Antimicrobial Textile Market by Active Agents (Synthetic Organic Compounds, Metal & Metallic Salts, Bio-based), Application (Medical Textiles, Apparels, Home Textiles), Fabric (Cotton, Polyester, and Polyamide), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Antimicrobial Textiles Market

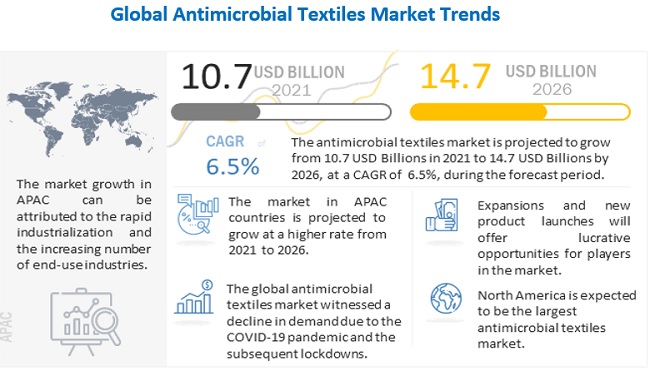

The global antimicrobial textiles market was valued at USD 10.7 billion in 2021 and is projected to reach USD 14.7 billion by 2026, growing at 6.5% cagr from 2021 to 2026. Due to rising demand across medical textile and apparel applications, the antimicrobial textiles market is likely to grow significantly in the upcoming years.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global antimicrobial textiles market

With the surge of COVID-19 cases, emergency protocols have been implemented, as well as the suspension of numerous operations and facilities in 2020. The COVID-19 outbreak in Wuhan, China, has spread throughout key APAC, European, and North American countries, disrupting the antimicrobial textiles market since most global manufacturers have offices in these regions. COVID-19 had disrupted the supply chain, slowing market expansion due to a scarcity of raw materials and personnel.

The COVID-19 pandemic had a minimal impact on the antimicrobial textiles market in 2020, with a minor drop in CAGR. Limited raw material production, supply chain disruptions, and restricted trade movements have all hampered the market in 2020. The pandemic had an impact on end-use industries such as food, beverage, retail, and home and personal care.

Antimicrobial Textiles Market Dynamics

Driver: Growing consumer awareness about hygiene in emerging economies

With a rising literacy rate and prevalent awareness campaigns, consumers are becoming aware of the potential dangers of microorganisms on textiles and the user of textiles. The demand for antimicrobial textiles is rising due to the increased awareness about hygiene, the rising disposable income, changing lifestyle along with increased concern about health, and the increasing pollution. Antimicrobial textiles create a barrier against bacteria responsible for skin infection, producing odor, and HAI. Therefore, antimicrobial textiles usage in apparel, sportswear, footwear, protective wear applications, and the healthcare industry is likely to grow significantly. This is expected to drive the market for antimicrobial textiles.

Restraint: Low efficiency of active agents

The efficiency of antimicrobial textiles depends upon the type of active agents used and the process through which active agents are applied to textiles. QAC, copper, and silver are strong active agents, but they tend to leach out of the fabrics. Some active agents, such as chitosan, are weak and are vanished from textiles after two-three washes. The metal and metallic salts are incorporated in the fabrics through the ionizing process and last longer than chemically induced antimicrobial properties. Still, the process makes up for 20%-30% additional cost to textile manufacturing. All these factors are restraining market growth.

Opportunity: Continuous research and technological advancements

Antimicrobial textiles are gaining popularity among researchers and manufacturers because of their ability to provide safety and quality life to users. Consumers are demanding better quality products in home textiles or apparel to support their healthier lifestyle choices. This is driving the need for new product development. Researchers are constantly trying to develop products that are skin-friendly, cost-effective, and environment-friendly. New active agents and fabrics are in the process of development, which can replace the existing, environmentally harmful active agents such as triclosan and PHMB. Manufacturers are trying to differentiate their products by using different active agents or fabrics to gain market share. They are using a different methodology to deliver antimicrobial properties to the fabric. For example, the use of bamboo fiber in the manufacturing of certain apparel is a unique way of providing antimicrobial properties to the apparel. Continuous research and technological advancement are expected to create vast opportunities for the growth of the antimicrobial textiles market.

