Aircraft Insulation Market by Platform (Fixed Wing, Rotary Wing), Type (Thermal, Acoustic & Vibration, Electric), Material (Foamed Plastics, Fiberglass, Mineral Wool, Ceramic-based Materials), Application (Airframe, Engine) and Region (2021-2026)

Update: 11/22/2024

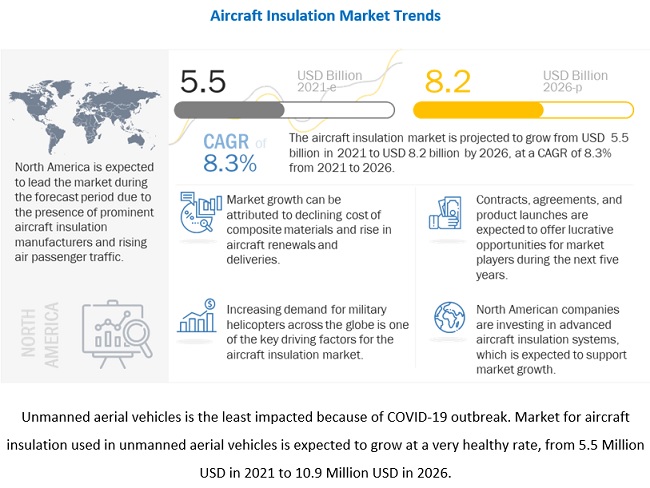

The Global Aircraft Insulation Market Size was valued at USD 5.5 billion in 2021 and is estimated to reach USD 8.2 billion by 2026, growing at a CAGR of 8.3% during the forecast period. The global Aircraft Insulation Market is critical for enhancing the safety, comfort, and efficiency of aircraft. Insulation materials are essential for thermal, acoustic, and electrical insulation in various parts of an aircraft, including the fuselage, cabin, and cargo areas. The market is driven by increasing demand for fuel-efficient aircraft, advancements in insulation technologies, and stringent regulations related to passenger safety and comfort.

The Aircraft Insulation Industry is driven by various factors, such as increase in demand for lightweight materials, introduction of advanced acoustic and fire resistant materials resulting in safer operations of aircraft, declining cost of composite materials, and increasing demand for military helicopters.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the aircraft insulation Market

The COVID-19 outbreak has led to several challenges for the aviation industry. The industry has faced many economic problems post the COVID-19 outbreak. Since the beginning of the outbreak, the civil aviation industry has been among the most severely hit sectors globally. The International Civil Aviation Organization (ICAO) and International Air Transport Association (IATA) actively monitor the economic impact on the aviation industry and regularly publish reports and forecasts.

Due to COVID-19 the aircraft delivery and backlogs, as the number of flights is reduced. Hence, the demand for aircraft insulation in the civil aviation industry, used in various aircraft applications such as cabin interior and flooring, landing gear doors, engine nacelles, aircraft tires, and others had also come down.

Aircraft Insulation Market Dynamics

Driver: Increase in demand for lightweight insulation materials

Increase in demand for lightweight insulation materials is a key factor that is expected to drive the aircraft insulation market. There is an increase in the use of composite materials to manufacture aerostructures. These materials include concrete, fiber-reinforced polymer, metal composites, and ceramic composites. These materials are combined to make composite materials that have high strength, flexibility, and are lightweight as compared to aluminum or steel. Furthermore, these materials are corrosion-resistant, which keeps the covers of an aerostructure tight under any weather condition.

Investments made towards research & development of new materials in the aircraft insulation market have led to the development of advanced composite materials, such as Polymer Matrix Composites (PMCs), Ceramic Matrix Composites (CMCs), and Metal Matrix Composites (MMCs). These composites have heat absorption capacity, less weight, noise cancellation capability, vibration absorbance, etc.

Such advancements in the aircraft insulation technology are expected to lead to their demand during the forecast period.

Opportunity: Increase in demand for composite materials from General Aviation (GA) and business jets industry to reduce cabin noise

The demand for general aviation and business jet services is increasing globally due to the increase in disposable income of people, standard of living, and corporate and recreational aviation. This, in turn, has led to a rise in demand for private jets, business jets, and small aircraft from the General Aviation (GA) industry. Presently, the General Aviation industry is focusing on increasing its market share in the North American and European regions. Following the rise in demand for aircraft and increase in passenger traffic, aircraft manufacturers are using composite materials to make aircraft cabin noise-free. Although aero grade aluminum alloy has been considered as a major material for current GA aircraft models, Carbon Fiber Reinforced Polymer (CFRP) is being widely adopted to manufacture new aircraft models.

