Automotive Shredded Residue (ASR) Market by Application (Landfill, Energy recovery, Recycling), Composition, Technology ( Air classification, Optical sorting, Magnetic separation, Eddy current separation, Screening) and Region - Global Forecast to 2028

Automotive Shredded Residue (ASR) Market

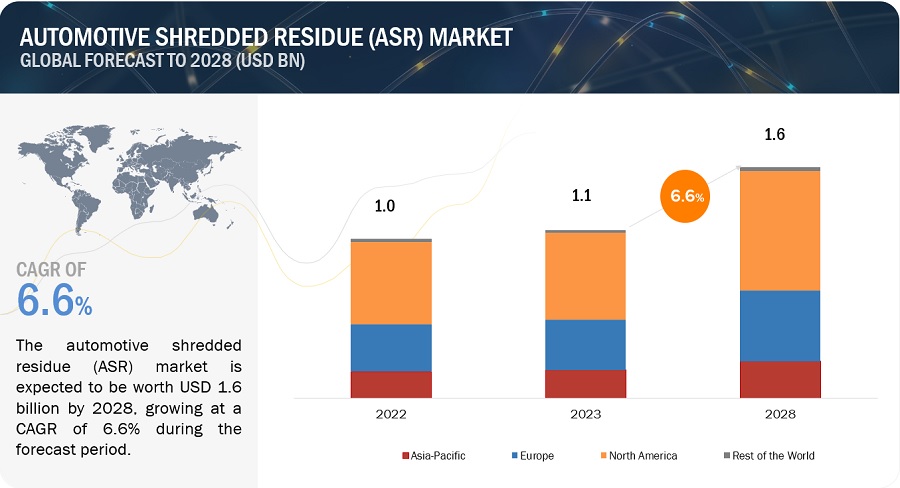

The global automotive shredded residue market is valued at USD 1.1 billion in 2023 and is projected to reach USD 1.6 billion by 2028, growing at 6.6% cagr during the forecast period. The market is mainly led by the significant usage of post shredder technology in various end-use industries. The regulatory pressure from government and environmental agencies, continuous technological advancement in post shredding technology, rising resource scarcity and increasing demand for recycled materials are driving the market for post shredder technology.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Automotive Shredded Residue (ASR) Market

Automotive Shredded Residue Market Dynamics

Driver: Regulatory pressures from governments and environmental agencies.

Regulatory pressure refers to the increasing legal requirements and standards set by governments and environmental agencies to address environmental issues, waste management, and sustainable practices. As concerns about environmental degradation and resource depletion have grown, authorities across the globe have taken a proactive approach to tackle these challenges. One of the areas where these regulations have had a significant impact is in waste management, particularly in the context of landfill waste and recycling. Landfills have long been a primary method of waste disposal, but they present several environmental challenges. When non-recyclable waste is sent to landfills, it decomposes over time, releasing harmful greenhouse gases like methane, which contributes to climate change. Moreover, landfills take up vast amounts of land, can contaminate soil and groundwater, and pose potential risks to human health and wildlife. To combat these issues, governments of different countries have started imposing stricter regulations on the amount of waste that can be sent to landfills. Many regions have set targets to reduce landfill waste significantly or even achieve zero waste to landfills. This approach is part of broader waste management strategies aimed at moving towards more sustainable practices. Utilizing post-shredder technologies helps divert significant amounts of waste from landfills, contributing to the reduction of landfill waste and associated environmental issues. Governments and environmental agencies recognize the potential benefits of recycling and have been actively promoting and incentivizing recycling efforts. Adopting post-shredder technologies enables companies and industries to comply with stricter regulations related to waste disposal and recycling, avoiding potential penalties and legal consequences. By incorporating post-shredder technologies into the waste management process, industries demonstrate their commitment to sustainability and environmental responsibility, aligning with the broader goals of regulatory frameworks.

Continuous technological advancement in post shredding technologies.

The continuous technological advancements have revolutionized the post-shredding technology market, making the recycling process more efficient, cost-effective, and environmentally friendly. By incorporating these cutting-edge technologies, plastic recycling facilities can significantly increase their material recovery rates, produce high-quality recycled plastics, and contribute to a more sustainable waste management ecosystem. Automation has played a significant role in improving post-shredder material recovery. Robotic systems and artificial intelligence (AI) algorithms are employed to control the sorting process efficiently. Automated systems can handle large volumes of waste materials, reduce manual labor, and enhance the accuracy of material identification. Modern post-shredder technology facilities often incorporate smart technologies, such as Internet of Things (IoT) devices and data analytics, to optimize the recovery process and improve overall efficiency. By analyzing operational data, AI algorithms can predict equipment maintenance needs and schedule maintenance activities proactively. This approach minimizes downtime and ensures the continuous operation of the facility. The combination of improved recovery rates, enhanced resource utilization, and efficient sorting methods has made post-shredder technologies more economically viable.

