Airport Stands Equipment Market by Equipment Type: Air Bridges (Steel, Glass), Preconditioned Air Unit (Fixed, Movable), Electrical Ground Power Unit (Fixed, Movable), Stand Entry Guidance System (VDGS, AVDGS), by Geography - Global Forecasts to 2025-2034

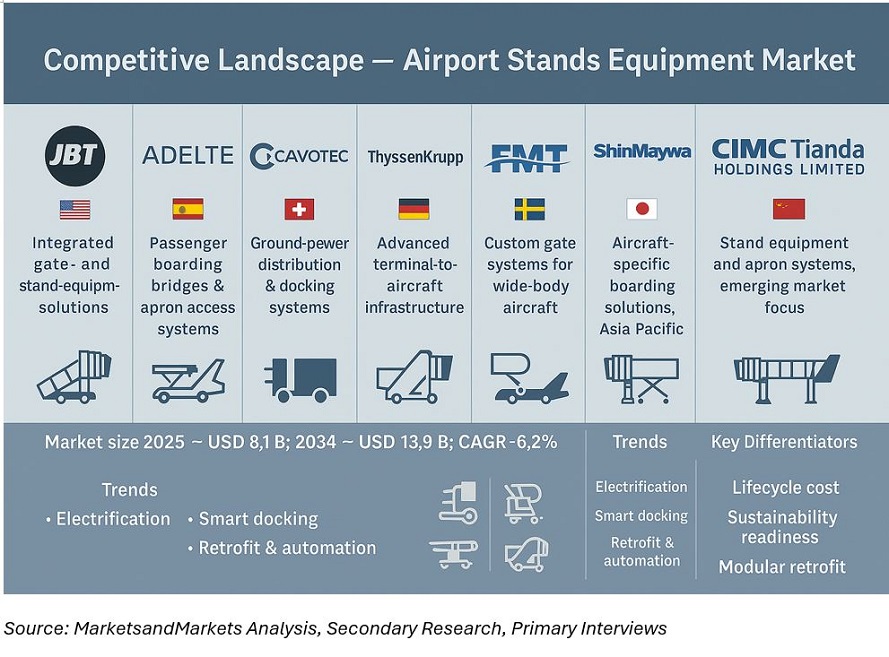

The airport stands equipment market is entering a decisive phase of modernization as global passenger volumes rebound and airports accelerate ground-support upgrades. In 2025, the market is estimated at around USD 8.1 billion and projected to reach approximately USD 13.9 billion by 2034, registering a compound annual growth rate (CAGR) of about 6.2%. This growth reflects expanding airport capacity, shorter turnaround-time demands, and a global push toward electrified, connected, and sustainable apron operations.

Airport stands equipment refers to the infrastructure and systems that service aircraft at parking positions—passenger boarding bridges (PBBs), ground power units (GPUs), pre-conditioned air (PCA) units, visual docking guidance systems (VDGS), and maintenance access platforms. These elements form the backbone of efficient ground operations by ensuring quick aircraft turnaround, passenger safety, and reduced fuel burn during idle periods.

With global aircraft movements expected to exceed pre-pandemic levels by 2026, airports are investing heavily in smart stands, remote-controlled docking, and low-emission GPUs. The shift from diesel-based systems to electrified or hybrid stand infrastructure represents not only a sustainability imperative but also a long-term cost advantage for airports striving for carbon neutrality under ICAO’s CORSIA framework.

Market Dynamics

Key Growth Drivers

The market’s expansion is primarily driven by five structural trends:

- Rising Air Traffic and Fleet Expansion: Post-pandemic recovery in global aviation, led by Asia and the Middle East, is driving terminal expansions and the construction of new remote stands.

- Operational Efficiency Demands: Airlines are targeting faster turnarounds, prompting airports to invest in automation, smart docking systems, and real-time stand management.

- Sustainability Mandates: Regulatory bodies and airport operators are replacing diesel GPUs with electric units and deploying fixed PCA systems to minimize aircraft auxiliary power usage.

- Technological Upgrades: IoT sensors, predictive maintenance, and remote monitoring are improving asset uptime and enabling Equipment-as-a-Service (EaaS) models.

- Greenfield and Brownfield Expansion: Emerging markets are prioritizing greenfield airports, while mature hubs are undergoing retrofit programs focused on energy efficiency.

Challenges

Despite steady growth, the market faces challenges in standardization, budgetary constraints, and skilled manpower for high-tech equipment. Varying regional procurement models and the long replacement cycles of heavy infrastructure slow adoption in some developing regions.

Opportunities

- Integration of smart-connected stands into airport operations control centers (AOCCs).

- Transition to autonomous or semi-autonomous stand guidance systems.

- Expansion of retrofit programs across European and U.S. airports.

- Electrification initiatives supported by green-airport financing frameworks.

