Aseptic Sampling Market by Type (Manual [Type (Traditional, Single-use), Product (Bags, Bottles, Syringes, Accessories)], Automatic), Application (Upstream, Downstream), Technique (Off-line, On-line), End User (R&D, CMO, CRO) - Global Forecast to 2025

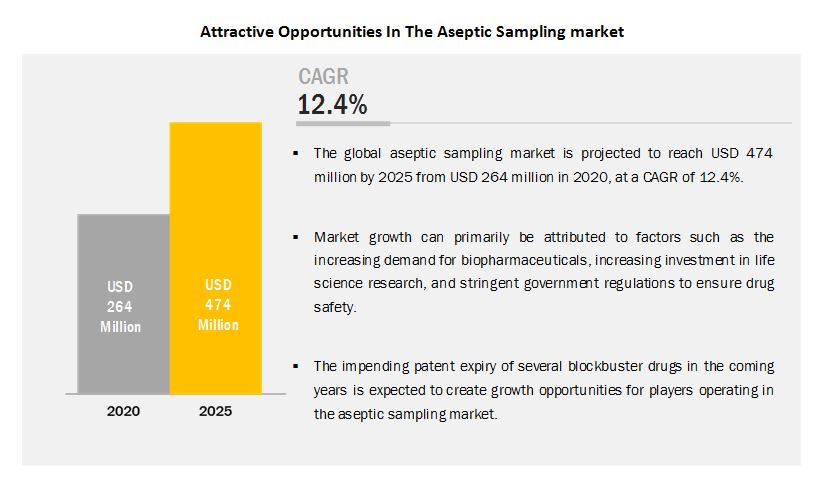

[138 Pages Report] The global aseptic sampling market is projected to reach USD 474 million by 2025 from USD 264 million in 2020, at a CAGR of 12.4% between 2020 and 2025. The growth of this market is driven majorly by the increasing demand for biopharmaceuticals, stringent government regulations to ensure drug safety, and funding to support life sciences research activities. On the other hand, issues related to leachables and extractables from single-use products is restraining market growth.

In 2019, biotechnology and pharmaceutical manufacturers held the largest share of the aseptic sampling market, by end user

Based on end user, the aseptic sampling market is segmented into biotechnology and pharmaceutical manufacturers, contract research and manufacturing organizations, R&D departments, and other end users. In 2019, biotechnology and pharmaceutical manufacturers segment dominated this market owing to the increasing adoption of aseptic sampling in existing manufacturing facilities owing to advantages such as low capital cost and easy implementation.

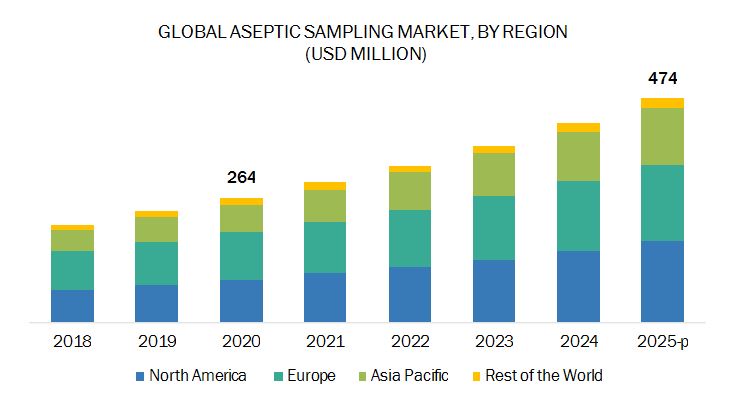

The Asia Pacific aseptic sampling market is expected to grow at the highest CAGR during the forecast period

The Asia Pacific is expected to grow at the highest rate in the aseptic sampling market. The major factors driving the growth of this market include the expanding biomanufacturing sector, increasing government support, developing R&D infrastructure, and the growing outsourcing of bioproduction processes to this region from North America and Europe.

Key Market Players

The prominent players in the aseptic sampling market include Sartorius Stedim Biotech (France), Merck Millipore (Germany), Danaher Corporation (US), and Thermo Fisher Scientific (US), Saint-Gobain (France), GEA Group (Germany), Avantor, Inc. (US), QualiTru Sampling Systems (US), Keofitt (Denmark), GEMÜ Group (US), W. L. Gore & Associates (US), Flownamics Analytical Instruments, Inc. (US), Lonza (Switzerland), and Trace Analytics (US). Major players have focused on expansion, agreements, and partnerships to increase their shares in the global aseptic sampling market.

