Food Anti-Caking Agents Market by Type (Calcium Compounds, Sodium Compounds, Silicon Dioxide, and Microcrystalline Cellulose), Application (Seasonings and Condiments, Bakery, Dairy, and Soups and Sauces), Source & Region - Global Forecast to 2025

The global food anti-caking agents market is estimated to reach $1,074 million by 2025, growing at a 5.5% compound annual growth rate (CAGR). The global market size was valued $822 million in 2020.

The report analyzes the market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the market. The market is driven by its usage in a wide range of applications, need for varied functionalities in diverse range of food products, concern toward food safety and hygiene in manufacturing practices, and demand for food products with better quality and enhanced shelf life.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Anti-Caking Agents Market Growth Insights

Driver: Rising consumption of food ingredients

The growth in the consumption of the food ingredients such as baking powder, milk & cream powder, cake mixes, and instant soup powder is expected to have an influential effect (positive) on the growth of food anti-caking agents, owing to their important functionality of maintaining free-flowing ability, texture & other organoleptic properties, and long shelf-life. Consequently, the growth in the consumption of food anti-caking agents is directly influenced by the growth in consumption of different food ingredients (especially, those that are hygroscopic in nature). These are the driving factors of food anti-caking agents market.

Restraint: Government regulations

Food and Drug Regulations, with respect to the use or presence of anti-caking agents, suggests the amount of the agent does not exceed the level suggested by regulatory bodies. Anti-caking agents also come under the Good Manufacturing Practice (GMP), which suggests that the amount of the agent that is added to the food in manufacturing and processing does not exceed the amount required to accomplish the purpose for which it has been added.

Opportunity: Demand from emerging markets

Increase in living standards and changes in lifestyles (busy lifestyles) have led to change in eating habits, making consumers value convenience. The demand for food anti-caking agents market is thus on the rise in emerging markets as the demand for convenience food with enhanced quality and shelf-life is increasing. Fast foods are also being increasingly differentiated from junk food as consumers seek options that are quick and easy but at the same time healthy. These are the opportunities in the market.

Challenge: Impact of anti-caking agents on the nutritive value of the food product

Anti-caking agents are widely used in powdered and granulated food particles to prevent the formation of lumps. They are frequently added to powdered foods to prevent the breakdown of certain nutrients, especially vitamin However, it has been found that anti-caking agents may degrade the nutrients in a powdered formulation. Instead of protecting certain nutrients, it may accelerate the breakdown of beneficial compounds such as vitamin.

Food Anti-Caking Agents Market by Type Insights

The silicone dioxide sub-segment is estimated to account for the fastest growth in the by type segment for market.

Silicon dioxide is widely accepted food anti-caking agent. It is available in natural as well as synthetic forms. Several natural sources of silicon dioxide are sand or quartz, rice husk powder, leafy green vegetables, beets, bell peppers, brown rice and oats, and alfalfa. The regulatory and consumer acceptance key factors responsible for market growth.

Food Anti-Caking Agents Market by Application Insights

By application, the seasonings and condiments sub-segment is estimated to accunt for the largest market share in the market.

Consumers’ demand for convenience food of high quality and long lasting shelf life is continuously rising due to the changing life style and hectic schedule. Further growth in population, drives the upsurge in demand for food, growing level of emphasis on hygiene in food manufacturing practices, concern towards food safety, ease in storage and packaging, and convenience in transportation of powdery food products such as seasonings and condiments that drive global growth in demand for food anti-caking agents.

Food Anti-Caking Agents Market by Source Insights

The synthetic sub-segment is estimated to account for the largest market share in the by source segment of the market over the forecst period.

Synthetic anti caking agents are easy for bulk production are nare a more cost effective multi-pupose alternative to the manufacturers due to which their demand in thre market is estimated to stay strong. The number synthetic anti caking agents manufactuers in the market is also increasing in the recent years.