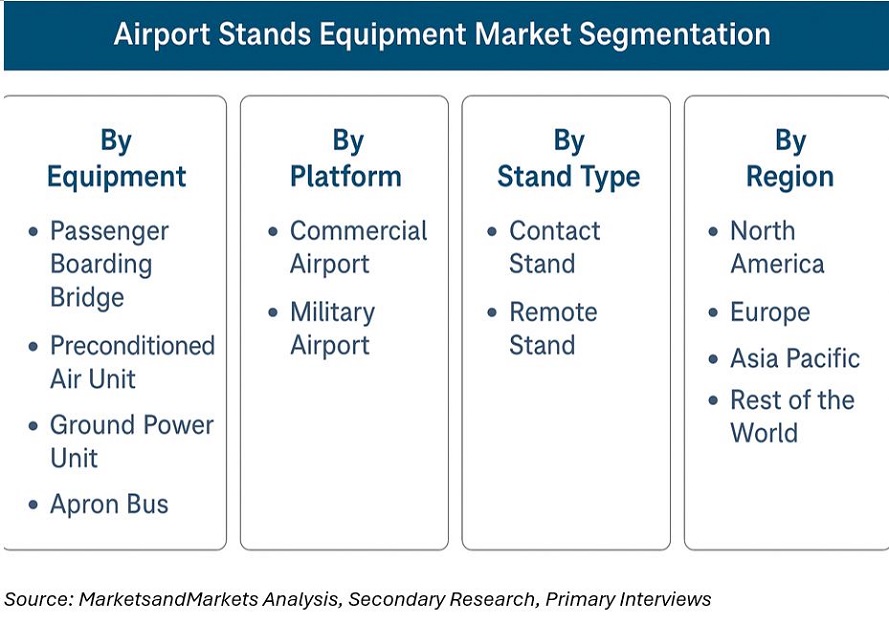

Market Segmentation

The airport stands equipment market is segmented by equipment type, airport category, and region as follows:

By Equipment Type

- Passenger Boarding Bridges (PBBs): Fixed and apron-drive systems connecting terminal to aircraft doorways.

- Ground Power Units (GPUs): Electric, hybrid, and diesel variants for aircraft power supply during ground operations.

- Pre-Conditioned Air (PCA) Units: Fixed and mobile systems maintaining cabin comfort without auxiliary engines.

- Stand Entry Guidance Systems: VDGS and advanced-VDGS ensuring accurate and safe aircraft positioning.

- Other Support Systems: Maintenance stands, engine-access platforms, tow bars, and stand lighting frameworks.

By Airport Type

- Commercial Airports: Large international and regional hubs.

- Military Airports: Tactical or training airbases.

- Private & Business Aviation Terminals: Focused on mobility, space optimization, and reduced noise footprint.

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Technology Landscape

Airport stands equipment is evolving toward a fully electrified, digital, and modular ecosystem.

- Electric GPUs and PCA systems are replacing diesel units, cutting apron emissions by up to 40%.

- Smart docking and guidance systems use radar, lidar, and video analytics to ensure precision alignment and reduce human error.

- IoT-based condition monitoring allows predictive maintenance scheduling, minimizing downtime.

- Retrofit and modular architecture enable existing airports to integrate advanced systems without major civil works.

- Equipment-as-a-Service (EaaS) contracts are transforming ownership models, offering airports access to upgraded assets with minimal upfront capital.

The intersection of digital twin technology and data analytics is also redefining stand management, allowing real-time visibility of stand occupancy, turnaround timelines, and equipment health across terminal complexes.

Competitive Landscape

The global market features a mix of established OEMs and specialized system integrators. Major participants include ADELTE Group, Cavotec SA, JBT Corporation, ThyssenKrupp Airport Systems, TLD Group, AERO Specialties, and Textron Ground Support Equipment.

Competition is intensifying around energy efficiency, low lifecycle cost, and aftermarket service offerings. Vendors are increasingly partnering with airports and airlines under long-term service agreements (LTSAs), which bundle installation, maintenance, and IoT monitoring into a unified operational package.

Regulatory and Sustainability Framework

Regulatory oversight by agencies such as the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and the International Civil Aviation Organization (ICAO) is shaping future procurement. Policies around apron safety, noise reduction, and energy consumption are guiding airports toward environmentally responsible investments.

Sustainability commitments under ACI’s Airport Carbon Accreditation Program are also accelerating the adoption of electric GPUs, lighter boarding bridges, and advanced control software that tracks idle times and emissions.

