Acrylic Adhesives Market by Type (Acrylic Polymer Emulsion, Cyanoacrylic, Methacrylic, UV Curable Acrylic), Application (Paper & Packaging, Construction, Transportation, Medical, Consumer, Electronics), Technology, and Region - Global Forecast to 2022

[152 Pages Report] The Acrylic Adhesives Market is projected to grow from USD 8.84 Billion in 2017 to USD 11.72 Billion by 2022, at a CAGR of 5.81% between 2017 and 2022. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objectives of the Study:

- To define, describe, and forecast the acrylic adhesives market based on type, formulating technology, application, and region

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, industry-specific challenges, winning imperatives, and burning issues influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, growth prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape of the market

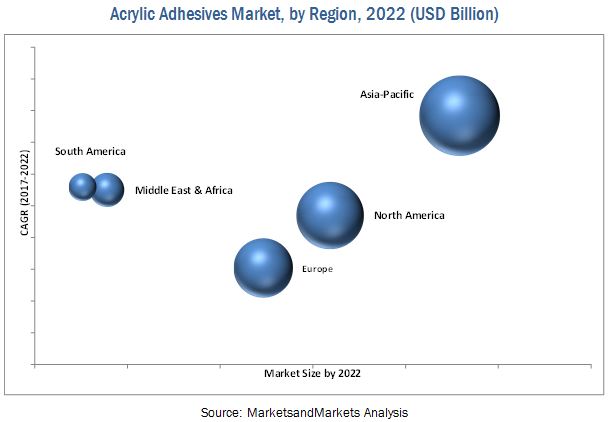

- To forecast the market size, in terms of value, with respect to regions (along with country-level data), namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America

- To profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the acrylic adhesives market

Both top-down and bottom-up approaches were used to estimate and validate the size of the acrylic adhesives market, and to estimate the size of various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for a technical, market-oriented, and commercial study of the acrylic adhesives market.

The acrylic adhesives market has a diversified and established ecosystem of upstream players such as raw material suppliers and downstream stakeholders such as manufacturers, vendors, end users, and government organizations. Key players operational in the market include Henkel AG & Company (Germany), 3M Company (U.S.), Bostik SA (France), H.B. Fuller (U.S.), Illinois Tool Works Inc. (U.S.), Avery Dennison (U.S.), Sika AG (Switzerland), Pidilite Industries Limited (India), and Royal Adhesives & Sealants LLC (U.S.).

Key Target Audience:

- Manufacturers of Acrylic Adhesives

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Acrylic Adhesives

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

Scope of the Report:

The global acrylic adhesives market has been covered in detail in this report. Current market demand and forecasts have also been included to provide a comprehensive market scenario.

Acrylic Adhesives Market, By Technology:

- Water-based

- Solvent-based

- Reactive and Others

Acrylic Adhesives Market, By Type:

- Acrylic Polymer Emulsion

- Cyanoacrylic

- Methacrylic

- UV Curable Acrylic

Acrylic Adhesives Market, By Application:

- Paper & Packaging

- Construction

- Transportation

- Medical

- Consumer

- Woodworking

- Electronics

- Others

Acrylic Adhesives Market, By Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the acrylic adhesives market based on type and application

- Detailed analysis and profiles of additional market players

The acrylic adhesives market is projected to grow from USD 8.84 Billion in 2017 to USD 11.72 Billion by 2022, at a CAGR of 5.81% between 2017 and 2022. Acrylic adhesives are versatile products that find application in varied industrial sectors. Growing usage of acrylic adhesives in end-use industries, improved quality of adhesives, and increased demand for durable adhesive products are the drivers for the market. The increasing demand in the developing Asia-Pacific region, high growth in end-use industries, and the shift in consumer preferences towards high-quality products are propelling the growth of the acrylic adhesives market. The demand for environmental benefits, such as reduced Volatile Organic Compound (VOC) emissions, and aesthetic bonding solutions for various substrates are expected to further fuel the growth of the acrylic adhesives market.

Medical is projected to be the fastest-growing application segment during the forecast period. Increasing aging population and advancements in medical devices such as lightweight and micro machineries will continue to fuel the use of UV curable and cyanoacrylic adhesives in medical devices, including IV delivery systems, catheters, syringes, hearing aids, silicone rubber components, and others. Such developments and advancements are expected to propel the growth of the acrylic adhesives market, globally.