Additionally, the emerging economies of the world contribute majorly to the growth of the business jets market. Countries such as India, China, Australia, Saudi Arabia, and Nigeria are the growing markets for business jets manufacturers. Enhancements in the interior of the business jets also attract new customers. This leads to a huge demand for insulation materials used in the aerospace sector, which are used in several cockpit and other luxury equipment of business jets.

Challenges: Insulation reliability issues in more electric aircraft

In More Electric Engines (MEE), which have high temperature applications (up to 450°C), inorganic materials, such as carbon composites, are used to insulate the wire, as traditional organic materials cannot service such high temperatures. Although inorganic insulation materials have been used for prolonged period in other high voltage components other than the aerospace industry, their behavior is not fully understandable as to how consistent the insulation will be on electrical wires.

Demand for acoustic & vibration insulation will drive the demand for type segment

There are different types of noises and vibrations generated from aerodynamics and other mechanical systems in an aircraft. However, the main sources of noise in an aircraft are engines and airflow, which transmit through a plane’s fuselage and structure. The noise is often perceived as a rumble or a roar. This creates an uncomfortable environment inside the aircraft. Vibration and acoustic insulation materials such as fiberglass and polyimides absorb the sound and vibration and stop the flow of vibration from one point to another. In addition, the damping treatment is carried out directly on an aircraft’s skin to reduce the effects of boundary-level excitation, engine exhaust, and engine vibration. They are also applied on the interior trim structure to reduce the effects of noise and vibration.

The foamed plastics segment is projected to witness a higher CAGR during the forecast period

The revenue generated by the foamed plastics market, which recorded USD 4,060.9 million in 2021, is expected to grow up to USD 6,124.4 million in 2026 with CAGR of 8.56%. Plastic foams are widely used in a cabin in seat cushions and mattresses to absorb heat, noise insulation, vibration, etc. The aerospace industry uses various materials such as polyimide and polyurethane foams, combining acoustic and thermal insulation to be used in aircraft cabin in linings, wall panels, and rest of the areas or insulation blankets for door areas of the aircraft.

Market for aircraft insulation used in airframe is projected to witness highest CAGR during the forecast period

Market for aircraft insulation used in airframe is expected to grow 4,565.5 Million USD in 2021 to 6,904.1 Million USD in 2026 with CAGR of 8.62%. The airframe of an aircraft includes aircraft wings, flight control surfaces, fuselage, etc. It is the backbone of the aircraft, and is responsible for a safe, efficient, and reliable flight. The use of lightweight and high-strength composite materials for the development of the structure of an aircraft is anticipated to drive the growth of the aircraft insulation market.

Demand for fixed wing aircraft will drive the demand for type segment

Aircraft insulation used in each type of fixed wing aircraft varies depending on the size of the aircraft. Aircraft insulation is commonly used in fixed wing aircraft for thermal and acoustic insulation, aircraft weather protection covers, and ancillary ground support equipment. It is also covers a range of composites, plastics, fiberglass insulation, fabrics, and webbing at cabin interiors of a fixed wing aircraft.

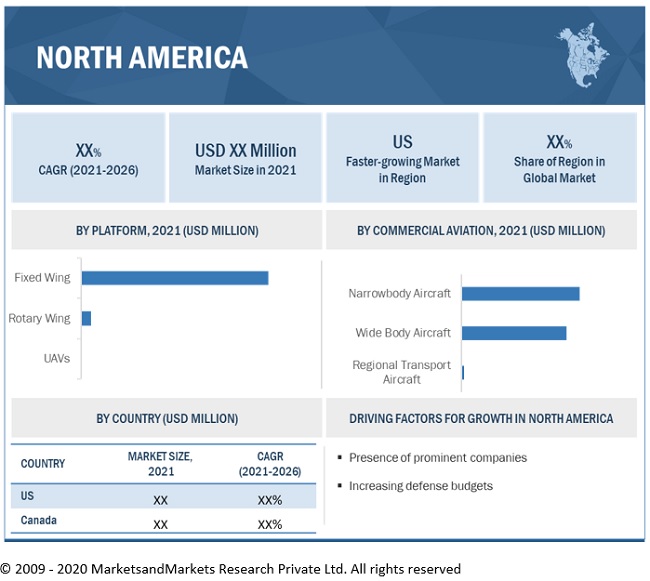

The North America market is projected to contribute the largest share from 2021 to 2026

