Aerospace Robotics Market by Robot Type (Traditional Robots, Collaborative Robots), Component (Controllers, Arm Processor, Sensors, Drive, End Effectors), Payload, Application, Region (North America, Europe, Asia Pacific, RoW) 2026

Update: 11/05/2024

Aerospace robotics involves the use of robotic systems to enhance the design, manufacturing, maintenance, and operation of aircraft, spacecraft, and other aerospace systems. In manufacturing, robots perform tasks such as welding, painting, assembly, and material handling with high precision, leading to better quality control and safety. In maintenance, robots like inspection drones and crawlers can conduct detailed checks on aircraft surfaces and engines, reducing downtime. In space applications, robotic arms on spacecraft perform satellite repairs, support construction in space, and assist in scientific exploration on planetary surfaces. Aerospace robotics is crucial for improving operational efficiency, precision, and safety while reducing labor costs and minimizing human risk in complex aerospace environments.

Aerospace Robotics Market Size & Growth

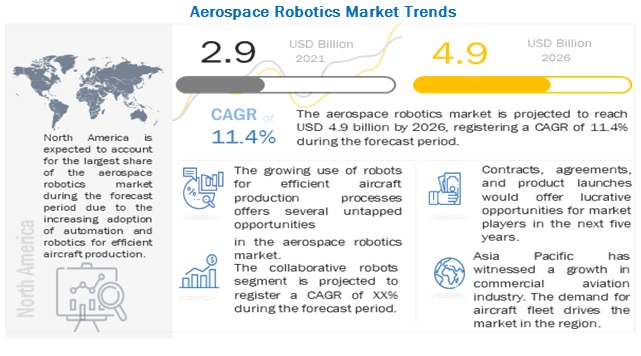

The Global Aerospace Robotics Industry Size was valued at USD 2.9 Billion in 2021 and is estimated to reach USD 4.9 billion by 2026, growing at a CAGR of 11.4% during the forecast period. The aerospace industry has witnessed significant growth, owing to increased air passenger traffic in recent years. This has consequently led to a rise in aircraft orders by various airliners globally. A larger number of aircraft manufacturers have been using traditional processes for aircraft manufacturing. Manufacturers are required to ensure efficient and error-free fleet production processes, owing to stringent rules and regulations regarding the quality of the product in the aerospace industry. Robots are increasingly replacing traditional methods across production processes to manufacture high quality products in less time. Robots can be programmed to repetitively perform tasks over without variation, with a high degree of accuracy. These tasks are performed by specified routines that specify the direction, acceleration, velocity, deceleration, and distance of a series of coordinated motions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Aerospace Robotics Market

- Components and required raw materials used to manufacture aerospace robotics were not available for ready production.

- The supply chain is experiencing transportation-related delays due to travel restrictions and shortage of workforce.

- Production/assembly lines are also either running at lower capacities or are completely shut down.

Long-term market drivers for aerospace robotics remain strong, and, before the pandemic, the market had started to show signs of recovery from the major market price reset. The COVID-19 pandemic has swept the world, with many industries trying to stay afloat. Governments and businesses involved with robotics are reacting differently to the new situation. Some product launches are moving forward, while some are not; some tests continue, and some are delayed; some companies still operate, and others have shuttered.

The spread of the COVID-19 pandemic has resulted in supply chain and logistical disruptions across North America. According to a survey published by the National Association of Manufacturers (NAM) in March 2020, ~80% of manufacturers expect that the pandemic will have a financial impact on their businesses. Some key companies in the region have closed their facilities and are mulling employee layoffs. The manufacturing sector, which employs ~13 million workers in the US, is also expected to be impacted by the pandemic, primarily for two reasons: firstly, a number of manufacturing jobs are onsite which eliminates the scope of working remotely. Secondly, slowed economic activities have reduced demand for industrial products in the US and globally.

Aerospace Robotics Market Dynamics

Driver: Increase in manual labor cost

Aircraft manufacturers are trying to gain a competitive advantage over the other market players by providing lower-priced products. Increasing labor cost is one of the major concerns in the aerospace industry. The use of robots is expected to cut down labor costs and increase productivity. Though the initial cost of robots is high, it proves more beneficial than employing a huge workforce in the long term. Human workers need to be compensated in other ways, such as salaries, incentives, leaves, and allowances. However, a robot does not require any such compensation.

Restraints: Lack of skilled operators

Industrial robotization is a global technological megatrend (Deloitte, 2017, 2020; PwC, 2016), and the field of aerospace robotics is rapidly developing, accelerating the demand for robots considerably. Aerospace, industrial, and service robotics are growing fast worldwide. The global supply of aerospace robotics has practically doubled from 159,000 in 2012 to 294,000 in 2016. It reached 422,000 robot installations in 2018 and is forecasted to grow on average by 12% per year from 2020 to 2022 (International Federation of Robotics [IFR], 2019; IFR World Robotics, 2017).

Highly skilled employees are required to operate robots, owing to their complex functioning. One of the major factors restraining the adoption of robotics in the aerospace industry is that companies find it difficult to employ skilled operators who possess the necessary technical skills to operate robots. Furthermore, the maintenance of a robot is not easy and requires a specific skill set to perform preventive maintenance. Operators should know running a robot and the basic knowledge of the software programs through which the robot operates. The shortage of skilled labor limits the manufacturers from using robots on a full scale in the manufacturing process.

