Automotive Filters Market by Filters Type (Air, Fuel, Oil, Cabin, Coolant, Brake Dust, Oil Separator, Transmission, Steering, EMI/EMC, Coolant, DPF, GPF, Urea), Vehicle Type, Electric & Hybrid Type, Aftermarket & Region - Global Forecast to 2030

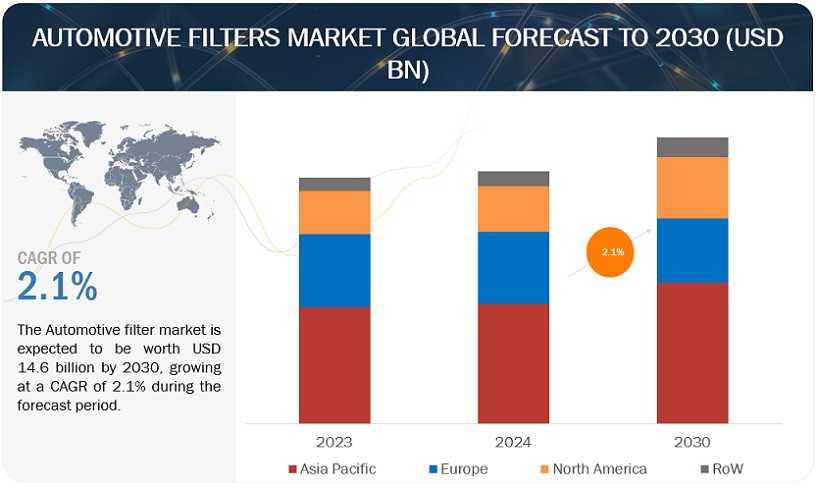

[382 Pages Report] The global automotive filters market is projected to grow from USD 12.9 billion in 2024 to USD 14.6 billion by 2030, at a CAGR of 2.1% during the forecast period. The automotive filter market's growth is primarily driven by technological advancements leading to more efficient filtration media and stringent emissions regulations necessitating adopting environmentally friendly solutions. Additionally, increasing vehicle production, rising demand for low-emission vehicles, and the expanding market for electric and hybrid vehicles contribute to the market's growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Replacement demand created by increasing vehicle parc and miles driven

The expansion of global vehicle fleets, propelled by improvements in road infrastructure and heightened vehicle sales, is set to increase the demand for automotive filters significantly. These essential components, including air, oil, and fuel filters, enhance engine performance and prolong vehicle lifespan. As vehicles accumulate mileage, these filters gradually accumulate contaminants, impairing their effectiveness and potentially jeopardizing engine functionality. Timely replacement of these filters is imperative, as failure to do so can lead to diminished vehicle performance and even mechanical breakdowns.

In the passenger car segment, replacement intervals for essential filters typically align with OEM recommendations, necessitating annual replacement for air, oil, and fuel filters, with cabin filters requiring replacement biannually. Similarly, heavy commercial vehicles such as trucks and buses adhere to distinct replacement schedules, regularly replacing air filters. Given the projected growth in passenger and heavy commercial vehicle fleets, a robust aftermarket demand for automotive filters emerges. This escalating demand underscores the significance of filter manufacturers and suppliers in meeting the evolving needs of the automotive industry.

RESTRAINT: Surge in adoption of battery electric vehicles (BEVs)

The escalating adoption of Battery Electric Vehicles (BEVs), characterized by a 42% surge in sales in 2023 compared to 2022, is poised to significantly impact the automotive filter market. Unlike Internal Combustion Engine (ICE) vehicles, BEVs eliminate the necessity for oil and fuel filters due to the absence of an engine and combustion process. Furthermore, BEVs employ regenerative braking systems, reducing brake strain and potentially decreasing the demand for replacement air filters.

The inherent design of BEVs, with fewer moving parts and the absence of combustion-generated contaminants, reduces maintenance requirements compared to ICE vehicles. Consequently, this translates into a diminished need for replacement filters. As BEVs continue to gain traction in the automotive market, their influence on reducing filter demand is anticipated to be a notable factor for businesses operating within the automotive filtration sector to consider.