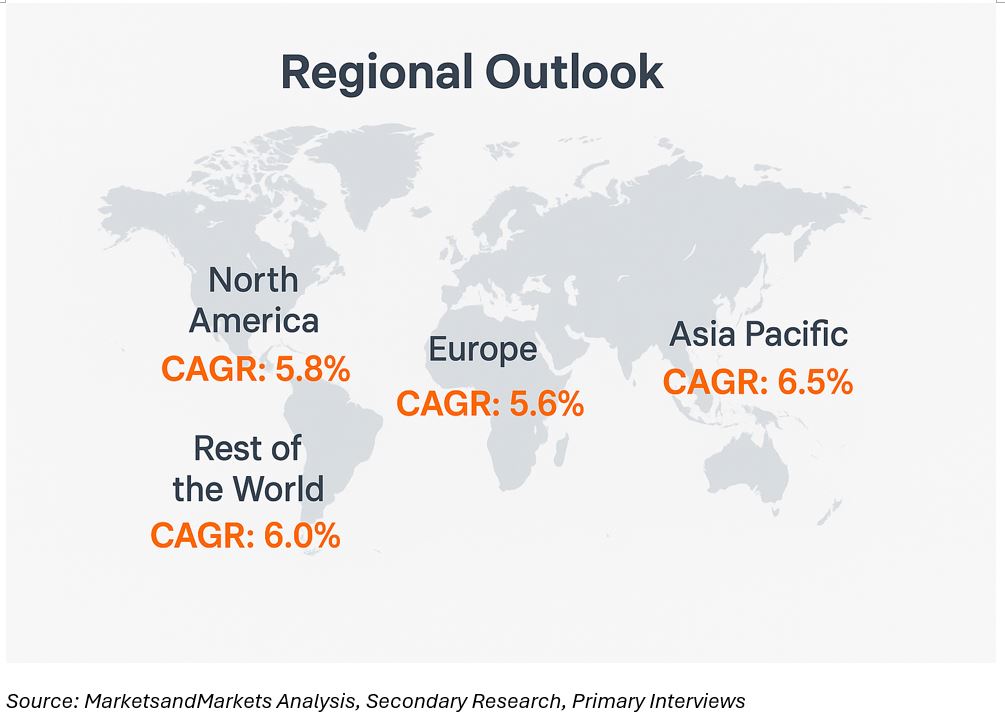

Regional Outlook

North America

North America remains the largest regional market, driven by airport modernization programs in the U.S. and Canada. The Infrastructure Investment and Jobs Act has allocated funding for airfield electrification and airside sustainability, encouraging replacement of diesel ground equipment. Major hubs such as Atlanta, Dallas/Fort Worth, and Toronto are upgrading to smart, connected stands with integrated guidance systems and digital monitoring dashboards.

Europe

Europe continues to lead in sustainability compliance. Airports like Amsterdam Schiphol, Frankfurt, and Heathrow are implementing carbon-neutral stand operations under the EU’s Green Airport Initiative. European OEMs specialize in fully electric GPUs and automated VDGS systems, setting a benchmark for smart-apron adoption.

Asia Pacific

Asia Pacific is the fastest-growing market segment, fueled by massive capacity expansions in India, China, Indonesia, and South Korea. The region’s focus on greenfield airports—such as Noida, Beijing Daxing, and Changi T5—creates extensive opportunities for integrated stand systems. Government funding in India under the UDAN scheme and private investments in Southeast Asia are catalyzing demand for energy-efficient boarding bridges and IoT-based apron control systems.

Middle East & Africa

The Middle East is investing aggressively in next-generation infrastructure to support aviation hubs such as Dubai, Doha, and Riyadh. Airports are integrating smart-stand automation and remote docking systems to handle high aircraft traffic density with minimal turnaround time. Africa’s emerging markets, including Kenya, Morocco, and South Africa, are seeing phased modernization aided by international funding and PPP models.

Latin America

Latin America’s modernization is comparatively slower but gaining traction in Brazil, Mexico, and Chile, where concession-based airport models are enabling private investment in advanced ground-support systems. Retrofitting initiatives and solar-assisted PCA units are gaining momentum in regional hubs.

Sustainability Perspective

The airport stands ecosystem is becoming a front line for aviation decarbonization. The transition from diesel GPUs and PCAs to grid-powered or renewable-assisted electric systems is cutting CO2 emissions per turnaround. OEMs are designing lightweight bridges with recycled aluminum structures and energy-efficient drives. Predictive maintenance supported by IoT sensors is extending asset lifespan, minimizing resource waste, and reducing the total cost of ownership (TCO).

Many airports now benchmark their carbon footprint per aircraft stand, tying equipment procurement directly to ESG performance metrics. This environmental visibility will continue to influence purchasing decisions through the forecast period.

Market Outlook and Key Takeaways

The airport stands equipment market will continue to expand steadily as airports adopt connected, sustainable, and automated systems to manage future traffic loads.

- Base Year: 2025

- Forecast Year: 2034

- Market Size: USD 8.1 B → USD 13.9 B

- CAGR: ~6.2%

- Fastest-Growing Region: Asia Pacific

- Core Trends: Electrification, Automation, Lifecycle-as-a-Service (LaaS), Smart Docking

Stakeholders who combine sustainability readiness, digital capability, and modular retrofit expertise will shape the next phase of airport ground-support modernization.

FAQs

1. What is the airport stands equipment market size?

As of 2025, the market is valued at around USD 8.1 billion and is expected to reach approximately USD 13.9 billion by 2034.

