Turf Protection Market by Product (Pest protection, Stress protection & Scarification), Solution ( Chemical, Biological & Mechanical), Mode of Application ( Soil, Seed & Foliar), Application (Sports & Recreational), & Region - Global Forecast to 2028

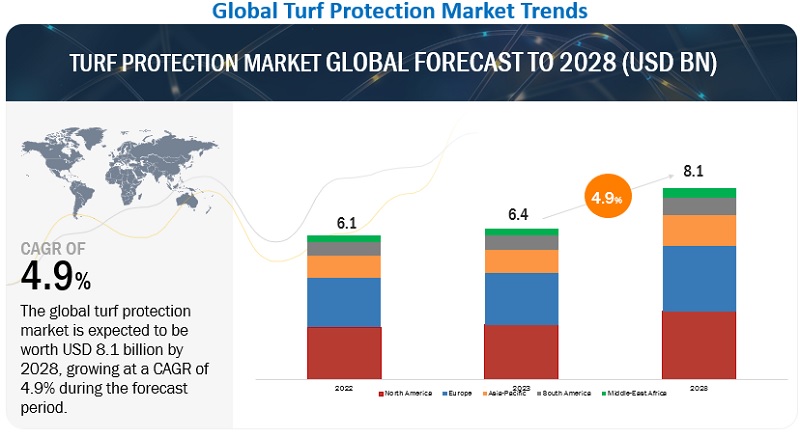

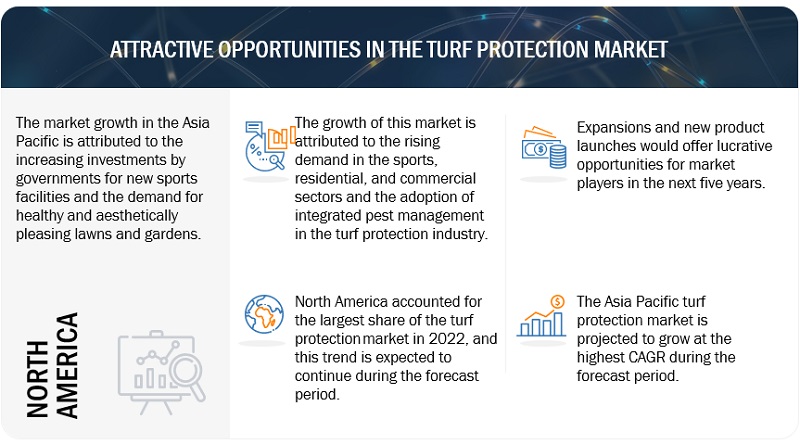

The global turf protection market is estimated to reach $8.1 billion by 2028, growing at a 4.9% compound annual growth rate (CAGR). The global market size was valued $6.4 billion in 2023. Owing to the increase in demand for sports, residential, and commercial sectors and the adoption of integrated pest management in the turf industry.

Key aspects of the turf protection market:

- Products and Solutions: This market offers a range of products and solutions designed to protect turf from damage caused by foot traffic, vehicles, inclement weather, or other factors. These may include turf reinforcement meshes, protective covers, erosion control products, temporary flooring systems, and specialized grass seed blends.

- Applications: Turf protection solutions are used in various applications such as sports stadiums and arenas, parks, construction sites, golf courses, racecourses, and outdoor events like concerts or festivals.

- Demand Drivers: Demand for turf protection products is driven by factors such as the increasing popularity of sports and outdoor events, the need for efficient land management practices, and the growing emphasis on environmental sustainability. Additionally, factors such as urbanization and climate change can also influence market dynamics.

- Environmental Concerns: With a greater focus on sustainability, there's a growing demand for turf protection solutions that are environmentally friendly and minimize harm to ecosystems. This includes products made from recycled materials, biodegradable options, and those that promote healthy soil and vegetation growth.

- Technological Advancements: Advances in materials science and engineering have led to the development of innovative turf protection products with enhanced durability, performance, and ease of installation. For instance, there are modular systems that allow for quick assembly and disassembly, as well as smart technologies for monitoring turf health and maintenance needs.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Increase in consumer demands from sports fields and residential areas and improvement in integrated pest management in the turf industry

The turf protection market continues to grow rapidly. Key factors contributing to this growth are an increase in demand from residential & commercial property development and increasing number of golf courses & other sports fields across the globe. Moreover, according to the survey, demand for apartments is at an all-time high. Also, around the world, there is also more investment being made in sports infrastructure. In the US, a number of sports clubs will start investing in new or refurbished stadiums in 2022. The Los Angeles Clippers of the National Basketball Association plan to invest USD 1.2 billion in the building of the facility.

Integrated Pest Management (IPM) systems that incorporate suitable control techniques to keep pest damage below an established threshold level are gaining acceptance in the turf industry. However, an IPM program should result in a more efficient use of pesticides, which usually means optimum usage of pesticides. Integrated pest management involves establishing a pest threshold level that is consistent with the intended function of the sports turf, thorough on-site monitoring & record-keeping, and consideration of different pest control measures.

RESTRAINT: Inconsistent regulations on synthetic chemicals

Regulatory compliance is one of the mandatory factors in the U.S. and in European countries, especially regarding the purchase, storage, application, and handling of insecticides, pesticides, and fertilizers used in golf courses and sports fields. European regulations pertaining to turf are more stringent; the European Union is considering legislation (Proposals for a Directive on the Sustainable Use of Pesticides) that would ban the use of synthetic chemicals such as insecticides and pesticides in urban areas. In order to achieve the goal of a just, healthy, and environmentally responsible food system set forth in the Farm to Fork Strategy, the Commission has proposed new regulations to minimize the use and risk of pesticides in the EU.

