Air Quality Monitoring System Market by Product (Indoor, Outdoor, Fixed, Portable, Wearable), Sampling, Pollutant (Chemical, Physical, Biological), End User (Govt, Petrochemical, Residential, Smart City), & Region - Global Forecast to 2028

Market Growth Outlook Summary

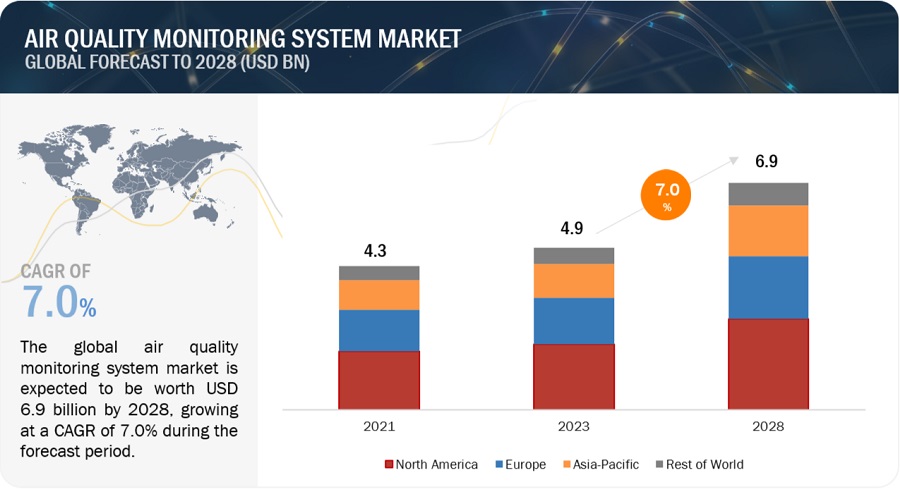

The global air quality monitoring system market, valued at US$4.3 billion in 2021, stood at US$4.9 billion in 2023 and is projected to advance at a resilient CAGR of 7.0% from 2023 to 2028, culminating in a forecasted valuation of US$6.9 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The market's growth is driven by increasing expenditures to combat rising global air pollution levels, government regulations mandating effective air pollution monitoring and control, rising public-private funding for efficient monitoring systems, heightened public awareness of environmental and healthcare impacts from air pollution, and governmental initiatives promoting environmentally friendly industries.

Trends in the Air Quality Monitoring System Market

For insights into the assumptions behind this study, you can Request a Free Sample Report

e- Estimated; p- Projected

Dynamics of the Air Quality Monitoring System Market

Driver: Supportive initiatives by public and private sectors for environmental conservation and awareness

Various initiatives by governmental and non-governmental organizations and the private sector aim to reduce air pollution through awareness campaigns and programs. These efforts not only raise public awareness but also draw international attention to the severe health and environmental impacts of air pollution. Key public organizations involved include the United States Environmental Protection Agency (EPA), Clean Air in London, Coalition for Clean Air, Sierra Club, Union of Concerned Scientists, Mom's Clean Air Force, Global Action Plan, Little Ninja, Earthjustice, and German VCD. For example, in June 2021, the WHO and UK Government recognized National Clean Air Day, promoting activities like car-free days and tree planting, while the United Nations Environment Programme partnered with South Korea’s Capital Metropolitan Area in April 2021 to combat regional air pollution.

Restraint: High costs of products

Budget constraints may prevent governments and organizations from establishing an adequate number of monitoring stations, leading to coverage gaps in understanding pollution levels and sources. Additionally, the maintenance and calibration costs of monitoring equipment can be prohibitive for some regions or municipalities.

Addressing cost constraints often requires collaboration among governments, the private sector, and non-governmental organizations. Strategies such as government funding allocations and public-private partnerships can help mitigate these challenges.

Opportunity: Ongoing R&D and technological advancements

Continuous research, development, and commercialization of advanced air quality monitoring systems (including nanotechnology-based solutions, infrared spectroscopy, and remote-sensing instruments) present growth opportunities for both established and emerging players in the market. Innovations like nanotechnology-based products offer benefits such as real-time monitoring, miniaturization, enhanced analytical capabilities, and cost-effective manufacturing.

