Aircraft Fuel Tanks Market by Type (External, Internal), End Use (Aftermarket, OEM), Platform (Commercial Aviation, Military Aviation), Material (Carbon-Based Composites, Metallic Alloys, Hybrid, Polymers), and Region - Global Forecast 2025 to 2035

The aviation industry is entering an era of transformation driven by sustainability goals, technological innovation, and the increasing demand for aircraft modernization. At the heart of this transformation lies the aircraft fuel tank a critical system that determines efficiency, performance, and safety across all flight operations. The Aircraft Fuel Tanks Market, categorized by type, end use, platform, and material, is poised for significant growth between 2025 and 2035, as advancements in materials science, manufacturing technology, and aerodynamics redefine fuel storage systems across commercial and military aviation.

Global air traffic recovery, coupled with next generation aircraft programs, is propelling the demand for lightweight, durable, and fuel efficient tank designs. Simultaneously, the integration of advanced materials such as carbon composites and hybrid polymers is revolutionizing tank construction, reducing maintenance costs, and extending operational life. The future of aviation fuel storage will depend on innovation that balances safety, sustainability, and performance.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNewNew.asp?id=181042233

Market Overview: Fuel Tanks as the Core of Aircraft Performance

An aircraft fuel tank is far more than a container; it is a dynamic component integral to flight safety, balance, and endurance. It ensures the controlled storage, pressurization, and distribution of fuel across various aircraft systems. With increasing emphasis on long range operations and sustainable fuel types, the design and materials used in fuel tanks are evolving rapidly.

The market growth from 2025 to 2035 is expected to be driven by rising commercial aircraft production, fleet modernization, and the adoption of advanced materials that enhance performance while reducing weight. Manufacturers are also investing in the development of fuel tanks compatible with alternative energy sources such as hydrogen and sustainable aviation fuels (SAF). This shift aligns with global environmental policies and the aviation sector’s commitment to achieving net zero emissions by 2050.

Type Analysis: Internal vs. External Fuel Tanks

Internal Fuel Tanks: Integrated Efficiency

Internal fuel tanks are permanently integrated into the aircraft’s wing, fuselage, or empennage structure. They form the backbone of modern aviation fuel systems and are widely used in both commercial and military aircraft. The demand for internal tanks is increasing due to their aerodynamic efficiency, reduced drag, and enhanced safety.

In commercial aviation, internal fuel tanks are designed to maximize fuel volume while maintaining structural integrity. Advanced sealing technologies and corrosion resistant materials ensure long term reliability. Aircraft such as the Boeing 787 and Airbus A350 utilize composite integrated internal tanks that contribute to overall weight reduction and improved fuel economy.

For military aircraft, internal tanks are crucial for stealth and operational endurance. They are engineered to withstand extreme pressures, G forces, and combat related stresses. As next generation fighters and UAVs emerge, the development of conformal fuel tanks integrated seamlessly into the aircraft’s frame is becoming a key design trend.

External Fuel Tanks: Flexibility and Extended Range

External fuel tanks, often referred to as drop tanks, are detachable units mounted beneath the wings or fuselage. They play an essential role in extending flight range and mission flexibility, particularly for military operations. The global rise in long range strike missions and air to air refueling limitations is increasing the demand for external fuel systems in defense aviation.

In modern military jets such as the F 15EX and Rafale, external tanks provide additional capacity without compromising maneuverability. These tanks are designed with aerodynamic precision, incorporating composite materials to minimize drag and radar cross section. As defense forces around the world modernize their fleets, the replacement and upgrade of external fuel tanks will remain a vital component of military logistics.

End Use Analysis: OEM vs. Aftermarket Dynamics

OEM Segment: Driven by New Aircraft Production

The Original Equipment Manufacturer (OEM) segment dominates the global aircraft fuel tanks market. With leading aircraft manufacturers such as Boeing, Airbus, Lockheed Martin, and Embraer expanding production to meet rising demand, OEM fuel tank integration is a critical focus area.

