Home Security Systems Market Size, Share, Industry Growth Analysis Report by Home Type (Independent Homes, Apartments), Security (Professionally Installed & Monitored, Do-It-Yourself), Systems (Access Control Systems), Services (Security System Integration Services), Global Growth Driver and Industry Forecast To 2030

Attractive opportunities in the Home Security Systems Market size

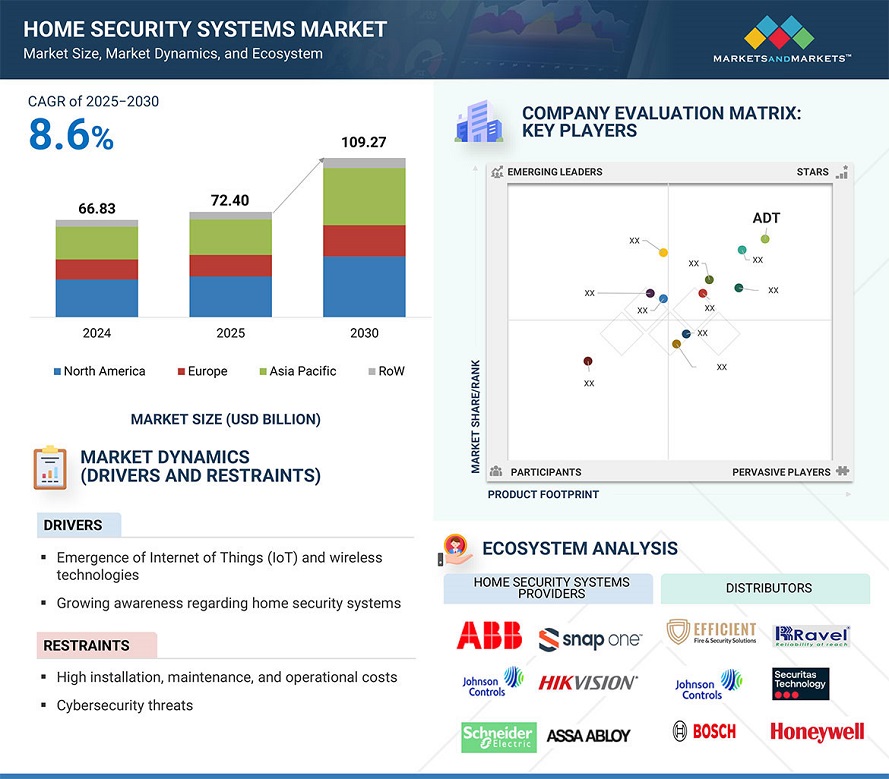

The global home security systems market was valued at USD 72.4 billion in 2025 and is estimated to reach USD 109.4 billion by 2030, registering a CAGR of 8.6% during the forecast period. There are several fundamental driving factors toward the home security systems market growth, such as increasing crime, especially in metropolitan cities that increase demands for security protection for homes and families. Enhancements in new technologies, with the advent of IoT and newly developed wireless technologies including wireless alarm systems that can be monitored remotely. Integrating with smart home ecosystems like Alexa and Google Assistant develops convenience and functionality. Growing awareness of personal safety, accelerating urbanization, and increasing disposable incomes have led to the growth of this market. Government promotion of smart cities and increased security is also boosting the adoption rate. These factors together are driving the higher demand for advanced home security systems worldwide.

Home Security Systems Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

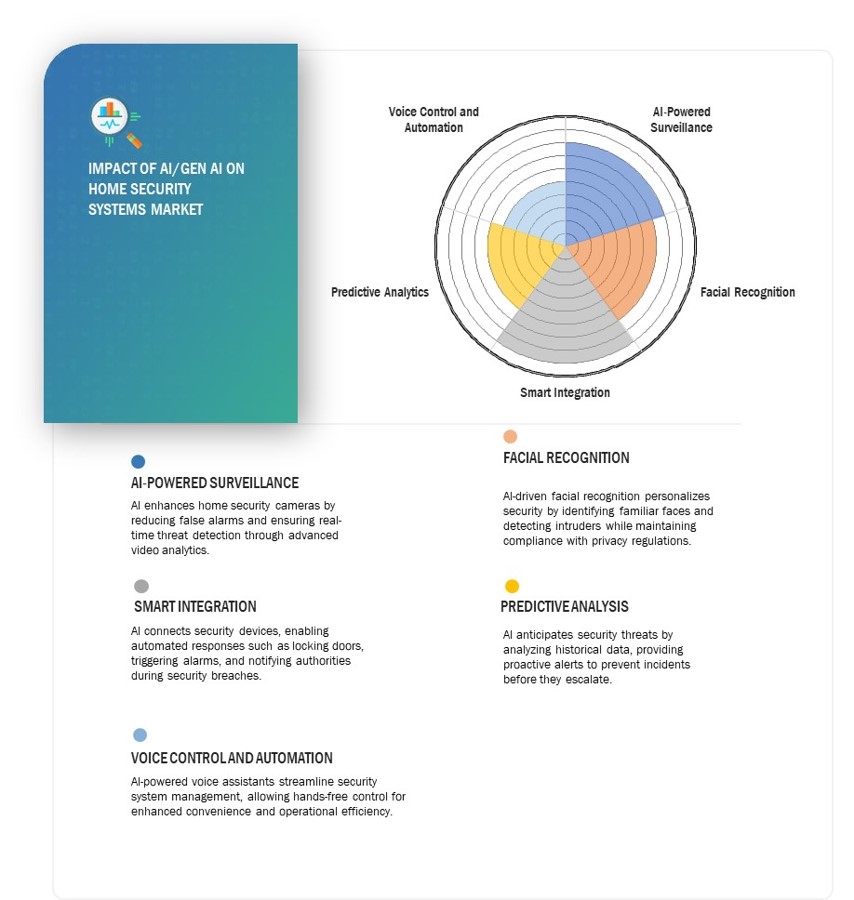

Impact of AI on Home security systems Market

AI is transforming the home security systems market by offering improvement in surveillance, threat detection, automation, and user experience. AI-based smart surveillance cameras can distinguish between real threats and false alarms as they monitor video feeds in real-time and do not produce unnecessary alerts. Facial and voice recognition are personalized security solutions as they identify known persons and alert the homeowners about a stranger. Predictive analytics will identify threats early, allowing detection of threats before they escalate from the analysis of behavioral patterns and potential security risks. Further, AI helps in the smart home integration, where security systems interface with locks, lights, and alarms to provide automatic emergency responses. On the other hand, AI-based cybersecurity measures ensure the protection of smart home networks from electronic threats. It is even more accessible to users via voice assistants like Alexa and Google Home. With its increased capabilities in AI, home security will be the most adaptable security measure ever, highly accurate, efficient, and sophisticated for homeowners.

