Antimicrobial Coatings Market by Type (Sliver, Copper, Titanium Dioxide), End-user Industry (Medical & Healthcare, Building & Construction, Protective Clothing, HVAC System, Transportation), and Region - Global Forecast to 2027

Updated on : August 28, 2025

Antimicrobial Coatings Market

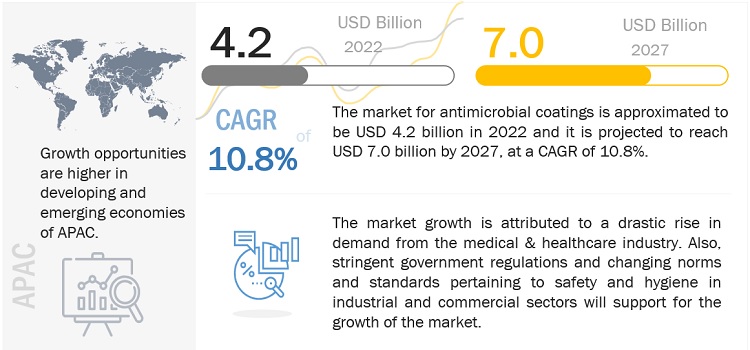

The global antimicrobial coatings market was valued at USD 4.2 billion in 2022 and is projected to reach USD 7.0 billion by 2027, growing at 10.8% cagr from 2022 to 2027. Antimicrobial coatings are the special types of coatings that help to inhibit the growth of various microorganisms such as bacteria, mold, mildew, and others. These coatings can be placed to the substrate surface to prevent microbial metabolic processes. Cooper, silver, and zinc are the most commonly utilised antimicrobial coatings. Antibacterial coatings are applied to substrate surfaces in order to extend their lifespan and stop the development of various bacteria.

Antimicrobial Coatings Market Trends

e- Estimated, p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Antimicrobial Coatings Market Dynamics

DRIVER: The market is driven by the escalating demand for antimicrobial coatings in the healthcare and medical industries.

The market in developed economies like the US, UK, and other areas is driven by the use of antimicrobial coatings in the medical and healthcare industry. Antimicrobial / Antibacterial coatings have gained popularity in the medical and healthcare sectors worldwide during the past few years. This can be due to rising hygienic consciousness and government efforts to stop the spread of hospital acquired illnesses (HAIs). Injections, catheters, and other medical devices that commonly penetrate the skin or implant into the body are linked, either directly or indirectly, to these HAIs. These coatings, which aid in halting microbial growth, are extensively employed in the medical and healthcare industries. The market for antibacterial coatings is projected to grow as a result of demand from this industry.

RESTRAINT: Antimicrobial coatings are expensive, and skilled labor is scarce.

Antimicrobial coatings are more expensive than conventional coatings. Since these coatings are frequently used to protect surfaces and people from various germs, other conventional coatings cannot perform the same function. It is understood that tastes vary mostly based on a product's price in developing nations. Lower purchasing power, limited understanding, and lower per capita income are the key factors limiting market expansion in emerging nations.

OPPORTUNITIES: Antimicrobial coatings used in innovative applications

The need for antimicrobial coatings has increased significantly during the COVID -19 pandemic in a number of industries, including electronic items, protective apparel, and consumer goods. Several businesses, like Droom, ZAGG Inc., and others have taken the initiative to put antimicrobial coatings to their products in recent years. To guard against numerous ailments, an IIT Madras start-up began to produce fabrics coated in antimicrobial substance.

CHALLENGES: Nanoparticle toxicity is a source of concern.

The hazardous properties of the moulded nanoparticles have raised questions about their potential uses, particularly in the medical and healthcare industries. The biological activity and poisonous nature of metal nanoparticles differ from those of their aggregate form. Long-term exposure to copper and silver coatings could be harmful to human health since breathing it in promotes skin illness. The biological creation of metal nanoparticles has become a possible method for lowering the amount of toxicity of these particles.