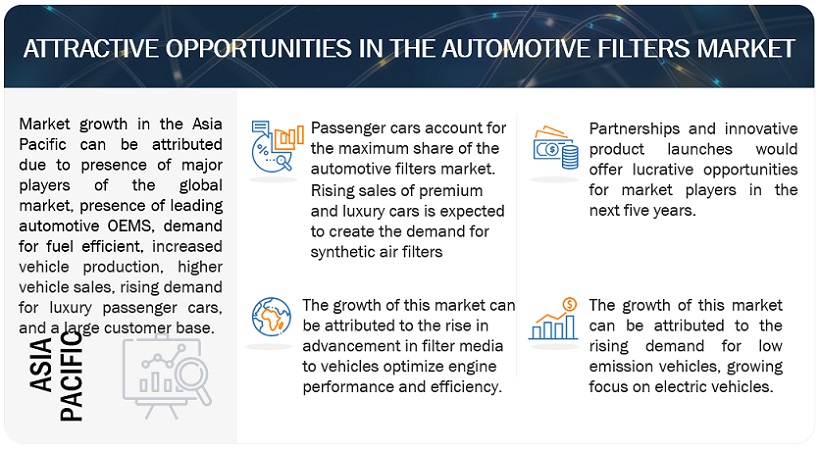

OPPORTUNITY: Progress has occurred in filtration media technology.

A vehicle filter's media composition is crucial for ensuring optimal engine performance and reliability. Different types of media, such as cellulose, synthetic, glass fiber, and activated carbon, are utilized in automotive filters, with premium filters leveraging advanced media to gain a competitive edge. Technological innovations in filter media present significant opportunities for manufacturers in the automotive filtration sector.

While cellulose media remains a cost-effective choice for most vehicle air intake filters, synthetic media is gaining traction due to its superior characteristics. Synthetic media offers advantages such as increased airflow, enhanced performance, and excellent water resistance, leading to improved combustion efficiency, fuel economy, and reduced emissions. Manufacturers like Mann+Hummel are developing synthetic ultra-fine fiber media to enhance filter lifespan and efficiency.

Introducing innovative filter media solutions, such as Ahlstrom's Ahlstrom ECO, which incorporates renewable and sustainable materials like lignin-based impregnation, signifies a shift towards eco-friendly filtration technologies. These advancements maintain filter durability and contribute to environmental sustainability by reducing reliance on fossil-based resources. Such technological progressions are poised to drive growth within the automotive filters market, presenting lucrative opportunities for manufacturers to capitalize on evolving consumer demands and regulatory requirements.

CHALLENGE: Fluctuating Raw Material Costs

Filters are manufactured using steel, aluminum, rubber, and synthetic fibers. These have experienced significant price fluctuations in recent years due to global economic conditions, geopolitical issues, and supply chain disruptions. When raw material costs surge, it becomes easier for filter manufacturers to maintain their profit margins. They are caught in a squeeze between rising input costs and the need to remain competitive in the market. To manage rising costs, some manufacturers might be tempted to reduce the quality of raw materials used in their filters.

However, this can compromise the performance and durability of the filters, potentially leading to customer dissatisfaction and impacting brand reputation. The fluctuating costs of raw materials create a complex and challenging environment for automotive filter manufacturers. Manufacturers must adopt effective strategies, such as hedging, exploring alternative materials, and optimizing production processes.