Recent advancements include the development of a low-power gas sensor nano-chip by international researchers, enabling the creation of personal air-quality monitoring devices. This nanochip sensor uses a chemical-sensitive field-effect transistor (CS-FET) platform based on 3.5-nanometer-thin silicon channel transistors (Source: American Association for the Advancement of Science journal). The expansion of technologically advanced air pollution monitoring systems into the market pipeline is expected to drive future growth.

Challenge: Installation and management of big data

Installing air quality monitoring systems in rural or remote areas poses logistical and financial challenges due to infrastructure limitations. Moreover, managing the substantial volume of data generated by these systems requires efficient data management systems, which can be particularly daunting for smaller organizations or those lacking experience in handling large datasets.

Air quality monitoring systems utilize diverse technologies and formats, complicating data integration and comparison across different sources. Standardization and compatibility issues may impede effective data analysis and policy formulation.

Market Ecosystem

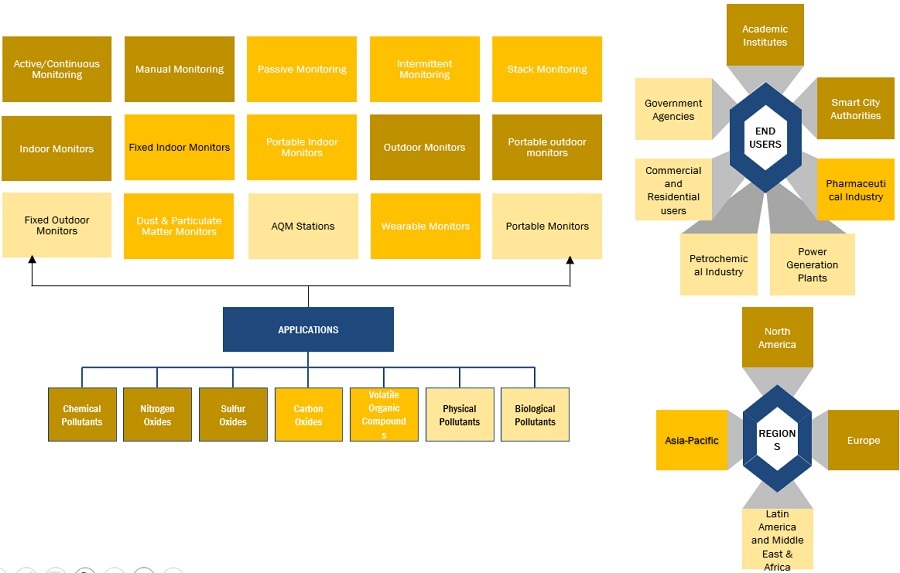

By product, the largest market share in the air quality monitoring system industry during the forecast period was held by indoor monitors.

The air quality monitoring system market, based on product, is segmented into indoor monitors, outdoor monitors, and wearable monitors. Indoor monitors further divide into fixed and portable types. In 2022, indoor monitors dominated the global market due to increasing demand for pollution-free indoor environments, rising awareness of indoor air pollution's health impacts, and the adoption of smart home and green-building technologies.

By pollutant, chemical pollutants had the largest share in the air quality monitoring system industry during the forecast period.

The market, categorized by pollutant, includes chemical, physical, and biological pollutants. Chemical pollutants, such as nitrogen oxides and volatile organic compounds, commanded the largest segment in 2022. Growth is fueled by increasing chemical pollutant levels globally, stringent pollution monitoring regulations, rising public awareness, and advancements in sensor technologies.

By sampling method, stack monitoring is anticipated to exhibit significant growth in the air quality monitoring system industry during the forecast period.

Classified by sampling method, the market comprises active, intermittent, continuous, passive, manual, and stack monitoring. Stack monitoring showed notable growth in 2022, driven by supportive regulations, technological advancements, and the widespread deployment of continuous monitoring systems. However, challenges such as high costs and training requirements may temper future growth.

By End User, government agencies and academic institutes are expected to experience the fastest growth in the air quality monitoring system industry during the forecast period.

The global market, segmented by end user, includes government agencies, academic institutes, commercial and residential users, petrochemical industry, power generation plants, pharmaceutical industry, smart city authorities, and other users. Government agencies held a substantial share in 2022 and are poised for rapid growth, driven by stringent environmental regulations, increased research collaborations, rising government investments, and expanded installation of monitoring stations.

For details on the assumptions behind this study, you can download the PDF brochure

The Asia Pacific region is expected to register the highest CAGR in the air quality monitoring system industry during the forecast period.

