Amorphous Polyethylene Terephatalate Market by Application (Bottles, Films/Sheets, Food Packaging), End-use Industry( Food & Beverage, Pharmaceutical) and Region (APAC, North America, MEA, Europe, South America) - Global Forecast to 2026

Updated on : October 25, 2024

Amorphous Polyethylene Terephthalate Market

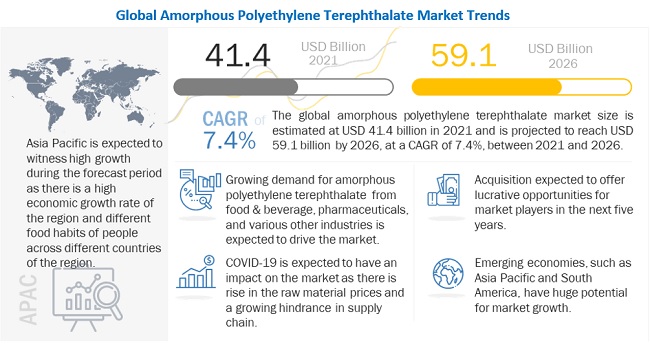

The global amorphous polyethylene terephthalate market was valued at USD 41.4 billion in 2021 and is projected to reach USD 59.1 billion by 2026, growing at 7.4% cagr from 2021 to 2026. Amorphous polyethylene terephthalate is being increasingly used for packaging carbonated soft drinks (CSD), juices, and water; personal care products; and pharmaceuticals; among other products, due to superior mechanical and physical properties offered by it. It is used in various end-use industries, such as pharmaceuticals and food & beverage. The shifting of the manufacturing bases of various companies to the Asia Pacific region has also contributed to the increased demand for amorphous polyethylene terephthalate from this region, thereby fueling the growth of the global amorphous polyethylene terephthalate market. Bottles, films/sheets, and food packaging are major applications of amorphous polyethylene terephthalate.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Amorphous Polyethylene Terephthalate Market

COVID-19 is an infectious disease caused by a newly discovered strain of the coronavirus. This disease is impacting the growth of economies across the globe. The virus was first identified in Wuhan (China) in December 2019. The COVID-19 pandemic has wreaked havoc on the world. COVID-19 significantly impacted the global GDP in 2020, and estimates, so far, indicate the virus had impacted the global economic growth by at least 0.5%- 1.5% in FY 2020-2021, but the economies are recovering with reduction in restrictions imposed by major countries. Owing to the swift spread of the disease, both lives and livelihoods are at risk. It is a global problem that calls for a global response. There cannot be estimates on how quickly this disease is going to retreat. This situation is somewhat unusual, as it affects both supply and demand, thus, also affecting the supply of amorphous polyethylene terephthalate, globally.

Various rigid plastic packaging suppliers are finding solutions and ways to communicate with their end users to help assure them by providing information on their websites and social media on how they are tackling the global challenges.

Amorphous Polyethylene Terephthalate Market Dynamics

Driver: Increasing demand for amorphous polyethylene terephthalate from food & beverage industry

The demand for packaged food items is increasing due to changing lifestyles of masses, globally. Amorphous polyethylene terephthalate is used extensively for packaging food items and beverages. It offers high strength and stiffness, clear visibility, and low creep characteristics, which make it perfect for use in food packaging applications. The food & beverage industry is one of the largest end users of bottles made of amorphous polyethylene terephthalate. Thus, the increasing use of amorphous polyethylene terephthalate in the food & beverage end-use industry is fueling the growth of the amorphous polyethylene terephthalate market across the globe.

Besides, the food & beverage industry is one of the largest end users of amorphous polyethylene terephthalate beverage packaging, where amorphous polyethylene terephthalate is used to provide additional characteristics to beverage packaging. Thus, the increasing usage of amorphous polyethylene terephthalate in diverse applications and the rising demand for it from various end-use industries are expected to fuel the growth of this market in the near future. High disposable income, rapid urbanization, and changing lifestyles are the major factors that contribute to the growth of the global food & beverage industry, which, in turn, drives the amorphous polyethylene terephthalate market.