Modern fuel tanks are being designed in tandem with aircraft airframes to ensure optimal weight distribution, safety, and structural compatibility. The emphasis on fuel efficient and eco friendly aircraft has encouraged OEMs to adopt composite based tanks that align with sustainability goals. Additionally, OEMs are collaborating with material science companies to develop tanks capable of storing sustainable aviation fuels and hydrogen based energy.

Between 2025 and 2035, the OEM market will experience strong growth due to a steady increase in commercial aircraft deliveries and modernization of military fleets. Technological advancements such as additive manufacturing and digital twin modeling are enhancing tank precision, reducing manufacturing time, and improving quality control.

Aftermarket Segment: Upgrades and Retrofits

The aftermarket segment plays a pivotal role in maintaining and upgrading existing aircraft fleets. With over 25,000 commercial aircraft expected to remain operational through the next decade, the demand for replacement and refurbishment of fuel tanks will surge.

Aging aircraft require regular inspection and maintenance to ensure fuel system integrity. Advanced coatings, sealants, and corrosion resistant materials are being applied to extend the service life of older tanks. Aftermarket providers are also offering retrofit solutions that allow existing aircraft to utilize sustainable fuels or achieve higher efficiency through upgraded tank designs.

Military aircraft often undergo midlife upgrades, which include the installation of improved external and internal tanks to increase range, reduce detection, and enhance operational capabilities. The growing market for maintenance, repair, and overhaul (MRO) services is expected to sustain aftermarket demand well into 2035.

Platform Analysis: Commercial vs. Military Aviation

Commercial Aviation: Sustainability and Efficiency

Commercial aviation represents the largest share of the aircraft fuel tanks market, driven by global air travel growth and rising aircraft production. Airlines are investing in new generation aircraft that offer reduced fuel burn and extended range, necessitating innovations in fuel storage and management systems.

Manufacturers are focusing on developing tanks that are lightweight, corrosion resistant, and compatible with sustainable aviation fuels (SAF). These materials contribute to reducing overall aircraft weight and emissions, aligning with carbon neutrality goals. Furthermore, digital monitoring technologies are enabling predictive maintenance by providing real time insights into fuel system performance, ensuring operational reliability.

As airlines prepare for SAF integration, the demand for adaptive tank technologies that can safely handle biofuels and hydrogen will increase. This will open new opportunities for tank design and material innovations over the forecast period.

Military Aviation: Endurance and Combat Advantage

Military aviation has distinct requirements for fuel storage, emphasizing operational endurance, safety, and flexibility. Fuel tanks in combat and transport aircraft must perform under extreme conditions, including high speed maneuvers, altitude variations, and battlefield threats.

The introduction of stealth aircraft and unmanned combat aerial vehicles (UCAVs) is driving innovation in low observable and conformal fuel tanks that enhance aerodynamic performance while reducing radar signatures. Additionally, military forces are exploring fuel systems designed for multi fuel compatibility, supporting both conventional and synthetic fuels.

Advancements in materials such as self sealing composites and nano coatings are improving the survivability of military fuel tanks under hostile conditions. With defense modernization programs underway across North America, Europe, and Asia Pacific, the military segment is expected to remain a vital contributor to market expansion.

Material Analysis: The Transition to Advanced Composites

Carbon Based Composites: Lightweight Revolution

Carbon fiber reinforced polymer (CFRP) materials are redefining aircraft fuel tank construction. They offer exceptional strength to weight ratios, corrosion resistance, and design flexibility. Aircraft manufacturers are increasingly integrating carbon composites into internal and external tank structures to achieve significant fuel savings.

CFRP tanks not only enhance performance but also support the aviation industry’s sustainability agenda by reducing overall emissions. As production techniques become more cost efficient, carbon composites are expected to dominate future fuel tank designs for both commercial and defense platforms.

Metallic Alloys: Proven Durability and Reliability

Metallic alloys such as aluminum and titanium continue to play a vital role in aircraft fuel tank manufacturing. These materials provide durability, structural strength, and proven reliability under extreme conditions. Despite their heavier weight compared to composites, metallic tanks remain indispensable in military applications where robustness and impact resistance are paramount.

