Automatic Feeding Market by Feeding Line (Controllers, Mixers, Distributors, Conveyors), Individual Feeding Equipment (Equine Feeders, Cow Feeders, Waterers), Livestock (Poultry, Swine, Fish, Ruminants, Equine), and Region - Global Forecast to 2022

[116 Pages Report] The global automatic feeding market was valued at USD 4.08 Billion in 2016 and is projected to grow at a CAGR of 7.5% from 2017, to reach USD 6.30 Billion by 2022. The objectives of the report are to define, segment, and estimate the size of the global market, in both quantitative and qualitative terms. Furthermore, the market has been segmented on the basis of feeding line, individual feeding equipment, livestock, feed, and region. The report also aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micro markets, opportunities for stakeholders, details of the competitive landscape, and profiles of the key players, with respect to their market share and competencies.

The years considered for the study are as follows:

- Base year: 2016

- Beginning of projection period: 2017

- End of projection period: 2022

Research Methodology:

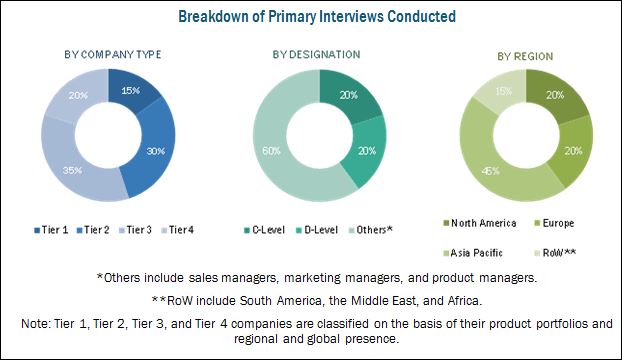

This research study involved the extensive use of secondary sources (which included directories and databases) such as Forbes, Bloomberg Businessweek, and Factiva to identify & collect information useful for this technical, market-oriented, and commercial study of the automatic feeding market. The primary sources that have been involved include industry experts from core & related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the market.

To know about the assumptions considered for the study, download the pdf brochure

The key manufacturers in the automatic feeding market include AGCO Corporation (US), Delaval Holding (Sweden), GEA (Germany), Big Dutchman (US), Kuhn (France), Trioliet B.V. (Netherlands), and Lely Holding SARL (Netherlands). These companies have diversified product portfolios and advance feeding technologies at major strategic locations. The other companies which are profiled include VDL Agrotech (Netherlands), Pellon Group OY (Finland), Rovibec Agrisolutions (Canada), Coromall AS (Denmark), and ROXELL (Belgium).

The stakeholders for automatic feeding market are mentioned below:

- Feed manufacturers, suppliers, and processors

- Feeding equipment manufacturers, suppliers, and processors

- Cattle farm owners, feed distributors, importers, and exporters

- Intermediary suppliers

- Feed and feeding equipment governing associations and regulatory authorities of several countries

- Research organizations and associations such as the Food and Agriculture Organization (FAO), Compound Livestock Feed Manufacturers Association of India (CLFMA), International Feed Industry Federation (IFIF), The Grain and Feed Trade Association (GAFTA), National Grain and Feed Association (NGFA), The American Feed Industry Association (AFIA), and Animal Feed Manufacturers Association (AFMA)

Scope of the Report:

- This research report categorizes the automatic feeding market based on feeding line, individual feeding equipment, livestock, feed, and region.

On the basis of Feeding Line, the automatic feeding market has been segmented into the following:

- Controllers

- Mixers

- Conveyors

- Distributors

On the basis of Individual Feeding Equipment, the automatic feeding market has been segmented into the following:

- Equine feeders

- Cow feeders

- Waterers

On the basis of Livestock, the automatic feeding market has been segmented into the following:

- Poultry

- Swine

- Fish

- Ruminants

- Equine

On the basis of Feed, the automatic feeding market has been segmented into the following:

- TMR (total mix ration)

- Starter feed

- Water

On the basis of Region, the automatic feeding market has been segmented into the following:

- North America

- Europe

- Asia Pacific

- Rest of the World (South America, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Individual Feeding Equipment Analysis

- Further breakdown of automatic feeding into equine feeders, cow feeders, and waterers.

Regional Analysis

- Further breakdown of the Rest of Europe market into Switzerland, Denmark, the Netherlands, and Poland.