Merck is one of the leading players in the aseptic sampling market. The company’s leading position can be attributed to its extensive portfolio of aseptic sampling and a strong geographical footprint. The company focuses on the high-growth Asia region to increase its market share and revenue. In the last three years, the company opened life science centers in China, India, South Korea, and Singapore, in order to facilitate the supply of its products in the region. Such developments help in expanding Merck’s presence in the aseptic sampling market, thus maintaining its leading position.

Recent Developments:

- In 2020, Merck announced its plans for the construction of a new biotech development facility in Switzerland. The facility will focus on the development of biotech medicines and manufacturing for clinical studies. The company will be investing USD 282.5 million for this purpose.

- In 2020, Thermo Fisher Scientific announced to invest USD 475 million in its new capabilities and capacities to cater to the increasing demand for new biologics, cell and gene therapies, and drug products. This investment, in addition to those made in 2019, takes the total investment over two years to approximately USD 800 million (in the company's pharma services business).

- In 2018, Pall Corporation (US) signed a partnership agreement with University College London (UCL) (UK). This partnership was aimed at forming the UCL-Pall Biotech Centre of Excellence (CoE). This center will be operational from September 2018 through 2024 for research and training.

Critical questions answered in the report:

- Which regions are likely to grow at the highest CAGR?

- What are the recent trends affecting the aseptic sampling market?

- Who are the key players in the market, and how intense is the competition?

- What are the application areas of aseptic sampling?

- What are the challenges hindering the adoption of aseptic sampling?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Inclusions & exclusions

1.3.2 Markets covered

1.3.3 Years considered for the study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes Made

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 Research Data

Figure 1 Research design

2.1.1 Secondary data

2.1.1.1 Key data from secondary sources

2.1.2 Primary data

Figure 2 Primary sources

2.1.2.1 Breakdown of primary sources

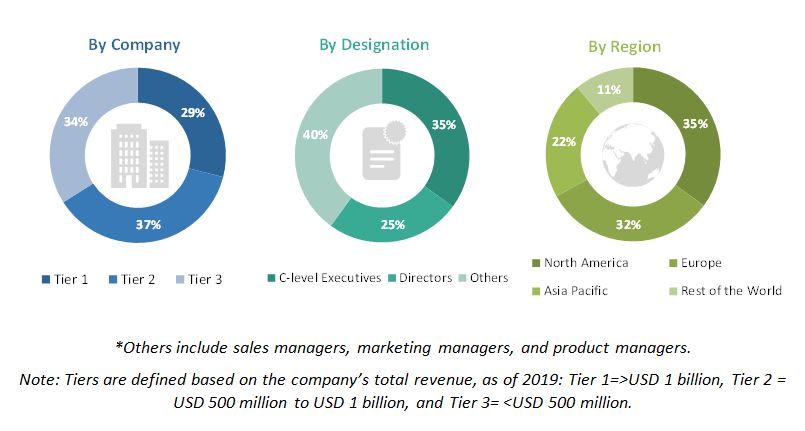

Figure 3 Breakdown of primary interviews: By company type, designation, and region

2.2 Market Size Estimation

Figure 4 Market size estimation: Revenue share analysis

Figure 5 Illustrative example of sartorius stedim biotech

2.3 Market Breakdown and Data Triangulation

Figure 6 Data triangulation methodology

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 EXECUTIVE SUMMARY (Page No. - 34)

Figure 7 Aseptic sampling market, by type, 2020 vs. 2025 (USD million)

Figure 8 Manual aseptic sampling market, by product, 2020 vs. 2025 (USD million)

Figure 9 Aseptic sampling market, by technique, 2020 vs. 2025 (USD million)

Figure 10 Aseptic sampling market, by application, 2020 vs. 2025 (USD million)

Figure 11 Aseptic sampling market, by end user, 2020 vs. 2025 (USD million)

Figure 12 Geographical snapshot of the aseptic sampling market

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 Aseptic Sampling Market Overview

Figure 13 Increasing demand for biopharmaceuticals will drive the growth of the aseptic sampling market

4.2 North America: Aseptic Sampling Market, By Type (2019)

Figure 14 Manual aseptic sampling segment accounted for the largest share of the North American market in 2019

4.3 Geographical Snapshot of the Aseptic Sampling Market

Figure 15 Asia Pacific to register the highest growth during the forecast period

5 MARKET OVERVIEW (Page No. - 40)

5.1 Introduction

Figure 16 Aseptic sampling market: Drivers, restraints, opportunities, and challenges