Restraint: Variations in environmental mandates and regulations

Environmental mandates and regulations for the packaging industry vary according to the country, thereby making it difficult for companies to adjust to these regulations. These environmental mandates affect not only manufacturers but also the commercial sector. There is an increased demand for biodegradable and eco-friendly packaging materials across the globe. Efforts are being made in the commercial sector to ensure that the packaging of products does not increase their costs to a large extent. Retailers are also focusing on using eco-friendly raw materials to manufacture boxes and bags used for packaging. The governments in the European and North American regions have formulated stringent regulations pertaining to the packaging industry with regard to their recycling rates, container deposits, and packaging levies. Such variations in the environmental mandates and regulations across different regions pose a challenge to the growth of the amorphous polyethylene terephthalate market.

Opportunity: Replacement of traditional packaging materials by polymer-based packaging materials

Increasing use of amorphous polyethylene terephthalate packaging materials over traditional packaging materials, such as metal cans, glass & plastic bottles, and liquid cartons, is leading to the growth of amorphous polyethylene terephthalate market across the globe. Amorphous polyethylene terephthalate offers excellent impact tolerance, barrier property, and stiffness. It has a high resistance to chemicals and solvents and offers improved clarity. Manufacturers of soft drinks, pharmaceuticals, and alcohols prefer amorphous polyethylene packaging materials over traditional packaging materials due to their flexibility, low costs, and a high potential for innovations. The innovations in the manufacturing methods of amorphous polyethylene terephthalate packaging have increased their application to a broad spectrum of products. Single-serve portions, portability, and easy-to-peel features offered by amorphous polyethylene terephthalate packaging have resulted in increased demand for polymer-based packaging materials from various industries over traditional packaging materials.

Challenges: Issues related to recyclability of polyethylene terephthalate

Plastic recycling is the process of recovering waste plastic and reprocessing the material into useful products. Transparent plastics are preferred in the recycled market, followed by white and colored. Within the colored category, dark-colored plastics have a higher market value than light-colored plastics. EU regulations make it necessary in choosing the correct pigment to meet the legal requirements of the specific application. In some applications, it is mandatory to use a certain grade of pigments, while for others, lower-cost substitutes can be used. For instance, the use of chrome yellow to color a polypropylene beach bat would be illegal if the product is classified as a toy. However, if it were defined as sports equipment, this pigment would be acceptable. Similarly, a nylon molding colored with food-grade cadmium yellow could be used in a food processing product as long as it does not clash with rules on the use of colors in electrical appliances. It is difficult to maintain a balance between cost, regulation mandates, and application needs. Thus, regulations related to plastic recycling is a major challenge faced by the inorganic pigment manufacturers as it is tough to customize solutions as per the needs of customers.

Bottles is the largest application segment of the amorphous polyethylene terephthalate market

On the basis of application, the market is segmented into bottles, films/sheets, and food packaging, and others. Because of its high transparency, which is similar to that of glass, amorphous PET is utilized in the manufacture of bottles and packaging.

Food & beverage is the largest end-use segment of the amorphous polyethylene terephthalate market

On the basis of end-use industry, the market is segmented into food & beverage, pharmaceutical, and others. The food & beverage end-use industry segment led the market in terms of both value and volume. Amorphous polyethylene terephthalate is being increasingly used for packaging carbonated soft drinks (CSD), juices, and water.

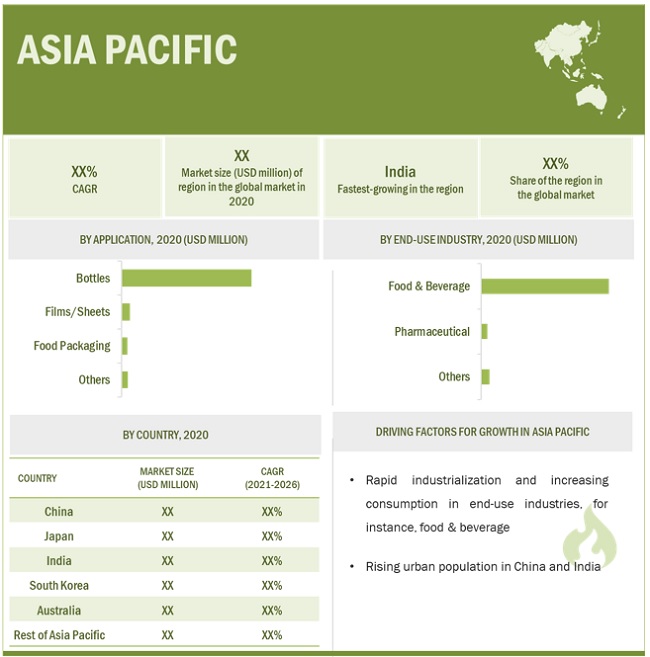

Asia Pacific is the largest market for amorphous polyethylene terephthalate market

