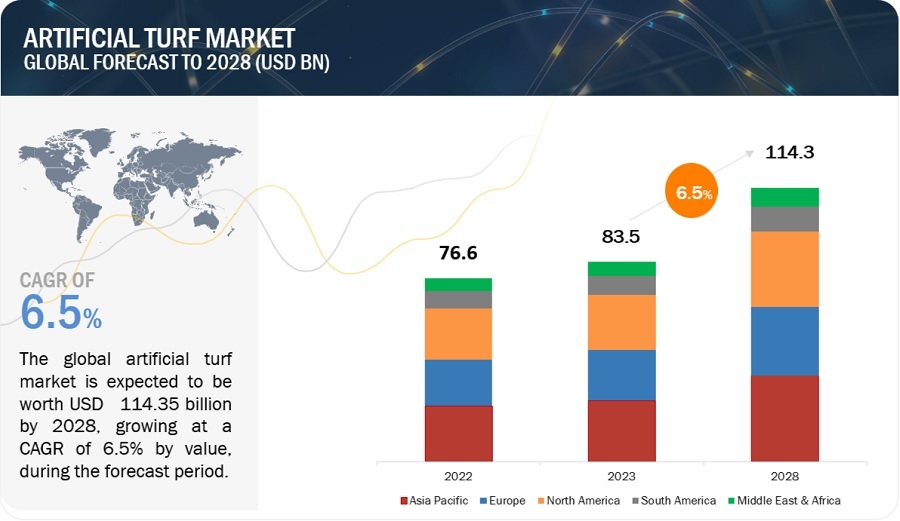

Artificial Turf Market by Material Type (Nylon, Polypropylene, Polyethylene), Filament Type (Monofilament, Multi-Filament), End-Use Industry (Building & Construction, Automotive, Artificial Grass), and Region - Global Forecast to 2028

Updated on : July 28, 2025

Artificial Turf Market

The global artificial turf market was valued at USD 76.6 billion in 2022 and is projected to reach USD 114.3 billion by 2028, growing at 6.5% cagr from 2023 to 2028. Numerous industries, including building & construction, automotive, artificial grass and others, consume artificial turf. The expansion of these sectors directly influences artificial turf demand.

Artificial Turf Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Artificial Turf Market

Artificial Turf Market Dynamics

Drivers: Water conservation

The water conservation of artificial turf market is a major driver of itsfor the popularity of artificial turf market. Artificial turf requires little water, fertilizer, or mowing, making it a more sustainable option than natural grass. In areas with water scarcity, artificial turf can be a valuable tool for conserving water and artificial turf emerges as an effective and sustainable solution to reduce water consumption significantly. This property makes artificial turf a reliable and durable material that can be used in a wide range of applications such as residential, Nnon-residential, automotive & transportation, artificial Ggrass., etc.

Artificial turf, with its synthetic grass blades and resilient backing, offers an appealing alternative to traditional natural grass lawns and landscapes. Its primary advantage lies is in its ability to thrive without constant irrigation, thereby circumventing the substantial water requirements associated with maintaining natural grass. For example, one study found that artificial turf athletic fields can save 500,000 to 1 million gallons of water per year (8.7 to 17.4 gallons/sq-ft), and that a turf lawn of 1,800 square feet can save 99,000 gallons of water per year, or about 70% of a homeowner's water bill. In California, where water conservation is a top priority, artificial turf is being used in a variety of settings, including schools, parks, and golf courses. The California Department of Water Resources estimates that artificial turf could save the state up to 500 billion gallons of water per year.

Restraints: Upfront cost of installation

The upfront cost of artificial turf is higher than the cost of natural grass. This is because artificial turf requires more materials and labor to install. However, the long-term cost of artificial turf is lower than the long-term cost of natural grass, as artificial turf requires less maintenance.

For homeowners considering artificial turf for their lawns, the cost of materials, labor, and installation can be notably higher than seeding or sodding with natural grass. This can discourage some homeowners, especially those with limited budgets. Commercial properties, sports facilities, and municipalities may face budget constraints that limit their ability to make the upfront investment in artificial turf. Other essential projects or operational costs may take precedence.

Opportunities: Expanding applications

The expanding applications of artificial turf present a burgeoning opportunity in a dynamic market. Beyond traditional uses, artificial turf is finding its place in urban landscapes, adorning rooftops, balconies, and even indoor spaces, fostering a connection to nature in the heart of cities. It i's becoming a favored choice for event venues, offering durability and customizability for various occasions. Sustainable landscaping practices are on the rise, where artificial turf combines with eco-friendly systems to reduce water consumption and manage stormwater sustainably. Moreover, iInnovations in sports surfaces make it suitable for an array range of sports beyond soccer and football, while institutional and commercial spaces are turning to synthetic grass for safety and aesthetics. Additionally, tThe pet industry is also embracing artificial turf for dog parks and pet-friendly facilities, further expanding its reach. In this landscape of diversification, artificial turf proves its adaptability, catering to a wide range of emerging market demands and trends while enhancing aesthetics, sustainability, and functionality across numerous applications.