Market Dynamics:

Driver: Increasing awareness of home security systems

Home security is one of the major concerns for homeowners these days. Due to this, awareness about the benefits of smart home technology is increasing globally. Recent technological advancements have expanded the functionality of security systems, providing greater flexibility and convenience for consumers. Many companies have introduced advanced security systems, which include smart surveillance cameras and automatic door control systems, that capture consumer attention and increase their demand to secure their home and personal belongings. For instance, ADT (US) launched ADT Plus, which integrates Google Nest camera and smart speakers into the Yale Assure Lock 2 with the Trusted Neighbor feature in July 2024. The system uses facial recognition and smart lock automation that assures safe access. It uses protocols like DECT ULE, Z-Wave, Wi-Fi, and BLE for seamless interaction with smart devices and is more aligned with an integrated DIY or professional installation strategy. The user gets notifications on the mobile device in case of intrusion, fire flame, and smoke around its house or building. The security solutions and control systems deployed at homes and buildings elevate the security as it allows continuous monitoring and easy control and communication. These solutions increasingly gain popularity based on Do-it-Yourself affordability and consumer demand. These offer consumers the DIY home security installations that they install and monitor. The increase in consumer awareness is also credited to other complementary markets, such as telecommunications and insurance. Telecommunication companies have also ventured into the home security business, which already has a huge residential customer base with existing internet and cable subscriptions. With this advantage, companies can precisely target opportunities with changing demographics and technological advancements. In addition to that, several insurance firms are offering attractive discounts to house owners who have an inbuilt home security system. Discounting helps consumers save their house insurance premiums and offset adopting a home security system.

Restraint: Cybersecurity threats to home security systems

Growing integration of home security systems with smart home technology brings with it severe cybersecurity challenges that function as a significant growth restraint within the market. As these systems become increasingly interlink with the smart surveillance cameras, smart locks, and voice-activated assistants, cyber threats like data breaches and hacking try to take hold. Potential buyers are afraid of investing in home security solutions because of the vulnerability of their personal data and the possibility of unauthorized access to their homes. For example, if a hacker obtains unauthorized entry into a home security system, he not only compromises the security of the property but may even start collecting sensitive information about the homeowner's daily routines and habits. This could make consumers hesitant to embrace such technologies unless firms can assure strong cybersecurity frameworks. In addition, the lack of uniform cybersecurity practices between various devices and platforms only adds to the problem, as it creates a vacuum that the hackers can take advantage of. Home security manufacturers and service providers are under increased pressure to focus on implementing advanced encryption, software updates, and security audits to ease customer concern. Failure to address the above cybersecurity issues may leave customers less confident, indirectly negatively impacting market growth. The regulatory authorities might also introduce stricter data protection rules, which could increase compliance costs and impair innovations. Hence, although smart home integration is a tremendous step forward for home security systems, it remains crucial to tackle the accompanying cybersecurity risks in order to unlock the market's full potential and sustain consumer adoption.

Opportunity Global expansion of smart city initiative to propel the market growth

The increased smart city initiatives worldwide offer a huge scope for the home security systems market. Governments and urban planners are currently focusing on integrating digital technologies into urban infrastructure. Smart cities rely on interconnected systems, which increase safety, efficiency, and sustainability. This is one of the most natural progressions toward the adoption of smart home security solutions. Smart door locks, wireless alarm systems, and wireless smart surveillance cameras form an integral component of a smart city system by providing much-needed security and convenience of security solutions. Further, wide adaptation of wireless security solutions including wireless alarm systems encourages easy setting and viewing through the web; therefore, these can explain the wide implementation into modern cities. Additionally, smart security systems add up towards energy efficiency and automation that falls within the wider vision of the smart city initiatives. At the same time, features like automatic lighting, motion-based surveillance, and emergency response systems with a network support system improve security and resource optimization.

Governments worldwide are allocating huge budgets toward building smart city infrastructure. For instance, as of December 2024, India's Smart Cities Mission has achieved a 91% project completion rate with USD 16.97 billion investment across 100 cities. The initiative, launched in June 2015, focuses on infrastructure, governance, and sustainable urban development through Area-Based Development (ABD) and Pan-City Projects to enhance the standard of urban living. This creates an encouraging environment for the security technology providers. This rise in investment in digitalization in urban areas increases demand and accelerates technological innovation, creating new security solutions. The collaboration between the manufacturers of security systems, providers of technology, and municipal authorities are expected to fuel market expansion.Advanced home security systems will likely be integrated with smart city frameworks, where the growing emphasis on public safety and data-driven urban management may lead to profitable growth opportunities in the market and strengthen the place of security technology in modern living.

Challenge: Privacy of highly confidential information

Highly confidential information privacy is the greatest challenge facing the home security systems market in light of the constant expansion of smart technologies. Typically, smart home security systems use massive amounts of data, which include personal user information, surveillance footage, access credentials, and routine behavioral patterns, all transmitted over networks for real-time monitoring and control. This sort of data increases security features and is an enabler for a smooth operation but also opens up vulnerabilities. This sensitive information might be exploited by unauthorized entities without proper protection, thus resulting in severe privacy breaches. Hacking home security systems could follow through if users' credentials to a house - login details or access codes are stolen. Gaining unauthorized entry into those homes or tampering with the security system can also cause threats. Data leaks and cyber-attacks grow as data is distributed across platforms and stored in the cloud. Apart from these issues, identity theft might also be one of the after-effects for the consumers as the personal information remains stored in the compromised systems. Other individuals will be more cautious of the security of linked home appliances. More cybercrimes and hacking cases heighten the concerns on data protection vulnerabilities in systems. Manufacturers and service providers are thus pressured to ensure strong protocols on cybersecurity, encryption, and ongoing updates regarding the protection of sensitive information and the consumer's trust.