To know about the assumptions considered for the study, download the pdf brochure

Food Anti-Caking Agents Market by Regional Insights

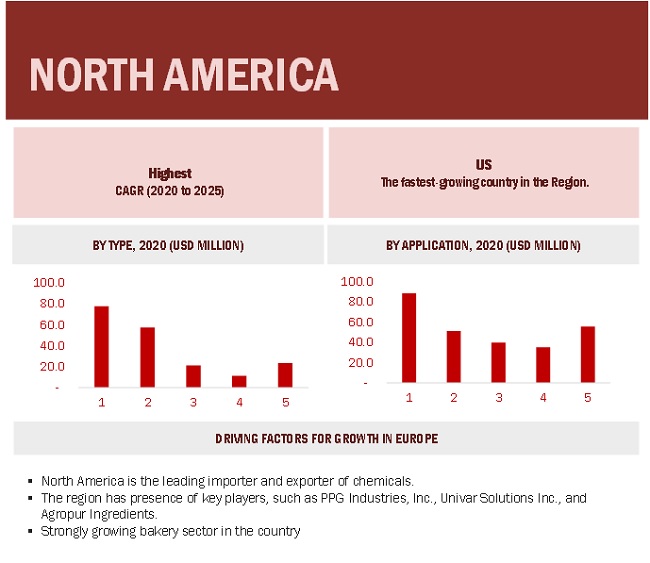

The increasing consumption of bakery snacks and ready-to-eat flour mixes in the North American region, accounts for the high market share of the region.

The high growth in the North American region is attributed to high consumption and continuously rising demand for a diverse range of food ingredients (which are hygroscopic in nature) and premixes in a varied range of food products/applications. The market in North America is dominated by the US, with share of ~75.1% in 2019. The consumption of processed and packaged food in the US has been considerably high. According to the USDA, the processed food market recorded more than USD 500 billion, and packaged food market recorded USD 388 billion in 2017.

Top Key Players in Food Anti-Caking Agents Market

Key players in the food anti-caking agents market include include major players such as Evonik Industries AG (US), PPG Industries, Inc. (US), Brenntag AG (Germany), Univar Solutions Inc. (US), Solvay SA (Belgium), Cabot Corporation. And Agropur Ingredients (US). These major players in this market are focusing on increasing their presence through expansions & acquisitions. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Food Anti-Caking Agents Market Scope

|

Report Metric |

Details |

| Market valuation in 2020 | USD 822 Million |

| Revenue prediction in 2025 | USD 1,074 Million |

| Forecast Period | 2020 to 2025 |

| Progress rate | CAGR of 5.5% |

|

Companies studied |

The major market players include Evonik Industries AG (US), PPG Industries, Inc. (US), Brenntag AG (Germany), Univar Solutions Inc. (US), Solvay SA (Belgium), Cabot Corporation. (US) and Agropur Ingredients (US) (Total 20 companies) |

|

Market Drivers |

|

|

Market Opportunities |

|

Food Anti-Caking Agents Market Segmentation

This research report categorizes the market based on Type, Applications, Source and Region.

|

Segment |

Subsegment |

|

Market By Type |

|

|

Market By Application |

|

|

Market By Source |

|

|

Market by Region |

|

*Rest of the World (RoW) includes South America, Middle East and Africa.

Frequently Asked Questions (FAQ):

What are food anti-caking agents?

Food anti-caking agents are substances added to powdered or granulated foods to prevent them from forming lumps or clumps, thereby maintaining their free-flowing properties. These agents work by absorbing moisture or by coating particles to prevent them from sticking together. They are commonly used in a variety of food products, including powdered spices, baking mixes, powdered sugar, and grated cheese.

How big is the food anti-caking agents market?

The global food anti-caking agents market is predicted to develop at an 5.5% compound annual growth rate (CAGR) to $1,074 million by 2025. In 2020, the global market size was valued $822 million.

Which players are involved in the manufacturing of food anti-caking agents market?

Key players in this market include Evonik Industries AG (US), PPG Industries, Inc. (US), Brenntag AG (Germany), Univar Solutions Inc. (US), Solvay SA (Belgium), Cabot Corporation. (US) and Agropur Ingredients (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION OF (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTS

1.3.2 GEOGRAPHIC SCOPE

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2019

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN: FOOD ANTI-CAKING AGENTS MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

2.2.2.1 Population growth and diversified food demand

FIGURE 3 GLOBAL POPULATION IS PROJECTED TO REACH ~9.5 BILLION BY 2050

2.2.2.1.1 Increase in middle-class population, 2009–2030

TABLE 2 GLOBAL MIDDLE-CLASS POPULATION, BY REGION, 2009–2030

2.2.2.2 GDP (purchasing power parity) & developing economies

2.2.2.3 Growth in the global beverage & dairy industry

FIGURE 4 GROWTH RATE OF GLOBAL BEVERAGE SALES, 2011–2018

2.2.2.4 Rising demand for bakery products

FIGURE 5 BAKERY PRODUCTS MARKET SIZE, 2010–2017 (USD BILLION)