Challenge: Compliance with stringent regulations for environmental protection

Certain active agents, such as triclosan, adversely affect the environment. Triclosan, when washed, does not mix in the water bodies and land and tends to settle on the surface, thus creating a barrier for oxygen to dissolve in water. Hence, stringent regulations are imposed on the use of such active agents. Manufacturers of antimicrobial textiles need to comply with regulations as some of these chemicals may pose a risk to health and the environment. The slightest defect in textiles may contaminate the product and ultimately risk the consumer's health. Along with the regulations, the manufacturer must conduct some test methods as well.

Cotton antimicrobial textiles is widely used.

Based on fibers, the cotton segment is projected to be the largest segment in the antimicrobial textiles market. Cotton is the most commonly used fabric around the world after polyester. Textiles made out of cotton are used for applications including clothing, bath towels, bedsheets, and other industrial applications. It is also most vulnerable to microbial attack as it is a naturally occurring fiber. Cotton can be given antimicrobial property by applying metal or non-metallic salts such as silver, copper, or chitosan.

Cotton textile goes into home applications as well as industrial applications. The antimicrobial coating on cotton textiles improves the durability of the fabric and improves the life-span of the material.

Significant increase in the demand for antimicrobial textiles in medical textile application

By application, medical textile segment is projected to be the largest segment in the antimicrobial textiles market. The medical textiles industry is a major consumer of antimicrobial textiles as most of the HAIs are transmitted through textiles. As healthcare associated diseases are increasing in a number of hospitals, it is very important to protect medical devices as well as clothing used in the hospital. Antimicrobial products should be integrated into every device and fabric of healthcare so that they resist the growth and spread of microbes and be odor-free. In the medical industry, the demand for antimicrobial textiles is high for attire, surgical supplies & wipes, sheets & blankets, and others.

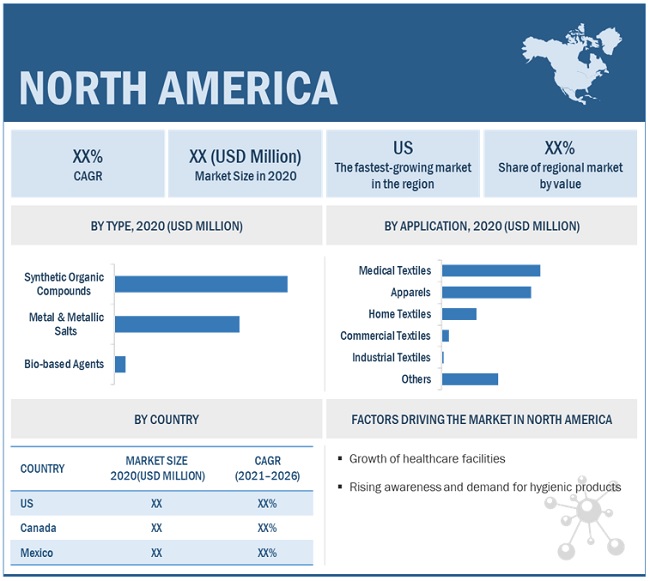

North America region to lead the global antimicrobial textiles market by 2026.

North America accounted for the largest market share of about 33.0%, in terms of value in 2020. The growth of the market in this region is attributed to the flourishing medical textile industry, presence of large customer base and leading companies in the region, which in turn, has increased the consumption of antimicrobial textiles. With the increased consumer awareness regarding health and hygiene and the growing demand for high-quality textile products has resulted in a rise in demand for antimicrobial textiles. Rapid industrialization, stringent industrial safety regulation, and advancements in textile materials also support the growth of the antimicrobial textiles market. The US is the leading market in the world in terms of both value and volume due to the presence of key players of antimicrobial textiles, strong export market, advanced and high-performance products as well as the expansion of the healthcare industry.

