To balance primary and secondary research for the AI in Medical Diagnotics market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, directories, and databases (Dun & Bradstreet, Bloomberg Businessweek, and Factiva, among others) to identify and collect information useful for the technical, market-oriented, and commercial study of AI in medical diagnostics market. Secondary data was collected and analyzed to arrive at the overall size of the global AI in medical diagnostics market, which was validated through primary research.

Primary Research

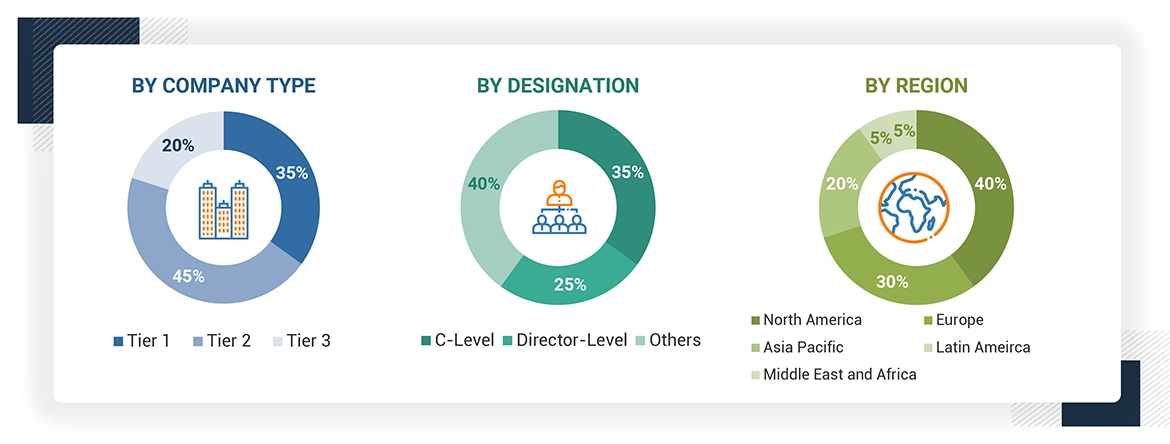

Extensive primary research was conducted after acquiring basic knowledge about the global of AI in medical diagnostics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Hospitals, Clinics and Other Healthcare Facilities, Diagnostic laboratories and Diagnostics Imaging Center, Other End Users- Employer Groups and Government Bodies) and supply side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, and Rest of the world. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, the market size of the global AI in medical diagnostics market was calculated in this report. Key players with significant shares in the market were identified as part of secondary research and their medical diagnostics business revenue was calculated, primaries validated the same. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

Both top-down and bottom-up approaches were used to estimate and validate the size of the AI in medical diagnostics market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

-

Revenues of individual companies were gathered from public sources and databases

-

The shares of the AI in medical diagnostics market players were gathered from secondary sources to the extent available. In certain cases, the shares of the businesses were ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling prices, and geographic reach and strength

-

Individual shares or revenue estimates were validated through expert interviews

-

All percentage shares, splits, and breakdowns for the global AI in medical diagnostics market were determined by using secondary sources and verified through primary sources

-

All key macro indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data

-

The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report

AI in medical diagnostics Market Size: Market Estimation Approach

Data Triangulation

To estimate the overall market size of the AI in medical diagnostics market, a detailed market size estimation process was followed. The market was then segmented into various segments and subsegments for more precise analysis. To ensure accuracy, data triangulation and market breakdown methodologies were applied where applicable. This approach involved analyzing various factors and trends from both the demand and supply sides, providing comprehensive and reliable insights into the market.

Market Definition

Artificial intelligence (AI) refers to the theory and development of computer systems capable of performing tasks that usually require human intelligence. AI involves the study & synthesis of intelligent agents—in this case, a computer system. The system perceives its environment and takes appropriate action to maximize success. AI is being developed to create expert systems and improve human intelligence in machines.

AI is used in the medical diagnostics market to analyze complex data from various imaging modalities and help end users interpret critical data points to diagnose disease conditions.

Stakeholders

-

Hospitals

-

Diagnostic care centers

-

Diagnostic laboratories

-

Radiologists and radiology clinics

-

Diagnostic imaging AI device manufacturers and suppliers

-

Medical research laboratories

-

Academic medical centers and universities

Report Objectives

-

To define, describe, and forecast artificial intelligence in the medical diagnostics market based on component, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the overall market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments concerning four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW)2

-

To profile the key players and comprehensively analyze their market shares and core competencies

-

To track and analyze competitive developments such as acquisitions, product launches/enhancements, expansions, agreements, collaborations, partnerships, and approvals in AI medical diagnostics market

Growth opportunities and latent adjacency in Artificial Intelligence (AI) in Medical Diagnostics Market