Hydrogen Fuel Cell Vehicle Market by Vehicle Type (Buses, Trucks, LCVs, Passenger Cars), Component, Fuel Type, Hydrogen Fuel Points, Operating Miles, Power, Capacity, Specialized Vehicle Type and Region - Global Forecast to 2030

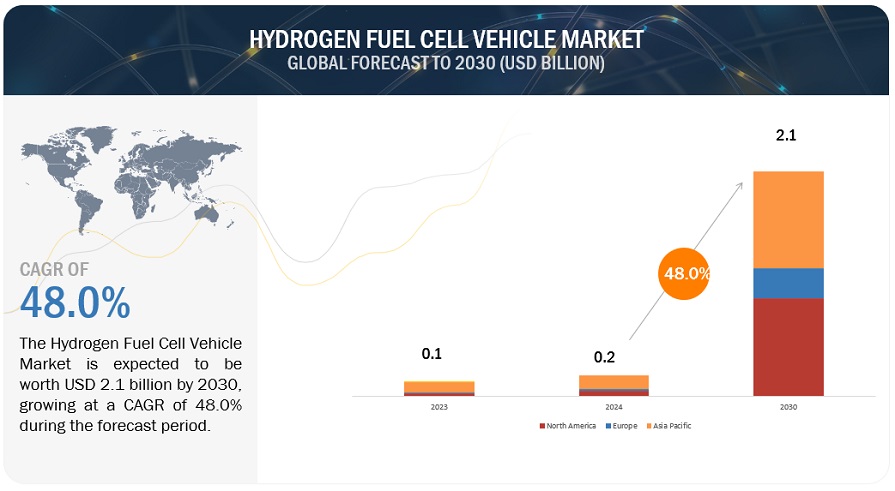

[330 Pages Report] The global hydrogen fuel cell vehicle market size is valued at USD 0.2 billion in 2024 and is expected to reach USD 2.1 billion by 2030, at a CAGR of 48.0%, during the forecast period 2024 to 2030. Government subsidies for environmentally friendly hydrogen production, the development of an integrated hydrogen ecosystem, the launch of new generation H2 fuel vehicles, and OEM plans to establish their own H2 refueling ecosystems are all expected to boost the automotive fuel cell business.

The sector is also seeing developments like mobile and community hydrogen fueling systems, which make H2 more accessible for home applications. Air Liquide, Linde, and Powertech Labs are among the companies exploring low-cost, mobile refueling options to help boost acceptance of fuel cell electric vehicles market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Hydrogen Fuel Cell Vehicle Market Dynamics:

Driver: Improved Fuel Efficiency and Driving Range

Vehicles powered by hydrogen fuel cells outperform ICE vehicles in terms of fuel efficiency. They can obtain over 63 miles per gallon gasoline equivalent (MPGge), beating most ICE vehicle models, which average 29 MPGge on the highway. Hybridization also has the potential to improve these vehicles' fuel efficiency by 3.2%. In cities, H2 FCEVs have a fuel economy of 55 MPGge, compared to ~20 MPGge in ICE vehicles. Further, FCEVs can have thravel over 300 miles from one refuel. The average EV on the other hand has a range of around 150 miles. Honda Clarity has the highest EPA range of up to 366 miles. This combination of fuel efficiency and extended driving range is expected to drive demand for H2 FCEVs, consequently driving demand of automotive fuel cells.

Restraint: High infrastructure costs for H2 fuel station setup

Hydrogen fuel station setup cost is much higher compared to petroleum, diesel, and other fuels including fast EV chargers. Further, cost of transportation for H2 fuel is also currently much higher than other fuel types. This can be led by cost of setting H2 pipelines as well as recurring cost of transport of cryogenic hydrogen. This has led to slower growth in H2 fueling infrastructure around the world than other alternative fuels. Higher safety system investment is also required due to necessary precautions and safety measures due to hydrogen being an easily combustible fuel. Hydrogen fuel station setup cost ~USD 1-2 million by value. Meanwhile gasoline fuel station cost ~USD 200,000 and CNG fuel station cost ~USD 150,000, and EV fast charging stations cost less than USD 200,000.

Opportunity: H2 Fuel Cell Vans to be a key emerging hydrogen fuel cell vehicle market opportunity

With surge in conventional fuel prices, and rising concern for automotive emissions, the automotive industry is witnessing a shift towards low emission vehicles, including fuel-cell vans. Companies such as Hyvia, Hyundai, and Bosch have planned to introduce H2 vans. OEMs such as Renault and Stellantis already have such vans operational across Europe. These vans come with higher range and can be refueled faster compared to their electric counterparts. Further, governments initiatives to promote fuel-cell technology and invest in hydrogen infrastructure will drive demand for these vehicles. Countries across Europe, along with China, and American states such as New York and California actively contributing to the development of hydrogen hubs.

Challenge:Insufficient hydrogen infrastructure and storage

Popularization of H2 powered vehicles require setup of sufficient H2 refueling stations and other hydrogen infrastructure. This includes hydrogen production plants, fuel stations, storage facilities, which are ideal for FCEVs. As per ACEA, there must be H2 fuel stations across every 300 miles to support H2 in vehicles, as that is the driving range for FCEVs. However, hydrogen refueling infrastructure setup is currently limited in most countries. H2 storage is another challenge that needs to be addressed for hydrogen fuel cell market growth. Hydrogen storage need to be under high pressure or as liquid H2 (−252.8?°C) with the help of chemical compounding. Further, high density of H2 poses a challenge for its storage. Thus, the concerns over hydrogen infrastructure and storage need to be settled for the market.

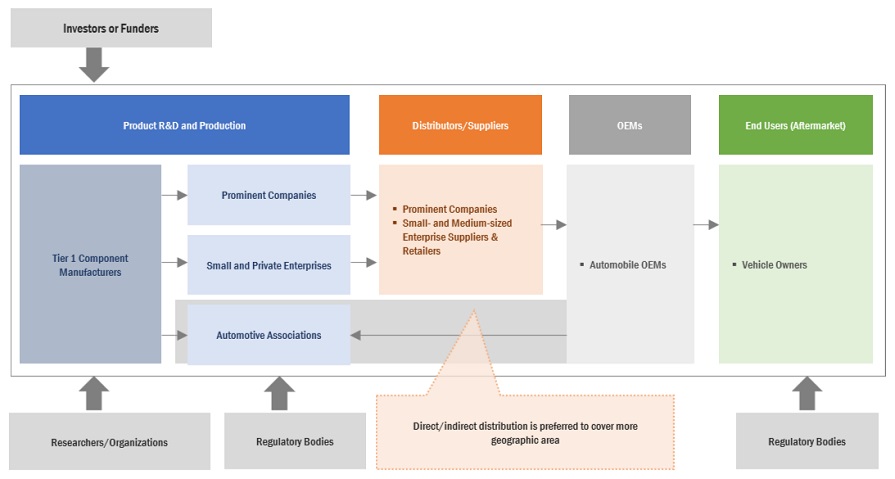

Market Ecosystem

Europe expected to be fastest growing H2 infrastructure provider during forecast period

The H2 re-fueling station demand across Europe is expanding, with Germany and France leading demand. Other countries, including UK and Denmark, are also leading the hydrogen fuel cell vehicle market expansion. Emission reduction plans are also driving the expansion in the number of refueling stations. Collaborations between local OEMs and the government have resulted in tremendous. growth, particularly in Germany. France has also collaborated with domestic OEMs to improve hydrogen fueling stations, which has positively impacted FCEV sales. Shell has also approved the development of Holland Hydrogen L, which will become Europe's largest renewable hydrogen plant by 2025. Similarly, in 2022, 82 MOBILITY received USD 135 million to expand H2 refueling stations with investments from firms such as Shell, Air Liquide, and Daimler.