North America is projected to be the largest regional share of the aircraft insulation market during the forecast period. In the North America section, the aircraft insulation market is majorly divided into two countries: US and Canada. largest number of OEMs and MRO companies of the aircraft insulation market. The largest aircraft deliveries are also seen in the North American Region. It also accounts for the largest passenger traffic. The North American region also spends the most in technological and R&D programs. It also has the largest defense spending in the world. North America is home to some of the giants in the aircraft manufacturing industry, like Raytheon Technologies, Boeing, Lockheed Martin etc.

To know about the assumptions considered for the study, download the pdf brochure

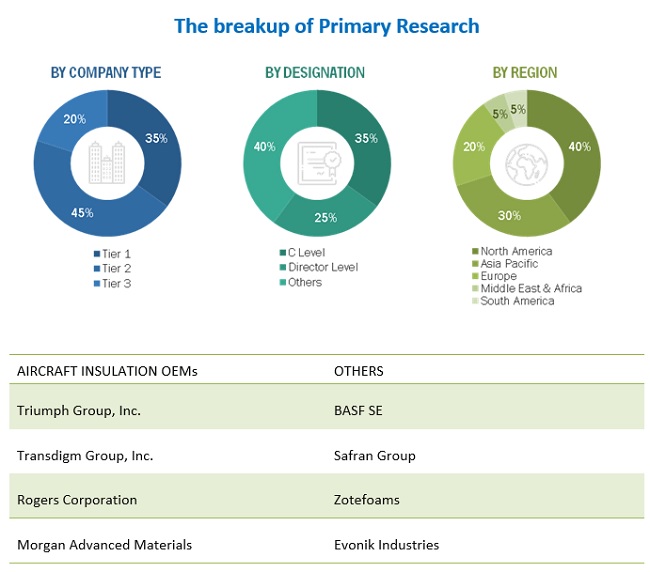

The Aircraft Insulation Companies are dominated by a few globally established players such as DuPont (US), BASF SE (Germany), Safran Group (France), Rogers Corporation (US), Morgan Advanced Materials (UK), Triumph Group, Inc. (US), Transdigm Group, Inc. (US), and Zotefoams (UK).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, By Material, By Application, By Platform, By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

DuPont (US), Triumph Group, Inc. (US), Transdigm Group, Inc. (US), Zotefoams (UK), BASF SE (Germany), Rogers Corporation (US), Safran Group (France), and Evonik Industries (Germany) |

The study categorizes the aircraft insulation market based on Type, Material, Application, Platform, and Region.

By Type

- Thermal Insulation

- Acoustic & Vibration Insulation

- Electric Insulation

By Material

- Foamed Plastics

- Fiberglass

- Mineral Wool

- Ceramic-based Materials

- Others

By Application

- Airframe

- Propulsion System

By Platform

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In September 2019, BASF SE developed particle foam based on polyethersulfone (PESU). The foam offers various features such as flame retardancy, high-temperature resistance, and lightweight.

- In March 2019, Transdigm Group, Inc. acquired Esterline Technologies Corporation (US), a manufacturer of aircraft parts & components, machine tool systems, aircraft insulation systems, and automated drilling products. The acquisition enabled Transdigm Group, Inc. to strengthen its position in the global aircraft insulation market.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aircraft insulation market?

The aircraft insulation market is expected to grow substantially owing to the technological development in designing of the new and compact missiles.

What are the key sustainability strategies adopted by leading players operating in the aircraft insulation market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft insulation market. The major players include DuPont (US), BASF SE (Germany), Safran Group (France), Triumph Group, Inc. (US), and Transdigm Group, Inc. (US), these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft insulation market?

Some of the major emerging technologies and use cases disrupting the market include Spider Silk Fiber and Bio-Composites

Who are the key players and innovators in the ecosystem of the aircraft insulation market?