Opportunities: Human-robot collaboration

Robots are replacing traditional production processes in the aerospace industry to perform tasks that require skills and precision that humans cannot achieve. The emergence of collaborative robots has increased collaboration between human-robot collaboration, with robots operating hand-in-hand with human employees. This integration of robots with the human workforce has resulted in increased productivity and efficiency. Furthermore, in manufacturing, some tasks can be better performed by humans, while others can perform better by robots. The introduction of robots in the manufacturing of aircraft is a key growth opportunity for the aerospace robotics market to explore the diverse strengths of humans and robots

Challenges: High initial cost of implanting robotics.

The incorporation of robots in manufacturing processes involves high initial costs. Manufacturers are planning to adopt robotics in their manufacturing process need to carefully consider the return on investment before applying a new system in their plants. The purchasing of sophisticated robots and software requires huge capital. Implementing new industrial robots, including robots, controllers, software, and other systems, for a specific application can cost around USD 100,000 to USD 150,000. The need for regular maintenance and skilled labor is also required to be considered. Order backlogs have led to aircraft manufacturers employing robots in their manufacturing processes despite the high cost. However, implementing completely automated processes is still a challenge due to the high initial cost.

Aerospace Robotics Market Segments

Based on robot type, the traditional robots will register the highest growth from 2021 to 2026.

Traditional robots are primarily used for manufacturing. Traditional robots are automated, programmable, and capable of movement on three or more axes. Typical applications of traditional robots include welding, painting, assembly, disassembly, pick and place printed circuit boards, packaging and labeling, palletizing, product inspection, and testing. They can assist in material handling in warehouse applications as well. In 2020, nearly 1.64 million units of industrial robots were installed for various operations worldwide, according to the International Federation of Robotics (IFR).Articulated robots are the most commonly used industrial robots. They look like human arms, which is why they are also known as robotic arms or manipulator arms. An articulated robot has rotary joints. It may range from simple two-jointed robots to 10 or more joints. The joints are arranged one after the other so that one joint supports the other joints further in the chain. The arm is connected to the base with a twisting joint. These joints provide flexibility in reaching any part of the working space of the robot. This type of robot is generally used for applications such as painting, welding, and inspection, among others. This is the most common type of robot used in the aerospace industry because of the wide range of applications. This robot leads the automated world because of the speed, agility, and high degree of freedom that it provides.

Based on Component, the end effector segment will register the highest growth from 2021 to 2026.

End effectors are tools, which include mechanical and electrical devices installed on a robot wrist. End effectors are also called End of Arm Tooling (EOAT). Robotic end-effectors are increasingly being deployed within industrial settings to automate mundane and repetitive tasks away from human labor. Leading industry’s adoption has been the use of bespoke end-effectors designed for specific tasks in reproducible environments. However, these effectors are specifically designed to do specific tasks, and there is a need for hybrid effectors which can multi-task. For instance, a hybrid end effector can synergize both suction and fingered grasping into a single design.

Based on application, the handling segment is anticipated to hold major share in aerospace robotics market.

Handling robots enhance the efficiency of production lines and increase customer satisfaction by providing quality products in a timely manner. Material handling robots can automate some of the most tedious, dull, and unsafe tasks in a production line and is one of the easiest ways to add automation. Material handling robots enhance the efficiency of production lines and increase customer satisfaction by providing quality products in a timely manner. The term material handling encompasses a wide variety of product movements on the shop floor. Part selection and transferring, palletizing, packing, and machine loading are just a few of the applications that are considered material handling. The robot can efficiently and accurately move products from one location to another by fitting the robot with an appropriate end of arm tool (for example, gripper).

Aerospace Robotics Market Robots

Based on region, Asia Pacific region will register the highest growth from 2021 to 2026.

The presence of players like Commercial Aircraft Corporation of China, Ltd. (COMAC) and local manufacturers providing aerospace robotics systems at lower costs compared to other manufacturers is driving the market. COMAC has increased the modernization of its assembly and production line, increasing its capabilities for meeting the demand for aircraft.India is considered to be a key player in the Asia Pacific region in terms of the domestic aviation market and the international aviation industry. The Indian government is implementing new aviation policies to expand the domestic manufacturing of aircraft. A recent government policy allowed 100% FDI in the aerospace and manufacturing sector, which has attracted foreign manufacturers to India. Such policies will boost the manufacture of aerospace robotics in the country, as well as ease the technology transfer from the Western countries to India.

To know about the assumptions considered for the study, download the pdf brochure

Aerospace Robotics Industry Companies: Top Key Market Players

The Aerospace Robotics Companies are dominated by globally established players such as:

- Kuka AG (Germany)

- ABB Group (Switzerland)

- FANUC Corporation (Japan)

- Yaskawa electric corporation (Japan)

- Kawasaki Heavy Industries, Ltd (Japan)

These are among the key manufacturers that secured aerospace robotics contracts in the last few years. Major focus was given to the development of new products due to the changing requirements of robotic capabilities across the world.