- Further breakdown of the Rest of Asia Pacific market into Indonesia, Singapore, and Thailand.

- Further breakdown of the RoW market into South America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global automatic feeding market is estimated at USD 4.37 Billion in 2017 and is projected to reach USD 6.30 Billion by 2022, growing at a CAGR of 7.5% during the forecast period. The primary factors that drive the market are increasing consumption of meat and dairy products and benefits of automation for farmers in the livestock industry.

The increase in the number of consumers for meat and dairy products across the globe has led to an increased interest among the farmers to use automatic feeding equipment for livestock to reduce labor and increase the productivity of the animals due to precise and proper feed delivery on time. The major restraining factor for the market is the lack of standardization of automatic feeding systems.

The automatic feeding market is segmented on the basis of feeding line, individual feeding equipment, livestock, feed, and region. On the basis of feeding line, the distributors segment dominated the global market, followed by the conveyors segment, in 2016. Two different types of equipment are used for distribution of feed among livestock rail-guided feed wagon and self-propelled feeder. Automatic feeding equipment help to provide feed at precise and regular intervals to animals.

On the basis of individual feeding equipment, the equine feeder segment accounted for the largest market share in 2016. Famers are increasingly concerned about the health of animals as proper feed is required for the better development and growth of the animals. Automatic equine feeders are easy to use, save time, and offer accuracy. They also help farmers to feed horses and stags efficiently and improve the health of equine.

The automatic feeding market, by livestock, is segmented into poultry, swine, equine, ruminants and fish. The ruminants segment accounted for the largest market share in 2016. Automatic feeding helps farmers to provide feed according to the requirements of the ruminants and helps to maintain a large herd. Ruminants are a source of milk and meat, and the quality of these products depends not only on the quality of the feed used but also on the efficiency and precision of the feeding process.

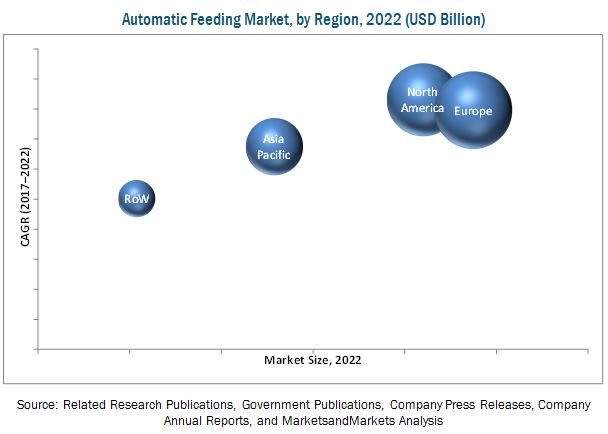

The European region is projected to dominate the largest market share, followed by the North American region, through 2022. The North American region is projected to be the fastest-growing automatic feeding market during the forecast period. This is mainly due to farm owners and farmers in the North American region who are looking to boost the market to address the growing demand from consumers for dairy and meat products. This has resulted in the innovation of various automatic feeding equipment such as individual feeders and group feeders by various companies in the global market.

High set up cost is one of the major restraining factors for the market. Feeding systems require high initial investments, efficient management tools, and skilled and knowledgeable farmers for uninterrupted and effective use. Most small & medium size farms do not have the capital required to invest in such automatic feeding equipment, thus restraining the growth of this market.

AGCO Corporation (US) is likely to emerge as a leading market player in the automatic feeding market in the coming years, owing to its line of various automatic feeding equipment. The major players in market are AGCO Corporation (US), GEA (Germany), Delaval Holding (Sweden), Big Dutchman (US), and Kuhn (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Automatic Feeding Market