2. What are the main growth drivers?

Increasing air traffic, sustainability mandates, greenfield airport projects, and demand for smart, connected apron infrastructure.

3. Which equipment types dominate the market?

Passenger boarding bridges, ground power units, and pre-conditioned air units account for the majority of installations globally.

4. Which region offers the highest growth potential?

Asia Pacific, led by India, China, and Southeast Asia, due to greenfield airport expansion and modernization programs.

5. How is sustainability shaping market demand?

Procurement now prioritizes electric GPUs, lightweight bridge materials, and IoT-based maintenance analytics aligned with global carbon-reduction goals.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.4 Key Data From Primary Sources

2.1.4.1 Key Industry Insights

2.1.4.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Worldwide Passenger Travelling By Air

2.2.2 Increasing Investment in the Emerging Countries

2.2.3 Supply Side Analysis

2.2.3.1 New Airport Projects

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 39)

4.1 Attractive Market Opportunities in the Airport Stand Equipment Market, 2015-2020

4.2 Airport Stand Equipment Market, By Product, 2015 -2020

4.3 Airport Stand Equipment Market Share of Asia-Pacific, 2015

4.4 Airport Stand Equipment Market: Asia-Pacific has the Highest Market Share Among All Regions, 2015

4.5 Airport Stand Equipment Market: Emerging vs Matured Nations (2015-2020)

4.6 Airport Stand Equipment Market: By Product Market (2015-2020)

4.7 Life Cycle Analysis, By Region, By 2020

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Airport Stands Equipment Market, By Product

