This research study conducted on the ammunition market involved extensive use of secondary sources, directories, and databases such as D&B Hoovers, the Global Firepower, the Small Arms Survey, UN COMTRADE, and Factiva to identify and collect information relevant to the ammunition market. Details regarding the procurement and consumption patterns of military and law enforcement applications in terms of contracts, supply agreements, and joint ventures, among others, were also available only for a limited set of countries.

Thus, manufacturer websites and annual reports, published news articles, defense blogs, government publications of different countries, and documents published by RAND Corporation (US), among others, were also referred to and used as a part of secondary research during the course of the study.

Primary sources considered included industry experts from the concerned market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. Ammunition is a sensitive topic, and therefore, several challenges were faced while conducting primary research.

Secondary Research

The share of companies in the ammunition market was determined using secondary data made available through paid and unpaid sources and by analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the ammunition market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the ammunition market, which was further validated by primary respondents.

Primary Research

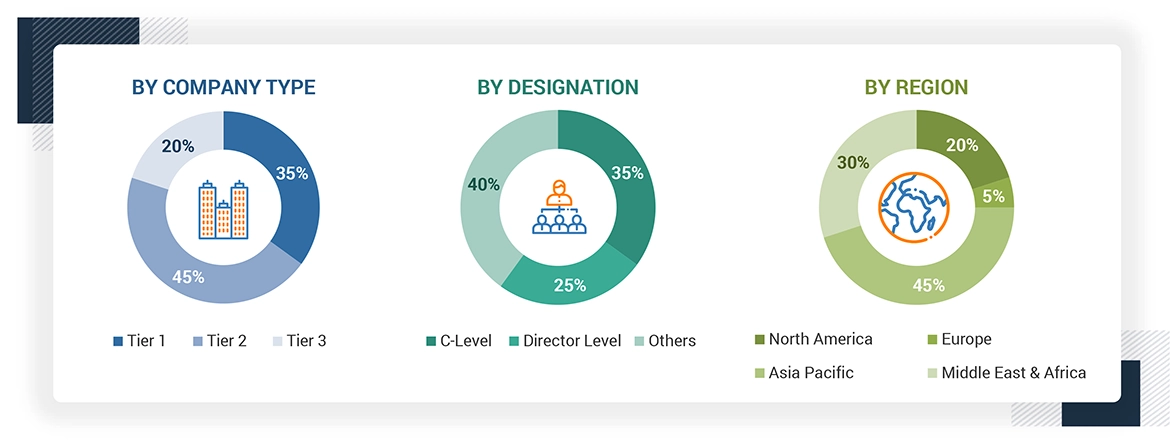

Extensive primary research was conducted after obtaining information about the current scenario of the ammunition market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Others include sales managers, marketing managers, and product managers.

Tier 1: Company revenue over USD 1 billion

Tier 2: Company revenue between USD 100 million and USD 1 billion

Tier 3: Company revenue less than USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

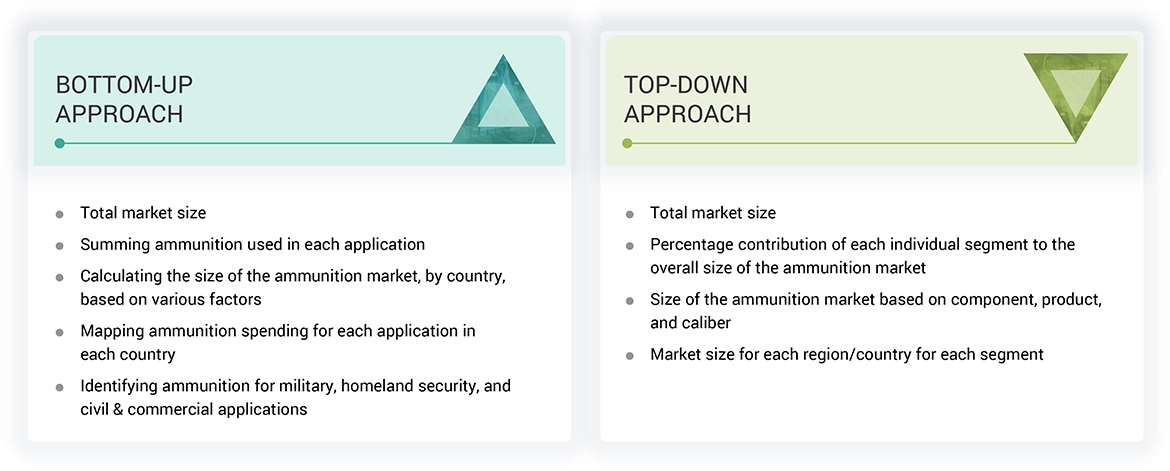

Both top-down and bottom-up approaches were used to estimate and validate the size of the ammunition market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the ammunition market.