4.2 Europe: Automatic Feeding Market, By Country & Livestock

4.3 Automatic Feeding Regional Markets, By Feed

4.4 Automatic Feeding Market Share, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Benefits of Automation

5.2.1.2 Increasing Consumption of Meat and Dairy Products

5.2.2 Restraints

5.2.2.1 High Setup Cost

5.2.3 Opportunities

5.2.3.1 Significant Growth Opportunities for Automated Feeding Systems in Developing Countries

5.2.3.2 Increasing Investments in Automated Feeding Systems

5.2.4 Challenges

5.2.4.1 Lack of Standardization of Automatic Feeding Systems

6 Automatic Feeding Market, By Feeding Line (Page No. - 37)

6.1 Introduction

6.2 Controllers

6.3 Mixers

6.4 Conveyors

6.5 Distributors

7 Automatic Feeding Market, By Individual Feeding Equipment (Page No. - 43)

7.1 Introduction

7.2 Equine Feeders

7.3 Cow Feeders

7.4 Waterers

8 Automatic Feeding Market, By Livestock (Page No. - 47)

8.1 Introduction

8.2 Poultry

8.3 Swine

8.4 Fish

8.5 Ruminants

8.6 Equine

9 Automatic Feeding Market, By Feed (Page No. - 53)

9.1 Introduction

9.2 TMR (Total Mix Ration)

9.3 Starter Feed

9.4 Water

10 Automatic Feeding Market, By Region (Page No. - 58)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 UK

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 87)

11.1 Overview

11.2 Market Ranking, By Key Player

11.3 Competitive Situation & Trends

11.3.1 New Product Launches

11.3.2 Agreements, Partnerships, and Collaborations

11.3.3 Expansions & Investments

12 Company Profiles (Page No. - 92)

(Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Agco Corporation

12.2 GEA

12.3 Delaval Holding AB

12.4 Big Dutchman

12.5 Kuhn

12.6 Lely Holding Sarl

12.7 Trioliet B.V.

12.8 VDL Agrotech

12.9 Pellon Group Oy

12.10 Rovibec Agrisolutions

12.11 Coromall as

12.12 Roxell

*Details on Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 108)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (65 Tables)

Table 1 USD Exchange Rates Considered for Study, 20142016

Table 2 Automatic Feeding Market Size, By Feeding Line, 20152022 (USD Million)

Table 3 Controllers Market Size, By Region, 20152022 (USD Million)

Table 4 Mixers Market Size, By Region, 20152022 (USD Million)

Table 5 Conveyors Market Size, By Region, 20152022 (USD Million)

Table 6 Distributors Market Size, By Region, 20152022 (USD Million)

Table 7 Automatic Feeding Market Size, By Individual Feeding Equipment, 20152022 (USD Million)

Table 8 Equine Feeders Market Size, By Region, 20152022 (USD Million)

Table 9 Cow Feeders Market Size, By Region, 20152022 (USD Million)

Table 10 Waterers Market Size, By Region, 20152022 (USD Million)

Table 11 Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 12 Automatic Feeding Market Size in Poultry, By Region, 20152022 (USD Million)

Table 13 Automatic Feeding Market Size in Swine, By Region, 20152022 (USD Million)

Table 14 Automatic Feeding Market Size in Fish, By Region, 20152022 (USD Million)

Table 15 Automatic Feeding Market Size in Ruminants, By Region, 20152022 (USD Million)

Table 16 Automatic Feeding Market Size in Equine, By Region, 20152022 (USD Million)

Table 17 Automatic Feeding Market Size, By Feed, 20152022 (USD Million)

Table 18 Total Mix Ration Market Size, By Region, 20152022 (USD Million)

Table 19 Starter Feed Market Size, By Region, 20152022 (USD Million)

Table 20 Automatic Feeding Market Size in Water, By Region, 20152022 (USD Million)

Table 21 Automatic Feeding Market Size, By Region, 20152022 (USD Million)

Table 22 North America: Automatic Feeding Market Size, By Country, 20152022 (USD Million)

Table 23 North America: Market Size, By Feeding Line, 20152022 (USD Million)

Table 24 North America: Market Size, By Individual Feeding Equipment, 20152022 (USD Million)

Table 25 North America: Market Size, By Feed, 20152022 (USD Million)

Table 26 North America: Market Size, By Livestock, 20152022 (USD Million)

Table 27 US: Automatic Size, By Livestock, 20152022 (USD Million)

Table 28 US: Automatic Size, By Feed, 20152022 (USD Million)

Table 29 Canada: Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 30 Mexico: Market Size, By Livestock, 20152022 (USD Million)

Table 31 Europe: Market Size, By Country, 20152022 (USD Million)

Table 32 Europe: Market Size, By Feeding Line, 20152022 (USD Million)

Table 33 Europe: Market Size, By Individual Feeding Equipment, 20152022 (USD Million)