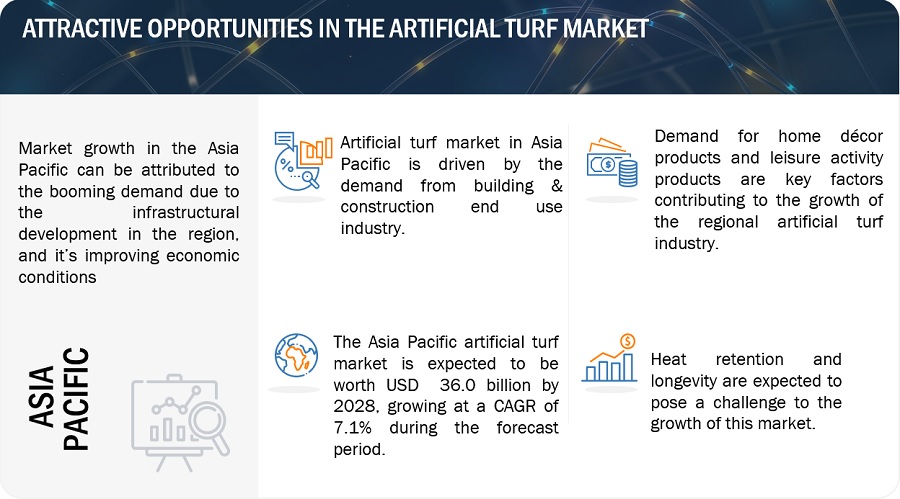

Challenges: heat retention in artificial turf

Heat retention in artificial turf poses a significant challenge, driven by concerns for player safety and comfort, limited usability during high-temperature conditions, and its contribution to urban heat islands. The eElevated surface temperatures can lead to heat-related injuries and discomfort, particularly in sports settings, affecting user experience and potentially deterring individuals from engaging in outdoor activities. Moreover, tThe environmental impact of localized heat islands also exacerbates the broader issue of urban warming. Addressing these challenges necessitates the development of cooling solutions without compromising the aesthetics and durability of artificial turf, making it a complex task for the industry.

In response to this challenge, innovative cooling technologies, such as heat-reflective infill materials and optimized turf construction, are being explored to mitigate heat retention. Striking a balance between safety and aesthetics while adhering to evolving regulations is crucial in finding effective solutions. Ensuring that artificial turf remains a comfortable and reliable surface for various applications, even in regions with hot climates, is imperative for the industry's continued growth and sustainability.

Artificial Turf Market Ecosystem

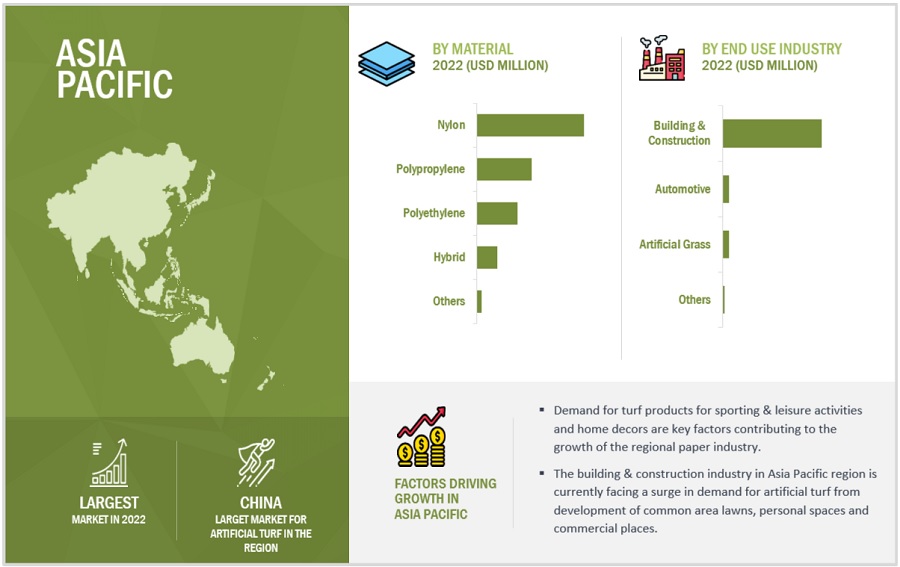

The Nylon material segment to account for the largest market share, in terms of value and volume

The artificial turf market, based on material type, has been segmented into polyethylene, polypropylene, nylon, hybrid (polypropylene + polyethylene), and others. These synthetic fibers impart a look and feel of artificial grass and form an important part of sports system. When artificial turf was initially introduced, nylon was used as a yarn fiber. It was used by Chemstrand, a division of Monsanto, in 1965. The high maintenance cost of natural grass is one of the major drivers for a shift toward artificial turf, made from synthetic fibers. It has gained immense popularity not only in the sports venues, but its application has expanded to residential lawns and commercial buildings.