The Asia Pacific region is projected to be the largest market, in terms of value. Asia Pacific is also expected to grow at the highest CAGR during the forecast period. The growth of Asia Pacific region can be attributed to the high economic growth rate of the region and different food habits of people across different countries of the region. In addition, the growing population of the region presents a huge customer base for fast-moving consumer goods (FMCG) products and packaged food & beverages, which, in turn, is expected to lead to the growth of the amorphous polyethylene terephthalate market during the forecast period. Owing to the increasing income of people in this region, the demand for high-end packaging products for food & beverage, and pharmaceutical, has been growing rapidly. Apart from the food & beverage industry, the region also exhibits significant opportunities in the packaging industry, which is expected to drive the market.

Indorama Ventures Public Company Limited (Thailand), Alpek (Mexico), Jiangsu Sanfangxiang Group Co., Ltd. (China), Far Eastern New Century Corporation (Taiwan), and DAK Americas (US) are key players in amorphous polyethylene terephthalate market.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Amorphous Polyethylene Terephthalate Market Players

Indorama Ventures Public Company Limited (Thailand), Alpek (Mexico), Jiangsu Sanfangxiang Group Co., Ltd. (China), Far Eastern New Century Corporation (Taiwan), and DAK Americas (US) are the key players operating in the amorphous polyethylene terephthalate market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to amorphous polyethylene terephthalate from emerging economies.

Amorphous Polyethylene Terephthalate Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Product Type, Application and Region |

|

Regions |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Indorama Ventures Public Company Limited (Thailand), Alpek (Mexico), Jiangsu Sanfangxiang Group Co., Ltd. (China), Far Eastern New Century Corporation (Taiwan), and DAK Americas (US) |

This research report categorizes the amorphous polyethylene terephthalate market based on application, end-use industry and region.

Amorphous polyethylene terephthalate Market, By Application:

- Bottles

- Films/sheets

- Food packaging

- Others

Amorphous polyethylene terephthalate Market, By End-use Industry:

- Food & Beverage

- Pharmaceuticals

- Others

Amorphous polyethylene terephthalate Market, By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In January 2022, Indorama Ventures Public Company Limited stated that it was in the process of acquiring Ngoc Nghia Industry – Service – Trading Joint Stock Company's shares (NN). NN is a provider of PET packaging materials to large global and Vietnamese brands in the beverage and non-beverage industries, operating with high quality standards. Its activities are managed by a seasoned management team with extensive industry expertise as well as a thorough awareness of the local market. These competitive advantages are strategic matches for Indorama Ventures Public Company Limited and are expected to enhance the company's long-term growth following the acquisition.

- In January 2022, Alpek, S.A.B. de C.V. announced that it has reached an agreement to acquire OCTAL Holding SAOC ("Octal") from OCTAL Holding SAOC. This purchase will help Alpek move forward in the high-value PET sheet business area, narrow the gap on its ESG targets, and better fulfil its clients' rising PET resin demands.

- In November 2021, The Coca-Cola System has partnered with Indorama Ventures and Trash Lucky to supply PPE suits made from recycled PET plastic bottles in three of Thailand's southern districts. ThaiNamthip Ltd., HaadThip Plc., and Coca-Cola (Thailand) Ltd. are a part of the Coca-Cola system in Thailand.

- In May 2021, Indo Rama Synthetics (India) Limited (IRSL), a subsidiary of global petrochemical company Indorama Ventures Public Company Limited, has planned to upgrade equipment and expand capacity. IRSL's capital investment strategy includes a new PET resin manufacturing plant, extra balancing equipment, and a wide selection of specialty yarns, all of which are expected to help the company better serve clients across the country. The new PET resin facility in Nagpur will increase capacity by 772 tons per day and is scheduled to open in the second quarter of 2022.

- In August 2021, Far Eastern New Century Corporation partnered with fiber expert OTIZ, Oriental Industries (Suzhou) Ltd. to create a recycling PET bottle technology for tire manufacturing. There are no intermediary chemical stages in reprocessing for high mechanical requirements in tire manufacturing. The grade of secondary raw material is comparable to that of virgin PET. Continental's sustainability strategy includes the circular economy.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the amorphous polyethylene terephthalate market?

Rise in demand for amorphous polyethylene terephthalate from emerging economies and growing popularity of growing demand from food & beverage, pharmaceuticals, automotive, personal care and electronic sectors are hot bets for the market.