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand of New Aircrafts

5.3.1.2 Increase the Operational Efficiency of Airports

5.3.1.3 Modernization of Airports

5.3.1.4 Technological Upgrades in the Ground Support Equipment

5.3.2 Restraints

5.3.2.1 Long Life of Equipment

5.3.2.2 Increase the Operating Cost of Low Cost Carriers

5.3.3 Challenges

5.3.3.1 Optimization of Operations During Peak Hours

6 Industry Trends (Page No. - 56)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Porter’s Five Forces Analysis

6.4.1 Threat From New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Strategic Benchmarking

6.5.1 Technological Integration & Product Enhancement

6.5.2 Product Positioning Strategy

6.5.3 Market Retention Strategy

7 Airport Stands Equipment Market, By Equipment Type (Page No. - 64)

7.1 Introduction

7.1.1 Airport Stands Equipment Market

7.1.2 Air Bridges Market

7.1.3 Pre-Conditioned Air Market

7.1.4 Fixed Electrical Ground Power Unit Market

7.1.5 Stand Entry Guidance System Market

8 Air Bridge Market (Page No. - 70)

8.1 Introduction

8.2 Global Air Bridge Market, By Structure Type

8.2.1 Global Steel Walled Air Bridge Market, By Region

8.2.2 Global Glass Walled Air Bridge Market, By Region

9 Preconditioning Air Unit (Page No. - 77)

9.1 Introduction

9.2 Global Preconditioned Air Unit Market, By Type

9.2.1 Global Fixed Preconditioned Air Unit Market, By Region

9.2.2 Global Movable Preconditioned Unit Market, By Region

10 Electrical Ground Power Unit (Page No. - 85)

10.1 Introduction

10.2 Global Electrical Ground Power Unit Market, By Type

10.2.1 Global Fixed Electrical Ground Power Unit Market, By Region

10.2.2 Global Movable Ground Power Unit Market, By Region

11 Stand Entry Guidance System Market (Page No. - 93)

11.1 Introduction

11.2 Global Stand Entry Guidance System Market, By Type

11.2.1 Global VDGS Market, By Region

11.2.2 Global A-VDGS Market, By Region

12 Airport Stand Equipment Market, By Technology (Page No. - 100)

12.1 Introduction

12.2 Air Bridges

12.3 Preconditioned Air Units

12.4 Electrical Ground Power Unit

12.5 Stand Entry Guidance Systems

13 Airport Stand Equipment Market, By Geography (Page No. - 107)

13.1 Introduction

13.2 Asia-Pacific

13.2.1 Asia-Pacific: Airport Stands Equipment Market Size, By Country

13.2.2 Asia-Pacific: Market Size, By Equipment Type

13.2.3 Asia-Pacific: Air Bridges Market Size, By Wall Structure

13.2.4 Asia-Pacific: Pre-Conditioned Air Units Market Size, By PCA Unit Type

13.2.5 Asia-Pacific: Electrical Ground Power Unit Market Size, By Type

13.2.6 Asia-Pacific: Stand Entry Guidance System Market Size, By Segs Type

13.2.7 China

13.2.7.1 China: Airport Stands Equipment Market Size, By Equipment Type

13.2.8 India

13.2.8.1 India: Airport Stand Equipment Market Size, By Equipment Type

13.2.9 Indonesia

13.2.9.1 Indonesia: Airport Stand Equipment Market Size, By Equipment Type

13.2.10 Australia

13.2.10.1 Australia: Airport Stands Equipment Market Size, By Equipment Type

13.3 Europe

13.3.1 Europe: Airport Stand Equipment Market, By Country

13.3.2 Europe: Market, By Equipment Type

13.3.3 Europe: Market, By Preconditioned Air Unit Type

13.3.4 Europe: Market, By Electronic Ground Power Unit Type

13.3.5 Europe: Market, By Segs Type

13.3.6 U.K.

13.3.6.1 U.K.: Airport Stand Equipment Market, By Equipment Type

13.3.6.2 Russia: Airport Stand Equipment Market, By Equipment Type

13.3.6.3 Turkey: Airport Stand Equipment Market, By Equipment Type

13.3.7 Germany

13.3.7.1 Germany: Airport Stand Equipment Market, By Equipment Type

13.4 North America

13.4.1 North America: Airport Stand Equipment Market Size, By Country

13.4.2 North America: Pre-Conditioned Air Units Market Size, By Type

13.4.3 North America: Electrical Ground Power Units Market Size, By Type

13.4.4 North America: Stand Entry Guidance Systems Market Size, By Type

13.4.5 U.S.

13.4.5.1 U.S.: Airport Stand Equipment Market Size, By Equipment

13.4.6 Canada

13.4.6.1 Canada: Airport Stand Equipment Market Size, By Equipment

13.5 Middle East

13.5.1 Middle East: Airport Stands Equipment Market Size, By Country

13.5.2 Middle East: Market Size, By Equipment Type

13.5.3 Middle East: Air Bridges Market Size, By Wall Structure

13.5.4 Middle East: Pre-Conditioned Air Market Size, By PCA Unit Type

13.5.5 Middle East: Electrical Ground Power Unit Market Size, By Egpu Type

13.5.6 Middle East: Stand Entry Guidance System Market Size, By Segs Type

13.5.7 UAE

13.5.7.1 UAE: Airport Stands Equipment Market Size, By Equipment Type

13.5.8 Saudi Arabia

13.5.8.1 Saudi Arabia: Airport Stand Equipment Market Size, By Equipment Type

13.5.9 Iraq

13.5.9.1 Iraq: Airport Stands Equipment Market Size, By Equipment Type

13.6 Rest of the World

13.6.1 Rest of the World: Airport Stand Equipment Market Size, By Country

13.6.2 RoW: Pre-Conditioned Air Units Market Size, By Type

13.6.3 RoW: Electrical Ground Power Units Market Size, By Type

13.6.4 RoW: Stand Entry Guidance Systems Market Size, By Type

13.6.5 Brazil

13.6.5.1 Brazil: Airport Stand Equipment Market Size, By Equipment

13.6.6 South Africa

13.6.6.1 South Africa: Airport Stand Equipment Market Size, By Equipment

14 Competitive Landscape (Page No. - 151)

14.1 Overview

14.2 Market Share Analysis, By Company

14.3 Competitive Situation & Trends

14.3.1 Contracts

14.3.2 New Product Launches, 2012–2015

14.3.3 Acquisition, 2013–2015

15 Company Profiles (Page No. - 156)

15.1 FMT Aircraft Gate Support Systems AB

15.1.1 Business Overview

15.1.2 Products

15.1.3 MnM View

15.2 Adelte Group S.L.

15.2.1 Business Overview

15.2.2 Products

15.2.3 Recent Developments

15.2.4 MnM View

15.3 John Bean Technologies Corp.

15.3.1 Business Overview

15.3.2 Products

15.3.3 Recent Developments

15.3.4 MnM View

15.4 Aero Specialties, Inc.

15.4.1 Business Overview

15.4.2 Products

15.4.3 Recent Developments

15.4.4 MnM View

15.5 TUG Technologies Corporation

15.5.1 Business Overview

15.5.2 Products

15.5.3 Recent Developments

15.5.4 MnM View

15.6 Shinmaywa Industries Ltd.

15.6.1 Business Overview

15.6.2 Products

15.6.3 Recent Developments

15.6.4 MnM View

15.7 Thyssenkrupp Airport Systems Inc.

15.7.1 Business Overview

15.7.2 Products

15.7.3 Recent Developments

15.7.4 MnM View

15.8 Cavotec SA

15.8.1 Business Overview

15.8.2 Products

15.8.3 Recent Developments

15.8.4 MnM View

15.9 Safegate Group

15.9.1 Business Overview

15.9.2 Products

15.9.3 Recent Developments

15.9.4 MnM View

15.10 Omega Aviation Services, Inc.

15.10.1 Business Overview

15.10.2 Products

15.10.3 MnM View

16 Appendix (Page No. - 178)

16.1 Discussion Guide

16.2 Introducing RT: Real Time Market Intelligence

16.3 Available Customizations

16.4 Related Reports

List of Tables (74 Tables)

Table 1 Important Airport Projects (2013–2014)

Table 2 Airport Modernization Projects (2013-2014)

Table 3 Modernization of Airports is Driving Growth of Airport Stand Equipment Market