Nylon was the first material utilised to make artificial turf. Its high strength and outstanding resilience make it an excellent choice for artificial turf makers. Even when used vigorously, it does not alter form. It is approximately 33% stronger than polyethylene and 26% stronger than polypropylene. When compared to polypropylene and polyethylene, it is the most costly synthetic fiber.

The multi-filament segment to account for the largest market share, in terms of value and volume

Multifilament fibers are made up of multiple strands of fiber that are twisted together. They are softer and more flexible than monofilament fibers, making them a good choice for playgrounds and other areas where a softer surface is desired. Multi-filament fibers are softer and more flexible, but they are not as durable as monofilament fibers.

Multi-filament artificial turf is a tough and adaptable synthetic turf variation distinguished by fiber made up of bundled smaller filaments, which are frequently constructed from polyethylene, polypropylene, or nylon. This artificial turf is valued for its remarkable endurance and resilience, making it an ideal choice for demanding applications such as sports fields, commercial landscaping, playgrounds, and public places. Multi-filament fibers are designed to survive intensive use and harsh circumstances while remaining visually pleasing. They are often utilised on soccer, football, and other sports fields, as well as in high-traffic commercial settings. Furthermore, because to its toughness and minimal care needs, multi-filament artificial turf provides a cushioned and safe surface for playgrounds and is used in golf course fairways, municipal parks, pet facilities, and even urban rooftop gardens.

Building & construction end-use industry to dominate the end use of the artificial turf market during the forecast period

Demand from the building & construction end-use industry is supported by increased investments in new housing constructions, and home renovation projects, such as the replacement of worn or out-of-style carpets. Factors such as moderate cost, ease of installation, and favorable aesthetics are expected to spur the demand for artificial turfs in newly built houses.

Artificial turf is widely employed in the building and construction end-use industry, particularly in the residential and non-residential sectors. Artificial turf applications in the residential sector include installations in new residential structures as well as repairs. Carpeting on floors improves aesthetic appeal and provides comfort. Carpets assist the user in achieving dynamic noise management, as well as providing comfort and safe, slop-resistant floors. Carpeting in residential buildings allows for temperature regulation. Another advantage of utilising carpets is that they are simple to maintain and do not require regular replacement.

In the non-residential sector, artificial turf is frequently utilised in healthcare, hospitality, education, retail, and workplace applications. The increased spending on office spaces and other commercial and institutional structures where carpets are extensively employed is likely to stimulate demand for artificial turf under current conditions. Non-residential building floors must endure high foot traffic and furniture loads. Carpet installation in non-residential constructions not only helps to reduce noise generated by footfall, but it also adds to the visual value of the interior space.

Asia Pacific holds the maximum share along with the maximum CAGR in terms of both, volume and value

The Asia Pacific region is expected to be the fastest-growing artificial turf market, with a CAGR of 7.1% from 2023 to 2028; it accounted for 30.4% of the market in 2022. Because of the demand from the building and construction, artificial turf business, the use of artificial turf is predicted to increase at a quicker rate. The key nations studied in this paper are China, India, Japan, and South Korea. The demand for artificial grass in Asia Pacific is mostly met by imports from North America and Europe. Increased wealth and purchasing power, a growing middle-class population, and demand for artificial turf from the building and construction industries all bode well for the artificial turf industry's future growth. China has a considerable market share in the Asia Pacific area for artificial turf.

To know about the assumptions considered for the study, download the pdf brochure

Artificial Turf Market Players

- DuPont (US)

- FieldTurf (Canada)

- Shaw Industries Group, Inc. (US)

- ACT Global (US)

- TigerTurf (US)

- Mohawk Industries, Inc. (US)

- Tarkett (France)

- Lowe’s Companies, Inc. (US)

- Interface, Inc. (US)

- Dixie Group, Inc. (US)

- Oriental Weavers (Egypt)

- Tai Ping Carpets International Limited (Hong Kong)

- Victoria PLC (UK)

- The Home Depot, Inc. (US)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the artificial turf industry. The study includes an in-depth competitive analysis of these key players in the artificial turf market, with their company profiles, recent developments, and key market strategies.