The acrylic polymer emulsion adhesives segment accounts for the largest share of the overall global acrylic adhesives market due to their easy availability and wide acceptability in applications such as paper & packaging and construction sectors. Water-based adhesives is the largest formulating technology segment, in terms of both value and volume. The increasing demand for VOC-free adhesives has given rise to the use of water-based acrylic adhesives in mature markets such as North America and Europe.

Asia-Pacific is the largest and fastest-growing market for acrylic adhesives. The increasing use of acrylic adhesives in paper & packaging, construction, and woodworking applications is expected to provide new growth opportunities to the market. High economic growth, growth in manufacturing industries, availability of cheap labor, growing end-use markets, and global shift of production facilities from developed markets to emerging markets are some of the key factors driving the acrylic adhesives market in Asia-Pacific.

The restraining factor for the acrylic adhesives market growth is identified as environmental regulations in European countries. Key manufacturers of acrylic adhesives include Henkel AG & Company (Germany), 3M Company (U.S.), Bostik SA (France), H.B. Fuller (U.S.), Illinois Tool Works Inc. (U.S.), Avery Dennison (U.S.), Sika AG (Switzerland), and Royal Adhesives & Sealants, LLC (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 By Region

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

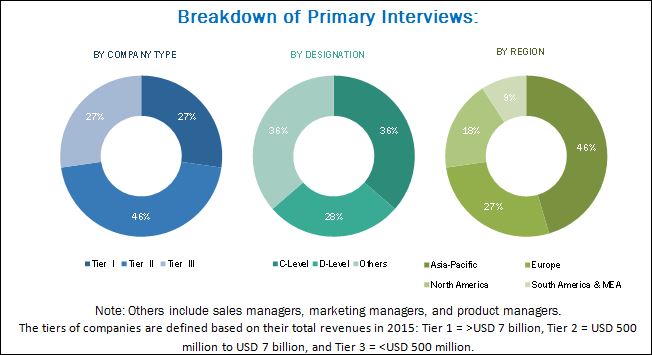

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Global Acrylic Adhesives Market

4.2 Acrylic Adhesives Market, By Type

4.3 Acrylic Adhesives Market, By Application and Country in Asia-Pacific

4.4 Acrylic Adhesives Market, By Country

4.5 Acrylic Adhesives Market, Developed vs Developing Countries

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Impact Analysis of Drivers

5.2.2 Drivers

5.2.2.1 Rise in Demand for Acrylic Adhesives in Asia-Pacific Region

5.2.2.2 Increasing Demand for Miniaturization and Automation in Electronics Industry

5.2.2.3 Technological Advancements in End-Use Industries

5.2.3 Restraints

5.2.3.1 Stringent Environmental Regulations in European Countries

5.2.3.2 Volatility in Raw Material Prices

5.2.4 Opportunities

5.2.4.1 Innovation in Applications and Products

5.2.4.2 Increase in Export From Asia-Pacific Countries

5.2.4.3 Lucrative Opportunities Across Asia-Pacific, the Middle East & Africa, and South America Markets

5.2.5 Challenges

5.2.5.1 Stringent and Time-Consuming Regulatory Policies

5.2.5.2 Controlling Prices to Ensure Affordability

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Porters Five Forces Analysis

