Feeding Systems Market

Feeding Systems Market by Type (Rail-guided, Conveyor, Self-propelled), Offering (Hardware, Software, Services), Technology (Manual, Automatic), Function, Power Source, Farm Size, Livestock, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The feeding systems market is projected to expand from USD 3.46 billion in 2025 to USD 5.10 billion by 2030, at a CAGR of 8.1% during the forecast period. The need for feeding systems is attributed to the rising livestock population worldwide and changes in farm operations and processes.

KEY TAKEAWAYS

- The North America feeding systems market accounted for 33.7% revenue share in 2024.

- By type, the self-propelled feeding systems segment is expected to register the highest CAGR of 9.1% during the forecast period.

- By livestock, the dairy cattle segment is projected to grow at the fastest rate from 2025 to 2030.

- By offering, the hardware segment is expected to dominate the market, growing at the highest rate of 8.2% during the forecast period.

- By function, the filling & screening segment is expected to dominate the market, growing at a rate of 8.8% during the forecast period.

- Tetra Laval, GEA Group Aktiengesellschaft, and Lely, were identified as some of the star players in the feeding systems market, given their strong market share and product footprint.

- HETWIN Automation Systems GmbH, JH AGRO A/S, and Valmetal, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The feeding systems market is projected to grow from USD 3.46 billion in 2025 to USD 5.10 billion by 2030, with an 8.1% CAGR during the forecast period. The need for these systems increases due to rising livestock populations and changing farm operations. Farms in both developed and developing regions are becoming increasingly commercialized, computerized, and technologically advanced. In North America and Europe, larger pig and dairy farms drive high adoption of fully automated systems. Meanwhile, emerging economies like India, China, and Brazil are adopting mechanization and semi-automatic systems suited for small to medium farms, shifting to more efficient models. Additionally, Industry 4.0 and smart farming are integrating feeding systems into farm management to monitor animal health, reproduction, feed costs, and performance, enhancing farmers' decision-making and livestock management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The feeding systems market is evolving as farms increasingly adopt automated, semi-automated, and precision feeding solutions to enhance livestock productivity and operational efficiency. Today, automated and semi-automated systems account for the majority of revenue, while precision feeding is projected to grow significantly in the future due to its ability to optimize feed intake across dairy, poultry, and swine operations. Automated systems for dairy cattle ensure higher milk yield and consistent feed distribution, while semi-automated feeding solutions in poultry reduce feed wastage and lower operational costs. Precision feeding for swine enables customized feed formulations and schedules, improving animal health, welfare, and growth performance. The integration of automation, robotics, and IoT-enabled data analytics allows farm operators to monitor feed consumption, optimize distribution, and improve overall efficiency. As adoption shifts toward more advanced solutions, farms are achieving improved feed conversion, reduced labor dependency, and better resource utilization, driving the sustained growth of the feeding systems market globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in livestock production

-

Surging labor costs and rising demand for automation in livestock industry

Level

-

High initial investments in equipment and its setup affect demand across developing regions

-

High-entry barriers for players

Level

-

Collaboration with tech companies for innovative solutions

-

Rising automation in livestock farming

Level

-

Integration with existing infrastructure

-

Compatibility issues between different equipment brands and sensor systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in livestock production

The global poultry industry's growth drives the feeding systems market. Rising poultry consumption, driven by health concerns and protein needs in emerging economies, leads to larger and more intensive operations. This shift increases demand for efficient feeding systems to ensure optimal nutrition and productivity. Precision feeding and automation are crucial for maintaining feed quality, minimizing waste, and improving farm efficiency. Stricter animal welfare and nutrition regulations further push producers to adopt advanced feeding technologies. Consequently, the industry’s expansion boosts market demand and fosters technological innovation in feeding systems.