Read More: Artificial Turf Companies

Artificial Turf Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 76.6 billion |

|

Revenue Forecast in 2028 |

USD 114.3 billion |

|

CAGR |

6.5% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (Million Square Meters) |

|

Segments covered |

By Material type, By Filament type, By End-Use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

DuPont (US), FieldTurf (Canada),Shaw Industries Group, Inc. (US), ACT Global (US), TigerTurf (US), Mohawk Industries, Inc. (US), Tarkett (France), Lowe’s Companies, Inc. (US), Interface, Inc. (US), Dixie Group, Inc. (US), Oriental Weavers (Egypt), Tai Ping Carpets International Limited (Hong Kong), Victoria PLC (UK), The Home Depot, Inc, (US) |

Artificial Turf Market based on Material:

- Nylon

- Polypropylrne

- Polyethylene

- Hybrid (Polypropylene + Polyethylene)

- Others (Acrylic, Polyester)

Artificial Turf Market based on Filament:

- Monofilament

- Multi-Filament

Artificial Turf Market based on the end-use industry:

- Building & Construction

- Automotive

- Artificial Grass

- Others (Yoga & Exercise Mat, Upholstery)

Artificial Turf Market based on the region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2023, ForeverLawn, Inc. announced an official synthetic turf partnership with Cleveland Browns. This partnership allows the use of ForeverLawn’s SportsGrass product line for various turf applications along with future synthetic turf fields.

- In July 2022, Mohawk Industries, Inc. has agreed on the acquisition of Georgia-based Foss Floors. Foss Floors has expertise in needle-punch technology for nonwoven materials used in products such as carpets and artificial turfs.

- In April 2021, Lowe’s Companies, Inc. acquired the most trusted, and recognized carpet brand, Stainmaster as a well-established playern improvement in the home improvement retailer.

Frequently Asked Questions (FAQ):

Which are the key players of artificial turf market and what are their strategies to strengthen their market presence/shares?

Some of the key players of artificial turf market are DuPont (US), FieldTurf (Canada),Shaw Industries Group, Inc. (US), ACT Global (US), TigerTurf (US), Mohawk Industries, Inc. (US), Tarkett (France), Lowe’s Companies, Inc. (US), Interface, Inc. (US), Dixie Group, Inc. (US), Oriental Weavers (Egypt), Tai Ping Carpets International Limited (Hong Kong), Victoria PLC (UK), The Home Depot, Inc, (US), among others, are the key manufacturers that secured contracts, deals in the last few years. Agreements, expansions, technological developments, contracts, and deals was the key strategies adopted by these companies to strengthen their market presence.

What are the drivers and restraints for the artificial turf market?

Water conservation and all-weather usage are the major drivers for artificial turf market, while upfront cost of installation and release of microplastics is acting as a restraint for artificial turf market.

Which is the fastest growing country-level market for artificial turf market and what would be the reason of that growth?

China is the fastest-growing artificial turf market. The growth is due to the construction and infrastructure sectors which witness significant growth in India. Artificial turf is used in these industries.

What is the major factor on which the final price of artificial turf rely?

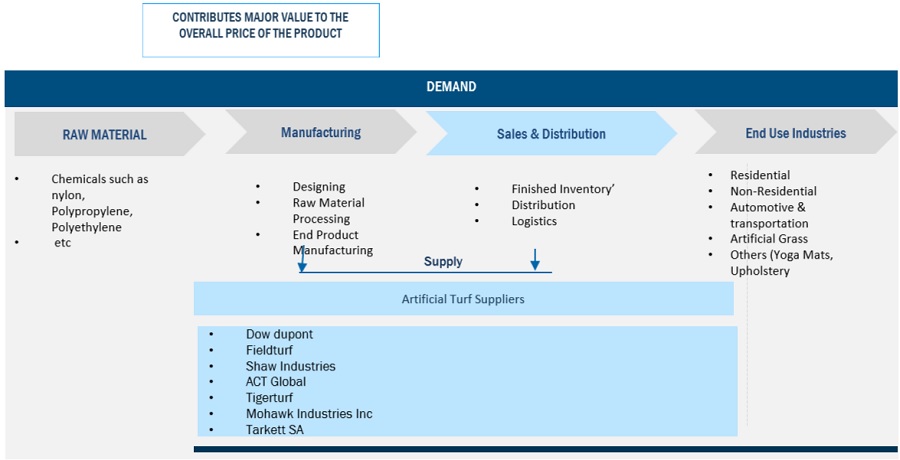

Price and availability of raw material along with the type of material and filament used plays an important role in determining the costs of the artificial turf.

Which region is expected to hold the highest market share?

Asia Pacific will dominate the market share in forecasted period i.e between 2023 to 2028, due to the huge demand coming from the countries like China, Japan, India and South Korea.

What is the biggest restraint in the artificial turf market?