6.2.1 Intensity of Competitive Rivalry

6.2.2 Bargaining Power of Buyers

6.2.3 Bargaining Power of Suppliers

6.2.4 Threat of Substitutes

6.2.5 Threat of New Entrants

7 Patent Analysis (Page No. - 43)

7.1 Introduction

7.2 Patent Details

8 Macro Economic Overview and Key Trends (Page No. - 47)

8.1 Introduction

8.2 Trends and Forecast of GDP

8.3 Trends and Forecast of the Construction Industry

8.3.1 North America: Trends and Forecast of the Construction Industry

8.3.2 Europe: Trends and Forecast of the Construction Industry

8.3.3 Asia-Pacific: Trends and Forecast of the Construction Industry

8.3.4 Middle East & Africa: Trends and Forecast of the Construction Industry

8.3.5 South America: Trends and Forecast of the Construction Industry

9 Adhesives Market, By Technology (Page No. - 51)

9.1 Introduction

9.2 Water-Based Acrylic Adhesives

9.3 Solvent-Based Acrylic Adhesives

9.4 Reactive & Other Acrylic Adhesives

10 Acrylic Adhesives Market, By Type (Page No. - 56)

10.1 Introduction

10.2 Acrylic Polymer Emulsion

10.2.1 Pure Acrylic

10.2.2 Styrene Acrylics

10.2.3 Vinyl Acrylics

10.3 Cyanoacrylic Adhesives

10.3.1 Ethyl Cyanoacrylate

10.3.2 Methyl Cyanoacrylate

10.3.3 Other Cyanoacrylates

10.3.3.1 N-Butyl Cyanoacrylate

10.3.3.2 2-Octyl Cyanoacrylate

10.4 Methacrylic Adhesives

10.5 UV Curable Acrylic Adhesives

11 Acrylic Adhesives Market, By Application (Page No. - 63)

11.1 Introduction

11.2 Paper & Packaging

11.3 Construction

11.4 Woodworking

11.5 Transportation

11.6 Electrical & Electronics

11.7 Consumer

11.8 Medical

11.9 Other Applications

11.9.1 Bookbinding

11.9.2 Signage

11.9.3 Leather & Footwear

12 Acrylic Adhesives Market, By Region (Page No. - 76)

12.1 Introduction

12.2 Asia-Pacific

12.2.1 Country-Wise Key Insights

12.2.1.1 China

12.2.1.2 India

12.2.1.3 Japan

12.2.1.4 South Korea

12.2.1.5 Taiwan

12.2.1.6 Thailand

12.2.1.7 Indonesia

12.2.1.8 Rest of Asia-Pacific

12.3 North America

12.3.1 Country-Wise Key Insights

12.3.1.1 U.S.

12.3.1.2 Canada

12.3.1.3 Mexico

12.4 Europe

12.4.1 Country-Wise Key Insights

12.4.1.1 Germany

12.4.1.2 France

12.4.1.3 U.K.

12.4.1.4 Russia

12.4.1.5 Italy

12.4.1.6 Turkey

12.4.1.7 Netherlands

12.4.1.8 Spain

12.4.1.9 Rest of Europe

12.5 Middle East & Africa

12.5.1 Country-Wise Key Insights

12.5.1.1 UAE

12.5.1.2 Saudi Arabia

12.5.1.3 South Africa

12.6 South America

12.6.1 Country-Wise Key Insights

12.6.1.1 Brazil

12.6.1.2 Argentina

12.6.1.3 Colombia

12.6.1.4 Rest of South America

13 Competitive Landscape (Page No. - 109)

13.1 Introduction

13.2 Dive Analysis for Acrylic Adhesives Market Players

13.2.1 Vanguards

13.2.2 Innovators

13.2.3 Dynamic

13.2.4 Emerging

13.3 Competitive Benchmarking

13.3.1 Product Offerings

13.3.2 Business Strategy

14 Company Profiles (Page No. - 113)

(Business Overview, Products & Services, Key Insights, Recent Developments, )*

14.1 Henkel AG & Company

14.2 H.B. Fuller

14.3 Bostik Sa

14.4 Illinois Tool Works Inc.

14.5 Sika AG

14.6 3M Company

14.7 Huntsman Corporation

14.8 Avery Dennison Corporation

14.9 Pidilite Industries

14.10 Toagosei Co., Ltd.

14.11 Royal Adhesives & Sealants, LLC

14.12 Permabond LLC.

14.13 List of Other Companies

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 146)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (85 Tables)

Table 1 Acrylic Adhesives: Market Snapshot

Table 2 Trends and Forecast of GDP, USD Billion (20152021)

Table 3 Construction Industry in North America, By Country, USD Billion (20142021)

Table 4 Construction Industry in Europe, By Country, USD Billion (20142021)

Table 5 Construction Industry in Asia-Pacific, By Country, USD Billion (20142021)

Table 6 Construction Industry in Middle East & Africa, USD Billion (20142021)

Table 7 Construction Industry in South America, USD Billion (20142021)

Table 8 Acrylic Adhesives Market Size, By Technology, 20152022 (USD Million)

Table 9 Market Size, By Technology, 20152022 (Kiloton)

Table 10 Water-Based Acrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 11 Water-Based Acrylic Adhesive Market Size, By Region, 20152022 (Kiloton)

Table 12 Solvent-Based Acrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 13 Solvent-Based Acrylic Adhesive Market Size, By Region, 20152022 (Kiloton)

Table 14 Reactive & Other Acrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 15 Reactive & Other Acrylic Adhesive Market Size, By Region, 20152022 (Kiloton)

Table 16 Acrylic Adhesives Market Size, By Type, 20152022 (USD Million)

Table 17 Market Size, By Type, 20152022 (Kiloton)

Table 18 Acrylic Polymer Emulsion Adhesives Market Size, By Region, 20152022 (USD Million)

Table 19 Acrylic Polymer Emulsion Adhesive Market Size, By Region, 20152022 (Kiloton)

