Application Hosting Market by Hosting Type (Managed, Cloud, & Colocation), Service Type, Application Type (Web-based, Mobile), Organization Size, Vertical, and Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2027

Updated on : April 13, 2023

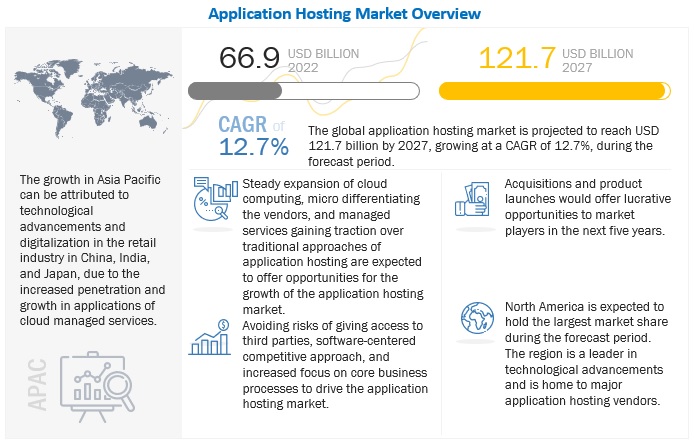

The global application hosting market in terms of revenue was estimated to be worth $66.9 billion in 2022 and is poised to reach $121.7 billion by 2027, growing at a CAGR of 12.7% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growing need for physical security, better management, high bandwidth, and low latency have increased the demand for colocation hosting services.

To know about the assumptions considered for the study, Request for Free Sample Report

Application Hosting Market Dynamics

Driver: Avoiding risks of giving system access to third parties

Allowing third-party access to one’s system come with several serious security risks and only increases granting access to multiple third parties. Relying on the honor system that vendors and other business partners will limit their activities to accessing only the data allotted to them is inviting trouble. There is no control over who is logging into the systems; any employee of these third parties could have access. Cybercriminals could target vendors of the clients with spear-phishing campaigns to get their passwords for access to systems. This leaves both the suppliers’ sensitive data and their customers vulnerable to unauthorized and/or criminal access.

Another problem is, if the networks of any of these third parties have been hacked, then the hackers have a backdoor entrance into system. A solution to this dilemma is pushing out the data that third parties require to a web application designed for this purpose. The application would be hosted elsewhere with a third-party service that has the expertise and technology to cope with this security issue.

Restraint:Regional IT development posing an infrastructural challenge for implementing hosting technology

Application hosting requires a significant amount of investment toward the development of servers, storage, and network and security ecosystem, necessary to support the needs of applications. The local resource pool exerts a major impact on the investment decision of a company to build data centers in any country. For instance, the US continues to be the heaven for application hosting organizations due to the favorable technological footing. Given the dependency on IT infrastructural raw material procurement costs, network infrastructure advancements, and IT support costs, most hosting businesses are centered in developed economies.

Countries with developed IT markets are preferred destinations for hosting companies to establish data centers. The setup cost for such countries is relatively low than other less developed countries. The cost of infrastructure and network along with a lack of skilled labor creates an ecosystem that is not feasible for application hosting vendors. In countries such as Saudi Arabia and the UAE, companies usually set up in-house data centers due to lack of managed services.

Opportunity: Innovative service delivery providing edge over rivals in fiercely competitive market

Service delivery will enable vendors to create niche markets for themselves. With the shift toward managed services, it would help organizations of all sizes by providing hosting services according to their need and budget.

The application hosting market is an ecosystem of vendors competing to become the best in the market. Well-established vendors incorporate acquisition, collaboration, partnership, expansion, and technology launch to gain a competitive advantage and maintain their market position.

Vendors are increasingly turning toward service delivery to reduce churn and increase renewal rates. Vendors such as Rackspace promise to provide the best quality solutions that are reliable, scalable, and affordable, with round-the-clock technical support. Innovative delivery models in the hosting space, such as “pay-as-you-go,” are removing barriers to adoption. The customer only pays for what they use, giving them control over unpredictable growth without the need of paying for needless fixed capacity.

Challenge: Providing scalability

E-commerce companies and website want their resources to be highly scalable. However, hosting providers are often forced to provide highly scalabe websites. Many web hosting companies face the challenge of outdated infrastructure, such as old server hardware, outdated software, a narrow broadband connection, and inadequately skilled support staff. Such restrictions impose a resource crunch, which affects the scalability. Even when the software or hardware is perfectly compatible, the limited resources being deployed, or the architecture of the data center might create bottlenecks. Emerging technologies such as IoT, artificial intelligence, and big data offer unlimited possibilities at the same time it demands for huge resources.