Home Security Systems Market Ecosystem

The home security systems market is consolidated. Major companies, such as ADT (US), Resideo Technologies Inc (US), Johnson Controls (Ireland), Hangzhou Hikvision Digital Technology (China), ASSA ABLOY (Sweden), SECOM (Japan), Robert Bosch (Germany), Allegionv (Ireland), Snap One LLC (US), and ABB (Switzerland) among others, are the major providers of home security systems. The market has numerous small- and medium-sized vital enterprises. Many players offer components and technologies, while other players offer integration services. These integration services are required in various applications.

Video Surveillance segment in the home security systems market to record the highest CAGR during the forecast period

The video surveillance segment in the home security systems market is expected to record the highest CAGR during the forecast period due to increasing consumer awareness of security threats and advancements in surveillance technology. High-definition (HD) and ultra-HD smart surveillance cameras have witnessed a high demand, as these are required for real-time monitoring and evidence collection. With artificial intelligence and machine learning incorporated into these systems, they are capable of undertaking such activities as facial recognition, motion detection, and behavior analysis in order to heighten threat detection and response. In addition, cloud-based storage solutions are increasingly becoming prevalent, making recorded footage accessible at all times to the user with more convenience and reliability. The increasing penetration of the smart home ecosystem also increases the demand for video surveillance because consumers want integrated security solutions that actually complement their other home automation systems. Not only are smart surveillance cameras affordable, but they are also easy to install, and more and more homeowners want these solutions. Urbanization and increased criminal activities have further triggered the use of modern security products. Incentives and regulatory policies by the governments of the residential and commercial sectors for the adoption of surveillance systems further fuels the market growth. These factors grow at a tremendous pace in the video surveillance segment together.

Security system integration services to hold the largest market share during the forecast period

Security system integration services to hold the largest market share during the forecast period as the access control service providers increasingly adopt integrated security solutions. As security threats become more complex, organizations and homeowners seek comprehensive security frameworks that incorporate one or more of its parts into a single system for security purposes. Security system integration deals with the correct installation and interconnection of hardware such as smart locks, access controllers, readers, emergency security systems, and monitoring devices that ensure communication is smooth and timely in response to threats. Integration improves the effectiveness and efficiency of security measures since it enables different security devices and platforms to operate in cycle with each other. The integration process needs the use of advanced communication technologies like NFC, ZigBee, Bluetooth Smart, and Wiegand 32-bit to enable secure and efficient data transfer between the devices. In addition, security system integration services not only include hardware installation but also a seamless connection with the existing security infrastructures, such as access control systems and intruder alarm management systems. This integration helps with situational awareness and has monitoring capabilities from the center. Through this integration, users can centrally monitor their security systems. The rising trend of smart, automated security solutions is what keeps organizations, residential buildings, and commercial facilities opting for professional security system integration services. As needs in security keep changing, a system integrator plays an essential role in bringing scalable, custom solutions to a level where effectiveness in overall security and efficiency in operations increase.

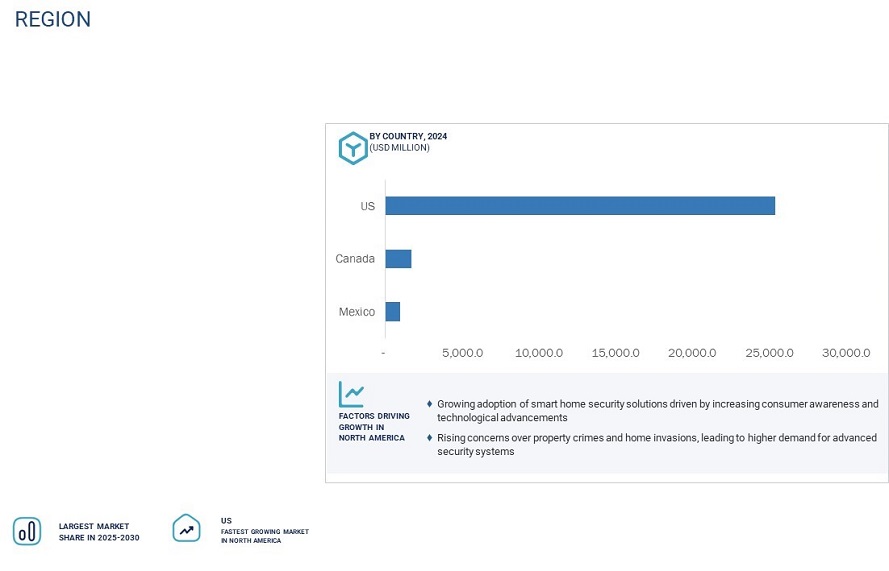

North America to hold largest market share for home security systems

North America will likely dominate the home security systems market as, including full-fledged awareness among consumers, superior technological infrastructure, and a strong presence of leading market players. A significant rise in the adoption of smart home security solutions has been observed here due to growing concerns relating to residential safety and increasing instances of property crime. Hence, consumers in North America are susceptible to smart surveillance cameras, motion detectors, smart locks, and integrated alarm systems, which translates into a growing need for comprehensive home security systems. The dominance of the region's market is therefore significantly added by major players such as ADT (US), Resideo Technologies Inc (US), Snap One LLC (US), Comcast (US), Alarm.com (US), Vivint, Inc. (US), SimpliSafe, Inc. (US), Alarms.org (US), Canary Connect, Inc. (US), and Scout Security Inc (US) through technological know-how in artificial intelligence (AI) and Internet of Things (IoT). The government has also introduced various programs and policies to enhance security standards that have accelerated the adoption of home security solutions. The extensive availability of high-speed internet has made it easier for individuals to connect and manage their smart homes remotely with all security systems integrated. Furthermore, increasing threat awareness regarding cybersecurity has compelled home security system suppliers in North America to spend significant amounts of money on cybersecurity solutions for safety and secured communications between connected devices. With these premium security products, consumer desire and growing demand for smart cities are going to drive steady expansion in the market for home security systems in North America.