Rising resource scarcity and increasing demand for recycled materials:

As human populations grow and economies expand, the demand for the resources has increased significantly, leading to their depletion and higher extraction costs. This scarcity is further exacerbated by inefficient resource management and wasteful consumption practices. In response to the challenges posed by resource scarcity and generation of plastic waste, there has been a growing emphasis on sustainable practices, including recycling and reusing materials. Recycling offers a way to extend the life cycle of resources by recovering valuable materials from waste streams and reintroducing them into the production process. Post-shredder technologies contribute to the increasing demand for recycled materials by efficiently processing ASR and recovering valuable metals and other materials. These recovered materials are of high quality and can be reintroduced into the supply chain for various applications.

Restraint: High initial investments and complexity of recycling waste composition.

The high initial investment required to implement post-shredder technology facilities is one of the significant restraints in the market. This investment encompasses various costs associated with setting up and operating the facility, purchasing advanced equipment, obtaining necessary permits, and ensuring compliance with regulations. Obtaining the necessary permits to operate a recycling facility can involve administrative expenses, consulting fees, and other related costs. Compliance with environmental regulations and waste management standards also requires investments in pollution control measures, worker safety, and waste disposal practices. As the post-shredder technology market evolves, new advancements and innovations may become available. Investing in the latest technologies and keeping up with industry standards may add to the initial capital outlay. The composition of ASR is highly complex, consisting of various materials, such as metals, plastics, rubber, glass, and other components, all mixed together after the shredding process. This complexity poses several challenges in the efficient recovery of valuable materials from ASR.

Environmental concerns and regulatory compliances

Environmental concerns related to post-shredder technologies are issues that arise when the recycling and material recovery processes are not managed properly, potentially leading to negative environmental impacts. These concerns are crucial to address as they can affect local air quality, soil contamination, and overall environmental sustainability. Post-shredder technology facilities must adhere to local, national, and international environmental regulations. Compliance ensures that the facility meets emission standards, waste disposal guidelines, and other environmental requirements, reducing the environmental impact and potential legal consequences.

Opportunity: Circular economy initiatives coupled with growing demand for e-waste recycling .

Post-shredder technologies play a pivotal role in the circular economy by enabling the recovery of valuable materials from waste streams. This circular economy approach aims to reduce reliance on virgin resources, conserve energy, and minimize the environmental impact of extraction and manufacturing. By efficiently sorting and separating materials, post-shredder technologies contribute to the recycling of metals, plastics, and other materials that can be reintroduced into the manufacturing process. As the circular economy gains momentum, the demand for post-shredder technologies is expected to rise, as they align perfectly with the principles of resource conservation and waste reduction thus achieving these circular economy goals.

Electronic waste (e-waste) is one of the fastest-growing waste streams globally, driven by the rapid turnover of electronic devices and gadgets. E-waste contains valuable materials such as precious metals, copper, and rare earth elements. Proper recycling of e-waste is essential to recover these valuable resources and prevent environmental pollution. The growth in e-waste recycling presents a significant opportunity for post-shredder technologies. By contributing to e-waste recycling efforts, post-shredder technologies can help reduce the pressure on natural resources, conserve valuable materials, and minimize the environmental impact of e-waste disposal. The increasing awareness of e-waste's environmental consequences is likely to drive the demand for post-shredder technologies in the e-waste recycling sector.

Challenge: High energy consumption and cost.

The energy consumption and associated costs in post-shredder technologies are significant challenges for the industry. Recycling processes, including shredding, sorting, and material recovery, require substantial amounts of energy to operate effectively. Shredding waste materials and operating sorting and separation equipment are energy-intensive processes. The mechanical force required for shredding and the operation of conveyors, motors, and sensors in sorting machines contribute to the overall energy demand. Recycling facilities need to operate continuously to maintain efficiency and meet processing demands. This prolonged operation leads to high energy consumption over time. Additionally, the maintenance of equipment and machinery is essential to ensure optimal performance, but it also requires additional energy. The source of energy used in recycling facilities can impact on their operating costs. The cost of electricity, natural gas, or other energy sources can fluctuate over time, affecting the overall operational expenses of recycling facilities.