The inability of an organization to scale up resources when required can make the websites unstable due to some unknown restrictions, inability to log on to the mailbox or send email attachments, and limits being imposed without any option to mitigate it. For clients, this translates to missed opportunities and poor end-customer experience.

Mobile application type is expected to register higher CAGR during the forecast period

Mobile applications have become the necessity of organizations in driving sales, enhancing customer experiences, and streamlining business processes. The availability of cloud-based, enterprise-grade mobile applications is said to be gaining traction among SMEs, due to their cost-effectiveness and lesser maintenance charges. Furthermore, new technologies, such as Accelerated Mobile Pages (AMP), enhance the user experience and page loading speed. As per a survey conducted by Adobe, the need for instant communication, increasing mobile workforce, and the need to remain competitive in the market drive the growth of enterprise mobile applications.

Managed hosting type is estimated to account for the largest market share in 2022

Managed hosting is a model where the service provider leases the dedicated servers and their associated infrastructure to its clients on a subscription basis. The infrastructure can be located at the hosting provider’s facility and managed by the service provider. Enterprises that have a large legacy system and an already deployed infrastructure opt for the managed hosting type. These enterprises leverage their infrastructure to the managed service providers, and the service providers offer the essential hosting services to the enterprises

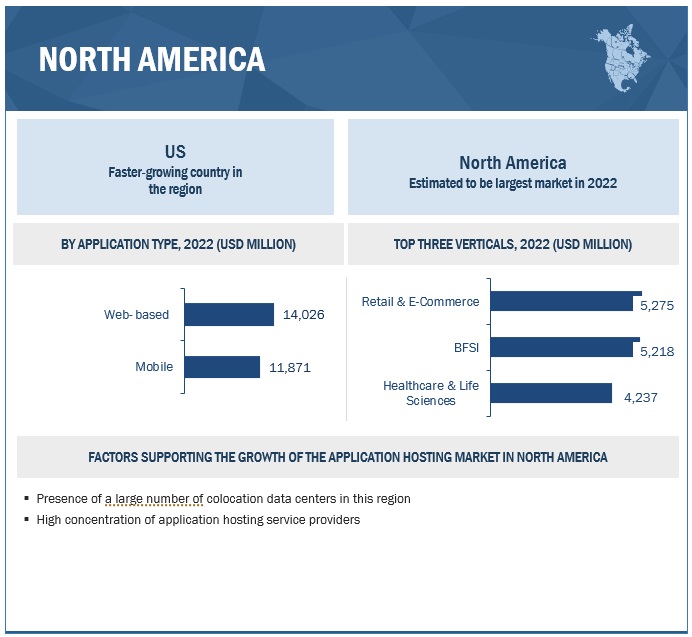

North America to account for largest market share during the forecast period

North America is estimated to account for the largest share of the application hosting market during the forecast period, due to the large-scale adoption of technologies by people and the presence of key market players in the region. Organizations shifting toward the adoption of emerging technologies and the increasing adoption of digital business strategies are the major factors for adopting application hosting service offerings in North America. Enterprises’ increasing budget allocation for application hosting is also expected to drive the market in North America. North America is expected to be the most promising region for major verticals, such as telecommunications, IT and ITeS, BFSI, and the government and public sector.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The application hosting market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in this market include AWS (US), IBM (US), Google (US), Rackspace (US), Microsoft (US), Liquid Web (US), Sungard AS (US), DXC Technology (Ireland), Apprenda (US), Navisite (US), Spectrum Enterprise (US), Capgemini (France), DigitalOcean (US), Oracle (US), NEC Corporation (Japan), Bluehost (US), HostGator (US), Netmagic Solutions (India), GreenGeeks (US), Cloudways (Malta), Hostwinds (US), Serverspace (Netherlands), Hostarium (UK), Appfleet (Poland), and BoltFlare (UK). The study includes an in-depth competitive analysis of these key market players along with their profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By hosting type, service type, organization size, application type, vertical, and regions |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

AWS (US), IBM (US), Google (US), Rackspace (US), Microsoft (US), Liquid Web (US), Sungard AS (US), DXC Technology (Ireland), Apprenda (US), Navisite (US), Spectrum Enterprise (US), Capgemini (France), Digital Ocean (US), Oracle (US), NEC Corporation (Japan), Bluehost (US), HostgatorHostGator (US), Netmagic Solutions (India), GreenGeeks (US), Cloudways (Malta), Hostwinds (US), Serverspace (Netherlands), Hostarium (UK), Appfleet (Poland), and Boltflare (UK) |