Medical and Healthcare industry accounted for the highest CAGR during the forecast period

In the medical and healthcare industry, the increasing concern about hospital-acquired infections (HAIs) and their effects on human health is driving the market for antimicrobial coatings. The HAIs primarily pass through the surgical instruments, catheters, and other healthcare settings. To mitigate the impact of HAIs on human health, the government of several countries such as the US, Canada, Mexico, and others imposed regulations and norms to maintain the safety and hygiene standards in hospitals and intensive care facilities.

Silver segment accounted for the highest CAGR during the forecast period

Silver-based antimicrobial coatings are estimated to be the fastest rising market during the forecast period. These coatings have high efficacy against several viruses, bacteria, and other microorganisms. On the application of silver-based antimicrobial coatings on substrate surfaces, it releases the silver ions in a controlled manner, which inhibits the growth of pathogens/microbes on the surface. Efforts and technology upgradation made by the manufacturers, to incorporate the silver-based antimicrobial coatings on medical devices such as surgical instruments and others, supports the growth of market.

To know about the assumptions considered for the study, download the pdf brochure

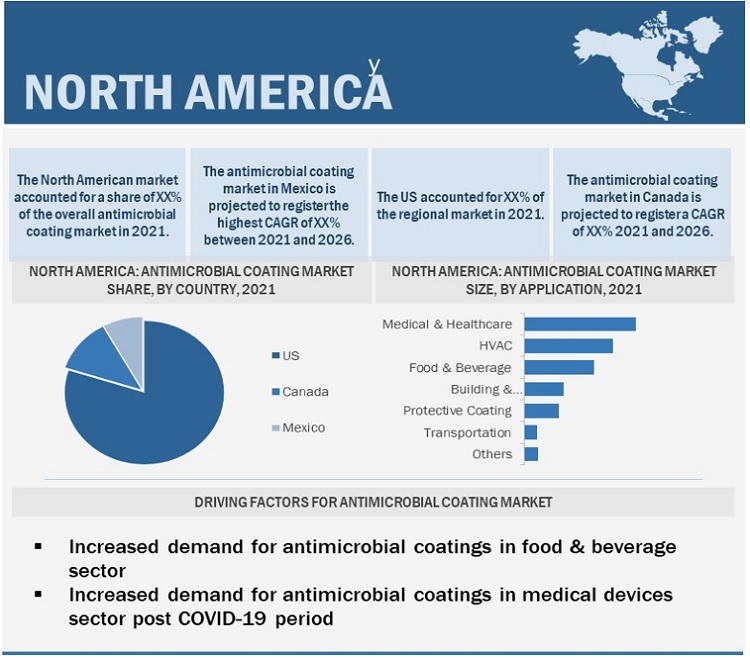

North America is projected to account for the highest CAGR in the antimicrobial coating market during the forecast period

North America is estimated to be the fastest growing market for antimicrobial coating during the forecast period. The antimicrobial Coating market is witnessing significant growth in several economies in the region such as the US, Canada, and Mexico owing to the rising awareness regarding hygiene and the increasing use of antibacterial coatings in several end-use industries such as the medical and healthcare sector, food & beverage, HVAC systems, building and construction, protective clothing, transportation, and others. Additionally, the growth of end-use industries major in the region will further boost the demand in the antimicrobial coatings market.

Antimicrobial Coatings Market Players

Antimicrobial Coatings comprises major manufacturers such as AkzoNobel N.V.(Netherlands), The Sherwin-Williams Company (US), PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd.(Japan), and AXALTA Coating Systems Ltd. (US) were the leading players in the antimicrobial coatings market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Antimicrobial Coating Market.