Table 4 Long Life Restricts the Market Progress

Table 5 Optimization of Operations During Peak Hours Poses A Challenge to the Market

Table 6 Airport Stands Equipment Market Size, By Product Type, 2013-2020 (USD Million)

Table 7 Global Air Bridge Market Size, By Region, 2013-2020 (USD MN)

Table 8 Global Air Bridge Market Size, By Structure, 2013-2020 (USD MN)

Table 9 Global Steel Walled Air Bridge Market Size, By Region, 2013-2020 (USD MN)

Table 10 Global Glass Walled Air Bridge Market Size, By Region, 2013-2020 (USD MN)

Table 11 Global Preconditioned Air Unit Market Size, By Region, 2013-2020 (USD MN)

Table 12 Global Preconditioned Air Unit Market Size, By Type, 2013-2020 (USD MN)

Table 13 Global Fixed Preconditioned Air Unit Market Size, By Region, 2013-2020 (USD MN)

Table 14 Global Movable Preconditioned Air Unit Market Size, By Region, 2013-2020 (USD MN)

Table 15 Global Electrical Ground Power Unit Market Size, By Region, 2013-2020 (USD MN)

Table 16 Global Electrical Ground Power Unit Market Size, By Type, 2013-2020 (USD MN)

Table 17 Global Fixed Electrical Ground Power Unit Market Size, By Region, 2013-2020 (USD MN)

Table 18 Global Movable Ground Power Unit Market Size, By Region, 2013-2020 (USD MN)

Table 19 Global Stand Entry Guidance Market Size, By Region, 2013-2020 (USD MN)

Table 20 Global Stand Entry Guidance System Market Size, By Type, 2013-2020 (USD MN)

Table 21 Global VDGS Market Size, By Region, 2013-2020 (USD MN)

Table 22 Global A-VDGS Market Size, By Region, 2013-2020 (USD MN)

Table 23 Global Air Bridges Market Size, By Technology, 2013-2020 (USD MN)

Table 24 Preconditioned Air Unit Market Size, By Fuel Type, 2013-2020 (USD MN)

Table 25 Electrical Ground Power Unit Market Size, By Fuel Type, 2013-2020 (USD MN)

Table 26 Airport Stand Equipment Market Size, By Region, 2013-2020 (USD MN)

Table 27 Asia-Pacific: Airport Stands Equipment Market Size, By Country, 2013-2020 (USD MN)

Table 28 Asia-Pacific: Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 29 Asia-Pacific: Air Bridges Market Size, By Wall Structure, 2013-2020 (USD MN)

Table 30 Asia-Pacific: Pre-Conditioned Air Units Market Size, By PCA Unit Type, 2013-2020 (USD MN)

Table 31 Asia-Pacific: Electrical Ground Power Unit Market Size, By Egpu Type, 2013-2020 (USD MN)

Table 32 Asia-Pacific: Stand Entry Guidance System Market Size, By Segs Type, 2013-2020 (USD MN)

Table 33 China: Airport Stands Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 34 India: Airport Stand Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 35 Indonesia: Airport Stand Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 36 Australia: Airport Stands Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 37 Europe: Airport Stand Equipment Market Size, By Country, 2013–2020 (USD MN)

Table 38 Europe: Airport Stand Equipment Market Size, By Equipment Type, 2013–2020 (USD MN)

Table 39 Europe: Airport Stand Equipment Market Size, By Airbridge Type, 2013–2020 (USD MN)

Table 40 Europe: Airport Stand Equipment Market Size, By PCA Type, 2013–2020 (USD Million )

Table 41 Europe: Airport Stand Equipment Market, By Egpu Type, 2013–2020 (USD MN)

Table 42 Europe: Airport Stands Equipment Market, By Segs Type, 2013–2020 (USD MN)

Table 43 U.K.: Airport Stand Equipment Market, By Equipment Type, 2013–2020 (USD MN)

Table 44 Russia: Airport Stand Equipment Market, By Equipment Type, 2013–2020 (USD MN)

Table 45 Turkey: Airport Stand Equipment Market, By Equipment Type, 2013–2020 (USD MN)

Table 46 Germany: Airport Stand Equipment Market, By Equipment Type, 2013–2020 (USD MN)

Table 47 North America: Airport Stand Equipment Market Size, By Country, 2013-2020 (USD MN)

Table 48 North America: Airport Stand Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 49 North America: Air Bridge Market Size, By Wall Structure, 2013-2020 (USD MN)

Table 50 North America: Pre-Conditioned Air Units Market Size, By Type, 2013-2020 (USD MN)

Table 51 North America: Electrical Ground Power Units Market Size, By Type, 2013-2020 (USD MN)

Table 52 North America: Stand Entry Guidance Systems Market Size, By Type, 2013-2020 (USD MN)

Table 53 U.S.: Airport Stand Equipment Market Size, By Equipment, 2013-2020 (USD MN)