OPPORTUNITY: Rising demand for bio-based turf protection products

The turf protection market is dominated by synthetic chemicals. However, due to stringent regulations across countries and resistance by environmental agencies toward synthetic chemicals, bio-based formulations such as biofertilizers and biostimulants are being developed. Biostimulants, when used correctly, may enhance turf stress tolerance and quality. Naturally occurring organic materials are the best sources of biostimulants. For instance, humic acid and seaweed extract are the two commonly used turf biostimulants. Thus, with the increasing demand for bio-based products, the number of product launches and research studies is expected to increase in this field.

CHALLENGE: Gradual rise in usage of artificial turf

Artificial or synthetic turf was first introduced as an alternative to natural turf in 1960 since natural turf was expensive to maintain. This artificial turf had significant enhancements in appearance, performance, drainage, durability, quality, and safety.

The synthetic turf market is now booming in three major segments: athletic fields, landscaping, and golf courses. Almost 90% of the North American synthetic turf market is in the United States, with the majority of installations taking place in the Midwest, according to the Synthetic Turf Council's "Synthetic Turf Market Report: North America 2020".

Over the past few years, the demand for artificial grass has increased significantly due to three main factors: improved sustainability, improved performance, and improved usability. Artificial turf comes with certain added advantages, such as better playability, aesthetic appeal, durability, and safety for players. Artificial grass is widely regarded as being considerably more sustainable than natural turf and contributes to the preservation of the regional ecosystem due to the nearly complete elimination of watering requirements as well as the usage of pesticides and fertilizers.

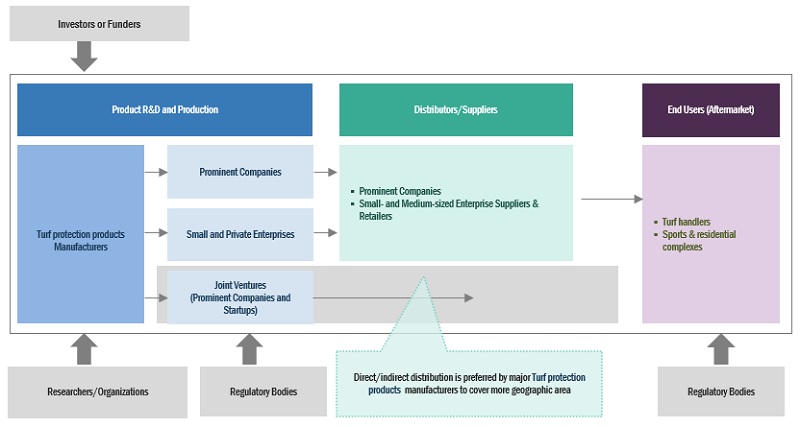

Turf Protection Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of turf protection. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Syngenta Crop Protection AG (Switzerland), UPL Limited (India), Corteva Agriscience (US), Nufarm (US), Bayer AG (Germany), BASF SE (Germany), SDS Biotech K.K. (Japan), AMVAC Chemical Corporation (US), Bioceres Crop Solutions (Argentina), Colin Campbell (Chemicals) Pty Ltd (Australia), ICL Group Ltd. (US), Andersons, Inc. (US), FMC Corporation (US), Soil Technologies Corporation (US), and CoreBiologic (US).

The adoption of foliar application is projected to drive the demand for the turf protection market

Foliar segment refers to the application of fertilizer, herbicides, and other turf management products directly to the leaves of the grass plant. This method of application has become increasingly popular in recent years as it allows for more targeted and efficient use of inputs.

One way in which the foliar segment is helping to grow the turf protection market is by improving the effectiveness of turf management products. When applied directly to the leaves of the grass plant, these products can be absorbed more quickly and efficiently, allowing for faster results and better overall performance.

The use of stress protection products in turf protection is expected to boost the market growth

Turf grass is an essential component of many landscapes, including golf courses, parks, athletic fields, and residential lawns. The demand for high-quality and resilient turf has increased in various applications such as sports fields and entertainment landscaping due to the benefits it offers. High-quality and resilient turf not only enhances the aesthetics of the landscape but also provides functional benefits such as improved playability, safety, and durability. However, turf grass can be subject to various types of stress, including abiotic and biotic stress. Abiotic stress refers to the non-living factors that can negatively affect the growth and health of turf grass, such as temperature extremes, drought, soil compaction, and exposure to chemicals. Biotic stress, on the other hand, is caused by living organisms such as pests, pathogens, and weeds. To protect turf grass from these stressful factors, a variety of products and techniques are available.

