Aspherical Lens Market by Type (Glass Aspherical lens, Plastic Aspherical lens), Offering (Double Aspherical lens and Single Aspherical lens), Manufacturing Technology (Molding, Polishing & Grinding), Application and Region - Global Forecast to 2028

Updated on : July 11, 2025

Aspherical Lens Market Size & Growth

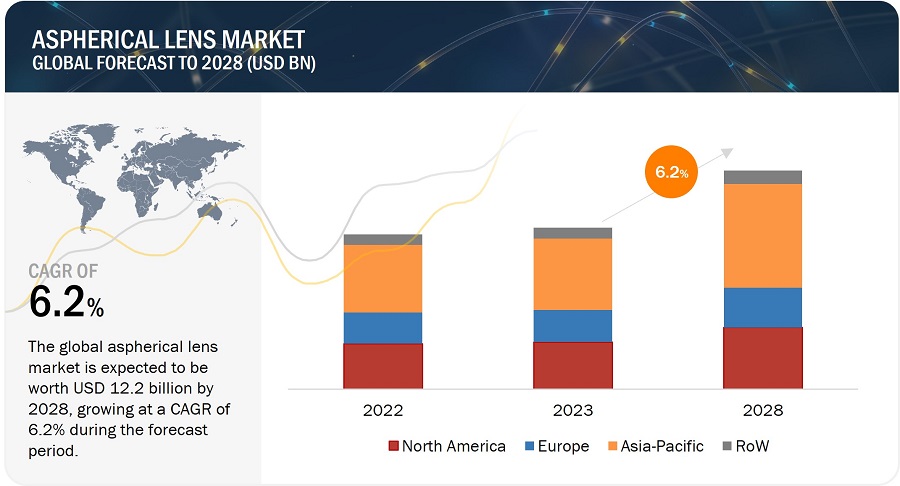

The aspherical lens market size is projected to grow from USD 9.0 billion in 2023 to USD 12.2 billion by 2028, growing at a CAGR of 6.2% during the forecast period from 2023 to 2028.

Aspherical Lens Market Key Takeaways

-

By 2028, the market is expected to reach USD 11.2 billion, growing from USD 8.0 billion in 2023, at a CAGR of 6.9%.

-

By Dynamics – rising demand in smartphones, cameras, and vehicles is fueling growth due to the lenses’ ability to reduce distortion and enhance clarity.

-

By Application – consumer electronics leads, with growing integration of compact optical solutions in smartphones and cameras.

-

By Type – molded lenses dominate, favored for their cost efficiency in mass production.

-

By Challenge – production complexity and need for precision manufacturing continue to be key hurdles.

-

By Material – glass lenses are preferred, offering durability and high-quality optics for automotive and medical devices.

-

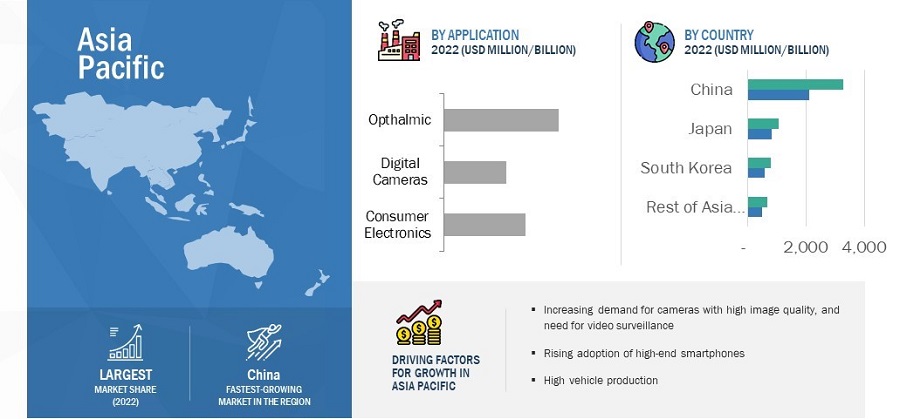

By Region – Asia Pacific holds the largest share, driven by strong electronics and automotive industries in China, Japan, and South Korea.