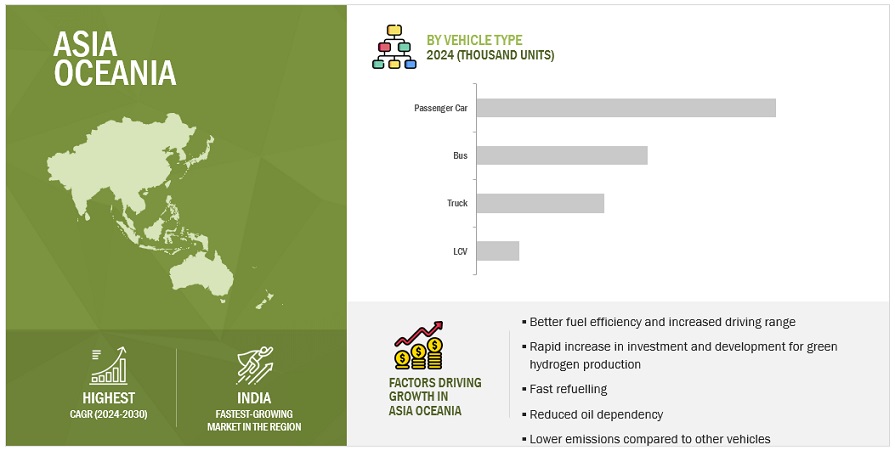

Passenger Car estimated to be the largest segment during forecast period

The hydrogen fuel cell vehicle market is expected to grow, with growing fuel cell demand in passenger cars leading demand during forecast period. The passenger car segment is expected to drive the demand, driven by a larger market share, growing demand for low emission personal-mobility, and government initiatives for zero-emission taxi fleets. Increasing popularity of H2 powered cars is evident through the sales of Toyota Mirai, Hyundai NEXO FCEV and Honda Clarity FCEV. OEMs such as BMW, Jaguar Land Rover are also actively investing in new H2 fuel cell models in response to the growing potential for FCEVs. BMW for instance, intends to introduce fuel cell technology in its X6 and X7 models. Further, Jaguar Land Rover is also developing its hydrogen fuel cell Defender, with zero tailpipe emissions by 2036.

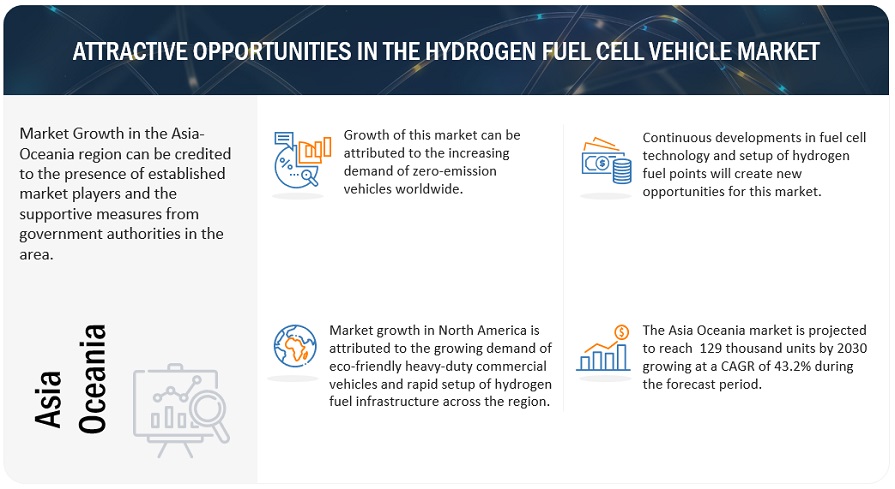

Asia Oceania's to lead the market with strong market demand in China

The Asia Oceania region has the largest H2 refueling station presence, with strong government support for setup across Japan, China and South Korea. This is driving the expansion of hydrogen stations and FCEVs in the region. They are also fostering the growth of FCEVs with an evolving hydrogen ecosystem in the hydrogen automotive fuel cell vehicle market. Leading OEMs such as Toyota and Hyundai are driving the adoption of fuel cell cars across the region. Countries have planned use of fuel cell buses and trucks, with companies such as Ballard playing key roles in developing an extensive FCEV bus & truck ecosystem. Leading factors such as growing deployment of H2 buses such as in Kansai Airport (Japan), mass deployment of H2 buses in China along with companies like Solaris and West Midlands deploying H2 fuel cell buses in Australia. In the H2 truck industry, companies such as SINOTRUK, BAIC, Hyundai, Sym.Pjg, among others are deploying heavy- duty hydrogen fuel cell trucks in the region.

Key Market Players

The hydrogen fuel cell vehicle market is dominated by companies such as Toyota Motor Corporation (Japan), Hyundai Group (South Korea), Honda (Japan), General Motors (US), Stellantis (Netherlands) among others. These OEMs provide best in class H2 vehicles and have strong global distribution networks. They have worked on expansion initiatives, enmgaged in deals, new product developments and other strategies to grow their presence in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million/Billion) |

|

Segments covered |

Market by Vehicle Type (Buses, Trucks, LCVs, Passenger Cars), Component, Fuel Type, Hydrogen Fuel Points, Operating Miles, Power, Capacity, Specialized Vehicle Type and Region |

|

Geographies covered |

Asia Oceania, Europe, North America, and RoW |

|

Companies Covered |

Toyota Motor Corporation (Japan), Hyundai Group (South Korea), Honda (Japan), General Motors (US), Stellantis (Netherlands) |

This research report categorizes the hydrogen fuel cell vehicle market based on vehicle type, component, specialized vehicle type, operating miles, power output, hydrogen fuel points and fuel cell type, and region.

Based on Vehicle Type:

- Buses

- LCVs

- Passenger Cars

- Trucks

Based on Component:

- Air Compressors

- Fuel Processors

- Fuel Stacks

- Humidifiers

- Power Conditioners

Based on Operating Miles:

- 0-250 Miles

- 251-500 Miles

- Above 500 Miles

Based on Power Output:

- <150 kW

- 150-250 kW

- >250 kW

Based on Specialized Vehicle Type:

- Material handling vehicles

- Refrigerated trucks

Based on Propulsion:

- FCEV

- FCHEV

Based on Hydrogen Fuel Points:

- Asia Oceania

- Europe

- North America

Based on Fuel Type:

- Hydrogen

- Methanol

- Ethanol

Based on Region:

-

Asia Oceania

- Australia

- China

- Japan

- India

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- Belgium

- Denmark

- France

- Germany

- Italy

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- UK

Recent Developments

- In December 2023, Plug Power set-up a 1 megawatt PEM electrolyzer at the Amazon Fulfillment Center, DEN8 (US). This initiative will drive more than 200 h2 fuel cell forklift trucks operating in the facility.

- In November 2023, Ballard Power Systems received 62 H2 fuel cell engine supply order from Solaris Bus & Coach sp. z o.o. (Poland). These engines are are developed for buses operating in Germany and Poland, to expand low emission transportation in the region.