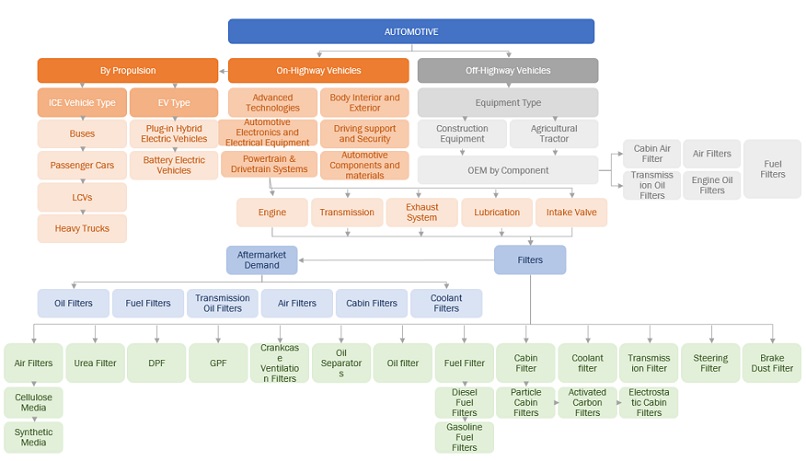

Automotive Filters Market Ecosystem

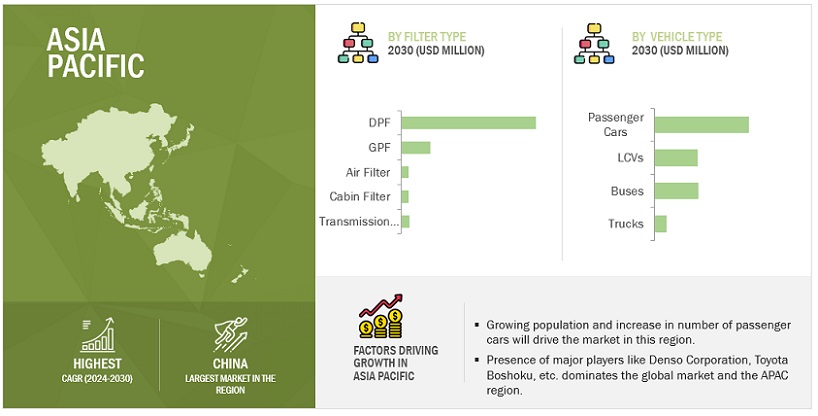

“Diesel Particulate Filter (DPF) is expected to lead the Filter Type segment in ICE vehicles.

A significant reason for DPF growth is the increasing stringency of emission regulations worldwide. Governments are cracking down on harmful pollutants from vehicles and machinery, forcing manufacturers to adopt cleaner technologies like DPFs. The global brake dust particle filter market will grow from USD XX million in 2024 to USD XX million in 2030 at a CAGR of 5.4%. These filters capture and trap soot particles in diesel exhaust, significantly reducing air pollution. In the Asia Pacific region, DPF dominates the automotive filters market. In 2022, China emerged as the leading market in the Asia-Pacific region for passenger car purchases, selling 23 million units.

The Asia-Pacific region is experiencing significant economic growth, leading to a rise in commercial vehicle sales, including trucks and construction equipment. These vehicles often rely on diesel engines for their power and torque. DPFs become crucial for these vehicles to comply with emission standards. Euro 6 tightened emission regulations, including PM limits. It requires that DPF in most new diesel vehicles comply with the standards. Stricter PM limits in recent China standards, such as China 6, effectively push manufacturers towards using DPFs, especially for heavy-duty vehicles, to meet compliance. Rapid regional urbanization leads to increased traffic congestion and worsening air quality. Public awareness about the health impacts of air pollution is growing, making DPFs a desirable technology to reduce harmful particulate matter emissions from diesel vehicles. The surge in commercial vehicle sales in the Asia-Pacific region is poised to drive the growth of automotive filters due to the increasing demand for environmentally friendly filters.

Particle cabin filters are anticipated to dominate the cabin filter market in terms of material type.

Particle cabin filters are projected to emerge as the leading segment within the automotive cabin filter market, primarily due to their cost-effectiveness compared to activated carbon and electrostatic filters and their above-average performance. These filters feature a low-cost barrier made of entirely synthetic non-woven fabric, offering distinct advantages such as resistance to deformation caused by water due to the non-hygroscopic nature of synthetic fibers. Consequently, this is anticipated to fuel steady growth in the particle filter market in the foreseeable future.