-

By Opportunity – medical imaging and wearable devices, where miniaturized, high-precision optics are increasingly required.

Market Size & Forecast Report

-

2023 Market Size: USD 8.0 Billion

-

2028 Projected Market Size: USD 11.2 Billion

-

CAGR (2023-2028): 6.9%

-

Asia Pacific : Witness highest demand

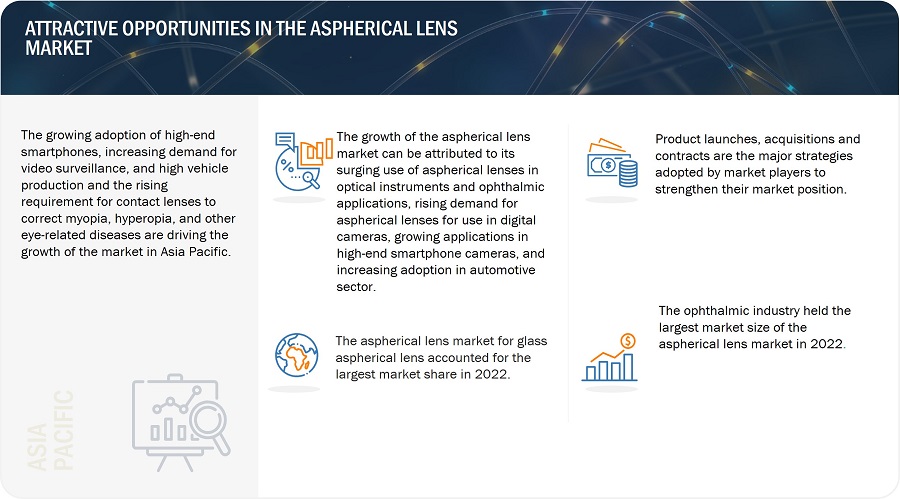

Surging use of aspherical lenses in optical instruments and ophthalmic applications, increasing adoption in automotive sector, growing use of infrared aspherical lenses in security and surveillance cameras, and rising demand for medical imaging are expected to propel the aspherical lens market in the next five years. However, high production cost of aspherical lenses and complexity of design and manufacturing processes are likely to pose challenges for the industry players.

The objective of the report is to define, describe, and forecast the aspherical lens industry based on type, manufacturing technology, offering, application, and region.

Aspherical Lens Market Size Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aspherical Lens Market Trends and Dynamics

Driver: Surging use of aspherical lenses in optical instruments and ophthalmic applications

Aspheric lenses are widely used in such optical instruments because aspheres minimize spherical aberrations in lenses, and result in clearer images. Aspheres also help to thin down and flatten the lens, which lessens peripheral magnification and enhances appearance. Aspherical lenses allow optical engineers to increase the numeric aperture size of a lens without reducing image quality, which is perfect for applications that require high light throughput. All these factors are expected to contribute to the growth of the aspherical lens market during the projected period. The rising demand for high-quality lenses for use in telescopes, binoculars, and other optical devices, as well as the need for more portable and lightweight equipment is driving market growth.

Aspherical lenses in eyeglasses can offer a broader field of view than conventional spherical lenses, less distortion, and a flatter appearance. With contact lenses, an aspherical design can lessen aberrations and improve visual clarity, especially in low light conditions. Aspherical surfaces can be added to intraocular lenses (IOLs) used in cataract surgery to enhance the visual outcomes for patients, including increased contrast sensitivity and decreased reflection. For instance, in 2022, CooperVision announced an addition to its Biofinity Energys® product portfolio: MyDay Energys® daily disposable contact lenses with an innovative single vision aspherical lens design.

The increasing prevalence of eye disorders such as cataract, presbyopia, and myopia, growing demand for advanced vision correction solutions, and technological advancements in lens manufacturing processes are driving the growth of the aspherical lens market.