Technological improvements, including advanced welding techniques and protective coatings, are extending the lifespan of metallic fuel tanks. Hybrid systems that combine metallic structures with composite reinforcements are emerging as an optimal balance between weight and resilience.

Hybrid Materials: The Best of Both Worlds

Hybrid fuel tanks incorporate both metallic and composite elements to optimize performance. These tanks leverage the strength of metals and the lightness of composites, offering improved fuel efficiency and structural integrity. Hybrid designs are particularly suited for next generation aircraft that demand adaptability, efficiency, and safety.

By 2035, hybrid tank technology is expected to become a key area of research and development, bridging the gap between cost effectiveness and sustainability.

Polymers: The Next Frontier

Polymers such as thermoplastics and advanced resins are gaining attention for their flexibility, chemical resistance, and lightweight characteristics. In smaller aircraft and UAVs, polymer based fuel tanks are proving effective due to their ease of manufacturing and adaptability to complex shapes.

Future innovations in polymer composites will likely focus on self healing materials and enhanced fuel compatibility, making them ideal for both traditional and alternative fuel systems.

Regional Outlook (2025–2035)

The North American market dominates the global aircraft fuel tanks industry, driven by the presence of major OEMs such as Boeing, Lockheed Martin, and Northrop Grumman. Continuous investments in military aircraft and the introduction of new commercial models are strengthening market growth.

Europe follows closely, supported by Airbus’ large scale production facilities and regional defense initiatives. European manufacturers are emphasizing sustainability and innovation, particularly in composite and hydrogen compatible fuel tank systems.

Asia Pacific is expected to be the fastest growing region, led by increasing air travel demand, airline expansion, and domestic aircraft manufacturing in China, India, and Japan. The rise of indigenous aircraft programs such as COMAC C919 and HAL Tejas is creating strong regional supply chain opportunities.

The Middle East and Africa are witnessing modernization across both commercial and defense aviation sectors, with countries like the UAE and Saudi Arabia investing in advanced aerospace infrastructure. Latin America, though smaller in scale, is showing steady progress in aircraft fleet modernization and MRO services, particularly in Brazil and Mexico.

Competitive Landscape and Key Players

The aircraft fuel tanks market is highly competitive and characterized by innovation, strategic partnerships, and material advancements. Key players such as Meggitt PLC, Cobham Limited, GKN Aerospace, Triumph Group, and Safran SA are leading global efforts to design efficient, durable, and sustainable fuel storage systems.

Emerging companies specializing in composite materials and additive manufacturing are entering the market with disruptive technologies that promise cost reductions and performance improvements. Collaborations between OEMs and material science companies are shaping the next phase of development, emphasizing sustainability and digital integration.

Future Outlook: Fuel Tanks for the Aviation of Tomorrow

By 2035, the aircraft fuel tanks market will evolve from a focus on fuel containment to intelligent, adaptive, and sustainable systems. The integration of sensors and smart materials will enable real time monitoring of fuel conditions, structural health, and temperature management.

Hydrogen and electric propulsion systems will create new design challenges, pushing manufacturers to develop tanks capable of handling cryogenic and high pressure fuels. The convergence of AI, IoT, and digital twins will enable predictive maintenance and optimize performance across fleets.

The aviation industry’s march toward sustainability, safety, and innovation ensures that fuel tank technology will remain a cornerstone of progress. As the world transitions toward cleaner, smarter aviation, the fuel tank will continue to play a defining role in shaping the skies of the future.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered

1.4 Currency & Pricing

1.5 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Market Definition & Scope

