Assistive Robotics Market by Mobility, Type (Physically, Socially, Mixed Assistive), Application (Elderly Assistance, Companionship, Handicap Assistance, Surgery Assistance, Industrial, Defense, Public Relations), and Geography - Global Forecast to 2024-2033

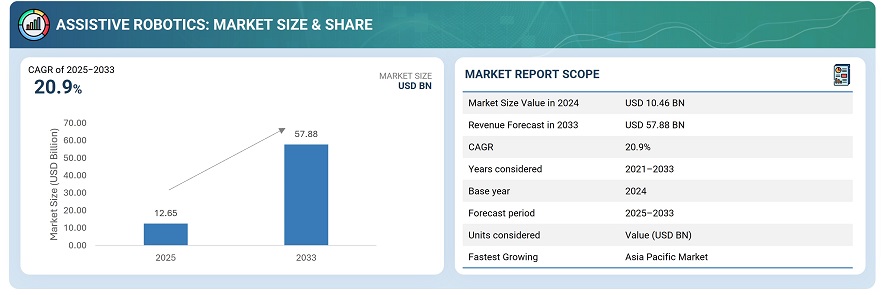

The global assistive robotics market was valued at USD 10.46 billion in 2024 and is estimated to reach USD 57.88 billion by 2033, at a CAGR of 20.9% between 2025 and 2033.

The assistive robotics market is experiencing robust growth due to accelerating advances in artificial intelligence, sensor capabilities, and user-friendly designs that enable robots to deliver highly personalized support. Increasing awareness of the benefits of robotic assistance, coupled with shifting demographics such as an aging population and a rise in chronic health conditions, is driving greater adoption in healthcare, rehabilitation, and home environments. Innovations focused on ease of integration, adaptability to user needs, and real-time monitoring are making assistive robots indispensable aids for improving autonomy and quality of life. Supportive government policies, increased healthcare investment, and collaborative industry strategies are collectively reinforcing this positive market trajectory.

An assistive robot is a robotic device that performs a physical task for people with disabilities, the elderly, toddlers, and industrial workers. The aim of assistive robotics is to develop robotic aids for supporting people living independently and those who have degenerative limitations, such as elderly and people with disabilities. Assistive robots have the capability to perceive their environment and individuals with the help of sensors and intelligent algorithms, to communicate with people multimodally, to navigate autonomously, and to make decisions independently. These assistive robotic systems are used in various applications such as elderly assistance, companionship, handicap assistance, surgery assistance, industrial, defense, public relations, and others.

Market by Mobility

Stationary assistive robotic systems accounted for the largest share in terms of value in 2024. Stationary assistive robotic systems are those that are fixed in one position. These systems perform their tasks at a fixed location. Robotic manipulators, dynamic arm supports, and meal supports are a few types of stationary assistive robotic systems. These robotic systems are mostly used in household and medical applications. For instance, the da Vinci surgical system, manufactured by Intuitive Surgical (US), is a stationary assistive robotic system used for performing robotic surgeries. Also, Kaspar, the social robot developed by the University of Hertfordshire’s Adaptive Systems Research Group (UK), is a stationary robot designed to help children with autism.

Market by Type

Physically assistive robots have the fastest growth during the forecast period. These robots help individuals suffering from medical conditions and injuries that limit upper-body or lower-body movements. These robots are also used in rehabilitation centres to provide rehabilitation to recover individuals who have suffered neurological and spinal cord injuries. Exoskeleton robots are used in rehabilitation centres and by individuals with disabilities.

Market by Geography

North America held the largest share of the assistive robotics market in 2024. Growing demand from the healthcare sector for rehabilitation, the increasing adoption of surgical robots by hospitals in the region, favourable funding scenario for research on assistive technologies, and the availability of technologically advanced assistive robots are a few of the key factors driving the growth of the assistive robotics market in North America. The market in APAC is expected to grow at the highest CAGR during the forecast period. The rising geriatric population in recent years and the lack of trained attendants are expected to drive the growth of the assistive robotics market in the region.