This research report categorizes the application hosting market to forecast revenues and analyze trends in each of the following subsegments:

Market By Hosting Type:

- Managed Hosting

-

Cloud Hosting

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

- Colocation Hosting

Market By Service Type:

- Application Monitoring

- Application Programming Interface Management

- Infrastructure Services

- Database Administration

- Backup and Recovery

- Application Security

Market By Application:

- Mobile-based

- Web-based

Market By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Market By Vertical:

- Banking, Financial Services, and Insurance

- Telecommunications and IT

- Media and Entertainment

- Retail and Ecommerce

- Healthcare

- Manufacturing

- Energy and Utilities

Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Middle East and Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Application Hosting Market:

- In February 2022, IBM acquired Neudesic, a leading Microsoft Azure Consultancy, this acquisition aims to expand IBM's portfolio of hybrid multicloud services and further influence the company's hybrid cloud and AI strategy

- In February 2022, Rackspace extended its Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) with an additional multi-year joint investment to drive customer value and innovation.

- In July 2021, Microsoft partnered with NEC, the partnership will see NEC adopt Microsoft Azure as its preferred cloud platform to deliver enhanced capabilities to drive sustained digitalization, help customers transform their business models, and build Digital Workplaces for the post-pandemic.

Frequently Asked Questions (FAQ):

What is the projected market value of the global application hosting market?

The global market of application hosting is projected to reach $121.7 billion.

What is the estimated growth rate (CAGR) of the global application hosting market for the next five years?

The global application hosting market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.7% from 2022 to 2027.

What are the major revenue pockets in the application hosting market currently?

North America is estimated to account for the largest share of the application hosting market during the forecast period, due to the large-scale adoption of technologies by people and the presence of key market players in the region. Organizations shifting toward the adoption of emerging technologies and the increasing adoption of digital business strategies are the major factors for adopting application hosting service offerings in North America. Enterprises increasing budget allocation for application hosting is also expected to drive the market in North America. North America is expected to be the most promising region for major verticals, such as telecommunications, IT and ITeS, BFSI, and the government and public sector.

Who are the key vendors in the application hosting market?

The key vendors operating in the application hosting market include AWS (US), IBM (US), Google (US), Rackspace (US), Microsoft (US), Liquid Web (US), Sungard AS (US), DXC Technology (Ireland), Apprenda (US), Navisite (US), Spectrum Enterprise (US), Capgemini (France), DigitalOcean (US), Oracle (US), NEC Corporation (Japan), Bluehost (US), HostGator (US), Netmagic Solutions (India), GreenGeeks (US), Cloudways (Malta), Hostwinds (US), Serverspace (Netherlands), Hostarium (UK), Appfleet (Poland), and BoltFlare (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 APPLICATION HOSTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE APPLICATION HOSTING MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 7 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 START-UP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 8 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 9 APPLICATION HOSTING MARKET, 2020-2027

FIGURE 10 LEADING SEGMENTS IN 2022

FIGURE 11 MARKET: REGIONAL AND COUNTRY-WISE SHARES, 2022

FIGURE 12 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN APPLICATION HOSTING

FIGURE 13 AVOIDING RISKS OF GIVING ACCESS TO THIRD PARTIES TO DRIVE GROWTH OF APPLICATION HOSTING MARKET

4.2 MARKET IN NORTH AMERICA, BY HOSTING TYPE AND VERTICAL

FIGURE 14 MANAGED HOSTING TYPE AND RETAIL & E-COMMERCE TO ACCOUNT FOR LARGEST SHARES IN 2022

4.3 ASIA PACIFIC MARKET, 2022

FIGURE 15 MANAGED HOSTING AND CHINA TO ACCOUNT FOR LARGE MARKET SHARES IN 2022

4.4 MARKET, BY COUNTRY

FIGURE 16 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: APPLICATION HOSTING MARKET

5.2.1 DRIVERS

5.2.1.1 Avoiding risks of giving system access to third parties

5.2.1.2 Software-centered competitive advantage approach gaining industry-agnostic acceptance

5.2.1.3 Application hosting facilitates increased focus on core business processes by providing business-specific IT solutions