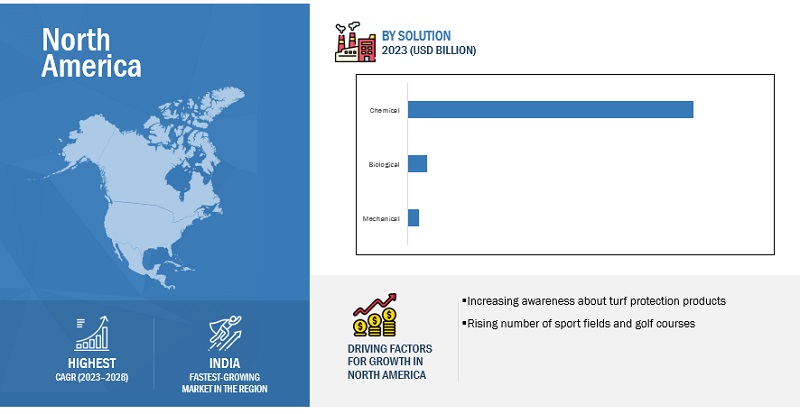

North America is expected to dominate the market during the forecast period

Countries such as the US, Canada, and Mexico have been considered in this study. Turf protection refers to the use of various products and techniques to protect natural or artificial turf from damage caused by environmental factors, heavy foot traffic, and other factors. The demand for turf protection products and services is driven by several factors, including the increasing popularity of outdoor sports and recreational activities, the growing use of artificial turf in landscaping and sports fields, and the need to maintain healthy and attractive lawns and landscapes.

The demand for turf protection products and services is particularly strong in developed countries with large and growing sports and landscaping industries. For example, in the United States, the demand for turf protection products and services is driven by the popularity of sports such as football, baseball, and soccer, as well as by the growing use of artificial turf in residential and commercial landscaping. According to a report by the Sports & Fitness Industry Association, participation in outdoor sports and fitness activities in the United States increased by 4.9% in 2020, despite the challenges posed by the COVID-19 pandemic. This trend is expected to continue in the coming years, driving demand for turf protection products and services.

Key Market Players

The key players in this include Syngenta Crop Protection AG (Switzerland), UPL Limited (India), Corteva Agriscience (US), Nufarm (US), Bayer AG (Germany), BASF SE (Germany), SDS Biotech K.K. (Japan), AMVAC Chemical Corporation (US), Bioceres Crop Solutions (Argentina), Colin Campbell (Chemicals) Pty Ltd (Australia), ICL Group Ltd. (US), Andersons, Inc. (US), FMC Corporation (US), Soil Technologies Corporation (US), and CoreBiologic (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Turf Protection Market Report

| Report Metric | Details |

|---|---|

| Base Year: | 2022 |

| Turf Protection Market Size in 2023: | USD 6.4 billion |

| Forecast Period: | 2023 to 2028 |

| Forecast Period 2023 to 2028 CAGR: | 4.9% |

| 2028 Value Projection: | USD 8.1 billion |

| No. of Pages: | 274 |

| Tables, & Figures: | 249 Tables, 71 Figures |

| Segments covered: | Product , Mode of Application, Solution, Application, and Region |

| Growth Drivers: |

|

Report Scope:

Turf protection Market:

By Product

- Pest protection

- Stress protection

- Scarification

By Mode of Application

- Foliar

- Seed

- Soil

By Solution

- Biological

- Chemical

- Mechanical

By Application

- Sports

- Recreational

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- In July 2021, BASF SE announced the introduction of Encartis, a new dual-active fungicide for golf course superintendents, turfgrass managers, and lawn care operators. Encartis combines the active ingredients of Intrinsic and Xzemplar fungicides, delivering a powerful tool for the control of turfgrass diseases, including anthracnose, brown patch, and dollar spot. This product launch expanded the company’s product portfolio for the turf protection market.

- In June 2020, Nufarm announced an extension of its partnership deal with Valent, a leading crop protection company. Under this partnership, Nufarm will continue to distribute Valent's herbicides, fungicides, and insecticides in Canada. This helped the company to increase its revenue flow.

Frequently Asked Questions (FAQ):

How big is the turf protection market?

The turf protection market size is expected to increase at a compound annual growth rate (CAGR) of 4.9% in terms of value, from USD 6.4 billion by 2023 to USD 8.1 billion by 2028.

Which players are involved in the manufacturing of turf protection market?

Syngenta Crop Protection AG (Switzerland), UPL Limited (India), Corteva Agriscience (US), Nufarm (US), Bayer AG (Germany), BASF SE (Germany), SDS Biotech K.K. (Japan), AMVAC Chemical Corporation (US), Bioceres Crop Solutions (Argentina), Colin Campbell (Chemicals) Pty Ltd (Australia), ICL Group Ltd. (US), Andersons, Inc. (US), FMC Corporation (US), Soil Technologies Corporation (US), and CoreBiologic (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for turf protection market?

On request, We will provide market size, key players, growth rate of this industry in the Oceania region.

What is the future growth potential of turf protection market?

The turf protection market demonstrates promising future growth potential, buoyed by several key factors. The increasing popularity of landscaping and recreational activities fuels the demand for turf protection products, essential for maintaining the visual appeal and functionality of lawns, sports fields, and public spaces. Investments in the sports industry, particularly in high-quality turf for stadiums and sports fields, contribute to the market's expansion as turf protection becomes crucial for ensuring durability and playability. Urbanization and infrastructure development projects further drive the need for turf protection solutions, preserving green spaces amidst urban growth.

What is the total CAGR expected to be recorded for the turf protection market during 2023-2028?

