Underwater Acoustic Communication Market Size, Share, Statistics and Industry Growth Analysis Report By Interface Platform (Sensor Interface, Acoustic Modem), Application (Environmental Monitoring, Pollution Monitoring, Hydrography, Oceanography), Communication Depth, End User and Region - Global Forecast to 2028

Updated on : October 22, 2024

The underwater acoustic communication market is witnessing significant growth due to rising demand for reliable communication solutions in marine environments. Industries such as oil and gas, maritime defense, and marine research are increasingly relying on efficient underwater communication systems, driven by the expansion of underwater robotics and autonomous underwater vehicles (AUVs). Key trends include advancements in signal processing and the development of sophisticated acoustic modems that enhance data transmission rates. Looking ahead, the market is set for further growth as investments in research and development focus on improving communication range and capabilities, driven by the need for resource exploration and environmental monitoring.

Underwater Acoustic Communication Market Size

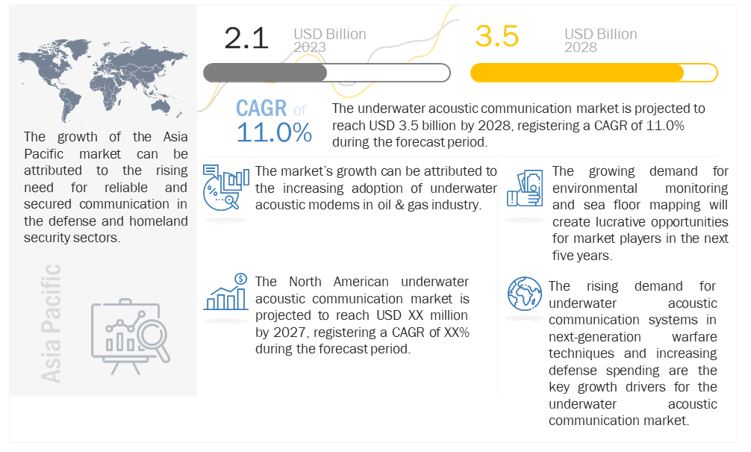

[199 Pages Report] Global Underwater acoustic communication market size is valued at USD 2.1 billion in 2023 and is anticipated to be USD 3.5 billion by 2028; growing at a CAGR of 11.0% from 2023 to 2028. Factors such as increasing adoption of underwater acoustic modems in oil & gas industry and growing deployment of acoustic navigation for underwater positioning are fueiling the market growth for underwater acoustic communication industry.

Underwater Acoustic Communication Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Underwater Acoustic Communication Market Dynamics

Driver: Growing deployment of acoustic navigation for underwater positioning

Acoustic navigation is the most used way for underwater navigation and positioning. Based on deployment, it can be classified as long-baseline system (LBL), short baseline system (SBL), and ultra-short baseline system (USBL). The acoustic method determines the relative positions of underwater vehicles by using deployed baseline transponders as underwater reference points and calculating signals from them. Acoustic navigation for underwater positioning is heavily used in defense and navy. Currently, LBL and USBL are the most commercially used, such as Kongsberg’s HiPAP series of acoustic positioning devices which can be used as both LBL or USBL as desired. These HiPAP series acoustic positioning devices can switch modes while having both the high accuracy of LBL and the convenience of USBL. These devices are so advanced that HiPAP-602 can work at a depth of 7,000 m and has an accuracy of 0.02 m. All these factors have increased the usage of underwater acoustic navigation and, hence, driving the market growth

Restraint: Delayed delivery rates in underwater communication

The propagation speed in underwater wireless sensor networks (UWSNs) is about 200,000 times slower than that in terrestrial wireless sensor networks (TWSNs). Specifically, the propagation speed of TWSN radio channels is 300,000,000 m/s, while the propagation speed of UWSN acoustic channels is only about 1500 m/s. Thus, guaranteeing bounded end-to-end delay would be challenging in underwater communication.

Opportunity: Usage of 5G network for underwater communication

Underwater wireless communication is intended to share information effectively among connected sensors, underwater vehicles, computing devices, surface stations, robotic equipment, etc. It helps to monitor real-world underwater assets, micro-organisms, human activities, sudden disasters, etc. 5G technology is pushing the boundaries of wireless communications, enabling use cases that rely on ultra-fast speeds, low latency, and high reliability. 5G supports all radio frequency, electromagnetic waves, optic signals, and acoustic signals for advanced underwater communication systems. 6G networks are combined with Space-Air-Ground-Sea Integrated Networks (SAGSIN) to attain universal coverage.