To know about the assumptions considered for the study, download the pdf brochure

Antimicrobial Textiles Market Players

Key manufacturers in the antimicrobial textiles market are Milliken & Company (US), PurThread Technologies (US), Trevira GmbH (Germany), Thai Acrylic Fiber Co. Ltd. (Thailand) and Vestagen Protective Technologies, Inc. (US), amongst others.

Antimicrobial Textiles Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 10.7 billion |

|

Revenue Forecast in 2026 |

USD 14.7 billion |

|

CAGR |

6.5% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Active Agent, Fibers, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Milliken & Company (US), PurThread Technologies (US), Trevira GmbH (Germany), Thai Acrylic Fiber Co. Ltd. (Thailand) and Vestagen Protective Technologies, Inc. (US), among others. |

This research report categorizes the antimicrobial textiles market based on active agent, fibers, application, and region.

Based on Active Agent:

- Synthetic Organic Agents (Quaternary Ammonium Compound (QAC), Polyhexamethylene Biguanides (PHMB), Triclosan, and Zinc Pyrithione)

- Metal & Metallic Salts (Silver, Copper, Zinc, and Others)

- Bio-based Agents (Chitosan, and Others)

- Others

Based on Fibers:

- Cotton

- Polyester

- Polyamide

- Others

Based on Application:

- Medical Textiles

- Apparel

- Home Textiles

- Commercial Textiles

- Industrial Textiles

- Others

Based on Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments:

- In March 2021, Milliken & Company has formally acquired Zebra-chem GmbH. Peroxide masterbatches, like those from Zebra-chem and Milliken, make it possible to incorporate up to 100% recycled content into these new plastics.

- In Jan 2020, Milliken & Company, has formally acquired Borchers Group Limited (“Borchers”), a global specialty chemicals company known for its innovative high-performance coating additives and specialty catalyst solutions from The Jordan Company, L.P.

- In May 2018, The company expanded its Guben site in Germany. This expansion will in Invest in equipment, which will affect all of the processes (polycondensation, spinning and textile processing) at its Guben site, where the company produces filament specialties for the textile industry.

- In Feb 2018, Mitsui & Co. (US) Inc. and PurThread Technologies Inc. entered into a distributorship agreement for Mitsui USA to bring PurThread’s patented permanent antimicrobial fibers and yarns to textiles and soft goods across Mitsui & Co.’s vast production and distribution networks in Japan.

- In August 2017, The company declared a partnership with Standard Textile Co., Inc. (US) to promote and sell its active barrier VESTEX garments for healthcare workers.

Frequently Asked Questions (FAQ):

What is the current size of the global antimicrobial textiles market?

The global antimicrobial textiles market size is projected to grow from USD 10.7 billion in 2021 to USD 14.7 billion by 2026, at a CAGR of 6.5% from 2021 to 2026.

Who are the key players in the global antimicrobial textiles market?

Key manufacturers in the antimicrobial textiles market are Milliken & Company (US), PurThread Technologies (US), Trevira GmbH (Germany), Thai Acrylic Fiber Co. Ltd. (Thailand) and Vestagen Protective Technologies, Inc. (US), amongst others.

What are the factors driving the growth of the antimicrobial textiles market?

The growth of the antimicrobial textiles market is attributed to the increase in demand for antimicrobial textiles in numerous applications, particularly in medical textile and apparel. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 ANTIMICROBIAL TEXTILES MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 ANTIMICROBIAL TEXTILES MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 3 ANTIMICROBIAL TEXTILES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 4 KEY MARKET INSIGHTS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 ANTIMICROBIAL TEXTILES MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

FIGURE 9 ASSUMPTIONS

FIGURE 10 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

FIGURE 11 SYNTHETIC ORGANIC COMPOUNDS SEGMENT TO LEAD ANTIMICROBIAL TEXTILES MARKET BY 2026

FIGURE 12 COTTON TO BE LARGEST SEGMENT IN ANTIMICROBIAL TEXTILES MARKET DURING FORECAST PERIOD

FIGURE 13 MEDICAL TEXTILES TO BE LARGEST SEGMENT IN ANTIMICROBIAL TEXTILES MARKET DURING FORECAST PERIOD

FIGURE 14 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF ANTIMICROBIAL TEXTILES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 HIGHER DEMAND FOR ANTIMICROBIAL TEXTILES EXPECTED FROM EMERGING ECONOMIES