The Asia Pacific market is projected to achieve significant growth, fueled by increased government spending on air quality monitoring, adoption of advanced environmental monitoring technologies, and infrastructure modernization due to rising disposable incomes and GDPs across the region.

As of 2022, prominent players in the air quality monitoring system market include Thermo Fisher Scientific (US), Emerson Electric (US), GE Healthcare (US), Siemens AG (Germany), Teledyne Technologies (US), 3M Company (US), HORIBA, Ltd. (Japan), Merck KGaA (Germany), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Spectris plc (UK), Honeywell International Inc (US), TSI Incorporated (US), Tisch Environmental Inc. (US), and Testo (Germany), among others.

Scope of the the Air Quality Monitoring System Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$4.9 billion |

|

Projected Revenue by 2028 |

$6.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.0% |

|

Market Driver |

Favorable public & private initiatives for environmental conservation and public awareness |

|

Market Opportunity |

Continuous R&D and technological advancements |

This report has segmented the global air quality monitoring system market to forecast revenue and analyze trends in each of the following submarkets:

By Sampling Method

- Active/Continuous Monitoring

- Manual Monitoring

- Passive Monitoring

- Intermittent Monitoring

- Stack Monitoring

By Pollutant

- Chemical Pollutants

- Nitrogen Oxides

- Sulfur Oxides

- Carbon Oxides

- Volatile Organic Compounds

- Other Chemical Pollutants

- Physical Pollutants

- Biological Pollutants

By Product

- Indoor Monitors

- Fixed Indoor Monitors

- Portable Indoor Monitors

- Outdoor Monitors

- Portable Outdoor Monitors

- Fixed Outdoor Monitors

- Dust & Particulate Matter Monitors

- AQM Stations

- Wearable Monitors

By End user

- Government Agencies and Academic Institutes

- Commercial and Residential Users

- Petrochemical Industry

- Power Generation Plants

- Pharmaceutical Industry

- Smart City Authorities

- Other end Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Air Quality Monitoring System Industry

- In March 2023, Siemens AG launched Connect Box, an open and easy-to-use IoT solution designed to manage small to medium-sized buildings.

- In January 2023, Thermo Fisher Scientific acquired the Binding Site Group, this would help in expanding the company’s existing specialty diagnostics portfolio.

- In January 2023, Teledyne Technologies Incorporated acquired ChartWorld, thus expanding the portfolios of Teledyne Marine segment. Teledyne now provides the electronic navigation charts and other value-added software information services directly to vessel pilots, owners and operators.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global air quality monitoring system market between 2023 and 2028?

The global air quality monitoring system market is expected to grow from USD 4.9 billion in 2023 to USD 6.9 billion by 2028, at a CAGR of 7.0%, driven by increasing government regulations and public awareness regarding air pollution.

What are the key factors driving the air quality monitoring system market?

The major factors driving the air quality monitoring system market include rising air pollution levels, supportive government initiatives, increased public-private funding for monitoring systems, and growing awareness of environmental health impacts.

What challenges does the air quality monitoring system market face?

Challenges include the high costs associated with air quality monitoring products, budget constraints that limit the establishment of adequate monitoring stations, and the complexity of managing large datasets generated by monitoring systems.

Which regions are expected to show growth in the air quality monitoring system market?

The Asia Pacific region is anticipated to exhibit the highest growth, driven by increased government spending on air quality monitoring and the adoption of advanced environmental technologies.

What types of products are used in air quality monitoring?

Key products in air quality monitoring include indoor monitors (both fixed and portable), outdoor monitors, wearable monitors, and air quality monitoring stations, all aimed at tracking various pollutants.

How do technological advancements impact the air quality monitoring system market?

Technological advancements, such as the development of nanotechnology-based solutions and real-time monitoring systems, are enhancing the capabilities and efficiency of air quality monitoring, driving market growth.

What are the recent developments in the air quality monitoring system market?

Recent developments include Siemens AG's launch of Connect Box for IoT solutions and Thermo Fisher Scientific's acquisition of the Binding Site Group, enhancing their air quality monitoring product offerings.

What role do government agencies play in the air quality monitoring system market?

Government agencies are significant end-users in the air quality monitoring system market, driving demand through regulatory requirements and investment in monitoring infrastructure and research initiatives.

How does the increasing awareness of air pollution impact the market?