2.1.4 Segment Definitions

2.1.4.1 Aircraft Fuel Tank Market, By Type

2.1.4.2 Aircraft Fuel Tank Market, By End Use

2.1.4.3 Aircraft Fuel Tank Market, By Platform

2.1.4.4 Aircraft Fuel Tank Market, By Material

2.2 Research Approach and Methodology

2.2.1 Bottom-Up Approach

2.2.1.1 OEM Aircraft Fuel Tank Market

2.2.1.2 Aftermarket Aircraft Fuel Tank Market

2.2.1.2.1 Parts Replacement Market

2.2.1.2.1 Maintenance, Repair, and Overhaul (MRO) Market

2.2.1.3 Total Aircraft Fuel Tank Market, By Platform and By Type

2.2.1.4 OEM Aircraft Fuel Tank Market, By Country

2.2.2 Top-Down Approach

2.2.2.1 Aftermarket Aircraft Fuel Tank Market, By Region and Country

2.2.2.2 Aircraft Fuel Tank Market, By Material

2.2.3 Pricing Analysis

2.3 Data Triangulation & Validation

2.3.1 Triangulation Through Secondary

2.3.2 Triangulation Through Primaries

2.4 Research Limitations

2.5 Research Assumptions

2.6 Risks

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 36)

4.1 Aircraft Fuel Tank Market, 2019–2025

4.2 Aircraft Fuel Tank Market, By Type

4.3 Aircraft Fuel Tank Market, By End Use

4.4 Aircraft Fuel Tank Market, By Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Aircraft Orders

5.2.1.2 Introduction of New Aircraft Programs

5.2.2 Opportunities

5.2.2.1 Hydrogen Fuel Cells

5.2.3 Challenges

5.2.3.1 Lack of Skilled Labor for MRO

5.2.3.2 Increasing Cost of Maintenance

5.2.3.3 Restricted Designing Prospects Due to Stringent Flammability Requirements

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Ecosystem

6.3 Key Influencers

6.4 Current and Futuristic Trends

6.4.1 Catalytic Inerting Technology

6.4.2 Foam-Based Solution for Flammability

6.4.3 3D Printing

6.4.4 Optical Fuel Gauging Technology

6.5 Innovation & Patent Registrations

7 Aircraft Fuel Tanks Market, By Type (Page No. - 51)

7.1 Introduction

7.2 External

7.2.1 Conformal Tanks

7.2.1.1 Provide Increased Range and Utility at A Small Performance Penalty

7.2.2 Drop Tanks

7.2.2.1 Expendable Fuel Tanks Result in No Performance Penalty

7.3 Internal

7.3.1 Integral Tanks

7.3.1.1 Demand for Wet Wings in Aircraft Drives the Demand for Integral Fuel Tanks

7.3.2 Rigid Removable Tanks

7.3.2.1 Growth in General Aviation Leading to Demand for Rigid Removable Tanks

7.3.3 Bladder Tanks

7.3.3.1 High-Performance, Lightweight Aircraft and UAVs Drive the Demand for Bladder Tanks

7.3.4 Tip Tanks

7.3.4.1 Provide Structural Integrity to the Wing Design of Aircraft

7.3.5 Auxiliary Tanks

7.3.5.1 Need for Increased Range and Back Up for Primary Internal Tanks Drive the Demand for Auxiliary Tanks

8 Aircraft Fuel Tanks Market, By End Use (Page No. - 57)

8.1 Introduction

8.2 Aftermarket

8.2.1 Parts Replacement

8.2.1.1 Old Aircraft Fleet, Bladder & Drop Tanks, and Other Fuel Tank Components Driving the Market

8.2.2 MRO

8.2.2.1 Mandatory Inspection and Repairs of Aircraft Fuel Tanks Driving the Market

8.3 OEM

8.3.1 Aircraft Demand Driving OEM Demand

9 Aircraft Fuel Tanks Market, By Platform (Page No. - 63)

9.1 Introduction

9.2 Commercial Aviation

9.2.1 Commercial Aircraft

9.2.1.1 Demand for Commercial Narrow-Body Aircraft Expected to Drive the Market

9.2.1.1.1 Narrow-Body Aircraft

9.2.1.1.2 Wide-Body Aircraft

9.2.1.1.3 Very Large Aircraft

9.2.1.1.4 Regional Transport Aircraft

9.2.2 General and Business Aircraft

9.2.2.1 Frequent Replacement of Ultralight and Light Aircraft Expected to Drive the Market

9.2.2.1.1 Ultralight Aircraft

9.2.2.1.2 Light Aircraft

9.2.2.1.3 Light Business Jets

9.2.2.1.4 Mid-Sized Business Jets

9.2.2.1.5 Large Business Jets

9.2.3 Helicopters

9.2.3.1 Demand for Medium Helicopters Expected to Drive the Market