5.1.1 Drivers

5.1.1.1 Increasing demand for biopharmaceuticals

5.1.1.2 Advantages of single-use aseptic sampling systems in improving process efficiency and reducing the risk of product cross-contamination

5.1.1.3 Stringent government regulations for ensuring drug safety

5.1.1.4 Funding to support life science research activities

5.1.2 Restraints

5.1.2.1 Issues related to leachables and extractables

5.1.3 Opportunities

5.1.3.1 Increased risk of pandemics and communicable diseases

5.1.3.2 Emerging markets to offer lucrative growth opportunities

5.1.3.3 Patent expiry of major drugs

Table 1 US: Biologics going off-patent in the coming years

5.1.4 Challenges

5.1.4.1 Waste disposal

5.1.4.2 Slow adoption of advanced technologies in biopharmaceutical manufacturing

5.1.4.3 Slowdown in R&D activities due to the COVID-19 pandemic

6 ASEPTIC SAMPLING MARKET, BY TYPE (Page No. - 46)

6.1 Introduction

Table 2 Aseptic sampling market, by type, 2018–2025 (USD million)

6.2 Manual Aseptic Sampling

Table 3 Manual aseptic sampling market, by type, 2018–2025 (USD million)

Table 4 Manual aseptic sampling market, by region, 2018–2025 (USD million)

Table 5 North America: Manual aseptic sampling market, by country, 2018–2025 (USD million)

Table 6 Europe: Manual aseptic sampling market, by country, 2018–2025 (USD million)

Table 7 Asia Pacific: Manual aseptic sampling market, by country, 2018–2025 (USD million)

6.2.1 Manual aseptic sampling market, by product

Table 8 Manual aseptic sampling market, by product, 2018–2025 (USD million)

6.2.1.1 bags

6.2.1.1.1 High adoption of bags in the R&D and commercial production of biopharmaceuticals to support the growth of this segment

Table 9 Manual aseptic Sampling bags market, by region, 2018–2025 (USD million)

Table 10 North America: Manual aseptic sampling bags market, by coutry, 2018–2025 (USD million)

Table 11 Europe: manual Aseptic sampling bags market, by country, 2018–2025 (USD million)

Table 12 Asia Pacific: Manual aseptic sampling bags market, by country, 2018–2025 (USD million)

6.2.1.2 bottles

6.2.1.2.1 Aseptic sampling bottles are available in single-use and autoclavable forms

Table 13 Manual aseptic sampling bottles market, by region, 2018–2025 (USD million)

Table 14 North America: Manual aseptic sampling bottles market, by country, 2018–2025 (USD million)

Table 15 Europe: Manual aseptic sampling bottles market, by country, 2018–2025 (USD million)

Table 16 Asia Pacific: Manual aseptic sampling bottles market, by country, 2018–2025 (USD million)

6.2.1.3 Syringes

6.2.1.3.1 Syringes for aseptic sampling are widely used in R&D and process development to eliminate products

Table 17 Manual aseptic sampling syringes market, by region, 2018–2025 (USD million)

Table 18 North America: Manual aseptic sampling syringes market, by country, 2018–2025 (USD million)

Table 19 Europe: Manual aseptic sampling syringes market, by country, 2018–2025 (USD thousand)

Table 20 Asia Pacific: Manual aseptic sampling syringes market, by country, 2018–2025 (USD thousand)

6.2.1.4 Accessories

Table 21 Manual aseptic sampling accessories market, by region, 2018–2025 (USD million)

Table 22 North America: Manual aseptic sampling accessories market, by country, 2018–2025 (USD million)

Table 23 Europe: Manual aseptic sampling accessories market, by country, 2018–2025 (USD million)

Table 24 Asia Pacific: Manual aseptic sampling accessories market, by country, 2018–2025 (USD million)

6.3 Automated Aseptic Sampling

6.3.1 Automated sampling systems offer advantages such as improved batch yields

Table 25 Automated aseptic sampling market, by region, 2018–2025 (USD million)

Table 26 North America: Automated aseptic sampling market, by country, 2018–2025 (USD million)

Table 27 Europe: Automated aseptic sampling market, by country, 2018–2025 (USD million)

Table 28 Asia Pacific: Automated aseptic sampling market, by country, 2018–2025 (USD million)