Home Security Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The home security systems market is dominated by a few globally established players, such as ADT (US), Resideo Technologies Inc (US), Johnson Controls (Ireland), Hangzhou Hikvision Digital Technology (China), ASSA ABLOY (Sweden), SECOM (Japan), Robert Bosch (Germany), Allegion (Ireland), Snap One LLC (US), ABB (Switzerland), Comcast (US), Alarm.com (US), Nice S.p.A. (Italy), Vivint, Inc. (US), SimpliSafe, Inc. (US), Alarms.org (US), Canary Connect, Inc. (US), Scout Security Inc (US), Legrand (France), and Schneider Electric (France).

Home Security Systems Market Report Scope :

|

Report Metric |

Detail |

| Market Size Value in 2025 | USD 72.4 Billion |

| Revenue Forecast in 2030 | USD 109.4 Billion |

| Growth Rate | 8.6% CAGR |

|

Base Year Considered |

2024 |

|

Historical Data Available for Year |

2018–2025 |

|

Forecast Period |

2022–2030 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | The emergence of the Internet of Things (IoT) and wireless technologies |

| Key Market Opportunity | Implementation of artificial intelligence (AI) and deep learning in home security systems |

| Largest Growing Region | North America |

This research report categorizes the home security systems market, by home type, security, systems, Trends,services, and region

Home Security Market Size , By Home Type:

- Independent Homes

- Condominiums/ Apartments

Home Security Market , By Security:

- Professional-installed and Monitored

- Self-installed and Professionally Monitored

- Do-It-Yourself (DIY)

Home Security Industry, By Systems:

- Fire Protection System

- Video Surveillance System

- Access Control System

- Entrance Control System

- Intruder Alarm System

Home Security Market Size , By Services:

- Security System Integration Services

- Remote Monitoring Services

- Fire Protection Services

- Video Surveillance Services

- Access Control Services

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East

- Africa

- South America

Recent Developments

- In July 2024, ADT (US) introduced its new ADT Plus smart security system, integrating proprietary hardware with Google Nest cameras and Yale’s Assure Lock 2. This system enhances home security through features like Trusted Neighbor, leveraging AI-driven automation and Z-Wave connectivity. ADT Plus replaces its previous Self Setup system following Google’s investment.

- In November 2024, Resideo Technologies Inc (US) introduced the First Alert VISTA H Series at CONNECT 2024, enhancing its VISTA security platform for residential and light-commercial applications. The scalable hybrid system integrates with existing peripherals, streamlining installations and reducing costs. The First Alert H3 Security Panel, the first in the series, launches this month.

- In April 2024, Hangzhou Hikvision Digital Technology (China) introduced the AX HOME series wireless alarm system designed for residential security. Certified to EN Grade 2 standards, it supports Open Things Access Protocol (OTAP) for seamless integration, offers energy efficiency, and features remote management via the Hik-Connect app. The system ensures simplified installation and maintenance.

- In September 2024, ASSA ABLOY (Sweden) acquired Level Lock, a California-based technology firm specializing in digital access solutions. The acquisition, which adds to ASSA ABLOY’s technology portfolio in the Americas, includes Level Lock’s innovative platform and approximately 70 employees. Level Lock reported sales of $16 million in 2023.

- In August 2024, SECOM (Japan) introduced Secom AWARE, an AI-powered security system integrating cloud-based controls and video analytics to enhance threat detection. Featuring predictive alerts, license plate tracking, and facial recognition, the system aims to prevent crimes by providing immediate notifications while minimizing false alarms through advanced analytics and deep learning.

Frequently Asked Questions (FAQs):

Which are the major companies in the home security systems market? What are their significant strategies to strengthen their market presence?

The major companies in the home security systems market are ADT (US), Resideo Technologies Inc (US), Johnson Controls (Ireland), Hangzhou Hikvision Digital Technology (China), ASSA ABLOY (Sweden). The significant strategies these players adopt are product launches & developments, contracts, collaborations, acquisitions, and expansions.

Which region has the highest potential in the home security systems market?

The Asia Pacific region is expected to register the fastest growth in the home security systems market.

What are the opportunities for new market entrants?

The home security systems market offers opportunities for new entrants to target emerging markets, develop affordable and customizable solutions, and leverage advanced technologies like AI and IoT for unique features.

What are the drivers and opportunities for the home security systems market?

Drivers and opportunities in the home security systems market include focus on rising crime rates and property-related incidents driving demand, Growing smart home adoption, and IoT integration. Integration with AI and machine learning for predictive security and expanding market for DIY security solutions.

What significant home security systems services are expected to drive the market’s growth in the next five years?

The significant services in the home security systems are video surveillance services, security system integration services, and fire protection services.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET: SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market size by top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 HOME SECURITY SYSTEMS MARKET: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 HOME SECURITY SYSTEMS MARKET, 2018–2027 (USD BILLION)

FIGURE 9 MARKET FOR CONDOMINIUMS/APARTMENTS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 MARKET FOR DIY SYSTEMS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 MARKET SHARE (%), BY OFFERING, 2022 & 2027

FIGURE 12 NORTH AMERICA TO DOMINATE MARKET BETWEEN 2022–2027, BY REGION

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN HOME SECURITY SYSTEMS MARKET, 2022–2027

FIGURE 13 INTEGRATION OF AI AND DEEP LEARNING IN HOME SECURITY SYSTEMS TO OFFER ATTRACTIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

4.2 HOME SECURITY SYSTEMS MARKET, BY SYSTEM

FIGURE 14 VIDEO SURVEILLANCE SYSTEM SEGMENT TO HVE HIGHEST GROWTH FROM 2022 TO 2027

4.3 MARKET, BY SYSTEMS AND COUNTRY

FIGURE 15 VIDEO SURVEILLANCE SYSTEM SEGMENT AND US HELD LARGEST SHARES OF MARKET IN 2021

4.4 US ACQUIRED LARGEST SHARE OF MARKET IN 2021

FIGURE 16 MARKET IN CHINA TO INFLUENCE HIGHEST GROWTH FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 HOME SECURITY SYSTEMS MARKET: DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Emergence of Internet of Things (IoT) and wireless technologies

