Aramid Honeycomb Core Materials Market in the Transportation Industry by Type (Nomex, Others), Aramid Type (Meta, Para), Application (Interior, Exterior), Transportation Type (Airways, Railways, Waterways, Roadways) and Region - Global Forecast to 2025

Aramid Honeycomb Core Materials Market

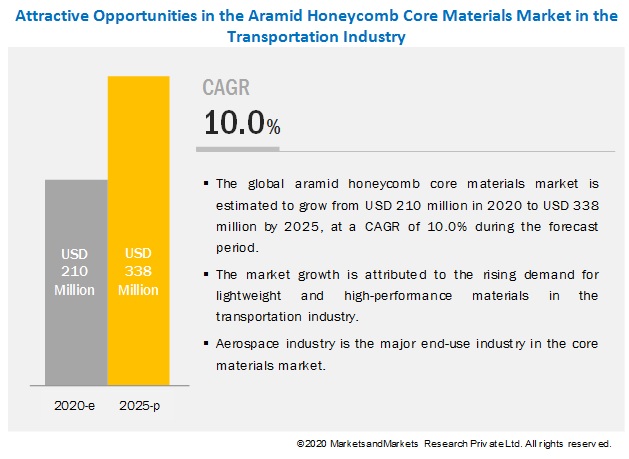

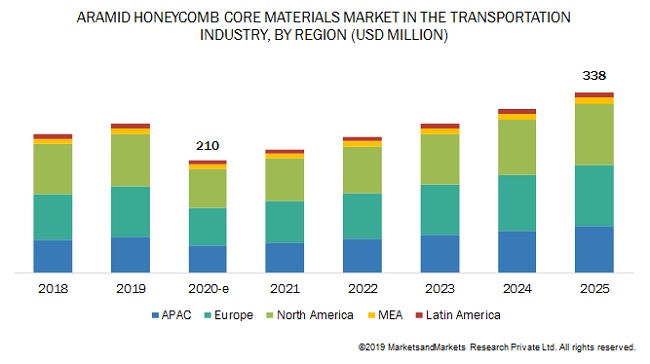

The global aramid honeycomb core materials market was valued at USD 210 million in 2020 and is projected to reach USD 338 million by 2025, growing at a cagr 10.0% from 2020 to 2025. The market is growing due to the superior performance properties of aramid honeycomb core materials and their ability to survive in harsh conditions.

In terms of volume, the airways segment has the largest market share

Airways dominated the global aramid honeycomb core materials market due to the high demand from commercial and defense aircraft. Owing to the high cost, the majority of the application of aramid honeycomb core materials is still restricted to the aerospace & defense industry. The lightweight property, combined with the high tensile strength of the aramid honeycomb core, increases fuel efficiency, reduces maintenance costs, and allows OEMs to comply with the stringent environmental regulations, especially those stipulated in Europe and North America. This further increases the demand for aramid honeycomb core materials in the airways. However, the COVID-19 pandemic has created ripples in the aerospace industry, resulting in a decrease in the number of aircraft deliveries and reduced demand for aramid honeycomb core materials.

Exterior application accounts for the major share, in terms of value, of the aramid honeycomb core materials market.

Owing to its superior attributes, such as strength, flexibility, durability, stability, low weight, and resistance to heat, temperature, and moisture, aramid honeycomb core materials are mainly used in exterior applications. Aramid honeycomb core materials such as Kevlar and Nomex are mostly used to make airframe structures, such as landing gears, leading and trailing edges, engine nacelles, undercarriages, fuselages, and wings. Besides this, the aramid honeycomb core materials are also used in exterior applications of marine industry such as boat hulls, stateroom for boats, decks, cargo linings, shells, hatches, and navy bulkhead joiner panels. They are also used in car bodies, trucks, and train panels. The coronavirus outbreak has reduced the demand for aramid honeycomb core materials from aircraft, automotive, ship, and rail industries.

Nomex accounted for the larger share of the aramid honeycomb core materials market in terms of value.

Nomex accounted for a larger share in terms of value. It is the brand name of aramid paper/sheet manufactured by DuPont. Nomex is used by all the leading honeycomb core manufacturers, such as Hexcel, Plascore, Euro-Composites, and The Gill Corporation. However, the aramid honeycomb core materials in the others segment are expected to register faster growth as compared to Nomex due to comparatively low price and equivalent performance properties. The COVID-19 pandemic would further reduce the demand for Nomex due to aircraft manufacturers looking for a cheaper alternative from other aramid honeycomb core material manufacturers.