Restraint: High production cost of aspherical lenses

Aspherical lense, do not have a singular radius of curvature. As a result, various areas on the surface employ smaller sub-apertures with different curvature radii. Because only one huge tool may be utilized, different manufacturing techniques must be used to address these sub-apertures in different ways. Hence, aspherical lenses require a more complex manufacturing process than traditional spherical lenses. This can result in higher production costs due to the need for advanced manufacturing technologies, equipment, and skilled labor. Such lenses also require the use of advanced materials, such as high-quality glass or specialized plastics, to achieve the necessary precision and performance. These materials can be expensive and further increase the cost of the lenses. Thus, the high cost of aspherical lenses can limit their adoption in some applications, particularly in price-sensitive markets, such as consumer electronics, where cost is a critical factor

Opportunities: Growing use of infrared aspherical lenses in security and surveillance cameras

An IR aspherical lens can transmit more infrared light than a conventional lens, allowing for sharper image capture even in complete darkness. This is particularly useful in security and surveillance applications where it is critical to record distinct photos of trespassers or suspicious activity. In the event of a break-in or crime, the lenses function as sensors that trigger alarms, discouraging criminals. These lenses aid in prompt suspect identification without alerting the subject to the camera's current location. Security systems employ far-infrared ray lenses to view through dust, severe rain, and fog. They also have a magnifying feature, which enhances focus on the subject being seen by the lens.

There has been a recent surge in the demand for security cameras in order to maintain 24x7 surveillance and avoid illegal activities. The number of security camera installations in the US increased by 80% between 2015 and 2021, from 47 million to 85 million, according to the US Bureau of Labor Statistics. Thus, the increasing demand for security and video surveillance cameras will create an opportunity for IR aspherical lens-based cameras in the future.

Challenges: Complexity of design and manufacturing processes

Aspherical lenses can also be more difficult to manufacture in larger sizes. This is because the larger the lens, the more complex the surface curvature becomes, making it more difficult to maintain precision during the manufacturing process. These limitations in terms of design and manufacturing techniques of aspherical lenses are creating challenges for market players.

Aspherical Lens Market Segmentation

Consumer Electronics to acquire significant share in aspherical lens market and is the second largest application

The consumer electronics is expected to hold the largest market share during the forecast period. Aspherical lenses are designed to correct for spherical aberration, which is a type of optical distortion that can cause images to appear blurry or distorted. By using aspherical lenses, smartphone manufacturers can improve the image quality and reduce distortion in the photos taken with their cameras. Aspherical lenses are also able to reduce the size and weight of the camera module, making it easier to integrate into the compact designs of modern smartphones. For example, to produce sharp photos, Zeiss created smartphones that require complicated, high-resolution lens elements that must be compressed into a very compact space; double-aspherical lens elements have been produced to address this demand. Many tablet and PC cameras also use aspherical lenses in their design. The growing need for higher image quality from smartphone cameras is driving the industry's demand for aspherical lenses. Furthermore, Major high-end smartphone market players are looking to upgrade their camera lenses, resulting in the rising use of aspherical lenses.

Single aspherical lens offering to command largest share in aspherical lens market

The single aspherical lens segment accounted for the largest market share in 2022. A single aspherical lens has two surfaces, one of which is spherical or flat while the other is not. Camera lenses, spectacles, and other optical systems that need the correction of aberrations frequently employ single aspherical lenses. A single aspherical lens has a simple design and fewer lens elements, making it less complex and less expensive to manufacture. The increasing demand for such lenses and rising research and development activities are driving market growth.

Aspherical Lens Industry Regional Analysis

China aspherical lens market to witness highest demand from Asia Pacific

China held the largest share of the aspherical lens market in Asia Pacific in 2022 and is projected to dominate both markets during the forecast period. China is witnessing rapid economic development. It has been increasingly focusing on shifting from a manufacturing-driven to an innovation-driven economy. The country has the world’s largest surveillance network and accounts for over half of all surveillance cameras deployed worldwide. According to National Development and Reform Commission data, all key public areas in China are expected to be protected with video surveillance cameras with facial recognition technology to reduce crime and ensure social stability. This increased demand for security cameras will drive the growth of the aspherical lens market.

