profiles

12.1 Introduction (Business Overview, Products Offered, Recent Developments, Swot Analysis, And Mnm View) *

12.2 Althen Gmbh

12.3 Nanotemper Technologies Gmbh

12.4 H. Heinz Meßwiderstände Gmbh

12.5 Transense Technologies Plc

12.6 Pro-Micron Gmbh & Co. Kg

12.7 Vectron International Inc.

12.8 Qualtre Inc.

12.9 Senseor Sas

12.10 Sensor Technology Ltd.

12.11 Hawk Measurement Systems

12.12 Key Innovators

12.12.1 Abracon Llc

12.12.2 Boston Piezo-Optics Inc.

12.12.3 Stmicroelectronics N.V.

12.12.4 Precision Acoustics Ltd.

12.12.5 Sensanna Incorporated

13 Appendix

13.1 Insights Of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing Rt: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List Of Tables (100 Figures)

Table 1 Acoustic Wave Sensor Market, In Terms Of Value, 2014–2023 (Usd Million)

Table 2 Market, By Type, 2014–2023 (Usd Million)

Table 3 Market, By Device, 2014–2023 (Usd Million)

Table 4 Market, For Resonators, By Region, 2014–2023 (Usd Million)

Table 5 Market, For Delay Lines, By Region, 2014–2023 (Usd Million)

Table 6 Market, By Sensing Parameter, 2014–2023 (Usd Million

Table 7 Market For Temperature,By Vertical, 2014–2023 (Usd Million)

Table 8 Market For Temperature, By Region, 2014–2023 (Usd Million)

Table 9 Market For Pressure, By Vertical, 2014–2023 (Usd Million)

Table 10 Acoustic Wave Sensor Market For Pressure, By Region, 2014–2023 (Usd Million)

Table 11 Market For Humidity, By Vertical, 2014–2023 (Usd Million)

Table 12 Market For Humidity, By Region, 2014–2023 (Usd Million)

Table 13 Market For Chemical Vapor/Gas, By Vertical, 2014–2023 (Usd Million)

Table 14 Market For Chemical Vapor/Gas, By Region, 2014–2023 (Usd Million)

Table 15 Market For Torque, By Vertical, 2014–2023 (Usd Million)

Table 16 Market For Torque, By Region, 2014–2023 (Usd Million)

Table 17 Market For Mass, By Vertical, 2014–2023 (Usd Million)

Table 18 Market For Mass, By Region, 2014–2023 (Usd Million)

Table 19 Market For Viscosity, By Vertical, 2014–2023 (Usd Million)

Table 20 Acoustic Wave Sensor Market For Viscosity, By Region, 2014–2023 (Usd Million)

Table 21 Market For Others, By Vertical, 2014–2023 (Usd Million)

Table 22 Market For Others, By Region, 2014–2023 (Usd Million)

Table 23 Market, By Vertical, 2014–2023 (Usd Million)

Table 24 Market For Military, By Sensing Parameter, 2014–2023 (Usd Million)

Table 25 Market For Military, By Region, 2014–2023 (Usd Million)

Table 26 Market For Automotive, By Sensing Parameter, 2014–2023 (Usd Million)

Table 27 Market For Automotive, By Region, 2014–2023 (Usd Million)

Table 28 Market For Automotive, By Application, 2014–2023 (Usd Million)

Table 29 Market For Industrial, By Sensing Parameter, 2014–2023 (Usd Million)

Table 30 Acoustic Wave Sensor Market For Industrial, By Application, 2014–2023 (Usd Million)

Table 31 Market For Industrial Vertical, By Region, 2014–2023 (Usd Million)

Table 32 Market For Healthcare, By Sensing Parameter, 2014–2023 (Usd Million)

Table 33 Market For Healthcare, By Region, 2014–2023 (Usd Million)

Table 34 Market For Food & Beverages, By Sensing Parameter, 2014–2023 (Usd Million)

Table 35 Market For Food & Beverages, By Region, 2014–2023 (Usd Million)

Table 36 Market For Environment Vertical, By Sensing Parameter, 2014–2023 (Usd Million)

Table 37 Market For Environment Vertical, By Region, 2014–2023 (Usd Million)

Table 38 Market For Others, By Region, 2014–2023 (Usd Million)

Table 39 Market, By Geography, 2014–2023 (Usd Million)

Table 40 Acoustic Wave Sensor Market In North America, By Device, 2014–2023 (Usd Million)

Table 41 Market In North America, By Sensing Parameter, 2014–2023 (Usd Million)

Table 42 Market In North America, By Vertical, 2014–2023 (Usd Million)