Read More: Antimicrobial Coatings Companies

Antimicrobial Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.2 billion |

|

Revenue Forecast in 2027 |

USD 7.0 billion |

|

CAGR |

10.8% |

|

Years Considered |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Unit considered |

Value (USD Billion), and Volume (Ton) |

|

Segments |

Type, End Use Industry, and Region |

|

Regions |

North America, Europe, South America, APAC, Middle East & Africa. |

|

Companies |

The major players are AkzoNobel N.V.(Netherlands), Axalta Coating Systems Ltd. (US), The Sherwin-Williams Company (US), BASF (Germany), PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd. (Japan), RPM International Inc. (US), Koninklijke DSM N.V.(Netherlands), Sika AG (Switzerland), Lanxess AG (Germany) and others are covered in the Antimicrobial Coatings market. |

This research report categorizes the global antimicrobial coatings market on the basis of Type, Application, and Region.

Antimicrobial Coatings Market by Type

- Silver

- Copper

- Titanium Dioxide

Antimicrobial Coatings Market by End Use Industry

- Medical & Healthcare

- Medical & Healthcare

- Building & Construction

- Protective Clothing

- HVAC System

- Transportation Automotive

Antimicrobial Coatings Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In August 2022, PPG Industries Inc. has announced to invest of USD 11 Million to enhance the production capacity of powder coatings in Mexico.

- In July 2022, an investment has been announced by AkzoNobel N. V. to increase and improve the production of aerospace coatings and improve the production flexibility of decorative paints in Europe.

- In July 2022, AkzoNobel N. V. acquired the wheel liquid coating business of Lankwitzer Lackfabrik GmbH.

- In June 2022, AkzoNobel N. V. acquired the paints and coatings business of Kansai Paint in South Africa.

- In June 2022, Sika AG opened a new manufacturing plant of concrete admixtures in Virginia (US). Sika AG will satisfy the strong demands in the Northeast and Mid-Atlantic regions.

- In March 2022, PPG Industries, Inc. announced to open of a Research and Development Centre in Milan, Italy. This R&D Center will develop innovative technologies for powder coatings.

- In March 2022, AkzoNobel N. V. started a global research and development center in the UK.

- In February 2022, PPG Industries, Inc. acquired the powder coatings business of Arsonsisi, headquartered in Milan, Italy

- In February 2022, Nippon Paint Holdings Co. Ltd. increased its product portfolio by adding a new product Protecton Floor VK Clear, which is an antiviral and antibacterial paint used for interior and semi-exterior floors. In the same year, Nippon Paint Holdings Co. Ltd. added a new product Protecton Interior Wall VK Coat to its product portfolio. This product is used for interior walls only.

- In February 2022, The Sherwin-Williams Company signed an agreement with the state of North Carolina, Iredell County, and the city of Statesville to expand the architectural paint and coatings manufacturing capacity. This includes the 36,000-square-foot extension and addition of 4 new rail spurs and the construction of 800,000-square-foot distribution and fleet transportation center.

- In January 2022, BASF collaborated with Permionics Membranes Pvt. Ltd. to build washable and reusable face masks for India

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Antimicrobial Coatings Market?

The major drivers influencing the growth of the Antimicrobial Coatings market are increasing demand for antimicrobial coatings in the Medical and Healthcare sector, HVAC systems, and food & beverage industry.

What are the major challenges in the Antimicrobial Coatings Market?

The major challenge in the Antimicrobial Coatings market is the growing concern about the toxicity of metal nanoparticles.

What are the restraining factors in Antimicrobial Coatings Market?

The major restraining factor faced by the antimicrobial coatings market is the high cost of products and the requirement for highly skilled labor.

What is the key opportunity in the antimicrobial coatings Market?

Rising usage in novel applications such as protective clothing, electronic products, and others has a new opportunity for the antimicrobial coatings market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 ANTIMICROBIAL COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical inputs from secondary research

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical inputs from primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 APPROACH TO CALCULATE BASE NUMBER

2.2.1 ESTIMATION OF ANTIMICROBIAL COATINGS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 7 FACTORS SUPPORTING GROWTH OF ANTIMICROBIAL COATINGS MARKET

FIGURE 8 SILVER SEGMENT ACCOUNTED FOR LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET, BY TYPE, IN 2021

FIGURE 9 MEDICAL & HEALTHCARE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE, BY APPLICATION, IN 2021

FIGURE 10 NORTH AMERICA DOMINATED ANTIMICROBIAL COATINGS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANTIMICROBIAL COATINGS MARKET