5.2.1.2 Growing awareness regarding home security systems

FIGURE 18 HOME SECURITY SYSTEMS MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation, maintenance, and operational costs

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of artificial intelligence (AI) and deep learning in home security systems

5.2.3.2 Worldwide proliferation of smart cities initiative

FIGURE 19 HOME SECURITY MARKET : IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 System complexity

5.2.4.2 Privacy of highly confidential information

FIGURE 20 MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 ORIGINAL EQUIPMENT MANUFACTURERS ADD MAXIMUM VALUE TO VALUE CHAIN OF HOME SECURITY SYSTEMS MARKET

5.4 EMERGING TRENDS

5.4.1 INCREASING ADOPTION OF CLOUD TECHNOLOGIES FOR SMART SURVEILLANCE

6 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS (Page No. - 55)

6.1 INTRODUCTION

TABLE 1 HOME SECURITY MARKET , BY TYPE, 2018–2021 (USD BILLION)

TABLE 2 MARKET, BY TYPE, 2022–2027 (USD BILLION)

6.2 SYSTEMS

FIGURE 22 VIDEO SURVEILLANCE SYSTEM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 3 HOME SECURITY MARKET , BY SYSTEMS, 2018–2021 (USD BILLION)

TABLE 4 HOME SECURITY SYSTEMS MARKET, BY SYSTEMS, 2022–2027 (USD BILLION)

6.3 FIRE PROTECTION SYSTEM MARKET

6.3.1 DEVELOPMENT OF INNOVATIVE AND EFFICIENT SYSTEMS TO BOOST GROWTH OF FIRE PROTECTION SYSTEMS MARKET

TABLE 5 MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2018–2021 (USD MILLION)

TABLE 6 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY REGION, 2022–2027 (USD MILLION)

TABLE 7 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 8 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY COMPONENT, 2022–2027 (USD MILLION)

6.3.1.1 Hardware

6.3.1.1.1 Market for fire alarm devices to register highest CAGR

TABLE 9 MARKET FOR FIRE PROTECTION SYSTEM, BY DEVICE, 2018–2021 (USD MILLION)

TABLE 10 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY DEVICE, 2022–2027 (USD MILLION)

6.3.1.1.2 Fire sprinklers

6.3.1.1.3 Fire extinguishers

6.3.1.1.4 Secure communication products

6.3.1.1.5 Sensors and detectors

6.3.1.1.6 Radiofrequency identification (RFID)

6.3.1.1.7 Fire alarm devices

6.3.1.1.8 Emergency lighting

6.3.1.1.9 Voice evacuation and public products

6.3.1.1.10 Others

6.3.1.2 Software

6.3.1.2.1 Increasing adoption of fire modeling and simulation software to fuel market growth

TABLE 11 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 12 HOME SECURITY MARKET FOR FIRE PROTECTION SYSTEM, BY SOFTWARE, 2022–2027 (USD MILLION)

6.3.1.2.2 Fire mapping & analysis software

6.3.1.2.3 Fire modeling & simulation software

6.4 VIDEO SURVEILLANCE SYSTEMS

6.4.1 INCREASING DEMAND FOR REAL-TIME MONITORING AND PERIMETER SURVEILLANCE

TABLE 13 MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY REGION, 2022–2027 (USD MILLION)

TABLE 15 MARKET, FOR VIDEO SURVEILLANCE SYSTEM, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 16 HOME SECURITY MARKET , FOR VIDEO SURVEILLANCE SYSTEM, BY COMPONENT, 2022–2027 (USD MILLION)

6.4.1.1 Hardware

6.4.1.1.1 Growing demand for IP cameras to push market demand for video surveillance systems

TABLE 17 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 18 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

6.4.1.1.2 Camera

TABLE 19 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY CAMERA TYPE, 2018–2027 (USD MILLION)

TABLE 20 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY CAMERA TYPE, 2022–2027 (USD MILLION)

6.4.1.1.2.1 IP cameras

6.4.1.1.2.2 Analog cameras

6.4.1.1.3 Monitors

6.4.1.1.4 Server

6.4.1.1.5 Storage

6.4.1.1.6 Others

6.4.1.2 Software

6.4.1.2.1 Market for video management software to exhibit highest CAGR

TABLE 21 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 22 HOME SECURITY MARKET FOR VIDEO SURVEILLANCE SYSTEM, BY SOFTWARE, 2022–2027 (USD MILLION)

6.4.1.2.2 Video analytics software

6.4.1.2.3 Video management software (VMS)

6.4.1.2.4 Neural networks and algorithms

6.5 ACCESS CONTROL SYSTEMS

6.5.1 INCREASING DEPLOYMENT OF CONTROLLERS AND SERVERS TO AMPLIFY MARKET FOR ACCESS CONTROL SYSTEMS

TABLE 23 HOME SECURITY MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 HOME SECURITY MARKET FOR ACCESS CONTROL SYSTEM, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 MARKET FOR ACCESS CONTROL SYSTEM, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 26 HOME SECURITY MARKET FOR ACCESS CONTROL SYSTEM, BY COMPONENT, 2022–2027 (USD MILLION)

6.5.1.1 Hardware

6.5.1.1.1 Rising demand for access control hardware in residential projects

TABLE 27 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL SYSTEM, BY DEVICE, 2018–2021 (USD MILLION)

TABLE 28 MARKET FOR ACCESS CONTROL SYSTEM, BY DEVICE, 2022–2027 (USD MILLION)

6.5.1.1.2 Controller/server

6.5.1.1.3 Card readers

TABLE 29 HOME SECURITY SYSTEMS MARKET FOR ACCESS CONTROL CARDS AND READERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 HOME SECURITY MARKETFOR ACCESS CONTROL CARDS AND READERS, BY TYPE, 2022–2027 (USD MILLION)