The key players in the aircraft insulation market include DuPont (US), BASF SE (Germany), Safran Group (France), Triumph Group, Inc. (US), and Transdigm Group, Inc. (US).

Which region is expected to hold the highest market share in the aircraft insulation market?

Aircraft insulation market in Asia Pacific is projected to hold the highest market share during the forecast period. The aviation industry in Asia-Pacific has witnessed significant growth in recent years, driven by the increasing air passenger traffic in the region. The growth in passenger traffic has resulted in an increased demand for new aircraft, which is anticipated to boost the demand for aircraft insulation during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 AIRCRAFT INSULATION MARKET

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 BY TYPE, ACOUSTIC & VIBRATION SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

FIGURE 7 BY MATERIAL, FOAMED PLASTICS SEGMENT ESTIMATED TO LEAD AIRCRAFT INSULATION MARKET DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA ESTIMATED TO LEAD AIRCRAFT INSULATION MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AIRCRAFT INSULATION MARKET

FIGURE 9 INCREASING DEMAND FOR MILITARY HELICOPTERS TO DRIVE AIRCRAFT INSULATION MARKET GROWTH

4.2 AIRCRAFT INSULATION MARKET, BY APPLICATION

FIGURE 10 AIRFRAME SEGMENT ESTIMATED TO LEAD AIRCRAFT INSULATION MARKET FROM 2021 TO 2026

4.3 NORTH AMERICA AIRCRAFT INSULATION MARKET, BY PLATFORM

FIGURE 11 FIXED WING SEGMENT TO LEAD AIRCRAFT INSULATION MARKET FROM 2021 TO 2026

4.4 AIRCRAFT INSULATION MARKET, BY COUNTRY

FIGURE 12 JAPAN PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 AIRCRAFT INSULATION MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for lightweight insulation materials

TABLE 1 COMMONLY USED PLASTICS IN INSULATION MATERIALS AND THEIR POTENTIAL APPLICATIONS

5.2.1.2 Introduction of advanced acoustic and fire resistant materials resulting in safer operations of aircraft

5.2.1.3 Declining cost of composite materials

FIGURE 14 DECLINE IN COST OF COMPOSITE MATERIALS AND PROPORTIONATE CONSUMPTION OF COMPOSITES (2012-2020)

FIGURE 15 COST OF COMPOSITE AEROSTRUCTURE MATERIALS

5.2.1.4 Increasing demand for military helicopters

TABLE 2 INCREASING MILITARY EXPENDITURE BY EMERGING ECONOMIES, 2011-2018 (USD BILLION)

5.2.2 RESTRAINTS

5.2.2.1 Low shelf life and issues with recycling of composite materials

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for composite materials from General Aviation (GA) and business jets industry to reduce cabin noise

5.2.4 ADVANCED AIR MOBILITY

5.2.5 CHALLENGES

5.2.5.1 Insulation reliability issues in more electric aircraft

5.3 COVID-19 IMPACT SCENARIOS

5.4 IMPACT OF COVID-19 ON THE AIRCRAFT INSULATION MARKET

TABLE 3 COVID-19 IMPACT ON PASSENGER NUMBERS AND PASSENGER REVENUE

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 ENHANCING DRONE TAXI PERFORMANCE USING INSULATION

FIGURE 16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 17 AIRCRAFT INSULATION ECOSYSTEM

TABLE 4 AIRCRAFT INSULATION MARKET ECOSYSTEM

5.7 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

5.8 TRADE DATA

5.8.1 TRADE ANALYSIS

TABLE 5 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 6 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.9 VALUE CHAIN ANALYSIS OF AIRCRAFT INSULATION MARKET