China is considered the world’s largest market for electric vehicles. The growing investment by OEMs in semi-autonomous vehicles also increases the demand for automotive cameras and thus drives market growth. The country is also a leading manufacturing hub for consumer electronics products. According to Mobile Economy China 2021 published by GSM Association, the total number of smartphone connections in the country is estimated to reach ~1.5 billion in 2025. The use of aspherical lenses in smartphone cameras will eventually drive the aspherical lens market. Samsung, Xiaomi, and OnePlus are among the companies using aspherical lens elements in their camera module.

Aspherical Lens Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Aspherical Lens Companies - Key Market Players:

Major vendors in the aspherical lens companies include

- Nikon Corporation (Japan),

- Canon, Inc. (Japan),

- Panasonic Holding Corporation (Japan),

- HOYA (Japan),

- Asahi Glass (AGC) (Japan),

- Schott (Germany),

- ZEISS International (Germany),

- Tokai Optical (Japan),

- SEIKO Optical Products Co., Ltd. (Japan),

- Calin Technology Co., Ltd. (Taiwan), among others.

Aspherical Lens Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 9.0 billion in 2023 |

| Projected Market Size | USD 12.2 billion by 2028 |

| Growth Rate | CAGR of 6.2% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Type, Manufacturing Technology, Offering, Application, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Nikon Corporation (Japan), Canon, Inc. (Japan), Panasonic Holding Corporation (Japan), HOYA Corporation (Japan), Asahi Glass (AGC) (Japan), Schott (Germany), ZEISS International (Germany), Tokai Optical (Japan), SEIKO Optical Products Co., Ltd. (Japan), and Calin Technology Co., Ltd. (Taiwan), among others. |

Aspherical Lens Market Highlights

This report categorizes the aspherical lens market share based on type, offering, manufacturing technology, application, and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Offering |

|

|

By Manufacturing Technology |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Aspherical Lens Industry

- In February 2023, Nikon Corporation announced the highly anticipated NIKKOR Z 85mm f/1.2 S, a professional-level ultra-fast prime lens that exemplifies the powerful potential of the Nikon Z Mount for stills or video footage.

- In January 2023, Panasonic introduced a new cost-effective ultra-wide-angle zoom lens, the LUMIX S 14-28mm F4-5.6 MACRO, based on the L-Mount system. The LUMIX S Series offers three budget-friendly lenses including the LUMIX S 14-28mm F4-5.6 MACRO (S-R1428), LUMIX S 20-60mm F3.5-5.6 (S-R2060) and LUMIX S 70-300mm F4.5-5.6 MACRO O.I.S. (S-R70300) to cover 14mm ultra wide-angle to 300mm telephoto.

- In January 2023, AGC Inc. reached an agreement with Shanghai Yaohua Pilkington Glass Group Co. Ltd. (SYP Group) to transfer its ownership stake in applied glass material company AGC Flat Glass (Dalian) Inc. Per the agreement, SYP Group takes over the company for a purchase price of ¥5.8 billion (approximately USD 43.8 million).

- In September 2022, Nikon Corporation announced the renewal of the brand’s partnership with NYC Salt, an organization that creates opportunities in visual arts and pathways to college and careers for underserved New York City youth with diverse backgrounds.

Frequently Asked Questions (FAQ):

Which are the major companies in the aspherical lens market share? What are their primary strategies to strengthen their market presence?

Nikon Corporation (Japan), Canon, Inc. (Japan), Panasonic Holding Corporation (Japan), HOYA corporation (Japan), ZEISS International (Germany) are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for the aspherical lens in terms of application?

Ophthalmic application is a potential market with high growth opportunities. The increasing research & development by aspherical lens manufacturers is also driving market growth. EssilorLuxottica, and JML Optiical are the prominent manufacturers of ophthalmic aspherical lenses.

What are the opportunities for new aspherical lens market share entrants?

Factors such as growing use of infrared aspherical lenses in security and surveillance cameras and rising demand for medical imaging are creating opportunities for the players in the market.