North America held the largest share in the global aramid honeycomb core materials market in the transportation industry in terms of value.

North America accounted for the largest share in the global aramid honeycomb core materials market in the transportation industry, in terms of value, due to high demand from aerospace & defense and marine industries. North America is home to many key aramid honeycomb core materials manufacturers, such as Hexcel Corporation, Plascore, Inc., and the Gill Corporation. However, due to the outbreak of COVID-19, the US aerospace industry is severely affected. This is expected to reduce the demand for aramid honeycomb core materials until the production facilities of aircraft start operating at full capacities.

Key Market Players

Hexcel Corporation (US), Euro-Composites S.A. (Luxembourg), The Gill Corporation (US), Plascore, Inc. (US), Argosy International, Inc. (US), Showa Aircraft Company Ltd. (Japan), Tasuns Composites Co. Ltd. (China), and Schutz Composite GmbH (Germany) are some of the key players of the aramid honeycomb core materials market. These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the industry. The study includes an in-depth competitive analysis of these companies in the aramid honeycomb core materials market in the transportation industry, with their company profiles, recent developments, and key market strategies.

Aramid Honeycomb Core Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Ton) |

|

Segments |

Type, Aramid Type, Application, Transportation Type, and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Hexcel Corporation (US), Euro-Composites S.A. (Luxembourg), The Gill Corporation (US), Plascore, Inc. (US), Argosy International, Inc. (US), Showa Aircraft Company Ltd. (Japan), Tasuns Composites Co. Ltd. (China), Schutz Composite GmbH (Germany). |

This research report categorizes the aramid honeycomb core materials market in the transportation industry based on type, aramid type, application, transportation type, and region.

By Type:

- Nomex

- Others

By Aramid Type:

- Meta-Aramid

- Para-Aramid

By Application:

- Interior

- Exterior

By Transportation Type:

- Airways

- Railways

- Waterways

- Roadways

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In September 2019, Plascore Inc. invested USD 6 million to expand its aerospace business unit Zeeland, Michigan, US. The company built a 73,500-square-feet addition onto its current plant, doubling the size of its facility. This expansion has helped the company to increase the production capacity of aramid honeycomb core materials at a competitive cost to meet the demand of aerospace customers.

- In February 2016, Euro-Composite SA invested USD 10.5 million to broaden its US operation. The company widened its facility by 51,000 sq.ft. and new equipment to bolster the production for aerospace composite-based parts, which would increase the demand for aramid honeycomb core materials in the aerospace industry.

- In June 2019, Euro-Composites invested USD 179 million; with this investment, the company extended its production halls and equipment, which is helping it to increase its honeycomb core material business.

Key Questions Addressed By the Report

- Which are the major transportation type in aramid honeycomb core materials?

- What the major aramid types used in manufacturing aramid honeycomb core materials?

- Which region is the largest and fastest-growing market for aramid honeycomb core materials in the transportation industry?

- What is the major type of aramid honeycomb core material in the transportation industry?

- What are the major applications of aramid honeycomb core materials in the transportation industry?

- What are the major strategies adopted by leading players in the aramid honeycomb core materials market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY SIDE ANALYSIS

2.2.2 SEGMENT ANALYSIS

2.2.3 FORECAST

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

4.2 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE AND REGION

4.3 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY TYPE

4.4 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY ARAMID TYPE

4.5 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY KEY COUNTRIES

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Government stimulus package for the aerospace industry amid the COVID-19 crisis

5.2.1.2 High demand from the transportation industry

5.2.1.3 Superior performance properties over other honeycomb core materials

5.2.2 RESTRAINTS

5.2.2.1 High price

5.2.2.2 Decrease in the number of aircraft deliveries

5.2.2.3 Disruption in the supply chain and lower production capacity utilization due to COVID-19 pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Low-cost aramid honeycomb core materials from Japanese, Chinese, and South Korean counterparts

