LNG Storage Tank Market

LNG Storage Tank Market by Material (Steel, 9% Nickel Steel, Aluminum, Other Materials), Type (Self-Supporting, Non-Self-Supporting), End-use Industry (Energy & Power, Industrial, and Transportation & Logistics), and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The LNG Storage Tanks market is projected to reach USD 21.22 billion by 2029 from USD 14.64 billion in 2024, at a CAGR of 7.7% from 2024 to 2029. LNG Storage Tanks are a class of specialized storage tanks for LNG storage. These tanks are usually located in ground, above ground, and in LNG operated vehicles or ships. They are fabricated in different arrangements, including vertical, horizontal, double-walled, and insulated. Thermal insulation is used when making LNG tanks in order to minimize evaporation, avoid the transfer of heat, and secure buildings from exposure to cryogenic temperatures

KEY TAKEAWAYS

-

BY TYPEBased on type, the LNG Storage Tank market has been segmented into self-supporting and non-self-supporting LNG Storage Tank. The self-supporting segment accounted for the largest share of the LNG Storage tank market in 2024 in terms of value and volume. The growth of the self-supporting type segment is driven by their ability to maintain cryogenic temperature and excellent mechanical properties. Self-supporting LNG storage tanks are also known as independent tanks. These tanks are called self-supporting as they can sustain and contain the cryogenic liquid with a primary barrier. These tanks also do not form a part of the ship’s hull structure. Self-supporting tanks have a strong and reliable structure, which is not prone to damage or crack. These factors are expected to continue driving the market growth of self-supporting tank type in the future. Self- supporting tanks are further segmented into single-containment, double-containment, and full-containment storage tanks, each having unique properties that contribute towards the demand of these respective tanks from the end-use industries. There is an increasing demand for self-supporting tanks from industries like energy & power, industrial, and transportation & logistics.

-

BY MATERIALOn the basis of material, the LNG Storage tank market has been segmented into steel, 9% nickel steel, aluminium alloy and other materials. Steel is one of the most widely used material for the manufacture of LNG storage tanks. Steel LNG storage tanks find extensive use in LNG ships and piping systems. Stainless steel is extensively utilized in membrane LNG storage tanks. SUS 304L is the most used stainless-steel grade in membrane-type LNG storage tanks due to its excellent corrosion resistance, high ductility, and superior toughness at cryogenic temperatures. In 2018, the International Maritime Organization (IMO) sanctioned the utilization of high manganese austenitic steel in cryogenic LNG storage tanks and fuel tanks. The material contains 22.5-25.5% manganese, which provides it with exceptional toughness and tensile strength than traditional material. Additionally, it is almost 30% lower in cost compared to 9% nickel steel, which reduces the production cost to a large degree. Austenitic steel is a common type of stainless steel. Due to high chromium and nickel content and low carbon, this steel possesses superior corrosion resistance, making it ideal for the fabrication of LNG storage tanks. The growth in LNG projects globally will boost the demand for steel in the market for LNG storage tanks.

-

BY END USE INDUSTRYBased on the end-use industry, the LNG Storage tank market has been segmented into energy & power, industrial, transportation & logistics. Among these end-use industries, the transportation & logistics industry will register the highest growth rate in the LNG Storage tank market during the forecast period. LNG storage tanks are a crucial component of the logistics and transportation end-use industry, especially in supplying fuel for heavy-duty trucks and facilitating the infrastructure that supports emissions reduction and operations efficiency. The shipping sector, such as cargo vessels, container ships, and tankers, is moving towards LNG as a propulsion fuel because it has a lower environmental footprint than conventional marine fuels like heavy fuel oil. LNG is gaining traction for use in ships sailing in areas with strict emission regulations, like the IMO 2020 sulfur cap regulations. LNG terminals in ports store the LNG that will be provided to ships while at port stoppage. The LNG is held in special tanks within marine refuelling terminals, and the LNG is either loaded onto ships directly or through bunkering ships. This equipment is essential for the smooth functioning of shipping organizations with LNG-powered ships. Few of the freight railway companies are starting to move from diesel to LNG-powered trains. LNG presents a cleaner choice than diesel, having fewer emissions and lowering the carbon footprint of railway transport

-

BY REGIONThe LNG Tanks market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia pacific is expected to dominate the global LNG storage tank market in terms of value and volume during the forecast period. The region has presence of some of the leading manufacturers of LNG storage tank market like IHI Corporation, Air Water Inc., CIMC Enric Holdings Limited, INOX India Limited, and Luxi New Energy Equipment Group Co. Ltd. The growth of Asia Pacific in LNG Storage market is attributed to increasing investments in the energy & power sector in the recent years, creating a high demand for LNG, which, in turn, will drive demand for LNG storage tanks in the region. Moreover the growing trade of small-scale LNG paired with the growth in the Asia Pacific metal manufacturing industry has been primarily by the domestic availability of raw materials and inexpensive labor

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Linde PLC (Ireland), IHI Corporation (Japan), and Air Water Inc. (Japan) have entered into a number of agreements and partnerships to cater to the growing demand for LNG Storage Taks across innovative applications.