Which type is expected to drive aspherical lens market growth in the next six years?

Glass aspherical lens is expected to remain the major offering driving aspherical lens demand.

What are the major strategies adopted by aspherical lens market players?

The agitator companies have adopted product launches, acquisitions, and contracts to strengthen their position in the industrial agitators market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing use of aspherical lenses in optical instruments and ophthalmic applications- Rising demand for aspherical lenses for use in digital cameras- Increasing application in high-end smartphone cameras- Growing adoption in automotive sectorRESTRAINTS- High production costOPPORTUNITIES- Growing use of infrared aspherical lenses in security and surveillance cameras- Rising demand for medical imagingCHALLENGES- Complexity of design and manufacturing processes

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF VARIOUS ASPHERICAL LENSES

-

5.7 TECHNOLOGY ANALYSISKEY TRENDS IN ASPHERICAL LENS MARKET- Augmented reality microscopes and aspherical lenses- Contact lenses as drug delivery devices

-

5.8 CASE STUDY ANALYSISOPTIPRO SYSTEMS HELPS OPTIMIZE LENS POLISHING FOR KREISCHER OPTICSVISION OPTICS PROVIDES ASPHERICAL LENSES FOR AUTO HEAD-UP DISPLAY (HUD) SYSTEM

-

5.9 PATENT ANALYSISMAJOR PATENTS

-

5.10 TRADE AND TARIFF ANALYSISTRADE ANALYSISTARIFF ANALYSIS

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO MARKETSTANDARDS AND REGULATIONS RELATED TO ASPHERICAL LENSES

- 6.1 INTRODUCTION

-

6.2 GLASS ASPHERICAL LENSINCREASINGLY USED IN CAMERAS, AND AUTOMOTIVE AND SURVEILLANCE APPLICATIONS

-

6.3 PLASTIC ASPHERICAL LENSLIGHT AND CHEAP OPTION USED IN VARIOUS APPLICATIONS

- 6.4 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 MOLDEDSUITED TO MASS PRODUCTION OF HIGH-THERMAL STABILITY LENSES

-

7.3 POLISHEDWIDELY USED FOR PROTOTYPING AND LOW-VOLUME PRODUCTION

-

7.4 OTHER MANUFACTURING TECHNOLOGIESINCREASINGLY USED TO CREATE PRECISE OPTICAL SURFACES

- 8.1 INTRODUCTION

-

8.2 SINGLE ASPHERICAL LENSINCREASINGLY USED FOR OPHTHALMIC APPLICATIONS AND IN OPTICAL SYSTEMS

-

8.3 DOUBLE ASPHERICAL LENSPROVIDES CLEAR AND PRECISE IMAGES

- 9.1 INTRODUCTION

-

9.2 DIGITAL CAMERASWIDE USE OF ASPHERICAL LENSES TO REDUCE ERRORS

-

9.3 AUTOMOTIVEGROWING USE OF ASPHERICAL LENSES IN SAFETY-CRITICAL DEVICES

-

9.4 CONSUMER ELECTRONICSRISING ADOPTION IN HIGH-END SMARTPHONES TO IMPROVE IMAGE QUALITY

-

9.5 OPHTHALMICINCREASING USE OF ASPHERICAL LENSES IN DIAGNOSTIC INSTRUMENTS

-

9.6 FIBER OPTICS & PHOTONICSRISING DEMAND FROM TELECOMMUNICATIONS AND OTHER INDUSTRIES

-

9.7 OTHERSMULTIPLE APPLICATIONS OF ASPHERICAL LENSES TO BOOST MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Growing demand for automotive cameras and smartphones to drive market growthCANADA- Increasing demand for aspherical lenses for ophthalmic applications to drive growthMEXICO- Rising demand for video surveillance and automotive cameras to boost market

-

10.3 EUROPEUK- Increasing adoption of professional cameras to positively impact marketGERMANY- Rising demand for fiber optics & photonics to drive marketFRANCE- Government initiatives to encourage autonomous vehicles to fuel market growthREST OF EUROPE- Growing need for camera-based safety features in vehicles to boost demand