6.5.1.1.3.1 Magnetic strip readers

6.5.1.1.3.2 Proximity card & readers

6.5.1.1.3.3 Smart cards & readers

6.5.1.1.4 Biometrics

6.5.1.1.5 Electronic locks

TABLE 31 HOME SECURITY MARKET FOR ACCESS CONTROL ELECTRONIC LOCKS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 32 HOME SECURITY MARKET FOR ACCESS CONTROL ELECTRONIC LOCKS, BY TYPE, 2022–2027 (USD MILLION)

6.5.1.1.5.1 Electromagnetic locks

6.5.1.1.5.2 Electric strike locks

6.5.1.1.5.3 Wireless locks

6.5.1.1.6 Multi-technology readers

6.5.1.2 Software

6.5.1.2.1 Rising deployment of access control software in new building projects to propel market during forecast period

6.6 ENTRANCE CONTROL SYSTEMS

6.6.1 INCREASING ADOPTION OF INTEGRATED ENTRANCE CONTROL SYSTEMS IN APARTMENTS AND CONDOMINIUMS

TABLE 33 MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR ENTRANCE CONTROL SYSTEM, BY REGION, 2022–2027 (USD MILLION)

6.7 INTRUDER ALARM

6.7.1 INCREASING CRIME RATE AND THEFTS TO POSITIVELY INFLUENCE DEMAND FOR INTRUDER ALARMS

TABLE 35 MARKET FOR INTRUDER ALARM, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR INTRUDER ALARM, BY REGION, 2022–2027 (USD MILLION)

7 HOME SECURITY SYSTEMS MARKET, BY SERVICES (Page No. - 79)

7.1 INTRODUCTION

FIGURE 23 VIDEO SURVEILLANCE SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 HOME SECURITY MARKET, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 38 HOME SECURITY MARKET , BY SERVICES, 2022–2027 (USD MILLION)

TABLE 39 HOME SECURITY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2 SECURITY SYSTEM INTEGRATION SERVICES

7.2.1 INCREASING ADOPTION OF SECURITY SYSTEM INTEGRATION BY ACCESS CONTROL SERVICE PROVIDERS

TABLE 41 SECURITY SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 SECURITY SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 REMOTE MONITORING SERVICES

7.3.1 COST-EFFECTIVE USER INTERFACES PROVIDED BY REMOTE MONITORING SERVICES

TABLE 43 REMOTE MONITORING SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 REMOTE MONITORING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 FIRE SECURITY SERVICES

7.4.1 GROWING NEED TO MAINTAIN FIRE SECURITY SYSTEMS TO DRIVE MARKET GROWTH

TABLE 45 FIRE SECURITY SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 FIRE SECURITY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 47 FIRE SECURITY SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 48 FIRE SECURITY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.4.2 ENGINEERING SERVICES

7.4.2.1 Rise in demand for fire risk management services

7.4.3 INSTALLATION AND DESIGN

7.4.3.1 Growing demand for installation and design services in independent homes

7.4.4 MAINTENANCE SERVICES

7.4.4.1 Growing demand for testing and inspection of fire protection systems

7.4.5 MANAGED SERVICES

7.4.5.1 Implementation of tested solutions in residential buildings

7.4.6 OTHERS

7.5 VIDEO SURVEILLANCE SERVICES

7.5.1 MARKET FOR VIDEO SURVEILLANCE SERVICES TO EXHIBIT HIGHEST CAGR

TABLE 49 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 VIDEO SURVEILLANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 52 VIDEO SURVEILLANCE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.5.2 INSTALLATION AND MAINTENANCE

7.5.2.1 High cost of repair commands more demand for installation and maintenance services

7.5.3 VIDEO SURVEILLANCE AS SERVICES (VSAAS)

7.5.3.1 Surging demand in security companies

TABLE 53 VIDEO SURVEILLANCE-AS-A-SERVICE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 54 VIDEO SURVEILLANCE-AS-A-SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.6 ACCESS CONTROL SERVICES

7.6.1 ADVANCEMENTS IN CLOUD TECHNOLOGY TO PUSH DEMAND FOR ACCESS CONTROL SERVICES

TABLE 55 ACCESS CONTROL SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 ACCESS CONTROL SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 ACCESS CONTROL SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 58 ACCESS CONTROL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.6.2 INSTALLATION & INTEGRATION

7.6.2.1 Integration enables devices to connect and provide communication access

7.6.3 MAINTENANCE SERVICE

7.6.3.1 Increasing adoption of real-time monitoring of access control systems to raise demand for maintenance services

7.6.4 ACCESS CONTROL-AS-A-SERVICE

7.6.4.1 Cost-effective operations provided by access control-as-a-services

8 HOME SECURITY SYSTEMS MARKET, BY SECURITY (Page No. - 92)

8.1 INTRODUCTION

FIGURE 24 PROFESSIONALLY INSTALLED AND MONITORED SYSTEMS TO HOLD LARGEST SHARE OF MARKET

TABLE 59 HOME SECURITY INDUSTRY, BY SECURITY, 2018–2021 (USD BILLION)

TABLE 60 HOME SECURITY INDUSTRY, BY SECURITY, 2022–2027 (USD BILLION)

8.2 PROFESSIONALLY INSTALLED AND MONITORED SYSTEMS

8.2.1 PROFESSIONALLY INSTALLED AND MONITORED SECURITY SYSTEMS PROVIDE USERS WITH SET OF DEDICATED CONSULTING AND ENGINEERING SERVICES

8.3 SELF-INSTALLED AND PROFESSIONALLY MONITORED SYSTEMS

8.3.1 INCREASING CONSUMER PREFERENCE FOR SELF-INSTALLED HOME SECURITY SYSTEMS TO DRIVE MARKET GROWTH

8.4 DO-IT-YOURSELF (DIY)

8.4.1 GROWING DEMAND FOR DIY SECURITY SYSTEMS TO FUEL MARKET GROWTH DURING FORECAST PERIOD

9 HOME SECURITY SYSTEMS MARKET, BY HOME TYPE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 25 HOME SECURITY INDUSTRY FOR CONDOMINIUM/APARTMENTS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 61 HOME SECURITY INDUSTRY, BY HOME TYPE, 2018–2021 (USD BILLION)

TABLE 62 HOME SECURITY INDUSTRY, BY HOME TYPE, 2022–2027 (USD BILLION)