The release of microplastics from artificial turf installations represents a notable restraint in the adoption of synthetic grass. Microplastics, tiny plastic particles shed from the synthetic grass fibers, raise environmental concerns as they can contaminate water bodies, soil, and potentially harm wildlife. Increased public awareness and regulatory scrutiny have intensified the need for mitigation efforts have an impact on the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Water conservation- All-weather useRESTRAINTS- Upfront cost of installation- Release of microplasticsOPPORTUNITIES- Expanding applications- New technologiesCHALLENGES- Quality and longevity- Heat retention in artificial turf

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY END-USE INDUSTRY (KEY PLAYERS)AVERAGE SELLING PRICE, BY MATERIAL TYPEAVERAGE SELLING PRICE, BY FILAMENT TYPE

- 5.6 AVERAGE SELLING PRICE TRENDS

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 TECHNOLOGY ANALYSIS

-

5.9 ECOSYSTEM MAPPING

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.13 KEY MARKETS FOR IMPORT/EXPORTCHINAUSNETHERLANDSFRANCE

-

5.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS IN ARTIFICIAL TURF MARKET

- 5.15 KEY CONFERENCES & EVENTS

-

5.16 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTSPATENTS BY POLYTEX SPORTBELAEGE PRODUKTIONS GMBHPATENTS BY DOW GLOBAL TECHNOLOGIES LLCPATENTS BY TEN CATE THIOLON B.V.TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 6.1 INTRODUCTION

-

6.2 NYLONHIGH STRENGTH AND DURABILITY TO DRIVE MARKET

-

6.3 POLYPROPYLENEINDOOR APPLICATIONS TO DRIVE MARKET

-

6.4 POLYETHYLENESOFTNESS AND DURABILITY TO DRIVE MARKET

-

6.5 HYBRID (POLYPROPYLENE + POLYETHYLENE)ENHANCED PROPERTIES OF MATERIAL TO DRIVE MARKET

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 MONOFILAMENTSUITABLE USE IN VARIOUS APPLICATIONS TO DRIVE MARKET

-

7.3 MULTI-FILAMENTCONTINUOUS DEVELOPMENTS AND INNOVATIONS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 BUILDING & CONSTRUCTIONWIDE APPLICATIONS IN RESIDENTIAL AND NON-RESIDENTIAL SECTORS TO DRIVE MARKET

-

8.3 AUTOMOTIVEAPPLICATIONS TO ENHANCE ESTHETICS AND COMFORT TO DRIVE MARKET

-

8.4 ARTIFICIAL GRASSINCREASING ADOPTION IN CONTACT SPORTS SEGMENT TO DRIVE MARKET

- 8.5 OTHERS

-

9.1 INTRODUCTIONARTIFICIAL TURF MARKET, BY REGION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPENORTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPENORTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRYNORTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY- US- Canada- Mexico

-

9.3 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: ARTIFICIAL TURF MARKET, BY MATERIAL TYPEEUROPE: ARTIFICIAL TURF MARKET, BY FILAMENT TYPEEUROPE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRYEUROPE: ARTIFICIAL TURF MARKET, BY COUNTRY- Germany- UK- France- Italy- Rest of Europe

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: ARTIFICIAL TURF MARKET, BY MATERIAL TYPEASIA PACIFIC: ARTIFICIAL TURF MARKET, BY FILAMENT TYPEASIA PACIFIC: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRYASIA PACIFIC: ARTIFICIAL TURF MARKET, BY COUNTRY- China- Japan- India- South Korea- Rest of Asia Pacific

-

9.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICASOUTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPESOUTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPESOUTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRYSOUTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY- Brazil- Argentina- Rest of South America

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPEMIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPEMIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY COUNTRY- Saudi Arabia- UAE- South Africa- Rest of Middle East & Africa

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 10.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

-

11.1 KEY COMPANIESDUPONT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIELDTURF- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHAW INDUSTRIES GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACT GLOBAL- Business overview- Products/Solutions/Services offered- MnM viewTIGERTURF- Business overview- Products/Solutions/Services offered- MnM viewMOHAWK INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTARKETT- Business overview- Products/Solutions/Services offered- MnM viewLOWE’S COMPANIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERFACE, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE DIXIE GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORIENTAL WEAVERS- Business overview- Products/Solutions/Services offered- MnM viewTAI PING- Business overview- Products/Solutions/Services offered- MnM viewVICTORIA PLC- Business overview- Products/Solutions/Services offered- MnM viewHOME DEPOT PRODUCT AUTHORITY LLC- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER COMPANIESEDEL GRASSSYNLAWNHATKOMANNINGTON MILLS, INC.BEAULIEU INTERNATIONAL GROUPENGINEERED FLOORS LLCROYALTY CARPET MILLS, INC.MILLIKENSIS PITCHESBELLINTURFCCGRASS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 ARTIFICIAL TURF MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 ARTIFICIAL TURF MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE, BY END-USE INDUSTRY (USD MILLION/MILLION SQUARE METER)