The CAGR is expected to record a CAGR of 4.9 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASED INVOLVEMENT IN OUTDOOR ACTIVITIESINCREASED RELIANCE ON USE OF FERTILIZERS FOR PRODUCTIVITY ENHANCEMENT

-

5.3 MARKET DYNAMICSDRIVERS- Rising demand from residential and commercial properties- Adoption of integrated pest management in turf industry- Increased emphasis on protecting turf from climate changeRESTRAINTS- Stringent and inconsistent regulations on synthetic chemicals- High R&D cost associated with formulating new active ingredientsOPPORTUNITIES- Rising demand for bio-based turf protection productsCHALLENGES- Gradual rise in usage of artificial turf

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND MANUFACTURINGPACKAGING, STORAGE, AND DISTRIBUTIONMARKETING, SALES, AND RETAIL

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM OF TURF PROTECTION MARKETDEMAND SIDESUPPLY SIDEECOSYSTEM MAP

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS IN TURF PROTECTION MARKET

-

6.6 TECHNOLOGY ANALYSISGENETICALLY MODIFIED BIOLOGICALS IN TURF PROTECTION PRODUCTSNANOTECHNOLOGY IN TURF PROTECTION CHEMICALS

-

6.7 PRICING ANALYSISSELLING PRICE OF TURF PROTECTION SOLUTIONS, BY KEY PLAYER

-

6.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

6.9 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 CASE STUDIESSYNGENTA'S PREVENTIVE APPROACH TO TURF PROTECTIONSYNGENTA FUNGICIDE

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.13 REGULATORY FRAMEWORKINTRODUCTIONWORLD HEALTH ORGANIZATION (WHO)REGULATIONS, BY COUNTRY/REGION- US- Canada- Mexico- Europe- China- India- Brazil- South Africa

-

6.14 PORTER’S FIVE FORCES ANALYSISTURF PROTECTION MARKET: PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 BIOLOGICALRISE IN DEMAND FOR NATURAL TURF PROTECTION TO DRIVE MARKET

-

7.3 CHEMICALAFFORDABILITY, LONGER SHELF LIFE, AND QUICK OUTCOMES—ADVANTAGES SUPPORTING MARKET GROWTH

-

7.4 MECHANICALINCREASING DEMAND FOR AESTHETIC LAWNS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 SEEDSEED TREATMENT IMPROVES SUCCESS RATE OF TURFGRASS

-

8.3 FOLIARINCREASING DEMAND FOR PRECISION AGRICULTURE TO SUPPORT MARKET GROWTH

-

8.4 SOILDEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PRACTICES TO RESULT IN INCREASED DEMAND FOR SOIL-BASED APPROACHES

- 9.1 INTRODUCTION

-

9.2 PEST PROTECTIONPESTICIDES HELP MAINTAIN HEALTHY, ATTRACTIVE, AND DURABLE TURFGRASS

-

9.3 STRESS PROTECTIONINCREASING FOCUS OF TURF GROWERS ON ABIOTIC STRESS PROTECTION TO DRIVE MARKET

-

9.4 SCARIFICATIONNEED FOR REGULAR TURF MAINTENANCE TO SUPPORT MARKET GROWTH

- 10.1 INTRODUCTION

-

10.2 SPORTSINCREASING POPULARITY OF SPORTS ACTIVITIES TO DRIVE MARKET

-

10.3 RECREATIONALRISING DEMAND FOR HIGH-QUALITY TURF PROTECTION PRODUCTS TO MAINTAIN AND ENHANCE TURF SURFACES TO SUPPORT MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increased interest in organic and environmentally friendly lawn care to drive marketCANADA- Increasing frequency and severity of droughts and other extreme weather events to support market growthMEXICO- Introduction of innovative turf protection products to aid market growth

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Growing demand for outdoor recreational activities to support market growthFRANCE- Technological advancements play a significant role in growth of turf protection marketUK- Growing demand for landscaping in commercial and residential spaces to propel marketRUSSIA- Challenging climatic conditions to drive demand for specialized turf protection productsREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing urbanization and green space development initiatives to drive marketINDIA- Growing demand for sports turf to drive marketJAPAN- Extreme weather conditions and government efforts to promote sports to propel market growthAUSTRALIA AND NEW ZEALAND- Government investments in sports infrastructure to drive marketREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increasing number of sports facilities in Brazil to drive demand for turf protection productsARGENTINA- Strong tradition of sports to result in increased demand for turf protection productsREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTAFRICA- Government investments in infrastructural development to drive marketMIDDLE EAST- Tourism industry major driver for turf protection products and services

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

12.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSSYNGENTA CROP PROTECTION AG- Business overview- Products offered- Recent developments- MnM viewUPL LIMITED- Business overview- Products offered- Recent developments- MnM viewCORTEVA AGRISCIENCE- Business overview- Products offered- Recent developments- MnM viewNUFARM- Business overview- Products offered- Recent developments- MnM viewBAYER AG- Business overview- Products offered- Recent developments- MnM viewBASF SE- Business overview- Products offered- Recent developments- MnM viewAMVAC CHEMICAL CORPORATION- Business overview- Products offered- Recent developments- MnM viewBIOBEST GROUP NV- Business overview- Products offered- Recent developments- MnM viewBIOCERES CROP SOLUTIONS- Business overview- Products offered- Recent developments- MnM viewCOLIN CAMPBELL (CHEMICALS) PTY LTD- Business overview- Products offered- Recent developments- MnM viewICL GROUP LTD.- Business overview- Products offered- Recent developments- MnM viewTHE ANDERSONS, INC.- Business overview- Products offered- Recent developments- MnM viewFMC CORPORATION- Business overview- Products offered- Recent developments- MnM viewSOIL TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developments- MnM viewCOREBIOLOGIC- Business overview- Products offered- Recent developments- MnM view