7 ASEPTIC SAMPLING MARKET, BY TECHNIQUE (Page No. - 58)

7.1 Introduction

Table 29 Aseptic sampling market, by technique, 2018–2025 (USD million)

7.2 Off-Line Sampling Technique

7.2.1 Off-line sampling technique segment to dominate the aseptic sampling market

Table 30 Off-line sampling technique market, by region, 2018–2025 (USD million)

Table 31 North America: Off-line sampling technique market, by country, 2018–2025 (USD million)

Table 32 Europe: Off-line sampling technique market, by country, 2018–2025 (USD million)

Table 33 Asia Pacific: Off-line sampling technique market, by country, 2018–2025 (USD million)

7.3 At-Line Sampling Technique

7.3.1 At-line analyzers do not require plumbing and analyze multiple samples from a variety of locations within the plant

Table 34 At-line sampling technique market, by region, 2018–2025 (USD million)

Table 35 North America: At-line sampling technique market, by country, 2018–2025 (USD million)

Table 36 Europe: At-line sampling technique market, by country, 2018–2025 (USD million)

Table 37 Asia Pacific: At-line sampling technique market, by country, 2018–2025 (USD million)

7.4 On-Line Sampling Technique

7.4.1 On-line sampling is a trending method as it offers consistency and certainty in results

Table 38 On-line sampling technique market, by region, 2018–2025 (USD million)

Table 39 North America: On-line sampling technique market, by country, 2018–2025 (USD million)

Table 40 Europe: On-line sampling technique market, by country, 2018–2025 (USD million)

Table 41 Asia Pacific: On-line sampling technique market, by country, 2018–2025 (USD million)

8 ASEPTIC SAMPLING MARKET, BY APPLICATION (Page No. - 65)

8.1 Introduction

Table 42 Aseptic sampling market, by application, 2018–2025 (USD million)

8.2 Upstream Processes

8.2.1 Higher importance of aseptic conditions in this stage is supporting the growth of this market segment

Table 43 Aseptic sampling market for upstream processes, by region, 2018–2025 (USD million)

Table 44 North America: Aseptic sampling market for upstream processes, by country, 2018–2025 (USD million)

Table 45 Europe: Aseptic sampling market for upstream processes, by country, 2018–2025 (USD million)

Table 46 Asia Pacific: Aseptic sampling market for upstream processes, by country, 2018–2025 (USD million)

8.3 Downstream Processes

8.3.1 Advantages of using single-use systems in downstream processes increasing the demand for aseptic sampling

Table 47 Aseptic sampling market for downstream processes, by region, 2018–2025 (USD million)

Table 48 North America: Aseptic sampling market for downstream processes, by country, 2018–2025 (USD million)

Table 49 Europe: Aseptic sampling market for downstream processes, by country, 2018–2025 (USD million)

Table 50 Asia Pacific: Aseptic sampling market for downstream processes, by country, 2018–2025 (USD million)

9 ASEPTIC SAMPLING MARKET, BY END USER (Page No. - 70)

9.1 Introduction

Table 51 Aseptic sampling market, by end user, 2018–2025 (USD million)

9.2 Biotechnology and Pharmaceutical Manufacturers

9.2.1 Favorable government regulations on drug safety resulting in the high adoption of aseptic sampling systems in pharmaceutical and biotechnology companies

Table 52 Aseptic sampling market for biotechnology and pharmaceutical manufacturers, by region, 2018–2025 (USD million)

Table 53 North America: Aseptic sampling market for biotechnology and pharmaceutical manufacturers, by country, 2018–2025 (USD million)

Table 54 Europe: Aseptic sampling market for biotechnology and pharmaceutical manufacturers, by country, 2018–2025 (USD million)

Table 55 Asia Pacific: Aseptic sampling market for biotechnology and pharmaceutical manufacturers, by country, 2018–2025 (USD million)

9.3 Contract Research and Manufacturing Organizations

9.3.1 Multinational pharmaceutical companies are outsourcing their research and manufacturing services to CDMOS and CROS in emerging economies

Table 56 Aseptic sampling market for contract research and manufacturing organizations, by region, 2018–2025 (USD million)

Table 57 North America: Aseptic sampling market for contract research and manufacturing organizations, by country, 2018–2025 (USD million)

Table 58 Europe: Aseptic sampling market for contract research and manufacturing organizations, by country, 2018–2025 (USD million)

Table 59 Asia Pacific: Aseptic sampling market for contract research and manufacturing organizations, by country, 2018–2025 (USD million)