Furthermore, there is a burgeoning demand for air-conditioned cabins in heavy trucks in Europe and North America, primarily driven by government regulations. Notably, the European Commission has mandated the adoption of cabin air conditioning in all heavy commercial trucks, a directive echoed by the Indian government, albeit yet to be fully realized commercially. This regulatory push, coupled with major commercial vehicle manufacturers' installation of air conditioning systems in heavy trucks and buses, is expected to propel the particle cabin filters market within the heavy vehicles segment.

The Asia Pacific automotive filter market is projected to hold the largest share by 2030.

The Asia Pacific region holds the largest automotive filter market share. China accounts for the largest share owing to shifting consumer preferences, increasing per capita income of the middle-class population, and cost advantages that have led OEMs to increase vehicle production in the region. Thus, strong demand has been noticed in China, India, and Japan, accelerating the automotive filter market growth.

Asia Pacific will contribute 57% of the total vehicle production worldwide in 2022, whereas China will contribute the region's highest production. Light commercial vehicles (LCVs) and passenger cars hold a significant share, driven by the region's growing automotive industry. LCVs and trucks dominate China, with manufacturers investing in environmentally friendly filters to meet fuel economy standards while prioritizing consumer health and convenience.

In China and India, the four primary filters, oil, fuel, air, and cabin filters, dominate the overall automotive filter market. They are expected to continue their dominance in the forecast period alongside the region's overall growth in vehicle production. Factors like growing vehicle production, increasing demand, rising consumer spending, and emissions norms and standards contribute to their popularity. Many Asian countries are progressively adopting stricter emission regulations aligning with European standards (like Euro 6) or implementing stringent regulations. This requires high-quality filters that meet these regulations, driving demand for advanced filtration technologies.

Key Market Players

The key players in the automotive filters market are MANN+HUMMEL (Germany), Donaldson Corporation (US), Robert Bosch GmbH (Germany), Denso Corporation (Japan), Parker Hannifin (US), Sogefi S.p.A (Italy), Cummins Inc. (US), MAHLE GmbH (Germany), Toyota Boshoku (Japan), and AHLSTROM-MUNKSJO (Sweden). These companies adopted new product launches, partnerships, and joint ventures to gain traction in the automotive filters market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments Covered |

By Filter Type (ICE), Vehicle Type (ICE), Fuel filters by fuel type (ICE), Air filter by Media type (ICE), Cabin filter by Material type (ICE), Electric & Hybrid vehicle filter by filter type, by Electric and Hybrid Vehicle Type, Aftermarket by filter type (ICE), off-highway by equipment type (ICE), Off-highway by filter type (ICE), and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and RoW |

|

Companies covered |

Mann+Hummel (Germany), Donaldson Company, Inc. (US), MAHLE GmbH (Germany), Robert Bosch GmbH (Germany), Sogefi S.p.A (Italy), Denso Corporation (Japan), Ahlstrom-Munksjö (Finland), Toyota Boshoku Corporation (Japan), Cummins Inc. (Indiana), and Parker Hannifin Corporation (US) |

The study categorizes the automotive filters market based on the following segments:

Automotive Filters Market By Filter Type (ICE)

- Air filter

- fuel filter

- oil filter

- cabin filter

- brake dust filters

- transmission oil filter

- coolant filter

- oil separator

- steering filter

- urea filter

- DPF filter

- GPF filter

- Crankcase ventilation filter

Automotive Filters Market By Vehicle Type

- Passenger cars

- Light Commerical Vehicles (LCV)

- Trucks

- Buses

Automotive Fuel Filters Market, By Fuel Type (ICE)

- Gasoline filters

- Diesel filters

Automotive Air filters Market By Media type (ICE)

- Cellulose

- Synthetic

Automotive Cabin Filters by Material Type (ICE)

- Particle Cabin

- Activated Carbon

- Electrostatic

Electric & Hybrid Vehicle Filters (OE) Market By Vehicle Type

- Air filter

- Fuel filter

- Oil filter

- Cabin filter,

- Brake dust filter

- Transmission oil filter

- EMI/EMC filters

- Cooling air particle filter

Electric & Hybrid Vehicle Filters (OE) Market By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Automotive Filters Aftermarket (ICE), By Filter Type