What are the market dynamics for the different application of amorphous polyethylene terephthalate?

On the basis of application, the market is segmented into bottles, films/sheets, and food packaging, and others. Because of its high transparency, which is similar to that of glass, amorphous PET is utilised in the manufacture of bottles and packaging.

What are the market dynamics for the different end-use industries of amorphous polyethylene terephthalate?

On the basis of end-use industry, the market is segmented into food & beverage, pharmaceutical, and others. The food & beverage end-use industry segment led the market in terms of both value and volume. Amorphous polyethylene terephthalate is being increasingly used for packaging carbonated soft drinks (CSD), juices, and water.

Who are the major manufacturers of the amorphous polyethylene terephthalate market?

Indorama Ventures Public Company Limited (Thailand), Alpek (Mexico), Jiangsu Sanfangxiang Group Co., Ltd. (China), Far Eastern New Century Corporation (Taiwan), and DAK Americas (US) are the key players operating in the amorphous polyethylene terephthalate market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the amorphous polyethylene terephthalate market being subjected to governance.

What are the effects of COVID-19 on the amorphous polyethylene terephthalate market?

The COVID-19 pandemic has significantly impacted the pigments industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. COVID-19 has had three major effects on the global economy: direct effects on production and demand, supply chain and market disruption, and financial impact on enterprises and financial markets. The market's expansion was hampered by disruptions in supply chain management and products and service transportation. The demand for essential services, such as personal and healthcare products is witnessing a spike, which can impact plastic packaging products, especially HDPE, PP, PE containers, and pharmaceutical bottles. However, the demand from packaging of non-essential industries is increasing gradually with many countries easing the restricted movement across countries. The key global players, such as Avery Dennison and CCL Labels continue their business operations with a focus on essential businesses, such as healthcare and food on priority. The market is expected to expand at a rapid pace in the next years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 3 APPROACH 1: SUPPLY-SIDE ANALYSIS

FIGURE 4 APPROACH – 2: TOP-DOWN APPROACH

FIGURE 5 APPROACH – 3: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.1.1 Key data from secondary sources

2.3.2 PRIMARY DATA

2.3.2.1 Key data from primary sources

2.4 DATA TRIANGULATION

2.5 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

2.7 RISK ASSESSMENT

2.7.1 LIMITATIONS & ASSOCIATED RISKS

2.7.2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 7 BOTTLES APPLICATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 FOOD & BEVERAGE END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC LED AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

FIGURE 10 GROWING DEMAND FROM END-USE INDUSTRIES TO DRIVE MARKET

4.2 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET, BY REGION

FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4.3 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET, BY APPLICATION

FIGURE 12 BOTTLES APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET IN ASIA PACIFIC

FIGURE 13 CHINA AND BOTTLES APPLICATION SEGMENT ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

4.5 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: BY COUNTRY

FIGURE 14 MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for amorphous polyethylene terephthalate from food & beverage industry

FIGURE 16 MARKET SIZE OF NON-ALCOHOLIC BEVERAGE INDUSTRY 2016-2024

FIGURE 17 MARKET SIZE OF ALCOHOLIC BEVERAGE INDUSTRY 2018-2024

5.2.1.2 Growing application of amorphous polyethylene terephthalate in various end-use industries in Asia Pacific

5.2.1.3 Flourishing global manufacturing industry

5.2.2 RESTRAINTS

5.2.2.1 Variations in environmental mandates and regulations

5.2.2.2 Fluctuating prices of raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Replacement of traditional packaging materials by polymer-based packaging materials

5.2.3.2 Growing demand for on-the-go products

5.2.4 CHALLENGES

5.2.4.1 Issues related to recyclability of polyethylene terephthalate

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM

FIGURE 19 AMORPHOUS POLYETHYLENE TEREPHTHALATE ECOSYSTEM

5.5 TRADE ANALYSIS

TABLE 3 POLYETHYLENE TEREPHTHALATE TRADE DATA IMPORT, 2020 (USD THOUSAND)

TABLE 4 POLYETHYLENE TEREPHTHALATE TRADE DATA EXPORT, 2020 (USD THOUSAND)

5.6 REGULATORY ANALYSIS

5.7 PRICE TREND ANALYSIS

TABLE 5 AVERAGE PRICES OF AMORPHOUS POLYETHYLENE TEREPHTHALATE, BY REGION (USD/KG)