FIGURE 18 VALUE CHAIN ANALYSIS

5.10 PORTER’S FIVE FORCES MODEL

5.10.1 AIRCRAFT INSULATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.2 THREAT OF NEW ENTRANTS

5.10.3 THREAT OF SUBSTITUTES

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 BARGAINING POWER OF BUYERS

5.10.6 COMPETITION IN THE INDUSTRY

5.11 TECHNOLOGY ANALYSIS

5.11.1 AEROGEL

5.12 USE CASE

5.12.1 PARTICLE FOAM DEVELOPED BY BASF

5.13 OPERATIONAL DATA

TABLE 7 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN ANALYSIS

6.2.1 RAW MATERIAL SUPPLIERS

6.2.2 AIRCRAFT MANUFACTURERS

6.2.3 END USERS/CUSTOMERS

6.3 PRESENT MATERIAL TRENDS

FIGURE 20 MATERIALS USED IN AIRCRAFT INSULATION

6.3.1 MAGNESIUM AND ALUMINUM OXIDES

6.3.2 CERAMIC MATRIX COMPOSITES

6.3.3 POLYURETHANE AND MELAMINE FOAMS

6.3.4 SOLIMIDE POLYIMIDE FOAMS

6.4 EMERGING INDUSTRY TRENDS

6.4.1 SPIDER SILK FIBER

6.4.2 BIO-COMPOSITES

6.5 INNOVATIONS AND PATENTS REGISTRATIONS, 2011-2019

7 AIRCRAFT INSULATION MARKET, BY TYPE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 21 ACOUSTIC & VIBRATION INSULATION SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 8 MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2 THERMAL INSULATION

7.2.1 INCREASING GOVERNMENT REGULATIONS REGARDING AIRCRAFT SAFETY TO DRIVE DEMAND

7.3 ACOUSTIC & VIBRATION INSULATION

7.3.1 RISING DEMAND FOR PASSENGER COMFORT TO DRIVE DEMAND

7.4 ELECTRIC INSULATION

7.4.1 INCREASING DEMAND FOR MORE ELECTRIC AIRCRAFT TO DRIVE THE SEGMENT

8 AIRCRAFT INSULATION MARKET, BY MATERIAL (Page No. - 71)

8.1 INTRODUCTION

FIGURE 22 FOAMED PLASTICS SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 9 MARKET, BY MATERIAL, 2018–2026 (USD MILLION)

8.2 FOAMED PLASTICS

8.2.1 INCREASING USE OF FOAMED PLASTICS FOR AIRCRAFT CABIN INTERIORS TO DRIVE DEMAND

8.3 FIBERGLASS

8.3.1 GROWING USE OF FIBERGLASS TO REDUCE AIRCRAFT WEIGHT TOD RIVE DEMAND

8.4 MINERAL WOOL

8.4.1 INCREASING DEMAND FOR THERMAL INSULATION TO DRIVE THE SEGMENT

8.5 CERAMIC-BASED MATERIALS

8.5.1 INCREASING AIRCRAFT MANUFACTURING TO DRIVE THE SEGMENT

8.6 OTHERS

8.6.1 ABILITY TO ABSORB EXTREME HEAT BY COMPOSITE MATERIALS TO DRIVE DEMAND

9 AIRCRAFT INSULATION MARKET, BY APPLICATION (Page No. - 75)

9.1 INTRODUCTION

FIGURE 23 AIRFRAME SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 10 MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

9.2 AIRFRAME

9.2.1 FAA REGULATIONS REGARDING MATERIALS USED FOR INSULATION IN AIRCRAFT AIRFRAME TO DRIVE DEMAND

9.2.2 AEROSTRUCTURE

9.2.2.1 Growing use of lightweight materials to drive the segment

9.2.3 CABIN INTERIOR

9.2.3.1 Growing demand for passenger comfort to drive the segment

9.2.4 AIRCRAFT SYSTEMS

9.2.4.1 Adoption of IFE systems to offer great travelling experince to passengers to drive demand

9.2.5 LANDING GEAR

9.2.5.1 Advanced products offered by companies such as DuPont to drive the segment

TABLE 11 MARKET, BY AIRFRAME, 2018–2026 (USD MILLION)

9.3 PROPULSION SYSTEM

9.3.1 INCREASING GOVERNMENT REGULATIONS REGARDING AIRCRAFT SAFETY TO DRIVE DEMAND

10 AIRCRAFT INSULATION MARKET, BY PLATFORM (Page No. - 79)

10.1 INTRODUCTION

FIGURE 24 FIXED WING SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 12 MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

10.2 FIXED WING

TABLE 13 MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

10.2.1 COMMERCIAL AVIATION

TABLE 14 FIXED WING: COMMERCIAL AVIATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