FIGURE 15 EMERGING ECONOMIES OFFERING ATTRACTIVE OPPORTUNITIES FOR ANTIMICROBIAL TEXTILES MARKET

4.2 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET, BY ACTIVE AGENTS AND COUNTRY

FIGURE 16 US WAS LARGEST MARKET FOR ANTIMICROBIAL TEXTILES IN 2020

4.3 ANTIMICROBIAL TEXTILES MARKET, BY ACTIVE AGENT

FIGURE 17 SYNTHETIC ORGANIC COMPOUNDS SEGMENT TO LEAD ANTIMICROBIAL TEXTILES MARKET

4.4 ANTIMICROBIAL TEXTILES MARKET, BY COUNTRY

FIGURE 18 ANTIMICROBIAL TEXTILES MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 ANTIMICROBIAL TEXTILES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing application of antimicrobial textiles in medical textiles

5.2.1.2 Growing consumer awareness about hygiene in emerging economies

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 20 CRUDE OIL PRICE TREND

5.2.2.2 Low efficiency of active agents

5.2.3 OPPORTUNITIES

5.2.3.1 Continuous research and technological advancements

5.2.3.2 Increasing demand for antimicrobial textiles in healthcare industry

5.2.4 CHALLENGES

5.2.4.1 Compliance with stringent regulations for environmental protection

5.2.4.2 Environmental and health concerns associated with antimicrobial textiles

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 ANTIMICROBIAL TEXTILES MARKET: SUPPLY CHAIN

TABLE 2 ANTIMICROBIAL TEXTILES MARKET: ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 SMALL & MEDIUM ENTERPRISES

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 ANTIMICROBIAL TEXTILES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 IMPACT OF COVID-19

5.5.1 IMPACT OF COVID-19 ON MEDICAL TEXTILES

5.5.2 IMPACT OF COVID-19 ON HOME TEXTILES

5.5.3 IMPACT OF COVID-19 ON APPAREL

6 ANTIMICROBIAL TEXTILES MARKET, BY ACTIVE AGENTS (Page No. - 46)

6.1 INTRODUCTION

FIGURE 23 METAL & METALLIC SALTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 4 ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 5 ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

6.2 SYNTHETIC ORGANIC COMPOUNDS

TABLE 6 ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 7 ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

6.2.1 QUATERNARY AMMONIUM COMPOUNDS (QACS)

6.2.1.1 Higher demand than other synthetic organic compounds due to compatibility with almost all types of fabrics

6.2.2 TRICLOSAN

6.2.2.1 Decreased demand due to ban in developed countries

6.2.3 POLYHEXAMETHYLENE BIGUANIDES (PHMB)

6.2.3.1 Rising use of PHMB in apparel and home textiles

6.2.4 ZINC PYRITHIONE

6.2.4.1 High demand for zinc pyrithione in attire and bedding applications

6.2.5 OTHERS

6.3 METAL & METALLIC SALTS

TABLE 8 ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 9 ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

6.3.1 SILVER

6.3.1.1 Increasing demand in textile applications as it can denature key enzyme systems of microbes

6.3.2 COPPER

6.3.2.1 Extensively used in home textiles and apparel

6.3.3 ZINC

6.3.3.1 Antibacterial activity of zinc against a wide range of bacteria to increase demand

6.3.4 OTHERS

6.4 BIO-BASED AGENTS

TABLE 10 ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 11 ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

6.4.1 CHITOSAN

6.4.1.1 Increased demand for environmentally safe agents

6.4.2 OTHERS

7 ANTIMICROBIAL TEXTILES MARKET, BY FABRIC (Page No. - 54)

7.1 INTRODUCTION

FIGURE 24 COTTON SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 ANTIMICROBIAL TEXTILES MARKET SIZE, BY FABRIC, 2019–2026 (USD MILLION)