-

10.4 ASIA PACIFICCHINA- Increasing use of aspherical lenses in smartphones to drive marketJAPAN- Increasing demand for self-driving vehicles to boost marketSOUTH KOREA- Rising security concerns to fuel demand for aspherical lensesREST OF ASIA PACIFIC- Increasing incidence of eye disease in geriatric population to drive demand

-

10.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Digital transformation measures to drive marketSOUTH AMERICA- Increasing demand for smartphones and high-end cameras to propel market growth

- 11.1 OVERVIEW

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS IN ASPHERICAL LENS MARKET

-

11.5 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPANY FOOTPRINT

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHES & DEVELOPMENTSDEALS

-

12.1 KEY PLAYERSNIKON CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCANON INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPANASONIC HOLDING CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHOYA CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewAGC INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSCHOTT- Business overview- Products/Services/Solutions offeredZEISS INTERNATIONAL- Business overview- Products/Services/Solutions offered- Recent developmentsTOKAI OPTICAL- Business overview- Products/Services/Solutions offered- Recent developmentsSEIKO OPTICAL PRODUCTS CO., LTD.- Business overview- Products/Solutions/Services offeredCALIN TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSLARGAN PRECISION CO., LTD.GENIUS ELECTRONIC OPTICALASIA OPTICAL CO., INC.SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITEDMINGYUE OPTICAL LENS CO., LTD.ZHEJIANG LANTE OPTICS CO., LTDESCO OPTICS, INC.SHANGHAI OPTICSLIGHTPATH TECHNOLOGIES, INCHYPERION OPTICSKNIGHT OPTICALDG OPTOELECTRONICSSUMITA OPTICAL GLASS INC.ESSILOR INTERNATIONALJENOPTIK AG

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF VARIOUS ASPHERICAL LENSES, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE OF KEY GLASS ASPHERICAL LENS MANUFACTURERS (USD)

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 4 MAJOR PATENTS IN ASPHERICAL LENS MARKET

- TABLE 5 MFN TARIFF FOR HS CODE 900211-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 6 MFN TARIFF FOR HS CODE 900211-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 7 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 8 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 MARKET: CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR MARKET

- TABLE 17 EUROPE: SAFETY STANDARDS FOR MARKET

- TABLE 18 ASIA PACIFIC: SAFETY STANDARDS FOR MARKET

- TABLE 19 ASPHERICAL LENS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 20 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 GLASS: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 22 GLASS: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 23 GLASS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 GLASS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 GLASS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 GLASS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 PLASTIC: ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 28 PLASTIC: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 29 PLASTIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 PLASTIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 PLASTIC: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 PLASTIC: ARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 OTHER TYPES: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 34 OTHER TYPES: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 35 OTHER TYPES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 OTHER TYPES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 OTHER TYPES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 OTHER TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ASPHERICAL LENS MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 40 MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 41 MOLDED: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 MOLDED: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 MOLDED: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 MOLDED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 POLISHED: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 POLISHED: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 POLISHED: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 POLISHED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OTHER MANUFACTURING TECHNOLOGIES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 OTHER MANUFACTURING TECHNOLOGIES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 OTHER MANUFACTURING TECHNOLOGIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 OTHER MANUFACTURING TECHNOLOGIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 54 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 55 SINGLE ASPHERICAL LENS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 DOUBLE ASPHERICAL LENS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 DIGITAL CAMERAS: ASPHERICAL LENS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 DIGITAL CAMERAS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 DIGITAL CAMERAS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 DIGITAL CAMERAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 OPHTHALMIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 74 OPHTHALMIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 OPHTHALMIC: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 OPHTHALMIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 FIBER OPTICS & PHOTONICS: ASPHERICAL LENS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 FIBER OPTICS & PHOTONICS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 FIBER OPTICS & PHOTONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 FIBER OPTICS & PHOTONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 OTHERS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ASPHERICAL LENS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: ASPHERICAL LENS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 117 ROW: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 122 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 ROW: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 124 ROW: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 125 ROW: MARKET, BY MANUFACTURING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 126 ROW: MARKET, BY MANUFACTURING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 127 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 128 ASPHERICAL LENS MARKET: DEGREE OF COMPETITION