Table 34 Europe: Market Size, By Feed, 20152022 (USD Million)

Table 35 Europe: Market Size, By Livestock, 20152022 (USD Million)

Table 36 Germany: Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 37 Germany: Market Size, By Feed, 20152022 (USD Million)

Table 38 France: Market Size, By Livestock, 20152022 (USD Million)

Table 39 Italy: Market Size, By Livestock, 20152022 (USD Million)

Table 40 UK: Market Size, By Livestock, 20152022 (USD Million)

Table 41 Spain: Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 42 Rest of Europe: Market Size, By Livestock, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size, By Feeding Line, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Individual Feeding Equipment, 20152022 (USD Million)

Table 46 Asia Pacific: Automatic Feeding Market Size, By Feed, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Livestock, 20152022 (USD Million)

Table 48 China: Market Size, By Livestock, 20152022 (USD Million)

Table 49 China: Market Size, By Feed, 20152022 (USD Million)

Table 50 Japan: Market Size, By Livestock, 20152022 (USD Million)

Table 51 India: Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 52 Australia & New Zealand: Market Size, By Livestock, 20152022 (USD Million)

Table 53 Rest of Asia Pacific: Market Size, By Livestock, 20152022 (USD Million)

Table 54 RoW: Market Size, By Region, 20152022 (USD Million)

Table 55 RoW: Market Size, By Feeding Line, 20152022 (USD Million)

Table 56 RoW: Market Size, By Individual Feeding Equipment, 20152022 (USD Million)

Table 57 RoW: Automatic Feeding Market Size, By Feed, 20152022 (USD Million)

Table 58 RoW: Market Size, By Livestock, 20152022 (USD Million)

Table 59 South America: Market Size, By Livestock, 20152022 (USD Million)

Table 60 South America: Market Size, By Feed, 20152022 (USD Million)

Table 61 Middle East: Automatic Feeding Market Size, By Livestock, 20152022 (USD Million)

Table 62 Africa: Market Size, By Livestock, 20152022 (USD Million)

Table 63 New Product Launches, 20122017

Table 64 Agreements, Partnerships, and Collaborations, 20122017

Table 65 Expansions & Investments, 20122017

List of Figures (34 Figures)

Figure 1 Automatic Feeding Market: Segmentation

Figure 2 Automatic Feeding Market Segmentation, By Region

Figure 3 Automatic Feeding Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Automatic Feeding Market: Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Limitations of the Research Study

Figure 10 Automatic Feeding Market, By Feeding Line (2017 vs 2022)

Figure 11 Automatic Feeding Market, By Individual Feeding Equipment (2017 vs 2022)

Figure 12 Automatic Feeding Market, By Livestock (2017 vs 2022)

Figure 13 Automatic Feeding Market, By Feed (2017 vs 2022)

Figure 14 Automatic Feeding Market, By Region, 2016

Figure 15 Shift in Preference From Manual Feeding to Automation is Expected to Drive Growth in the Market Between 2017 & 2022

Figure 16 Germany is Estimated to Account for the Largest Share of the Market in 2017

Figure 17 TRM (Total Mixed Ration) Estimated to Dominate the Market Across All Regions in 2017

Figure 18 US is Estimated to Be the Largest Market in 2017

Figure 19 Market Dynamics: Automatic Feeding Market

Figure 20 Per Capita Consumption of Livestock Products (1964-2015)

Figure 21 Automatic Feeding Process

Figure 22 Distributors Segment is Projected to Dominate the Market Through 2022

Figure 23 Equine Feeders Expected to Be the Largest Segment Throughout the Forecast Period (2017-2022)

Figure 24 Ruminants Segment Projected to Be the Largest Through the Forecast Period

Figure 25 TRM (Total Mixed Ration) Segment Expected to Be the Largest Throughout the Forecast Period (2017-2022)

Figure 26 Automatic Feeding Market Size, By Region, 2015 vs 2022 (USD Million)

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 Key Developments By Leading Players in the Market for 2012-2017

Figure 30 Market Evaluation Framework (2015-2017)

Figure 31 Agco Corporation: Company Snapshot

Figure 32 GEA: Company Snapshot

Figure 33 Delaval Holding AB: Company Snapshot

Figure 34 Big Dutchman: Company Snapshot

Growth opportunities and latent adjacency in Automatic Feeding Market