- Oil Filter

- Fuel Filter

- Air Filter

- Cabin Filter

- Coolant Filter

- Transmission Oil Filter

Off-Highway Vehicle Filters Market, By Equipment Type

- Construction Equipment

- Agricultural Tractors

Off-Highway Filters (OE) Market, By Filter Type

- Fuel Filter

- Oil Filter

- Air Filter

- Cabin Air Filter

- Transmission Oil Filter

- Automotive Filters Market By Region

- Asia Pacific

- Europe

- North America

- RoW

Recent Developments

- In January 2024, Robert Bosch GmbH launched the FILTER+pro, a cabin filter that ensures the prevention of viruses and mold growth. Its antimicrobial filter layer is finely tuned to effectively combat bacteria, pollen, and allergens. The carbon layer eliminates odors and harmful gases like ozone or smog, while the ultrafine microfiber layer filters out over 98% of particulate matter sized 2.5 micrometers or more significantly.

- In October 2023, MANN+HUMMEL Group finalized its acquisition of a majority share in Suzhou U-Air Environmental Technology ("U-Air"), emphasizing its dedication to fulfilling the increasing worldwide need for cleaner air solutions. This strategic decision further solidifies MANN+HUMMEL's presence in China and Southeast Asia's expanding air filtration market.

- In August 2023, Donaldson partnered with NAPA Auto Parts stores (US). Donaldson Corporation will provide the NAPA United States network with a comprehensive range of heavy-duty air filtration products under the NAPA Gold product line.

- In April 2023, Ahlstrom launched eco-friendly filtration solutions tailored for automotive use. This newly developed renewable and sustainable filter media, created by Ahlstrom, employs lignin-based impregnation, substituting fossil-based resin. The resin formula incorporates a notable portion of bio-based, renewable lignin, ensuring that the mechanical attributes and resilience of the filter media remain intact, even in demanding conditions.

- In April 2022, MANN+HUMMEL developed a cutting-edge filter medium named MULTIGRADE F-MB 2000, providing 99.95 percent separation efficiency for particles sized down to four micrometers. These particles are up to 18 times smaller than the width of a human hair. This filter medium is utilized in the MANN-FILTER WK 11 051 fuel filter, which retains 9,995 out of 10,000 flowing particles.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive filter market?

The global automotive filters market is projected to grow from USD 12.9 billion in 2024 to USD 14.6 billion by 2030, at a CAGR of 2.1% during the forecast period.

Which filter type is currently leading the global automotive filter market?

Diesel Particulate Filters are leading in the global automotive filters market.

Many companies are operating in the global automotive filters market space. Do you know who the front leaders are and what strategies they have adopted?

The automotive filters market is dominated by a few globally established companies such as MANN+HUMMEL (Germany), Donaldson Corporation (US), Robert Bosch GmbH (Germany), Denso Corporation (Japan), Parker Hannifin (US), Sogefi S.p.A (Italy), Cummins Inc. (US), MAHLE GmbH (Germany), Toyota Boshoku (Japan), and AHLSTROM-MUNKSJO (Sweden). These companies adopted new product launches, partnerships, and joint ventures to gain traction in the automotive filters market.

Which cabin filter holds the largest market share?

Particle Cabin Filters hold the largest market share in automotive fitlers market.

How does the demand for the global automotive filter market vary by region?

The Asia Pacific region is predicted to lead the automotive filters market with a CAGR of 2.7 %. The growing demand for low-emission vehicles and rising emission norms and regulations are critical reasons this region has the largest market for automotive filters, with USD 7.1 Billion in 2030. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four main activities to estimate the current size of the automotive filters market.