The demand for LNG Storage Tank is driven by several key factors, including growth of global LNG trade as cleaner energy alternative and increasing number of floating storage and regasification units. LNG Storage Tanks are mainly used in energy & power, industrial, and transportation & logistics end-use industry. LNG storage tanks play a crucial role in the energy and power industry by providing a reliable means to store liquefied natural gas (LNG) for various applications. Companies are expanding their geographical reach and expertise through mergers and acquisitions, and are focused on developing innovative tank designs. The industry is evolving to offer a wider choice of commercial structures to meet changing needs, and full-services solutions encompassing tank construction, maintenance, and financing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of LNG tank manufacturers. The diagram illustrates how the revenue streams for companies in material and technology sectors are expected to transform significantly due to major trends and disruptions. Historically, only 20% of revenues have come from emerging areas like new technologies, use cases, and ecosystem partnerships, but this is projected to grow to 80% in the future as businesses increasingly focus on innovation-driven offerings, new client partnerships, and targeted M&A strategies. This transformation affects the broader value chain, involving major industrial clients such as Indian Oil Corporation, Sinopec, Hyundai Heavy Industries, and others, who require solutions for storage, distribution, power generation, transportation, and heating. Their priorities are increasingly shaped by end-user demands for outcomes like lower emissions, improved energy distribution, prolonged machinery and engine lifespans, lower sulfur content, and broader environmental benefits. The shift aligns with wider industry trends where sustainability, decarbonization, and technological advancements are accelerating business model evolution and driving revenue mixes toward cleaner, more efficient, and environmentally friendly solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth of global LNG trade as cleaner energy alternative

-

Increasing number of floating storage and regasification units

Level

-

High initial investment and installation cost for LNG storage tanks

-

Volatility in raw material prices

Level

-

Growing opportunities in marine transport

-

Increasing spending on infrastructure

Level

-

LNG leakage and boil-off gas

-

Environmental and regulatory pressures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of global LNG trade as cleaner energy alternative

LNG is a clean fuel, and its application as a shipping fuel is on the rise globally because of more stringent environmental regulations. Sustainable growth in LNG consumption has been facilitated by rising global liquefaction capacity and LNG imports. International LNG trade increased to 401.42 million tons in 2023 by 2.1% from 2022 to 2023, according to the International Gas Union (IGU). In February 2024, the global liquefaction capacity for LNG was 483.1 million tons annually. The US, Australia, and Qatar were top three exporters of the gas in 2023 and covered nearly 60% of the total LNG exports globally, a report by the US Energy Information Administration reported. The capacity for LNG regasification all over the globe is rising yearly. As of 2023, Japan is the largest holder of the global LNG regasification capacity with a total capacity of 217.5 million metric tons annually. Regasification involves the conversion of liquefied natural gas (LNG) at - 259°F to natural gas at atmospheric temperature. A few of the notable projects which were commissioned in the period from 2021 to 2024 are: Wilhelmshaven (5.5 MTPA), Eemshaven (5.9 MTPA), Inkoo FSRU, BW Tatiana FSRU (2.2 MTPA), Lubmin FSRU (3.8 MTPA), Brunsbuttel LNG Terminal (3.7 MTPA), and Gulf of Saros FSRU (21.8 MTPA). With the escalating global energy demand and the rise in climate action projects initiated by governments across the globe, LNG is proving to be a suitable solution. Not only does LNG fulfill the rising energy demands of industries, transport, and domestic sectors, but it also offers a cleaner alternative than conventional fossil fuels like coal and oil. This transition towards LNG is highly influenced by its lower carbon footprint when combusted, in line with most nations' targets to curb greenhouse gas emissions and mitigate climate change. Moreover, LNG infrastructure has been evolving quickly, becoming more available and affordable. Consequently, demand for LNG continues to rise, making it a preferred option over other energy sources in the move towards a more sustainable energy future