Aerospace Robotics Market Report Scope:

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 2.9 Billion |

|

Revenue Forecast in 2026 |

USD 4.9 Billion |

|

Growth Rate |

11.4% |

|

Forecast period |

2021-2026 |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Robot type, By Component, By Application, By Payload |

|

Geographies covered |

|

|

Companies covered |

Kuka AG (Germany), ABB Group (Switzerland), FANUC Corporation (Japan), Yaskawa electric corporation (Japan), Kawasaki Heavy Industries Ltd (Japan), Mtorres (Spain), Oliver Crispin Robotics Limited (UK), Gudel AG (Switzerland), Electroimpact Inc. (US), Universal Robots A/S (Denmark) and others. Total 25 Market Players |

The study categorizes the aerospace robotics market based on robot type, component, application, payload, and region.

Aerospace Robotics Market by Solution

- Traditional robots

- Collaborative robots

By Component

- Controller

- Sensor

- Drive

- End effector

By Application

- Drilling & Fastening

- Non-destructive testing & Inspection

- Welding & soldering

- Sealing & dispensing

- Processing

- Handling

- Assembling & disassembling

By Payload

- up to 16.00 kg

- 16.01–60.00 kg

- 60.01–225.00 kg

- More than 225.00 kg

Aerospace Robotics Market By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In October 2021, Tecnoideal, an integrator specializing in the medical sector, contracted ABB industrial robots for its automated applications. Based in Modena, Italy, the company designs, exports and installs its machinery solutions all over the world, opening new possibilities for the fast, efficient and safe production of disposable medical devices.

- In August 2021, FANUC received a major order in the field of e-mobility. Scheduled for delivery in 2022, the company will supply the Cologne plant of Ford with around 500 robots to assist in the construction of electric car bodies.

- In June 2021, TP Advanced Manufacturing signed a contract with Swisslog AG to acquire and implement its robotic solutions to digitalize the entire material flow to production and manufacturing.

- In May 2021, Kawasaki Heavy Industries announced its receipt of an order by Modus Subsea Services Limited (MODUS) in UK for an AUV called SPICE. SPICE is the world's first AUV equipped with a robot arm for performing subsea pipeline inspections, developed based on a fusion of submarine-related technologies and industrial robot technologies fostered at Kawasaki over many years.

- In April 2021, The Daimler automotive group and the KUKA AG signed a new framework contract for the coming years. The order encompasses a four-figure number of robots and linear units as well as other KUKA technologies such as software and controllers.

- In December 2020, KUKA received an order from Mercedes-Benz for the engineering and construction, as well as the assembly and commissioning, of several body-in-white production lines. In the future, various vehicle models will be produced here.

Frequently Asked Questions (FAQ):

Which are the major companies in the aerospace robotics market? What are their major strategies to strengthen their market presence?

Some of the key players in the aerospace robotics market are Kuka AG (Germany), ABB Group (Switzerland), FANUC Corporation (Japan), Yaskawa electric corporation (Japan), Kawasaki Heavy Industries, Ltd (Japan), among others, are the key manufacturers that secured aerospace robotics contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their aerospace robotics market presence.

What are the drivers and opportunities for the aerospace roboticsmarket?

The market for aerospace roboticshas grown substantially across the globe, and especially in Asia Pacific, where an increase in fighter aircraft investments such as China, India, and South Korea, will offer several opportunities foraerospace roboticsindustrycompanies. An increase in global aircraft demand and manufacturing, increasing use of robots for efficient aircraft production processes, growing use of robotics to handle aircraft orders backlog, increasing manual labor cost are fueling the growth of the aerospace robotics market.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand from aerospace robotic systems in the region. China, Japan, and India in the Asia Pacific region are expected to increase acquisitions of robotic systems and invest in research & development in aerospace manufacturing. In addition to this, these countries are investing in automated solutions to strengthen their manufacturing capacities and make advancements in the manufacturing process. Companies from China and India are importing robotic technologies from Western countries to enhance the productivities of their facilities.

Which application of aerospace robotics systemis expected to significantlylead in the coming years?

The processing segment will register the highest growth from 2021 to 2026. When a product is made in a factory, it has to go through several different processes before it is shipped out to reach the consumer. First, it has to be picked, then it has to be packed into a box, and then those boxes have to be palletized. All of these applications can be automated with robots. Many aerospace manufacturing companies invest in picking, packing, or palletizing robots as they are able to perform these functions more accurately and efficiently than manual operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SEGMENTATION

1.2.2 REGIONAL SCOPE

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY & PRICING

1.4 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 AEROSPACE ROBOTICS MARKET: RESEARCH FLOW

FIGURE 2 AEROSPACE ROBOTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary insights

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

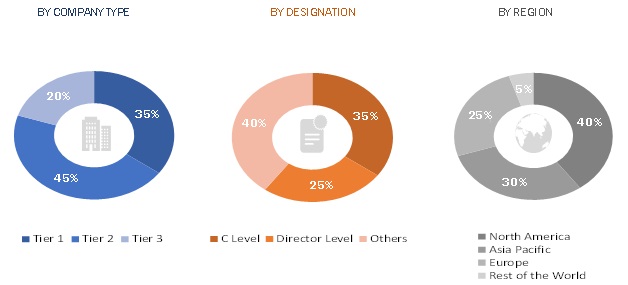

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.4 Primary details

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND SIDE INDICATORS

2.2.2.1 Increase in global demand for aircraft

FIGURE 4 GLOBAL AIRCRAFT DELIVERIES FROM 2016 TO 2020

2.2.2.2 Rise in demand for collaborative robot

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Increase in research & development on advanced aerospace robotics