Table 43 Market In North America For Industrial, By Application, 2014–2023 (Usd Million)

Table 44 Market In North America For Automotive, By Application, 2014–2023 (Usd Million)

Table 45 Market In North America, By Country, 2014–2023 (Usd Million)

Table 46 Market In Us, By Device, 2014–2023 (Usd Million)

Table 47 Market In Us, By Sensing Parameter, 2014–2023 (Usd Million)

Table 48 Market In Us, By Vertical, 2014–2023 (Usd Million)

Table 49 Market In Canada, By Device, 2014–2023 (Usd Million)

Table 50 Acoustic Wave Sensor Market In Canada, By Sensing Parameter, 2014–2023 (Usd Million)

Table 51 Market In Canada, By Vertical, 2014–2023 (Usd Million)

Table 52 Market In Mexico, By Device, 2014–2023 (Usd Million)

Table 53 Market In Mexico, By Sensing Parameter, 2014–2023 (Usd Million)

Table 54 Market In Mexico, By Vertical, 2014–2023 (Usd Million)

Table 55 Market In Europe, By Device, 2014–2023 (Usd Million)

Table 56 Market In Europe, By Sensing Parameter, 2014–2023 (Usd Million)

Table 57 Market In Europe, By Vertical, 2014–2023 (Usd Million)

Table 58 Market In Europe For Industrial, By Application, 2014–2023 (Usd Million)

Table 59 Market In Europe For Automotive, By Application, 2014–2023 (Usd Million)

Table 60 Market In Europe, By Country, 2014–2023 (Usd Million)

Table 61 Acoustic Wave Sensor Market In Germany, By Device, 2014–2023 (Usd Million)

Table 62 Market In Germany, By Sensing Parameter, 2014–2023 (Usd Million)

Table 63 Market In Germany, By Vertical, 2014–2023 (Usd Million)

Table 64 Market In Uk, By Device, 2014–2023 (Usd Million)

Table 65 Market In Uk, By Sensing Parameter, 2014–2023 (Usd Million)

Table 66 Market In Uk, By Vertical, 2014–2023 (Usd Million)

Table 67 Market In France, By Device, 2014–2023 (Usd Million)

Table 68 Market In France, By Sensing Parameter, 2014–2023 (Usd Million)

Table 69 Market In France, By Vertical, 2014–2023 (Usd Million)

Table 70 Market In Roe, By Device, 2014–2023 (Usd Million)

Table 71 Acoustic Wave Sensor Market In Roe, By Sensing Parameter, 2014–2023 (Usd Million)

Table 72 Market In Roe, By Vertical, 2014–2023 (Usd Million)

Table 73 Market In Apac, By Device, 2014–2023 (Usd Million)

Table 74 Market In Apac, By Sensing Parameter, 2014–2023 (Usd Million)

Table 75 Market In Apac, By Vertical, 2014–2023 (Usd Million)

Table 76 Market In Apac For Industrial, By Application, 2014–2023 (Usd Million)

Table 77 Market In Apac For Automotive, By Application, 2014–2023 (Usd Million)

Table 78 Market In Apac, By Country, 2014–2023 (Usd Million)

Table 79 Market In China, By Device, 2014–2023 (Usd Million)

Table 80 Market In China, By Sensing Parameter, 2014–2023 (Usd Million)

Table 81 Acoustic Wave Sensor Market In China, By Vertical, 2014–2023 (Usd Million)

Table 82 Market In Japan, By Device, 2014–2023 (Usd Million)

Table 83 Market In Japan, By Sensing Parameter, 2014–2023 (Usd Million)

Table 84 Market In Japan, By Vertical, 2014–2023 (Usd Million)

Table 85 Market In India, By Device, 2014–2023 (Usd Million)

Table 86 Market In India, By Sensing Parameter, 2014–2023 (Usd Million)

Table 87 Market In India, By Vertical, 2014–2023 (Usd Million)

Table 88 Market In Roapac, By Device, 2014–2023 (Usd Million)

Table 89 Market In Roapac, By Sensing Parameter, 2014–2023 (Usd Million)

Table 90 Acoustic Wave Sensor Market In Roapac, By Vertical, 2014–2023 (Usd Million)

Table 91 Market In Row, By Device, 2014–2023 (Usd Million)

Table 92 Market In Row, By Sensing Parameter, 2014–2023 (Usd Million)

Table 93 Market In Row, By Vertical, 2014–2023 (Usd Million)

Table 94 Market In Row For Industrial, By Application, 2014–2023 (Usd Million)

Table 95 Acoustic Wave Sensor Market In Row For Automotive, By Application, 2014–2023 (Usd Million)