9.4 R&D Departments

9.4.1 With growing availability of single-use upstream and downstream solutions, the adoption of these systems is expected to increase in R&D departments

Table 60 Aseptic sampling market for r&d departments, by region, 2018–2025 (USD million)

Table 61 North America: aseptic sampling market for r&d departments, by country, 2018–2025 (USD million)

Table 62 Europe: Aseptic sampling market for r&d departments, by country, 2018–2025 (USD million)

Table 63 Asia Pacific: Aseptic sampling market for r&d departments, by country, 2018–2025 (USD million)

9.5 Other End Users

Table 64 Aseptic sampling market for other end users, by region, 2018–2025 (USD million)

Table 65 North America: Aseptic sampling market for other end users, by country, ]2018–2025 (USD million)

Table 66 Europe: Aseptic sampling market for other end users, by country, ]2018–2025 (USD thousand)

Table 67 Asia Pacific: Aseptic sampling market for other end users, by country, 2018–2025 (USD thousand)

10 ASEPTIC SAMPLING MARKET, BY REGION (Page No. - 78)

10.1 Introduction

Table 68 Aseptic sampling market, by region, 2018–2025 (USD million)

10.2 North America

Table 69 North America: Aseptic sampling market, by country, 2018–2025 (USD million)

Table 70 North America: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 71 North America: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 72 North America: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 73 North America: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 74 North America: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.2.1 US

10.2.1.1 US is the largest market for aseptic sampling systems in North America

Table 75 US: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 76 US: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 77 US: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 78 US: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 79 US: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.2.2 Canada

10.2.2.1 R&D facilities are more likely to adopt single-use technologies as they reduce set-up cost and initial investment

Table 80 Canada: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 81 Canada: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 82 Canada: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 83 Canada: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 84 Canada: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3 Europe

Figure 17 Europe: Aseptic sampling market snapshot

Table 85 Europe: Aseptic sampling market, by country, 2018–2025 (USD million)

Table 86 Europe: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 87 Europe: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 88 Europe: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 89 Europe: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 90 Europe: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.1 Germany

10.3.1.1 Strong research infrastructure and manufacturing base support the strong position of Germany in the European market

Table 91 Germany: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 92 Germany: Manual aseptic sampling market, by product, 018–2025 (USD million)

Table 93 Germany: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 94 Germany: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 95 Germany: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.2 UK

10.3.2.1 Growth in the life sciences industry to drive the market for aseptic sampling in the UK

Table 96 Uk: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 97 UK: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 98 UK: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 99 UK: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 100 UK: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.3 France

10.3.3.1 Increasing investments in infrastructure development for life sciences R&D to support market growth in France

Table 101 France: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 102 France: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 103 France: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 104 France: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 105 France: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.4 Italy

10.3.4.1 Increasing R&D investments by pharmaceutical companies to increase the demand for aseptic sampling in the country

Table 106 Italy: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 107 Italy: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 108 Italy: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 109 Italy: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 110 Italy: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.5 Spain

10.3.5.1 Increasing R&D activities in pharmaceutical companies to drive market growth in Spain

Table 111 Spain: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 112 Spain: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 113 Spain: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 114 Spain: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 115 Spain: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.3.6 Rest of Europe

Table 116 ROE: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 117 ROE: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 118 ROE: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 119 ROE: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 120 ROE: Aseptic sampling market, by end user, 2018–2025 (USD thousand)

10.4 Asia Pacific

Figure 18 Asia Pacific: Aseptic sampling market snapshot

Table 121 Asia Pacific: Aseptic sampling market, by country, 2018–2025 (USD million)

Table 122 Asia Pacific: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 123 Asia Pacific: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 124 Asia Pacific: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 125 Asia Pacific: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 126 Asia Pacific: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.4.1 Japan

10.4.1.1 Government initiatives to boost the biotechnology industry to drive market growth in Japan

Table 127 Japan: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 128 Japan: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 129 Japan: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 130 Japan: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 131 Japan: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.4.2 China

10.4.2.1 Government initiatives and strategic initiatives by key players to strengthen the biotechnology sector in the country

Table 132 China: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 133 China: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 134 China: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 135 China: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 136 China: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.4.3 India

10.4.3.1 Government initiatives have strengthened the life sciences industry in India

Table 137 India: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 138 India: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 139 India: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 140 India: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 141 India: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.4.4 Rest of Asia Pacific