Table 54 Canada: Airport Stand Equipment Market Size, By Equipment, 2013-2020 (USD MN)

Table 55 Middle East: Airport Stands Equipment Market Size, By Country, 2013-2020 (USD MN)

Table 56 Middle East: Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 57 Middle East: Air Bridges Market Size, By Wall Structure, 2013-2020 (USD MN)

Table 58 Middle East: Pre-Conditioned Air Market Size, By PCA Unit Type, 2013-2020 (USD MN)

Table 59 Middle East: Electrical Ground Power Unit Market Size, By Egpu Type, 2013-2020 (USD MN)

Table 60 Middle East: Stand Entry Guidance System Market Size, By Segs Type, 2013-2020 (USD MN)

Table 61 UAE: Airport Stands Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 62 Saudi Arabia: Airport Stand Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 63 Iraq: Airport Stands Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 64 Rest of the World: Airport Stand Equipment Market Size, By Country, 2013-2020 (USD MN)

Table 65 RoW: Airport Stand Equipment Market Size, By Equipment Type, 2013-2020 (USD MN)

Table 66 RoW: Air Bridge Market Size, By Structure, 2013-2020 (USD MN)

Table 67 RoW: Pre-Conditioned Air Units Market Size, By Type, 2013-2020 (USD MN)

Table 68 RoW: Electrical Ground Power Units Market Size, By Type, 2013-2020 (USD MN)

Table 69 RoW: Stand Entry Guidance Systems Market Size, By Type, 2013-2020 (USD MN)

Table 70 Brazil: Airport Stand Equipment Market Size, By Equipment, 2013-2020 (USD MN)

Table 71 South Africa: Airport Stand Equipment Market Size, By Equipment, 2013-2020 (USD MN)

Table 72 Contracts, 2012–2015

Table 73 New Product Launches, 2012–2015

Table 74 Acquisitions, 2011-2014

List of Figures (81 Figures)

Figure 1 Market Scope : Airport Stands Equipment Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Worldwide Passenger Traveled By Air, 2010-2014

Figure 5 Emerging Markets are A Huge Opportunity for Airport Stand Equipment Market

Figure 6 Emerging Countries: Fleet, Population, and GDP

Figure 7 South Asia is Estimated to Lead the Annual GDP Growth

Figure 8 New Airport Construction Market Share, By Region, 2013

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 Data Triangulation Methodology

Figure 12 Assumptions of the Research Study

Figure 13 Airport Stands Equipment Market Share, By Region, 2014

Figure 14 Market Size, By Region, 2014–2020 (USD MN)

Figure 15 Market Size, By Equipment Type, 2014–2020 (USD MN)

Figure 16 Gaining More Contracts is the Key Strategy Adopted By Major Companies in Airport Stand Equipment Market

Figure 17 Thyssenkrupp Airport Systems, Inc. has Emerged as A Leader in the Airport Stands Equipment Market

Figure 18 Attractive Market Opportunities in the Airport Stand Equipment Market, 2015-2020

Figure 19 Stand Entry Guidance System is Estimated to Witness the Maximum Growth in the Airport Stand Equipment Market (2015-2020)

Figure 20 Asia-Pacific Will Capture the Largest Share in the Airport Stand Equipment Market in 2015

Figure 21 Asia-Pacific Holds the Highest Market Share in the Airport Stand Equipment Market in 2015

Figure 22 Emerging Markets to Grow at A Faster Rate Than the Matured Nations By 2020

Figure 23 Stand Entry Guidance System has A the Highest Growth Potential in the Developing Economies of APAC Region, 2015

Figure 24 APAC is Estimated to Be the Fastest-Growing Region During the Forecast Period

Figure 25 Airport Stands Equipment Market, By Product

Figure 26 Modernization of Airports is the Major Driver for the Airport Stand Equipment Market

Figure 27 Aircraft Deliveries Till 2020

Figure 28 Global Air Traffic Passenger Flow, 2005-2013

Figure 29 Airport Stands Equipment Market Value-Chain Analysis

Figure 30 Airport Stand Equipment Market Supply Chain Analysis

Figure 31 Porter’s Five Forces Analysis

Figure 32 Modernization Plan for Airports is A Growing Trend in the Airport Stands Equipment Market

Figure 33 Product Positioning Strategy Adopted By Key Market Players

Figure 34 Market Retention Strategy Adopted By Key Market Players

Figure 35 Airport Stands Equipment Market, By Region, 2015–2020 (USD MN)

Figure 36 Air Bridges Market, By Region, 2015-2020 (USD MN)

Figure 37 Pre-Conditioned Air Market, By Region, 2015-2020 (USD MN)

Figure 38 Fixed Electrical Ground Power Unit Market, By Region, 2015–2020 (USD MN)

Figure 39 Stand Entry Guidance System Market, By Region, 2015–2020 (USD MN)

Figure 40 Global Air Bridges Market, By Region, 2015 vs 2020 (USD MN)

Figure 41 Global Air Bridges Market, By Structure Type, 2014 (USD MN)