Table 96 Ranking Of Top 5 Players, 2018

Table 97 Product Launches And Developments, 2014–2023

Table 98 Contracts, 2014–2023

Table 99 Partnerships, 2014–2023

Table 100 Agreements, 2014–2023

List of Figures (38 Figures)

Figure 1 Acoustic Wave Sensor Market: Markets Covered

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, 2014–2023 (USD Million)

Figure 7 Acoustic Wave Sensor Market, By Type, 2017 and 2023

Figure 8 Resonators to Hold Larger Size of Market, 2017 and 2023

Figure 9 Market for Automotive to Grow at Highest CAGR Between 2017 and 2023

Figure 10 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Demand in Automotive Vertical Expected to Create Attractive Growth Opportunities in Market During the Forecast Period

Figure 12 Saw Sensors to Hold Larger Size of Market During Forecast Period

Figure 13 Market for Torque to Grow at Highest CAGR Between 2017 and 2023

Figure 14 North America to Hold Largest Share of Market in 2017

Figure 15 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 16 Increasing Demand for Acoustic Wave Sensors in Automotive Vertical Drives Market

Figure 17 Acoustic Wave Sensor Market, By Type

Figure 18 Market for Saw Sensors to Grow at Higher CAGR During Forecast Period

Figure 19 Market, By Device

Figure 20 Acoustic Wave Sensor Market for Resonators in APAC to Grow at Highest CAGR During Forecast Period

Figure 21 Market: By Sensing Parameter

Figure 22 Market for Torque to Grow at Highest CAGR Between 2017 and 2023

Figure 23 Acoustic Wave Sensor, By Vertical

Figure 24 Market for Automotive to Grow at Highest CAGR Between 2017 and 2023

Figure 25 Market for Automotive Torque Measurement to Grow at Highest CAGR During Forecast Period

Figure 26 Market for Food and Beverages for Temperature Sensing to Grow at Highest CAGR During Forecast Period

Figure 27 Market, By Geography

Figure 28 Geographic Snapshot of Market (2017)

Figure 29 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 30 Snapshot of Market in North America

Figure 31 Acoustic Wave Sensor Market in Europe for Automotive Segment for Tire Pressure Monitoring System to Grow at Highest CAGR Between 2017 and 2023

Figure 32 Snapshot of Acoustic Wave Sensor in APAC

Figure 33 Product Launches and Developments as Key Growth Strategies Adopted By Companies Between 2014 and 2015

Figure 34 Market (Global), Competitive Leadership Mapping, 2017

Figure 35 Market Evolution Framework: Product Launches and Developments Fueled Growth of Market (2014–2015)

Figure 36 Product Launches and Developments as Key Strategy Adopted By Companies

Figure 37 Transense Technologies PLC: Company Snapshot

Figure 38 Vectron International Inc.: Company Snapshot

The study involved 4 major activities in estimating the size of the acoustic wave sensor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the acoustic wave sensor market begins with capturing data on revenues of key vendors in the market, through secondary research. This study incorporates extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the acoustic wave sensor market. Vendor offerings have also been taken into consideration to determine market segmentation. The entire research methodology includes studying annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

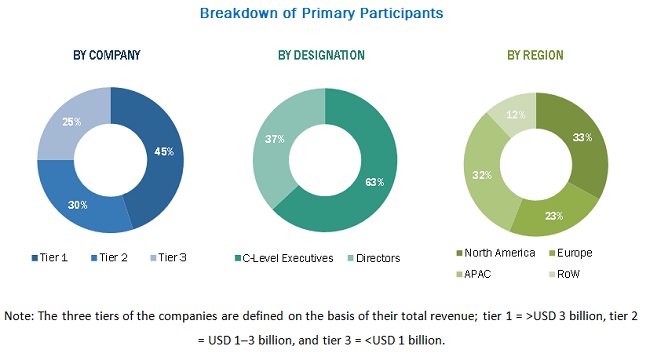

Primary Research

The acoustic wave sensor market comprises several stakeholders, such as suppliers of standard components and original equipment manufacturers (OEMs). The demand side of this market is characterized by the development of military, automotive, industrial healthcare, food and beverages, environment, and other end-user verticals. The supply side is characterized by advancements in the types of sensors and diverse offerings. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the acoustic wave sensor market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends in both the demand and supply sides of the acoustic wave sensor market.

Research Objective

- To describe and forecast the acoustic wave sensor market, in terms of value, by type, device, sensing parameter, vertical, and region

- To describe and forecast the acoustic wave sensor market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the acoustic wave sensor market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the acoustic wave sensor ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the acoustic wave sensor market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Acoustic Wave Sensor Market