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 COLLABORATIVE ROBOTS SEGMENT TO EXHIBIT HIGHEST CAGR, 2021-2026

FIGURE 9 CONTROLLER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 HANDLING SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO COMMAND MAJOR SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN AEROSPACE ROBOTICS MARKET

FIGURE 12 DEMAND FOR EFFICIENT AIRCRAFT PRODUCTION OFFERS UNTAPPED OPPORTUNITIES

4.2 AEROSPACE ROBOTICS MARKET, BY PAYLOAD

FIGURE 13 UP TO 16.00 KG PAYLOAD SEGMENT TO DOMINATE AEROSPACE ROBOTICS MARKET IN 2021

4.3 AEROSPACE ROBOTICS MARKET, BY REGION

FIGURE 14 NORTH AMERICA HELD LARGEST SHARE OF AEROSPACE ROBOTICS MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 AEROSPACE ROBOTICS MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in global aircraft demand and manufacturing

5.2.1.2 Increasing use of robots for efficient aircraft production processes

5.2.1.3 Growing use of robotics to handle aircraft orders backlog

FIGURE 16 AIRCRAFT DELIVERY BACKLOG, REGIONAL SHARE,2021

5.2.1.4 Increasing manual labor cost

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled operators

5.2.2.2 Maintenance requirement for robots

5.2.3 OPPORTUNITIES

5.2.3.1 Human-robot collaboration

5.2.3.2 Developments in automated additive manufacturing technology

5.2.4 CHALLENGES

5.2.4.1 High initial cost of implanting robotics

5.2.4.2 Possible hazards at workplace with implementation of robotics

5.3 IMPACT OF COVID-19 ON AEROSPACE ROBOTICS MARKET

FIGURE 17 IMPACT OF COVID-19 ON AEROSPACE ROBOTICS MARKET

5.4 RANGES AND SCENARIOS

FIGURE 18 IMPACT OF COVID-19 ON AEROSPACE ROBOTICS MARKET: 3 GLOBAL CENARIOS

5.5 VALUE CHAIN ANALYSIS OF AEROSPACE ROBOTICS MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AEROSPACE ROBOTICS MANUFACTURERS

FIGURE 20 REVENUE SHIFT IN AEROSPACE ROBOTICS MARKET

5.7 AEROSPACE ROBOTICS MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 21 MARKET ECOSYSTEM MAP: AEROSPACE ROBOTICS MARKET

TABLE 1 AEROSPACE ROBOTICS MARKET ECOSYSTEM

5.8 AVERAGE SELLING PRICE OF AEROSPACE ROBOTICS

TABLE 2 AVERAGE SELLING PRICE TRENDS OF AEROSPACE ROBOTICS, 2020 (USD MILLION)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 COMPETITIVE RIVALRY IN INDUSTRY

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

5.11 TRADE ANALYSIS

TABLE 4 COUNTRY-WISE IMPORT, INDUSTRIAL ROBOTICS, 2019–2020 (USD THOUSAND)

TABLE 5 COUNTRY-WISE EXPORTS, INDUSTRIAL ROBOTICS, 2019–2020 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 USE CASE ANALYSIS

6.2.1 USE CASE: ARC WELDING ROBOTS

6.2.2 USE CASE: AI IN AEROSPACE ROBOTICS

6.2.3 USE CASE: FULLY AUTONOMOUS MOBILE ROBOTS

6.3 TECHNOLOGY TRENDS

6.3.1 OPTOELECTRONICS SOLUTIONS FOR EMBEDDED SENSORS

TABLE 6 OPTOELECTRONIC EMBEDDED SENSORS: POSSIBLE APPLICATION IN AEROSPACE ROBOTICS

6.3.2 NANO TECHNOLOGY

TABLE 7 APPLICATION POSSIBILITY OF NANO TECHNOLOGY IN AEROSPACE ROBOTICS

6.3.3 INCREASING USE OF OPEN ARCHITECTURE SOFTWARE

TABLE 8 USE OF OPEN ARCHITECTURE IN AEROSPACE ROBOTICS:

TABLE 9 PROGRAMING LANGUAGE SOURCED, BY MAJOR INDUSTRIAL ROBOT MANUFACTURERS

6.3.4 ARTIFICIAL INTELLIGENCE

TABLE 10 APPLICATION OF ARTIFICIAL INTELLIGENCE IN AEROSPACE ROBOTICS

FIGURE 22 ARTIFICIAL INTELLIGENCE MARKET, 2014-2023

6.4 IMPACT OF MEGATRENDS

6.4.1 3D PRINTING

6.4.2 SHIFT IN GLOBAL ECONOMIC POWER

6.5 INNOVATION & PATENT REGISTRATIONS

TABLE 11 INNOVATION & PATENT REGISTRATIONS, 2018-2021

7 AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 23 TRADITIONAL ROBOTS SEGMENT PROJECTED TO LEAD AEROSPACE ROBOTICS MARKET FROM 2021 TO 2026

TABLE 12 AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 13 AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

7.2 TRADITIONAL ROBOTS

TABLE 14 TRADITIONAL ROBOTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 15 TRADITIONAL ROBOTS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.2.1 ARTICULATED