7.2 COTTON

7.2.1 INCREASED SUSCEPTIBILITY TO ANTIMICROBIAL ATTACK DRIVES USE OF COTTON FOR ANTIMICROBIAL COATING

7.3 POLYESTER

7.3.1 ANTIMICROBIAL POLYESTER IS HIGH IN DEMAND IN TEXTILE APPLICATIONS AS IT IS LESS SUSCEPTIBLE TO MICROBIAL ATTACK

7.4 POLYAMIDE

7.4.1 SILVER OR COPPER PARTICLES ARE USED TO IMPART ANTIMICROBIAL ACTIVITY ON POLYAMIDE FABRICS

7.5 OTHERS

8 ANTIMICROBIAL TEXTILES MARKET, BY FINISHING TECHNIQUE (Page No. - 57)

8.1 INTRODUCTION

8.2 EXHAUST

8.3 PAD-DRY-CURE

8.4 SPRAYING

8.5 FOAM FINISHING METHOD

TABLE 13 ADVANTAGES AND DISADVANTAGES OF FINISHING TECHNIQUES

9 ANTIMICROBIAL TEXTILES MARKET, BY APPLICATION (Page No. - 59)

9.1 INTRODUCTION

FIGURE 25 MEDICAL TEXTILES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 ANTIMICROBIAL TEXTILES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 MEDICAL TEXTILES

TABLE 15 ANTIMICROBIAL TEXTILES MARKET SIZE, BY MEDICAL TEXTILES, 2019–2026 (USD MILLION)

9.2.1 ATTIRE

9.2.1.1 Attire to be largest application in medical textiles segment

9.2.2 SHEETS & BLANKETS

9.2.2.1 Use of antimicrobial textiles in sheets and blankets to prevent infectious diseases

9.2.3 SURGICAL SUPPLIES & WIPES

9.2.3.1 Rising demand in surgical supplies & wipes due to HAIs

9.2.4 OTHERS

9.3 COMMERCIAL TEXTILES

TABLE 16 ANTIMICROBIAL TEXTILES MARKET SIZE, BY COMMERCIAL TEXTILES, 2019–2026 (USD MILLION)

9.3.1 PROTECTIVE WEAR

9.3.1.1 Reduced bacterial growth and increased durability to grow demand

9.3.2 OTHERS

9.4 APPAREL

TABLE 17 ANTIMICROBIAL TEXTILES MARKET SIZE, BY APPAREL, 2019–2026 (USD MILLION)

9.4.1 SPORTSWEAR

9.4.1.1 Sportswear to drive demand for antimicrobial textiles

9.4.2 INTIMATES

9.4.2.1 High demand for antimicrobial textiles for intimates

9.4.3 OUTDOOR CLOTHING

9.4.3.1 Use of antimicrobial textiles in outdoor clothing for durability

9.5 HOME TEXTILES

TABLE 18 ANTIMICROBIAL TEXTILES MARKET SIZE, BY HOME TEXTILES, 2019–2026 (USD MILLION)

9.5.1 CARPETS

9.5.1.1 Protection from spread of infections in infants driving use of antimicrobial textiles in carpets

9.5.2 BEDDING

9.5.2.1 Use of antibacterial textiles in bedding segment to experience highest demand in home textiles

9.5.3 CURTAINS & DRAPES

9.5.3.1 Demand for antimicrobial textiles in curtains & drapes due to increased awareness about transmission of microbes

9.5.4 OTHERS

9.6 INDUSTRIAL TEXTILES

TABLE 19 ANTIMICROBIAL TEXTILES MARKET SIZE, BY INDUSTRIAL TEXTILES, 2019–2026 (USD MILLION)

9.6.1 HVAC SYSTEM

9.6.1.1 Increasing demand for antimicrobial textiles in HVAC systems in public places

9.6.2 FILTERS

9.6.2.1 Stringent regulations related to atmospheric microbe driving use of antimicrobial textiles in filters

9.7 OTHERS

10 ANTIMICROBIAL TEXTILES MARKET, BY REGION (Page No. - 67)

10.1 INTRODUCTION

FIGURE 26 INDIA TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

TABLE 20 GLOBAL ANTIMICROBIAL TEXTILES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 GLOBAL ANTIMICROBIAL TEXTILES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SNAPSHOT