2.2.2.5 Growing level of spice production

FIGURE 6 GLOBAL SPICE PRODUCTION, 2005–2013 (TONS)

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Research & development

2.2.3.2 Food processing equipment and technologies

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH OF FOOD ANTI-CAKING AGENTS MARKET

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

2.7 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7.1 SCENARIO-BASED MODELLING

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: THE GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 62)

3.1 SILICON DIOXIDE EXPECTED TO ACHIEVE ATTRACTIVE GROWTH DURING THE FORECAST PERIOD

FIGURE 13 MARKET, BY TYPE (2020 VS. 2025)

3.2 SEASONINGS & CONDIMENTS APPLICATION PROJECTED TO DOMINATE THROUGH 2025

FIGURE 14 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

3.3 SYNTHETIC SEGMENT PROJECTED TO BE THE LARGEST SOURCE OF FOOD ANTI-CAKING AGENTS BY 2025

FIGURE 15 MARKET SIZE FOR FOOD ANTI-CAKING AGENTS, BY SOURCE, 2020 VS. 2025 (USD MILLION)

3.4 ASIA PACIFIC REGION TO BE THE FASTEST-GROWING MARKET FROM 2020 TO 2025

FIGURE 16 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 OPPORTUNITIES IN THE MARKET

FIGURE 17 GROWTH IN POWDERED BEVERAGE DEMAND TO DRIVE GROWTH OF THE MARKET

4.2 MARKETS: KEY COUNTRIES

FIGURE 18 THE US IS ESTIMATED TO BE THE LARGEST MARKET IN 2020

4.3 EUROPE: MARKET, BY SOURCE AND COUNTRY

FIGURE 19 GERMANY IS ESTIMATED TO BE THE LARGEST IN THE EUROPEAN MARKET IN 2020

4.4 FOOD ANTI-CAKING AGENTS MARKET, BY TYPE AND REGION

FIGURE 20 CALCIUM COMPOUND ESTIMATED TO DOMINATE THE MARKET IN 2020

4.5 MARKET, BY APPLICATION

FIGURE 21 SEASONING & CONDIMENTS PROJECTED TO DOMINATE THE MARKET, 2020 VS. 2025

4.6 COVID-19 IMPACT ON THE MARKET

FIGURE 22 COMPARISON OF PRE-COVID & POST-COVID SCENARIO, 2017-2021

5 MARKET OVERVIEW (Page No. - 71)

5.1 INTRODUCTION

TABLE 3 CONNECTED/ADJACENT MARKETS

5.2 COVID-19 IMPACT ON THE MARKET DYNAMICS OF FOOD-ANTICAKING AGENTS

5.2.1 COVID-19 BOOSTNG THE DEMAND FOR HIGH-QUALITY AND PREMIUM PRODUCTS

5.2.2 COVID-19 TO REFORMULATE THE DEMAND FOR FOOD TO LOWER COSTS

5.2.3 COVID-19 IMPACT ON RAW MATERIAL AVAILABILITY AND SUPPLY CHAIN DISRUPTION

5.2.4 COVID-19 TO SHIFT THE DEMAND TOWARD PLANT-SOURCED INGREDIENTS

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rising consumption of food ingredients

TABLE 4 FOOD INGREDIENTS & THEIR APPLICATIONS

5.3.1.2 Growing demand for convenience foods

5.3.1.3 Research & development driving innovation

5.3.1.4 Functionalities of food anti-caking agents

5.3.1.5 Demand for food products with better quality and longer shelf-life

5.3.2 RESTRAINTS

5.3.2.1 Government regulations

5.3.2.2 Health hazards

5.3.3 OPPORTUNITIES

5.3.3.1 Demand from emerging markets

FIGURE 23 INDIAN FOOD PROCESSING INDUSTRY MARKET, 2015 VS. 2020 (USD BILLION)

FIGURE 24 INDIAN FOOD PROCESSING INDUSTRY PROJECTIONS, BY 2030

5.3.3.2 Adoption of advanced technologies

5.3.4 CHALLENGES

5.3.4.1 Impact of anti-caking agents on the nutritive value of the food product

5.3.4.2 Consumer perception for e-numbers

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 PRICING ANALYSIS

FIGURE 25 PRICING ANALYSIS, FOOD ANTI-CAKING AGENTS MARKET, BY TYPE, 2017-2025 (USD/KG)