- In October 2023, a 50kW FC module was developed by Toyota Motors, representing a compact fuel cell system. This fuel cell module, will be used for delivery trucks, lift trucks, agricultural machinery, and construction equipment, and provides versatile installation possibilities.

- In March 2023, Hyster-Yale officially launched its G-Series Fuel Cell System, offered in 360 kW and 470 kW module. This power solution is designed for applications in the fuel cell commercial vehicle and industrial sectors.

- In September 2023, Ballard Power Systems collaborated with QUANTRON to develop a FCEV, integrating QUANTRON's vehicle engineering expertise with Ballard's fuel cell technology.

Frequently Asked Questions (FAQ):

What is the current market size of hydrogen fuel cell vehicle market by volume?

The hydrogen fuel cell vehicle market has been estimated to be 23 thousand units by volume in 2024.

Who are the winners in the hydrogen fuel cell vehicle market?

The hydrogen fuel cell vehicle market is dominated by companies such as Toyota Motor Corporation (Japan), Hyundai Group (South Korea), Honda (Japan), General Motors (US), Stellantis (Netherlands) among others. They have worked with other companies in the hydrogen ecosystem by initiating partnerships for their fuel cell technology and provide best-in-class products to customers.

Which region will have the largest hydrogen fuel cell vehicle market by value?

North America will be leading the hydrogen fuel cell vehicle market, by value due to the huge investment volume in the region, particularly for H2 powered heavy duty vehicles.

What key technologies are impacting the hydrogen fuel cell vehicle market?

Key technologies impacting the hydrogen fuel cell vehicle market are use of non-precious metal catalyst (NPMC), shift to compact fuel cell module, and new H2 propulsion technologies.

Which vehicle type will grow fastest in demand in hydrogen fuel cell vehicle market?

Hydrogen fuel cell vehicle market demand will grow fastest in class 8 H2 trucks and H2 transit buses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Better fuel efficiency and driving range than ICE vehicles- Growing investment in green hydrogen production- Fast refueling- Reduced oil dependency- Lower emissions than other vehiclesRESTRAINTS- High flammability- Hard to detect hydrogen leakages- High initial investments in hydrogen fueling infrastructure- Lower efficiency than BEVs and HEVsOPPORTUNITIES- Rising demand for fuel cell vehicles in automotive & transportation sector- Growth potential of fuel cell vans for OEMs- Government initiatives promoting hydrogen infrastructure- Development of mobile and community hydrogen fueling systemsCHALLENGES- High vehicle costs- Lack of proper hydrogen infrastructure- Rising demand for BEVs and HEVs

- 5.3 EXISTING AND UPCOMING FCEV MODELS

-

5.4 CASE STUDY ANALYSISCASE STUDY 1: BALLARD FUEL CELL ZERO-EMISSION BUSES IN LONDONCASE STUDY 2: BALLARD FUEL CELL ZERO-EMISSION TRUCKS IN SHANGHAICASE STUDY 3: NON-PRECIOUS METAL CATALYST BY BALLARDCASE STUDY 4: FUEL CELL ZERO-EMISSION BUSES BY BALLARDCASE STUDY 5: FUEL-CELL BUSES FOR CITY TRANSIT IN FRANCE

-

5.5 PATENT ANALYSIS

-

5.6 ECOSYSTEM ANALYSISHYDROGEN FUEL SUPPLIERSTIER I SUPPLIERS (FUEL CELL AND RELATED COMPONENT PRODUCERS)OEMS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 FUEL CELL PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY VEHICLE TYPE

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 ROADMAP OF DEPLOYMENT OF HYDROGEN TECHNOLOGY IN AUTOMOTIVE SECTOR

-

5.11 FCEV LAUNCH SCHEDULED BY MAJOR OEMSHYDROGEN FUEL CELL VEHICLES TO GAIN MOMENTUM ACROSS DIVERSE LANDSCAPES

-

5.12 STAKEHOLDERS’ PLAN IN HYDROGEN-FUELED VEHICLE ECOSYSTEM

- 5.13 BUSINESS MODELS

-

5.14 TECHNOLOGY ANALYSISDIRECT BOROHYDRIDE FUEL CELLFUEL CELL HYBRID ELECTRIC VEHICLEHYDROGEN INTERNAL COMBUSTION ENGINENON-PRECIOUS METAL CATALYST-BASED FUEL CELLPACKAGED FUEL CELL SYSTEM MODULEHYDROGENIOUS LIQUID ORGANIC HYDROGEN CARRIERCARBONATE-SUPERSTRUCTURED SOLID FUEL CELL

-

5.15 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA OCEANIAREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES AND EVENTS IN 2024–2025

-

5.17 KEY STAKEHOLDERS AND BUYING CRITERIALCVBUSTRUCKKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 OPERATIONAL DATA

-

6.3 FUEL STACKSTRINGENT EMISSION REGULATIONS AND GOVERNMENT INCENTIVES TO DRIVE MARKET

-

6.4 FUEL PROCESSORRAPID GROWTH OF FUEL CELL TECHNOLOGIES IN ASIA OCEANIA AND NORTH AMERICA TO DRIVE MARKET

-

6.5 POWER CONDITIONERPRESENCE OF LEADING FCEV MANUFACTURERS IN ASIA OCEANIA TO DRIVE MARKET

-

6.6 AIR COMPRESSORGROWING ADOPTION OF FUEL CELL BUSES IN NORTH AMERICA TO DRIVE MARKET

-

6.7 HUMIDIFIERINCREASING DEMAND FOR FCEVS IN EUROPE TO DRIVE MARKET

- 6.8 KEY PRIMARY INSIGHTS

- 7.1 INTRODUCTION

- 7.2 HYDROGEN

- 7.3 METHANOL

- 7.4 ETHANOL

- 7.5 KEY PRIMARY INSIGHTS

- 8.1 INTRODUCTION

- 8.2 OPERATIONAL DATA

- 8.3 ASIA OCEANIA

- 8.4 EUROPE

- 8.5 NORTH AMERICA

- 8.6 KEY PRIMARY INSIGHTS

- 9.1 INTRODUCTION

- 9.2 OPERATIONAL DATA

-

9.3 0–250 MILESNORTH AMERICA AND ASIA OCEANIA TO DRIVE MARKET

-

9.4 251–500 MILESCONSIDERABLE RANGE ACHIEVABLE ON SINGLE FUELING TO DRIVE MARKET

-

9.5 ABOVE 500 MILESRESILIENCE IN DIFFERENT LOAD CYCLES TO DRIVE MARKET

- 9.6 KEY PRIMARY INSIGHTS

- 10.1 INTRODUCTION

- 10.2 OPERATIONAL DATA

-

10.3 <150 KWGROWING DEMAND FOR FUEL CELL PASSENGER CARS TO DRIVE MARKET

-

10.4 150–250 KWGROWING DEMAND FOR HEAVY-DUTY TRUCKS AND BUSES TO DRIVE MARKET

-

10.5 >250 KWHIGH DEMAND FOR LONG-HAUL TRUCKING TO DRIVE MARKET

- 10.6 KEY PRIMARY INSIGHTS

- 11.1 INTRODUCTION

- 11.2 OPERATIONAL DATA

-

11.3 FCHEVSMOOTH POWER DELIVERY REDUCING STRESS ON FUEL CELLS TO DRIVE MARKET

-

11.4 FCEVHIGH DEMAND FOR SUSTAINABLE AND ZERO-EMISSION TRANSPORTATION TO DRIVE MARKET

- 11.5 KEY PRIMARY INSIGHTS

- 12.1 INTRODUCTION

- 12.2 MATERIAL HANDLING VEHICLE

- 12.3 AUXILIARY POWER UNIT FOR REFRIGERATED TRUCKS

- 12.4 KEY PRIMARY INSIGHTS

- 13.1 INTRODUCTION

- 13.2 OPERATIONAL DATA

-

13.3 PASSENGER CARGROWING ENVIRONMENTAL CONCERNS, STRICTER EMISSION REGULATIONS, AND ADVANCEMENTS IN TECHNOLOGY TO DRIVE MARKET