- TABLE 4 AVERAGE SELLING PRICE TRENDS IN ARTIFICIAL TURF MARKET, BY REGION

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 COMPARATIVE STUDY OF ARTIFICIAL TURF MANUFACTURING PROCESSES

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CURRENT STANDARD CODES FOR ARTIFICIAL TURF MARKET

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO ARTIFICIAL TURF AND RELATED MARKETS, 2023–2024

- TABLE 14 ARTIFICIAL TURF MARKET: GLOBAL PATENTS

- TABLE 15 ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 16 ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 17 NYLON: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NYLON: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 19 POLYPROPYLENE: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 POLYPROPYLENE: ARTIFICIAL TURF MARKET, BY REGION, 2 021–2028 (MILLION SQUARE METER)

- TABLE 21 POLYETHYLENE: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 POLYETHYLENE: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 23 HYBRID: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 HYBRID: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 25 OTHERS: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 OTHERS: ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 27 ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 28 ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 29 ARTIFICIAL TURF MARKET IN MONOFILAMENT TYPE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 ARTIFICIAL TURF MARKET IN MONOFILAMENT TYPE, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 31 ARTIFICIAL TURF MARKET IN MULTI-FILAMENT TYPE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 ARTIFICIAL TURF MARKET IN MULTI-FILAMENT TYPE, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 33 ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 34 ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 35 ARTIFICIAL TURF MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 ARTIFICIAL TURF MARKET IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 37 ARTIFICIAL TURF MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 ARTIFICIAL TURF MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 39 ARTIFICIAL TURF MARKET IN ARTIFICIAL GRASS END-USE INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 ARTIFICIAL TURF MARKET IN ARTIFICIAL GRASS END-USE INDUSTRY, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 41 ARTIFICIAL TURF MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 ARTIFICIAL TURF MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 43 ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 ARTIFICIAL TURF MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 45 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 47 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 49 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 51 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 53 US: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 54 US: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 55 CANADA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 56 CANADA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 57 MEXICO: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 58 MEXICO: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 59 EUROPE: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 61 EUROPE: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 62 EUROPE: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 63 EUROPE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 64 EUROPE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 65 EUROPE: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 67 GERMANY: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 68 GERMANY: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 69 UK: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 70 UK: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 71 FRANCE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 72 FRANCE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 73 ITALY: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 74 ITALY: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 75 REST OF EUROPE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 77 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 79 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 81 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 83 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 85 CHINA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 86 CHINA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 87 JAPAN: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 88 JAPAN: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 89 INDIA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 90 INDIA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 91 SOUTH KOREA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 92 SOUTH KOREA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 93 REST OF ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 95 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 96 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 97 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 98 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 99 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 100 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 101 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 103 BRAZIL: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 104 BRAZIL: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 105 ARGENTINA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 106 ARGENTINA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 107 REST OF SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 108 REST OF SOUTH AMERICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 109 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY MATERIAL TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 111 MIDDLE EAST & AFRICA: TURF MARKET, BY FILAMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY FILAMENT TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 113 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 115 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 117 SAUDI ARABIA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 118 SAUDI ARABIA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 119 UAE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 120 UAE: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 121 SOUTH AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 122 SOUTH AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL TURF MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 125 DEGREE OF COMPETITION: ARTIFICIAL TURF MARKET

- TABLE 126 COMPANY PRODUCT FOOTPRINT

- TABLE 127 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 128 COMPANY REGION FOOTPRINT

- TABLE 129 ARTIFICIAL TURF MARKET: KEY STARTUPS/SMES

- TABLE 130 ARTIFICIAL TURF MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 131 ARTIFICIAL TURF MARKET: DEALS, 2021–2028

- TABLE 132 DUPONT: COMPANY OVERVIEW

- TABLE 133 FIELDTURF: COMPANY OVERVIEW

- TABLE 134 SHAW INDUSTRIES GROUP, INC.: COMPANY OVERVIEW

- TABLE 135 ACT GLOBAL: COMPANY OVERVIEW

- TABLE 136 TIGERTURF: COMPANY OVERVIEW

- TABLE 137 MOHAWK INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 138 TARKETT: COMPANY OVERVIEW