-

13.3 START UPS/SMESTERAGANIX HOLDINGS, LLC- Business overview- Products offered- Recent developments- MnM viewPUREAG LLC- Business overview- Products offered- Recent developments- MnM viewAGRICHEM- Business overview- Products offered- Recent developments- MnM viewBACTIVATE- Business overview- Products offered- Recent developments- MnM viewSDS BIOTECH K.K.- Business overview- Products offered- Recent developments- MnM viewBIOIBERICA S.A.U.BIO HUMA NETICS, INC.LEBANON SEABOARD CORPORATIONKALOPBI-GORDON CORPORATION

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 BIOFERTILIZERS MARKETMARKET DEFINITIONMARKET OVERVIEWBIOFERTILIZERS MARKET, BY TYPEBIOFERTILIZERS MARKET, BY REGION

-

14.4 CROP PROTECTION CHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEWCROP PROTECTION CHEMICALS MARKET, BY TYPECROP PROTECTION CHEMICALS MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2022

- TABLE 2 TURF PROTECTION MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 TURF PROTECTION MARKET: ECOSYSTEM MAP

- TABLE 4 AVERAGE SELLING PRICE FOR TURF PROTECTION SOLUTIONS, 2022 (USD/KT)

- TABLE 5 PEST PROTECTION: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KT)

- TABLE 6 STRESS PROTECTION: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KT)

- TABLE 7 SCARIFICATION: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KT)

- TABLE 8 LIST OF PATENTS IN TURF PROTECTION, 2019–2021

- TABLE 9 EXPORT DATA OF CHEMICALS (INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, AND PLANT GROWTH REGULATORS) FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 10 IMPORT DATA OF CHEMICALS (INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, AND PLANT GROWTH REGULATORS) FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 11 KEY CONFERENCES AND EVENTS IN TURF PROTECTION MARKET

- TABLE 12 APPROACH TO TURF PROTECTION AND EDUCATE CUSTOMERS ON IMPORTANCE OF PREVENTIVE MEASURES

- TABLE 13 EFFECTIVE FUNGICIDE USED TO CONTROL DISEASES IN TURFGRASS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 19 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 20 TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 21 TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 22 BIOLOGICAL: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 BIOLOGICAL: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CHEMICAL: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 CHEMICAL: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MECHANICAL: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 MECHANICAL: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 29 TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 SEED: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 SEED: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 FOLIAR: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 FOLIAR: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 SOIL: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 SOIL: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 37 TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 38 TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 39 TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 40 PEST PROTECTION: TURF PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 41 PEST PROTECTION: TURF PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 PEST PROTECTION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 PEST PROTECTION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 PEST PROTECTION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (KT)

- TABLE 45 PEST PROTECTION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (KT)

- TABLE 46 STRESS PROTECTION: TURF PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 47 STRESS PROTECTION: TURF PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 STRESS PROTECTION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 STRESS PROTECTION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 STRESS PROTECTION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (KT)

- TABLE 51 STRESS PROTECTION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (KT)

- TABLE 52 SCARIFICATION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 SCARIFICATION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 SCARIFICATION: TURF PROTECTION MARKET, BY REGION, 2018–2022 (KT)

- TABLE 55 SCARIFICATION: TURF PROTECTION MARKET, BY REGION, 2023–2028 (KT)

- TABLE 56 TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 57 TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 SPORTS: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 SPORTS: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 RECREATIONAL: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 RECREATIONAL: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 TURF PROTECTION MARKET, BY REGION, 2018–2022 (KT)

- TABLE 65 TURF PROTECTION MARKET, BY REGION, 2023–2028 (KT)

- TABLE 66 NORTH AMERICA: TURF PROTECTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: TURF PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 73 NORTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 74 NORTH AMERICA: PEST PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: PEST PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: STRESS PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: STRESS PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 US: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 83 US: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 85 CANADA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 86 MEXICO: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 87 MEXICO: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: TURF PROTECTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: TURF PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 95 EUROPE: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 96 EUROPE: PEST PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: PEST PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: STRESS PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: STRESS PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 101 EUROPE: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 105 GERMANY: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 106 FRANCE: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 107 FRANCE: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 108 UK: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 109 UK: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 110 RUSSIA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 111 RUSSIA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TURF PROTECTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TURF PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 121 ASIA PACIFIC: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 122 ASIA PACIFIC: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PEST PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PEST PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: STRESS PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: STRESS PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 131 CHINA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 132 INDIA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 133 INDIA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 134 JAPAN: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 135 JAPAN: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 136 AUSTRALIA AND NEW ZEALAND: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 137 AUSTRALIA AND NEW ZEALAND: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 140 SOUTH AMERICA: TURF PROTECTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 141 SOUTH AMERICA: TURF PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 147 SOUTH AMERICA: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 148 SOUTH AMERICA: PEST PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PEST PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: STRESS PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 151 SOUTH AMERICA: STRESS PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 152 SOUTH AMERICA: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 155 SOUTH AMERICA: TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 BRAZIL: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 157 BRAZIL: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 158 ARGENTINA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 159 ARGENTINA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: TURF PROTECTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 163 REST OF THE WORLD: TURF PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: TURF PROTECTION MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 169 REST OF THE WORLD: TURF PROTECTION MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 170 REST OF THE WORLD: PEST PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: PEST PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: STRESS PROTECTION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: STRESS PROTECTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 REST OF THE WORLD: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: TURF PROTECTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: TURF PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 AFRICA: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 179 AFRICA: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST: TURF PROTECTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST: TURF PROTECTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 182 TURF PROTECTION MARKET: DEGREE OF COMPETITION