Table 20 Cyanoacrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 21 Cyanoacrylic Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 22 Methacrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 23 Methacrylic Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 24 UV Curable Acrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 25 UV Curable Acrylic Adhesive Market Size, By Region, 20152022 (Kiloton)

Table 26 Acrylic Adhesives Market Size, By Application, 20152022 (USD Million)

Table 27 Market Size, By Application, 20152022 (Kiloton)

Table 28 Acrylic Adhesives Market Size in Paper & Packaging Application, By Region, 20152022 (USD Million)

Table 29 Market Size in Paper & Packaging Application, By Region, 20152022 (Kiloton)

Table 30 Acrylic Adhesives Market Size in Construction Application, By Region, 20152022 (USD Million)

Table 31 Market Size in Construction Application, By Region, 20152022 (Kiloton)

Table 32 Acrylic Adhesives Market Size in Woodworking Application, By Region, 20152022 (USD Million)

Table 33 Market Size in Woodworking Application, By Region, 20152022 (Kiloton)

Table 34 Acrylic Adhesives Market Size in Transportation Application, By Region, 20152022 (USD Million)

Table 35 Market Size in Transportation Application, By Region, 20152022 (Kiloton)

Table 36 Acrylic Adhesives Market Size in Electrical & Electronics Application, By Region, 20152022 (USD Million)

Table 37 Market Size in Electrical & Electronics Application, By Region, 20152022 (Kilotons)

Table 38 Acrylic Adhesives Market Size in Consumer Application, By Region, 20152022 (USD Million)

Table 39 Market Size in Consumer Application, By Region, 20152022 (Kiloton)

Table 40 Acrylic Adhesives Market Size in Medical Application, By Region, 20152022 (USD Million)

Table 41 Market Size in Medical Application, By Region, 20152022 (Kiloton)

Table 42 Acrylic Adhesives Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 43 Market Size in Other Applications, By Region, 20152022 (Kiloton)

Table 44 Acrylic Adhesives Market Size, By Region, 20152022 (USD Million)

Table 45 Market Size, By Region, 20152022 (Kiloton)

Table 46 Asia-Pacific: Acrylic Adhesives Market Size, By Country, 20152022 (USD Million)

Table 47 Asia-Pacific: By Market Size, By Country, 20152022 (Kiloton)

Table 48 Asia-Pacific: By Market Size, By Type, 20152022 (USD Million)

Table 49 Asia-Pacific: By Market Size, By Type, 20152022 (Kiloton)

Table 50 Asia-Pacific: By Market Size, By Technology, 20152022 (USD Million)

Table 51 Asia-Pacific: By Market Size, By Technology, 20152022 (Kiloton)

Table 52 Asia-Pacific: By Market Size, By Application, 20152022 (USD Million)

Table 53 Asia-Pacific: By Market Size, By Application, 20152022 (Kiloton)

Table 54 North America: Acrylic Adhesives Market Size, By Country, 20152022 (USD Million)

Table 55 North America: By Market Size, By Country, 20152022 (Kiloton)

Table 56 North America: By Market Size, By Type, 20152022 (USD Million)

Table 57 North America: By Market Size, By Type, 20152022 (Kiloton)

Table 58 North America: By Market Size, By Technology, 20152022 (USD Million)

Table 59 North America: By Market Size, By Technology, 20152022 (Kiloton)

Table 60 North America: By Market Size, By Application, 20152022 (USD Million)

Table 61 North America: By Market Size, By Application, 20152022 (Kiloton)

Table 62 Europe: Acrylic Adhesives Market Size, By Country, 20152022 (USD Million)

Table 63 Europe: By Market Size, By Country, 20152022 (Kiloton)

Table 64 Europe: By Market Size, By Type, 20152022 (USD Million)

Table 65 Europe: By Market Size, By Type, 20152022 (Kiloton)

Table 66 Europe: By Market Size, By Technology, 20152022 (USD Million)

Table 67 Europe: By Market Size, By Technology, 20152022 (Kiloton)

Table 68 Europe: By Market Size, By Application, 20152022 (USD Million)

Table 69 Europe: By Market Size, By Application, 20152022 (Kiloton)

Table 70 Middle East & Africa: Acrylic Adhesives Market Size, By Country, 20152022 (USD Million)

Table 71 Middle East & Africa: By Market Size, By Country, 20152022 (Kiloton)

Table 72 Middle East & Africa: Acrylic Adhesives Market Size, By Type, 20152022 (USD Million)

Table 73 Middle East & Africa: By Market Size, By Type, 20152022 (Kiloton)

Table 74 Middle East & Africa: By Market Size, By Technology, 20152022 (USD Million)