- TABLE 139 LOWE’S COMPANIES, INC.: COMPANY OVERVIEW

- TABLE 140 INTERFACE, INC.: COMPANY OVERVIEW

- TABLE 141 THE DIXIE GROUP: COMPANY OVERVIEW

- TABLE 142 ORIENTAL WEAVERS: COMPANY OVERVIEW

- TABLE 143 TAI PING: COMPANY OVERVIEW

- TABLE 144 VICTORIA PLC: COMPANY OVERVIEW

- TABLE 145 HOME DEPOT PRODUCT AUTHORITY LLC: COMPANY OVERVIEW

- TABLE 146 EDEL GRASS: COMPANY OVERVIEW

- TABLE 147 SYNLAWN: COMPANY OVERVIEW

- TABLE 148 HATKO: COMPANY OVERVIEW

- TABLE 149 MANNINGTON MILLS, INC.: COMPANY OVERVIEW

- TABLE 150 BEAULIEU INTERNATIONAL GROUP: COMPANY OVERVIEW

- TABLE 151 ENGINEERED FLOORS LLC: COMPANY OVERVIEW

- TABLE 152 ROYALTY CARPET MILLS, INC.: COMPANY OVERVIEW

- TABLE 153 MILLIKEN: COMPANY OVERVIEW

- TABLE 154 SIS PITCHES: COMPANY OVERVIEW

- TABLE 155 BELLINTURF: COMPANY OVERVIEW

- TABLE 156 CCGRASS: COMPANY OVERVIEW

- FIGURE 1 ARTIFICIAL TURF MARKET SEGMENTATION

- FIGURE 2 ARTIFICIAL TURF MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 ARTIFICIAL TURF MARKET: DATA TRIANGULATION

- FIGURE 6 NYLON MATERIAL TYPE SEGMENT DOMINATED GLOBAL ARTIFICIAL TURF MARKET IN 2022

- FIGURE 7 MULTI-FILAMENT TYPE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 8 BUILDING & CONSTRUCTION INDUSTRY TO DOMINATE ARTIFICIAL TURF MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC LED ARTIFICIAL TURF MARKET IN 2022

- FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN ARTIFICIAL TURF MARKET BETWEEN 2023 AND 2028

- FIGURE 11 ASIA PACIFIC LARGEST MARKET IN 2022

- FIGURE 12 MULTI-FILAMENT TYPE SEGMENT DOMINATED MARKET IN 2022

- FIGURE 13 BUILDING & CONSTRUCTION END-USE INDUSTRY TO DOMINATE MARKET BY 2028

- FIGURE 14 CHINA TO BE FASTEST-GROWING ARTIFICIAL TURF MARKET, (2023–2028)

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ARTIFICIAL TURF MARKET

- FIGURE 16 ARTIFICIAL TURF MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES (USD/KG)

- FIGURE 18 AVERAGE SELLING PRICES BASED ON MATERIAL TYPE (USD MILLION/MILLION SQUARE METER)

- FIGURE 19 AVERAGE SELLING PRICES BASED ON FILAMENT TYPE (USD MILLION/MILLION SQUARE METER)

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 22 VALUE CHAIN ANALYSIS: ARTIFICIAL TURF MARKET

- FIGURE 23 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 24 GLOBAL PATENT PUBLICATION TREND: 2017–2022

- FIGURE 25 ARTIFICIAL TURF MARKET: LEGAL STATUS OF PATENTS

- FIGURE 26 GLOBAL JURISDICTION ANALYSIS

- FIGURE 27 POLYTEX SPORTBELAGE PRODUKTIONS-GMBH REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 28 NYLON MATERIAL TYPE SEGMENT TO DOMINATE ARTIFICIAL TURF MARKET BY 2028 (USD MILLION)

- FIGURE 29 MULTI-FILAMENT TYPE SEGMENT TO LEAD ARTIFICIAL TURF MARKET DURING FORECAST PERIOD

- FIGURE 30 BUILDING & CONSTRUCTION END-USE INDUSTRY SEGMENT TO DOMINATE ARTIFICIAL TURF MARKET DURING FORECAST PERIOD

- FIGURE 31 INDIA TO BE FASTEST-GROWING ARTIFICIAL TURF MARKET DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: ARTIFICIAL TURF MARKET SNAPSHOT

- FIGURE 33 EUROPE: ARTIFICIAL TURF MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: ARTIFICIAL TURF MARKET SNAPSHOT