Table 142 RoAPAC: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 143 RoAPAC: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 144 RoAPAC: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 145 RoAPAC: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 146 RoAPAC: Aseptic sampling market, by end user, 2018–2025 (USD million)

10.5 Rest of the World

Table 147 RoW: Aseptic sampling market, by type, 2018–2025 (USD million)

Table 148 RoW: Manual aseptic sampling market, by product, 2018–2025 (USD million)

Table 149 RoW: Aseptic sampling market, by technique, 2018–2025 (USD million)

Table 150 RoW: Aseptic sampling market, by application, 2018–2025 (USD million)

Table 151 RoW: Aseptic sampling market, by end user, 2018–2025 (USD million)

11 COMPETITIVE LANDSCAPE (Page No. - 109)

11.1 Introduction

11.2 Market Evaluation Framework

Figure 19 Market evaluation framework: Collaborative efforts were a prominent target for companies

11.3 Revenue Analysis of Top Market Players

Figure 20 Aseptic sampling market in 2019

11.4 Competitive Leadership Mapping, 2019

11.4.1 Stars

11.4.2 Emerging leaders

11.4.3 Pervasive

11.4.4 Emerging companies

Figure 21 Competitive leadership mapping: Aseptic sampling market

11.5 Competitive Scenario

11.5.1 Key partnerships and agreements

Table 152 Partnerships and agreements (2017–2020)

11.5.2 Key expansions

Table 153 Expansions (2017–2020)

12 COMPANY PROFILES (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, and MNM View)*

12.1 Merck KGAA

Figure 22 Merck KGAA: Company snapshot (2019)

12.2 Sartorius Stedim Biotech

Figure 23 Sartorius Stedim Biotech: Company snapshot (2019)

12.3 Thermo Fisher Scientific

Figure 24 Thermo Fisher Scientific: Company snapshot (2019)

12.4 Danaher Corporation

Figure 25 Danaher Corporation: Company snapshot (2019)

12.5 Saint-Gobain

Figure 26 Saint-Gobain: company snapshot (2017)

12.6 GEA Group

Figure 27 GEA Group: Company snapshot (2019)

12.7 Qualitru Sampling Systems

12.8 Keofitt

12.9 Gemü Group

12.10 W. L. Gore & Associates

12.11 Flownamics Analytical Instruments

12.12 Lonza

Figure 28 Lonza: Company snapshot (2019)

12.13 Trace Analytics

12.14 VWR International, LLC. (Avantor, Inc.)

Figure 29 Avantor, Inc.: Company snapshot (2019)

12.15 Bbi-Biotech Gmbh

12.16 Advanced Microdevices Pvt. Ltd.

12.17 Deltalab

12.18 Other Compofanies

12.18.1 MTC Bio

12.18.2 Biomatics technology

12.18.3 Labplas

*Details on Business Overview, Products Offered, Recent Developments, and MNM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 137)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

The Aseptic sampling market study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the aseptic sampling market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the aseptic sampling market. Primary sources from the demand side included industry experts, such as researchers & scientists. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics. A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The aseptic sampling market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by technology, application, and region).

Data Triangulation

After arriving at the market size, the aseptic sampling market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Report Objectives

- To define, describe, segment, and forecast the global aseptic sampling market by type, technique, application, end user, and region.

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the aseptic sampling market in five main regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile key players in the global aseptic sampling market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as expansion, partnerships, and collaborations in the aseptic sampling market

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Values (USD) |

|

Segments Covered |

Type, Technique, Application, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

Sartorius Stedim Biotech (France), Merck Millipore (Germany), Danaher Corporation (US), and Thermo Fisher Scientific (US), Saint-Gobain (France), GEA Group (Germany), Avantor, Inc. (US), QualiTru Sampling Systems (US), Keofitt (Denmark), GEMÜ Group (US), W. L. Gore & Associates (US), Flownamics Analytical Instruments, Inc. (US), Lonza (Switzerland), and Trace Analytics (US). |

The research report categorizes the aseptic sampling market into the following segments and subsegments:

By Type

-

Manual Aseptic Sampling

- Bags

- Bottles

- Syringes

- Accesories

- Automatic Aseptic Sampling

By Technique

- Off-Line Sampling Technique

- At-Line Sampling Technique

- On-Line Sampling Technique

By Application

- Upstream Processes

- Downstream Processes

By End User

- Biotechnology and Pharmaceutical Manufacturers

- Contract Research and Manufacturing Organizations

- R&D Departments

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- Thiland

- Rest of Asia Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aseptic Sampling Market