5.8 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN OF AMORPHOUS POLYETHYLENE TEREPHTHALATE

5.9 TECHNOLOGY ANALYSIS

5.10 CASE STUDY ANALYSIS

5.10.1 INTRODUCTION

5.10.2 CASE STUDY 1: OPTIMIZED PET PACKAGING HELPS ONE CENTURY-OLD COMPANY STAY ‘YOUNG’

5.11 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS

5.11.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR AMORPHOUS POLYETHYLENE TEREPHTHALATE MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR AMORPHOUS POLYETHYLENE TEREPHTHALATE MANUFACTURERS

6 PATENT ANALYSIS (Page No. - 58)

6.1 AMORPHOUS POLYETHYLENE TEREPHTHALATE PATENT ANALYSIS

6.1.1 INTRODUCTION

6.1.2 METHODOLOGY

6.1.3 DOCUMENT TYPE

FIGURE 22 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 23 PUBLICATION TRENDS - LAST 10 YEARS

6.1.4 INSIGHT

6.1.5 LEGAL STATUS OF THE PATENTS

FIGURE 24 JURISDICTION ANALYSIS

6.1.6 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP APPLICANTS OF AMORPHOUS POLYETHYLENE TEREPHTHALATE

6.1.7 LIST OF PATENTS BY JINBAOLI TECHNOLOGY SUZHOU CO LTD.

6.1.8 LIST OF PATENTS BY KAO CORPORATION

6.1.9 LIST OF PATENTS BY MITSUBISHI POLYESTER FILM GMBH

6.1.10 LIST OF PATENTS BY BOSTIK INC

6.1.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6.2 COVID-19 IMPACT ON AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

6.2.1 COVID-19 IMPACT ON GLOBAL PACKAGING INDUSTRY

7 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET, BY APPLICATION (Page No. - 65)

7.1 INTRODUCTION

FIGURE 26 BOTTLES APPLICATION SEGMENT TO LEAD AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET DURING FORECAST PERIOD

TABLE 6 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 7 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

7.2 BOTTLES

7.2.1 DEMAND FOR AMORPHOUS POLYETHYLENE TEREPHTHALATE BOTTLES FOR PACKAGING MINERAL WATER, CARBONATED SOFT DRINKS TO BOOST MARKET 67

7.3 FILMS/SHEETS

7.3.1 DEMAND FROM MANUFACTURERS OF MULTI-LAYERED TRAYS, CUPS, AND GRAPHIC ARTS FILMS TO DRIVE FILMS/SHEETS SEGMENT

7.4 FOOD PACKAGING

7.4.1 USABILITY IN FOOD PACKAGING DUE TO OPTIMUM CHEMICAL AND PHYSICAL PROPERTIES TO BOOST MARKET

7.5 OTHERS

8 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET, BY END-USE INDUSTRY (Page No. - 69)

8.1 INTRODUCTION

FIGURE 27 FOOD & BEVERAGE END-USE INDUSTRY SEGMENT TO LEAD AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET DURING FORECAST PERIOD

TABLE 8 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 9 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.2 FOOD & BEVERAGE

8.2.1 PHYSICAL AND CHEMICAL PROPERTIES OF AMORPHOUS POLYETHYLENE TEREPHTHALATE TO BOOST MARKET

8.2.2 BOTTLES

8.2.3 CONTAINERS

8.2.4 OTHERS

8.3 PHARMACEUTICALS

8.3.1 PACKAGING MADE FROM AMORPHOUS POLYETHYLENE TEREPHTHALATE ENSURES PROTECTION & SECURITY OF PRODUCTS

8.3.2 BOTTLES

8.3.3 CONTAINERS

8.4 OTHERS

8.4.1 AUTOMOTIVE

8.4.2 TEXTILES

8.4.3 ELECTRICAL & ELECTRONICS

9 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: REGIONAL ANALYSIS (Page No. - 74)

9.1 INTRODUCTION

TABLE 10 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 28 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

TABLE 11 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SNAPSHOT

TABLE 13 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 14 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 15 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 16 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 17 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 18 NORTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.1 US

9.2.1.1 Increased preference for packaged food is expected to drive amorphous polyethylene terephthalate market

TABLE 19 US: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 20 US: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.2 CANADA

9.2.2.1 Increasing food production and changing food habits are favorable for market growth

TABLE 21 CANADA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 22 CANADA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.3 MEXICO