Heightened public awareness of the health impacts of air pollution is driving demand for air quality monitoring systems, prompting both governmental and non-governmental organizations to invest in improved monitoring solutions.

What opportunities exist in the air quality monitoring system market?

Opportunities in the air quality monitoring system market are driven by ongoing research and development, technological advancements, and increasing public and private sector collaborations aimed at environmental conservation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government initiatives for AQM due to rising industrialization and urbanization- Growing concerns over rising air pollution- Favorable public-private initiatives for environmental conservation- Supportive funding investments for effective air pollution controlRESTRAINTS- Premium product pricing- Technical limitations associated with AQM productsOPPORTUNITIES- Rising technological advancements in AQM systems- Increasing R&D activities for environmental policiesCHALLENGES- Inadequate implementation of air pollution control reforms- Availability of alternative monitoring solutions- Challenges associated with identifying emerging pollutants

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 REGULATORY ANALYSISWORLD HEALTH ORGANIZATION (WHO)DEFINITION OF PARTICULATE MATTER BY WHO- Definition of ozone- Definition of nitrogen dioxide- Definition of sulfur dioxideUS- Office of Air Quality Planning and Standards (OAQPS)- Office of Atmospheric Programs (OAP)- Office of Transportation and Air Quality (OTAQ)- Office of Radiation and Indoor Air (ORIA)EUROPEAN UNION- Existing air quality legislation in EU- EU and international air pollution policies- IndiaCHINA

-

5.5 ECOSYSTEM COVERAGE

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED ENTERPRISES

- 5.8 PRICING ANALYSIS

-

5.9 PATENT ANALYSISPATENT DETAILS

- 6.1 INTRODUCTION

-

6.2 ACTIVE/CONTINUOUS MONITORINGINCREASING INSTALLATION OF CONTINUOUS MONITORING STATIONS TO DRIVE MARKET

-

6.3 MANUAL MONITORINGUTILIZATION IN SMALL-SCALE OPERATIONS TO SUPPORT MARKET GROWTH

-

6.4 PASSIVE MONITORINGWIDE UTILIZATION IN PHARMA COMPANIES OWING TO COST-EFFECTIVENESS TO PROPEL MARKET

-

6.5 INTERMITTENT MONITORINGRISING PUBLIC EMPHASIS ON EFFECTIVE AIR POLLUTION MONITORING TO SUPPORT MARKET GROWTH

-

6.6 STACK MONITORINGHIGH EFFICIENCY AND LOW OPERATIONAL COSTS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 CHEMICAL POLLUTANTSNITROGEN OXIDES- Rising activities in petrol & metal refining to drive marketSULFUR OXIDES- Expansion of petrochemical and power generation industries to propel marketCARBON OXIDES- Increasing vehicular emissions and energy consumption to support market growthVOLATILE ORGANIC COMPOUNDS- Limited preference in mature markets to restrain marketOTHER CHEMICAL POLLUTANTS

-

7.3 PHYSICAL POLLUTANTSRISING INDUSTRIALIZATION AND URBANIZATION TO PROPEL MARKET

-

7.4 BIOLOGICAL POLLUTANTSGROWTH IN PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 INDOOR MONITORSFIXED INDOOR MONITORS- Rising need to maintain controlled indoor environment to drive marketPORTABLE INDOOR MONITORS- Advantages such as ease-of-use and portability to drive market

-

8.3 OUTDOOR MONITORSPORTABLE OUTDOOR MONITORS- Increasing public-private investments for product development to support market growthFIXED OUTDOOR MONITORS- Stringent government regulations to establish environmental-safe industries to support market growthDUST & PARTICULATE MATTER MONITORS- Ability to provide accurate measurements of PM concentration in air samples to propel marketAQM STATIONS- Increasing installation of AQM stations to propel market

-

8.4 WEARABLE MONITORSCONTINUOUS REAL-TIME MONITORING BENEFITS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 GOVERNMENT AGENCIES AND ACADEMIC INSTITUTESRISING INVESTMENTS FOR EFFECTIVE AIR POLLUTION CONTROL TO DRIVE MARKET