- Exhaustive secondary research and country-wise model mapping to collect information on automotive filter type, vehicle type, filter media type, fuel type, and automotive filter materials.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

- After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources referred for this research study include automotive organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), the International Energy Agency (IEA), and the European Automobile Manufacturers' Association. The secondary sources included annual reports, press releases, and investor presentations of manufacturers; white papers, certified publications; articles from recognized authors, directories, and industry databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain critical information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

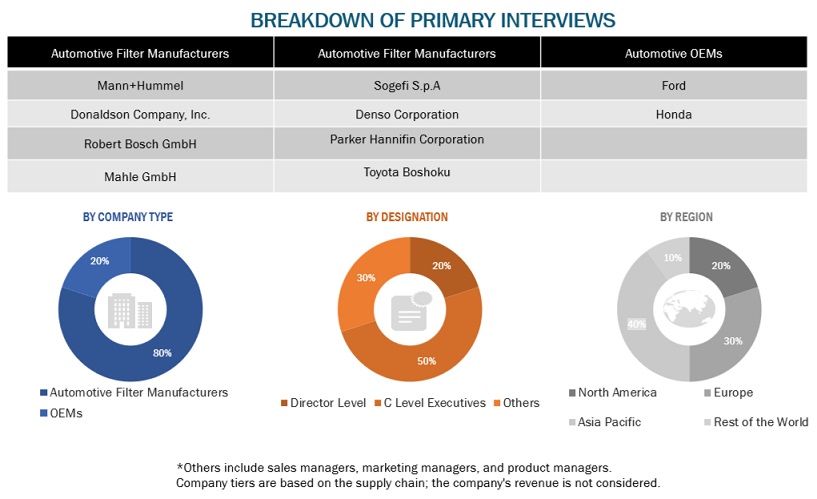

Primary Research

After understanding the automotive filters market scenario, extensive primary research was conducted. Several industry experts from automotive filter providers, component/system providers, and end-user organizations across four major regions, North America, Europe, Asia Pacific, and RoW, were contacted for the primary interviews. Most interviews were conducted from the supply side and some from OEMs. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries. After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the conclusions delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

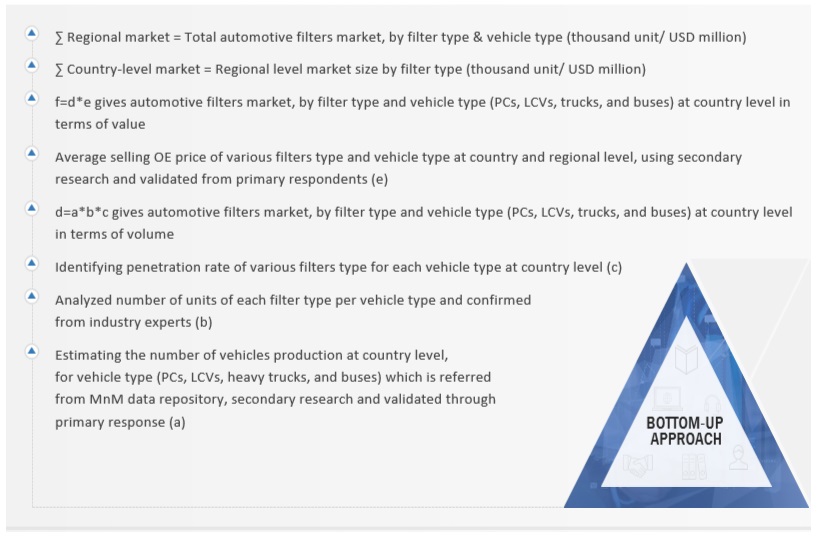

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the automotive filter market. The market size, by volume, of the automotive filters market has been derived by identifying the country-level vehicle production data (a) for each vehicle type (PCs, LCVs, trucks, and buses) and the number of units installed of different filter types per vehicle in all considered vehicle types (b) and penetration rate of each filter type in different vehicle types considered (c). Multiplying all three factors will provide the country-level market size by volume filter and vehicle type. The market size, by value, has been arrived at by multiplying the average selling OE price of filters for each vehicle type at the country level. The summation of the country-level market gives regional and global automotive filter markets by filter type and vehicle type. A similar approach is followed for the electric & hybrid vehicle filters market by vehicle type and filter types, off-highway by equipment type and filter type, and aftermarket by filter type in terms of volume and value.