5.2.3.2 Increasing penetration of para-aramid honeycomb core in the aerospace industry

5.2.4 CHALLENGES

5.2.4.1 Maintenance of uninterrupted supply chain and operating at full production capacity

5.2.4.2 Liquidity crunch

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 MACROECONOMIC OVERVIEW AND KEY TRENDS IN THE AEROSPACE INDUSTRY (Page No. - 49)

6.1 MACROECONOMIC OVERVIEW AND KEY TRENDS IN THE AEROSPACE INDUSTRY

6.1.1 INTRODUCTION

6.1.2 TRENDS AND FORECAST OF GDP

6.1.3 TRENDS IN THE AEROSPACE INDUSTRY

6.1.3.1 Disruption in the industry

6.1.3.2 Impact on customers’ output & strategies to resume/improve production

6.1.3.3 Impact on customers’ revenue

6.1.3.4 Most affected countries

6.1.3.5 Short-term strategies to manage cost structure and supply chains

6.1.3.6 New opportunities

7 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY TYPE (Page No. - 53)

7.1 INTRODUCTION

7.1.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE N THE TRANSPORTATION INDUSTRY, BY TYPE

7.2 NOMEX

7.2.1 NOMEX HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION

7.3 OTHERS

7.3.1 OTHER ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION

8 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY ARAMID TYPE (Page No. - 57)

8.1 INTRODUCTION

8.1.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY ARAMID TYPE

8.2 META-ARAMID

8.2.1 META-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION

8.3 PARA-ARAMID

8.3.1 PARA-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION

9 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY APPLICATION (Page No. - 61)

9.1 INTRODUCTION

9.1.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY APPLICATION

9.2 INTERIOR

9.2.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR INTERIOR APPLICATION, BY REGION

9.3 EXTERIOR

9.3.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR EXTERIOR APPLICATION, BY REGION

10 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (Page No. - 66)

10.1 INTRODUCTION

10.1.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, BY TRANSPORTATION TYPE

10.2 AIRWAYS

10.2.1 CIVIL

10.2.2 DEFENSE

10.2.3 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN AIRWAYS, BY AIRCRAFT-TYPE

10.2.4 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN AIRWAYS, BY REGION

10.3 RAILWAYS

10.3.1 METROS AND MONO RAILS

10.3.2 PASSENGER RAILS

10.3.3 HIGH-SPEED AND BULLET TRAINS

10.3.4 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY RAIL TYPE

10.3.5 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY REGION

10.4 WATERWAYS

10.4.1 POWER BOAT

10.4.2 SAILBOAT

10.4.3 CRUISE SHIP

10.4.4 OTHERS

10.4.5 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN WATERWAYS, BY BOAT TYPE

10.4.6 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN WATERWAYS, BY REGION

10.5 ROADWAYS

10.5.1 AUTOMOTIVE

10.5.2 RECREATIONAL VEHICLES

10.5.3 OTHERS

10.5.4 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY VEHICLE TYPE

10.5.5 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY REGION

11 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY, BY REGION (Page No. - 78)

11.1 INTRODUCTION

11.1.1 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, BY TRANSPORTATION TYPE

11.2.2 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY

11.2.3 US

11.2.3.1 US: aramid honeycomb core materials market size in the transportation industry

11.2.4 CANADA

11.2.4.1 Canada: aramid honeycomb core materials market size in the transportation industry

11.3 EUROPE

11.3.1 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE

11.3.2 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY

11.3.3 FRANCE

11.3.3.1 France: aramid honeycomb core materials market size in the transportation industry

11.3.4 GERMANY

11.3.4.1 Germany: aramid honeycomb core materials market size in the transportation industry

11.3.5 UK

11.3.5.1 UK: aramid honeycomb core materials market size in the transportation industry

11.3.6 ITALY

11.3.6.1 Italy: aramid honeycomb core materials market size in the transportation industry

11.3.7 SPAIN

11.3.7.1 Spain: aramid honeycomb core materials market size in the transportation industry

11.3.8 REST OF EUROPE

11.3.8.1 Rest of Europe: aramid honeycomb core materials market size in the transportation industry

11.4 APAC

11.4.1 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE

11.4.2 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY

11.4.3 JAPAN

11.4.3.1 Japan: aramid honeycomb core materials market size in the transportation industry

11.4.4 CHINA

11.4.4.1 China: aramid honeycomb core materials market size in the transportation industry

11.4.5 SOUTH KOREA

11.4.5.1 South Korea: aramid honeycomb core materials market size in the transportation industry

11.4.6 INDIA

11.4.6.1 India: aramid honeycomb core materials market size in the transportation industry

11.4.7 REST OF APAC

11.4.7.1 Rest of APAC: aramid honeycomb core materials market size in the transportation industry

11.5 MEA

11.5.1 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE

11.5.2 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY

11.5.3 SOUTH AFRICA

11.5.3.1 South Africa: aramid honeycomb core materials market size in the transportation industry, by transportation type