Challenge: Security threat in underwater communication

Underwater networks are usually left unattended for long durations, exposing them to diverse potential threats. Due to the wide data broadcasting range of these networks, their physical channel (both wired and wireless) is prone to eavesdropping. Secure communication is crucial in many internet of underwater things (IoUT) infrastructures such as harbor security, coastal defense, and many more, where unauthorized access can have serious consequences. The security threats in underwater communications can be divided into passive and active attacks, in accordance with the actions taken by the intruders.

Acoustic modem by interface platform to capture highest market share of underwater acoustic communication market during forecast period

The increasing adoption of underwater acoustic modems in naval defense to support communication systems is projected to drive the growth of the acoustic modem segment. These systems are used in applications such as submarine communication, diver communication, remote underwater monitoring, and command and control. Developed countries are focusing on their naval defense forces and actively using unmanned underwater vehicles for communication and navigation applications.

Medium water segment by communication depth to hold highest market share in underwater acoustic communication market during the forecast period.

Increasing environmental awareness among the public and industries to minimize environmental impact is creating new requirements for effective monitoring and safe process control systems Sonardyne’s Modem 6 Sub-Mini is a compact and transmission-suitable acoustic modem for transferring data from a wide range of sensors, including current profilers, temperatures, depth, and custom instrumentation. An acoustic modem named type 8377-1111 has a depth rating of 1,000 m and an omnidirectional transducer designed for horizontal and water communication in medium water depth.

Environmental monitoring applications expected to hold the largest share in underwater acoustic communication market during the forecast period

The US Environmental Protection Agency (EPA) Environmental Monitoring and Assessment Program (EMAP) perform research on the undersea environment to study the aquatic ecosystems across the US. The risk of oil spills and leaks from offshore oil and gas production is a major challenge and threat to the environment. In underwater acoustics, environmental monitoring is one of the major applications allowing the transmission of information in a directivity controlled and efficient manner.

Scientific Research & Development segment by end user is expected to hold the largest market share of underwater acoustic communication market

Underwater acoustic communication is affected by the seawater environment and the complexity of underwater acoustic channels. Underwater acoustic communication is of great significance to the marine survey, thus, witnessing a continuous demand for scientific research & development. Various countries attach great importance to the development of underwater acoustic communication technology and continuously overcome the difficulties of underwater communication problems.

Underwater Wireless Communication Market

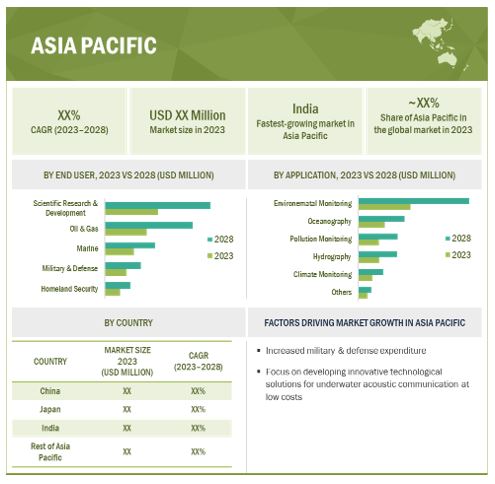

Underwater Acoustic Communication Market in asia pacific to grow at highest CAGR during the forecast period

Underwater Acoustic Communication Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The underwater acoustic communication companies such as Teledyne Technologies Incorporated (US), KONGSBERG (Norway), Thales (France), L3Harris (US), Ultra (UK), Sonardyne International (UK), EvoLogics GmbH (Germany), Moog, Inc. (US) and Nortek (Norway). These players have adopted product launches, contracts, collaborations, agreements, and acquisitions to grow in the market.

Underwater Acoustic Communication Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.1 billion in 2023 |

| Projected Market Size | USD 3.5 billion by 2028 |

| Growth Rate | CAGR of 11.0% |

|

Market size available for years |

2019–2023 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Interfcae Platform, By Communication Depth, By Application, By End User and By Region |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies covered |

The key players operating in the underwater acoustic communication market are L3Harris (US), Ultra (UK), KONGSBERG (Norway), Thales (France), Sonardyne International (UK), Teledyne Technologies Incorporated (US), EvoLogics GmbH (Germany), Moog, Inc. (US) and Nortek (Norway). |

Underwater Acoustic Communication Market Highlights

The study categorizes the underwater acoustic communication market based on By Interface Platform, By Communication Depth, By Application, By End User and By Region

|

Aspect |

Details |

|

By Interface Platform: |

|

|

By Communication Depth: |

|

|

By Application: |

|

|

By End-User: |

|

|

By Region: |

|

Recent Developments in Underwater Acoustic Communication Industry

- In August 2022, KONGSBERG Marine has launched EcoAdvisor, which monitors the vessel operations and its environment, including power generation, propulsion, environmental forces, and control system dynamics. EcoAdvisor enables operators to reduce fuel, emissions, and maintenance costs without compromising vessel redundancy margins or operational efficiency.