- TABLE 129 COMPANY FOOTPRINT

- TABLE 130 TYPE FOOTPRINT OF COMPANIES

- TABLE 131 OFFERING FOOTPRINT OF COMPANIES

- TABLE 132 MANUFACTURING TECHNOLOGY FOOTPRINT OF COMPANIES

- TABLE 133 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 134 REGION FOOTPRINT OF COMPANIES

- TABLE 135 MARKET: KEY STARTUPS/SMES

- TABLE 136 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 137 MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2019–JANUARY 2023

- TABLE 138 ASPHERICAL LENS MARKET: DEALS, JANUARY 2019–JANUARY 2023

- TABLE 139 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 140 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 141 NIKON CORPORATION: DEALS

- TABLE 142 CANON INC.: COMPANY OVERVIEW

- TABLE 143 CANON INC.: PRODUCT LAUNCHES

- TABLE 144 CANON INC.: DEALS

- TABLE 145 PANASONIC HOLDING CORPORATION: COMPANY OVERVIEW

- TABLE 146 PANASONIC HOLDING CORPORATION: PRODUCT LAUNCHES

- TABLE 147 PANASONIC HOLDING CORPORATION: DEALS

- TABLE 148 HOYA CORPORATION: COMPANY OVERVIEW

- TABLE 149 AGC INC.: COMPANY OVERVIEW

- TABLE 150 AGC INC.: DEALS

- TABLE 151 SCHOTT: COMPANY OVERVIEW

- TABLE 152 SCHOTT: DEALS

- TABLE 153 ZEISS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 154 ZEISS INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 155 TOKAI OPTICAL: COMPANY OVERVIEW

- TABLE 156 TOKAI OPTICAL: PRODUCT LAUNCHES

- TABLE 157 SEIKO OPTICAL PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 158 CALIN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 ASPHERICAL LENS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES TILL 2023

- FIGURE 7 GLASS SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 8 MOLDED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 DOUBLE ASPHERICAL LENS SEGMENT TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 10 OPHTHALMIC APPLICATION TO HOLD LARGEST MARKET SHARE IN FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 12 INCREASING DEMAND FROM OPHTHALMIC AND CONSUMER ELECTRONICS APPLICATIONS TO FUEL GROWTH OF MARKET

- FIGURE 13 GLASS SEGMENT HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 14 OPHTHALMIC APPLICATION AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2022

- FIGURE 15 US TO DOMINATE ASPHERICAL LENS SERVICES MARKET DURING FORECAST PERIOD

- FIGURE 16 ASPHERICAL LENS MARKET: DYNAMICS

- FIGURE 17 MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 18 MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 19 MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 20 MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY MANUFACTURERS AND ASSEMBLY & PACKAGING TEAMS

- FIGURE 22 REVENUE SHIFT IN ASPHERICAL LENS MARKET

- FIGURE 23 AVERAGE SELLING PRICE OF KEY GLASS ASPHERICAL LENS MANUFACTURERS (USD)

- FIGURE 24 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 25 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- FIGURE 26 IMPORT DATA FOR HS CODE 900211, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 900211, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 900490, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 900490, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 33 ASPHERICAL LENS MARKET, BY TYPE

- FIGURE 34 PLASTIC SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE GLASS ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 36 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE PLASTIC ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 37 MOLDED MANUFACTURING TECHNOLOGY TO DOMINATE OTHERS SEGMENT OF MARKET DURING FORECAST PERIOD

- FIGURE 38 MARKET, BY MANUFACTURING TECHNOLOGY

- FIGURE 39 MOLDED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 GLASS TYPE TO DOMINATE MOLDED ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 41 GLASS TYPE TO DOMINATE POLISHED ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 42 PLASTIC TYPE TO RECORD HIGHEST CAGR IN OTHERS SEGMENT DURING FORECAST PERIOD