FIGURE 11 HIGH DEMAND FOR ANTIMICROBIAL COATINGS IN MEDICAL & HEALTHCARE SECTOR

4.2 ASIA PACIFIC ANTIMICROBIAL COATINGS MARKET, BY TYPE AND COUNTRY

FIGURE 12 SILVER SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC ANTIMICROBIAL COATINGS MARKET IN 2021

4.3 ANTIMICROBIAL COATINGS MARKET, BY COUNTRY

FIGURE 13 SAUDI ARABIA TO REGISTER HIGHEST CAGR IN ANTIMICROBIAL COATINGS MARKET DURING REVIEW PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 ANTIMICROBIAL COATINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased demand for antimicrobial coatings in healthcare sector in post-COVID-19 period

TABLE 1 NATIONAL ACUTE CARE HOSPITAL HOSPITAL-ACQUIRED INFECTION (HAI) METRICS, 2020

5.2.1.2 Rising installation of heating, ventilation, and air conditioning (HVAC) systems

FIGURE 15 GLOBAL HEATING, VENTILATION, AND AIR CONDITIONING (HVAC) SYSTEM MARKET SIZE IN VALUE (USD BILLION) AND Y-O-Y GROWTH (%), 2016–2021

5.2.1.3 Increasing demand for antimicrobial coatings in food & beverage industry

5.2.2 RESTRAINTS

5.2.2.1 High costs of antimicrobial coatings and requirement for skilled labor

5.2.2.2 Need to comply with stringent governmental regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of antimicrobial coatings in novel applications

5.2.3.2 Expanding smart antimicrobials market

5.2.4 CHALLENGES

5.2.4.1 Growing concern regarding toxicity of nanoparticles

TABLE 2 TOXICITY OF METAL NANOPARTICLES

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 ANTIMICROBIAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

5.5 YC AND YCC SHIFT

5.5.1 YC SHIFT

5.5.2 YCC SHIFT

5.6 ECOSYSTEM ANALYSIS

5.7 CASE STUDY ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.9 TRADE ANALYSIS

TABLE 3 IMPORT TRADE DATA FOR SILVER NANOPARTICLES, 2021 (USD MILLION)

TABLE 4 EXPORT TRADE DATA FOR SILVER NANOPARTICLES, 2021 (USD MILLION)

5.10 TARIFF AND REGULATORY ANALYSIS

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 6 ANTIMICROBIAL COATINGS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11.1 PRODUCT SELECTION CRITERIA

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 DOCUMENT TYPE

FIGURE 17 DOCUMENT TYPE (2019)

FIGURE 18 PUBLICATION TRENDS, 2015–2020

5.12.3 INSIGHTS

FIGURE 19 JURISDICTION ANALYSIS (TILL 2019)

5.12.4 TOP APPLICANTS

FIGURE 20 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2019)

TABLE 7 LIST OF PATENTS BY BECTON, DICKINSON AND COMPANY

TABLE 8 LIST OF PATENTS BY ROHM AND HAAS COMPANY & DOW GLOBAL TECHNOLOGIES LLC.

TABLE 9 LIST OF PATENTS BY ARGEN LAB GLOBAL LTD.

TABLE 10 LIST OF PATENTS BY ETHICON INC.