9.2.3.1.1 Light

9.2.3.1.2 Medium

9.2.3.1.3 Heavy

9.3 Military Aviation

9.3.1 Fixed Wing

9.3.1.1 Fighter Aircraft Programs and Demand Expected to Drive the Market

9.3.1.1.1 Fighter

9.3.1.1.2 Transport

9.3.1.1.3 Reconnaissance & Surveillance

9.3.2 Helicopters

9.3.2.1 Accessibility of Helicopters for Special Missions Expected to Drive the Market

9.3.2.1.1 Attack & Reconnaissance

9.3.2.1.2 Special Mission

9.3.2.1.3 Maritime

9.3.2.1.4 Transport

9.3.3 Unmanned Aerial Vehicles (UAV)

9.3.3.1 Intelligence, Surveillance, and Reconnaissance Missions Drive the Demand for UAVs and Create Demand for UAV Fuel Tanks

10 Aircraft Fuel Tank Market, By Material (Page No. - 79)

10.1 Introduction

10.2 Carbon-Based Composites

10.2.1 Lightweight Property of Composite Materials Drives Demand for Composite-Based Fuel Tanks

10.3 Metallic Alloys

10.3.1 Durability and Corrosion Resistance of Metallic Alloys Drive Their Demand in Transport Aircraft

10.4 Hybrid

10.4.1 Need for High-Strength Low-Weight Tanks in Military Aviation Drives Demand for Hybrid Fuel Tanks

10.5 Polymers

10.5.1 Self-Sealing Properties Drive Demand for Polymers Used in Fuel Tanks

11 Aircraft Fuel Tanks Adjacent Market (Page No. - 84)

11.1 Introduction

11.2 Hydraulic Reservoirs

11.2.1 Commercial Aviation

11.2.1.1 Increase in Passenger Traffic Leading to Rising Demand for Commercial Aviation

11.2.2 Military Aviation

11.2.2.1 Increase in Delivery of Fighter Aircraft is A Major Driving Factor

11.3 Waste & Water Tanks

12 Regional Analysis (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Military Spending and Aircraft Orders Drive Demand

12.2.2 Canada

12.2.2.1 Presence of Leading Players in Business Jets Expected to Drive Demand

12.3 Europe

12.3.1 UK

12.3.1.1 Investment in the Procurement of F-35 Fighter Aircraft Expected to Drive Demand

12.3.2 France

12.3.2.1 Presence of Major Aircraft OEMs Expected to Drive Demand

12.3.3 Sweden

12.3.3.1 Procurement Plans of Gripen Fighter Aircraft Expected to Drive Demand

12.3.4 Russia

12.3.4.1 Procurement Plans of Mig-35 Fighter Aircraft Expected to Drive Demand

12.3.5 Italy

12.3.5.1 Major Shift in Military Aircraft Fleet Due to Retirement of Current Fleet Expected to Drive Demand

12.3.6 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Aircraft Demand Generated Due to Military Spending Expected to Drive the Market

12.4.2 Japan

12.4.2.1 Increase in Demand for Business Jets and Passenger Traffic Expected to Drive the Market

12.4.3 India

12.4.3.1 Availability of Cheap Labor and Procurement Deal for Rafale Fighter Aircraft Expected to Drive the Market

12.4.4 Rest of Asia Pacific

12.5 Latin America

12.5.1 Brazil

12.5.1.1 Presence of Embraer, A Leading Business Jet OEM, Expected to Drive Market

12.5.2 Rest of Latin America

12.6 Rest of the World

12.6.1 Middle East

12.6.2 Africa

13 Competitive Landscape (Page No. - 112)

13.1 Introduction

13.2 Competitive Analysis

13.2.1 Aircraft Fuel Tank Market: Competitive Leadership Mapping

13.2.1.1 Visionary Leaders

13.2.1.2 Innovators

13.2.1.3 Dynamic Differentiators

13.2.1.4 Emerging Companies

13.3 Competitive Scenario

14 Company Profiles (Page No. - 118)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Aero Tec Laboratories Inc (ATL)

14.2 Robertson Fuel Systems LLC

14.3 Northstar

14.4 Cobham PLC

14.5 Meggitt PLC

14.6 GKN Aerospace

14.7 General Dynamics Corporation

14.8 Elbit Systems – Cyclone Ltd.

14.9 Safran S.A.

14.10 Marshall Aerospace and Defence Group

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 137)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (91 Tables)