9.2.3.1 Rising demand for plastics to fuel consumption of amorphous polyethylene terephthalate

TABLE 23 MEXICO: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 24 MEXICO: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3 ASIA PACIFIC

9.3.1 IMPACT OF COVID-19 IN ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SNAPSHOT

TABLE 25 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 26 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 27 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 28 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 29 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 30 ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.2 CHINA

9.3.2.1 China to continue dominating in Asia Pacific market

TABLE 31 CHINA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 32 CHINA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.3 INDIA

9.3.3.1 Increasing demand in the food & beverage industry is expected to drive amorphous polyethylene terephthalate market

TABLE 33 INDIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 34 INDIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.4 JAPAN

9.3.4.1 Increasing government initiatives to drive the market

TABLE 35 JAPAN: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 36 JAPAN: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.5 AUSTRALIA

9.3.5.1 Food & beverage industry driving the market

TABLE 37 AUSTRALIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 38 AUSTRALIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.6 SOUTH KOREA

9.3.6.1 Increasing preference for ready-to-eat products to boost the market in the country

TABLE 39 SOUTH KOREA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 40 SOUTH KOREA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.7 REST OF ASIA PACIFIC

TABLE 41 REST OF ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 42 REST OF ASIA PACIFIC: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4 EUROPE

FIGURE 31 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SNAPSHOT

TABLE 43 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 45 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 46 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 47 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 48 EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.1 GERMANY

9.4.1.1 Food & beverage market in Germany to be a strong growth factor

TABLE 49 GERMANY: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 50 GERMANY: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.2 FRANCE

9.4.2.1 Growing export of agri-food and seafood to boost the market

TABLE 51 FRANCE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 52 FRANCE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.3 UK

9.4.3.1 Growth of food & beverage as key industry to boost demand for amorphous polyethylene terephthalate

TABLE 53 UK: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 54 UK: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.4 ITALY

9.4.4.1 Export of food items to drive the market

TABLE 55 ITALY: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 ITALY: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.5 SPAIN

9.4.5.1 Changing food habits to boost amorphous polyethylene terephthalate market

TABLE 57 SPAIN: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 58 SPAIN: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.6 RUSSIA

9.4.6.1 Automotive and construction industries to drive market

TABLE 59 RUSSIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 60 RUSSIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.7 REST OF EUROPE

TABLE 61 REST OF EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 62 REST OF EUROPE: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5 SOUTH AMERICA

TABLE 63 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 65 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 66 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 67 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 68 SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.1 BRAZIL

9.5.1.1 The growing packaging industry is a lucrative market for amorphous polyethylene terephthalate

TABLE 69 BRAZIL: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 70 BRAZIL: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.2 ARGENTINA

9.5.2.1 Government’s initiative to promote exports impacting market in Argentina positively

TABLE 71 ARGENTINA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 72 ARGENTINA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.3 REST OF SOUTH AMERICA

TABLE 73 REST OF SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 74 REST OF SOUTH AMERICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

TABLE 75 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 77 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 79 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.2 SAUDI ARABIA

9.6.2.1 Increasing opportunities in end-use industries to fuel the market for amorphous polyethylene terephthalate

TABLE 81 SAUDI ARABIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 82 SAUDI ARABIA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.3 SOUTH AFRICA

9.6.3.1 Growth in pharmaceuticals industry to fuel market

TABLE 83 SOUTH AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 84 SOUTH AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 85 REST OF MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 86 REST OF MIDDLE EAST & AFRICA: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 113)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 32 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY DURING 2017–2022

10.3 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS, 2020

10.3.1 INDORAMA VENTURES PUBLIC COMPANY LIMITED

10.3.2 ALPEK

10.3.3 JIANGSU SANFANGXIANG GROUP CO., LTD.

10.3.4 FAR EASTERN NEW CENTURY CORPORATION

10.3.5 DAK AMERICAS

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

10.5 MARKET SHARE ANALYSIS

TABLE 87 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: GLOBAL MARKET SHARES OF KEY PLAYERS

FIGURE 35 SHARE OF LEADING COMPANIES IN AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET

10.6 COMPANY EVALUATION QUADRANT

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING: AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET, 2020

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 EMERGING LEADER

10.6.4 PARTICIPANT

10.7 COMPETITIVE BENCHMARKING

10.7.1 STRENGTH OF PRODUCT PORTFOLIO

10.7.2 BUSINESS STRATEGY EXCELLENCE

TABLE 88 COMPANY APPLICATION TYPE FOOTPRINT

TABLE 89 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 90 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 STARTING BLOCKS