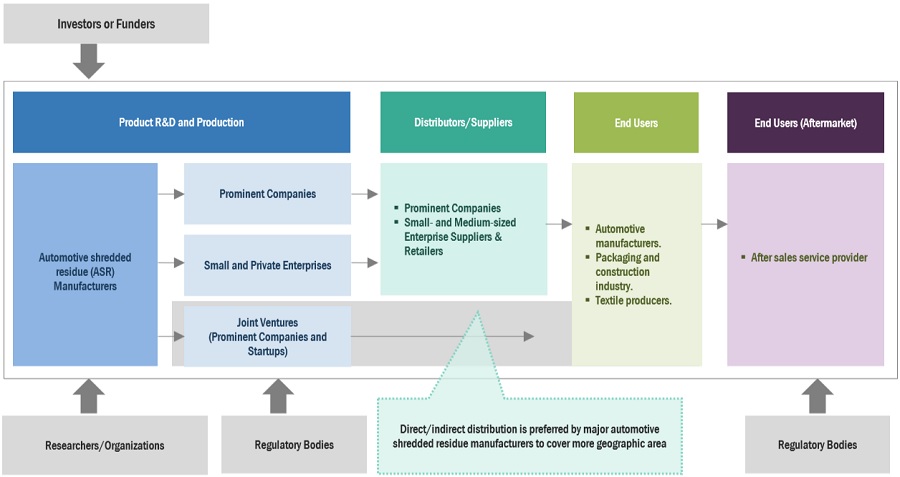

Automotive Shredded Residue Market Ecosystem

A market ecosystem encompasses the intricate web of individuals, enterprises, and various entities engaged within a specific market. This intricate network encompasses a diverse range of participants, including producers, distributors, retailers, customers, and regulatory bodies, all collaborating to exchange goods, services, and information. The notable players in this market are those with established financial stability, cutting-edge technologies, a robust global marketing network, and a proven track record in sales. The key players in this market are Tomra Systems ASA (Norway), Gallo (Belgium), Sims Limited (Australia), MBA Polymers Inc.(US), Binder+Co. (Austria), PLANIC (Japan), Axion Ltd.(UK), SRW metal float GmbH (Germany), Machinex Industries, Inc. (Canada), Wendt Corporation (US), CP Manufacturing Inc. (US), BT-Wolfgang Binder GmbH (Austria), Agilyx (US), Steinert (Germany).

"Recycling is the fastest growing application for automotive shredded residue in 2023, in terms of value."

Recycling allows for the recovery of valuable resources from discarded materials, including metals, plastics, paper, and more. Post shredder technologies play a crucial role in efficiently sorting and processing recyclables, making recycling economically viable and helping conserve valuable resources. Governments and municipalities around the world have established recycling objectives and regulations aimed at waste reduction and the promotion of recycling. These regulatory measures frequently incentivize the advancement and uptake of cutting-edge post shredder technologies to improve the efficiency of recycling processes. The idea of a circular economy, characterized by the reuse and recycling of materials to minimize waste, is gaining traction. Recycling stands as a cornerstone of this approach, with post-shredder technologies playing a pivotal role in realizing recycling objectives. Increasing consumer awareness and environmental concerns have resulted in a heightened desire for products and packaging crafted from recycled materials. This incentivizes businesses to integrate recycled content into their offerings, further driving the demand for recycling technologies. The scarcity and rising costs associated with specific materials, such as rare earth metals and certain minerals extracted from natural sources, are prompting the adoption of recycling as a sustainable and cost-efficient means of recovering these resources from discarded products.

"Magnetic separation is the largest technology type for automotive shredded residue (ASR) market in 2023, in terms of value."