- TABLE 183 STRATEGIES ADOPTED BY KEY TURF PROTECTION MANUFACTURERS

- TABLE 184 COMPANY FOOTPRINT, BY SOLUTION

- TABLE 185 COMPANY FOOTPRINT, BY MODE OF APPLICATION

- TABLE 186 COMPANY FOOTPRINT, BY REGION

- TABLE 187 OVERALL COMPANY FOOTPRINT

- TABLE 188 TURF PROTECTION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 189 TURF PROTECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 TURF PROTECTION MARKET: KEY PRODUCT LAUNCHES

- TABLE 191 TURF PROTECTION MARKET: KEY DEALS

- TABLE 192 TURF PROTECTION MARKET: OTHER KEY DEVELOPMENTS

- TABLE 193 SYNGENTA CROP PROTECTION AG: BUSINESS OVERVIEW

- TABLE 194 SYNGENTA CROP PROTECTION AG: PRODUCTS OFFERED

- TABLE 195 SYNGENTA CROP PROTECTION AG: DEALS

- TABLE 196 UPL LIMITED: BUSINESS OVERVIEW

- TABLE 197 UPL LIMITED: PRODUCTS OFFERED

- TABLE 198 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- TABLE 199 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 200 NUFARM: BUSINESS OVERVIEW

- TABLE 201 NUFARM: PRODUCTS OFFERED

- TABLE 202 NUFARM: DEALS

- TABLE 203 NUFARM: OTHER DEVELOPMENTS

- TABLE 204 BAYER AG: BUSINESS OVERVIEW

- TABLE 205 BAYER AG: PRODUCTS OFFERED

- TABLE 206 BAYER AG: DEALS

- TABLE 207 BASF SE: BUSINESS OVERVIEW

- TABLE 208 BASF SE: PRODUCTS OFFERED

- TABLE 209 BASF SE: PRODUCT LAUNCHES

- TABLE 210 AMVAC CHEMICAL CORPORATION: BUSINESS OVERVIEW

- TABLE 211 AMVAC CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 212 AMVAC CHEMICAL CORPORATION: PRODUCT LAUNCHES

- TABLE 213 BIOBEST GROUP NV: BUSINESS OVERVIEW

- TABLE 214 BIOBEST GROUP NV: PRODUCTS OFFERED

- TABLE 215 BIOCERES CROP SOLUTIONS: BUSINESS OVERVIEW

- TABLE 216 BIOCERES CROP SOLUTIONS: PRODUCTS OFFERED

- TABLE 217 BIOCERES CROP SOLUTION: DEALS

- TABLE 218 COLIN CAMPBELL (CHEMICALS) PTY LTD: BUSINESS OVERVIEW

- TABLE 219 COLIN CAMPBELL (CHEMICALS) PTY LTD: PRODUCTS OFFERED

- TABLE 220 ICL GROUP LTD.: BUSINESS OVERVIEW

- TABLE 221 ICL GROUP LTD.: PRODUCTS OFFERED

- TABLE 222 THE ANDERSONS, INC.: BUSINESS OVERVIEW

- TABLE 223 THE ANDERSONS, INC.: PRODUCTS OFFERED

- TABLE 224 THE ANDERSONS, INC.: DEALS

- TABLE 225 FMC CORPORATION: BUSINESS OVERVIEW

- TABLE 226 FMC CORPORATION: PRODUCTS OFFERED

- TABLE 227 SOIL TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 228 SOIL TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 229 COREBIOLOGIC: BUSINESS OVERVIEW

- TABLE 230 COREBIOLOGIC: PRODUCTS OFFERED

- TABLE 231 TERAGANIX HOLDINGS, LLC: BUSINESS OVERVIEW

- TABLE 232 TERAGANIX HOLDINGS, LLC: PRODUCTS OFFERED

- TABLE 233 PUREAG LLC: BUSINESS OVERVIEW

- TABLE 234 PUREAG LLC: PRODUCTS OFFERED

- TABLE 235 AGRICHEM: BUSINESS OVERVIEW

- TABLE 236 AGRICHEM: PRODUCTS OFFERED

- TABLE 237 BACTIVATE: BUSINESS OVERVIEW

- TABLE 238 BACTIVATE: PRODUCTS OFFERED

- TABLE 239 SDS BIOTECH K.K.: BUSINESS OVERVIEW

- TABLE 240 SDS BIOTECH K.K.: PRODUCTS OFFERED

- TABLE 241 ADJACENT MARKETS TO TURF PROTECTION

- TABLE 242 BIOFERTILIZERS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 243 BIOFERTILIZERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 244 BIOFERTILIZERS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 245 BIOFERTILIZERS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 246 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016–2019 (USD MILLION)

- TABLE 247 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 248 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 249 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2020–2025 (USD MILLION)

- FIGURE 1 TURF PROTECTION MARKET SEGMENTATION

- FIGURE 2 TURF PROTECTION MARKET: REGIONAL SEGMENTATION

- FIGURE 3 TURF PROTECTION MARKET: RESEARCH DESIGN

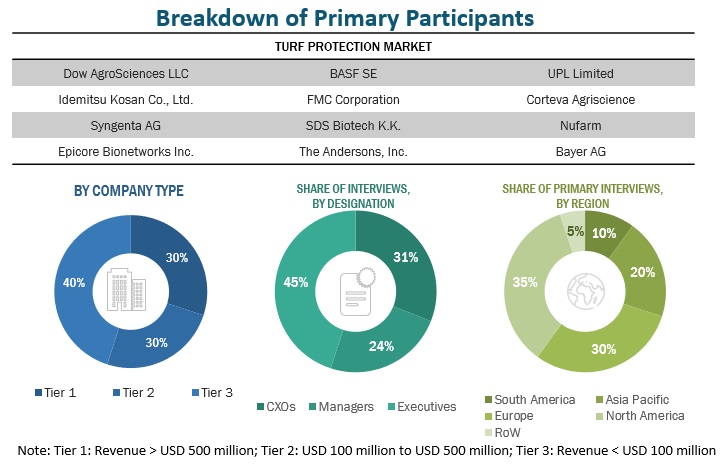

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 TURF PROTECTION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 TURF PROTECTION MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 TURF PROTECTION MARKET SIZE ESTIMATION, BY SIZE (SUPPLY SIDE)