-

13.4 LCVRISING DEMAND FOR LAST MILE DELIVERY TO DRIVE MARKET

-

13.5 BUSSURGING URBAN AIR QUALITY CONCERNS AND RAPID REFUELING ADVANCEMENTS TO DRIVE MARKET

-

13.6 TRUCKEXPANDING HYDROGEN INFRASTRUCTURE AND INCREASING GOVERNMENT INCENTIVES TO DRIVE MARKET

- 13.7 KEY PRIMARY INSIGHTS

- 14.1 INTRODUCTION

-

14.2 ASIA OCEANIACHINA- Emphasis on utilizing industrial by-product hydrogen to drive marketJAPAN- Plans to increase production of hydrogen to drive marketSOUTH KOREA- Transition to hydrogen economy to drive marketAUSTRALIA- Government investment in hydrogen ecosystem to drive marketINDIA- Initiatives by government for green transportation to drive market

-

14.3 EUROPEBELGIUM- Tax incentives to drive marketDENMARK- Investments in hydrogen infrastructure to drive marketFRANCE- Presence of major OEM fleets to drive marketGERMANY- Fast-paced developments in hydrogen infrastructure to drive marketITALY- Focus on developing fuel cell technology to drive marketNETHERLANDS- Dutch Hydrogen Coalition to drive marketNORWAY- Robust fueling infrastructure plans to drive marketSWEDEN- Advancement in fuel cells to drive marketSPAIN- Government plans and investments to drive marketSWITZERLAND- Ending tax exemption for electric cars to drive marketUK- Plan for zero-emission public transport to drive market

-

14.4 NORTH AMERICACANADA- Inclusion of benefits in tax credit to drive marketMEXICO- Shift to zero-emission transport alternative to drive marketUS- Government investment in green hydrogen to drive market

- 15.1 OVERVIEW

- 15.2 MARKET RANKING ANALYSIS

- 15.3 KEY PLAYERS’ STRATEGIES, 2020–2023

-

15.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 15.5 COMPANY FOOTPRINT (FUEL CELL MANUFACTURERS), 2023

- 15.6 COMPANY APPLICATION FOOTPRINT (FUEL CELL MANUFACTURERS), 2023

- 15.7 COMPANY REGIONAL FOOTPRINT (FUEL CELL MANUFACTURERS), 2023

-

15.8 STARTUP EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

15.9 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHES/DEVELOPMENTSEXPANSIONS

-

16.1 KEY PLAYERS (OEMS)TOYOTA MOTOR CORPORATION- Business overview- Recent developments- MnM viewHYUNDAI GROUP- Business overview- Recent developments- MnM viewHONDA- Business overview- Recent developments- MnM viewGENERAL MOTORS- Business overview- Recent developments- MnM viewSTELLANTIS- Business overview- Recent developments- MnM view

-

16.2 KEY PLAYERS (FUEL CELL PROVIDERS)BALLARD POWER SYSTEMS- Business overview- Recent developments- MnM viewHYSTER-YALE- Business overview- Recent developments- MnM viewPLUG POWER- Business overview- Recent developmentsCUMMINS- Business overview- Recent developmentsDOOSAN GROUP- Business overview- Recent developmentsADVENT TECHNOLOGIES HOLDINGS- Business overviewITM POWER- Business overview- Recent developmentsCERES POWER- Business overview- Recent developmentsNEDSTACK- Business overview- Recent developmentsPROTON MOTOR POWER SYSTEMS- Business overview- Recent developmentsTOSHIBA- Business overview- Recent developmentsPOWERCELL AB- Business overview- Recent developments

-

16.3 OTHER PLAYERSPANASONICTORAY INDUSTRIESSUNRISE POWER CO. LTDBOSCHINTELLIGENT ENERGYSYMBIOELRINGKLINGER AGSWISS HYDROGEN POWERDANA INCORPORATEDFUEL CELL SYSTEM MANUFACTURING LLCVOLKSWAGEN AGDAIMLERRIVERSIMPLESAIC MOTORSVAN HOOLMEBIUS FUEL CELLHYDRA ENERGY CORPORATIONISUZU MOTORSFORD MOTOR COMPANYFUELCELL ENERGYBLOOM ENERGYSUNFIREIONOMR INNOVATIONSBRAMBLE ENERGY

- 17.1 JAPAN, SOUTH KOREA, AND CHINA ARE KEY FOCUS COUNTRIES FOR AUTOMOTIVE FUEL CELL MARKET

- 17.2 TECHNOLOGICAL ADVANCEMENTS TO BOOST MARKET FOR FCEVS

- 17.3 CONCLUSION

- 18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

18.4 CUSTOMIZATION OPTIONSAUTOMOTIVE FUEL CELL MARKET, BY PROPULSION AT COUNTRY LEVELMARKET, ADDITIONAL COUNTRIES (UP TO 3)PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 AUTOMOTIVE FUEL CELL MARKET DEFINITION, BY COMPONENT

- TABLE 2 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 MARKET DEFINITION, BY SPECIALIZED VEHICLE TYPE

- TABLE 4 MARKET DEFINITION, BY POWER OUTPUT

- TABLE 5 MARKET DEFINITION, BY OPERATING MILES

- TABLE 6 MARKET DEFINITION, BY PROPULSION

- TABLE 7 MARKET DEFINITION, BY FUEL TYPE

- TABLE 8 INCLUSIONS AND EXCLUSIONS

- TABLE 9 CURRENCY EXCHANGE RATES

- TABLE 10 ATTRIBUTES OF FCEV VS. ADVANCED BEV FOR 200-MILE AND 300-MILE RANGE

- TABLE 11 ZERO-EMISSION LIGHT-DUTY VEHICLE REFERENCE COMPARISON: BEV CHARGING VS. FCEV HYDROGEN FUELING

- TABLE 12 US: GASOLINE AVERAGE PRICING TREND (2018–2024)

- TABLE 13 FUEL CELL COMMERCIAL FREIGHT TRUCK DEVELOPMENTS

- TABLE 14 MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 15 EXISTING AND UPCOMING PASSENGER CAR FCEV MODELS

- TABLE 16 EXISTING AND UPCOMING COMMERCIAL FCEV MODELS

- TABLE 17 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

- TABLE 18 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 19 AUTOMOTIVE FUEL CELL STACK PRICE: REGIONAL PRICE TREND, 2020 VS. 2022