Market Dynamics

Driver: Rapidly ageing global population

One of the major drivers of the assistive robotics market is the rapidly ageing global population, which intensifies the need for innovative solutions that support independent living and healthcare. As seniors face increasing mobility and cognitive challenges, assistive robots are being adopted to help them manage everyday tasks, monitor their health, and maintain autonomy. This demographic shift is prompting families and healthcare systems to seek robotic support, particularly amid labour shortages and increasing care demands. Consequently, technological advancements and policy support are further accelerating adoption in both home and clinical settings.

Restraint: Necessity to abide by various standards and certifications, especially in the medical industry

The rise in the geriatric population worldwide, along with the lack of attendants for them, has resulted in technological innovations to help people in their daily lives. These technological innovations have given rise to assistive robotic solutions, particularly in the medical industry. Currently, the healthcare industry is one of the most dynamic areas for the research and development of assistive robotics. From robot-assisted surgery through robotic nurses to in-home rehabilitation and eldercare robots, there are numerous possibilities and benefits. At the same time, taking advantage of these market opportunities presents major challenges, especially for those companies that are unfamiliar with the rigorous regulatory approval schemes and strict oversight pertinent to medical devices in the US, the European Union (EU), Japan, and other major medical device markets.

Opportunity: Rise in the geriatric population globally

Due to the availability of advanced healthcare products and services, people are living longer with an improved lifestyle. This longer life expectancy, coupled with declining birth rates, is resulting in a rapid increase in the ageing population. According to the United Nations, the world population above the age of 60 has tripled over the last 50 years and is expected to triple again to 2 billion by 2050. With a worldwide increase in the geriatric population, the number of individuals suffering from physical disabilities is also likely to increase. Assistive robots are proposed as a way of helping elderly people, as taking care of the elderly is one of the major challenges faced by the ageing population. Assistive robots for the elderly can be grouped into 2 types, namely, rehabilitation robots and socially assistive robots. Rehabilitation robots such as artificial limbs, exoskeletons, and smart wheelchairs provide physical assistance, whereas socially assistive robots can either be companion-type robots or service-type robots and are meant to improve the user’s health and well-being. Technological advancements have enabled the development of assistive robots that help manage routine tasks in medical and residential care environments for the elderly and people with disabilities. These technological advancements are likely to offer growth opportunities for players operating in the assistive robotics market.

Challenge: Lack of social awareness about the benefits of adopting assistive robotic systems

Human Robot Interaction (HRI) researchers have identified many reasons behind the low adoption rate of assistive robots and one of the major reasons is the lack of social awareness about the benefits of adopting assistive robotic systems. Assistive robotic systems provide numerous benefits to the users in various industries, such as households, medical, and education. For instance, rehabilitation robotic systems help people recover from physical and mental disabilities, which include cerebral, neurogenic, spinal, muscular or bone-related disorders. Also, companionship and social robots help the elderly with various day-to-day activities, such as monitoring the house, operating household appliances, including televisions and air-conditioners, making and receiving phone/video calls and others. Educational robots, along with providing STEM education, help to develop social skills in children suffering from the autism spectrum disorder. But the lack of awareness about these benefits is likely to be a major challenge for the growth of the assistive robotics market.

Future Outlook

Between 2025 and 2033, assistive robotics is highly promising, shaped by rapid advancements in artificial intelligence, sensor integration, and user-centric design. In the coming years, assistive robots are expected to move beyond basic support and evolve into sophisticated companions capable of personalized care, real-time emotional sensing, and adaptive learning. Integration with IoT and cloud platforms will enable seamless health monitoring and environment adaptation, while humanoid and wearable robots will further enhance mobility and daily independence for users. As affordability and accessibility improve, user acceptance will rise, driven by features that prioritize privacy, intuitive interfaces, and ethical design. Collaborative industry efforts and policy support will play crucial roles in ensuring safety, trust, and widespread adoption across healthcare and home care sectors.