10.2.1.1 Narrow body aircraft

10.2.1.1.1 Growth in air passenger traffic to drive demand

FIGURE 25 NARROW BODY AIRCRAFT DELIVERIES, BY YEAR

10.2.1.2 Wide body aircraft

10.2.1.2.1 Development of more electric aircraft to fuel segment growth

FIGURE 26 WIDE BODY AIRCRAFT DELIVERIES, 2019 TO 2021 (Q1)

10.2.1.3 Regional transport

10.2.1.3.1 Increasing demand for regional transport aircraft in the US and India to drive the segment

10.2.2 BUSINESS & GENERAL AVIATION

TABLE 15 FIXED WING: BUSINESS & GENERAL AVIATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

10.2.2.1 Business jets

10.2.2.1.1 Increase in private players opting for business jets

10.2.2.2 Light aircraft

10.2.2.2.1 Light aircraft are used for person or freight transportation and sightseeing

10.2.3 MILITARY AVIATION

TABLE 16 FIXED WING: MILITARY AVIATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

10.2.3.1 Fighter aircraft

10.2.3.1.1 Rising concerns over border tensions to drive demand

10.2.3.2 Transport aircraft

10.2.3.2.1 Increasing use of transport aircraft in military operations to drive demand

10.2.3.3 Special mission aircraft

10.2.3.3.1 Rising defense spending and territorial disputes to drive demand

10.3 ROTARY WING

TABLE 17 ROTARY WING MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

10.3.1 CIVIL HELICOPTERS

10.3.1.1 High maneuverability and ability to climb high altitudes increasing usage for multiple purposes

10.3.2 MILITARY HELICOPTERS

10.3.2.1 High military spending of China and India to boost growth

10.4 UNMANNED AERIAL VEHICLES

10.4.1 ADOPTION OF UAVS BY THE ARMED FORCES OF THE US AND CHINA TO FUEL SEGMENT GROWTH

11 AIRCRAFT INSULATION MARKET, BY REGION (Page No. - 88)

11.1 INTRODUCTION

FIGURE 27 MARKET: REGIONAL SNAPSHOT

11.2 IMPACT OF COVID-19

FIGURE 28 IMPACT OF COVID-19 ON MARKET

TABLE 18 MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 19 BY TYPE, MARKET SIZE, 2018-2026 (USD MILLION)

TABLE 20 BY MATERIAL, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 21 BY APPLICATION, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 22 BY AIRFRAME, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 23 BY PLATFORM, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 24 BY FIXED WING, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 25 BY COMMERCIAL AVIATION, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 26 BY BUSINESS & GENERAL AVIATION, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 27 BY MILITARY AVIATION, MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 28 BY ROTARY WING, MARKET SIZE, 2018–2026 (USD MILLION)

11.3 NORTH AMERICA

11.3.1 IMPACT OF COVID-19 ON NORTH AMERICA

11.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 29 NORTH AMERICA: AIRCRAFT INSULATION MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.3.3 US

11.3.3.1 Growing UAV market to drive the aircraft insulation market

TABLE 36 US: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 37 US: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 38 US: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 39 US: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 40 US: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 41 US: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.3.4 CANADA

11.3.4.1 Aircraft modernization programs to drive the market

TABLE 42 CANADA: AIRCRAFT INSULATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 43 CANADA: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 44 CANADA: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 45 CANADA: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 46 CANADA: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

11.4 EUROPE

11.4.1 IMPACT OF COVID-19 ON EUROPE

11.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 30 EUROPE: AIRCRAFT INSULATION MARKET SNAPSHOT

TABLE 47 EUROPE: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.4.3 ITALY

11.4.3.1 Aviation industry growing in air freight and passenger volume

TABLE 54 ITALY: AIRCRAFT INSULATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 55 ITALY: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 56 ITALY: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 57 ITALY: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 58 ITALY: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.4.4 UK

11.4.4.1 Technological advancements in air travel to drive the market

TABLE 59 UK: AIRCRAFT INSULATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 60 UK: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 61 UK: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

11.4.5 GERMANY

11.4.5.1 Rising investments in air travel and aircraft development to drive the market

TABLE 62 GERMANY: AIRCRAFT INSULATION MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 63 GERMANY: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 64 GERMANY: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

