Automotive Chassis Market by Chassis Type (Backbone, Ladder, Monocoque, Modular), Material (Steel, Aluminum Alloy, Carbon Fiber Composite), Electric Vehicle (BEV, PHEV, HEV), Vehicle Type (PC, CV), and Region - Global Forecast to 2025

[151 Pages Report] The global automotive chassis market size was valued at USD 50.78 billion in 2017 and is expected to reach USD 78.44 billion by 2025 at a CAGR of 6.5% during the forecast period 2017-2025. The report analyzes and forecasts the global market size, in terms of volume (units). The report segments the market and forecasts its size, by volume & value, on the basis of chassis type, material type, vehicle type, electric vehicle type, and region. It provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It strategically profiles key players and comprehensively analyzes their market shares and core competencies. The report also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as International Organization of Motor Vehicle Manufacturers (OICA), China Association of Automobile Manufacturers (CAAM), and others. Experts from related industries and suppliers have been interviewed to understand the future trends of the market. The bottom-up and top-down approaches have been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the total production volumes and analyzing the demand trends.

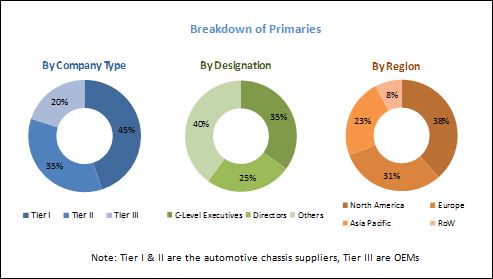

The figure given below illustrates the break-up of the profiles of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive chassis market consists of manufacturers such as Continental (Germany), ZF (Germany), Magna (Canada), Aisin Seiki (Japan), Tower International (US), Benteler (Germany), CIE Automotive (Spain), Schaeffler (Germany), F-Tech (Japan) & KLT Auto (India)

Target Audience

- Tier 1 manufacturers

- Automotive associations

- Raw material suppliers

- Vehicle manufacturers/OEMs

- Automotive software providers

- Automotive chassis suppliers

Scope of the Report

-

By Chassis Type

- Backbone Chassis

- Ladder Chassis

- Monocoque Chassis

- Modular Chassis

-

By Material

- High Strength Steel

- Aluminum Alloy

- Mild Steel

- Carbon Fiber Composite

-

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

-

By Electric Vehicle Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

-

By Region

- North America

- Asia Pacific

- Europe

- RoW

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional regions (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

The market is estimated to be USD 50.78 Billion in 2017 and is projected to grow to USD 78.44 Billion by 2025, at a CAGR of 5.59%

Design for automotive chassis systems such as ladder chassis, monocoque chassis, and modular frame chassis has been evolving. The new trend in the automotive industry is to manufacture chassis with lighter material, which will make the vehicles lighter without compromising on the safety of the vehicle.

Monocoque chassis is estimated to hold the largest market share in the market. With the implementation of mandates to make vehicles more safe and fuel efficient with minimum emission, monocoque chassis is expected to grow better than other type of chassis such as ladder chassis in passenger car segment.

Whereas in HCV segment, modular chassis is expected to grow well owing to its advantages such as providing better stability to vehicle body as well as light weight in comparison to conventional ladder chassis system.

By raw material, the market for aluminum alloy is estimated to experience the highest growth during the forecast period. With regulations to make vehicle more environment friendly and the rapid adoption of electric vehicles, aluminum alloy-induced chassis system is to gain strong affinity from automotive OEMs. And during the forecast period, aluminum will gain larger market share in comparison to other raw materials for manufacturing of chassis systems.

In electric vehicle type, skateboard chassis will gain larger market share during the forecast period. Skateboard chassis consists of a frame that enables it to hold the massive battery pack that spans the entire area of the frame i.e. between the four wheels along with the suspension, brakes, and the cylindrical motors. Furthermore, this chassis system can support different body styles for different applications.