5.2.1.4 Comprehensive hosting solutions with array of complementing services over core offerings

5.2.2 RESTRAINTS

5.2.2.1 Security and privacy concerns inhibit organizational change

5.2.2.2 Regional IT development poses infrastructural challenges for implementing hosting technology

5.2.2.3 Local regulations inhibit entry

5.2.3 OPPORTUNITIES

5.2.3.1 Steady expansion of cloud computing creating new growth areas, augmenting offerings, and micro-differentiating vendors

5.2.3.2 Managed services gaining ground over traditional approaches

5.2.3.3 Innovative service delivery providing edge over rivals

5.2.4 CHALLENGES

5.2.4.1 Vendor lock-in for cloud hosting could affect flexibility desired by organizations

5.2.4.2 Providing scalability

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 APPLICATION HOSTING MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 18 MARKET: SUPPLY CHAIN

5.4 ECOSYSTEM

FIGURE 19 MARKET: ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES MODEL

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

5.5.6.1 Key stakeholders in buying process

FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS (%)

5.5.6.2 Buying criteria

FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 BIG DATA AND ANALYTICS

5.6.3 CLOUD COMPUTING

5.6.4 ARTIFICIAL INTELLIGENCE

5.6.5 MACHINE LEARNING

5.7 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 22 REVENUE SHIFT FOR APPLICATION HOSTING MARKET

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2019–2022

5.8.3 INNOVATION AND PATENT APPLICATION

FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY, 2019–2022

5.8.3.1 Top applicants

FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

5.9 PRICING ANALYSIS

TABLE 8 PRICING ANALYSIS OF CLOUD COMPUTING PROVIDERS

5.10 CASE STUDY ANALYSIS

5.10.1 CASE STUDY 1: WORLDSYS USED ORACLE’S SOLUTION TO IMPROVE AGILITY

5.10.2 CASE STUDY 2: WITH LIQUID WEB’S HIPAA-COMPLIANT HOSTING, SPECIALIST PHARMACY IMPROVED REFILLING PROCESS

5.10.3 CASE STUDY 3: SUNGARD DELIVERED SECURE AND RESILIENT SOLUTION WITH ECS

5.10.4 CASE STUDY 4: DXC TECHNOLOGY DELIVERED SCALABLE AND COST-EFFICIENT ENVIRONMENT TO GOLDENSOURCE

5.10.5 CASE STUDY 5: ORION DEPLOYED TO LIQUID WEB’S CLOUD INFRASTRUCTURE FOR ELASTIC SCALABILITY

5.11 KEY CONFERENCES & EVENTS IN 2022

TABLE 9 APPLICATION HOSTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 REGULATORY COMPLIANCES

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

5.12.4 MIDDLE EAST & AFRICA

5.12.5 LATIN AMERICA

6 APPLICATION HOSTING MARKET, BY HOSTING TYPE (Page No. - 81)

6.1 INTRODUCTION

6.1.1 HOSTING TYPE: MARKET DRIVERS

FIGURE 25 CLOUD HOSTING TO GROW AT HIGHEST CAGR

TABLE 10 MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 11 MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

6.2 MANAGED HOSTING

6.2.1 ENTERPRISES HAVING LARGE LEGACY SYSTEMS TO OPT FOR MANAGED HOSTING

TABLE 12 MANAGED HOSTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 MANAGED HOSTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 CLOUD HOSTING

6.3.1 REDUCED INFRASTRUCTURE, LOW MAINTENANCE COST, 24X7 DATA ACCESSIBILITY, AND EFFECTIVE MONITORING TO DRIVE SEGMENT

TABLE 14 CLOUD HOSTING: APPLICATION HOSTING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 CLOUD HOSTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 16 CLOUD HOSTING: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 17 CLOUD HOSTING: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.2 INFRASTRUCTURE AS A SERVICE

TABLE 18 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 PLATFORM AS A SERVICE

TABLE 20 PLATFORM AS A SERVICE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 PLATFORM AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4 SOFTWARE AS A SERVICE

TABLE 22 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 COLOCATION HOSTING

6.4.1 SCALABILITY AND PHYSICAL SECURITY TO DRIVE SEGMENT

TABLE 24 COLOCATION HOSTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 COLOCATION HOSTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 APPLICATION HOSTING MARKET, BY SERVICE TYPE (Page No. - 90)