-

9.3 COMMERCIAL AND RESIDENTIAL USERSRISING TECHNOLOGICAL ADVANCEMENTS IN AIR QUALITY MONITORS TO DRIVE MARKET

-

9.4 PETROCHEMICAL INDUSTRYGROWING DEMAND FOR CONTINUOUS AND INTERMITTENT AIR QUALITY MONITORS TO PROPEL MARKET

-

9.5 POWER GENERATION PLANTSEFFORTS BY NATIONAL & INTERNATIONAL AGENCIES TO CONTROL EMISSIONS FROM POWER PLANTS TO PROPEL MARKET

-

9.6 SMART CITY AUTHORITIESRISING USE OF AQM PRODUCTS IN SMART CITY PROJECTS TO SUPPORT MARKET GROWTH

-

9.7 PHARMACEUTICAL INDUSTRYSTRINGENT REGULATIONS FOR MICROBIAL CONTAMINATION ASSESSMENT IN PHARMACEUTICAL TESTING TO DRIVE MARKET

- 9.8 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Large end-user base for industrial & indoor AQM products to drive marketCANADA- Active government participation in AQM to support growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate AQM systems market in EuropeUK- Rapid technology adoption and government initiatives to support market growthFRANCE- High pollution levels to drive adoption of AQM systemsITALY- Need to curb air pollution to drive demand for AQM systemsSPAIN- Rising public-private initiatives to boost growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Japan to dominate APAC AQM systems marketCHINA- Stringent government scrutiny on entry of private players to hamper market growthINDIA- Active government involvement in air pollution monitoring and control to drive marketAUSTRALIA- Increased air pollution due to bushfires to boost demand for pollution controlSOUTH KOREA- Low awareness about air quality enhancement to hinder market growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Shortage of skilled technicians to restrain market growthMEXICO- Low adoption of advanced technologies to hinder market growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICASLOW IMPLEMENTATION OF GOVERNMENT REGULATIONS TO RESTRAIN MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 REVENUE SHARE ANALYSIS OF TOP FIVE MARKET PLAYERS

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

-

11.4 COMPANY EVALUATION MATRIX

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- Recent developments- Other developments- MnM viewSIEMENS AG- Business overview- Products offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products offered- Recent developments- MnM viewEMERSON ELECTRIC CO.- Business overview- Products offered- Recent developmentsGE POWER- Business overview- Products offered- Recent developments3M- Business overview- Products offered- Recent developmentsHORIBA, LTD.- Business overview- Products offered- Recent developmentsMERCK KGAA- Business overview- Products offered- Recent developmentsSPECTRIS- Business overview- Products offered- Recent developmentsTSI- Business overview- Products offered- Recent developmentsTESTO SE & CO. KGAA- Business overview- Products offeredHONEYWELL INTERNATIONAL INC.- Business overview- Products offered- Recent developmentsAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsPERKINELMER INC.- Business overview- Products offeredTISCH ENVIRONMENTAL, INC.- Business overview- Products offered

-

12.2 OTHER PLAYERSAEROQUALFORBES MARSHALLPLUME LABSATMOTECH, INC.HANGZHOU ZETIAN TECHNOLOGYSERVOMEX GROUP LIMITEDVAISALARICARDOBALL CORPORATIONAMBEE

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AIR QUALITY MONITORING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 AIR QUALITY GUIDELINES

- TABLE 3 PRICING ANALYSIS FOR AIR QUALITY MONITORING SYSTEMS, 2022 (ASP IN USD)

- TABLE 4 AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 5 ACTIVE/CONTINUOUS AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 6 MANUAL AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 7 PASSIVE AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 8 INTERMITTENT AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 9 STACK AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 10 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 11 AIR QUALITY MONITORING SYSTEMS MARKET FOR CHEMICAL POLLUTANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 AIR QUALITY MONITORING SYSTEMS MARKET FOR CHEMICAL POLLUTANTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 AIR QUALITY MONITORING SYSTEMS MARKET FOR NITROGEN OXIDES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 SULFUR DIOXIDE EMISSIONS FROM HOTSPOTS, 2021 (KT/YEAR)