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 26 SUPPLY CHAIN: FOOD ANTI-CAKING AGENT MARKET

6.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF SUPPLIERS

6.4.4 BARGAINING POWER OF BUYERS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

7 REGULATORY FRAMEWORK (Page No. - 88)

7.1 IDENTIFYING FOOD ADDITIVES IN PRODUCTS

7.2 US FDA

7.2.1 CALCIUM SILICATE

7.2.2 SILICON DIOXIDE

7.2.3 SODIUM FERROCYNAIDE (YELLOW PRUSSIATE OF SODA)

7.3 CANADA

7.3.1 CALCIUM COMPOUNDS

TABLE 5 CALCIUM COMPOUNDS: FOOD APPLICATIONS & PERMISSIBLE LIMITS

7.3.2 SODIUM COMPOUNDS

TABLE 6 SODIUM COMPOUNDS: FOOD APPLICATIONS & PERMISSIBLE LIMITS

7.3.3 SILICON DIOXIDE

TABLE 7 SILICON DIOXIDE: FOOD APPLICATIONS & PERMISSIBLE LIMITS

7.3.4 MAGNESIUM COMPOUNDS

TABLE 8 MAGNESIUM COMPOUNDS: FOOD APPLICATIONS & PERMISSIBLE LIMITS

7.3.5 MICROCRYSTALLINE CELLULOSE

TABLE 9 MICROCRYSTALLINE CELLULOSE: FOOD APPLICATIONS & PERMISSIBLE LIMITS

7.4 EUROPE

7.4.1 E-NUMBERS

TABLE 10 LIST OF ANTI-CAKING AGENTS IN EUROPEAN UNION WITH E NUMBERS

7.4.2 LIST OF BANNED FOOD ANTI-CAKING AGENTS IN EUROPEAN UNION

7.4.3 RECENT AMENDMENTS

8 FOOD ANTI-CAKING AGENTS MARKET, BY TYPE (Page No. - 95)

8.1 INTRODUCTION

FIGURE 28 MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 11 MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 13 MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 14 MARKET SIZE, BY TYPE, 2020–2025 (KT)

8.1.1 COVID-19 IMPACT ON MARKET, BY TYPE

8.1.1.1 Realistic scenario

TABLE 15 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.2 Optimistic scenario

TABLE 16 OPTIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2 CALCIUM COMPOUNDS

8.2.1 HIGH MOISTURE ABSORPTION PROPERTIES OF CALCIUM COMPOUNDS IS DRIVING THE MARKET OF ANTI-CAKING AGENTS

TABLE 18 CALCIUM COMPOUNDS: PERMISSIBLE LIMITS & FOOD APPLICATIONS

FIGURE 29 CALCIUM COMPOUNDS: BY MARKET SIZE, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 19 CALCIUM COMPOUNDS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 CALCIUM COMPOUNDS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 CALCIUM COMPOUNDS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 22 CALCIUM COMPOUNDS: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 23 CALCIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 24 CALCIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 25 CALCIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 26 CALCIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 27 CALCIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 28 CALCIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 29 CALCIUM COMPOUNDS: ROW BY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 CALCIUM COMPOUNDS: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 SODIUM COMPOUNDS

8.3.1 COLOR, FLAVOR, TEXTURE ENHANCER ARE THE KEY PROPERTIES OF SODIUM COMPOUNDS ALONG WITH ANTI-CAKING

TABLE 31 SODIUM COMPOUNDS: PERMISSIBLE LIMITS & FOOD APPLICATIONS

TABLE 32 SODIUM COMPOUNDS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 SODIUM COMPOUNDS: FOOD ANTI-CAKING AGENTS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 34 SODIUM COMPOUNDS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 35 SODIUM COMPOUNDS: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 36 SODIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 37 SODIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 38 SODIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 39 SODIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 40 SODIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 41 SODIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 42 SODIUM COMPOUNDS: ROW MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 SODIUM COMPOUNDS: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 SILICON DIOXIDE

8.4.1 NATURAL AND SYNTHETIC FORMS OF SILICA AS ANTI-CAKING AGENT IS FUELLING DEMAND IN THE MARKET

TABLE 44 SILICON DIOXIDE: PERMISSIBLE LIMITS & FOOD APPLICATIONS

TABLE 45 SILICON DIOXIDE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 SILICON DIOXIDE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 SILICON DIOXIDE: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 48 SILICON DIOXIDE: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 49 SILICON DIOXIDE: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 50 SILICON DIOXIDE: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 51 SILICON DIOXIDE: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 52 SILICON DIOXIDE: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 53 SILICON DIOXIDE: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 54 SILICON DIOXIDE: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 55 SILICON DIOXIDE: ROW MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 SILICON DIOXIDE: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.5 MAGNESIUM COMPOUNDS