Restraint: High initial investments in equipment and its setup affect demand across developing regions

Automated feeding machinery has high initial costs and requires complex management, which can be challenging for farmers without prior experience. Small and medium-sized farms often cannot afford these systems, which rely heavily on data collection, such as geospatial data. Many small farmers struggle to invest in automation tools, control systems, and GIS or GPS data collection systems. For example, Trioliet’s ruminant feeding system costs about USD 96,685, mainly due to automation and structural costs. Though automation can reduce operational expenses over time, the upfront investment is significant. DairyMate’s Automatic TMR Wagon costs around USD 7,000, while manual mixers range from USD 1,000 to 1,500, making ruminant feeding equipment among the most expensive livestock tools.

Opportunity: Collaboration with tech companies for innovative solutions

Feeding system manufacturers are collaborating with tech companies to leverage AI, IoT, and ML to enhance efficiency, accuracy, and automation. These upgrades lead to improved livestock health, optimized feed utilization, and lower costs. AI and ML enable precise feed delivery by analyzing data for optimal timing, supported by IoT sensors for real-time tracking. Farmers can monitor animal behavior, reduce waste, and make better decisions. Examples include AKVA Group and Observe Technologies' 2021 AKVA Observe, which utilizes AI to analyze fish behavior and adjust feeding accordingly. Similarly, Lely and Konrad Pumpe teamed up in 2023 to integrate dosing systems into Lely’s feeding solutions, expanding market reach and offering more options to farmers.

Challenge: Integration with existing infrastructure

A significant challenge in adopting automation technologies is the integration with existing infrastructure, which can be especially limiting for smaller operations. Substantial modifications are often necessary to ensure seamless integration with existing systems. This may involve rewiring, reprogramming, and redesigning layouts to accommodate the new technologies. Adopting new technology successfully hinges on aligning it with current farm operations, a task that demands a clear and strategic approach. This is especially relevant for feed robotics. Integrating this technology requires significant operational changes, including infrastructure overhauls and staff retraining. These necessary disruptions can increase complexity and costs, presenting a considerable barrier to adoption for many producers.

Feeding Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Automated feeding systems for dairy cattle | Optimized feed distribution, increased milk yield, reduced labor, and better herd health |

|

Battery-operated and hydraulic feeding systems for cattle | Battery-operated and hydraulic feeding systems for cattle |

|

Integrated feed management solutions for large-scale farms | Integrated feed management solutions for large-scale farms |

|

Centralized and water-based feeding systems for aquaculture, including FeedStation, feed cannons, and water-transport solutions | Enhanced feed efficiency, reduced energy consumption, extended equipment lifespan, improved fish welfare, and better integration with farm management systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established and financially sound manufacturers of feeding systems. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the key players in this market include Tetra Laval (Sweden), GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), Trioliet B.V. (Netherlands), VDL Agrotech BV (Netherlands), ScaleAQ (Norway), AGCO Corporation (US), BouMatic (US), Pellon Group Oy (Finland), Rovibec Agrisolutions (Canada), CTB, Inc. (US), AKVA Group (Norway), Dairymaster (US), Maskinfabrikken Cormall A/S (Denmark), and Schauer Agrotronic GmbH (Austria).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Feeding Systems Market, By Type

The global feeding systems market is expected to grow substantially, driven by advancements in automation and increased efficiency in livestock operations. Self-propelled systems will lead due to their mobility, precision, and suitability for large-scale farming operations. Other types include conveyor and rail-guided systems, which are used primarily in poultry, swine, and cattle farms for consistent or precise feed delivery. Technological advancements, such as IoT, automation, and data optimization, support growth. Rising labor costs, sustainability efforts, and operational efficiency are fueling global adoption.

Feeding Systems Market, By Livestock

Ruminants, primarily dairy and beef cattle, dominate the feeding systems market due to their large-scale farming operations, which require efficient and consistent feed delivery. Automated systems improve feed conversion, reduce waste, and boost production, ensuring good ROI. Dairy farms are early adopters of precision livestock solutions, such as IoT and AI, which enhance feeding accuracy and enable real-time animal monitoring. Given high operational costs and labor requirements, automation is economically viable in the long term. Most developed countries support automated systems with incentives, subsidies, and regulations to increase efficiency and reduce environmental impact, making ruminants the leading livestock in the global feeding systems market.