- TABLE 15 AIR QUALITY MONITORING SYSTEMS MARKET FOR SULFUR OXIDES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 AIR QUALITY MONITORING SYSTEMS MARKET FOR CARBON OXIDES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 AIR QUALITY MONITORING SYSTEMS MARKET FOR VOLATILE ORGANIC COMPOUNDS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 AIR QUALITY MONITORING SYSTEMS MARKET FOR OTHER CHEMICAL POLLUTANTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 AIR QUALITY MONITORING SYSTEMS MARKET FOR PHYSICAL POLLUTANTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 AIR QUALITY MONITORING SYSTEMS MARKET FOR BIOLOGICAL POLLUTANTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 22 INDOOR MONITORS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 24 INDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 25 INDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 26 INDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 FIXED INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 28 FIXED INDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 29 FIXED INDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 30 FIXED INDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 PORTABLE INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 32 PORTABLE INDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 33 PORTABLE INDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 34 PORTABLE INDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 36 OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 37 OUTDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 OUTDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 PORTABLE OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 40 PORTABLE OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 41 PORTABLE OUTDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 42 PORTABLE OUTDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 FIXED OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 44 FIXED OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 45 FIXED OUTDOOR MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 FIXED OUTDOOR MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 DUST & PARTICULATE MATTER MONITORS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 48 DUST & PARTICULATE MATTER MONITORS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 49 DUST & PARTICULATE MATTER MONITORS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 DUST & PARTICULATE MATTER MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 AQM STATIONS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 52 AQM STATIONS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 53 AQM STATIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 54 AQM STATIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 55 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 56 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 57 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 59 AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 AIR QUALITY MONITORING SYSTEMS MARKET FOR GOVERNMENT AGENCIES AND ACADEMIC INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 AIR QUALITY MONITORING SYSTEMS MARKET FOR COMMERCIAL AND RESIDENTIAL USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 AIR QUALITY MONITORING SYSTEMS MARKET FOR PETROCHEMICAL INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 AIR QUALITY MONITORING SYSTEMS MARKET FOR POWER GENERATION PLANTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 AIR QUALITY MONITORING SYSTEMS MARKET FOR SMART CITY AUTHORITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 65 AIR QUALITY MONITORING SYSTEMS MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 AIR QUALITY MONITORING SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 67 AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 EPA GRANTS OFFERED FOR AIR POLLUTION CONTROL AND RELATED EFFORTS (2020−2021)

- TABLE 75 US: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 US: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 CANADA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 78 CANADA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 UK: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 UK: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 FRANCE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 90 FRANCE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 ITALY: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 92 ITALY: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION

- TABLE 93 SPAIN: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 94 SPAIN: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 REST OF EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 JAPAN: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 104 JAPAN: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 CHINA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 106 CHINA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 INDIA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 108 INDIA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 AUSTRALIA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 110 AUSTRALIA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 BRAZIL: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 122 BRAZIL: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 MEXICO: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 124 MEXICO: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 REST OF LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 126 REST OF LATIN AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 AIR QUALITY MONITORING SYSTEMS MARKET: KEY DEVELOPMENTS

- TABLE 133 AIR QUALITY MONITORING SYSTEMS MARKET: PRODUCT LAUNCHES (2019-2022)

- TABLE 134 AIR QUALITY MONITORING SYSTEMS MARKET: DEALS (2019−2022)

- TABLE 135 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 136 SIEMENS AG: BUSINESS OVERVIEW

- TABLE 137 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

- TABLE 138 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

- TABLE 139 GE POWER: BUSINESS OVERVIEW

- TABLE 140 3M: BUSINESS OVERVIEW

- TABLE 141 HORIBA, LTD.: BUSINESS OVERVIEW

- TABLE 142 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 143 SPECTRIS: BUSINESS OVERVIEW

- TABLE 144 TSI: BUSINESS OVERVIEW

- TABLE 145 TESTO SE & CO. KGAA: BUSINESS OVERVIEW

- TABLE 146 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 147 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 148 PERKINELMER INC.: BUSINESS OVERVIEW

- TABLE 149 TISCH ENVIRONMENTAL, INC.: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF AIR QUALITY MONITORING SYSTEMS MARKET

- FIGURE 13 GOVERNMENT INITIATIVES FOR AIR POLLUTION CONTROL DUE TO RISING INDUSTRIALIZATION TO DRIVE MARKET

- FIGURE 14 ACTIVE/CONTINUOUS MONITORING SEGMENT IN GERMANY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 15 NITROUS OXIDES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 AIR QUALITY MONITORING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- FIGURE 19 TOP 10 PATENT APPLICANTS IN AIR QUALITY MONITORING SYSTEMS MARKET