7.2.1.1 Articulated robots are generally used painting, welding, and inspection

7.2.2 PARALLEL

7.2.2.1 Parallel robots are most used for handling and assembly

7.2.3 LINEAR/CARTESIAN

7.2.3.1 Cartesian robots are used for CNC machines and 3D printing

7.2.4 SCARA

7.2.4.1 SCARA robots are used for jobs that require precise lateral movements

7.2.5 OTHERS

7.3 COLLABORATIVE ROBOTS

7.3.1 COLLABORATIVE ROBOTS ARE MANUFACTURING BOTS DESIGNED TO WORK ALONGSIDE HUMANS RATHER THAN IN THEIR SPACE

TABLE 16 COLLABORATIVE ROBOTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 COLLABORATIVE ROBOTS MARKET, BY REGION, 2021–2026 (USD MILLION)

8 AEROSPACE ROBOTICS MARKET, BY COMPONENT (Page No. - 80)

8.1 INTRODUCTION

FIGURE 24 CONTROLLER SEGMENT ESTIMATED TO LEAD AEROSPACE ROBOTICS MARKET IN 2021

TABLE 18 AEROSPACE ROBOTICS SIZE, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 19 AEROSPACE ROBOTICS SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

8.2 CONTROLLER

8.2.1 CONTROLLER INTERPRETS CODE TO INSTRUCT ROBOTS TO OPERATE

8.3 SENSORS

8.3.1 ROBOTIC SENSORS PROVIDE ESSENTIAL INPUTS ABOUT AN OBJECT’S MOTION, LOCATION, VELOCITY, AND TEMPERATURE

8.4 DRIVE

8.4.1 DRIVE SYSTEM ENABLES MOVEMENT OF ROBOTS

8.5 END EFFECTOR

8.5.1 WELDING GUNS

8.5.1.1 Robots equipped with welding guns automate the welding process

8.5.2 GRIPPERS

8.5.2.1 Grippers are the most common type of end effector used on a robotic arm

8.5.3 ROBOTIC SCREWDRIVERS

8.5.3.1 Repeatability is the advantage of using robots for screwdriving applications

8.5.4 SANDING & DEBURRING TOOLS

8.5.4.1 Growing demand for complex and customized grinding solutions for diverse requirements drive this segment

8.5.5 SPECIALTY & HYBRID END EFFECTORS

8.5.5.1 Growing demand to automate mundane and repetitive tasks will drive this segment

9 AEROSPACE ROBOTICS MARKET, BY PAYLOAD (Page No. - 86)

9.1 INTRODUCTION

FIGURE 25 UP TO 16.00 KG SEGMENT PROJECTED TO LEAD AEROSPACE ROBOTICS MARKET FROM 2021 TO 2026

TABLE 20 AEROSPACE ROBOTICS, BY PAYLOAD, 2018–2020 (USD MILLION)

TABLE 21 AEROSPACE ROBOTICS, BY PAYLOAD, 2021–2026 (USD MILLION)

9.2 UP TO 16.00 KG

9.2.1 CAPABILITY OF A WIDE RANGE OF MOTION WITH SIX DEGREES OF FREEDOM

TABLE 22 UP TO 16.00 KG AEROSPACE ROBOTICS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 UP TO 16.00 KG AEROSPACE ROBOTICS, BY REGION, 2021–2026 (USD MILLION)

9.3 16.01–60.00 KG

9.3.1 DEMAND FROM APPLICATIONS INVOLVING HIGH PROCESS FORCES

TABLE 24 16.01–60.00 KG AEROSPACE ROBOTICS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 16.01–60.00 KG AEROSPACE ROBOTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 60.01–225.00 KG

9.4.1 CAPABILITY TO REPLACE FORKLIFTS, CRANES, AND LIFTS WHILE PROVIDING INCREASED PRODUCTION FLEXIBILITY

TABLE 26 60.01–225.00 KG AEROSPACE ROBOTICS, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 60.01–225.00 KG AEROSPACE ROBOTICS, BY REGION, 2021–2026 (USD MILLION)

9.5 MORE THAN 225.00 KG

9.5.1 EASE TO REPROGRAM FOR PRODUCTION CHANGES

TABLE 28 MORE THAN 225.00 KG AEROSPACE ROBOTICS, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 MORE THAN 225.00 KG AEROSPACE ROBOTICS, BY REGION, 2021–2026 (USD MILLION)

10 AEROSPACE ROBOTICS MARKET, BY APPLICATION (Page No. - 92)

10.1 INTRODUCTION

FIGURE 26 HANDLING SEGMENT PROJECTED TO LEAD AEROSPACE ROBOTICS MARKET FROM 2016 TO 2022

TABLE 30 AEROSPACE ROBOTICS MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 31 AEROSPACE ROBOTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 DRILLING & FASTENING

10.2.1 AIRCRAFT MANUFACTURING REQUIRES PRECISION DRILLING AND FASTENING FOR AIRCRAFT FUSELAGE AND WING ASSEMBLIES

TABLE 32 AEROSPACE ROBOTICS MARKET FOR DRILLING & FASTENING, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 AEROSPACE ROBOTICS MARKET FOR DRILLING & FASTENING, BY REGION, 2021–2026 (USD MILLION)

10.3 NON-DESTRUCTIVE TESTING & INSPECTION

10.3.1 ROBOTIC NON-DESTRUCTIVE TESTING OFFERS HIGH ACCURACY, PRECISION, AND SPEED OF INSPECTION WHILE REDUCING PRODUCTION TIME AND ASSOCIATED LABOR COSTS