Key Market Players

Top assistive robotics companies, Kinova Inc. (Canada), Meditech (Netherlands), SoftBank Robotics (Japan), Intuitive Surgical Operations, Inc. (US) and Ekso Bionics (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 8 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in Assistive Robotics Market

4.2 Market, By Type

4.3 Market, By Mobility

4.4 Market in APAC, By Application vs Country

4.5 Market, By Application

4.6 Market, By Country

5 Assistive Robotics Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Strokes and Spinal Cord Injuries

5.2.1.2 Rising Insurance Coverage for Medical Exoskeletons and Robotic Surgeries

5.2.2 Restraints

5.2.2.1 Necessity to Abide Various Standards and Certifications, Especially in Medical Industry

5.2.3 Opportunities

5.2.3.1 Increase in Funding Worldwide for Research on Assistive Robotics

5.2.3.2 Rise in Geriatric Population Globally

5.2.4 Challenges

5.2.4.1 Lack of Social Awareness About Benefits of Adopting Assistive Robotic Systems

5.2.4.2 Risk of Injuries and Accidents Associated With Assistive Robots

5.3 Value Chain Analysis

6 Assistive Robotics Market, By Mobility (Page No. - 40)

6.1 Introduction

6.2 Stationary

6.2.1 Stationary Assistive Robotic Systems are Mostly Used in Household and Medical Applications

6.3 Mobile

6.3.1 Mobile Assistive Robotic Systems are Majorly Used in Applications Such as Elderly Assistance and Companionship

7 Assistive Robotics Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Physically Assistive Robots

7.2.1 Increasing Cases of Spinal Cord Injuries and the Shifting Focus of Governments on Exoskeletons in the Defense Sector is Likely to Drive the Market for Exoskeleton Robots

7.3 Socially Assistive Robots

7.3.1 Rise in the Elderly Population is Expected to Act as A Key Driving Factor for Growth of Market for Companion Robots

7.3.2 Increasing Applications of Artificial Intelligence is Likely to Be Major Driving Factor Impelling Growth of Public Relation Robots

7.4 Mixed Assistive Robots

7.4.1 Elderly Care Robots are Used to Provide Comprehensive and Cost-Effective Support to Elderly

7.4.2 Surgical Robots Account for A Large Share of Assistive Robotics Market Due to Increasing Number of Laparoscopic Surgeries Globally

7.4.2.1 Laparoscopic Robotic Systems

7.4.2.2 Orthopedic Robotic Systems

7.4.2.3 Neurosurgical Robotic Systems

8 Assistive Robotics Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Surgery Assistance

8.2.1 People are Moving Toward Adoption of Robot-Assisted Surgeries Due to Various Advantages They Offer

8.3 Public Relation

8.3.1 Deployment of Assistive Robots for Public Relation Applications is on Rise and is Expected to Garner Significant Market Share in Coming Years

8.4 Handicap Assistance

8.4.1 With Technological Advancements and Evolution of Artificial Intelligence, Deployment of Assistive Robotic Systems in Healthcare Industry has Become Easy

8.5 Elderly Assistance

8.5.1 Demand for Assistive Robots for Elderly Care Application is Likely to Grow at Substantial Rate, Enhancing Opportunity of Mobility and Promoting Independence

8.6 Industrial

8.6.1 Due to Their Numerous Advantages, Various Manufacturing Companies have Started Adopting Assistive Technologies on Large Scale

8.7 Companionship

8.7.1 With People Across World Living Longer, and Most of Them Staying Alone, Assistive Robots Can Be Deployed as Companions to Help Senior Citizens Stay Mentally and Socially Engaged

8.8 Defense

8.8.1 Use of Exoskeletons has Helped Reduce Metabolic Cost and Helped Soldiers Carry Heavy Armors

8.9 Others

9 Geographic Analysis (Page No. - 83)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Held Largest Share Market in North America in 2018

9.2.2 Canada

9.2.2.1 Canada to Record Highest CAGR in Overall Market During Forecast Period

9.2.3 Mexico

9.2.3.1 Mexico to Witness Accelerated Demand for Assistive Robots Due to Rise in Neurological Diseases and Increase in Geriatric Population