- FIGURE 20 TOP 10 PATENT OWNERS IN AIR QUALITY MONITORING SYSTEMS MARKET

- FIGURE 21 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET SNAPSHOT

- FIGURE 22 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET SNAPSHOT

- FIGURE 23 AIR QUALITY MONITORING SYSTEMS MARKET: REVENUE SHARE ANALYSIS (2022)

- FIGURE 24 AIR QUALITY MONITORING SYSTEMS MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 25 AIR QUALITY MONITORING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 26 AIR QUALITY MONITORING SYSTEMS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 27 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 28 SIEMENS AG: COMPANY SNAPSHOT (2022)

- FIGURE 29 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 30 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT (2022)

- FIGURE 31 GE POWER: COMPANY SNAPSHOT (2022)

- FIGURE 32 3M: COMPANY SNAPSHOT (2022)

- FIGURE 33 HORIBA, LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 35 SPECTRIS: COMPANY SNAPSHOT (2022)

- FIGURE 36 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

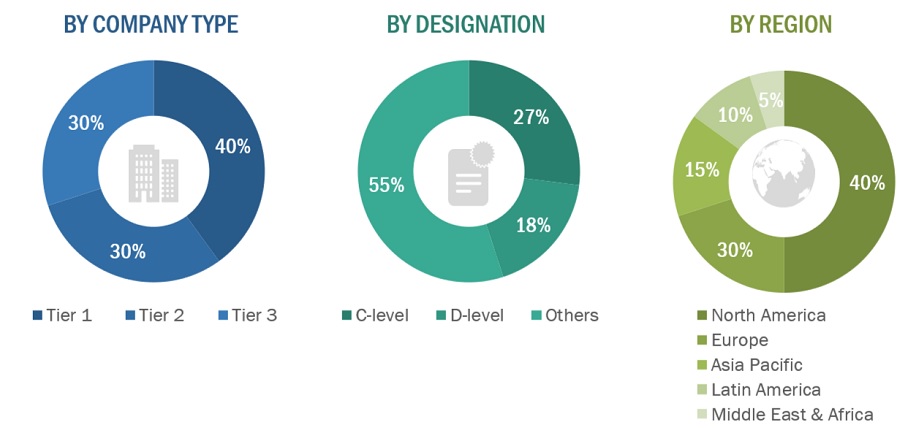

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the air quality monitoring systems market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the air quality monitoring systems market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the global air quality monitoring systems market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the air quality monitoring systems business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the air quality monitoring systems market

- Mapping annual revenues generated by major global players from the air quality monitoring systems segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover major share of the global market, as of 2022

- Extrapolating the global value of the air quality monitoring systems industry

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global air quality monitoring systems market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the air quality monitoring systems market was validated using both top-down and bottom-up approaches.

Market Definition

Air quality monitoring is the systematic approach to observing and studying air pollution through the analysis of various parameters, such as particulate matter, specific microbes, and the level of gaseous pollutants in an air sample. This approach is mainly used to evaluate and monitor changes in air quality parameters as well as to assess the impact of air pollution on human health and the environment.

Key Market Stakeholders

- Manufacturers and distributors of air quality monitoring products

- Air quality monitoring software developers

- Research laboratories and academic institutes

- Air pollution monitoring committees

- Pharmaceutical and biotechnology companies

- Government and non-government agencies

- National and regional air pollution control boards and organizations

- Petrochemical and biofuel product manufacturing companies

- Metal and mining companies

- Oil and gas production and distribution companies

- Gas operators, distributors, and regulators

- Power generation and power distribution units

- Municipalities and municipal corporations

- Sewage and wastewater treatment plants

- Food & beverage manufacturing companies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the air quality monitoring systems market on the basis of product, sampling method, pollutant, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global air quality monitoring systems market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global air quality monitoring systems market.

- To analyze key growth opportunities in the global air quality monitoring systems market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and rest of the world.

- To profile the key players in the global air quality monitoring systems market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global air quality monitoring systems market, such as product launches, agreements, expansions, and & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global air quality monitoring systems market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe air quality monitoring systems market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific air quality monitoring systems market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the Latin America air quality monitoring systems market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Quality Monitoring System Market

Which factors are playing a key role in the global growth of Air Quality Monitoring System Market?

Which are the main growth restraining factors for the Air Quality Monitoring System Market?

Can you elaborate more on the emerging trends in the Global Air Quality Monitoring System Market?