11.4.6 FRANCE

11.4.6.1 Significant investments in aerospace to drive the market

TABLE 66 FRANCE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 67 FRANCE: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 68 FRANCE: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 69 FRANCE: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.4.7 RUSSIA

11.4.7.1 Increasing manufacturing of military aircraft to boost market growth

TABLE 72 RUSSIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 73 RUSSIA: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 74 RUSSIA: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 75 RUSSIA: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 76 RUSSIA: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 77 RUSSIA: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 78 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 80 REST OF EUROPE: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 81 REST OF EUROPE: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 82 REST OF EUROPE: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.5 ASIA PACIFIC

11.5.1 IMPACT OF COVID-19 ON ASIA PACIFIC

11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 83 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.5.3 CHINA

11.5.3.1 Increasing demand for new aircraft to drive the market

TABLE 90 CHINA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 91 CHINA: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 92 CHINA: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 93 CHINA: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 94 CHINA: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

11.5.4 INDIA

11.5.4.1 Development of airport infrastructure to drive the market

TABLE 95 INDIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 96 INDIA: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 97 INDIA: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 98 INDIA: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 99 INDIA: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.5.5 JAPAN

11.5.5.1 Increasing in-house development of aircraft to drive the market

TABLE 100 JAPAN: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 101 JAPAN: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 102 JAPAN: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 103 JAPAN: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 104 JAPAN: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.5.6 REST OF ASIA PACIFIC

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

11.6 REST OF THE WORLD

11.6.1 IMPACT OF COVID-19 ON REST OF THE WORLD

11.6.2 PESTLE ANALYSIS:REST OF THE WORLD

FIGURE 32 REST OF THE WORLD: MARKET SNAPSHOT

TABLE 108 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 109 REST OF THE WORLD: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 110 REST OF THE WORLD: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 111 REST OF THE WORLD: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 113 REST OF THE WORLD: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

TABLE 114 REST OF THE WORLD: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 Growing investment in alternative sources of energy along the aerospace industry to drive the market

TABLE 115 BRAZIL: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 116 BRAZIL: MARKET, BY FIXED WING, 2018–2026 (USD MILLION)

TABLE 117 BRAZIL: MARKET, BY COMMERCIAL AVIATION, 2018–2026 (USD MILLION)

TABLE 118 BRAZIL: MARKET, BY BUSINESS & GENERAL AVIATION, 2018–2026 (USD MILLION)

TABLE 119 BRAZIL: MARKET, BY MILITARY AVIATION, 2018–2026 (USD MILLION)

11.6.4 TURKEY

11.6.4.1 Growing drone industry to drive the market

TABLE 120 TURKEY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 121 TURKEY: MARKET, BY ROTARY WING, 2018–2026 (USD MILLION)

11.6.5 SOUTH AFRICA

11.6.5.1 Growing use of UAVs for different applications to drive the market

TABLE 122 SOUTH AFRICA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 130)

12.1 INTRODUCTION

TABLE 123 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARKET BETWEEN 2017 AND 2019

12.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS 2020

TABLE 124 DEGREE OF COMPETITION

FIGURE 33 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

12.3 RANK ANALYSIS, 2020

FIGURE 34 RANK ANALYSIS, 2020

TABLE 125 COMPANY REGION FOOTPRINT

TABLE 126 COMPANY TYPE FOOTPRINT

TABLE 127 COMPANY APPLICATION AREA FOOTPRINT

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 35 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

FIGURE 36 MARKET COMPETITIVE LEADERSHIP MAPPING (START UP MATRIX)