Feeding Systems Market, By Offering

Feeding large livestock traditionally, with manual tracking and record-keeping, is now considered unprofitable, time-consuming, and labor-intensive, especially on large farms. These systems can't meet modern high-capacity demands. Most farms are transitioning to cloud-based and web-based software to enhance feed management, track intake, and optimize feed allocation, thereby improving livestock performance and operations. The market favors SaaS solutions that distribute data processing across servers, enabling scalability for large farms. Adoption is limited due to high costs, lack of trained staff, and concerns over data privacy and security.

REGION

Europe to be fastest-growing region in global feeding systems market during forecast period

Europe is projected to dominate the global feeding systems market, led by economies such as the UK, Germany, France, Italy, and Spain. The region's robust agricultural sector, particularly dairy (accounting for over 12% of agricultural output), and innovation support market growth. European regulations promote advanced feeding systems that improve animal health, hygiene, and nutrient delivery. Leaders like Lely, DeLaval, and GEA Group develop automated milking, feeding, and hygiene tools. In aquaculture, automated feeding systems enhance fish growth by ensuring consistent feeding, maintaining optimal water quality, and improving feed conversion efficiency. Companies like Linn offer cost-effective solutions such as feed sprayers.

Feeding Systems Market: COMPANY EVALUATION MATRIX

In the feeding systems market matrix, GEA Group (Star) leads the market with its advanced, technology-driven feeding solutions, including self-propelled, rail-guided, and conveyor feeding systems for diverse applications across dairy, poultry, swine, and aquaculture operations. Schauer Agrotronic GmbH (Emerging Player) is expanding its global footprint by offering innovative automated and precision feeding solutions, including IoT-enabled monitoring, robotic feeders, and integrated farm management systems. While GEA dominates through its extensive R&D capabilities, strong market presence, and comprehensive product portfolio, Schauer Agrotronic continues to grow through strategic partnerships, technology adoption, and customization for different livestock types, demonstrating strong potential to enhance its position in the feeding systems market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.22 Billion |

| Market Forecast in 2030 (Value) | USD 5.10 Billion |

| Growth Rate | CAGR of 8.1% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Feeding Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Dairy & Cattle Farm Operators | Feeding system adoption forecast by livestock type and automation level | Improved milk yield, reduced labor costs, and better feed efficiency |

| Poultry Integrators | Analysis of feed distribution accuracy across conveyor and automated systems | Reduced feed wastage, optimized growth rates, and operational consistency |

| Swine Producers | Evaluation of precision feeding technologies for nutrient management | Cost-effective feed formulation, improved feed conversion ratio, and reduced environmental impact |

| Equipment Manufacturers | Competitive benchmarking of self-propelled, rail-guided, and battery-operated systems | Product positioning insights, investment prioritization, and innovation strategy |

| Farm Management Tech Providers | Integration landscape of feeding systems with IoT platforms and data analytics | Opportunities for system interoperability, real-time monitoring, and value-added services |

| Government & Agri Bodies | Region-wise analysis of automation adoption and labor challenges | Support for policy framing, subsidy programs, and rural mechanization efforts |

RECENT DEVELOPMENTS

- November 2024 : ScaleAQ joined hands with KSS to strengthen its presence and service capabilities in the Faroe Islands. This partnership ensures local storage of spare parts and maintenance support, boosting reliability for aquaculture operations. With KSS’s 96 years of regional expertise, the collaboration addresses the challenges of the area’s harsh maritime conditions.

- September 2024 : Trioliet partnered with Ålgård Landbrukssenter AS to introduce high-quality feeding technology to Norwegian farmers. This partnership ensures better access to Trioliet’s products, along with full sales and service support. It further strengthened Trioliet’s role as a trusted supplier of agricultural solutions in Norway.

- July 2024 : AKVA Group acquired Observe Technologies Ltd. to help it (AKVA) grow its business by offering better tools to fish farmers. This acquisition enables AKVA to fully control and build upon a successful product that is already helping customers save costs. It also makes AKVA’s overall service more complete, helping it stand out from competitors and attract more customers.