TABLE 22 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 24 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

TABLE 26 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

TABLE 28 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

TABLE 30 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

TABLE 32 NORTH AMERICA: ANTIMICROBIAL TEXTILES MARKET, BY APPLICATION, 2019–2026 (KILOTON)

10.2.1 US

10.2.1.1 Rising concerns for healthier hygienic lifestyle

10.2.2 CANADA

10.2.2.1 Growing demand for medical textiles to drive market

10.2.3 MEXICO

10.2.3.1 Second fastest-growing country for antimicrobial textiles in North America

10.3 EUROPE

TABLE 33 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 35 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 36 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

TABLE 37 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 38 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

TABLE 39 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 40 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

TABLE 41 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

TABLE 43 EUROPE: ANTIMICROBIAL TEXTILES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rise in geriatric services due to increase in senile population to drive market

10.3.2 UK

10.3.2.1 Increasing demand for antimicrobial textiles from healthcare industry

10.3.3 FRANCE

10.3.3.1 Increasing applications of antimicrobial textiles in medical textiles

10.3.4 ITALY

10.3.4.1 High consumption of antimicrobial textiles in apparel and medical and home textiles

10.3.5 TURKEY

10.3.5.1 Growing consumer awareness and accelerating textile industry to influence market positively

10.3.6 SPAIN

10.3.6.1 Demand for higher value-added textile products to drive the market

10.3.7 RUSSIA

10.3.7.1 Government initiatives to improve demand for antimicrobial textiles

10.3.8 REST OF EUROPE

10.4 APAC

TABLE 44 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 46 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 47 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

TABLE 48 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 49 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

TABLE 50 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 51 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

TABLE 52 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 53 APAC: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

TABLE 54 APAC: ANTIMICROBIAL TEXTILES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Demand of high-quality fabrics from industrial sectors to drive market

10.4.2 JAPAN

10.4.2.1 Rising awareness about safety against microbes to offer growth opportunities for market

10.4.3 INDIA

10.4.3.1 Rapid industrialization, expansion of healthcare and apparel industries, rising disposable income, and growing population to support market growth

10.4.4 INDONESIA

10.4.4.1 Rising textile industry to drive demand for antimicrobial textiles

10.4.5 SOUTH KOREA

10.4.5.1 Rising demand for antimicrobial textiles in apparel

10.4.6 REST OF APAC

10.5 MIDDLE EAST & AFRICA

TABLE 55 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 57 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

TABLE 59 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

TABLE 61 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

TABLE 63 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

TABLE 65 MIDDLE EAST & AFRICA: ANTIMICROBIAL TEXTILES MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.5.1 UAE

10.5.1.1 High demand for antimicrobial textiles in healthcare industry

10.5.2 SAUDI ARABIA

10.5.2.1 Increasing healthcare facilities driving use of antimicrobial textiles

10.5.3 SOUTH AFRICA

10.5.3.1 Public awareness and governmental programs boosting demand for antimicrobial textiles

10.5.4 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

TABLE 66 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 68 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (USD MILLION)

TABLE 69 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY ACTIVE AGENTS, 2019–2026 (KILOTON)

TABLE 70 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (USD MILLION)

TABLE 71 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY SYNTHETIC ORGANIC COMPOUNDS, 2019–2026 (KILOTON)

TABLE 72 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (USD MILLION)

TABLE 73 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY METAL & METALLIC SALTS, 2019–2026 (KILOTON)

TABLE 74 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (USD MILLION)

TABLE 75 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY BIO-BASED AGENTS, 2019–2026 (KILOTON)

TABLE 76 SOUTH AMERICA: ANTIMICROBIAL TEXTILES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Improving textile industry and growing awareness of hygiene accelerating demand