6 ANTIMICROBIAL COATINGS MARKET, BY TYPE (Page No. - 66)

6.1 INTRODUCTION

FIGURE 21 SILVER SEGMENT TO HOLD LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET DURING REVIEW PERIOD

TABLE 11 ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 12 ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (TON)

6.2 SILVER

6.2.1 RISING DEMAND FOR HIGH-EFFICACY PRODUCTS IN VARIOUS APPLICATIONS

6.3 COPPER

6.3.1 RISE IN DEMAND FOR COPPER-BASED ANTIMICROBIAL COATINGS IN MEDICAL & HEALTHCARE SECTOR

6.4 TITANIUM DIOXIDE

6.4.1 GROWING POPULARITY OF TITANIUM DIOXIDE-BASED COATINGS IN SEVERAL APPLICATIONS

6.5 OTHERS

7 ANTIMICROBIAL COATINGS MARKET, BY APPLICATION (Page No. - 70)

7.1 INTRODUCTION

FIGURE 22 MEDICAL & HEALTHCARE SEGMENT TO HOLD LARGEST SHARE OF ANTIMICROBIAL COATINGS MARKET DURING FORECAST PERIOD

TABLE 13 ANTIMICROBIAL COATING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 14 ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020–2027 (TON)

7.2 MEDICAL & HEALTHCARE

7.2.1 GROWING DEMAND FOR ANTIMICROBIAL COATINGS TO PREVENT HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.3 FOOD & BEVERAGE

7.3.1 GROWING CONCERN REGARDING MAINTAINING QUALITY OF FOODS AND BEVERAGES

7.4 BUILDING & CONSTRUCTION

7.4.1 GROWING AWARENESS REGARDING BENEFITS OF ANTIMICROBIAL COATINGS AND INCREASING DEMAND IN DEVELOPING COUNTRIES

7.5 PROTECTIVE CLOTHING

7.5.1 GROWING DEMAND FOR PROTECTIVE CLOTHING IN MEDICAL & HEALTHCARE SECTOR

7.6 HVAC SYSTEM

7.6.1 PRESENCE OF REGULATORY POLICIES REGARDING INDOOR AIR QUALITY IN SEVERAL COUNTRIES

7.7 TRANSPORTATION

7.7.1 GROWING USE OF ANTIMICROBIAL COATINGS IN AEROSPACE INDUSTRY

7.8 OTHERS

8 ANTIMICROBIAL COATINGS MARKET, BY REGION (Page No. - 76)

8.1 INTRODUCTION

FIGURE 23 ASIA PACIFIC TO BE FASTEST-GROWING ANTIMICROBIAL COATINGS MARKET DURING FORECAST PERIOD

TABLE 15 ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020–2027 (TON)

8.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: SNAPSHOT OF ANTIMICROBIAL COATINGS MARKET

TABLE 17 NORTH AMERICA: ANTIMICROBIAL COATING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (TON)

TABLE 19 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 20 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (TON)

TABLE 21 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.2.1 US

8.2.1.1 Rising demand for antimicrobial coatings in medical & healthcare sector

TABLE 23 US: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 24 US: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 25 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 26 US: MARKET, BY APPLICATION, 2020–2027 (TON)

8.2.2 CANADA

8.2.2.1 Booming medical & healthcare sector

TABLE 27 CANADA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 CANADA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 29 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 30 CANADA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.2.3 MEXICO

8.2.3.1 Low purchasing power and limited awareness regarding antimicrobial coatings

TABLE 31 MEXICO: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 32 MEXICO: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 33 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 34 MEXICO: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3 EUROPE

TABLE 35 EUROPE: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 EUROPE: MARKET, BY COUNTRY, 2020–2027 (TON)

TABLE 37 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 38 EUROPE: MARKET, BY TYPE, 2020–2027 (TON)

TABLE 39 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.1 GERMANY

8.3.1.1 Rising emphasis on safety of patients and hospital staff

TABLE 41 GERMANY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 GERMANY: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 43 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 GERMANY: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.2 UK

8.3.2.1 Increasing healthcare spending

TABLE 45 UK: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 46 UK: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 47 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 48 UK: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.3 FRANCE

8.3.3.1 Expanding medical & healthcare sector

TABLE 49 FRANCE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 FRANCE: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 51 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 52 FRANCE: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.4 ITALY

8.3.4.1 Presence of stringent workplace safety norms

TABLE 53 ITALY: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 ITALY: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 55 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 ITALY: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.5 SPAIN