- FIGURE 8 TURF PROTECTION MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 WORLD INFLATION RATE, 2011–2021

- FIGURE 12 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON TURF PROTECTION MARKET

- FIGURE 14 GLOBAL TURF PROTECTION MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 15 TURF PROTECTION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 TURF PROTECTION MARKET, BY SOLUTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 TURF PROTECTION MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 TURF PROTECTION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 TURF PROTECTION MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 RISING DEMAND IN SPORTS, RESIDENTIAL, AND COMMERCIAL SECTORS TO DRIVE MARKET

- FIGURE 21 FOLIAR SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 22 BIOSTIMULANTS AND CHEMICAL SEGMENTS ACCOUNTED FOR LARGEST MARKET SHARES IN 2022

- FIGURE 23 US ACCOUNTED FOR LARGEST SHARE OF TURF PROTECTION MARKET IN 2022

- FIGURE 24 NORTH AMERICA DOMINATED TURF PROTECTION SOLUTIONS MARKET IN 2022

- FIGURE 25 US: HIGHEST CROSS-PARTICIPATION IN OUTDOOR ACTIVITIES, 2021

- FIGURE 26 TURF PROTECTION MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 TURF PROTECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 TURF PROTECTION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 TURF PROTECTION MARKET: ECOSYSTEM MAP

- FIGURE 30 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN TURF PROTECTION MARKET

- FIGURE 31 SELLING PRICE OF KEY PLAYERS FOR TURF PROTECTION SOLUTIONS

- FIGURE 32 AVERAGE SELLING PRICE, BY PRODUCT, 2018–2022 (USD/KT)

- FIGURE 33 NUMBER OF PATENTS GRANTED FOR TURF PROTECTION, 2011–2022

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR TURF PROTECTION, 2019–2022

- FIGURE 35 CHEMICAL (INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, AND PLANT GROWTH REGULATORS) EXPORTS, BY KEY COUNTRY, 2018–2021 (USD THOUSAND)

- FIGURE 36 CHEMICAL (INSECTICIDES, RODENTICIDES, FUNGICIDES, HERBICIDES, AND PLANT GROWTH REGULATORS) IMPORTS, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TURF PROTECTION APPLICATIONS

- FIGURE 38 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 39 MECHANICAL SEGMENT TO REGISTER HIGHEST GROWTH RATE FROM 2023 TO 2028

- FIGURE 40 SEED SEGMENT TO DOMINATE TURF PROTECTION MARKET DURING FORECAST PERIOD

- FIGURE 41 PEST PROTECTION SEGMENT TO DOMINATE TURF PROTECTION MARKET DURING FORECAST PERIOD

- FIGURE 42 SPORTS SEGMENT TO DOMINATE TURF PROTECTION MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC MARKET TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC

- FIGURE 45 NORTH AMERICA: TURF PROTECTION MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 47 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 48 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 49 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 50 ASIA PACIFIC: TURF PROTECTION MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 52 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 53 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 54 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 55 BRAZIL: NUMBER OF SPORTS CLUBS AND FACILITIES, 2016–2019

- FIGURE 56 REST OF THE WORLD: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 57 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 58 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

- FIGURE 59 TURF PROTECTION MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 60 TURF PROTECTION MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 61 SYNGENTA CROP PROTECTION AG: COMPANY SNAPSHOT

- FIGURE 62 UPL LIMITED: COMPANY SNAPSHOT

- FIGURE 63 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 64 NUFARM: COMPANY SNAPSHOT

- FIGURE 65 BAYER AG: COMPANY SNAPSHOT

- FIGURE 66 BASF SE: COMPANY SNAPSHOT

- FIGURE 67 AMVAC CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 BIOCERES CROP SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 69 ICL GROUP LTD.: COMPANY SNAPSHOT

- FIGURE 70 THE ANDERSONS, INC.: COMPANY SNAPSHOT

- FIGURE 71 FMC CORPORATION: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the turf protection market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), CropLife Europe, U.S. Environment Protection Agency, Plant Protection Association of India, International Association for the Plant Protection Sciences, Organization for Economic Co-operation & Developments (OECD), were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The turf protection market comprises several stakeholders, including turf protection manufacturers and suppliers, golf terrain developers, sports and recreational landscape developers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, turf protection distributors and wholesalers, importers & exporters of turf protection, turf protection manufacturers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of sports and golf landscape developing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the turf protection market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the protein ingredients and plant-based protein market—was considered to validate further the market details of turf protection .