10.8.4 DYNAMIC COMPANIES

FIGURE 37 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

10.9 COMPETITIVE SCENARIO AND TRENDS

10.9.1 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: EXPANSION, JANUARY 2017–AUGUST 2022

10.9.2 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: MERGERS & ACQUISITIONS, JANUARY 2017–AUGUST 2022

10.9.3 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: PARTNERSHIP, JANUARY 2017–AUGUST 2022

10.9.4 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: INVESTMENT, JANUARY 2017–AUGUST 2022

10.9.5 AMORPHOUS POLYETHYLENE TEREPHTHALATE MARKET: NEW PRODUCT DEVELOPMENTS, JANUARY 2017–AUGUST 2022

11 COMPANY PROFILES (Page No. - 128)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 INDORAMA VENTURES PUBLIC COMPANY LIMITED

TABLE 91 INDORAMA VENTURES PUBLIC COMPANY LIMITED: BUSINESS OVERVIEW

FIGURE 38 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

11.1.2 FAR EASTERN NEW CENTURY CORPORATION

TABLE 92 FAR EASTERN NEW CENTURY CORPORATION: BUSINESS OVERVIEW

FIGURE 39 FAR EASTERN NEW CENTURY CORPORATION: COMPANY SNAPSHOT

11.1.3 DAK AMERICAS

TABLE 93 DAK AMERICAS: BUSINESS OVERVIEW

11.1.4 JBF INDUSTRIES LIMITED

TABLE 94 JBF INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 40 JBF INDUSTRIES LIMITED: COMPANY SNAPSHOT

11.1.5 RELIANCE INDUSTRIES LIMITED

TABLE 95 RELIANCE INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 41 RELIANCE INDUSTRIES LIMITED: COMPANY SNAPSHOT

11.1.6 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

TABLE 96 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY: BUSINESS OVERVIEW

11.1.7 ALPEK

TABLE 97 ALPEK: BUSINESS OVERVIEW

FIGURE 42 ALPEK: COMPANY SNAPSHOT

11.1.8 JIANGSU SANFANGXIANG GROUP CO., LTD.

TABLE 98 JIANGSU SANFANGXIANG GROUP CO., LTD.: BUSINESS OVERVIEW

11.1.9 PETRO POLYMER SHARGH

TABLE 99 PETRO POLYMER SHARGH: BUSINESS OVERVIEW

11.1.10 COVESTRO AG

TABLE 100 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 43 COVESTRO AG: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 NEO GROUP, UAB

11.2.2 NOVAPET, S.A.

11.2.3 INVISTA

11.2.4 EQUIPOLYMERS

11.2.5 LOTTE CHEMICAL

11.2.6 NAN YA PLASTICS CORPORATION

11.2.7 PLASTIVERD

11.2.8 POLISAN HOLDING

11.2.9 OCTAL

11.2.10 SHAHID TONDGOOYAN PETROCHEMICAL COMPANY

11.2.11 IVL DHUNSERI PETROCHEM INDUSTRIES PVT. LTD.

11.2.12 TEIJIN LIMITED

11.2.13 CHINA RESOURCES PACKAGING MATERIALS CO.

11.2.14 MPI POLYESTER INDUSTRIES

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 164)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

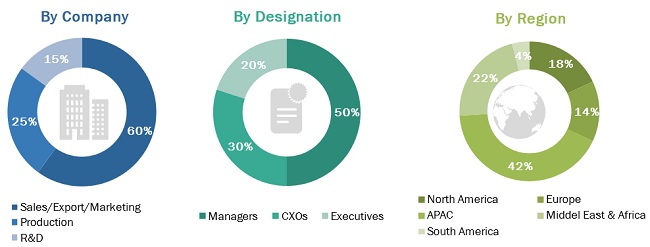

The study involved four major activities in estimating the current market size for the amorphous polyethylene terephthalate market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as food & beverage, pharmaceuticals, personal care, textile companies, and other companies of the customer/end users who are using amorphous polyethylene terephthalate were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of amorphous polyethylene terephthalate and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the amorphous polyethylene terephthalate market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global amorphous polyethylene terephthalate market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the amorphous polyethylene terephthalate market based on process and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisitions, collaborations, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Amorphous Polyethylene Terephatalate Market