7.1 INTRODUCTION

7.1.1 SERVICE TYPE: MARKET DRIVERS

7.2 APPLICATION MONITORING

7.2.1 COMPLEXITY IN BUSINESS SOFTWARE INSTALLATION TO DRIVE SEGMENT

7.3 APPLICATION PROGRAMMING INTERFACE MANAGEMENT

7.3.1 MANAGES API TRAFFIC INTERNALLY AND EXTERNALLY

7.4 INFRASTRUCTURE SERVICES

7.4.1 BRIDGE BETWEEN ACTUAL RESOURCES AND APPLICATIONS

7.5 DATABASE ADMINISTRATION

7.5.1 SIMPLIFIES DATABASE SETUP IN CLOUD AND ON-PREMISES

7.6 BACKUP AND RECOVERY

7.6.1 IMPROVED UPTIME AND REDUCED DOWNTIME OF APPLICATION DURING HOSTING

7.7 APPLICATION SECURITY

7.7.1 RISE IN SECURITY BREACHES TO DRIVE SEGMENT

8 APPLICATION HOSTING MARKET, BY APPLICATION TYPE (Page No. - 93)

8.1 INTRODUCTION

8.1.1 APPLICATION TYPE: MARKET DRIVERS

FIGURE 26 MOBILE APPLICATIONS TO REGISTER HIGHER CAGR

TABLE 26 MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 27 MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

8.2 MOBILE APPLICATIONS

8.2.1 ACCELERATED MOBILE PAGES TO ENHANCE USER EXPERIENCE AND PAGE LOADING SPEED

TABLE 28 MOBILE APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 MOBILE APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 WEB-BASED APPLICATIONS

8.3.1 EVOLUTION OF NEW TECHNOLOGIES TO RESHAPE ENTERPRISE BUSINESS APPLICATIONS

TABLE 30 WEB-BASED APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 WEB-BASED APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 APPLICATION HOSTING MARKET, BY ORGANIZATION SIZE (Page No. - 98)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 27 SMES TO REGISTER HIGHER CAGR

TABLE 32 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 EMERGENCE OF DIGITAL CHANNELS, E-COMMERCE, AND SOCIAL MEDIA TO TRIGGER ENTERPRISES TO INVEST HEAVILY

TABLE 34 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SMES

9.3.1 CLOUD HOSTING SERVICES EMPOWER THESE ORGANIZATIONS TO HOST THEIR APPLICATIONS

TABLE 36 SMES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 APPLICATION HOSTING MARKET, BY VERTICAL (Page No. - 103)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

FIGURE 28 RETAIL & E-COMMERCE TO GROW AT HIGHEST CAGR

TABLE 38 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 39 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 CLOUD HOSTING HELPS IDENTIFY AND CREATE SIGNIFICANT OPPORTUNITIES THAT HELP BANKS DEVELOP CUSTOMER-CENTRIC BUSINESS MODELS

TABLE 40 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 IT/ITES

10.3.1 INVESTMENT IN NEW TECHNOLOGIES TO DRIVE MARKET

TABLE 42 IT/ITES: APPLICATION HOSTING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 IT/ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TELECOM

10.4.1 HIGH AVAILABILITY, RELIABILITY, AND ABILITY TO LEVERAGE EXISTING NETWORKING INFRASTRUCTURE TO DRIVE MARKET

TABLE 44 TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 MEDIA & ENTERTAINMENT

10.5.1 HOSTING OF MEDIA & ENTERTAINMENT APPLICATIONS TO EMPOWER ENTERPRISES TO INCREASE CONSUMER BASE

TABLE 46 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 RETAIL & E-COMMERCE

10.6.1 APPLICATION HOSTING SERVICES EMPOWER INTEGRATION OF MULTIPLE SHOPPING CHANNELS

TABLE 48 RETAIL & E-COMMERCE: APPLICATION HOSTING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 RETAIL & E-COMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 HEALTHCARE & LIFE SCIENCES

10.7.1 NEED TO OVERCOME CHALLENGES AND SUSTAIN IN COMPETITIVE MARKET

TABLE 50 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 MANUFACTURING

10.8.1 MIGRATION OF APPLICATIONS TO CLOUD ENVIRONMENT ENABLES MANUFACTURERS TO ADOPT SMART MANUFACTURING TECHNOLOGIES

TABLE 52 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 ENERGY & UTILITIES

10.9.1 ENERGY & UTILITIES USE VARIOUS SOFTWARE APPLICATIONS TO ENHANCE PRODUCTIVITY AND EFFICIENCY

TABLE 54 ENERGY & UTILITIES: APPLICATION HOSTING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.10 OTHER VERTICALS

10.10.1 NEED FOR PROCESSING LARGE UNSTRUCTURED DATA AND STORAGE TO ACCELERATE ADOPTION OF APPLICATION HOSTING SERVICES

TABLE 56 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 APPLICATION HOSTING MARKET, BY REGION (Page No. - 115)