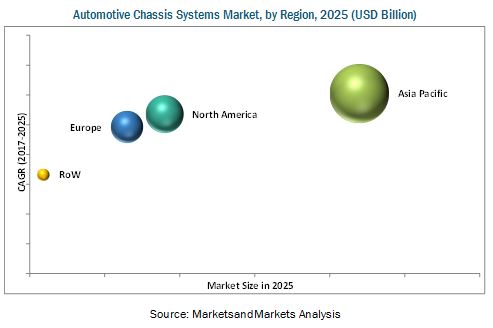

The Asia Pacific region is estimated to dominate the market, in terms of value, in 2017, followed by North America and Europe. Demand for lighter weight chassis has increased in recent years, with suppliers catering not only to the domestic demand but also to the overseas demand. Moreover, in 2025 the region is likely to lead the electric vehicle market, in terms of volume, followed by Europe and North America, as key suppliers are significantly investing to expand their presence in Asia Pacific.

In near future, shared mobility will be the face of automotive market. To decrease traffic congestion and to make travel more economical, shared mobility will be strongly preferred by commuters. With increase in shared mobility, individual purchasing of car will decline. Fall in sales of vehicle per individual will negatively affect the production of vehicles, which will, in turn, reduce the demand of chassis.

Automotive chassis systems market is dominated by key players such as Continental (Germany), ZF Friedrichshafen (Germany), Magna (Canada), Schaeffler (Germany), Aisin Seiki (Japan), CIE Automotive (Spain), Benteler (Germany), Hyundai Mobis (Korea Republic) and AL-KO (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Data Triangulation

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Increasing Demand to Reduce Co2 Emission Levels

2.3.2.2 Increasing Concern for Safety and Security of Passengers

2.3.3 Supply-Side Analysis

2.3.3.1 Changing Design of Car Chassis

2.3.3.2 Use of Lighter Materials to Build Chassis

2.4 Market Size Estimation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Market

4.2 Market, By Region, 2017 vs 2025

4.3 Market, By Chassis Type

4.4 Market, By Vehicle Type

4.5 Electric Vehicle Chassis Market, By Chassis Type

4.6 Market, By Material Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Vehicles With Better Mileage

5.2.1.2 Increase in Sales of Commercial Vehicles

5.2.2 Restraints

5.2.2.1 Shared Mobility

5.2.3 Opportunities

5.2.3.1 Growth in Electric Vehicle Sales

5.2.3.2 Growth in Lcv Sales Owing to Boom in E-Commerce Business

5.2.4 Challenges

5.2.4.1 In-House Production of Chassis Systems

5.2.4.2 Change in Material for Rendering Benefit

5.3 Autonomous Vehicles Chassis Systems Market

5.4 Macro Indicators Analysis

6 Market, By Chassis Type (Page No. - 46)

6.1 Introduction

6.2 Backbone Chassis

6.3 Ladder Chassis

6.4 Monocoque Chassis

6.5 Modular Chassis

7 Market, By Material Type (Page No. - 54)

7.1 Introduction

7.2 AL Alloy

7.3 Carbon Fibre Composite

7.4 HSS (High Speed Steel)

7.5 MS (Mild Steel)

8 Market, By Vehicle Type (Page No. - 63)

8.1 Introduction

8.2 Passenger Cars

8.3 Light Commercial Vehicles

8.4 Heavy Commercial Vehicles

9 Market, By Electric Vehicle Type (Page No. - 70)

9.1 Introduction

9.2 Battery Electric Vehicle (BEV)

9.3 Hybrid Electric Vehicle (HEV)

9.4 Plug-In Hybrid Vehicle (PHEV)

10 Market, By Manufacturing Process (Page No. - 78)

10.1 Introduction

10.2 Hydro-Forming

10.3 Stamping

10.4 Laser Cutting

10.5 Welding

11 Market, By Region (Page No. - 81)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 RoW

11.5.1 Brazil

11.5.2 Russia

11.5.3 South Africa

12 Competitive Landscape (Page No. - 108)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Expansions

12.3.2 Partnerships/Supply Contracts/Collaborations/JVS

12.3.3 Mergers & Acquisitions

12.3.4 New Product Developments

13 Company Profiles (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Continental

13.2 ZF

13.3 Magna

13.4 Schaeffler

13.5 Aisin Seiki

13.6 CIE Automotive

13.7 Tower International

13.8 Hyundai Mobis

13.9 F-Tech

13.10 KLT-Auto

13.11 AL-Ko

13.12 Benteler

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 144)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.5.1 Detailed Analysis and Profiling of Market Players (Up to 3)