- FIGURE 43 MARKET, BY OFFERING

- FIGURE 44 DOUBLE ASPHERICAL LENS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO DOMINATE SINGLE ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO DOMINATE DOUBLE ASPHERICAL LENS MARKET DURING FORECAST PERIOD

- FIGURE 47 MARKET, BY APPLICATION

- FIGURE 48 OPHTHALMIC SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 49 ASPHERICAL LENS MARKET, BY REGION

- FIGURE 50 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 52 EUROPE: MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 54 ROW: MARKET SNAPSHOT

- FIGURE 55 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

- FIGURE 56 MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 57 ASPHERICAL LENS MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- FIGURE 58 NIKON CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 CANON INC.: COMPANY SNAPSHOT

- FIGURE 60 PANASONIC HOLDING CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 HOYA CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 AGC INC.: COMPANY SNAPSHOT

- FIGURE 63 SCHOTT: COMPANY SNAPSHOT

- FIGURE 64 ZEISS INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 65 CALIN TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

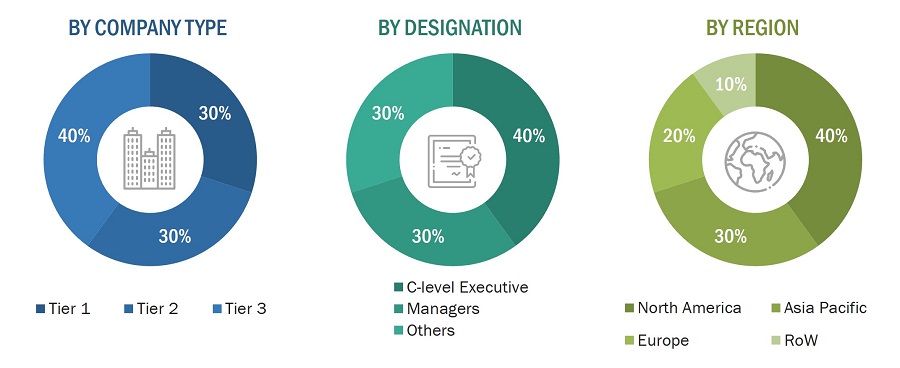

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the aspherical lens market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the aspherical lens market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the aspherical lens market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, aspherical lens products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the aspherical lens market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the aspherical lens market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Aspherical Lens Market: Bottom-up Approach

Data triangulation

After arriving at the overall size of the aspherical lens market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Aspherical lenses have non-spherical shapes and a more complicated front surface, including ellipses, parabolas, hyperbolas, quadrics, and torics. They are designed to reduce or eliminate spherical aberration, which is an optical distortion that occurs when a spherical lens is used to focus light. Spherical aberration results in a blurred image and loss of image quality. Aspherical lenses offer greater aberration correction than conventional spherical optics with multiple surfaces, allowing optical designers to correct aberrations using fewer elements. Although the elements of an aspherical lens are more complicated than those of a spherical lens, it is typically harder to fabricate using traditional fabrication methods like molding, and grinding & polishing. Aspherical lenses are commonly used in high-end camera lenses, as well as in consumer electronics and other optical devices such as telescopes, microscopes, and binoculars. They are also used in eyeglasses to correct certain types of vision problems.

Key Stakeholders for Aspherical Lens Market

- Digital camera companies

- Aspherical lens providers

- Aspherical lens vendors

- Automobile companies

- Architecture and engineering firms

- Third-party aspherical lens system integrators

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to aspherical lenses

Report Objectives

- To describe and forecast the aspherical lens market, in terms of value, based on type, manufacturing technology, offering, and application

- To describe and forecast the aspherical lens market size, in terms of value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the aspherical lens market

- To provide a detailed overview of the supply chain of the aspherical lens ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments in the aspherical lens market, such as acquisitions, product launches, partnerships, expansions, and collaborations

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aspherical Lens Market