11.5.4 UAE

11.5.4.1 UAE: aramid honeycomb core materials market size in the transportation industry, by transportation type

11.5.5 REST OF MEA

11.5.5.1 Rest of MEA: aramid honeycomb core materials market size in the transportation industry, by transportation type

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE

11.6.2 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY

11.6.3 BRAZIL

11.6.3.1 Brazil: aramid honeycomb core materials market size in the transportation industry, by transportation type

11.6.4 MEXICO

11.6.4.1 Mexico: aramid honeycomb core materials market size in the transportation industry, by transportation type

11.6.5 REST OF LATIN AMERICA

11.6.5.1 Rest of Latin America: aramid honeycomb core materials market size in the transportation industry, by transportation type

12 COMPETITIVE LANDSCAPE (Page No. - 111)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 EMERGING COMPANIES

12.2.4 INNOVATORS

12.3 MARKET RANKING

12.4 COMPETITIVE SCENARIO

12.4.1 EXPANSION

13 COMPANY PROFILES (Page No. - 116)

(Business overview, Products offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, Right To Win, MNM view)*

13.1 HEXCEL CORPORATION

13.2 PLASCORE, INC.

13.3 THE GILL CORPORATION

13.4 EURO-COMPOSITES

13.5 ACP COMPOSITES, INC.

13.6 TORAY INDUSTRIES, INC.

13.7 ARGOSY INTERNATIONAL INC.

13.8 SHOWA AIRCRAFT INDUSTRY CO. LTD

13.9 SCHÜTZ GMBH & CO. KGAA

13.10 ADVANCED HONEYCOMB TECHNOLOGIES

13.11 ARAMICORE COMPOSITES CO. LTD

13.12 HONEYLITE

13.13 COREX HONEYCOMB

13.14 TASUNS COMPOSITE TECHNOLOGY CO. LTD.

14 COMPANY PROFILES FOR ARAMID FIBER MANUFACTURERS (Page No. - 145)

14.1 DUPONT DE NEMOURS, INC.

14.2 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.

14.3 TEIJIN LIMITED

14.4 HYOSUNG CORPORATION

14.5 HUVIS

14.6 TAEKWANG INDUSTRIAL CO. LTD.

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, Right To Win, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 159)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

LIST OF TABLES (99 Tables)

TABLE 1 ANNUAL PERCENTAGE CHANGE OF GDP, BY REGION, APRIL 2020

TABLE 2 NUMBER OF AIRPLANE DELIVERIES, BY MANUFACTURERS, 2019

TABLE 3 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TYPE, 2018–2025 (TON)

TABLE 5 NOMEX HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 NOMEX HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2020–2025 (TON)

TABLE 7 OTHERS ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 OTHERS ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 9 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY ARAMID TYPE, 2018–2025 (USD MILLION)

TABLE 10 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY ARAMID TYPE, 2018–2025 (TON)

TABLE 11 META-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 META-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 13 PARA-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 PARA-ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 15 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 16 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY APPLICATION, 2018–2025 (TON)

TABLE 17 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR INTERIOR APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR INTERIOR APPLICATION, BY REGION, 2018–2025 (TON)

TABLE 19 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR EXTERIOR APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY FOR EXTERIOR APPLICATION, BY REGION, 2018–2025 (TON)

TABLE 21 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 22 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 23 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN AIRWAYS, BY AIRCRAFT-TYPE, 2018–2025 (USD MILLION)

TABLE 24 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN AIRWAYS, BY AIRCRAFT-TYPE, 2018–2025 (TON)

TABLE 25 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN AIRWAYS, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN IN AIRWAYS, BY REGION, 2018–2025 (TON)