Data Triangulation

After arriving at the overall size of the ammunition market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented wherever applicable to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments.

The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches. The following figure indicates the market breakdown structure and data triangulation procedure that was implemented in the market engineering process to make this report on the ammunition market.

Market Definition

Ammunition is fired, scattered, or dropped from a weapon or a weapon system. It can be broadly classified into four categories: Small-Caliber ammunition, Medium-Caliber ammunition, Large-Caliber ammunition, and others. Ammunition is mainly procured by military and law enforcement agencies such as state police and federal police. Small-caliber ammunition is used by civilians in hunting, sports activities, and self-defense applications.

The small-caliber ammunition category includes rounds that are 5.56 mm, 7.62 mm, 12.7 mm, and 14.5 mm in size, while the Medium-Caliber ammunition includes rounds that are 20 mm, 25 mm, 30 mm, and 40 mm in size. The large-caliber ammunition category includes mortar shells, tank ammunition, and artillery shells of size 60 mm, 81 mm, 120 mm, 122 mm, and 155 mm. Illumination rounds, hand grenades, and rubber bullets are being considered under other categories. Illumination rounds and hand grenades are not launched as weapons in the air but are thrown or manually lit at targets.

Stakeholders

Various stakeholders of the market are listed below:

-

Armed Forces

-

Defense Regulatory Bodies

-

Law Enforcement Agencies

-

Home Ministries/Ministries of Interior

-

Ammunition Manufacturers

-

Component Manufacturers

-

Distributors and Suppliers

-

Research Organizations, Forums, Alliances, and Associations

-

Sporting and Hunting Associations

Report Objectives

-

To define, describe, segment, and forecast the size of the ammunition market in terms of value based on application, caliber, guidance mechanism, product, component, lethality, and region from 2023 to 2028

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the ammunition market

-

To forecast the size of various segments of the ammunition market with respect to six major regions: North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa

-

To identify the opportunities for stakeholders in the market by identifying key market and technology trends

-

To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, product launches & developments, and research & development (R&D) activities in the ammunition market

-

To anticipate the status of the ammunition procurements by different countries, the number of their military personnel, their defense spending; technological advancements in ammunition; and joint developments undertaken by leading players to analyze the degree of competition in the market.

-

To provide a comprehensive competitive landscape of the ammunition market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

User

Mar, 2020

Where can I get comprehensive data about different types of 130 mm and 155 mm ammunition?.

Paul

Apr, 2019

A large A/E/C firm has asked me to conduct research regarding the future prospects for the design and construction of facilities related to ammunition production, storage, etc..

Kaylee

Jul, 2019

Hello, we are currently engaging in some strat planning focused around the munitions market for the next 3-5 years. Would love to sample this report and see if your research provides us the info we are seeking..

Caroline

Jun, 2019

Hi. I found your report Ammunition Market by Application (Defense, Civil & Commercial), Caliber (Small, Medium, Large), Product (Bullets, Aerial Bombs, Grenades, Artillery Shells, Mortars), Component, Guidance, Lethality, Region - Global Forecast to 2025. I work for a company that provides consulting services to a factory that produces magazines. We’re interested in data regarding this market. Do you have anything ready? I’m looking forward to hearing back from you. Thanks, Caroline..

Bada

Oct, 2019

The reason I want to purchase this report is because I want to know the size of the arms market in each country in detail. It would be nice to have as much detail as possible on each weapon system..

Arto

Sep, 2019

Hello. I am looking for a small caliber center-fire ammunition market study with focus on military and law enforcement applications. What would be your best option? Contact by email, please. Kind regards, Arto..

jeff

May, 2019

I'm trying to determine the size of the global small ammunition market. Specifically, I'd like to know the breakdown by government (national defense), commercial, and law enforcement by region (country or otherwise), and focused on small caliber (.223, .308, 5.56, 7.62, 50cal, 338 Norma, etc...). If you feel your report can answer those questions, please contact me. Thanks..

Andre

Jan, 2019

Caliber (Small, Medium, Large), Product (Bullets, Aerial Bombs, Grenades, Artillery Shells, Mortars), .