TABLE 34 AEROSPACE ROBOTICS MARKET FOR NON-DESTRUCTIVE TESTING & INSPECTION, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 AEROSPACE ROBOTICS MARKET FOR NON-DESTRUCTIVE TESTING & INSPECTION, BY REGION, 2021–2026 (USD MILLION)

10.4 WELDING & SOLDERING

10.4.1 WELDING ROBOTS PERFORM ACCORDING TO A SET PROGRAM AND CAN BE TUNED AS PER THE AIRCRAFT STRUCTURE

TABLE 36 AEROSPACE ROBOTICS MARKET FOR WELDING & SOLDERING, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 AEROSPACE ROBOTICS MARKET FOR WELDING & SOLDERING, BY REGION, 2021–2026 (USD MILLION)

10.5 SEALING & DISPENSING

10.5.1 SEALING AND DISPENSING USE ROBOTS DUE TO THE PRECISION REQUIRED AND POTENTIALLY HAZARDOUS MATERIALS OFTEN USED AS SEALANTS FOR AIRCRAFT COMPONENTS

TABLE 38 AEROSPACE ROBOTICS MARKET FOR SEALING & DISPENSING, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 AEROSPACE ROBOTICS MARKET FOR SEALING & DISPENSING, BY REGION, 2021–2026 (USD MILLION)

10.6 PROCESSING

10.6.1 PROCESSING ROBOTS CAN PERFORM FUNCTIONS MORE ACCURATELY AND EFFICIENTLY THAN MANUAL OPERATIONS

TABLE 40 AEROSPACE ROBOTICS MARKET FOR PROCESSING, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 AEROSPACE ROBOTICS MARKET FOR PROCESSING, BY REGION, 2021–2026 (USD MILLION)

10.7 HANDLING

10.7.1 MATERIAL HANDLING ROBOTS ENHANCE THE EFFICIENCY OF PRODUCTION LINES AND INCREASE CUSTOMER SATISFACTION BY PROVIDING QUALITY PRODUCTS IN A TIMELY MANNER

TABLE 42 AEROSPACE ROBOTICS MARKET FOR HANDLING, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 AEROSPACE ROBOTICS MARKET FOR HANDLING, BY REGION, 2021–2026 (USD MILLION)

10.8 ASSEMBLING & DISASSEMBLING

10.8.1 ROBOTIC ASSEMBLY SYSTEMS LOWER COSTS WHILE BOOSTING QUALITY AND CAPACITY

TABLE 44 AEROSPACE ROBOTICS MARKET FOR ASSEMBLING & DISASSEMBLING, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 AEROSPACE ROBOTICS MARKET FOR ASSEMBLING & DISASSEMBLING, BY REGION, 2021–2026 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 102)

11.1 INTRODUCTION

FIGURE 27 AEROSPACE ROBOTICS MARKET IN ASIA PACIFIC PROJECTED TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 46 AEROSPACE ROBOTICS, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 AEROSPACE ROBOTICS, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 COVID-19 IMPACT ON NORTH AMERICA

11.2.2 PESTLE ANALYSIS

FIGURE 28 NORTH AMERICA AEROSPACE ROBOTICS MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: AEROSPACE ROBOTICS, BY PAYLOAD, 2018–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: AEROSPACE ROBOTICS, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: AEROSPACE ROBOTICS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: AEROSPACE ROBOTICS, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.3 US

11.2.3.1 Presence of leading OEMs to drive the market in the US

TABLE 56 US: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 57 US: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 58 US: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 59 US: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Aircraft modernization programs to drive the market in Canada

TABLE 60 CANADA: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 61 CANADA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 62 CANADA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 63 CANADA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 COVID-19 IMPACT ON EUROPE

11.3.2 PESTLE ANALYSIS

FIGURE 29 EUROPE AEROSPACE ROBOTICS MARKET SNAPSHOT

TABLE 64 EUROPE: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 65 EUROPE: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 66 EUROPE: AEROSPACE ROBOTICS, BY PAYLOAD, 2018–2020 (USD MILLION)

TABLE 67 EUROPE: AEROSPACE ROBOTICS, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 68 EUROPE: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 69 EUROPE: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 70 EUROPE: AEROSPACE ROBOTICS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 71 EUROPE: AEROSPACE ROBOTICS, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.3 UK

11.3.3.1 Presence of MRO service providers and extension in the air force will drive market in the UK

TABLE 72 UK: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 73 UK: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 74 UK: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 75 UK: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Manufacturing and assembly activities are expected to drive the need for aerospace robotics

TABLE 76 GERMANY: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 77 GERMANY: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 78 GERMANY: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 79 GERMANY: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Anticipated to boost air traffic, subsequently driving the aerospace robotics market in the country.