9.3 Europe

9.3.1 UK

9.3.1.1 UK Accounted for Largest Share of European Market in 2018

9.3.2 Germany

9.3.2.1 Germany to Witness Growing Demand for Assistive Robots Due to Favorable Reimbursement Policies

9.3.3 France

9.3.3.1 French Market to Adopt Assistive Robotic Systems Primarily for Companionship and Defense Applications

9.3.4 Italy

9.3.4.1 Italy to Witness Highest CAGR in European Market

9.3.5 Rest of Europe (RoE)

9.3.5.1 Increasing Adoption of Physically Assistive Robots to Improve Quality of Life Will Boost Demand in RoE

9.4 Asia Pacific (APAC)

9.4.1 Japan

9.4.1.1 Japan Held Largest Share of Market in APAC in 2018

9.4.2 China

9.4.2.1 Market in China to Grow at Highest CAGR in APAC During Forecast Period

9.4.3 South Korea

9.4.3.1 Financial Support of South Korean Government to Develop Surgical Robots Likely to Propel Market Growth

9.4.4 Rest of APAC

9.4.4.1 Rise in Adoption of Robots in Healthcare Industry to Fuel Growth of Market in RoAPAC

9.5 Rest of the World

9.5.1 Middle East and Africa

9.5.1.1 Middle East and Africa Held Larger Share of Market in RoW

9.5.2 South America

9.5.2.1 South America to Witness Higher CAGR in Market During Forecast Period

10 Competitive Landscape (Page No. - 98)

10.1 Overview

10.2 Market Ranking Analysis: Assistive Robotics Market, 2018

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio (25 Players)

10.5 Business Strategy Excellence (25 Players)

10.6 Competitive Situations and Trends

10.6.1 Product Launches

10.6.2 Partnerships, Collaborations and Joint Ventures

10.6.3 Expansions

10.6.4 Contracts and Agreements

11 Company Profiles (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 Kinova Robotics

11.1.2 Focal Meditech

11.1.3 Softbank Robotics

11.1.4 Cyberdyne

11.1.5 Intuitive Surgical

11.1.6 EKSO Bionics

11.1.7 Ubtech Robotics

11.1.8 Barrett Technology

11.1.9 Rewalk Robotics

11.1.10 Hyundai

11.2 Other Players

11.2.1 Stryker Corporation

11.2.2 Hocoma

11.2.3 Blue Frog Robotics

11.2.4 Dreamface Technologies

11.2.5 Double Robotics

11.2.6 Fourier Intelligence

11.2.7 CT Asia Robotics

11.2.8 Intuition Robotics

11.2.9 Mojin Robotics

11.2.10 F&P Robotics

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 138)

12.1 Discussion Guide

12.2 Available Customizations

12.3 Related Reports

12.4 Author Details

List of Tables (68 Tables)

Table 1 Assistive Robotics Market, By Mobility, 2016–2024 (USD Billion)

Table 2 Assistive Robotic Market, By Mobility, 2016–2024 (Thousand Units)

Table 3 Market for Stationary Robots, By Type, 2016–2024 (USD Million)

Table 4 Market for Stationary Robots, By Type, 2016–2024 (Thousand Units)

Table 5 Market for Mobile Robots, By Type, 2016–2024 (USD Million)

Table 6 Market for Mobile Robots, By Type, 2016–2024 (Thousand Units)

Table 7 Market, By Type, 2016–2024 (USD Million)

Table 8 Assistive Robotics Market, By Type, 2016–2024 (Thousand Units)

Table 9 Physically Assistive Robotic Market, By Application, 2016–2024 (USD Million)

Table 10 Market, By Type, 2016–2024 (USD Million)

Table 11 Market, By Type, 2016–2024 (Thousand Units)

Table 12 Socially Assistive Robotics Market, By Application, 2016–2024 (USD Million)

Table 13 Mixed Assistive Robotic Market, By Type, 2016–2024 (USD Million)

Table 14 Market, By Type, 2016–2024 (Thousand Units)

Table 15 Market, By Application, 2016–2024 (USD Million)

Table 16 Assistive Robotics Market for Surgical Robots, By Type, 2016–2024 (USD Million)

Table 17 Assistive Robotic Market for Surgical Robots, By Type, 2016–2024 (Units)

Table 18 Market, By Application, 2016–2024 (USD Million)

Table 19 Market for Surgery Assistance Application, By Region, 2016–2024 (USD Million)

Table 20 Market for Surgery Assistance Application in North America, By Country, 2016–2024 (USD Million)

Table 21 Market for Surgery Assistance Application in Europe, By Country, 2016–2024 (USD Million)

Table 22 Market for Surgery Assistance Application in APAC, By Country, 2016–2024 (USD Million)

Table 23 Market for Surgery Assistance Application in RoW, By Region, 2016–2024 (USD Million)

Table 24 Market for Public Relations Application, By Region, 2016–2024 (USD Million)