- March 2024 : GEA Group Aktiengesellschaft acquired CattleEye, thereby enhancing its position in the feeding systems market by integrating advanced AI to monitor cow health and nutrition in real-time. This integration enables farmers to optimize feeding based on body condition scores, thereby improving productivity and animal welfare. The move strengthened GEA’s position in smart, data-driven dairy farm management solutions.

Table of Contents

Methodology

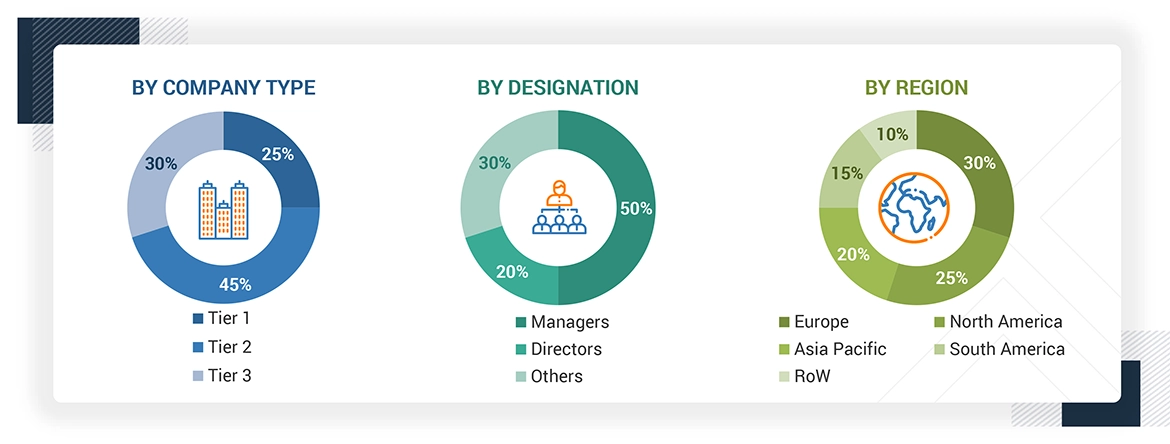

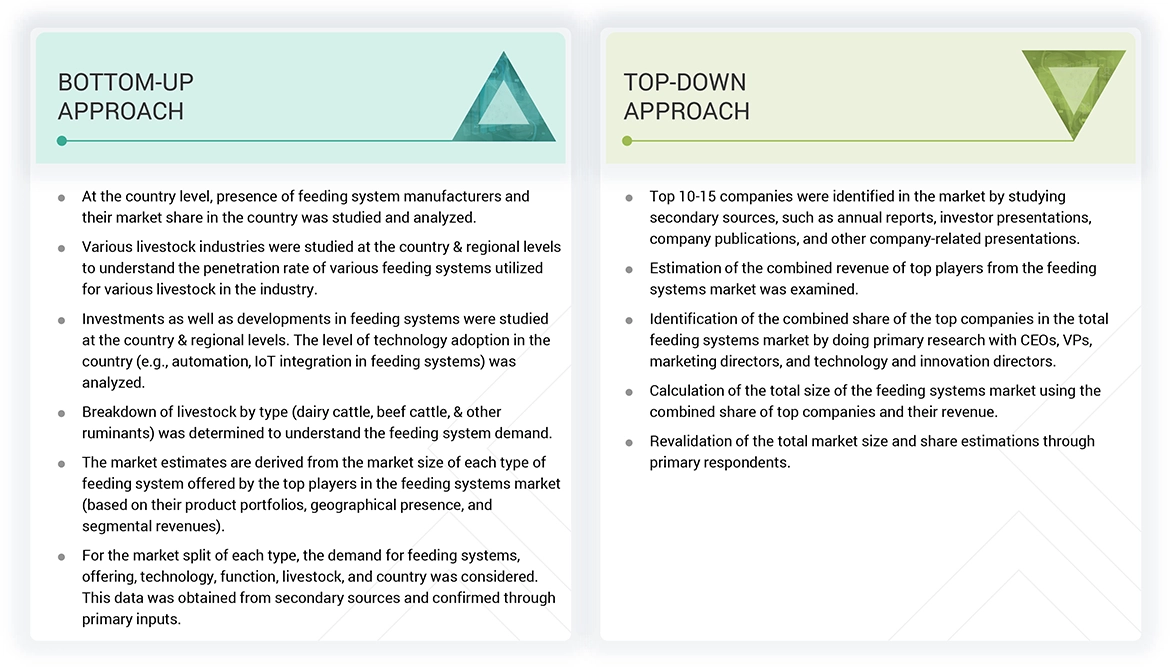

This study involved two major approaches in estimating the current size of the feeding systems market. Exhaustive secondary research was conducted to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were adopted to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the feeding systems market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to the type, livestock, technology, offering, function, power source, farm size, and region. Stakeholders from the demand side, such as livestock rearing flocks, dairy farms, and the poultry industry, were interviewed to understand the buyers’ perspective on the suppliers, products, and their current usage of feeding systems and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2:

USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Tetra Laval (Sweden) |

General Manager |

|

GEA Group Aktiengesellschaft (Germany) |

Sales Manager |

|

Lely (Netherlands) |

Manager |

|

Trioliet (Netherlands) |

Head of Processing Department |

|

ScaleAQ (Norway) |

Marketing Manager |

|

AGCO Corporation (US) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the feeding systems market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Feeding Systems Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall feeding systems market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

A feeding system is a structured approach for distributing feed to a group of animals during a single production cycle. These systems encompass various technologies and machinery designed for feed distribution on farms. They include all types of equipment, such as rail-guided systems, conveyor belts, and self-propelled feeders. Feeding systems can be either manual or automatic and perform essential functions such as collecting, mixing, filling, and screening.

According to the Deutsche Landwirtschafts-Gesellschaft (German Agricultural Society), various technical approaches have been developed for the automatic feeding of cattle, with group-related systems commonly in use. According to Meat & Livestock Australia, the feeding system must be well designed to achieve good cattle performance, efficient feedlot operation, and maintain high environmental standards. In addition, it must provide livestock with free and continual access to fresh and palatable feed.