Table 1 USD Exchange Rates

Table 2 Innovation & Patent Registration (April 2015–November 2016)

Table 3 Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 4 External Aircraft Fuel Tank Market Size, By Region, 2017–2025 (USD Million)

Table 5 External Aircraft Fuel Tank Market Size, By Sub Type, 2017–2025 (USD Million)

Table 6 Internal Aircraft Fuel Tank Market Size, By Region, 2017–2025 (USD Million)

Table 7 Internal Aircraft Fuel Tank Market Size, By Sub Type, 2017–2025 (USD Million)

Table 8 Aircraft Fuel Tank Market Size, By End Use, 2017–2025 (USD Million)

Table 9 Aircraft Fuel Tanks OEM Market Size, By Type, 2017–2025 (USD Million)

Table 10 Aircraft Fuel Tanks Parts Replacement Market Size, By Type, 2017–2025 (USD Million)

Table 11 Aircraft Fuel Tanks MRO Market Size, By Type, 2017–2025 (USD Million)

Table 12 Aircraft Fuel Tanks Aftermarket Size, By End Use, 2017–2025 (USD Million)

Table 13 Aircraft Fuel Tanks Aftermarket Size, By Region, 2017–2025 (USD Million)

Table 14 Aircraft OEM Fuel Tanks Market Size, By Region, 2017–2025 (USD Million)

Table 15 Aircraft Fuel Tank Market Size, By Platform, 2017–2025 (USD Million)

Table 16 Aircraft Fuel Tank Market Size for Commercial Aviation, By Aircraft Type, 2017–2025 (USD Million)

Table 17 Aircraft Fuel Tank Market Size for Commercial Aviation, By Region, 2017–2025 (USD Million)

Table 18 Commercial Aircraft Fuel Tank Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 19 Narrow-Body Commercial Aircraft Fuel Tank Market Size, By Aircraft Model, 2017–2025 (USD Million)

Table 20 Wide-Body Commercial Aircraft Fuel Tank Market Size, By Aircraft Model, 2017–2025 (USD Million)

Table 21 Very Large Commercial Aircraft Fuel Tank Market Size, By Aircraft Model, 2017–2025 (USD Million)

Table 22 Regional Transport Commercial Aircraft Fuel Tank Market Size, By Aircraft Model, 2017–2025 (USD Million)

Table 23 General and Business Aircraft Fuel Tank Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 24 Helicopter Fuel Tanks Market Size, By Helicopter Type, 2017–2025 (USD Million)

Table 25 Military Aviation Aircraft Fuel Tank Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 26 Military Aviation Aircraft Fuel Tank Market Size, By Region, 2017–2025 (USD Million)

Table 27 Fixed-Wing Military Aircraft Fuel Tank Market Size, By Aircraft Type, 2017–2025 (USD Million)

Table 28 Military Helicopters Fuel Tanks Market Size, By Helicopter Type, 2017–2025 (USD Million)

Table 29 Aircraft Fuel Tank Market Size, By Material, 2017–2025 (USD Million)

Table 30 Carbon-Based Composite Fuel Tanks Market Size, By Region, 2017–2025 (USD Million)

Table 31 Metallic Alloy Fuel Tanks Market Size, By Region, 2017–2025 (USD Million)

Table 32 Hybrid Fuel Tanks Market Size, By Region, 2017–2025 (USD Million)

Table 33 Polymer Fuel Tanks Market Size, By Region, 2017–2025 (USD Million)

Table 34 Aircraft Fuel Tanks Adjacent Market Size, By Type, 2017–2025 (USD Million)

Table 35 Hydraulic Reservoirs Market Size, By Platform, 2017–2025 (USD Million)

Table 36 Aircraft Fuel Tank Market Size, By Region, 2017–2025 (USD Million)