TABLE 80 FRANCE: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 81 FRANCE: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 82 FRANCE: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 83 FRANCE: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.6 SPAIN

11.3.6.1 Presence of key aircraft manufacturers will drive market

TABLE 84 SPAIN: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 85 SPAIN: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 86 SPAIN: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 87 SPAIN: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.7 ITALY

11.3.7.1 Plans to renew airborne fleet expected to propel market in Italy

TABLE 88 ITALY: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 89 ITALY: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 90 ITALY: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 91 ITALY: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 92 REST OF EUROPE: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 93 REST OF EUROPE: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 95 REST OF EUROPE: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 COVID-19 IMPACT ON ASIA PACIFIC

11.4.2 PESTLE ANALYSIS

FIGURE 30 ASIA PACIFIC AEROSPACE ROBOTIC MARKET SNAPSHOT (2021)

TABLE 96 ASIA PACIFIC: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 99 ASIA PACIFIC: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 100 ASIA PACIFIC: AEROSPACE ROBOTICS, BY PAYLOAD, 2018–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: AEROSPACE ROBOTICS, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: AEROSPACE ROBOTICS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 103 ASIA PACIFIC: AEROSPACE ROBOTICS, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Increasing number of aging fleets and emphasis on domestic maintenance of aircraft components will fuel growth of market

TABLE 104 CHINA: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 105 CHINA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 106 CHINA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 107 CHINA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Procurement of modern robotic systems and Make in India initiative to drive market

TABLE 108 INDIA: AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 109 INDIA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 110 INDIA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 111 INDIA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.5 JAPAN

11.4.5.1 Presence of major manufacturers in the country boost the demand for aerospace robotics

TABLE 112 JAPAN: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 113 JAPAN: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 114 JAPAN: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 115 JAPAN: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA

11.4.6.1 Presence of major MRO service providers will drive the market

TABLE 116 AUSTRALIA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 117 AUSTRALIA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 118 AUSTRALIA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 119 AUSTRALIA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 120 REST OF ASIA PACIFIC: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 REST OF THE WORLD

11.5.1 COVID-19 IMPACT ON THE REST OF THE WORLD

11.5.2 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 124 REST OF THE WORLD: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 125 REST OF THE WORLD: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 126 REST OF THE WORLD: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 127 REST OF THE WORLD: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 128 REST OF THE WORLD: AEROSPACE ROBOTICS, BY PAYLOAD, 2018–2020 (USD MILLION)

TABLE 129 REST OF THE WORLD: AEROSPACE ROBOTICS, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 130 REST OF THE WORLD: AEROSPACE ROBOTICS, BY REGION, 2018–2020 (USD MILLION)

TABLE 131 REST OF THE WORLD: AEROSPACE ROBOTICS, BY REGION, 2021–2026 (USD MILLION)

11.5.3 SOUTH AMERICA

11.5.3.1 Presence of leading airlines and aircraft manufacturers will fuel market growth

TABLE 132 SOUTH AMERICA: AEROSPACE ROBOTIC MARKET, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 133 SOUTH AMERICA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 134 SOUTH AMERICA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 135 SOUTH AMERICA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 MIDDLE EAST & AFRICA

11.5.4.1 Increase in new tech startups in aerospace industry to drive market

TABLE 136 MIDDLE EAST & AFRICA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2018–2020 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: AEROSPACE ROBOTICS, BY ROBOT TYPE, 2021–2026 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: AEROSPACE ROBOTICS, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: AEROSPACE ROBOTICS, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 147)

12.1 INTRODUCTION

12.2 COMPETITIVE ANALYSIS OF THE AEROSPACE ROBOTICS MARKET

TABLE 140 KEY DEVELOPMENTS BY LEADING PLAYERS IN AEROSPACE ROBOTIC MARKET BETWEEN 2018 AND 2020

12.3 COMPANY EVALUATION MATRIX

12.3.1 STAR

12.3.2 EMERGING LEADER

12.3.3 PERVASIVE

12.3.4 PARTICIPANT

FIGURE 31 COMPANY EVALUATION MATRIX, 2020

12.4 STARTUPS/SME EVALUATION QUADRANT

12.4.1 PROGRESSIVE COMPANIES

12.4.2 RESPONSIVE COMPANIES

12.4.3 DYNAMIC COMPANIES

12.4.4 STARTING BLOCKS

FIGURE 32 STARTUPS/SME EVALUATION QUADRANT, 2020

12.5 MARKET SHARE OF KEY PLAYERS, 2020

FIGURE 33 MARKET SHARE ANALYSIS OF TOP PLAYERS IN AEROSPACE ROBOTICSMARKET, 2020

TABLE 141 AEROSPACE ROBOTIC MARKET: DEGREE OF COMPETITION

12.6 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 34 RANKING OF TOP PLAYERS IN AEROSPACE ROBOTICS MARKET, 2020

FIGURE 35 REVENUE ANALYSIS OF AEROSPACE ROBOTIC MARKET PLAYERS, 2016-2020

12.7 COMPETITIVE BENCHMARKING

TABLE 142 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 143 COMPANY TECHNOLOGY FOOTPRINT

TABLE 144 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE SCENARIO

12.8.1 DEALS, 2019–2021

TABLE 145 DEALS, 2019–2021

13 COMPANY PROFILES (Page No. - 162)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 KUKA AG

TABLE 146 KUKA AG : BUSINESS OVERVIEW

FIGURE 36 KUKA AG: COMPANY SNAPSHOT

TABLE 147 KUKA AG: PRODUCT LAUNCHES

TABLE 148 KUKA AG: DEALS

13.2.2 ABB GROUP

TABLE 149 ABB GROUP: BUSINESS OVERVIEW

FIGURE 37 ABB GROUP.: COMPANY SNAPSHOT

TABLE 150 ABB GROUP: PRODUCT LAUNCHES

TABLE 151 ABB GROUP: DEALS

13.2.3 FANUC CORPORATION

TABLE 152 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 38 FANUC CORPORATION: COMPANY SNAPSHOT

TABLE 153 FANUC CORPORATION: PRODUCT LAUNCHES

TABLE 154 FANUC CORPORATION: DEALS

13.2.4 YASKAWA ELECTRIC CORPORATION

TABLE 155 YASKAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 39 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 156 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