10.6.2 ARGENTINA

10.6.2.1 Argentina’s improving healthcare industry drives demand for antimicrobial textiles

10.6.3 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 98)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 28 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY, 2016–2021

11.3 MARKET RANKING

FIGURE 29 MARKET RANKING OF KEY PLAYERS, 2020

11.3.1 MILLIKEN & COMPANY

11.3.2 THAI ACRYLIC FIBRE CO., LTD.

11.3.3 TREVIRA GMBH

11.3.4 UNITIKA LTD.

11.3.5 PURTHREADS TECHNOLOGIES LTD.

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 30 ANTIMICROBIAL TEXTILES MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

11.5 COMPETITIVE SCENARIO AND TRENDS

11.5.1 DEALS

TABLE 77 ANTIMICROBIAL TEXTILES MARKET: DEALS, MARCH 2016- MARCH 2021

11.5.2 NEW PRODUCT DEVELOPMENT

TABLE 78 ANTIMICROBIAL TEXTILES MARKET: NEW PRODUCT DEVELOPMENT, JANUARY 2016-SEPTEMBER 2021

12 COMPANY PROFILES (Page No. - 104)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

12.1 KEY COMPANIES

12.1.1 MILLIKEN & COMPANY

TABLE 79 MILLIKEN & COMPANY: BUSINESS OVERVIEW

TABLE 80 MILLIKEN & COMPANY: PRODUCT OFFERED

TABLE 81 MILLIKEN & COMPANY: PRODUCT LAUNCHES

TABLE 82 MILLIKEN & COMPANY: DEALS

12.1.2 UNITIKA LTD.

TABLE 83 UNITIKA LTD: BUSINESS OVERVIEW

FIGURE 31 UNITIKA LTD.: COMPANY SNAPSHOT

TABLE 84 UNITIKA LTD.: PRODUCTS OFFERED

12.1.3 TREVIRA GMBH

TABLE 85 TREVIRA GMBH: BUSINESS OVERVIEW

TABLE 86 TREVIRA GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 87 TREVIRA GMBH: DEALS