TABLE 27 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY RAIL TYPE, 2018–2025 (USD MILLION)

TABLE 28 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY RAIL TYPE, 2018–2025 (TON)

TABLE 29 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN RAILWAYS, BY REGION, 2018–2025 (TON)

TABLE 31 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN WATERWAYS, BY BOAT TYPE, 2018–2025 (USD MILLION)

TABLE 32 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN WATERWAYS, BY BOAT TYPE, 2018–2025 (TON)

TABLE 33 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN WATERWAYS, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN IN WATERWAYS, BY REGION, 2018–2025 (TON)

TABLE 35 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 36 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY VEHICLE TYPE, 2018–2025 (TON)

TABLE 37 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN ROADWAYS, BY REGION, 2018–2025 (TON)

TABLE 39 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 41 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (TON)

TABLE 43 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (TON)

TABLE 45 US: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 46 US: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 47 CANADA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 48 CANADA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 49 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (TON)

TABLE 51 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (TON)

TABLE 53 FRANCE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 54 FRANCE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 55 GERMANY: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 56 GERMANY: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 57 UK: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 58 UK: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 59 ITALY: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 60 ITALY: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 61 SPAIN: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 62 SPAIN: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 63 REST OF EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 64 REST OF EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 65 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 66 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (TON)

TABLE 67 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 69 JAPAN: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 70 JAPAN: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 71 CHINA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 72 CHINA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 73 SOUTH KOREA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 74 SOUTH KOREA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 75 INDIA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 76 INDIA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 77 REST OF APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 78 REST OF APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 79 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE, IN THE TRANSPORTATION INDUSTRY BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 80 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (TON)

TABLE 81 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 82 MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (TON)

TABLE 83 SOUTH AFRICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 84 SOUTH AFRICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 85 UAE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 86 UAE: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 87 REST OF MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 88 REST OF MEA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 89 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 90 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE (TON)

TABLE 91 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY COUNTRY, 2018–2025 (TON)

TABLE 93 BRAZIL: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 94 BRAZIL: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 95 MEXICO: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 96 MEXICO: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 97 REST OF LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (USD MILLION)

TABLE 98 REST OF LATIN AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET SIZE IN THE TRANSPORTATION INDUSTRY, BY TRANSPORTATION TYPE, 2018–2025 (TON)

TABLE 99 EXPANSION, 2015-2020

LIST OF FIGURES (48 Figures)

FIGURE 1 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY: RESEARCH DESIGN

FIGURE 2 MARKET NUMBER ESTIMATION

FIGURE 3 ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY MARKET: DATA TRIANGULATION

FIGURE 4 NOMEX DOMINATES THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 5 PARA-ARAMID HONEYCOMB CORE MATERIALS TO REGISTER THE HIGHER CAGR BETWEEN 2020 AND 2025

FIGURE 6 EXTERIOR APPLICATION TO LEAD THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY BETWEEN 2020 AND 2025

FIGURE 7 AIRWAYS TO DOMINATE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY BETWEEN 2020 AND 2025

FIGURE 8 THE US TO LEAD THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY DURING THE FORECAST PERIOD

FIGURE 9 APAC TO BE THE FASTEST-GROWING MARKET FOR ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 10 HIGH DEMAND FROM THE AEROSPACE & DEFENSE INDUSTRY TO DRIVE THE MARKET

FIGURE 11 AIRWAYS SEGMENT AND NORTH AMERICA TO BE THE LARGEST ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 12 NOMEX DOMINATES THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 13 META-ARAMID HONEYCOMB CORE MATERIALS TO DOMINATE THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 14 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 NOMEX TO LEAD THE ARAMID HONEYCOMB CORE MATERIALS MARKET

FIGURE 18 PARA-ARAMID TO REGISTER HIGHER GROWTH RATE IN THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 19 EXTERIOR APPLICATION DOMINATES THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 20 AIRWAYS TO DOMINATE THE ARAMID HONEYCOMB CORE MATERIALS MARKET

FIGURE 21 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 22 NORTH AMERICA: ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY SNAPSHOT

FIGURE 23 EUROPE: ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY SNAPSHOT