Figure 42 Global Steel Walled Air Bridge Market, By Region, 2015 vs 2020 (USD MN)

Figure 43 Global Glass Walled Air Bridge Market, By Region, 2015 vs 2020 (USD MN)

Figure 44 Global Preconditioned Air Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 45 Global Preconditioned Air Unit Market, By Type, 2015 (USD MN)

Figure 46 Global Fixed Preconditioned Air Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 47 Global Movable Preconditioned Air Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 48 Global Electrical Ground Power Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 49 Global Electrical Ground Power Unit Market, By Type, 2015 (USD MN)

Figure 50 Global Fixed Electrical Ground Power Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 51 Global Movable Ground Power Unit Market, By Region, 2015 vs 2020 (USD MN)

Figure 52 Global Stand Entry Guidance System Market, 2015 vs 2020 (USD MN)

Figure 53 Global Stand Entry Guidance System Market, By Type, 2014 (USD MN)

Figure 54 Global VDGS Market, By Region, 2015 vs 2020 (USD MN)

Figure 55 Global A-VDGS Market, By Region, 2015 vs 2020 (USD MN)

Figure 56 Global Air Bridge Market Size, By Technology, 2013–2020 (USD MN)

Figure 57 Global Preconditioned Air Market Size, By Fuel Type, 2013-2020 (USD MN)

Figure 58 Global Electrical Ground Power Unit Market Size, By Fuel Type, 2013-2020 (USD MN)

Figure 59 Airport Stand Equipment Market, Geographic Snapshot, 2015-2020: Countries in Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 60 Asia-Pacific Airport Stand Equipment Market Snapshot, 2020 (USD MN)

Figure 61 Russia has the Major Share in the European Airport Stand Equipment Market (2015)

Figure 62 North American Airport Stand Equipment Market Snapshot: the U.S. Commands the Largest Market Share

Figure 63 Middle East: Airport Stands Equipment Market Snapshot, 2020 (USD MN)

Figure 64 Companies Adopted Gaining Maximum Contracts as the Key Growth Strategy During the Studied Period (2012-2015)

Figure 65 Market Share Analysis, 2015

Figure 66 Battle for Market Share: Gaining New Contracts is the Key Strategy

Figure 67 FMT Aircraft Gate Support Systems AB: Business Overview

Figure 68 Adelte Group S.L.: Business Overview

Figure 69 John Bean Technologies Corp.: Business Overview

Figure 70 John Bean Technologies Corp.: SWOT Analysis

Figure 71 Aero Specialities, Inc.: Business Overview

Figure 72 TUG Technologies Corp.: Business Overview

Figure 73 TUG Technologies Ltd.: SWOT Analysis

Figure 74 Shinmaywa Industries, Ltd.: Business Overview

Figure 75 Shinmaywa Industries Ltd.: SWOT Analysis

Figure 76 Thyssenkrupp Airport Systems Inc.: Business Overview

Figure 77 Thyssenkrupp Airport Systems Inc.: SWOT Analysis

Figure 78 Cavotec SA: Business Overview

Figure 79 Cavotec SA: SWOT Analysis

Figure 80 Safegate Group: Business Overview

Figure 81 Omega Aviation Services, Inc.: Business Overview

The global airport stands equipment market is projected to witness high growth in the next five years. The growth of this market is estimated to be driven by the increasing demand from upcoming airports. The market is further driven by the demand for ground support equipment such as electrical ground power unit, preconditioned air unit, and stands entry guidance system. The purpose of the airport stands equipment report is to identify various types and technologies involved and the major drivers & restraints of the market. The key players of the global airport stands equipment are comprehensively covered in the report, along with their growth strategies and recent developments.

The high growth potential in emerging markets and increase in demand for refurbishing market offers opportunities to the players in the airport stands equipment market. However, optimum utilization of resources present at the stands is the major challenge faced by the industry.

Asia-Pacific is estimated to be the fastest-growing global airport stands equipment market. China and India are projected to register the highest CAGR in APAC from 2015 to 2020. The growth in these countries is expected to be driven by the increase in passenger traffic and increase in the number of airports during the forecast period.

The market players such as ThyssenKrupp Airport Systems Inc. (U.S.), John Bean Technologies Corporation (U.S.), and TUG Technologies Corporation (U.S.) are adopting various strategies such as new product developments, long-term contracts, and expansions to strengthen their positions in the global market. They are investing considerable amounts of their revenue into R&D to introduce advanced stands equipment with reduced weight.

Scope of the Report

Airport stands equipment research report categorizes the global market into the following segments and subsegments:

Airport Stands Equipment Market, By Equipment

- Passenger Boarding Bridge

- Preconditioned Air Unit

- Stands Entry Guidance System

- Electrical Ground Power Unit

Airport Stands Equipment Market, By Geography

- North America

- Europe

- APAC

- Middle East

- Rest of the World

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

-

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific market into Australia, Malaysia, and New Zealand, among others

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Airport Stands Equipment Market