12.1.4 THAI ACRYLIC FIBRE CO., LTD.

TABLE 88 THAI ACRYLIC FIBRE CO., LTD.: BUSINESS OVERVIEW

TABLE 89 THAI ACRYLIC FIBRE CO., LTD.: PRODUCT OFFERED

TABLE 90 THAI ACRYLIC FIBRE CO., LTD.: PRODUCT LAUNCHES

12.1.5 PURTHREAD TECHNOLOGIES INC.

TABLE 91 PURTHREAD TECHNOLOGIES INC.: BUSINESS OVERVIEW

TABLE 92 PURTHREAD TECHNOLOGIES INC.: PRODUCTS OFFERD

12.1.6 VESTAGEN PROTECTIVE TECHNOLOGIES INC.

TABLE 93 VESTAGEN PROTECTIVE TECHNOLOGIES INC.: BUSINESS OVERVIEW

TABLE 94 VESTAGEN PROTECTIVE TECHNOLOGIES INC.: PRODUCT OFFERED

TABLE 95 VESTAGEN PROTECTIVE TECHNOLOGIES INC.: DEALS

12.1.7 LIFE THREADS LLC

TABLE 96 LIFE THREADS LLC: BUSINESS OVERVIEW

TABLE 97 LIFE THREADS LLC: PRODUCT OFFERED

TABLE 98 LIFE THREADS LLC: DEALS

12.1.8 HERCULITE INC.

TABLE 99 HERCULITE INC.: BUSINESS OVERVIEW

TABLE 100 HERCULITE INC.: PRODUCT OFFERED

TABLE 101 HERCULITE INC.: PRODUCT LAUNCHES

12.1.9 SMITH & NEPHEW

TABLE 102 SMITH & NEPHEW: BUSINESS OVERVIEW

FIGURE 32 SMITH & NEPHEW: COMPANY SNAPSHOT

TABLE 103 SMITH & NEPHEW: PRODUCTS OFFERD

12.1.10 SINTERAMA S.P.A.

TABLE 104 SINTERAMA S.P.A..: BUSINESS OVERVIEW

TABLE 105 SINTERAMA S.P.A.: SERVICES OFFERED

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted comp

12.2 ADDITIONAL PLAYERS

12.2.1 SWICOFIL AG

12.2.2 SMARTFIBER AG

12.2.3 TOYOBO CO. LTD.

12.2.4 MEDTRONIC

12.2.5 SURGICOTFAB TEXTILES PRIVATE LIMITED

12.2.6 MEDITEX TECHNOLOGY

12.2.7 BALVIGNA WEAVING MILLS PVT. LTD.

12.2.8 INNOVA TEX

12.2.9 SUN DREAM ENTERPRISE PVT. LTD.

12.2.10 MAINE-LEE TECHNOLOGY GROUP, LLC

12.2.11 STAFFORD TEXTILE LTD

12.2.12 A WORLD OF WIPES

12.2.13 BARJAN MANUFACTURING LIMITED

12.2.14 SUZHOU CHUNSHEN ENVIRONMENT PROTECTION FIBER CO. LTD

12.2.15 VERSATILE TEXTILE PRIVATE LIMITED

13 APPENDIX (Page No. - 133)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

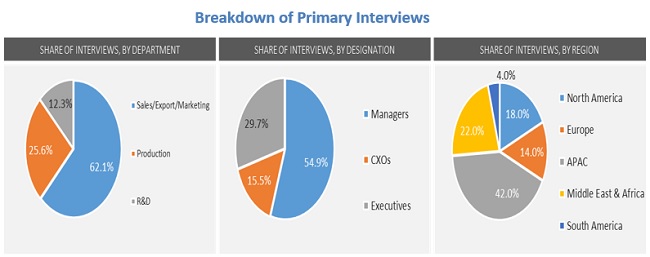

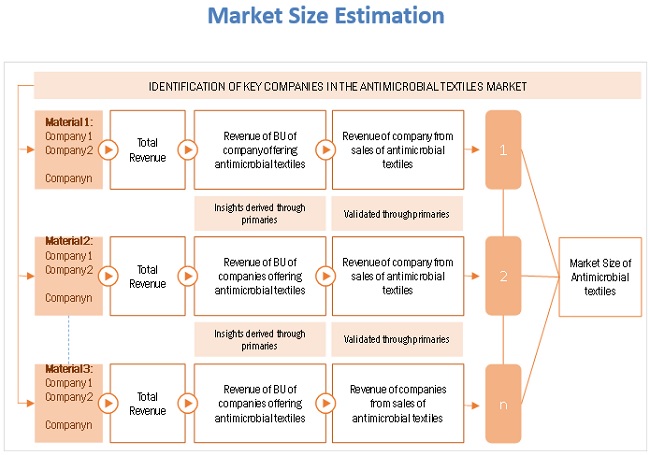

The study involved four major activities for estimating the current global size of the antimicrobial textiles market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of antimicrobial textiles through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the antimicrobial textiles market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the antimicrobial textiles market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the antimicrobial textiles market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the antimicrobial textiles industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

The above approach was used to estimate and validate the global size of the antimicrobial textiles market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the antimicrobial textiles market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the antimicrobial textiles market in terms of value and volume based on active agent, fibers, application and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the antimicrobial textiles report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis

- Further analysis of the antimicrobial textiles market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Textile Market

Specific information on antimicrobial textiles market in Japan

Technical Textiles Market with inclusion of Anti-odor textile and Sun protection textile

General market data on antimicrobial products in textile industry

Market information on anti-microbial, biocides, preservatives etc.

General information on antimicrobial textiles and its different areas of application

General Information on the antimicobial textiles market

General information on antibacterial fabric

Antimicrobial Polyester Filament yarn - manufacturing process and probable customers/weavers

General information on antimicrobial textiles market

Market analysis on antimicrobial textiles market

overall antimicrobial textile space by application and break out of Nylon portion

General information on antimicrobial polyester yarn market

Anti Microbial textile Wash and Finish process market