- FIGURE 35 SHARE OF TOP COMPANIES IN ARTIFICIAL TURF MARKET

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN ARTIFICIAL TURF MARKET

- FIGURE 37 ARTIFICIAL TURF MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 39 DUPONT: COMPANY SNAPSHOT

- FIGURE 40 MOHAWK INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 41 TARKETT: COMPANY SNAPSHOT

- FIGURE 42 LOWE’S COMPANIES, INC.: COMPANY SNAPSHOT

- FIGURE 43 INTERFACE, INC.: COMPANY SNAPSHOT

- FIGURE 44 THE DIXIE GROUP: COMPANY SNAPSHOT

- FIGURE 45 TAI PING: COMPANY SNAPSHOT

- FIGURE 46 VICTORIA PLC: COMPANY SNAPSHOT

- FIGURE 47 HOME DEPOT PRODUCT AUTHORITY LLC: COMPANY SNAPSHOT

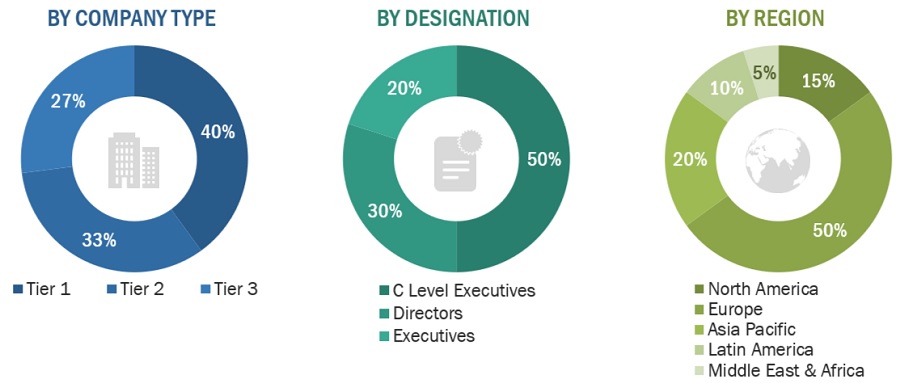

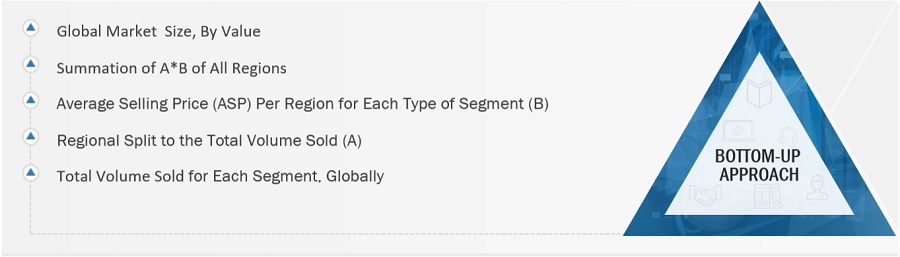

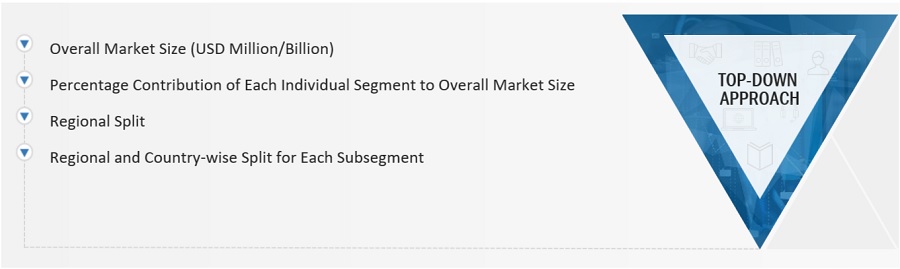

The study involved two major activities in estimating the current size of the artificial turf market. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering artificial turf and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the artificial turf market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the artificial turf market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from artificial turf industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the artificial turf industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of artificial turf and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

The research methodology used to estimate the size of the artificial turf market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations of artificial turf in different applications at a regional level. Such procurements provide information on the demand aspects of the artificial turf industry for each application. For each application, all possible segments of the artificial turf market were integrated and mapped.

Artificial turf Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial turf Market Size: Top Down Approach

Data Triangulation:

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Artificial turfs are man-made materials, that are used in making different application products such as carpets, artificial grass, yoga & exercise mats and others. Tufting is the process in which specialized multi-needle sewing machines are used to make carpets. Hundreds of rows of pile yarn which are tufted together through a backing fabric, called the primary backing, are stitched using several hundred needles. After setting the fibers, the carpet is dyed to obtain the desired color. Processed artificial turf finds application in diverse industries, including building & construction, automotive, artificial grass, and others.

Key Stakeholders

- Artificial turf manufacturers and distributors

- Key application segments for Artificial turf

- Research and consulting firms

- R&D institutions

- Associations and government institutions

- Environmental support agencies

Report Objectives:

- To estimate and forecast the size of the artificial turf market in terms of volume (Million Square Meters) and value (USD million)

- To define, describe, and forecast the size of the artificial turf market based on material type, filament type, end-use industry, and region

- To forecast the size of various segments of the market based on five main regions-—Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with major countries in each region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the artificial turf market across the globe

- To identify and profile key market players and analyze their core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Artificial Turf Market