This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the animal genetics market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the animal genetics markets. Primary sources from the demand side include professionals from veterinary centers & institutes, professors, veterinanians and researchers.

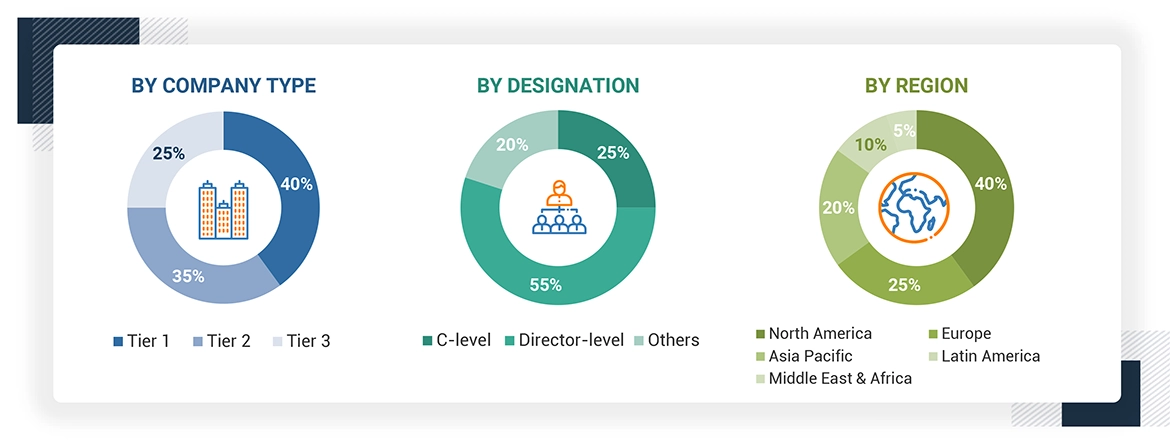

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2023: Tier 1 = >USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3 = < USD 200 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the animal genetics market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

The animal genetics market includes products, like animal genetic materials, and services, such as genetic tests, used for selective breeding and genetic enhancement in farm animals, companion animals, and birds. This market focuses on improving animal traits for better yield, health, and adaptability. Farmers, breeders, and veterinary professionals are increasingly adopting gene modification and selective breeding to enhance productivity and quality in animal-derived products, driven by the need for efficient and sustainable solutions.

Stakeholders

-

Manufacturing companies of animal genetics products

-

Service providers of animal genetic tests and programs

-

Distributors of products associated with animal genetics

-

Animal genetics companies

-

Veterinary hospitals and clinics

-

Veterinary diagnostics centers

-

Veterinary practitioners

-

Research institutes and academic centers

-

Contract research organizations (CROs)

-

Market research and consulting firms

-

Venture capitalists and investors

-

Regulatory agencies and government bodies

Report Objectives

-

To define, describe, and forecast the animal genetics market by animal type, product & service, technology, end user, and region

-

To strategically analyze the industry trends, technology trends, pricing analysis, regulatory scenario, supply/value chain, ecosystem/market map, Porter’s Five Forces, trade & patent analysis, key stakeholders & buying criteria, and conferences & events

-

To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and industry trends

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall animal genetics market.

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

-

To strategically profile the key market players and comprehensively analyze their shares and core competencies¬2

-

To forecast the market size in key regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To track and analyze competitive developments such as product or service launches and approvals, acquisitions, partnerships, collaborations, and expansions.

Oliver

Oct, 2022

What are the major challenges faced by key players of the global animal genetics market?.

George

Oct, 2022

I am looking for the detailed geographical analysis of the global animal genetics market.

George

Oct, 2022

In what way the COVID19 is impacting the global growth of animal genetics market.