11.1 INTRODUCTION

FIGURE 29 MARKET: REGIONAL SNAPSHOT

TABLE 58 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 UNITED STATES

11.2.2.1 High level of technology awareness and presence of several CSPs, TSPs, and MSPs

TABLE 72 UNITED STATES: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 73 UNITED STATES: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 74 UNITED STATES: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 75 UNITED STATES: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 76 UNITED STATES: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 77 UNITED STATES: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 78 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 79 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 80 UNITED STATES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 81 UNITED STATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Opening of data center in Montreal to store data within Canada

TABLE 82 CANADA: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 83 CANADA: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 84 CANADA: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 88 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 89 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 90 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 91 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 92 EUROPE: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UNITED KINGDOM

11.3.1.1 Higher adoption rate of cloud technologies

11.3.2 GERMANY

11.3.2.1 Increasing adoption of digitalization in personal and professional life

11.3.3 FRANCE

11.3.3.1 Government increasing spending on cloud

11.3.4 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China-based software and outsourcing companies shifting to adoption of cloud-based technologies

11.4.3 JAPAN

11.4.3.1 SMEs moving toward cloud adoption

11.4.4 INDIA

11.4.4.1 Adoption of application hosting services and cloud-based solutions due to increasing access to Internet

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 116 MIDDLE EAST AND AFRICA: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST AND AFRICA

11.5.2.1 Governments in this region providing complete support to SMEs for technology adoption

11.5.3 AFRICA

11.5.3.1 Emergence of cloud-native applications and improvements in IT service delivery

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 128 LATIN AMERICA: APPLICATION HOSTING MARKET, BY HOSTING TYPE, 2016–2021 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET, BY HOSTING TYPE, 2022–2027 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET, BY CLOUD, 2016–2021 (USD MILLION)

TABLE 131 LATIN AMERICA: MARKET, BY CLOUD, 2022–2027 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 133 LATIN AMERICA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Reduced expenditure on hardware and physical infrastructure

11.6.3 MEXICO

11.6.3.1 Mexican government’s initiative toward adoption of data security steps and digital transformation

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 153)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK, 2019–2021

12.3 COMPETITIVE SCENARIO AND TRENDS

12.3.1 PRODUCT LAUNCHES

TABLE 140 APPLICATION HOSTING MARKET: PRODUCT LAUNCHES, 2019-2021

12.3.2 DEALS

TABLE 141 DEALS, 2019-2021

12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 142 MARKET: DEGREE OF COMPETITION

FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 34 HISTORICAL REVENUE ANALYSIS, 2017-2021

12.6 COMPANY EVALUATION MATRIX OVERVIEW

12.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 143 PRODUCT FOOTPRINT WEIGHTAGE

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 35 APPLICATION HOSTING MARKET: COMPANY EVALUATION MATRIX (2022)

12.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 144 COMPANY PRODUCT FOOTPRINT

TABLE 145 COMPANY COMPONENT FOOTPRINT

TABLE 146 VERTICAL FOOTPRINT

TABLE 147 COMPANY REGION FOOTPRINT

12.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 36 RANKING OF KEY PLAYERS (2022)

12.10 START-UP/SME EVALUATION MATRIX: METHODOLOGY AND DEFINITIONS

FIGURE 37 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 148 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.10.1 PROGRESSIVE COMPANIES

12.10.2 RESPONSIVE COMPANIES

12.10.3 DYNAMIC COMPANIES

12.10.4 STARTING BLOCKS

FIGURE 38 APPLICATION HOSTING MARKET: SMES/STARTUPS COMPANY EVALUATION MATRIX (2022)

12.11 COMPETITIVE BENCHMARKING FOR SMES/START-UPS

TABLE 149 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 150 MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY VERTICAL AND HOSTING TYPE