Table 25 Assistive Robotics Market for Public Relations Application in North America, By Country, 2016–2024 (USD Million)

Table 26 Assistive Robotic Market for Public Relations Application in Europe, By Country, 2016–2024 (USD Million)

Table 27 Market for Public Relations Application in APAC, By Country, 2016–2024 (USD Million)

Table 28 Market for Public Relations Application in RoW, By Region, 2016–2024 (USD Million)

Table 29 Market for Handicap Assistance Application, By Region, 2016–2024 (USD Million)

Table 30 Market for Handicap Assistance Application in North America, By Country, 2016–2024 (USD Million)

Table 31 Market for Handicap Assistance Application in Europe, By Country, 2016–2024 (USD Million)

Table 32 Market for Handicap Assistance Application in APAC, By Country, 2016–2024 (USD Million)

Table 33 Market for Handicap Assistance Application in RoW, By Region, 2016–2024 (USD Thousand)

Table 34 Market for Elderly Assistance Application, By Region, 2016–2024 (USD Million)

Table 35 Market for Elderly Assistance Application in North America, By Country, 2016–2024 (USD Million)

Table 36 Market for Elderly Assistance Application in Europe, By Country, 2016–2024 (USD Million)

Table 37 Market for Elderly Assistance Application in APAC, By Country, 2016–2024 (USD Million)

Table 38 Market for Elderly Assistance Application in RoW, By Region, 2016–2024 (USD Million)

Table 39 Market for Industrial Application, By Region, 2016–2024 (USD Million)

Table 40 Market for Industrial Application in North America, By Country, 2016–2024 (USD Million)

Table 41 Market for Industrial Application in Europe, By Country, 2016–2024 (USD Thousand)

Table 42 Market for Industrial Application in APAC, By Country, 2016–2024 (USD Million)

Table 43 Market for Industrial Application in RoW, By Region, 2016–2024 (USD Thousands)

Table 44 Market for Companionship Application, By Region, 2016–2024 (USD Million)

Table 45 Market for Companionship Application in North America, By Country, 2016–2024 (USD Million)

Table 46 Market for Companionship Application in Europe, By Country, 2016–2024 (USD Million)

Table 47 Market for Companionship Application in APAC, By Country, 2016–2024 (USD Million)

Table 48 Assistive Robotics Market for Companionship Application in RoW, By Region, 2016–2024 (USD Million)

Table 49 Assistive Robotic Market for Defense Application, By Region, 2016–2024 (USD Million)

Table 50 Market for Defense Application in North America, By Country, 2016–2024 (USD Million)

Table 51 Market for Defense Application in Europe, By Country, 2016–2024 (USD Thousand)

Table 52 Market for Defense Application in APAC, By Country, 2016–2024 (USD Thousand)

Table 53 Market for Defense Application in RoW, By Region, 2016–2024 (USD Thousand)

Table 54 Market for Other Applications, By Region, 2016–2024 (USD Thousand)

Table 55 Market for Other Applications in North America, By Country, 2016–2024 (USD Thousand)

Table 56 Assistive Robotics Market for Other Applications in Europe, By Country, 2016–2024 (USD Thousand)

Table 57 Assistive Robotic Market for Other Applications in APAC, By Country, 2016–2024 (USD Thousand)

Table 58 Market for Other Applications in RoW, By Region, 2016–2024 (USD Thousand)

Table 59 Market, By Region, 2016–2024 (USD Million)

Table 60 Market in North America, By Country, 2016–2024 (USD Million)

Table 61 Market in Europe, By Country, 2016–2024 (USD Million)

Table 62 Market in APAC, By Country, 2016–2024 (USD Million)

Table 63 Market in RoW, By Region, 2016–2024 (USD Million)

Table 64 Market Ranking, 2018

Table 65 Product Launches, 2018

Table 66 Partnerships and Collaborations, 2018

Table 67 Expansions,2018

Table 68 Contracts and Agreements, 2016–2018

List of Figures (40 Figures)

Figure 1 Segmentation of Assistive Robotics Market

Figure 2 Assistive Robotics Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Assistive Robotic Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market for Mobile Assistive Robots to Grow at A Higher CAGR During Forecast Period

Figure 7 in Terms of Value, Mixed Assistive Robots to Hold Largest Share of Market By 2024