9.2 INDEPENDENT HOUSES

9.2.1 INDEPENDENT HOMEOWNERS LEVERAGE COST EFFECTIVENESS OF ADVANCED AND CONNECTED HOME SECURITY SYSTEMS

9.3 CONDOMINIUMS/APARTMENTS

9.3.1 GROWING DEMAND FOR INTEGRATED SECURITY SOLUTIONS IN CONDOMINIUMS/APARTMENTS

10 GEOGRAPHIC ANALYSIS (Page No. - 99)

10.1 INTRODUCTION

FIGURE 26 GEOGRAPHIC ANALYSIS: MARKET (2022–2027)

TABLE 63 MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 64 MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2 NORTH AMERICA

10.2.1 PRESENCE OF STRINGENT REGULATION AND ADOPTION OF INNOVATIVE TECHNOLOGIES TO BOOST MARKET GROWTH

FIGURE 27 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 65 HOME SECURITY SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 HOME SECURITY INDUSTRY IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 68 HOME SECURITY MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 69 HOME SECURITY INDUSTRY IN NORTH AMERICA, BY SYSTEMS, 2018–2021 (USD MILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY SYSTEMS, 2022–2027 (USD MILLION)

TABLE 71 HOME SECURITY INDUSTRY IN NORTH AMERICA, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 72 HOME SECURITY INDUSTRY IN NORTH AMERICA, BY SERVICES, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 Increasing demand for intelligent video surveillance systems in US

10.2.3 CANADA

10.2.3.1 Low mortgage and interest rates for construction activities to drive demand for home security systems in Canada

10.2.4 MEXICO

10.2.4.1 High crime rate to increase adoption of video surveillance security solutions in Mexico

10.3 EUROPE

10.3.1 GROWING ADOPTION OF FIRE PROTECTION SYSTEMS DURING RENOVATION OF CONVENTIONAL BUILDINGS TO FUEL EUROPEAN MARKET

FIGURE 28 EUROPE: SNAPSHOT OF HOME SECURITY SYSTEMS MARKET

TABLE 73 HOME SECURITY INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 HOME SECURITY INDUSTRY IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 HOME SECURITY INDUSTRY IN EUROPE, BY SYSTEMS, 2018–2021 (USD MILLION)

TABLE 78 HOME SECURITY INDUSTRY IN THE EUROPE, BY SYSTEMS, 2022–2027 (USD MILLION)

TABLE 79 MARKET IN EUROPE, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY SERVICES, 2022–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Stringent regulations and privacy laws to increase demand for home security systems in Germany

10.3.3 UK

10.3.3.1 Stringent regulations for fire safety to propel market growth in UK

10.3.4 FRANCE

10.3.4.1 Increasing adoption of home security systems in conventional buildings to push market in France

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 GROWING DEMAND FOR INTELLIGENT CAMERAS IN HOUSING PROJECTS TO RAISE MARKET DEMAND IN ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: SNAPSHOT OF HOME SECURITY SYSTEMS MARKET

TABLE 81 HOME SECURITY INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 HOME SECURITY INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 HOME SECURITY INDUSTRY IN ASIA PACIFIC, BY SYSTEMS, 2018–2021 (USD MILLION)

TABLE 86 HOME SECURITY INDUSTRY IN ASIA PACIFIC, BY SYSTEMS, 2022–2027 (USD MILLION)

TABLE 87 MARKET IN ASIA PACIFIC, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN ASIA PACIFIC, BY SERVICES, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Rapid urbanization to generate demand for home security systems in China

10.4.3 JAPAN

10.4.3.1 Growing emphasis by government on fire safety measures to grow market for home security systems in Japan

10.4.4 SOUTH KOREA

10.4.4.1 Increasing R&D for innovative security products to drive market in South Korea

10.4.5 INDIA

10.4.5.1 Increasing demand for wireless technologies and advanced cameras to raise market growth in India

10.4.6 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

10.5.1 GROWING DEMAND FOR VIDEO SURVEILLANCE AND ACCESS CONTROL SYSTEMS TO BOOST MARKET IN REST OF THE WORLD

TABLE 89 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY REGI0N, 2022–2027 (USD MILLION)

TABLE 91 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY TYPE, 2018–2021 (USD MILLION)

TABLE 92 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY TYPE, 2022–2027 (USD MILLION)

TABLE 93 MARKET IN REST OF THE WORLD, BY SYSTEMS, 2018–2021 (USD MILLION)

TABLE 94 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY SYSTEMS, 2022–2027 (USD MILLION)

TABLE 95 MARKET IN REST OF THE WORLD, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 96 HOME SECURITY INDUSTRY IN REST OF THE WORLD, BY SERVICES, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Increasing adoption of security solutions by independent homeowners to influence positive demand in South America

10.5.3 MIDDLE EAST

10.5.3.1 Increasing urbanization and government spending on infrastructure development in the Middle East

10.5.4 AFRICA

10.5.4.1 Growing demand for security systems from residential homeowners to help grow African market

11 COMPETITIVE LANDSCAPE (Page No. - 120)

11.1 OVERVIEW

11.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 30 HOME SECURITY INDUSTRY : REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 97 MARKET: MARKET SHARE ANALYSIS (2021)

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE COMPANIES

11.4.4 PARTICIPANTS

FIGURE 31 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5 COMPETITIVE SITUATIONS AND TRENDS

TABLE 98 HOME SECURITY SYSTEMS MARKET: PRODUCT LAUNCHES, DECEMBER 2019–MARCH 2021

TABLE 99 HOME SECURITY INDUSTRY : DEALS, FEBRUARY 2019-APRIL 2022

12 COMPANY PROFILES (Page No. - 127)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 ADT

TABLE 100 ADT: BUSINESS OVERVIEW

FIGURE 32 ADT: COMPANY SNAPSHOT

TABLE 101 ADT: PRODUCTS OFFERED

12.1.2 RESIDEO TECHNOLOGIES INC

TABLE 102 RESIDEO TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 33 RESIDEO TECHNOLOGIES INC.: COMPANY SNAPSHOT

TABLE 103 RESIDEO TECHNOLOGIES, INC.: PRODUCTS OFFERED

12.1.3 JOHNSON CONTROLS

TABLE 104 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 34 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 105 JOHNSON CONTROLS: PRODUCTS OFFERED