Magnetic separation accounted for the largest market share in the global automotive shredded residue (ASR) market, in terms of value, in 2023. Magnetic separation stands as the foremost post-shredder technology in recycling and waste management for several compelling reasons. Firstly, it excels in the recovery of ferrous metals from shredded materials, a vital component of recyclables, particularly in automotive scrap, due to its ubiquity. Second, magnetic separation boasts high purity levels in reclaimed metals, crucial for quality-sensitive applications like automotive component manufacturing. Notably, it's non-destructive, preserving material integrity during recovery. Third, its seamless automation capabilities render it suitable for large-scale operations, reducing labor costs while efficiently processing substantial volumes of shredded materials. Moreover, magnetic separation proves cost-effective, with relatively simple equipment integration into existing recycling facilities. Its environmentally friendly profile is evident in the diminished need for virgin metal extraction and reduced greenhouse gas emissions. Additionally, its versatility extends beyond ferrous metals, adaptable to remove other magnetic materials like specific stainless steel variants, nickel, and cobalt. Waste reduction benefits accrue from its effectiveness, lowering waste volumes requiring further processing or disposal. Lastly, magnetic separation ensures regulatory compliance through its provision of high purity in recovered materials.

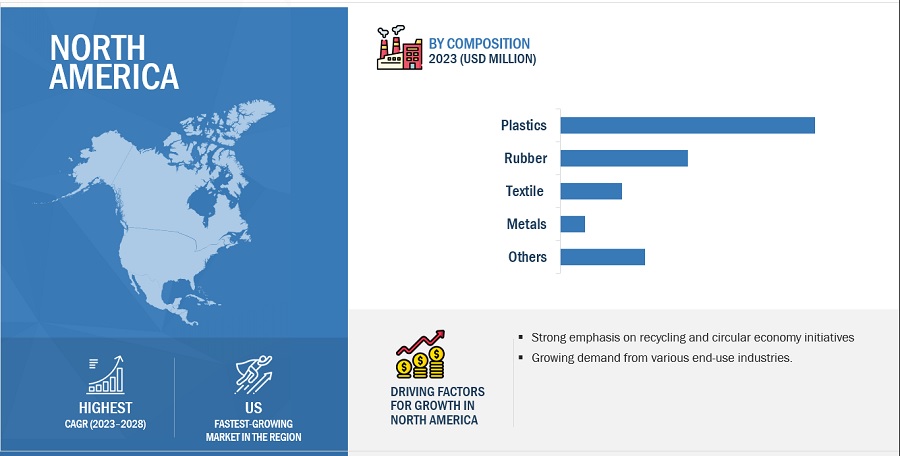

"Plastics was the largest composition for automotive shredded residue (ASR) market in 2023, in terms of value."

There has been a global surge in prioritizing recycling and minimizing plastic waste, with governments, businesses, and consumers demonstrating heightened awareness of plastics' environmental impact. This impetus drives intensified endeavors to efficiently recycle and process plastics. Over time, post shredder technologies have evolved, rendering the processing of plastics by composition more feasible and cost-effective. These technologies enable the identification and separation of distinct plastic types based on their composition, enhancing recycling efficiency. The demand for recycled plastics has been on the rise, particularly in sectors such as packaging, automotive, and consumer goods. Companies are actively seeking more sustainable materials, with recycled plastics frequently meeting their sustainability objectives. Governments in many countries have been enacting regulations and offering incentives to stimulate recycling and the utilization of recycled materials. This regulatory support can encourage investments in post shredder technologies tailored for plastics. The concept of a circular economy, advocating for the reuse and recycling of materials instead of disposal, is gaining prominence. This ideology fosters the development of technologies adept at efficiently processing and recycling plastics into new products. Increased public consciousness regarding plastic pollution in oceans and ecosystems has led to demands for more effective recycling and waste management solutions. Consequently, investments in technologies capable of handling post shredder plastics with greater efficiency will ensue.

"North America was the largest market for automotive shredded residue (ASR) in 2023, in terms of value."

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest market for the global post shredder technology, in terms of value, in 2023. The regulatory environment in North America is characterized by a intricate network of federal, state, and provincial regulations related to waste management and recycling. This complex framework underscores the necessity for advanced technologies to align with regulatory requirements and enhance the efficiency of recycling operations. North America, especially in the United States and Canada, possesses a strong industrial and manufacturing sector that produces significant amounts of industrial and post-consumer waste, demanding efficient waste processing and recycling solutions, including the utilization of post-shredder technology. industries such as automotive, manufacturing, and packaging within North America exhibit robust demand for recycled materials. This demand serves as a catalyst for the development of technologies that efficiently process post shredder materials.

Automotive Shredded Residue Market Players

The key players in this market are Tomra Systems ASA (Norway), Gallo (Belgium), Sims Limited (Australia), MBA Polymers Inc.(US), Binder+Co. (Austria), PLANIC (Japan), Axion Ltd.(UK), SRW metal float GmbH (Germany), Machinex Industries, Inc. (Canada), Wendt Corporation (US), CP Manufacturing Inc. (US), BT-Wolfgang Binder GmbH (Austria), Agilyx (US), Steinert (Germany).