Restraint: Volatility in raw material prices

One of the fundamental basic materials that are utilized in the production of storage tanks is nickel. Indonesia dominates the global nickel trade, followed by Australia. The Indonesian government has placed restrictions on raw nickel exports in a bid to promote local manufacturing, as Indonesia is the globe's largest nickel producer, accounting for over 20% of global nickel exports. Raw material supply chains were very much affected by this strategy. The policy by the Indonesian government, in trying to increase jobs and GDP domestically, led to steep increases in the cost for producing LNG storage tanks. Steel, one of the main raw materials for the manufacture of tanks, experienced price hikes in 2018 when the US slapped a 25% tariff on Chinese-made steel. In February 2025, the US applied a new 10% additional tariff on Chinese products. To manufacturers, such price changes significantly increase scepticism that can have an impact on the profitability and viability of a project. Budget overspends and expansion in the market result from the raw material cost unpredictability, particularly by smaller firms with an intent to enter the LNG storage tanks sector. The recent global political realignments have resulted in rise in uncertainties related to raw material supply chains and prices, which will have a negative impact on projects by inducing cost and schedule overruns and deterring businesses from actively participating in market activities

Opportunity: Growing opportunities in marine transport

Sulphur oxides are exhaust ship engine gases that burn the marine fuel that has sulphur. Other than damaging human health, they also lead to acidification of the soil and water. The International Maritime Organization (IMO) in 2020 introduced 'Global Sulphur Cap", which was announced to lower the sulphur content in marine fuel from 3.5% to 0.5% of the total. This has contributed to decreasing the sulphur oxide emission by approximately 70%. The compliant fuel is very low sulphur fuel oil (VLSFO) and marine gas oil (MGO). Certain new ships are constructed with LNG being a potential fuel for the adaptation of the vessels to meet the future marine fuel standards requirement. LNG produces no sulphur oxide and no particulate matter, which is different compared to other fuel types, and is non-corrosive as well as non-toxic in nature. LNG will result in long-term and cost-effective options as a conventional marine fuel, as against other fuels including very-low sulphur fuel oil (VLSFO) and marine gas oil (MGO). Increased demand for the ships with LNG, which can be readily accepted to the future fuel and emission regulations, is a chance for the market of LNG storage tanks to expand. LNG storage tanks are increasingly deployed in intermodal freight transportation. Intermodal facilities such as depots, container yards, cargo, and storage tanks, which will offer additional alternatives for marine transportation and numerous oil & gas firms, which will drive the market for LNG storage tanks.

Challenge: Environmental and regulatory pressures

Apart from emissions, the environmental footprint includes other ecological concerns. LNG terminals have the potential to pollute surface and groundwater from industrial activity, chemicals, and hydrocarbon products. Extensive risk management strategies and major investments in state-of-the-art containment and monitoring systems are needed given the magnitude of these environmental risks. Since LNG plants are recognized as major emitters of greenhouse gases, increasing attention on methane emissions poses significant operational challenges. Government agencies are putting more stringent environmental standards into practice, and regulatory regimes are becoming tighter, which can pose as a challenge for the growth of the LNG storage tank market. There is mounting pressure on this sector to convert to alternative energy sources. Due to LNG's massive climatic impact, a number of companies are voluntarily adopting carbon capture and storage technologies in an effort to maintain their legitimacy of operation. There is a pressure on LNG storage facilities to adhere to Environmental, Health, and Safety (EHS) guidelines, which require robust management systems for hazardous materials, air emissions, and waste. Compliance with these standards can be very costly and time consuming

LNG Storage Tank Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Engineering, procurement, and construction (EPC) of full-containment LNG storage tanks. | Proven safety, large storage capacity, compliance with global standards (API 625, ACI 376).. |

|

Uses 9% nickel steel inner tanks with reinforced concrete outer tanks. | Superior cryogenic performance, structural integrity at low temperatures, long lifespan. |

|

LNG storage tank design and modular construction for onshore LNG terminals. | Faster deployment, reduced construction time, and scalable modular systems. |

|

Cryogenic LNG tank solutions using membrane and full containment technologies. | Space-saving design, adaptable for various site conditions, improved thermal efficiency |

|

Operates and maintains large-scale LNG tank farms across South Korea. | Operational reliability, safety in extreme climates, high storage efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Ecosystem mapping for the LNG storage tanks market involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. This mapping delineates the flow of resources, information, and value within the ecosystem, highlighting dependencies, collaborations, and potential disruptions. Raw material suppliers are crucial in providing key materials for LNG storage tanks, while LNG tank manufacturers supply these materials to end users for their operations. Distributors facilitate the supply chain by delivering products directly to retailers or end users who use LNG storage tanks in automotive & transportation, aerospace, electronics, military & defense, and construction industries.|