TABLE 157 YASKAWA ELECTRIC CORPORATION: DEALS

13.2.5 KAWASAKI HEAVY INDUSTRIES, LTD

TABLE 158 KAWASAKI HEAVY INDUSTRIES, LTD: BUSINESS OVERVIEW

FIGURE 40 KAWASAKI HEAVY INDUSTRIES, LTD: COMPANY SNAPSHOT

TABLE 159 KAWASAKI HEAVY INDUSTRIES, LTD: PRODUCT LAUNCHES

TABLE 160 KAWASAKI HEAVY INDUSTRIES, LTD: DEALS

13.2.6 MTORRES

TABLE 161 MTORRES: BUSINESS OVERVIEW

TABLE 162 MTORRES: PRODUCT LAUNCHES

TABLE 163 MTORRES: DEALS

13.2.7 OLIVER CRISPIN ROBOTICS LIMITED

TABLE 164 OLIVER CRISPIN ROBOTICS LIMITED: BUSINESS OVERVIEW

13.2.8 GUDEL AG

TABLE 165 GUDEL AG: BUSINESS OVERVIEW

TABLE 166 GUDEL AG: PRODUCT LAUNCHES

13.2.9 ELECTROIMPACT INC.

TABLE 167 ELECTROIMPACT INC.: BUSINESS OVERVIEW

TABLE 168 ELECTROIMPACT INC.: DEALS

13.2.10 UNIVERSAL ROBOTS A/S

TABLE 169 UNIVERSAL ROBOTS A/S: BUSINESS OVERVIEW

TABLE 170 UNIVERSAL ROBOTS A/S: PRODUCT LAUNCHES

13.2.11 SWISSLOG AG

TABLE 171 SWISSLOG AG: BUSINESS OVERVIEW

TABLE 172 SWISSLOG AG: DEALS

13.2.12 STÄUBLI

TABLE 173 STÄUBLI: BUSINESS OVERVIEW

TABLE 174 STÄUBLI: PRODUCT LAUNCHES

13.2.13 COMAU

TABLE 175 COMAU: BUSINESS OVERVIEW

TABLE 176 COMAU: PRODUCT LAUNCHES

TABLE 177 COMAU: DEALS

13.2.14 FESTO

TABLE 178 FESTO: BUSINESS OVERVIEW

13.2.15 REIS ROBOTICS

TABLE 179 REIS ROBOTICS: BUSINESS OVERVIEW

13.2.16 BOSTON DYNAMICS

TABLE 180 BOSTON DYNAMICS: BUSINESS OVERVIEW

TABLE 181 BOSTON DYNAMICS: PRODUCT LAUNCHES

TABLE 182 BOSTON DYNAMICS: DEALS

13.2.17 BOSCH REXROTH AG

TABLE 183 BOSCH REXROTH AG: BUSINESS OVERVIEW

TABLE 184 BOSCH REXROTH AG: PRODUCT LAUNCHES

13.2.18 OMRON ADEPT TECHNOLOGY, INC.

TABLE 185 OMRON ADEPT TECHNOLOGY, INC.: BUSINESS OVERVIEW

TABLE 186 OMRON ADEPT TECHNOLOGY, INC.: PRODUCT LAUNCHES

13.2.19 NACHI-FUJIKOSHI CORP.

TABLE 187 NACHI-FUJIKOSHI CORP.: BUSINESS OVERVIEW

TABLE 188 NACHI-FUJIKOSHI CORP.: PRODUCT LAUNCHES

13.2.20 SEIKO EPSON

TABLE 189 SEIKO EPSON: BUSINESS OVERVIEW

13.2.21 APEX AUTOMATION AND ROBOTICS

TABLE 190 APEX AUTOMATION AND ROBOTICS: BUSINESS OVERVIEW

13.3 OTHER PLAYERS

13.3.1 DILIGENT ROBOTICS

13.3.2 BLUEFIN ROBOTICS

13.3.3 RIGHTHAND ROBOTICS, INC.

13.3.4 RETHINK ROBOTICS

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 213)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved various activities in estimating the market size for aerospace robotics. Exhaustive secondary research was undertaken to collect information on the aerospace robotics market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the aerospace robotics market.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, Secondary sources include Publications of Statista, The International Air Transport Association (IATA), Commercial Space Transportation Advisory Committee (COMSTAC), and FAA (Federal Aviation Administration), as well as corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations, among others, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the aerospace robotics market.

Primary Research

The aerospace robotics market comprises several stakeholders such as armed forces, civil aviation companies, regulatory bodies, research institutes and organizations, wholesalers, retailers, and distributors of aerospace robotics components in its supply chain. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the aerospace robotics market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the aerospace robotics market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace robotics market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global aerospace robotics market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aerospace robotics market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aerospace robotics market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the aerospace robotics market based on robot type, component, payload, application and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the aerospace robotics market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the aerospace robotics market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the aerospace robotics market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aerospace robotics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerospace Robotics Market