Automotive Filters Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

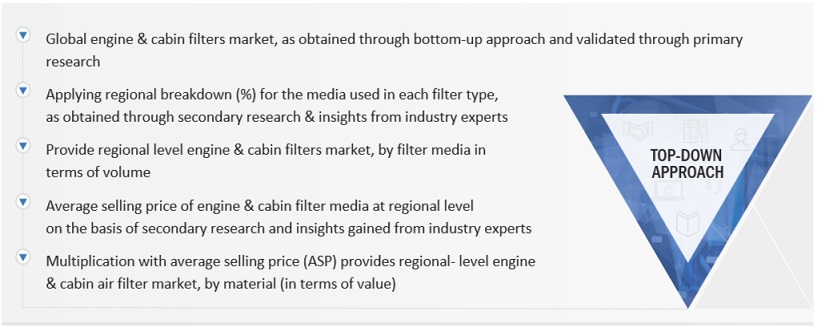

The market size of engine & cabin air filters, by material, was calculated using the top-down approach. Extensive secondary and primary research was carried out to understand the global market scenario for the types of material used in engine & cabin air filters. Several primary interviews were conducted with key opinion leaders concerning cabin air filter development, including key OEMs, Tier-I suppliers, and filter manufacturers. Qualitative aspects, such as market drivers, restraints, opportunities, and challenges, were considered while calculating and forecasting the market size.

Automotive Filters Market: Top-Down Approach

Market Definition:

Filters in a vehicle remove foreign and unwanted substances/particles, which can cause severe damage to the vehicle system or human health. Some automotive filters include air filters, oil filters, brake dust filters, steering filters, cabin air filters, fuel filters, and coolant filters.

According to Mann+Hummel, a renowned automotive filter market player, combustion air always contains particles that should not be allowed to penetrate the inside of the engine. Therefore, applying air filters is essential to protect the engine and its components.

Stakeholders:

- Automotive OEMs

- Filters Manufacturers

- Component and Raw Material Suppliers of Automotive Filters

- On-highway and Off-highway Vehicle Manufacturers

- Automotive Component Providers

- Filters Design Companies

- Automobile Organizations/Associations

- Traders, Distributors, and Suppliers of Automotive Filters

- Legal and Regulatory Authorities

- Dealers, Distributors, and Retailers

- Associations, Forums, and Alliances Related to ICE and Electric Vehicles

- Government Agencies and Policymakers

- Automobile Organizations/Associations

Report Objectives

-

To define, describe, and forecast the automotive filters market based on

- Filter types (air filters, fuel filters, oil filters, oil separators, transmission oil filters, coolant filters, steering filters, brake dust filters, cabin filters, urea filters, DPF (Diesel Particulate Filters), GPF (Gasoline Particulate Filters), and crankcase ventilation filters)

- Air filter by media type (cellulose and synthetic)

- Cabin filter by material type (particle cabin filters, activated carbon filters, and electrostatic cabin filters)

- Fuel filter by fuel type (gasoline filters and diesel filters)

- Automotive Filter Aftermarket, by Filter Type (oil filters, fuel filters, air filters, cabin filters, coolant filters, and transmission oil filters)

- Automotive Filters Market by vehicle type (passenger cars, light commercial vehicles, buses, and trucks)

- Electric & hybrid vehicle filters market by vehicle type (BEV (battery electric vehicle) and PHEV (Plug-in hybrid electric vehicle)

- Electric & hybrid vehicle filters market by filter type (air filters, fuel filters, oil filters, transmission oil filters, EMI/EMC filters, brake dust filters, cabin filters, cooling air particle filters)

- Off-highway filters market by equipment type (agriculture tractors and construction equipment)

- Off-highway filters market by filter type (fuel filters, engine oil filters, air filters, cabin air filters, and transmission oil filters)

- By Region [Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of Asia Pacific), Europe (France, Germany, Russia, Spain, Turkey, the UK, and Rest of Europe), North America (Canada, Mexico, US) and RoW (Iran, Brazil, and Others in RoW)

- To provide detailed information about significant factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To evaluate the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To strategically analyze the key player strategies/right to win

- To study the market with supply chain analysis, ecosystem analysis, trade analysis, case study analysis, pricing analysis, patent analysis, trends/disruptions impacting buyers, technology trends, regulatory analysis, and recession impact analysis

- Analyzing the competitive leadership mapping of the global automotive filter manufacturers in the market and understanding their market position with the help of a company evaluation matrix.