8.3.5.1 High focus on revival of economy after aftermath of COVID-19

TABLE 57 SPAIN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 SPAIN: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 59 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 SPAIN: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.6 RUSSIA

8.3.6.1 Growing concern about safety at workplaces

TABLE 61 RUSSIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 RUSSIA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 63 RUSSIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 RUSSIA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.3.7 REST OF EUROPE

TABLE 65 REST OF EUROPE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 REST OF EUROPE: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 67 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4 ASIA PACIFIC

TABLE 69 ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: ANTIMICROBIAL COATING MARKET, BY COUNTRY, 2020–2027 (TON)

TABLE 71 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (TON)

TABLE 73 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.1 CHINA

8.4.1.1 Growing adoption of antimicrobial coatings in industrial sector to comply with international standards

TABLE 75 CHINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 CHINA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 77 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 CHINA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.2 SOUTH KOREA

8.4.2.1 Growing demand for protective clothing

TABLE 79 SOUTH KOREA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 SOUTH KOREA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 81 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.3 JAPAN

8.4.3.1 Focus of paint and coating companies on strategizing growth plans by keeping antimicrobial coatings at epicenter

TABLE 83 JAPAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 JAPAN: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 85 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 JAPAN: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.4 INDIA

8.4.4.1 Growing awareness regarding benefits of antimicrobial coatings

TABLE 87 INDIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 INDIA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 89 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 90 INDIA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.5 AUSTRALIA & NEW ZEALAND

8.4.5.1 Growing adoption of antimicrobial coatings in industrial sector

TABLE 91 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 93 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2020–2027 (TON)

8.4.6 REST OF ASIA PACIFIC

TABLE 95 REST OF ASIA PACIFIC: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 97 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (TON)

8.5 SOUTH AMERICA

TABLE 99 SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 SOUTH AMERICA: ANTIMICROBIAL COATING MARKET, BY COUNTRY, 2020–2027 (TON)

TABLE 101 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (TON)

TABLE 103 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.5.1 BRAZIL

8.5.1.1 Rising demand for antimicrobial coatings in medical & healthcare sector

TABLE 105 BRAZIL: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 BRAZIL: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 107 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (TON)

8.5.2 ARGENTINA

8.5.2.1 Rising healthcare spending

TABLE 109 ARGENTINA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 ARGENTINA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 111 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.5.3 REST OF SOUTH AMERICA

TABLE 113 REST OF SOUTH AMERICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 REST OF SOUTH AMERICA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 115 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.6 MIDDLE EAST & AFRICA

TABLE 117 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: ANTIMICROBIAL COATING MARKET, BY COUNTRY, 2020–2027 (TON)

TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (TON)

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.6.1 SAUDI ARABIA

8.6.1.1 Government initiatives to develop healthcare sector

TABLE 123 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 SAUDI ARABIA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 125 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 SAUDI ARABIA: ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020–2027 (TON)

8.6.2 UAE

8.6.2.1 Rising healthcare spending

TABLE 127 UAE: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 UAE: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 129 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 130 UAE: MARKET, BY APPLICATION, 2020–2027 (TON)

8.6.3 SOUTH AFRICA

8.6.3.1 Increasing penetration of antimicrobial coatings in medical & healthcare sector

TABLE 131 SOUTH AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 SOUTH AFRICA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 133 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 134 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (TON)

8.6.4 IRAN

8.6.4.1 Rise in demand for protective clothing, healthcare instruments, and medical devices

TABLE 135 IRAN: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 IRAN: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 137 IRAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 138 IRAN: MARKET, BY APPLICATION, 2020–2027 (TON)

8.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 139 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 REST OF MIDDLE EAST & AFRICA: ANTIMICROBIAL COATING MARKET, BY TYPE, 2020–2027 (TON)

TABLE 141 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 142 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (TON)

9 COMPETITIVE LANDSCAPE (Page No. - 137)

9.1 OVERVIEW

TABLE 143 COMPANIES ADOPTED PRODUCT LAUNCH AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2022