- TABLE 20 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY VEHICLE TYPE

- TABLE 21 FUEL CELL BUS SALES AND UPCOMING PROJECTS

- TABLE 22 NORTH AMERICA: POLICIES & INITIATIVES SUPPORTING HYDROGEN-POWERED VEHICLES & HYDROGEN INFRASTRUCTURE

- TABLE 23 EUROPE: POLICIES & INITIATIVES SUPPORTING HYDROGEN-POWERED VEHICLES & HYDROGEN INFRASTRUCTURE

- TABLE 24 ASIA OCEANIA: POLICIES & INITIATIVES SUPPORTING HYDROGEN-POWERED VEHICLES & HYDROGEN INFRASTRUCTURE

- TABLE 25 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 30 KEY BUYING CRITERIA FOR FUEL CELL VEHICLE TYPES

- TABLE 31 MARKET, BY COMPONENT, 2020–2023 (USD MILLION)

- TABLE 32 MARKET, BY COMPONENT, 2024–2030 (USD MILLION)

- TABLE 33 POPULAR FUEL CELL PROVIDERS WORLDWIDE

- TABLE 34 FUEL STACK: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 35 FUEL STACK: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 36 FUEL PROCESSOR: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 37 FUEL PROCESSOR: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 38 POWER CONDITIONER: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 39 POWER CONDITIONER: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 40 AIR COMPRESSOR: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 41 AIR COMPRESSOR: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 42 HUMIDIFIER: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 43 HUMIDIFIER: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 44 COMPARISON OF FUEL TYPES USED IN FUEL CELLS AND LITHIUM-ION BATTERIES

- TABLE 45 HYDROGEN FUEL POINTS: MARKET, BY REGION, 2020–2023 (UNITS)

- TABLE 46 HYDROGEN FUEL POINTS: MARKET, BY REGION, 2024–2030 (UNITS)

- TABLE 47 NUMBER OF HYDROGEN FUEL POINTS, BY COUNTRY (DECEMBER 2023)

- TABLE 48 ASIA OCEANIA: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2020–2023 (UNITS)

- TABLE 49 ASIA OCEANIA: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2024–2030 (UNITS)

- TABLE 50 EUROPE: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2020–2023 (UNITS)

- TABLE 51 EUROPE: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2024–2030 (UNITS)

- TABLE 52 NORTH AMERICA: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2020–2023 (UNITS)

- TABLE 53 NORTH AMERICA: AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY COUNTRY, 2024–2030 (UNITS)

- TABLE 54 AUTOMOTIVE FUEL CELL MARKET, BY OPERATING MILES, 2020–2023 (THOUSAND UNITS)

- TABLE 55 MARKET, BY OPERATING MILES, 2024–2030 (THOUSAND UNITS)

- TABLE 56 POPULAR FCEVS WORLDWIDE, BY OPERATING MILES

- TABLE 57 0-250 MILES: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 58 0-250 MILES: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 59 BESTSELLING FCEVS WITH 251–500 MILES RANGE

- TABLE 60 251–500 MILES: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 61 251–500 MILES: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 62 ABOVE 500 MILES: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 63 ABOVE 500 MILES: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 64 MARKET, BY POWER OUTPUT, 2020–2023 (THOUSAND UNITS)

- TABLE 65 MARKET, BY POWER OUTPUT, 2024–2030 (THOUSAND UNITS)

- TABLE 66 POPULAR FCEVS WORLDWIDE, BY POWER OUTPUT

- TABLE 67 <150 KW: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 68 <150 KW: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 69 150–250 KW: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 70 150–250 KW: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 71 >250 KW: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 72 >250 KW: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 73 MARKET, BY PROPULSION, 2020–2023 (THOUSAND UNITS)

- TABLE 74 MARKET, BY PROPULSION, 2024–2030 (THOUSAND UNITS)

- TABLE 75 POPULAR FCEV AND FCHEV MODEL LAUNCHES

- TABLE 76 COMPARISON OF POLYMER ELECTROLYTE MEMBRANE (PEM) FUEL CELL AND BATTERY-POWERED FORKLIFTS AND PALLET JACKS

- TABLE 77 TABLE OF COMPARISON OF DIFFERENT TYPES OF HYDROGEN VEHICLES

- TABLE 78 MARKET, BY VEHICLE TYPE, 2020–2023 (THOUSAND UNITS)

- TABLE 79 MARKET, BY VEHICLE TYPE, 2024–2030 (THOUSAND UNITS)

- TABLE 80 POTENTIAL MARKET FOR NEW ZERO-EMISSION BUSES PER YEAR ACROSS EUROPE

- TABLE 81 PASSENGER CAR: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 82 PASSENGER CAR: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 83 LCV: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 84 LCV: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 85 EXAMPLES OF BUS DEPLOYMENT PROJECTS

- TABLE 86 BUS: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 87 BUS: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 88 OVERVIEW OF VEHICLE WEIGHT CLASSES

- TABLE 89 MASS DIFFERENCE BETWEEN BASELINE VEHICLE AND ITS FUEL CELL TRUCK VERSION

- TABLE 90 DEMONSTRATION PROJECTS/DEPLOYMENT OF FUEL CELL TRUCKS

- TABLE 91 MAJOR FUEL CELL TRUCK PROTOTYPES

- TABLE 92 POWERTRAIN BENCHMARKING FOR TRUCKS >12 TONS

- TABLE 93 TRUCK: MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 94 TRUCK: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 95 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 96 MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 97 MARKET, BY REGION, 2020–2023 (THOUSAND UNITS)

- TABLE 98 MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 99 STEPS TAKEN BY MAJOR COUNTRIES TO BOOST MARKET

- TABLE 100 ASIA OCEANIA MARKET: UPCOMING PROJECTS

- TABLE 101 ASIA OCEANIA: MARKET, BY COUNTRY, 2020–2023 (THOUSAND UNITS)

- TABLE 102 ASIA OCEANIA: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 103 CHINA: TARGETS, VISIONS, AND PROJECTIONS

- TABLE 104 CHINA: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 105 CHINA: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 106 JAPAN: TARGETS, VISIONS, AND PROJECTIONS

- TABLE 107 JAPAN: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 108 JAPAN: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 109 SOUTH KOREA: TARGETS, VISIONS, AND PROJECTIONS

- TABLE 110 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 111 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 112 AUSTRALIA: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 113 AUSTRALIA: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 114 INDIA: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 115 INDIA: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 116 EUROPE: RELEVANT EXPERIENCE/PRODUCTS OF OEMS

- TABLE 117 EUROPE: TARGETS, VISIONS, AND PROJECTIONS

- TABLE 118 EUROPEAN MARKET: ONGOING PROJECTS

- TABLE 119 EUROPE: MARKET, BY COUNTRY, 2020–2023 (THOUSAND UNITS)

- TABLE 120 EUROPE: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 121 BELGIUM: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 122 BELGIUM: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 123 DENMARK: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 124 DENMARK: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 125 FRANCE: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 126 FRANCE: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 127 GERMANY: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 128 GERMANY: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 129 ITALY: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 130 ITALY: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 131 NETHERLANDS: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 132 NETHERLANDS: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 133 NORWAY: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 134 NORWAY: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 135 SWEDEN: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 136 SWEDEN: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 137 SPAIN: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 138 SPAIN: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 139 SWITZERLAND: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 140 SWITZERLAND: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 141 UK: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 142 UK: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 143 NORTH AMERICAN MARKET: UPCOMING PROJECTS