The market's ongoing evolution, which encompasses activities such as the introduction of new products, mergers and acquisitions, agreements, and expansions, is anticipated to drive its growth. Prominent post shredder technology manufacturers have chosen to launch new products as a means to maintain their market presence.

Automotive Shredded Residue Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.1 billion |

|

Revenue Forecast in 2028 |

USD 1.6 billion |

|

CAGR |

6.6% |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million), Volume (Kilotons) |

|

Segments |

Application, Composition, Technology and Region |

|

Regions |

Asia Pacific, North America, Europe, Rest of the World |

|

Companies |

Galloo (Belgium), MBA Polymers Inc. (US), PLANIC (Japan), Sims Limited (Australia), Axion Ltd (UK), SRW metal float GmbH (Germany), Machinex Industries Inc. (Canada), Wendt Corporation (US), Binder+Co. (Austria), CP Manufacturing Inc. (US), Tomra Systems ASA (Norway), BT-Wolfgang Binder GmbH (Austria), Agilyx (US), Steinert (Germany) |

This report categorizes the global automotive shredded residue (ASR) market based on processing, composition, technology, and region.

On the basis of application, the market has been segmented as follows:

- Landfill

- Energy recovery

- Recycling

On the basis of composition, the market has been segmented as follows:

- Metals

- Plastics

- Rubber

- Textile

- Others

On the basis of technology, the market has been segmented as follows:

- Air classification

- Optical sorting

- Magnetic separation

- Eddy current separation

- Screening

- Others

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In June 2023, Tomra Systems ASA (Norway) unveiled its latest innovation AUTOSORT PULSE. This cutting edge technology machine incorporates dynamic laser induced breakdown spectroscopy (LIBS) and is desiged for high throughput sorting of aluminium alloys and opens up possibilities for green aluminium production.

- In June 2023, Galloo (Belgium) announced its joint venture with Stellantis (Netherlands) to facilitate the end of life vehicles recycling. The service is scheduled for a late 2023 launch and is set to target France, Belgium and Luxembourg expanding its operation in Europe.

- In January 2023, Wendt Corpoartion (US) announced its joint venture with Proman Infrastructure Service limited. (India) resulting in the establishment of a new company Wendt Proman Metal Recycling Pvt. Ltd. As it identified India and an emerging market for shredding and separation technologies.

- In October 2022, MBA Polymers, Inc. (US) has inaugurated its third facility in the UK, situated in the EMR Duddeston site in central Birmingham. This new site provides an opportunity for Uk based manufacturers to minimize plastic waste generation during their production processes and procure environmental friendly recycled materials through a closed loop supply chainfor postindustrial plastics.

- In July 2022, Machinex Industries, Inc. (Canada) announced a new project with long time partner Rumpke Waste and Recycling that includes the delivery of a brand new 56 ton per hour (TPH) residential single stream system in Columbus, Ohio. The new material recovery facility will feature the best sorting capabilities and the most automation available. This will also be one of the largest dedicated residential single stream systems in the country.

- In May 2022, Tomra Systems ASA launched a new sorting equipment X-TRACT. This advanced version features a redesigned structure and revolutionary innovations. By leveraging Tomra’s cutting edge x-ray transmission (XRT) technology, it achieves remarkable advancement in metal and diamond recovery, redefining the industry benchmarks for sensor based aluminium sorting.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the automotive shredded residue (ASR) market?

This study's forecast period for the automotive shredded residue (ASR) market is 2023-2028. The market is expected to grow at a CAGR of 6.6%, in terms of value, during the forecast period.

Who are the major key players in the automotive shredded residue (ASR) market?

The key players in this market are Tomra Systems ASA (Norway), Gallo (Belgium), Sims Limited (Australia), MBA Polymers Inc.(US), Binder+Co. (Austria), PLANIC (Japan), Axion Ltd.(UK), SRW metalfloat GmbH (Germany), Machinex Industries, Inc. (Canada), Wendt Corporation (US), CP Manufacturing Inc. (US), BT-Wolfgang Binder GmbH (Austria), Agilyx (US), Steinert (Germany).

What are the major regulations of the automotive shredded residue (ASR) market in various countries?