8.5.1 SALT AND CONFECTIONER’S SUGAR ARE KEY APPLICATION AREAS FOR THE MAGNESIUM COMPOUNDS

TABLE 57 MAGNESIUM COMPOUNDS: FOOD APPLICATIONS

TABLE 58 MAGNESIUM COMPOUNDS: FOOD ANTI-CAKING AGENTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MAGNESIUM COMPOUNDS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 60 MAGNESIUM COMPOUNDS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 61 MAGNESIUM COMPOUNDS: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 62 MAGNESIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 MAGNESIUM COMPOUNDS: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 64 MAGNESIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 65 MAGNESIUM COMPOUNDS: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 66 MAGNESIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 67 MAGNESIUM COMPOUNDS: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 68 MAGNESIUM COMPOUNDS: ROW MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 MAGNESIUM COMPOUNDS: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.6 MICROCRYSTALLINE CELLULOSE

8.6.1 WOOD IS A KEY SOURCE FOR MICROCRYSTALLINE CELLULOSE

TABLE 70 MICROCRYSTALLINE CELLULOSE: PERMISSIBLE LIMITS & FOOD APPLICATIONS

TABLE 71 MICROCRYSTALLINE CELLULOSE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 MICROCRYSTALLINE CELLULOSE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 73 MICROCRYSTALLINE CELLULOSE: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 74 MICROCRYSTALLINE CELLULOSE: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 75 MICROCRYSTALLINE CELLULOSE: NORTH AMERICAN BY MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 MICROCRYSTALLINE CELLULOSE: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 77 MICROCRYSTALLINE CELLULOSE: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 78 MICROCRYSTALLINE CELLULOSE: EUROPEAN BY MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 79 MICROCRYSTALLINE CELLULOSE: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 80 MICROCRYSTALLINE CELLULOSE: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 81 MICROCRYSTALLINE CELLULOSE: ROW MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 MICROCRYSTALLINE CELLULOSE: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.7 OTHER TYPES

8.7.1 ALUMINIUM SILICATE (KAOLIN) IS AMONG KEY OTHER ANTI-CAKING AGENTS

TABLE 83 OTHER TYPES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 84 OTHER TYPES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 85 OTHER TYPES: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 86 OTHER TYPES: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 87 OTHER TYPES: NORTH AMERICAN BY MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 OTHER TYPES: NORTH AMERICAN MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 OTHER TYPES: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 90 OTHER TYPES: EUROPEAN MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 91 OTHER TYPES: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2016–2019 (USD MILLION)

TABLE 92 OTHER TYPES: ASIA PACIFIC MARKET SIZE, BY COUNTRY / REGION, 2020–2025 (USD MILLION)

TABLE 93 OTHER TYPES: ROW MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 94 OTHER TYPES: ROW MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 FOOD ANTI-CAKING AGENTS MARKET, BY APPLICATION (Page No. - 129)

9.1 INTRODUCTION

FIGURE 30 MARKET SIZE FOR FOOD ANTI-CAKING AGENTS, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 95 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 98 MARKET SIZE, BY APPLICATION, 2020–2025 (KT)

9.1.1 COVID-19 IMPACT ON MARKET, BY APPLICATION

9.1.1.1 Realistic scenario

TABLE 99 REALISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

9.1.1.2 Optimistic scenario

TABLE 100 OPTIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 101 PESSIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

9.2 SEASONINGS & CONDIMENTS

9.2.1 CONSUMPTION OF SPICES MAJORLY IN POWDERED FORM IS MARKET DRIVER FOR THE SEGMENT

FIGURE 31 FOOD ANTI-CAKING AGENTS IN SEASONINGS & CONDIMENTS MARKET SIZE, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 102 SEASONINGS & CONDIMENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 103 SEASONINGS & CONDIMENTS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 104 SEASONINGS & CONDIMENTS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 105 SEASONINGS & CONDIMENTS: MARKET SIZE, BY REGION, 2020–2025 (KT)

9.3 BAKERY

9.3.1 GROWING DEMAND FOR BAKERY PREMIXES IN POWDERED FORM IS PROVIDING OPPORTUNITY FOR ANTI-CAKING AGENTS

TABLE 106 BAKERY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 BAKERY: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 108 BAKERY: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 109 BAKERY: MARKET SIZE, BY REGION, 2020–2025 (KT)