- TABLE 144 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (THOUSAND UNITS)

- TABLE 145 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 146 CANADA: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 147 CANADA: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 148 MEXICO: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 149 MEXICO: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 150 US: TARGETS, VISIONS, AND PROJECTIONS

- TABLE 151 US: MARKET, BY VEHICLE TYPE, 2020–2023 (UNITS)

- TABLE 152 US: MARKET, BY VEHICLE TYPE, 2024–2030 (UNITS)

- TABLE 153 KEY PLAYERS’ STRATEGIES, 2020–2023

- TABLE 154 MARKET: COMPANY FOOTPRINT

- TABLE 155 MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 156 MARKET: REGIONAL FOOTPRINT

- TABLE 157 LIST OF KEY STARTUPS/SMES

- TABLE 158 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 159 MARKET: DEALS, 2020–2023

- TABLE 160 MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2023

- TABLE 161 MARKET: EXPANSIONS, 2020–2023

- TABLE 162 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 163 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 164 TOYOTA MOTOR CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 165 TOYOTA MOTOR CORPORATION: DEALS

- TABLE 166 TOYOTA MOTOR CORPORATION: EXPANSIONS

- TABLE 167 HYUNDAI GROUP: COMPANY OVERVIEW

- TABLE 168 HYUNDAI GROUP: PRODUCTS OFFERED

- TABLE 169 HYUNDAI GROUP: PRODUCT LAUNCHES

- TABLE 170 HYUNDAI GROUP: DEALS

- TABLE 171 HONDA: COMPANY OVERVIEW

- TABLE 172 HONDA: PRODUCTS OFFERED

- TABLE 173 HONDA: PRODUCT DEVELOPMENTS

- TABLE 174 HONDA: DEALS

- TABLE 175 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 176 GENERAL MOTORS: DEALS

- TABLE 177 STELLANTIS: COMPANY OVERVIEW

- TABLE 178 STELLANTIS: PRODUCTS OFFERED

- TABLE 179 STELLANTIS: PRODUCT LAUNCHES

- TABLE 180 STELLANTIS: DEALS

- TABLE 181 STELLANTIS: EXPANSIONS

- TABLE 182 BALLARD POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 183 BALLARD POWER SYSTEMS: FUEL CELL STACK

- TABLE 184 BALLARD POWER SYSTEMS: PRODUCTS OFFERED

- TABLE 185 BALLARD POWER SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 186 BALLARD POWER SYSTEMS: DEALS

- TABLE 187 BALLARD POWER SYSTEMS: EXPANSIONS

- TABLE 188 HYSTER-YALE: COMPANY OVERVIEW

- TABLE 189 HYSTER-YALE: PRODUCTS OFFERED

- TABLE 190 HYSTER-YALE: PRODUCT DEVELOPMENTS

- TABLE 191 HYSTER-YALE: DEALS

- TABLE 192 HYSTER-YALE: EXPANSIONS

- TABLE 193 PLUG POWER: COMPANY OVERVIEW

- TABLE 194 PLUG POWER: OPERATIONAL CHARACTERISTICS OF EV CHARGERS FOR LIGHT-DUTY VEHICLES

- TABLE 195 PLUG POWER: PRODUCTS OFFERED

- TABLE 196 PLUG POWER: PRODUCT DEVELOPMENTS

- TABLE 197 PLUG POWER: DEALS

- TABLE 198 PLUG POWER: OTHER DEVELOPMENTS

- TABLE 199 CUMMINS: COMPANY OVERVIEW

- TABLE 200 CUMMINS: PRODUCTS OFFERED

- TABLE 201 CUMMINS: PRODUCT PORTFOLIO

- TABLE 202 CUMMINS: PRODUCT DEVELOPMENTS

- TABLE 203 CUMMINS: DEALS

- TABLE 204 CUMMINS: OTHER DEVELOPMENTS

- TABLE 205 DOOSAN GROUP: COMPANY OVERVIEW

- TABLE 206 DOOSAN GROUP: PRODUCTS OFFERED

- TABLE 207 DOOSAN GROUP: PRODUCT DEVELOPMENTS

- TABLE 208 DOOSAN GROUP: DEALS

- TABLE 209 DOOSAN GROUP: OTHER DEVELOPMENTS

- TABLE 210 ADVENT TECHNOLOGIES HOLDINGS: COMPANY OVERVIEW

- TABLE 211 ADVENT TECHNOLOGIES HOLDINGS: PRODUCTS OFFERED

- TABLE 212 ADVENT TECHNOLOGIES HOLDINGS: DEALS

- TABLE 213 ITM POWER: COMPANY OVERVIEW

- TABLE 214 ITM POWER: PRODUCTS OFFERED

- TABLE 215 ITM POWER: DEALS

- TABLE 216 ITM POWER: OTHER DEVELOPMENTS

- TABLE 217 CERES POWER: COMPANY OVERVIEW

- TABLE 218 CERES POWER: PRODUCTS OFFERED

- TABLE 219 CERES POWER: PRODUCT DEVELOPMENTS

- TABLE 220 CERES POWER: DEALS

- TABLE 221 CERES POWER: EXPANSIONS

- TABLE 222 NEDSTACK: COMPANY OVERVIEW

- TABLE 223 NEDSTACK: PRODUCTS OFFERED

- TABLE 224 NEDSTACK: DEALS

- TABLE 225 PROTON MOTOR POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 226 PROTON MOTOR POWER SYSTEMS: PRODUCTS OFFERED

- TABLE 227 PROTON MOTOR POWER SYSTEMS: PRODUCT DEVELOPMENTS

- TABLE 228 PROTON MOTOR POWER SYSTEMS: DEALS

- TABLE 229 TOSHIBA: COMPANY OVERVIEW

- TABLE 230 TOSHIBA: PRODUCTS OFFERED

- TABLE 231 TOSHIBA: DEALS

- TABLE 232 TOSHIBA: OTHER DEVELOPMENTS

- TABLE 233 POWERCELL AB: COMPANY OVERVIEW

- TABLE 234 POWERCELL AB: PRODUCTS OFFERED

- TABLE 235 POWERCELL AB: DEALS

- FIGURE 1 AUTOMOTIVE FUEL CELL MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 MARKET ESTIMATION NOTES

- FIGURE 10 RESEARCH DESIGN AND METHODOLOGY: DEMAND SIDE

- FIGURE 11 DATA TRIANGULATION

- FIGURE 12 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 13 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 14MARKET OVERVIEW

- FIGURE 15 AUTOMOTIVE FUEL CELL MARKET, BY REGION, 2024–2030 (USD MILLION)

- FIGURE 16 PASSENGER CAR TO BE LARGEST VEHICLE TYPE DURING FORECAST PERIOD

- FIGURE 17 GROWING DEMAND FOR ALTERNATIVE ZERO-EMISSION TRANSPORT OPTIONS TO DRIVE MARKET

- FIGURE 18 PASSENGER CAR TO BE LARGEST VEHICLE TYPE DURING 2024–2030

- FIGURE 19 ASIA OCEANIA TO BE FASTEST-GROWING SEGMENT DURING 2024–2030

- FIGURE 20 150-250 KW POWER OUTPUT TO GROW RAPIDLY DURING FORECAST PERIOD

- FIGURE 21 FUEL STACK COMPONENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 251-500 MILES SEGMENT TO LEAD MARKET DURING 2024–2030