9.2 MARKET SHARE ANALYSIS

FIGURE 25 ANTIMICROBIAL COATINGS MARKET: MARKET SHARE ANALYSIS

9.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 26 REVENUE ANALYSIS FOR TOP FIVE COMPANIES IN ANTIMICROBIAL COATING MARKET

9.4 ANTIMICROBIAL COATINGS MARKET: COMPANY EVALUATION QUADRANT, 2021

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 27 COMPETITIVE LEADERSHIP MAPPING: ANTIMICROBIAL COATINGS MARKET, 2021

9.5 ANTIMICROBIAL COATING MARKET: SMALL AND MEDIUM-SIZED ENTERPRISE (SME) MATRIX, 2021

9.5.1 PROGRESSIVE COMPANIES

9.5.2 RESPONSIVE COMPANIES

9.5.3 DYNAMIC COMPANIES

9.5.4 STARTING BLOCKS

FIGURE 28 SME MATRIX: ANTIMICROBIAL COATING MARKET, 2021

9.6 COMPETITIVE SCENARIOS AND TRENDS

9.6.1 ANTIMICROBIAL COATINGS MARKET: DEALS

TABLE 144 DEALS, 2018–2022

9.6.2 ANTIMICROBIAL COATING MARKET: PRODUCT LAUNCHES

TABLE 145 PRODUCT LAUNCHES, 2017–2022

9.6.3 ANTIMICROBIAL COATING MARKET: OTHERS

TABLE 146 OTHERS, 2017–2022

10 COMPANY PROFILES (Page No. - 157)

10.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 AKZONOBEL N.V.

TABLE 147 AKZONOBEL N.V.: COMPANY OVERVIEW

FIGURE 29 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 148 AKZONOBEL N.V.: DEALS

TABLE 149 AKZONOBEL N.V.: PRODUCT LAUNCHES

TABLE 150 AKZONOBEL N.V.: OTHERS

10.1.2 AXALTA COATING SYSTEMS LTD.

TABLE 151 AXALTA COATING SYSTEMS LTD.: COMPANY OVERVIEW

FIGURE 30 AXALTA COATING SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 152 AXALTA COATING SYSTEMS LTD.: DEALS

TABLE 153 AXALTA COATING SYSTEMS LTD.: OTHERS

10.1.3 THE SHERWIN-WILLIAMS COMPANY

TABLE 154 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 31 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

TABLE 155 THE SHERWIN-WILLIAMS COMPANY: DEALS

TABLE 156 THE SHERWIN-WILLIAMS COMPANY: OTHERS

10.1.4 BASF

TABLE 157 BASF: COMPANY OVERVIEW

FIGURE 32 BASF: COMPANY SNAPSHOT

TABLE 158 BASF: DEALS

TABLE 159 BASF: OTHERS

10.1.5 PPG INDUSTRIES, INC.

TABLE 160 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 33 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 161 PPG INDUSTRIES, INC.: DEALS

TABLE 162 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

TABLE 163 PPG INDUSTRIES, INC.: OTHERS

10.1.6 NIPPON PAINT HOLDINGS CO., LTD.

TABLE 164 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

FIGURE 34 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

TABLE 165 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

TABLE 166 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

TABLE 167 NIPPON PAINT HOLDINGS CO., LTD.: OTHERS

10.1.7 RPM INTERNATIONAL INC.

TABLE 168 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 35 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 169 RPM INTERNATIONAL INC: DEALS

TABLE 170 RPM INTERNATIONAL INC: OTHERS

10.1.8 KONINKLIJKE DSM N.V.

TABLE 171 KONINKLIJKE DSM N.V.: COMPANY OVERVIEW

FIGURE 36 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 172 KONINKLIJKE DSM N.V.: DEALS