Table 37 North America Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 38 North America: Aircraft Fuel Tank Market Size, By End Use, 2017–2025 (USD Million)

Table 39 North America: Aircraft Fuel Tank Market Size, By Platform, 2017–2025 (USD Million)

Table 40 North America: Aircraft Fuel Tank Market Size, By Country, 2017–2025 (USD Million)

Table 41 US: Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 42 US: Aircraft Fuel Tank Market Size, By End Use, 2017–2025 (USD Million)

Table 43 Canada: Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 44 Canada: Aircraft Fuel Tank Market Size, By End Use, 2017–2025 (USD Million)

Table 45 Europe: Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 46 Europe: Aircraft Fuel Tanks Market Size, By End Use, 2017–2025 (USD Million)

Table 47 Europe: Aircraft Fuel Tank Market Size, By Platform, 2017–2025 (USD Million)

Table 48 Europe: Aircraft Fuel Tank Market Size, By Country, 2017–2025 (USD Million)

Table 49 UK: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 50 UK: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 51 France: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 52 France: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 53 Sweden: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 54 Sweden: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 55 Russia: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 56 Russia: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 57 Italy: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 58 Italy: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 59 Rest of Europe: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 60 Rest of Europe: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 61 Asia Pacific: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 62 Asia Pacific: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 63 Asia Pacific: Aircraft Fuel Tanks Size, By Platform, 2017–2025 (USD Million)

Table 64 Asia Pacific: Aircraft Fuel Tanks Size, By Country, 2017–2025 (USD Million)

Table 65 China: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 66 China: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 67 Japan: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 68 Japan: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 69 India: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 70 India: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 71 Rest of Asia Pacific: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 72 Rest of Asia Pacific: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 73 Latin America: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 74 Latin America: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 75 Latin America: Aircraft Fuel Tanks Size, By Platform, 2017–2025 (USD Million)

Table 76 Latin America: Aircraft Fuel Tanks Size, By Country, 2017–2025 (USD Million)

Table 77 Brazil: Aircraft Fuel Tanks Market Size, By Type, 2017–2025 (USD Million)

Table 78 Brazil: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 79 Rest of Latin America: Aircraft Fuel Tank Market Size, By Type, 2017–2025 (USD Million)

Table 80 Rest of Latin America: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 81 Rest of the World: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 82 Rest of the World: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 83 Rest of the World: Aircraft Fuel Tanks Size, By Platform, 2017–2025 (USD Million)

Table 84 Rest of the World: Aircraft Fuel Tanks Size, By Region, 2017–2025 (USD Million)

Table 85 Middle East: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 86 Middle East: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 87 Africa: Aircraft Fuel Tanks Size, By Type, 2017–2025 (USD Million)

Table 88 Africa: Aircraft Fuel Tanks Size, By End Use, 2017–2025 (USD Million)

Table 89 Contracts and Agreements, January 2018–July 2019

Table 90 Expansion, January 2018–July 2019

Table 91 Mergers & Acquisitions, January 2018–July 2019

List of Figures (45 Figures)

Figure 1 Aircraft Fuel Tank Market Segmentation

Figure 2 Research Flow

Figure 3 Research Design: Aircraft Fuel Tank Market

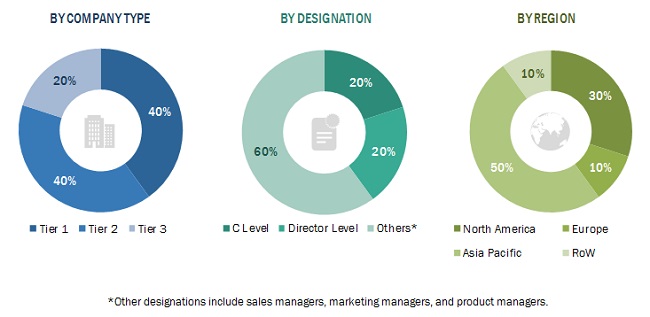

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions for the Research Study

Figure 9 By Type, Internal Segment Projected to Lead Aircraft Fuel Tank Market During Forecast Period