12.1.4 HANGZHOU HIKVISION DIGITAL TECHNOLOGY

TABLE 106 HANGZHOU HIGVISION DIGITAL TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 35 HANGZHOU HIGVISION DIGITAL TECHNOLOGY: COMPANY SNAPSHOT

TABLE 107 HANGZHAU HIGVISION DIGITAL TECHNOLOGY: PRODUCTS OFFERED

12.1.5 ASSA ABLOY

TABLE 108 ASSA ABLOY: BUSINESS OVERVIEW

FIGURE 36 ASSA ABLOY: COMPANY SNAPSHOT

TABLE 109 ASSA ABLOY: PRODUCTS OFFERED

12.1.6 SECOM

TABLE 110 SECOM: BUSINESS OVERVIEW

FIGURE 37 SECOM: COMPANY SNAPSHOT

TABLE 111 SECOM: PRODUCTS OFFERED

12.1.7 ROBERT BOSCH

TABLE 112 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 38 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 113 ROBERT BOSCH: PRODUCTS OFFERED

12.1.8 ALLEGION

ABLE 114 ALLEGION: BUSINESS OVERVIEW

FIGURE 39 ALLEGION: COMPANY SNAPSHOT

TABLE 115 ALLEGION: PRODUCTS OFFERED

12.1.9 SNAP ONE, LLC

TABLE 116 SNAP ONE, LLC: BUSINESS OVERVIEW

FIGURE 40 SNAP ONE, LLC: COMPANY SNAPSHOT

TABLE 117 SNAP ONE, LLC: PRODUCT OFFERINGS

12.1.10 ABB

TABLE 118 ABB: BUSINESS OVERVIEW

FIGURE 41 ABB: COMPANY SNAPSHOT

TABLE 119 ABB: PRODUCT OFFERINGS

12.2 OTHER PLAYERS

12.2.1 COMCAST

TABLE 120 COMCAST: BUSINESS OVERVIEW

12.2.2 ALARM.COM

TABLE 121 ALARM.COM: BUSINESS OVERVIEW

12.2.3 NORTEK SECURITY & CONTROL

TABLE 122 NORTEK SECURITY & CONTROL: BUSINESS OVERVIEW

12.2.4 VIVINT

TABLE 123 VIVINT: BUSINESS OVERVIEW

12.2.5 SIMPLISAFE

TABLE 124 SIMPLISAFE: BUSINESS OVERVIEW

12.2.6 ARMORAX

TABLE 125 ARMORAX: BUSINESS OVERVIEW

12.2.7 CANARY

TABLE 126 CANARY: BUSINESS OVERVIEW

12.2.8 SCOUT

TABLE 127 SCOUT: BUSINESS OVERVIEW

12.2.9 LEGRAND

TABLE 128 LEGRAND: BUSINESS OVERVIEW

12.2.10 SCHNEIDER ELECTRIC

TABLE 129 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 161)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 VIDEO SURVEILLANCE MARKET, BY SYSTEM

TABLE 130 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2017–2020 (USD MILLION)

TABLE 131 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2021–2026 (USD MILLION)

13.3.1 ANALOG VIDEO SURVEILLANCE SYSTEM

13.3.1.1 Analog surveillance systems mainly consist of analog cameras and DVRs

13.3.2 IP VIDEO SURVEILLANCE SYSTEM

13.3.2.1 IP video surveillance systems offer enhanced security and better resolution

14 APPENDIX (Page No. - 164)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the home security systems market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the home security systems market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the home security systems industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the home security systems market based on home type, security, systems, services, and region. It also includes information about the key developments undertaken from both markets- and technology-oriented perspectives.

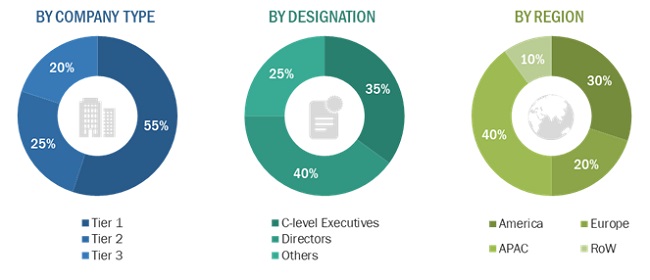

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the home security services market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the home security systems market.

- First, companies offering home security systems have been identified, and their product mapping with respect to different parameters such as systems type, offering, and services has been carried out.

- The size of the home security services market has been estimated based on the demand for different types of systems. The revenues of the companies operating in the home security system ecosystem and the anticipated change in the demand for home security systems offered by them in the post-COVID-19 scenario have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the home security systems market to validate the global size of the market. The discussions included the impact of COVID-19 on the ecosystem of the home security systems market.

- The CAGR of the home security systems market has been calculated considering the historical and future market trends and the impact of COVID-19 by understanding the penetration rate of home security systems and their demand and supply in residential applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases were also studied.

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the home security systems market.

- Focusing on the top-line investment and expenditure in the ecosystems, and further splitting the market based on new installations, upgraded devices, software implementation, and the key developments in the major market areas.

- Building and developing the information related to revenue generated by key product, service, and software providers.

- Conducting multiple on-field discussions with key opinion leaders across each major company involved in the development of products, services, and software.

- Estimating the geographic split using secondary sources, based on various factors such as the number of players in a specific country and region, types of products, levels of services offered, and types of software implemented.

- The impact of COVID-19 on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the home security systems market.

Report Objectives

- To define, describe, and forecast the home security systems market, in terms of value, by home type, systems, services, security type, and geography.

- To forecast the market size for the concerned segments with respect to the 4 key regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To analyze the value chain to understand the flow of activities performed by various companies to develop and deliver the products to consumers

- To analyze the micromarkets1 with regard to industry trends and prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the home security systems market and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To analyze the competitive developments such as partnerships, collaborations, mergers and acquisitions, and product launches and developments in the home security systems market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Home Security Systems Market

Does this report contain details of security cameras linked with mobile phones. As our organization is targeting them specifically, we would need such data.