- FIGURE 23 ASIA OCEANIA TO BE LARGEST MARKET IN 2024 BY VOLUME

- FIGURE 24 HYDROGEN FUEL CELL ELECTRIC VEHICLE SYSTEM

- FIGURE 25MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 NATURAL GAS REQUIRED TO PROPEL BEV TO 300 MILES VS. FCEV TRAVELING 300 MILES

- FIGURE 27 NUMBER OF HYDROGEN FUEL STATIONS IN US (2017–2022)

- FIGURE 28 LIQUID OIL CONSUMPTION (MILLION BARRELS PER DAY), 2017–2022

- FIGURE 29 COMPARISON OF AUTOIGNITION TEMPERATURES OF VARIOUS FUELS

- FIGURE 30 DISPENSED FUEL COST BUILDUP FOR FUTURE TRANSPORTATION FUELS

- FIGURE 31 INITIAL INVESTMENT IN INFRASTRUCTURE FOR VARIOUS FUELS

- FIGURE 32 COMPARISON OF BEV AND FCEV

- FIGURE 33 GLOBAL ELECTRIC VEHICLE SALES, 2019–2023

- FIGURE 34 COMPARISON OF HYDROGEN AND ELECTRIC VEHICLE DRIVE

- FIGURE 35 OPERATED FUEL CELL BUSES, 2023

- FIGURE 36 GOVERNMENT-LED HYDROGEN HUB INITIATIVES IN US AND CANADA

- FIGURE 37 MOBILE HYDROGEN-REFUELING STATIONS IN JAPAN

- FIGURE 38 COST OF FUEL CELL STACK FOR PRODUCTION VOLUME OF 1,000 UNITS/YEAR VS. 500,000 UNITS/YEAR

- FIGURE 39 HYDROGEN INFRASTRUCTURE MAINTENANCE COSTS, BY COMPONENT

- FIGURE 40 NUMBER OF PUBLISHED AUTOMOTIVE FUEL CELL PATENTS (2019–2023)

- FIGURE 41 TOP PATENT APPLICANTS

- FIGURE 42 AUTOMOTIVE FUEL CELL MARKET: ECOSYSTEM ANALYSIS

- FIGURE 43 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 44 FUEL CELL SYSTEM COST, 2006–2025

- FIGURE 45 FUEL CELL SYSTEM AND FUEL CELL STACK COST

- FIGURE 46 MARKET: NEW REVENUE SOURCES

- FIGURE 47 LAUNCH OF HYDROGEN MODELS

- FIGURE 48 BUSINESS MODELS IN MARKET

- FIGURE 49 DIRECT BOROHYDRIDE FUEL CELL WORKING

- FIGURE 50 TOYOTA’S NEW PACKAGED FUEL CELL SYSTEM MODULE

- FIGURE 51 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 52 KEY BUYING CRITERIA FOR MARKET

- FIGURE 53 MARKET, BY COMPONENT, 2024–2030 (USD MILLION)

- FIGURE 54 FUEL CELL POWERTRAIN

- FIGURE 55 INFRASTRUCTURE COST COMPARISON FOR FCEV AND BEV

- FIGURE 56 AUTOMOTIVE HYDROGEN FUEL POINTS MARKET, BY REGION, 2024–2030 (UNITS)

- FIGURE 57 MARKET, BY OPERATING MILES, 2024–2030 (THOUSAND UNITS)

- FIGURE 58 MARKET, BY POWER OUTPUT, 2024–2030 (THOUSAND UNITS)

- FIGURE 59 MARKET, BY PROPULSION, 2024–2030 (THOUSAND UNITS)

- FIGURE 60 MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- FIGURE 61 MARKET, BY REGION, 2024–2030 (USD MILLION)

- FIGURE 62 ASIA OCEANIA: MARKET SNAPSHOT

- FIGURE 63 EUROPE: MARKET, 2024–2030 (THOUSAND UNITS)

- FIGURE 64 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 65 MARKET RANKING ANALYSIS (OEMS), 2023