Figure 8 Handicap Assistance Application to Exhibit Highest CAGR in Market During Forecast Period

Figure 9 North America to Hold Largest Share of Market By 2019

Figure 10 Increasing Insurance Coverage for Medical Exoskeletons and Robotic Surgeries to Drive Growth Market During Forecast Period

Figure 11 Market for Physically Assistive Robots to Grow at Highest CAGR During Forecast Period

Figure 12 in Terms of Volume, Mobile Robots to Hold Larger Share of Market By 2019

Figure 13 Surgery Assistance Application to Hold Largest Share of Market in APAC By 2019

Figure 14 Surgery Assistance Application to Hold Largest Share of Market By 2019

Figure 15 US to Hold Largest Share of Market By 2019

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 World Population Above 60 Years By 2050

Figure 18 Value Chain Analysis of Assistive Robotic Ecosystem: R&D and Manufacturing Phases Contribute Maximum Value

Figure 19 Market, in Terms of Value, for Mobile Robots to Grow at Higher CAGR During Forecast Period

Figure 20 Market for Physically Assistive Robots, in Terms of Value, to Grow at Highest CAGR During Forecast Period

Figure 21 Surgical Robots Expected to Dominate Mixed Assistive Robots Market During Forecast Period

Figure 22 Market for Handicap Assistance Application to Grow at Highest CAGR During Forecast Period

Figure 23 Market for Public Relations Application in APAC to Grow at Highest CAGR During Forecast Period

Figure 24 Market for Elderly Assistance Application in APAC to Grow at Highest CAGR During Forecast Period

Figure 25 Market for Companionship Application in APAC to Grow at Highest CAGR During Forecast Period

Figure 26 Assistive Robotics Market for Other Applications in APAC to Grow at Highest CAGR During Forecast Period

Figure 27 Canada to Register Highest CAGR in Global Assistive Robotics Market During Forecast Period

Figure 28 APAC to Witness Highest CAGR in Assistive Robotic Market During Forecast Period

Figure 29 Snapshot of Market in North America

Figure 30 Snapshot of Assistive Robotic Market in Europe

Figure 31 Snapshot of Market in APAC

Figure 32 Market in South America to Grow at Higher CAGR During Forecast Period

Figure 33 Players in Assistive Robotic Market Adopted Product Launches as Their Key Strategy for Business Expansion From 2016 to 2018

Figure 34 Assistive Robotics Market (Global) Competitive Leadership Mapping, 2018

Figure 35 Market Witnessed Significant Growth From 2016 to 2018

Figure 36 Cyberdyne: Company Snapshot

Figure 37 Intuitive Surgical: Company Snapshot

Figure 38 EKSO Bionics: Company Snapshot

Figure 39 Rewalk Robotics: Company Snapshot

Figure 40 Hyundai: Company Snapshot

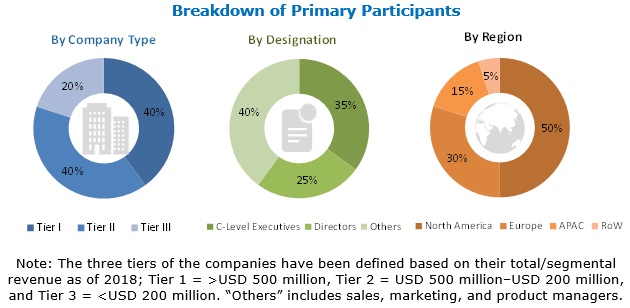

The study involved four major activities in estimating the current size of the assistive robotics market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the assistive robotics market begins with capturing data on revenues of the key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The assistive robotics market comprises several stakeholders, such as suppliers, system integrators, suppliers of standard components, software providers, and original equipment manufacturers (OEMs) in the supply chain. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW to gather both qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the assistive robotics market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the assistive robotics market, in terms of value, segmented based on mobility, type, application, and region

- To describe and forecast market, in terms of volume, segmented based on mobility and type

- To describe and forecast the market size, in terms of value, for various applications with regard to four main regions: North America, Europe, Asia Pacific (APAC), and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain pertaining to the assistive robotics ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of market

- To benchmark players within the market using proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as acquisitions, product launches, and research and developments in the assistive robotics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5).

Growth opportunities and latent adjacency in Assistive Robotics Market