Table 75 Middle East & Africa: By Market Size, By Technology, 20152022 (Kiloton)

Table 76 Middle East & Africa: By Market Size, By Application, 20152022 (USD Million)

Table 77 Middle East & Africa: Market Size, By Application, 20152022 (Kiloton)

Table 78 South America: Acrylic Adhesives Market Size, By Country, 20152022 (USD Million)

Table 79 South America: Market Size, By Country, 20152022 (Kiloton)

Table 80 South America: Market Size, By Type, 20152022 (USD Million)

Table 81 South America: Market Size, By Type, 20152022 (Kiloton)

Table 82 South America: Market Size, By Technology, 20152022 (USD Million)

Table 83 South America: Market Size, By Technology, 20152022 (Kiloton)

Table 84 South America: Market Size, By Application, 20152022 (USD Million)

Table 85 South America: Market Size, By Application, 20152022 (Kiloton)

List of Figures (47 Figures)

Figure 1 Acrylic Adhesives Market Segmentation

Figure 2 Acrylic Adhesive Market, By Region

Figure 3 Acrylic Adhesive Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Acrylic Adhesive Market: Data Triangulation

Figure 7 Asia-Pacific to Dominate Acrylic Adhesive Market During Forecast Period

Figure 8 Acrylic Polymer Emulsion Adhesives Dominates Overall Acrylic Adhesive Market (20172022)

Figure 9 Medical to Be the Fastest-Growing Application Between 2017 and 2022

Figure 10 Asia-Pacific to Be the Fastest-Growing Market for Acrylic Adhesives By 2022

Figure 11 Emerging Economies Offer Lucrative Opportunities in the Acrylic Adhesive Market During Forecast Period

Figure 12 Acrylic Polymer Emulsion to Dominate Acrylic Adhesive Market During Forecast Period

Figure 13 Paper & Packaging Application Accounts for Largest Share of Asia-Pacific Market in 2016

Figure 14 India to Be the Fastest-Growing Market for Acrylic Adhesives

Figure 15 Market in Developing Countries to Grow Faster Than That Developed Countries, 20172022

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Acrylic Adhesive Market

Figure 17 Impact Analysis: Acrylic Adhesive Market

Figure 18 Growth in Electronics Industry, 2015 to 2017

Figure 19 Acrylic Adhesives Market: Porters Five Forces Analysis

Figure 20 Japan Accounted for Highest Number of Patents Registered Between 2015 and 2017*

Figure 21 3M Company Registered Highest Number of Patents Between 2015 and 2017*

Figure 22 GDP of Major Countries in 2016

Figure 23 Acrylic Adhesives to Continue Dominating the Market Between 2017 and 2022

Figure 24 Rising Demand From Major Applications to Drive the Market

Figure 25 Medical is the Largest Application Segment, 20172022

Figure 26 Global Production of Vehicles, 2015 and 2016

Figure 27 Growth in Medical Device & Equipment Adhesives Market

Figure 28 Regional Snapshot: Asia-Pacific Countries to Register the Highest CAGR in Acrylic Adhesive Market During Forecast Period

Figure 29 Emerging Regions to Be the Fastest-Growing Acrylic Adhesive Market

Figure 30 Asia-Pacific: Strategic Destination for All Acrylic Adhesive Technologies

Figure 31 Asia-Pacific Dominates Acrylic Adhesive Market, By Application

Figure 32 Asia-Pacific Dominated the Acrylic Adhesive Market in 2016

Figure 33 Asia-Pacific Accounted for the Largest Market Share, in Terms of Value, in 2016

Figure 34 Asia-Pacific Market Snapshot: China is the Most Lucrative Acrylic Adhesive Market

Figure 35 North American Acrylic Adhesive Market Snapshot: the U.S. Was the Largest Market in 2016

Figure 36 European Acrylic Adhesive Market Snapshot: Germany Was the Largest Market in 2016

Figure 37 Acrylic Adhesive Market: Dive Chart

Figure 38 Henkel AG & Company: Company Snapshot

Figure 39 H.B. Fuller: Company Snapshot

Figure 40 Bostik Sa: Company Snapshot

Figure 41 Illinois Tool Works Inc. Company Snapshot

Figure 42 Sika AG: Company Snapshot

Figure 43 3M Company: Company Snapshot

Figure 44 Huntsman Corporation: Company Snapshot

Figure 45 Avery Dennison Corporation: Company Snapshot

Figure 46 Pidilite Industries: Company Snapshot

Figure 47 Toagosei Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Acrylic Adhesives Market