12.4.5 PROGRESSIVE COMPANIES

12.4.6 RESPONSIVE COMPANIES

12.4.7 STARTING BLOCKS

12.4.8 DYNAMIC COMPANIES

12.5 COMPETITIVE SCENARIO

12.5.1 NEW PRODUCT LAUNCHES

TABLE 128 NEW PRODUCT LAUNCHES, AUGUST 2018–AUGUST 2021

12.5.2 DEALS

TABLE 129 DEALS, AUGUST 2018– AUGUST 2021

12.5.3 ACQUISTIONS

TABLE 130 ACQUISTIONS, AUGUST 2018–AUGUST 2021

13 COMPANY PROFILES (Page No. - 141)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 DUPONT

TABLE 131 DUPONT: BUSINESS OVERVIEW

FIGURE 37 DUPONT: COMPANY SNAPSHOT

13.2.2 TRANSDIGM GROUP, INC.

TABLE 132 TRANSDIGM GROUP, INC.: BUSINESS OVERVIEW

FIGURE 38 TRANSDIGM GROUP, INC.: COMPANY SNAPSHOT

TABLE 133 TRANSDIGM GROUP, INC.: ACQUISITION

13.2.3 TRIUMPH GROUP, INC.

TABLE 134 TRIUMPH GROUP, INC.: BUSINESS OVERVIEW

FIGURE 39 TRIUMPH GROUP, INC.: COMPANY SNAPSHOT

TABLE 135 TRIUMPH GROUP, INC.: AGREEMENT

13.2.4 ROGERS CORPORATION

TABLE 136 ROGERS CORPORATION: BUSINESS OVERVIEW

FIGURE 40 ROGERS CORPORATION: COMPANY SNAPSHOT

13.2.5 MORGAN ADVANCED MATERIALS

TABLE 137 MORGAN ADVANCED MATERIALS: BUSINESS OVERVIEW

FIGURE 41 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

13.2.6 BASF SE

TABLE 138 BASF SE: BUSINESS OVERVIEW

FIGURE 42 BASF SE: COMPANY SNAPSHOT

TABLE 139 BASF SE.: NEW PRODUCT DEVELOPMENT

13.2.7 SAFRAN GROUP

TABLE 140 SAFRAN GROUP: BUSINESS OVERVIEW

FIGURE 43 SAFRAN GROUP: COMPANY SNAPSHOT

TABLE 141 SAFRAN GROUP: ACQUISITION

13.2.8 ZOTEFOAMS

TABLE 142 ZOTEFOAMS: BUSINESS OVERVIEW

FIGURE 44 ZOTEFOAMS: COMPANY SNAPSHOT

13.2.9 EVONIK INDUSTRIES

TABLE 143 EVONIK INDUSTRIES: BUSINESS OVERVIEW

FIGURE 45 EVONIK INDUSTRIES: COMPANY SNAPSHOT

13.2.10 3M

TABLE 144 3M: BUSINESS OVERVIEW

FIGURE 46 3M: COMPANY SNAPSHOT

TABLE 145 3M: ACQUISITION

13.2.11 ARMACELL

TABLE 146 ARMACELL: BUSINESS OVERVIEW

FIGURE 47 ARMACEL: COMPANY SNAPSHOT

13.3 OTHER PLAYERS

13.3.1 DURACOTE CORPORATION

13.3.2 POLYMER TECHNOLOGIES INC.

13.3.3 DUNMORE CORPORATION

13.3.4 INSULTECH, LLC.

13.3.5 ACM AIRCRAFT CABIN MODIFICATION GMBH

13.3.6 AEROPAIR LTD

13.3.7 ZEUS INDUSTRIAL PRODUCTS, INC.

13.3.8 CONCEPT GROUP LLC

13.3.9 NORPLEX-MICARTA

13.3.10 XTO, INC.

13.3.11 DEVICE TECHNOLOGIES, INC.

13.3.12 FRALOCK

13.3.13 HUTCHINSON

13.3.14 JOHNS MANVILLE

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 178)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

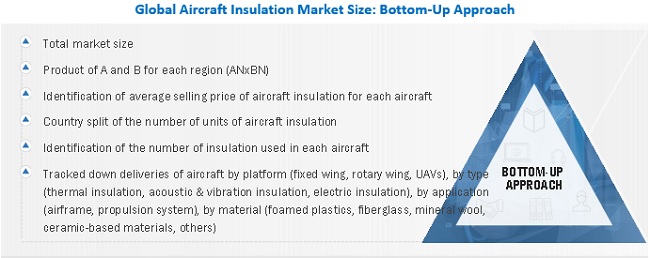

The study involved four major activities in estimating the current size of the aircraft insulation market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft insulation vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft insulation vendors were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft insulation vendors and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft insulation market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aircraft insulation Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aircraft insulation market.

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft insulation market based on type, material, application, platform, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft insulation market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft insulation market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft Insulation Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Insulation Market