- In July 2022, Teledyne Technologies acquired NL Acoustics (Finland), an advanced acoustics-based predictive maintenance solution provider. NL Acoustics specializes in advanced acoustic imaging instruments. The company’s easy-to-use acoustic cameras are designed and manufactured in Finland and used for predictive maintenance, such as locating faults, making production processes more efficient, and saving energy and costs.

- In March 2022, Sonardyne launched Deck Topside, which can acoustically test, load, interrogate and activate the acoustic release transponders, as well as initiation transponder 6 (IT 6)

Frequently Asked Questions (FAQ):

What is the current size of the global underwater acoustic communication market?

The underwater acoustic communication market is projected to grow from USD 2.1 billion in 2023 to USD 3.5 billion by 2028; it is expected to grow at a CAGR of 11.0% from 2023 to 2028.

What is underwater acoustic communication?

Underwater acoustic communication is a technique of sending and receiving messages below the water. The Underwater Acoustic Sensor Network (UW-ASN) consists of many sensors and vehicles that are deployed to perform collaborative monitoring tasks over a given area. These sensors and vehicles can adapt to the characteristics of the ocean environment. Underwater acoustic communication is widely used for coastal surveillance and autonomous underwater vehicle (AUV) operations. Compared to terrestrial communication, underwater communication has low data rates because it uses acoustic waves instead of electromagnetic waves.

What are the challenges in the underwater acoustic communication market?

Security threats in underwater communication and bandwidth limitation are some of the challenges faced by underwater acoustic communication market.

What are the technological trends going in the underwater acoustic communication market?

The Internet of Underwater Things (IoUT) is an emerging communication ecosystem developed for connecting underwater objects in underwater environments and maritime.

Which are the major companies in the underwater acoustic communication market?

The key players in the underwater acoustic communication market are Thales (France), L3Harris (US), Teledyne Technologies Incorporated (US), KONGSBERG (Norway) and Ultra (UK),

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the underwater acoustic communication market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

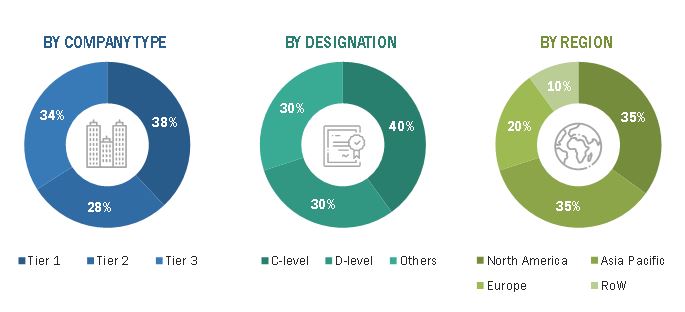

Primary Research

Extensive primary research was conducted after understanding and analyzing the underwater acoustic communication market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East & Africa and South America).

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the overall underwater acoustic communication market size and the various dependent submarkets. The key players involved in the manufacturing of underwater acoustic communication equipment in the market have been identified through secondary research, and their market shares in the respective geographies have been determined through primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to derive the final quantitative and qualitative data. This data is consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

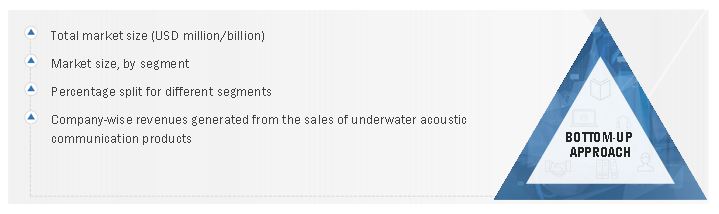

Market Size Estimation Methodology-Bottom-up approach

The bottom-up procedure has been employed to arrive at the overall size of the underwater acoustic communication from the revenue of key players (companies) and their market share.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained in the earlier sections, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the underwater acoustic communication market in terms of value and based on interface platform, communication depth, application, end user, and operating range (qualitative information)

- To forecast the underwater acoustic communication market in terms of volume

- To forecast the market size of the various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and their core competencies2 and provide the details of the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, product launches, and research and development (R&D) activities in the underwater acoustic communication market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Underwater Acoustic Communication Market