9.4 DAIRY PRODUCTS

9.4.1 INCREASING SHELF LIFE ALONG WITH ANTI-CAKING PROPERTIES TO UPLIFT THE DEMAND IN DAIRY SEGMENT

TABLE 110 DAIRY PRODUCTS: BY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 111 DAIRY PRODUCTS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 112 DAIRY PRODUCTS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 113 DAIRY PRODUCTS: MARKET SIZE, BY REGION, 2020–2025 (KT)

9.5 SOUPS & SAUCES

9.5.1 THE SOUPS AND SAUCES MARKET IS GAINING TRACTION IN POWDERED FORM

TABLE 114 SOUPS & SAUCES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 115 SOUPS & SAUCES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 116 SOUPS & SAUCES: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 117 SOUPS & SAUCES: MARKET SIZE, BY REGION, 2020–2025 (KT)

9.6 OTHER APPLICATIONS

9.6.1 CALCIUM STEARATE AND SILICON DIOXIDE ARE LARGELY USED IN MEAT APPLICATION

TABLE 118 FOOD ANTI-CAKING AGENTS, BY FOOD PRODUCT

TABLE 119 OTHER APPLICATIONS: BY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 120 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 121 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 122 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2020–2025 (KT)

10 FOOD ANTI-CAKING AGENTS MARKET, BY SOURCE (Page No. - 143)

10.1 INTRODUCTION

FIGURE 32 GLOBAL MARKET, BY SOURCE, 2020 VS. 2025

TABLE 123MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 124 MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

10.1.1 COVID-19 IMPACT ON MARKET, BY SOURCE

10.1.1.1 Realistic Scenario

TABLE 125 REALISTIC SCENARIO: BY MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic Scenario

TABLE 126 OPTIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE 127 PESSIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

10.2 SYNTHETIC

10.2.1 DEVELOPMENT OF BAKERY AND CONFECTIONERY SECTORS GLOBALLY DRIVING THE USE OF QUALITY ANTI-CAKING AGENTS

TABLE 128 SYNTHETIC: BY MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 129 SYNTHETIC: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

10.3 NATURAL

10.3.1 INCREASING FOOD SAFETY AWARENESS AMONG THE GLOBAL POPULATION PROPELLING THE DEMAND FOR NATURAL ANTI-CAKING AGENTS

TABLE 130 NATURAL: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 131 NATURAL: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

11 MARKET, BY REGION (Page No. - 149)

11.1 INTRODUCTION

FIGURE 33 GEOGRAPHIC SNAPSHOT: NEW HOTSPOTS EMERGING IN ASIA PACIFIC

TABLE 132 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 133 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 134 MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 135 MARKET SIZE, BY REGION, 2020–2025 (KT)

11.1.1 COVID-19 IMPACT ON BY MARKET, BY REGION

11.1.1.1 Realistic scenario

TABLE 136 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.2 Optimistic scenario

TABLE 137 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.3 Pessimistic scenario

TABLE 138 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: MARKET

TABLE 139 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KT)

TABLE 142 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KT)

TABLE 143 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 146 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (KT)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (KT)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

11.2.1 US

TABLE 153 US: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 US: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.2 CANADA

TABLE 155 CANADA: BY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 CANADA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.3 MEXICO

TABLE 157 MEXICO: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 158 MEXICO: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3 EUROPE

FIGURE 35 EUROPE: MARKET

TABLE 159 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (USD MILLION)

TABLE 160 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 161 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (KT)

TABLE 162 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (KT)

TABLE 163 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 164 EUROPE: FOOD ANTI-CAKING AGENTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 165 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 166 EUROPE: MARKET SIZE, BY TYPE, 2020–2025 (KT)

TABLE 167 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 169 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 170 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (KT)

TABLE 171 EUROPE: MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 172 EUROPE: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

11.3.1 GERMANY

TABLE 173 GERMANY: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 174 GERMANY: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.2 FRANCE

TABLE 175 FRANCE: BY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 176 FRANCE: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.3 UK

TABLE 177 UK: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 UK: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.4 ITALY

TABLE 179 ITALY: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 180 ITALY: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.5 RUSSIA

TABLE 181 RUSSIA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 182 RUSSIA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 183 REST OF EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 184 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (KT)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (KT)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (KT)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 196 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (KT)

TABLE 197 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

11.4.1 CHINA

TABLE 199 CHINA: FOOD ANTI-CAKING AGENTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 200 CHINA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.2 JAPAN