TABLE 151 MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY REGION

13 COMPANY PROFILES (Page No. - 169)

13.1 MAJOR PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 AWS

TABLE 152 AWS: BUSINESS OVERVIEW

FIGURE 39 AWS: COMPANY SNAPSHOT

TABLE 153 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 AWS: DEALS

13.1.2 IBM

TABLE 155 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

TABLE 156 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 IBM: DEALS

13.1.3 GOOGLE

TABLE 158 GOOGLE: BUSINESS OVERVIEW

FIGURE 41 GOOGLE: COMPANY SNAPSHOT

TABLE 159 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 GOOGLE: DEALS

13.1.4 MICROSOFT

TABLE 161 MICROSOFT: BUSINESS OVERVIEW

FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

TABLE 162 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 MICROSOFT: DEALS

TABLE 164 MICROSOFT: OTHERS

13.1.5 RACKSPACE

TABLE 165 RACKSPACE: BUSINESS OVERVIEW

FIGURE 43 RACKSPACE: COMPANY SNAPSHOT

TABLE 166 RACKSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 167 RACKSPACE: PRODUCT LAUNCHES

TABLE 168 RACKSPACE: DEALS

13.1.6 LIQUID WEB

TABLE 169 LIQUID WEB: BUSINESS OVERVIEW

TABLE 170 LIQUID WEB: PRODUCTS OFFERED

TABLE 171 LIQUID WEB: PRODUCT LAUNCHES

TABLE 172 LIQUID WEB: DEALS

13.1.7 SUNGARD AS

TABLE 173 SUNGARD AS: BUSINESS OVERVIEW

TABLE 174 SUNGARD AS: PRODUCTS OFFERED

TABLE 175 SUNGARD AS: PRODUCT LAUNCHES

TABLE 176 SUNGARD AS: DEALS

TABLE 177 SUNGARD AS: OTHERS

13.1.8 DXC TECHNOLOGY

TABLE 178 DXC TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 44 DXC TECHNOLOGY: FINANCIAL OVERVIEW

TABLE 179 DXC TECHNOLOGY: PRODUCTS OFFERED

TABLE 180 DXC TECHNOLOGY: PRODUCT LAUNCHES

TABLE 181 DXC TECHNOLOGY: DEALS

TABLE 182 DXC TECHNOLOGY: OTHERS

13.1.9 APPRENDA

TABLE 183 APPRENDA: BUSINESS OVERVIEW

TABLE 184 APPRENDA: PRODUCTS OFFERED

TABLE 185 APPRENDA: DEALS

13.1.10 NAVISITE

TABLE 186 NAVISITE: BUSINESS OVERVIEW

TABLE 187 NAVISITE: PRODUCTS OFFERED

TABLE 188 NAVISITE: DEALS

TABLE 189 NAVISITE: OTHERS

13.1.11 SPECTRUM ENTERPRISE

13.1.12 CAPGEMINI

13.1.13 DIGITALOCEAN

13.1.14 ORACLE

13.1.15 NCE CORPORATION

13.1.16 BLUEHOST

13.1.17 HOSTGATOR

13.1.18 NETMAGIC SOLUTIONS

13.2 START-UPS/SMES

13.2.1 GREENGEEKS

13.2.2 CLOUDWAYS

13.2.3 HOSTWINDS

13.2.4 SERVERSPACE

13.2.5 HOSTARIUM

13.2.6 APPFLEET

13.2.7 BOLTFLARE

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 206)

14.1 INTRODUCTION

14.1.1 LIMITATIONS

14.2 MANAGED SERVICES MARKET – GLOBAL FORECAST TO 2026

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 Managed services market, By service type

TABLE 190 MANAGED SERVICES MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 191 MANAGED SERVICES MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

14.2.2.2 Managed services market, By security services

TABLE 192 MANAGED SECURITY SERVICES MARKET, BY SECURITY SERVICES TYPE, 2016–2020 (USD MILLION)

TABLE 193 MANAGED SECURITY SERVICES MARKET, BY SECURITY SERVICES TYPE, 2021–2026 (USD MILLION)

14.2.2.3 Managed services market, By managed network services

TABLE 194 MANAGED NETWORK SERVICES MARKET, BY MANAGED NETWORK SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 195 MANAGED NETWORK SERVICES MARKET, BY MANAGED NETWORK SERVICE TYPE, 2021–2026 (USD MILLION)

14.2.2.4 Managed services market, By organization size

TABLE 196 MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 197 MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

14.2.2.5 Managed services market, By deployment mode

TABLE 198 MANAGED SERVICES MARKET, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 199 MANAGED SERVICES MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

14.2.2.6 Managed services market, By vertical

TABLE 200 MANAGED SERVICES MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 201 MANAGED SERVICES MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

14.2.2.7 Managed services market, By region

TABLE 202 MANAGED SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 203 MANAGED SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3 MOBILE ENTERPRISE APPLICATION MARKET — GLOBAL FORECAST TO 2021