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LNG Storage Tanks Market, By Type

Self-supporting LNG storage tanks are expected to have the largest market share over the forecasted period favored over non-self supporting tanks for various factors like enhanced safety, reliability, and versatility. These tanks can withstand the extreme temperatures and pressures required for LNG storage. Self-supporting tanks are also suitable for a wide range of applications, including onshore, offshore, and marine environments. Self-supporting LNG storage tanks do not rely on the container structure for support. They are strong enough to handle the load due to their construction. Their structure makes them more stable and safer, as they are less susceptible to structural failure. On the other hand, the non self suppoting segment is expected to have the fastest CAGR in the forecasted period.

REGION

Asia Pacific to be fastest-growing region in global LNG Storage Tanks market during forecast period

Asia Pacific is projected to register the highest CAGR in the LNG storage tank market during the forecast period. Asia Pacific is the biggest market for LNG storage tanks. China, India, Japan, Australia, South Korea, Taiwan, and several Southeast Asian nations, such as Thailand and Malaysia, are key markets for LNG storage tanks across the region. The Asia Pacific region is estimated to be the fastest-growing LNG storage tank market due to significant growth in energy sector investments during the recent past, leading to a high demand for small-scale LNG, consequently fuelling demand for LNG storage tanks across the region. In addition, the increasing import of small-scale LNG and the increase in the Asia Pacific steel and metal production industry have been propelled primarily by domestic raw material availability (for example, iron ore) and affordable labour. The steel industry has been the prime driver for India's manufacturing sector, and the latter fuels the demand for LNG storage tanks in the Asia Pacific. China is also experiencing strong growth in the energy sector, driven by ongoing energy demand and favourable policies pushing economic activities. Other developing economies of Asia are also bound to provide scope for LNG development within the region, despite policy sensitivity and price levels being unclear. Therefore, the growths in the energy sector are anticipated to propel the LNG storage tanks market.

LNG Storage Tank Market: COMPANY EVALUATION MATRIX

In the LNG Storage Tanks market matrix, Linde PLC (Star) leads with a strong market share and extensive product footprint, due to its global leadership in industrial gases and engineering equipment, as well as its vast experience in providing premium cryogenic tanks and tailored solutions for liquefied natural gas storage. CIMC Enric Holdings Limited (Emerging Leader) is gaining visibility due to its superior, secure, and effective cryogenic storage solutions made with cutting-edge high-vacuum multi-layer insulation technology that reduces heat transmission and prolongs LNG storage time. While Linde PLC dominates through scale and a diverse portfolio, CIMC Enric Holdings Limited shows significant potential to move toward the leaders’ quadrant as demand for LNG Storage tanks continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.64 Billion |

| Market Forecast in 2029 (Value) | USD 21.22 Billion |

| Growth Rate | CAGR of 7.7% from 2025-2030 |

| Years Considered | 2021-2029 |

| Base Year | 2024 |

| Forecast Period | 2025-2029 |

| Units Considered | Value (USD Million), Volume (Million Cubic Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: LNG Storage Tank Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cryogenic Tank Material Supplier |

|

|

| LNG Project Developer |

|

|

| LNG Terminal Operator |

|

|

| EPC Contractor |

|

|

| Tank Fabricator / Constructor |

|

|

RECENT DEVELOPMENTS

- May 2024 : CB&I, formed from the merger of McDermott International and Chicago Bridge & Iron Company, secured a significant contract from Marsa Liquefied Natural Gas LLC (a joint venture between Total Energies and OQ) for a 165,000 cubic meter full containment concrete LNG storage tank in Oman. The project emphasizes low greenhouse gas emissions and is expected to support energy transition efforts in the region

- April 2023 : Air Water Engineering Inc. acquired M1 Engineering, a notable provider of specialized cryogenic distribution equipment. This acquisition enhanced Air Water’s capabilities in LNG and cryogenic technologies, allowing them to offer more comprehensive solutions for LNG storage and distribution systems, which is critical as the market expands

- September 2021 : Wärtsilä collaborated with ABS and Hudong Zhonghua Shipbuilding to develop a flexible, future-proof, and modular LNG carrier vessel concept for a multi-fuel electric liquefied natural gas carrier (LNGC) designed to reduce CO2 emissions and be ready for future decarbonization technologies