TABLE 201 JAPAN: BY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 202 JAPAN: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.3 INDIA

TABLE 203 INDIA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 204 INDIA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.4 AUSTRALIA

TABLE 205 AUSTRALIA: BY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 206 AUSTRALIA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 207 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

TABLE 209 ROW: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 210 ROW: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 211 ROW: MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 212 ROW: MARKET SIZE, BY REGION, 2020–2025 (KT)

TABLE 213 ROW: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 214 ROW: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 215 ROW: MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 216 ROW: MARKET SIZE, BY TYPE, 2020–2025 (KT)

TABLE 217 ROW: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 218 ROW: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 219 ROW: MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 220 ROW: MARKET SIZE, BY APPLICATION, 2020–2025 (KT)

TABLE 221 ROW: MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 222 ROW: MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

11.5.1 SOUTH AMERICA

TABLE 223 SOUTH AMERICA: FOOD ANTI-CAKING AGENTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.2 MIDDLE EAST

TABLE 225 MIDDLE EAST: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 226 MIDDLE EAST: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.3 AFRICA

TABLE 227 AFRICA: BY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 228 AFRICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 196)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS

FIGURE 37 TOP FIVE COMPANIES IN THE MARKET, 2019

12.2.1 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET: TRENDS IN COMPANY STRATEGIES, 2017–2019

12.3 COMPETITIVE SCENARIO

12.3.1 EXPANSIONS

TABLE 229 EXPANSIONS, 2019

12.3.2 ACQUISITIONS

TABLE 230 ACQUISITIONS, 2017

12.4 COVID-19 SPECIFIC COMPANY RESPONSE

12.5 COMPANY EVALUATION MATRIX (OVERALL MARKET)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 39 MARKET: COMPANY EVALUATION MATRIX, 2019

12.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 40 FOOD ANTI-CAKING AGENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

13 COMPANY PROFILES (Page No. - 203)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.1 PPG INDUSTRIES, INC.

FIGURE 41 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 42 PPG INDUSTRIES, INC.: SWOT ANALYSIS

13.2 EVONIK INDUSTRIES AG

FIGURE 43 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 44 EVONIK INDUSTRIES AG: SWOT ANALYSIS

13.3 BRENNTAG AG

FIGURE 45 BRENNTAG AG: COMPANY SNAPSHOT

FIGURE 46 BRENNTAG AG: SWOT ANALYSIS

13.4 UNIVAR SOLUTIONS INC.

FIGURE 47 UNIVAR SOLUTIONS INC.: COMPANY SNAPSHOT

FIGURE 48 UNIVAR SOLUTIONS INC.: SWOT ANALYSIS

13.5 CABOT CORPORATION

FIGURE 49 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 50 CABOT CORPORATION: SWOT ANALYSIS

13.6 SOLVAY S.A.

FIGURE 51 SOLVAY S.A.: COMPANY SNAPSHOT

13.7 AGROPUR INGREDIENTS

13.8 HUBER ENGINEERED MATERIALS

13.9 INTERNATIONAL MEDIA AND CULTURES, INC.

13.10 PQ CORPORATION

FIGURE 52 PQ CORPORATION: COMPANY SNAPSHOT

13.11 SWEETENER SUPPLY CORP.

13.12 JELU-WERK J. EHRLER GMBH & CO. KG

13.13 W. R. GRACE & CO.-CONN.

FIGURE 53 W. R. GRACE & CO.-CONN.: COMPANY SNAPSHOT

13.14 JINSHA PRECIPITATED SILICA MANUFACTURING CO., LTD.

13.15 BIMAL PHARMA PVT. LTD.

13.16 GUJARAT MULTI GAS BASE CHEMICALS PVT. LTD.

13.17 RAVAGO CHEMICALS

13.18 HYDRITE CHEMICAL CO.

13.19 PENTA MANUFACTURING COMPANY

13.20 SPECTRUM CHEMICAL MANUFACTURING CORP.

13.21 SHANDONG ZHONGHAI NEW MATERIAL GROUP CO., LTD

13.22 WEGO CHEMICAL GROUP

13.23 ASTRRA CHEMICALS.

13.24 SUNSHINE INDUSTRIES

13.25 OSIAN MARINE CHEMICALS PVT.LTD

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 239)

14.1 INTRODUCTION

TABLE 231 ADJACENT FOOD ANTI-CAKING AGENTS MARKET

14.2 LIMITATIONS

14.3 FOOD ADDITIVES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 232 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

