The study encompassed four primary tasks to determine the present and future scope of the automotive piston market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. The complete market size was estimated by using both top-down and bottom-up methodologies. Following this, a market breakdown and data triangulation approaches were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to for this research study include auto industry organizations (such as OICA), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. The secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

Primary Research

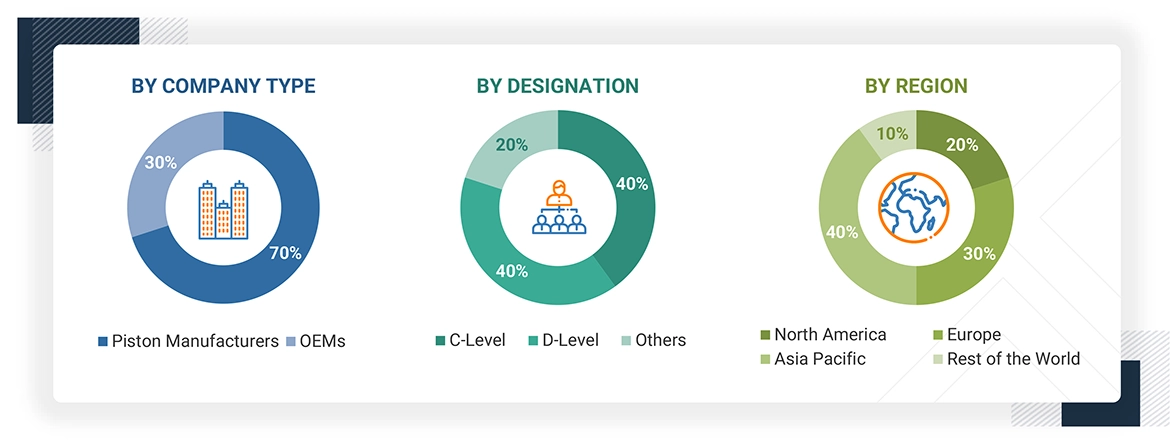

Extensive primary research was conducted after understanding the automotive piston system market scenario through secondary research. Several primary interviews were conducted with market experts from the demand (OEM) and supply side (automotive piston manufacturers and distributors) players across four major regions—namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% of primary interviews were conducted on the demand side and 70% on the supply side.

Primary data was collected through questionnaires, mail, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, administration, and so on, were covered to provide a holistic viewpoint in the report.

After interacting with industry participants, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This and the opinions of the in-house subject matter experts led to the findings described in the remainder of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive piston market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

The global market size was estimated and validated using a bottom-up approach, analyzing country-level vehicle production (passenger cars, LCVs, HCVs) through industry associations and OICA. Market forecasts are based on macroeconomic indicators, emissions regulations, industry growth, GDP, and government initiatives. Piston market volume was calculated by multiplying vehicle production by country-specific fuel type distribution (diesel, gasoline, alternative), then further multiplied by engine configuration penetration (inline-3/4/5/6, V-6/8/12, H-6) identified through model mapping, giving the country-level automotive piston market volumes by fuel type.

Further, the country-level piston market size, by volume, was multiplied by the country-level average OE price (AOP) of each fuel type for each vehicle type to get the country-level piston market by fuel type in terms of value.

The summation of the country-level market gives the regional market; further summation of the regional market provides the global automotive piston market by fuel type. A similar methodology was followed for the automotive piston market by vehicle type (passenger cars, LCVs, HCVs).

Automotive Piston Market : Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are said to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

Pistons are essential components in internal combustion engines that transform combustion's thermal energy into mechanical work. Sealed within cylinders by piston rings, they maintain gas-tight conditions while transferring expansion force to the crankshaft via connecting rods, enabling the engine's power generation process.

The main functions of the piston are: -

-

To transmit the gas forces via a connecting rod to the crankshaft.

-

To seal the clearance between piston rings and cylinder liner against gas leakage to the crankcase and prevent oil infiltration into the combustion chamber.

Stakeholders

-

Automotive component manufacturers

-

Associations, forums, and alliances related to automobiles

-

Automotive original equipment manufacturers

-

Automotive investors

-

Manufacturers of automotive piston systems

-

Raw material suppliers for automotive piston systems

-

Traders, distributors, and suppliers of automotive piston systems

-

The automotive industry as an end-use industry and regional automobile associations

-

Government agencies and policymakers

Report Objectives

-

To define, describe, and forecast the size of the automotive piston market in terms of value (USD million) and volume (thousand units) based on the following segments:

-

By Component (Piston Heads, Piston Rings, and Piston Pins)

-

By Coating (Dry Film Lubricant, Thermal Barrier, and Oil Shedding)

-

By Shape (Flat-top Pistons, Bowl Pistons, and Dome Pistons)

-

By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles)

-

By Fuel Type (Gasoline, Diesel, and Alternate Fuels)

-

By Material (Steel and Aluminum)

-

By Aftermarket Component ( Piston Heads, Piston Rings, and Piston Pins)

-

By Region (Asia Pacific, Europe, North America, and Rest of the World)

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges)

-

To analyze the share of key players operating in the market

-

To analyze the competitive landscape and prepare a competitive leadership mapping for the global market players

-

To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the market

-

To study the following with respect to the market

-

Trends and Disruptions Impacting Customer Business

-

Ecosystem Analysis

-

Technology Analysis

-

Supply Chain Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Case Study Analysis

-

Key Stakeholders and Buying Criteria

-

Key Conferences and Events

-

Trade Analysis

-

Pricing Analysis

-

To analyze the supplier analysis of the market to understand the OEM-wise piston suppliers

-

To analyze and give MnM insights on the impact of biofuel & e-fuel-based vehicles on automotive pistons

-

To strategically profile key players and analyze their strategies and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs.

The following customization options are available for the report:

AUTOMOTIVE PISTON MARKET, BY COUNTRY AND VEHICLE TYPE

Note: This market will be provided at the country level in terms of volume and value.

AUTOMOTIVE PISTON AFTERMARKET, BY COUNTRY AND COMPONENT

-

Piston Heads

-

Piston Rings

-

Piston Pins

Note: This market will be provided at the country level in terms of volume and value.

AUTOMOTIVE PISTON MARKET, BY COUNTRY AND COMPONENT

-

Piston Heads

-

Piston Rings

-

Piston Pins

Note: This market will be provided at the country level in terms of volume and value.

Amey

Nov, 2019

I would like to ask you for a sample of this analysis o the piston market especially in Europe. Thank you best regards Lukas .

Amey

Nov, 2019

Selected tables in the report describing the names and locations of piston manufacturers to target sales actions of raw materials used in the industry. .

Amey

Nov, 2019

Piston pin Market in India and top suppliers in India and news on any player wanting to foothold in European market.

apoorv

Jul, 2019

we wanna contract market research but some of them there is no real in our opinion. So we decide to first know that. We control the piston market in Europe and we wanna you to counteract and after that if we have the same control or ideas of the market...speech with your company to contract you. We have been working 2 years with market research with no good experience..