10.1.9 SIKA AG

TABLE 173 SIKA AG: COMPANY OVERVIEW

FIGURE 37 SIKA AG.: COMPANY SNAPSHOT

TABLE 174 SIKA AG.: DEALS

TABLE 175 SIKA AG.: OTHERS

10.1.10 LANXESS AG.

TABLE 176 LANXESS AG.: COMPANY OVERVIEW

FIGURE 38 LANXESS AG.: COMPANY SNAPSHOT

TABLE 177 LANXESS AG.: DEALS

TABLE 178 LANXESS AG.: PRODUCT LAUNCHES

TABLE 179 LANXESS AG: OTHERS

10.2 OTHER PLAYERS

10.2.1 BURKE INDUSTRIAL COATINGS LLC

TABLE 180 BURKE INDUSTRIAL COATINGS LLC: COMPANY OVERVIEW

10.2.2 LONZA GROUP AG

TABLE 181 LONZA GROUP AG: COMPANY OVERVIEW

10.2.3 CLEVELAND-CLIFFS INC.

TABLE 182 CLEVELAND-CLIFFS INC.: COMPANY OVERVIEW

10.2.4 TROY CORPORATION

TABLE 183 TROY CORPORATION: COMPANY OVERVIEW

10.2.5 SPECIALTY COATING SYSTEMS INC.

TABLE 184 SPECIALTY COATING SYSTEMS INC.: COMPANY OVERVIEW

10.2.6 ALLIED BIOSCIENCE INC.

TABLE 185 ALLIED BIOSCIENCE INC.: COMPANY OVERVIEW

10.2.7 H.B. FULLER CONSTRUCTION PRODUCTS INC.

TABLE 186 H.B. FULLER CONSTRUCTION PRODUCTS INC.: COMPANY OVERVIEW

10.2.8 FIBERLOCK TECHNOLOGIES, INC.

TABLE 187 FIBERLOCK TECHNOLOGIES, INC.: COMPANY OVERVIEW

10.2.9 FLORA COATINGS LLC

TABLE 188 FLORA COATINGS LLC: COMPANY OVERVIEW

10.2.10 HYDROMER INC.

TABLE 189 HYDROMER INC.: COMPANY OVERVIEW

10.2.11 IFS COATINGS INC.

TABLE 190 IFS COATINGS INC.: COMPANY OVERVIEW

10.2.12 NANO-CARE DEUTSCHLAND AG.

TABLE 191 NANO-CARE DEUTSCHLAND AG.: COMPANY OVERVIEW

10.2.13 PROTECH-OXYPLAST GROUP

TABLE 192 PROTECH-OXYPLAST GROUP: COMPANY OVERVIEW

10.2.14 AEREUS TECHNOLOGIES INC

TABLE 193 AEREUS TECHNOLOGIES INC: COMPANY OVERVIEW

10.2.15 MEDIVATORS INC.

TABLE 194 MEDIVATORS INC.: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 210)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the antimicrobial coatings market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The antimicrobial coatings market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the antimicrobial coatings market. Primary sources from the supply side include associations and institutions involved in the antimicrobial coatings industry, key opinion leaders, and processing players.

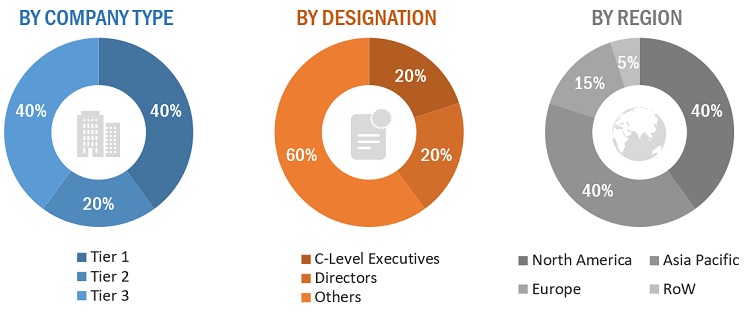

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3=

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global antimicrobial coatings market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global antimicrobial coatings market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, region, and end-use application.

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, South America, APAC, Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Antimicrobial Coatings market

- Further breakdown of the Rest of Europe’s Antimicrobial Coatings market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Coatings Market