FIGURE 24 APAC: ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY SNAPSHOT

FIGURE 25 EXPANSION IS THE KEY GROWTH STRATEGY ADOPTED BETWEEN 2015 AND 2020

FIGURE 26 ARAMID HONEYCOMB CORE MATERIALS IN TRANSPORTATION MARKET: (GLOBAL) COMPETITIVE LEADERSHIP MAPPING

FIGURE 27 TOP FIVE PLAYERS IN THE ARAMID HONEYCOMB CORE MATERIALS MARKET IN THE TRANSPORTATION INDUSTRY

FIGURE 28 HEXCEL CORPORATION: COMPANY SNAPSHOT

FIGURE 29 HEXCEL CORPORATION: SWOT ANALYSIS

FIGURE 30 PLASCORE, INC.: SWOT ANALYSIS

FIGURE 31 THE GILL CORPORATION: SWOT ANALYSIS

FIGURE 32 EURO-COMPOSITES: SWOT ANALYSIS

FIGURE 33 ACP COMPOSITES: SWOT ANALYSIS

FIGURE 34 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 35 TORAY INDUSTRIES: SWOT ANALYSIS

FIGURE 36 ARGOSY INTERNATIONAL INC.: SWOT ANALYSIS

FIGURE 37 SHOWA AIRCRAFT INDUSTRY CO. LTD: COMPANY SNAPSHOT

FIGURE 38 SHOWA AIRCRAFT INDUSTRY CO. LTD: SWOT ANALYSIS

FIGURE 39 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

FIGURE 40 DUPONT DE NEMOURS, INC.: SWOT ANALYSIS

FIGURE 41 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.: SWOT ANALYSIS

FIGURE 42 TEIJIN LIMITED: COMPANY SNAPSHOT

FIGURE 43 TEIJIN LIMITED: SWOT ANALYSIS

FIGURE 44 HYOSUNG CORPORATION: COMPANY SNAPSHOT

FIGURE 45 HYOSUNG CORPORATION: SWOT ANALYSIS

FIGURE 46 HUVIS: COMPANY SNAPSHOT

FIGURE 47 HUVIS: SWOT ANALYSIS

FIGURE 48 HUVIS: SWOT ANALYSIS

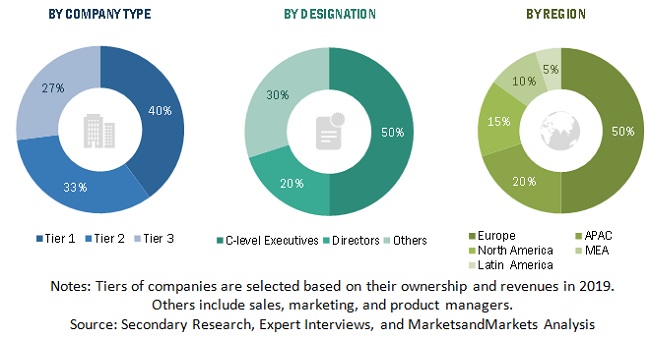

The study involves two major activities in estimating the current size of the aramid honeycomb core materials market in the transportation industry. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to, for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The aramid honeycomb core materials market in the transportation industry comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the transportation, wind energy, aerospace & defense, and construction & infrastructure end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total aramid honeycomb core materials market in the transportation industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall aramid honeycomb core materials market size in the transportation industry using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive, aerospace & defense, marine, and rail industries.

Report Objectives

- To analyze and forecast the global aramid honeycomb core materials market in the transportation industry in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type, aramid type, application, and transportation type.

- To analyze and forecast the market size and impact of COVID-19 on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To strategically analyze the markets with respect to individual growth trends, prospects, and contribution to the global market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To analyze competitive development strategies, such as expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies*

- To analyze the impact of COVID- 19 on the aramid honeycomb core materials market on airways, roadways, railways, and waterways

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the aramid honeycomb core materials market in the transportation industry in Rest of APAC

- Further breakdown of the aramid honeycomb core materials market in the transportation industry in Rest of Europe

- Further breakdown of the aramid honeycomb core materials market in the transportation industry in Rest of North America

- Further breakdown of the aramid honeycomb core materials market in the transportation industry in Rest of MEA

- Further breakdown of the aramid honeycomb core materials market in the transportation industry in Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Aramid Honeycomb Core Materials Market