Stakeholders

- Manufacturers, dealers, and suppliers of feeding systems

- Livestock farm owners

- Farm equipment suppliers

- Intermediate suppliers such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions:

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Compound Livestock Feed Manufacturers Association of India (CLFMA)

- International Feed Industry Federation (IFIF)

- Grain and Feed Trade Association (GAFTA)

- National Grain and Feed Association (NGFA)

- American Feed Industry Association (AFIA)

- Animal Feed Manufacturers Association (AFMA)

- Logistics providers & transporters

-

Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sector

Report Objectives

- To determine and project the size of the feeding systems market with respect to the type, technology, functions, livestock, and region

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe feeding systems market into key countries.

- Further breakdown of the Rest of Asia Pacific feeding systems market into key countries.

- Further breakdown of the Rest of South America feeding systems market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the feeding systems market?

The feeding systems market is estimated to be USD 3.46 billion in 2025 and is projected to reach USD 5.10 billion by 2030, registering a CAGR of 8.1% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Tetra Laval (Sweden), GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), Trioliet B.V. (Netherlands), VDL Agrotech BV (Netherlands), ScaleAQ (Norway), AGCO Corporation (US), and BouMatic (US), are some of the key market players. The feeding systems market is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing.

Which region is projected to account for the largest share of the feeding systems market?

North America is estimated to lead the feeding systems market. The region, particularly the US and Canada, has a high concentration of large commercial livestock farms. These operations manage hundreds to thousands of animals, necessitating the use of automated and efficient feeding systems to maintain productivity, consistency, and animal health.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the feeding systems market?

Factors driving the market include growth in livestock production, surging labor costs, rising demand for automation in the livestock industry, and increasing efficiency associated with advanced feeding systems.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Feeding Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Feeding Systems Market