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 Mobile enterprise application market, By software

TABLE 204 MOBILE ENTERPRISE APPLICATION MARKET, BY SOFTWARE, 2014–2021 (USD BILLION)

14.3.2.2 Mobile enterprise application market, By type of app

TABLE 205 MOBILE ENTERPRISE APPLICATION MARKET, BY TYPE OF APP, 2014–2021 (USD BILLION)

14.3.2.3 Mobile enterprise application market, By operating system

TABLE 206 MOBILE ENTERPRISE APPLICATION MARKET, BY OPERATING SYSTEM, 2014–2021 (USD BILLION)

14.3.2.4 Mobile enterprise application market, By organization size

TABLE 207 MOBILE ENTERPRISE APPLICATION MARKET, BY ORGANIZATION SIZE, 2014–2021 (USD BILLION)

14.3.2.5 Mobile enterprise application market, By vertical

TABLE 208 MOBILE ENTERPRISE APPLICATION MARKET, BY VERTICAL, 2014–2021 (USD BILLION)

14.3.2.6 Mobile enterprise application market, By region

TABLE 209 MOBILE ENTERPRISE APPLICATION MARKET, BY REGION, 2014–2021 (USD BILLION)

15 APPENDIX (Page No. - 218)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

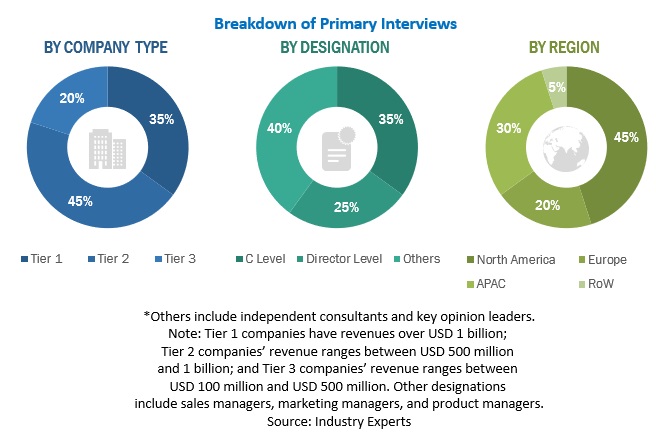

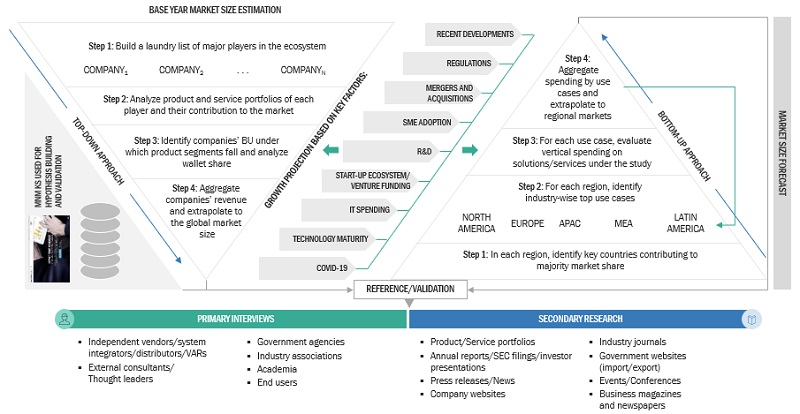

This research study involved the use of extensive secondary sources, directories, and databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the application hosting market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers (SPs), technology developers, alliances, and organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the application hosting market.

Secondary Research

The market size of the companies offering application hosting hardware, solutions, and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Application hosting spending of various countries was extracted from the respective sources. The secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from application hosting solution vendors, system integrators, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the hardware, solutions, and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users that use application hosting solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of application hosting solutions, which is projected to impact the overall application hosting market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation of the application hosting market. The first approach involved estimating the market size by the summation of company revenues generated through the different types of hosting: managed hosting, cloud hosting, and colocation hosting. The top-down and bottom-up approaches were used to estimate and validate the size of the application hosting market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players are not limited to AWS, IBM, Google, Rackspace, Microsoft, LiquidWeb, Sungard, DXC Technology, Apprenda and Navigine; other players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Application hosting Market: Top-down and Bottom-up Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the application hosting market based on hosting type, service type, organization size, application type, vertical, and region from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the application hosting market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and research & development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Application Hosting Market

Interested in market growth trends of application hosting services