Table of Contents

Methodology

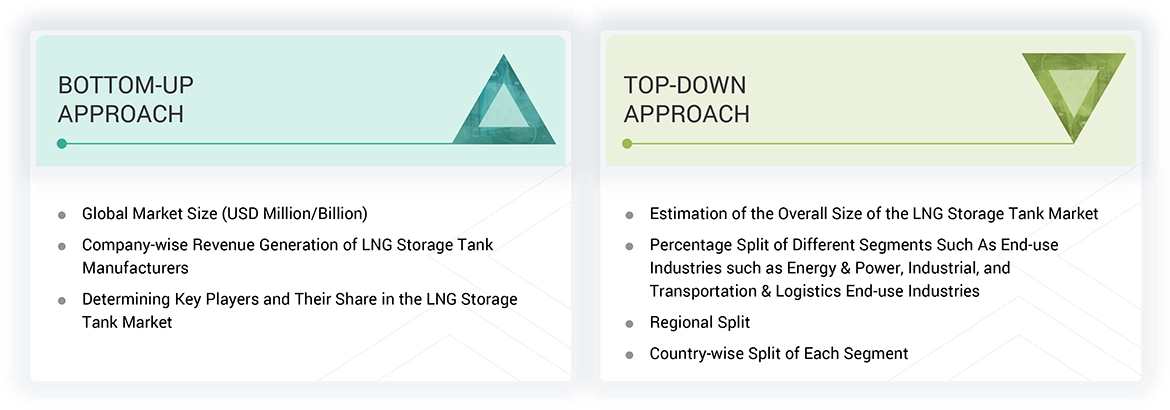

The study involves two major activities in estimating the current market size for the LNG Storage Tank market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering LNG Storage Tank and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the LNG Storage Tank market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the LNG Storage Tank market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from LNG Storage Tank industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to resin type, fiber type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking LNG Storage Tank services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of LNG Storage Tank and future outlook of their business which will affect the overall market.

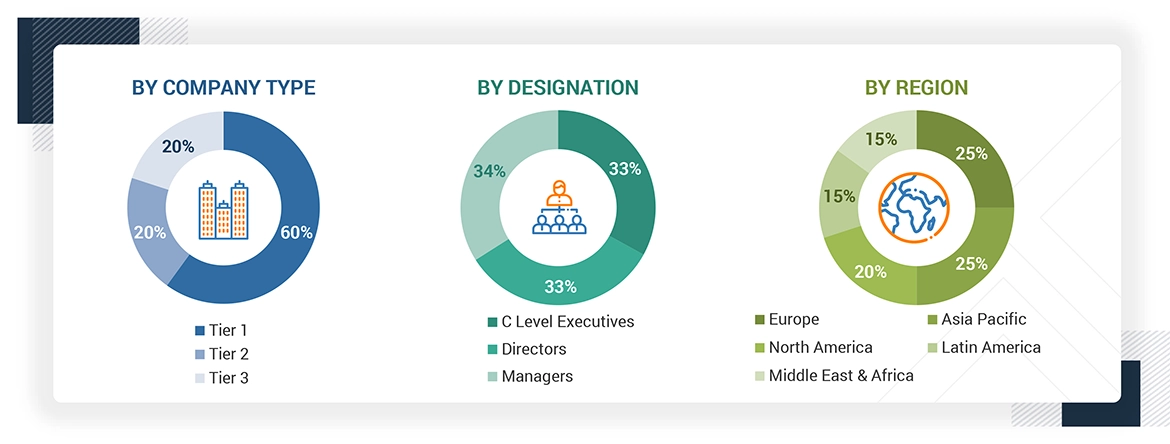

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the LNG Storage Tank market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for LNG Storage Tank in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the LNG Storage Tank industry for each application. For each end-use, all possible segments of the LNG Storage Tank market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

LNG Storage Tanks are specialized types of storage tanks used for storing LNG. These tanks are generally found in ground, above ground, and in LNG carriers or vehicles. They are made in various configurations, such as horizontal, vertical, double-walled, and insulated. LNG storage tanks are constructed with thermal insulation to reduce evaporation, prevent heat transfer, and protect structures from cryogenic temperatures. These tanks are used in various end-use industries, such as energy & power, industrial, and transportation & logistics.

Stakeholders

- LNG Storage Tank Manufacturers

- LNG Storage Tank Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the LNG Storage Tank market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global LNG Storage Tank market, by material, by type, by end-use industry, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LNG Storage Tank Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LNG Storage Tank Market