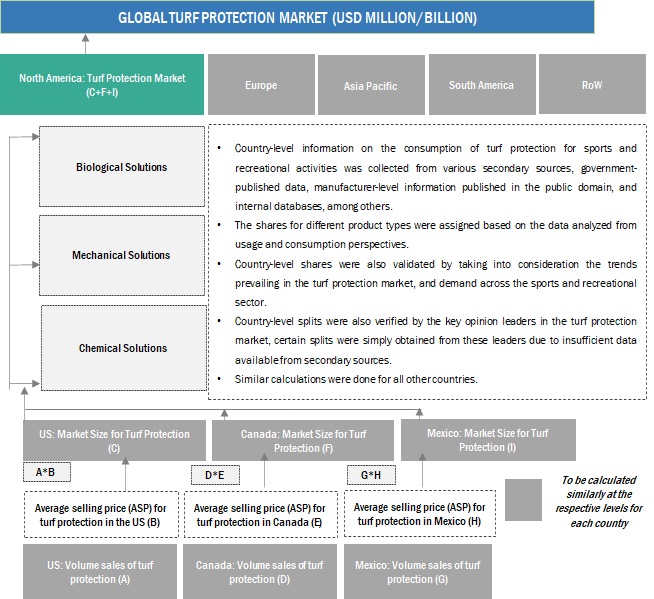

Bottom-up approach:

-

- The market size was analyzed based on the share of each type of turf protection and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include demand within the supply chain including food and feed industry; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting turf protection market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market size estimation: Bottom-up approach

In the bottom-up approach, each country's market size for turf protection and the product types and application, including sports and recreational, was arrived at through secondary sources, such as annual reports, investor presentations, journals, and government publications. The bottom-up procedure was also implemented on the data extracted from secondary research to validate the market segment sizes obtained.

The penetration rate of each solution of turf protection as a percentage of the application sector in each country was calculated from secondary sources. Country-level data for turf protection were estimated based on the adoption rate of each solution of turf protection within the application sector. The mode of application of each product type was tracked via product mapping and studied for its penetration level to estimate the market size at the regional level. Each product type was studied for its commercially available mode of application and product type. The market size arrived at was further validated by primary respondents.

Turf Protection Market size estimation: bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

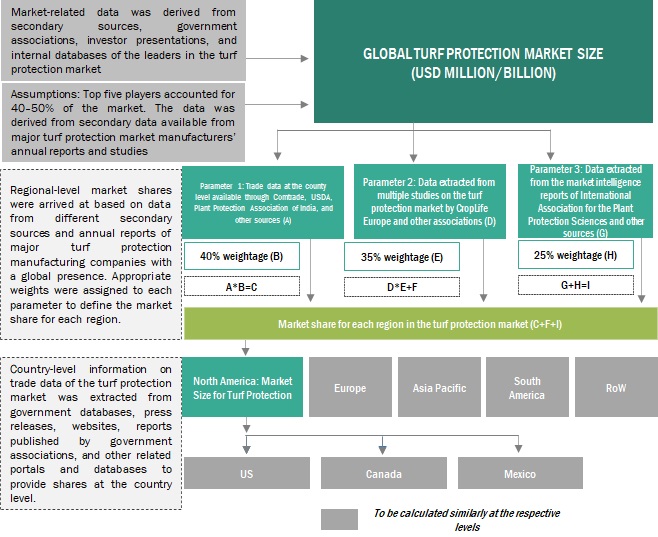

Market size estimation methodology: top-down approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Secondary reports from CropLife Europe, the US Environment Protection Agency, the Plant Protection Association of India, and the International Association for the Plant Protection Sciences were considered. Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of manufacturing units, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Turf Protection Market size estimation: top-down approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall turf protection market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The turf protection market studies the products used for the cultivation, maintenance, and safeguarding of all types of turf grass. These include products such as stimulants, fertilizers, and pesticides used on turfs and lawns.

- According to The Michigan Department of Agriculture and Rural Development (MDARD), a material that is employed for its plant nutrient content and is intended for use or is said to have value in encouraging plant development is referred to as fertilizer if it contains one or more recognized plant nutrients. Unprocessed animal and vegetable manures, marl, lime, limestone, wood ashes, and other substances exempted by regulations issued under this article are not considered fertilizer.

-

Different methods are used to control insect pests that harm turfgrass. In addition to utilizing pesticides, integrated pest management also makes use of economic thresholds, scouting, resistant cultivars, cultural practices, and natural parasites, predators, and illnesses. The United States Environmental Protection Agency Pesticide law defines a “pesticide” (with certain minor exceptions) as:

- Any substance or mixture of substances intended for preventing, destroying, repelling, or mitigating any pest.

- Any substance or mixture of substances intended for use as a plant regulator, defoliant, or desiccant.

- The USDA considers a plant biostimulant to be “a substance or micro-organism that, when applied to seeds, plants, or the rhizosphere, stimulates natural processes to enhance or benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, or crop quality and yield.” The usage of biostimulants can enhance turf quality and performance by enhancing their capacity to endure abiotic stress. Biostimulants have been acknowledged as a good method for making grass more sustainable and environmentally friendly.

Key Stakeholders

- Supply-side: Manufacturers (pesticide, insecticide, biostimulants, plant growth regulators, moss killers, and biofertilizers), scarification equipment manufacturers, suppliers, distributors, importers, and exporters

- Demand-side: Turf handlers, sports, landscape, and lawn owners, and research organizations

- Regulatory-side: Related government authorities, commercial research & development (R&D) institutes, and other regulatory bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the turf protection market based on source, type, nature, method of extraction, form, application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the turf protection market

Competitive Intelligence

- Identifying and profiling the key market players in the turf protection market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the turf protection market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European turf protection market, by key country

- Further breakdown of the Rest of South America turf protection market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Turf Protection Market