14.5.2 Detailed Analysis of Additional Countries

14.6 Related Reports

14.7 Author Details

List of Tables (72 Tables)

Table 1 Currency Exchange Rates

Table 2 Vehicle Sales of Top Three Economies (Million Units)

Table 3 Market Size, By Chassis Type, 2015–2025 (’000 Units)

Table 4 Market Size, By Chassis Type, 2015–2025 (USD Billion)

Table 5 Ladder Chassis: Market Size, By Region, 2015–2025 (’000 Units)

Table 6 Ladder Chassis: Market Size, By Region, 2015–2025 (USD Billion)

Table 7 Monocoque Chassis: Market Size, By Region, 2015–2025 (’000 Units)

Table 8 Monocoque Chassis: Market Size, By Region, 2015–2025 (USD Billion)

Table 9 Modular Chassis: Market Size, By Region, 2015–2025 (’000 Units)

Table 10 Modular Chassis: Market Size, By Region, 2015–2025 (USD Billion)

Table 11 Market Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 12 Market Size, By Vehicle Type, 2015–2025 (USD Billion)

Table 13 Passenger Cars: Market Size, By Region, 2015–2025 (‘000 Units)

Table 14 Passenger Cars: Market Size, By Region, 2015–2025 (USD Billion)

Table 15 Light Commercial Vehicles: Market Size, By Region, 2015–2025 (‘000 Units)

Table 16 Light Commercial Vehicles: Market Size, By Region, 2015–2025 (USD Billion)

Table 17 Heavy Commercial Vehicles: Market Size, By Region, 2015–2025 (‘000 Units)

Table 18 Heavy Commercial Vehicles: Market Size, By Region, 2015–2025 (USD Billion)

Table 19 Market Size, By Electric Vehicle Type, 2015–2025 (‘000 Units)

Table 20 Europe: Battery Electric Vehicle Chassis Systems Market, By Chassis Type, 2015-2025, (‘000 Units)

Table 21 North America: Battery Electric Vehicle Chassis Systems Market, By Chassis Type, 2015-2025 (‘000 Units)

Table 22 Asia Pacific: Battery Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 23 Europe: Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 24 North America: Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015-2025 (‘000 Units)

Table 25 Asia Pacific: Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 26 Europe: Plug-In Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 27 North America: Plug-In Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 28 Asia Pacific: Plug-In Hybrid Electric Vehicle Chassis Systems Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 29 Market, By Region, 2015–2025 (‘000 Units)

Table 30 Automotive Chassis System Market, By Region, 2015–2025 (USD Billion)

Table 31 Asia Pacific: Market, By Country, 2015–2025 (‘000 Units)

Table 32 Asia Pacific: Automotive Chassis System Market, By Country, 2015–2025 (USD Billion)

Table 33 China: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 34 China: Market, By Chassis Type, 2015–2025 (USD Million)

Table 35 India: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 36 India: Market, By Chassis Type, 2015–2025 (USD Million)

Table 37 Japan: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 38 Japan: Market, By Chassis Type, 2015–2025 (USD Million)

Table 39 South Korea: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 40 South Korea: Market, By Chassis Type, 2015–2025 (USD Million)

Table 41 Europe: Market, By Country, 2015–2025 (‘000 Units)

Table 42 Europe: Market, By Country, 2015–2025 (USD Billion)

Table 43 France: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 44 France: Market, By Chassis Type, 2015–2025 (USD Million)

Table 45 Germany: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 46 Germany: Market, By Chassis Type, 2015–2025 (USD Million)

Table 47 Italy: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 48 Italy: Market, By Chassis Type, 2015–2025 (USD Million)

Table 49 Spain: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 50 Spain: Market, By Chassis Type, 2015–2025 (USD Million)

Table 51 UK: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 52 UK: Market, By Chassis Type, 2015–2025 (USD Million)