- FIGURE 66 MARKET RANKING ANALYSIS (COMPONENT PROVIDERS), 2023

- FIGURE 67 REVENUE ANALYSIS OF TOP PUBLIC/LISTED PLAYERS IN AUTOMOTIVE FUEL CELL MARKET DURING LAST 5 YEARS

- FIGURE 68 MARKET: COMPANY EVALUATION MATRIX (TOP COMPONENT PROVIDERS), 2023

- FIGURE 69 MARKET: COMPANY EVALUATION MATRIX (OEMS), 2023

- FIGURE 70 MARKET: START-UP MATRIX, 2023

- FIGURE 71 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 TOYOTA MOTOR CORPORATION: GLOBAL DATA BY REGION

- FIGURE 73 HYUNDAI GROUP: COMPANY SNAPSHOT

- FIGURE 74 HONDA: COMPANY SNAPSHOT

- FIGURE 75 GENERAL MOTORS: COMPANY SNAPSHOT

- FIGURE 76 GENERAL MOTORS: FUEL CELL MANUFACTURING CAPACITY

- FIGURE 77 STELLANTIS: COMPANY SNAPSHOT

- FIGURE 78 BALLARD POWER SYSTEMS: COMPANY SNAPSHOT

- FIGURE 79 BALLARD POWER SYSTEMS: MACRO LANDSCAPE

- FIGURE 80 BALLARD POWER SYSTEMS: FUTURE PLANS

- FIGURE 81 BALLARD POWER SYSTEMS: STATIONARY POWER GENERATION WITH HYDROGEN FUEL CELLS

- FIGURE 82 HYSTER-YALE’S SUBSIDIARY NUVERA AT A GLANCE

- FIGURE 83 HYSTER-YALE: COMPANY SNAPSHOT

- FIGURE 84 PLUG POWER: COMPANY SNAPSHOT

- FIGURE 85 CUMMINS: PARTICIPATION IN HYDROGEN ECONOMY

- FIGURE 86 CUMMINS: COMPANY SNAPSHOT

- FIGURE 87 CUMMINS: SALES FOR ENGINE SEGMENT

- FIGURE 88 DOOSAN GROUP: COMPANY SNAPSHOT

- FIGURE 89 ADVENT TECHNOLOGIES HOLDINGS: COMPANY SNAPSHOT

- FIGURE 90 ADVENT TECHNOLOGIES HOLDINGS: OFFERINGS

- FIGURE 91 ITM POWER: COMPANY SNAPSHOT

- FIGURE 92 ITM POWER: KEY PARTNERSHIPS

- FIGURE 93 CERES POWER: PROGRESS WITH KEY COMMERCIAL PARTNERSHIP

- FIGURE 94 CERES POWER: COMPANY SNAPSHOT

- FIGURE 95 PROTON MOTOR POWER SYSTEMS: COMPANY SNAPSHOT

- FIGURE 96 TOSHIBA: COMPANY SNAPSHOT

- FIGURE 97 TOSHIBA: CYBER PHYSICAL SYSTEMS (CPS) TECHNOLOGY

- FIGURE 98 POWERCELL AB: COMPANY SNAPSHOT

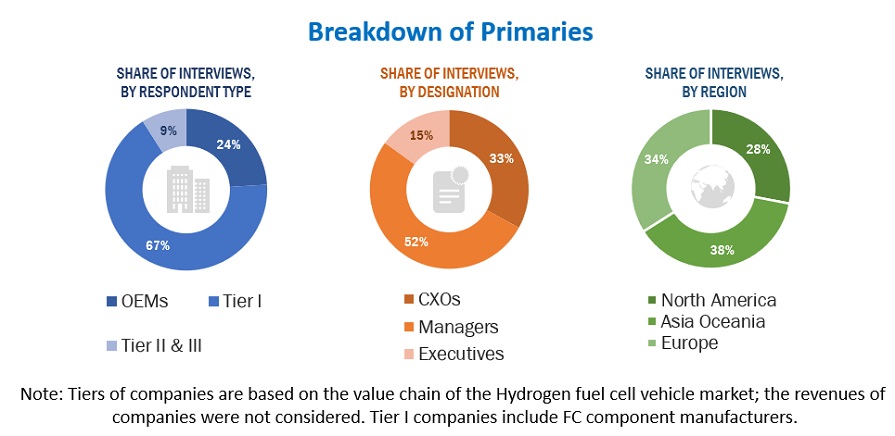

The study involved four major activities in estimating the current size of the hydrogen fuel cell vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, Fuel Cell and Hydrogen Energy Association (FCHEA), International Organization of Motor Vehicle Manufacturers, European Alternative Fuels Observatory (EAFO), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive cell market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the hydrogen fuel cell vehicle market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (automotive fuel cell providers) sides across major regions, namely, North America, Europe, and Asia Oceania. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

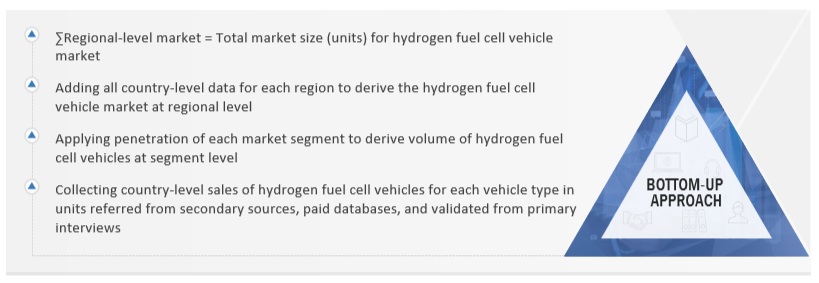

The bottom-up approach has been used to estimate and validate the size of the Hydrogen fuel cell vehicle market by vehicle type. In this approach, the vehicle sales statistics for each vehicle type [Passenger Cars, Light Commercial Vehicles, Buses, and Trucks] have been considered at the country level.

To determine the market size, in terms of volume, a mapping of fuel cell vehicles has been carried out for each country and vehicle type. The number of fuel cell electric models varied from country to country. After this, the types of FCEVs sold were identified, which derived the volume of each segment type. The country-level data was summed up to arrive at the region-level data in terms of volume. The summation of the country-level market size gives the regional market size, and a further summation of the regional market size provides the global Hydrogen fuel cell vehicle market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Validation

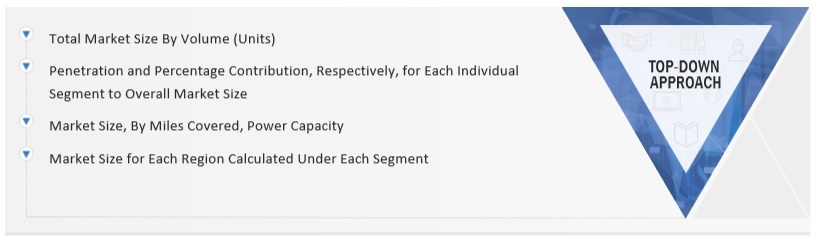

The top-down approach has been used to estimate and validate the size of the hydrogen fuel cell vehicle market at the global level, and by miles covered, power capacity, fuel cell type in terms of volume.

The top-down approach has been used to estimate and validate the size of the market. This approach identifies key fuel cell type, miles covered and power capacity segments of hydrogen fuel cell vehicles at the regional level. The penetration of each identified segment is multiplied by the volume of each vehicle at the regional level to derive the total segment volume.

For instance,

- The Hydrogen fuel cell vehicle market for operating miles was derived using the top-down approach to estimate the subsegments- <250 miles,251-500 miles, above 500 miles.

- The market size, in terms of volume, was derived at the regional level for each segment using this method. The total volume of the market was multiplied by the adoption rate breakup percentage of these segments in regional level (for miles covered, power capacity) and global level (for fuel cell type), respectively.

Data Triangulation

After arriving at the overall hydrogen fuel cell vehicle market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

A fuel cell electric vehicle (FCEV) is a type of electric vehicle that uses a fuel cell. These vehicles employ hydrogen to create electricity via a chemical process within a fuel cell, resulting in the emission of solely water as a residual product. Stringent emission regulations have led to the increased use of fuel cells in the automotive and transportation industry. A fuel cell can also be used in combination with a battery or supercapacitor to power the onboard electric motor. In an FCEV, hydrogen is pumped into the car and then fed to the fuel cell stack. The fuel cell stack is the center where hydrogen is electrochemically converted into electricity with no combustion and zero emissions. Fuel cells in vehicles generate electricity to power the motor. As long as hydrogen is available, the fuel cell will continue to produce electricity. Most fuel cell vehicles are classified as zero-emission vehicles that emit only water and heat.

List of Key Stakeholders

- Alternative Fuels Data Center (AFDC)

- Automobile OEMs providing Hydrogen Vehicles

- Automotive fuel cell raw material suppliers

- Automotive fuel cell suppliers

- California Fuel Cell Partnership (CaFCP)

- California Hydrogen Business Council (CHBC)

- Canadian Hydrogen Fuel Cell Association (CHFCA)

- Environmental Protection Agency (EPA)

- Fuel Cell and Hydrogen Energy Association (FCHEA)

- Hydrogen gas suppliers

- Hydrogen station service providers

- United States Council for Automotive Research LLC (USCAR)

Report Objectives

- To segment and forecast the hydrogen fuel cell vehicle market size in terms of volume (thousand units) and Value (USD Million)

- To define, describe, and forecast the market based on vehicle type, component, specialized vehicle type, H2 fuel station, power output, operating miles, fuel cell type, fuel type and region.

- To segment the market and forecast its size, by volume and value, based on region (Asia Oceania, Europe, and North America)

- To segment and forecast the market based on vehicle type (passenger car, light commercial vehicle, bus, truck)

- To segment and forecast the market based on component (fuel processor, fuel stack, humidifier, air compressor, and power conditioner)

- To segment and forecast the market based on H2 Fuel Station (Asia Oceania, Europe, and North America)

- To segment and forecast the market based on power capacity (<150 kW, 150-250 kW, >250 kW)

- To segment and forecast the market based on operating miles (0-250 Miles, 250-500 Miles, Above 500 Miles)

- To segment and forecast the market based on fuel type (hydrogen, methanol, ethanol, others)

- To analyze the technological developments impacting the hydrogen fuel cell vehicle market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Pricing Analysis

- Technological Roadmap

- Ecosystem

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants.

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Hydrogen fuel cell vehicle market, By Propulsion at Country Level

- Hydrogen fuel cell vehicle market, Additional Countries (Up to 3)

- Profiling of additional market players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrogen Fuel Cell Vehicle Market