14.4 FOOD PROCESSING INGREDIENTS

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 233 FOOD PROCESSING INGREDIENTS MARKET, BY APPLICATION, 2016 - 2023 (USD MILLION)

14.5 INTEGRATED FOOD INGREDIENTS MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

TABLE 234 BEVERAGES: INTEGRATED FOOD INGREDIENTS MARKET SIZE, BY INGREDIENT, 2016–2023 (USD BILLION)

15 APPENDIX (Page No. - 244)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

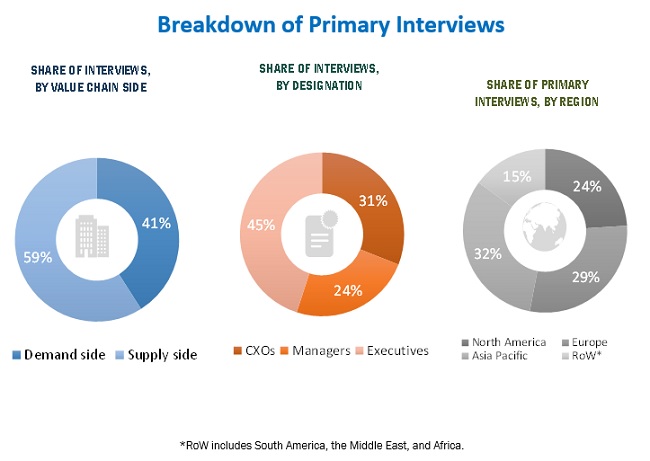

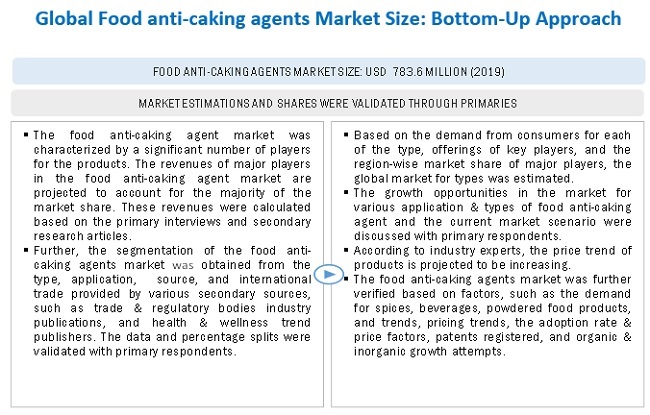

The study involved four major activities in estimating the food anti-caking agents market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the United States Food and Drug Administration (US FDA), Organisation for Economic Co-operation and Development (OECD), Food and Agriculture Organization, and the United States Department of Agriculture, were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The food anti-caking agents market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, and food manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include food manufacturers. The primary sources from the demand-side include distributors, importers, exporters, and end-consumers.

To know about the assumptions considered for the study, download the pdf brochure

Food Anti-Caking Agents Market Size Estimation

Market size estimation involves the determination of segmental revenue sales for food anti-caking agents of the top 20 manufacturers operating in the global market and validating the same with the determination of volume sales through a top-down approach.

Approach 1:

- Mapping of key food anti-caking agents manufacturers operating in the market through taking into consideration of several key factors such as annual revenue, annual production capacity and its global presence

- Determining the segment revenue sales which is responsible for generating sales of food anti-caking agents for each manufacturer

- Taking into on several factors such as market being fragmented comprising of more than 30 active players in the global market, ascertaining collective value share for top 20 players

Approach 2:

- Determination of annual consumption of each food anti-caking agent in terms of volume sales (tons) at the global level

- With reference to key secondary sources, determined the consumption of each of the food anti-caking agents at the regional level; this step not only provided share splits of food anti-caking agents market segment by type at regional level but also at the global level

- Initiated summation of food anti-caking agents regional consumption to arrive at the global volume sales in terms of kilotons (KT)

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food anti-caking agents were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Anti-Caking Agents Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the overall food anti-caking agents and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the market with respect to type, source, application, and region, over a five year period ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling the key market players in themarket

- Determining the market share of key players operating in the market

-

Providing a comparative analysis of the food anti-caking agents market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Providing insights on the trade scenario

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific food anti-caking agents market into South East Asian Countries and Oceania

- Further breakdown of the Rest of the World market into Middle-East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Anti-Caking Agents Market

Well-researched market report. This market has a lot of growth potential.