Table 53 North America: Market, By Country, 2015–2025 (‘000 Units)

Table 54 North America: Market, By Country, 2015–2025 (USD Billion)

Table 55 Canada: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 56 Canada: Market, By Chassis Type, 2015–2025 (USD Million)

Table 57 Mexico: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 58 Mexico: Market, By Chassis Type, 2015–2025 (USD Million)

Table 59 US: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 60 US: Market, By Chassis Type, 2015–2025 (USD Million)

Table 61 RoW: Market, By Country, 2015–2025 (‘000 Units)

Table 62 RoW: Market, By Country, 2015–2025 (USD Billion)

Table 63 Brazil: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 64 Brazil: Market, By Chassis Type, 2015–2025 (USD Million)

Table 65 Russia: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 66 Russia: Market, By Chassis Type, 2015–2025 (USD Million)

Table 67 South Africa: Market, By Chassis Type, 2015–2025 (‘000 Units)

Table 68 South Africa: Market, By Chassis Type, 2015–2025 (USD Million)

Table 69 Expansions, 2016–2017

Table 70 Partnerships/Supply Contracts/Collaborations/JVS, 2013–2017

Table 71 Mergers & Acquisitions, 2015–2017

Table 72 New Product Development, 2016-2017

List of Figures (44 Figures)

Figure 1 Market: Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Increase in CO2 Emissions in Transport Sector, 1980–2030

Figure 6 US Road Accident Data, Per 100,000 Inhabitants, 1994–2015

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Attractiveness Bubble Chart for Market, 2017–2025

Figure 9 Market Size, By Chassis Type (USD Billion)

Figure 10 Market Size, By Region (USD Billion)

Figure 11 Market Size, By Vehicle Type (USD Billion)

Figure 12 Growing Demand for Reduction in Automotive Emission is Expected to Boost the Market (USD Billion)

Figure 13 Asia Pacific to Dominate the Market During the Forecast Period in Terms of Value

Figure 14 Monocoque Chassis Holds the Largest Share of the Market, 2017 vs 2025

Figure 15 Passenger Car Segment to Dominate the Market, 2017 vs 2025

Figure 16 Skateboard Chassis to Witness the Highest Growth in Electric Vehicle Chassis Market, 2017 vs 2025

Figure 17 Aluminum Alloy to Hold the Largest Share of the Market, 2017 vs 2025

Figure 18 Market: Market Dynamics

Figure 19 Commercial Vehicle Sales, 2005-2016

Figure 20 U.S. Vehicle Production Will Be the Primary Macro Indicator Which Will Impact the Overall Market

Figure 21 China GNI Per Capita Year on Year Growth Will Be the Primary Macro Indicator Which Will Impact the Overall Market

Figure 22 India GDP PPP Will Be the Primary Macro Indicator Which Will Impact the Overall Market

Figure 23 Market, By Chassis Type, 2017 vs 2025 (USD Billion)

Figure 24 Market, By Material Type, 2017 vs 2025 (Tons)

Figure 25 Market, By Vehicle Type, 2017 vs 2025 (USD Billion)

Figure 26 Market, By Electric Vehicle Type, 2017 vs 2025 (‘000 Units)

Figure 27 Hydroform Chassis

Figure 28 Stamping

Figure 29 China Accounts for the Largest Market Share of the Asia Pacific Region for Market, 2017 vs 2025

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Europe: Market Snapshot

Figure 32 North America: Market Snapshot

Figure 33 Key Developments By Leading Players in Market From 2014 to 2017

Figure 34 Market Ranking: 2016

Figure 35 Continental: Company Snapshot

Figure 36 ZF: Company Snapshot

Figure 37 Magna: Company Snapshot

Figure 38 Schaeffler: Company Snapshot

Figure 39 Aisin Seiki: Company Snapshot

Figure 40 CIE Automotive: Company Snapshot

Figure 41 Tower International: Company Snapshot

Figure 42 Hyundai Mobis: Company Snapshot

Figure 43 F-Tech: Company Snapshot

Figure 44 Benteler: Company Snapshot

Growth opportunities and latent adjacency in Automotive Chassis Market