Figure 10 By End Use, Aftermarket Segment Projected to Dominate Aircraft Fuel Tank Market During Forecast Period

Figure 11 By Platform, Commercial Aviation Segment to Hold Larger Share of Aircraft Fuel Tank Market During Forecast Period

Figure 12 By Material, Carbon-Based Composites Segment Estimated to Hold the Largest Share of the Aircraft Fuel Tank Market in 2019

Figure 13 North America to Account for Largest Share of Aircraft Fuel Tank Market in 2019

Figure 14 Increase in Aircraft Deliveries and Upcoming New Programs to Drive the Aircraft Fuel Tank Market

Figure 15 Internal Tanks Projected to Lead Aircraft Fuel Tank Market During Forecast Period

Figure 16 OEM Expected to have A Higher CAGR During Forecast Period

Figure 17 India Aircraft Fuel Tank Market to Grow at Highest CAGR During Forecast Period

Figure 18 Key Insights From Industry Experts

Figure 19 Market Dynamics of the Aircraft Fuel Tank Market

Figure 20 Growth of Commercial Aviation Fleet, 2018–2037

Figure 21 General Aviation Aircraft Deliveries, 2010–2018

Figure 22 Percentage Increase in Military Spending of Major Countries, 2018

Figure 23 Global AMT Demand By Region, 2019–2038

Figure 24 Ecosystem: Aircraft Fuel Tank Market

Figure 25 Catalytic Inerting System

Figure 26 Aircraft Fuel Tank Market Size, By Type, 2019 & 2025 (USD Million)

Figure 27 Aircraft Fuel Tank Market Size, By End Use, 2019 & 2025 (USD Million)

Figure 28 Aircraft Fuel Tank Market Size, By Platform, 2019 & 2025 (USD Million)

Figure 29 Aircraft Fuel Tank Market Size, By Material, 2019 & 2025 (USD Million)

Figure 30 North America Estimated to Account for the Largest Share of the Aircraft Fuel Tank Market in 2019

Figure 31 North America Aircraft Fuel Tank Market Snapshot

Figure 32 Europe Aircraft Fuel Tank Market Snapshot

Figure 33 Asia Pacific Aircraft Fuel Tank Market Snapshot

Figure 34 Companies Adopted Contracts as A Key Growth Strategy Between January 2018 and July 2019

Figure 35 Aircraft Fuel Tanks Market Competitive Leadership Mapping, 2018

Figure 36 Strength of Product Portfolio

Figure 37 Business Strategy Excellence

Figure 38 Cobham PLC: Company Snapshot

Figure 39 Cobham PLC: SWOT Analysis

Figure 40 Meggitt PLC: Company Snapshot

Figure 41 GKN Aerospace Corporation: Company Snapshot

Figure 42 General Dynamics Corporation: Company Snapshot

Figure 43 General Dynamics Corporation: SWOT Analysis

Figure 44 Safran S.A.: Company Snapshot

Figure 45 Marshall Aerospace and Defence Group: Company Snapshot

The study considered major activities to estimate the current market size for aircraft fuel tanks. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Aerospace Magazine were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The aircraft fuel tanks market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by various end-users, such as OEMs and aftermarket players. The supply side is characterized by advancements in aircraft fuel tanks technology and the development of aircraft fuel tanks systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft fuel tanks market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends, from both the demand and supply sides, in the aircraft fuel tanks market.

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft fuel tanks market based on type, platform, material, end use, and region

- To forecast the market size of various segments of the aircraft fuel tanks market with respect to 5 major regions: North America, Europe, Asia Pacific, Latin America, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft fuel tanks market

- To identify industry trends, market trends, and technology trends currently prevailing in the aircraft fuel tanks market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the aircraft fuel tanks market by identifying key market players

- To analyze competitive developments, such as contracts, agreements, mergers & acquisitions, expansions, and certifications of key players in the aircraft fuel tanks market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the aircraft fuel tanks market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Adjacent Market

- Market sizing and regional breakdown for aircraft hydraulic tanks and waste & water tanks

Growth opportunities and latent adjacency in Aircraft Fuel Tanks Market