- To track and analyze competitive developments, such as joint ventures, collaborations, partnerships, mergers & acquisitions, new product developments, and expansions, in the automotive filters market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s needs.

Automotive Filters Market By Sales Channel (Region Level)

- Aftermarket

- OEM

Automotive Filters Market By Ice Vehicle Type (Country Level)

- Passenger Cars

- LCVs

- Trucks

- Buses

Electric And Hybrid Vehicle Filters Market, By Filter Type And Vehicle Type

- Oil Filters

- Fuel Filters

- Air Filters

- Cabin Filters

- Transmission Oil Filters

- Brake Dust Filters

- EMI/EMC Filters

- Cooling Air Particle Filters

Note: Asia Pacific (China, India, Japan, South Korea, Thailand, and others); Europe (France, Germany, Russia, Spain, Turkey, the UK, and others); North America (Canada, Mexico, the US) and RoW (Iran, Brazil, and others)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Filters Market

Up to date (2017) Off highway filter marketplace Globally and by region for all types - Oil, Fuel, prefuel, hydraulic, transmission

I would appreciate to have a sample of market research of the Brazilian Oil,Fuel,Air and HVAC market, production and market players split

Air , Oil and Fuel filter Market at Canada , who is suppliers what size is it in aoutomotive including buses,trucks and business heavy equipments market

Hello, I am interested in receiving reports for Aftermarket data for filters in the United States. Specifically, I would like to locate Vehicle in Operation information, or demands for Heavy Duty Filters. Any information provided would be much appreciated. Thank you

What is the expected evolution of filter markets considering that the reliability of vehicles and quality of oils is continuously improving and enable to space out visits?

yes Fuel Filters especially the Diesel Market size. I would like to see if you have info specifically units and dollars for the diesel fuel filter market in the u.s

Interested to Know market potential for Fuel Filter Cum Water Separator for Ashok leyland Vehicles and current After market share held by various competetions in India

we are conducting a final career project on filters for motorbikes. Your study migth help us. Regards

I am seeking an air filter market report with a narrow focus. Specifically, the focus is medium and heavy vehicle in the North America markets (US and Canada data). May I please have a quote and a table of contents for a report with this focus? Thank you, Megan

I'm specifically interested in automotive-filter manufacturers based in China and the markets/regions they supply to/support.

I want to get a sense of how Mahle are doing in the UK and Europe within the Aftermarket compared to the leader. If I can get this, I will be able understand the full value of the report

Hi, I am looking for specific information on Capacitive dividers for EVT, Testing, RC Dividers, Grading AIS, Grading GIS, TRV AIS, TRV GIS, Thyristor Valve, HVDC Bypass, Filter capacitor, EVT For the following countries and region - Europe. U.S., Canada, India, China, South America, and Middle East Can you please help me with a quote and timeline for the same?

Diesel and Gasoline Particulate Filters, Catalysts for the automotive industry globally and all vehicle segments(i.e PC HCV). Thanks

Hello, I am a consultant/investor in the North America Automotive Aftermarket space and would like a sample report to determine if it can add value for my filter manufacturer client. Regards, Frank

We would be interested in purchasing the Report on automotive filters. Could you please provide us with some information prior to the purchase: Is there an extended table of content that you can share with us? Could you share with us the forecast model that is underlying the report?

What is the source of the data used in the forecast? (Is it based on IHS data when it comes to volumes for instance?)

Can you give us details regarding the methodology? We would need datapoints going back to 2013. Could you provide these? Many thanks in advance!