Environmental protection agencies of different countries have laid down certain regulations for the proper use of post-shredder technology. Compliance with relevant standards such as the International Organization for Standardization (ISO), Environmental Protection Agency (EPA), European Committee for Standardization (CEN), National Institute for Occupational Safety and Health (NIOSH), European Environment Agency (EEA) etc.

What are the drivers and opportunities for the automotive shredded residue (ASR) market?

The drivers are regulatory pressures from governments and environmental agencies, technological developments in the post shredding technologies, rising resource scarcity and increasing demand for recycled materials. The opportunity is circular economy initiatives coupled with growing demand for e-waste recycling.

What are the key technology trends prevailing in the automotive shredded residue (ASR) market?

The integration of advanced sensors, such as near-infrared (NIR), X-ray, and hyperspectral sensors, is enhancing the precision and speed of material identification and separation in post-shredder processes. These sensors can identify and sort materials more accurately, resulting in higher recovery rates and improved purity levels. AI and machine learning algorithms are being used to optimize post-shredder processes. These technologies can analyze data from sensors and cameras in real time, enabling better decision-making and process control. AI-driven systems can adapt to changing material streams and improve overall efficiency. Robotics is playing a growing role in post-shredder technologies. Robotic systems are used for tasks such as material picking, sorting, and quality control. They can work alongside human operators or in fully automated systems, increasing efficiency and reducing labor costs. Energy-efficient design and operation of post-shredder systems are becoming increasingly important. Technologies that reduce energy consumption, such as regenerative braking systems and energy recovery systems, are being integrated into recycling facilities to lower operational costs and environmental impact. Blockchain technology is being explored to enhance traceability and transparency in recycling. It can be used to create digital records of material origins, processing steps, and environmental impact, providing consumers and businesses with verifiable information about the recycled content of products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Regulatory pressures from government and environmental agencies- Continuous technological advancements in post shredding technology- Increasing resource scarcity and rising demand for recycled materialsRESTRAINTS- High initial investments and complexity of recycling waste composition- Environmental concerns and regulatory compliancesOPPORTUNITIES- Circular economy initiatives coupled with growing demand for e-waste recyclingCHALLENGES- High energy consumption and cost

-

5.3 CURRENT SCENARIOINTRODUCTIONCHALLENGES TO AUTOMOTIVE SHREDDED RESIDUE PROCESSINGTECHNOLOGICAL ADVANCEMENTS TO ADDRESS CHALLENGESCOMPANIES LEADING TECHNOLOGICAL ADVANCEMENTS IN AUTOMOTIVE SHREDDED RESIDUE PROCESSINGAUTOMOBILE MANUFACTURING COMPANIES USE RECYCLED PLASTICS- Škoda- Jaguar- Volvo- Toyota Motor Corporation- Ford Motors

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSPOST SHREDDER TECHNOLOGY PROVIDERSRECYCLED MATERIAL PROCESSINGDISTRIBUTORSEND-USE INDUSTRIES

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 ECOSYSTEM

-

6.5 AUTOMOTIVE SHREDDED RESIDUE MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPE- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSLIST OF MAJOR PATENTS

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY COMPOSITIONAVERAGE SELLING PRICE, BY PLASTIC COMPOSITION

- 6.8 TECHNOLOGY ANALYSIS

- 6.9 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR POST SHREDDER TECHNOLOGY MANUFACTURERS

-

6.13 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.14 CASE STUDYCASE STUDY ABOUT A MSW (MUNICIPAL SOLID WASTE) SORTING FACILITY IN NORWAY – IVARCASE STUDY ABOUT CHALLENGES AROUND AUTOMOTIVE SHREDDED RESIDUE PRODUCTION AND DISPOSALCASE STUDY ABOUT SELECTIVE THERMAL TRANSFORMATION OF AUTOMOTIVE SHREDDED RESIDUES INTO HIGH-VALUE NANO SILICON CARBIDECASE STUDY ABOUT DEMONSTRATION OF A POST SHREDDING TECHNOLOGY (PST) FOR RECOVERY OF RAW MATERIALS FROM AUTOMOTIVE SHREDDED RESIDUECASE STUDY ABOUT RECOVERING PLASTICS FROM AUTOMOTIVE SHREDDED RESIDUE

- 7.1 INTRODUCTION

-

7.2 COMPOSITION OF AUTOMOTIVE SHREDDED RESIDUEMETALS- Reuse in various industries to drive marketPLASTICS- Ability to remold and reshape to drive market- Polypropylene (PP)- Polyethylene (PE)- Other plasticsRUBBERS- Use in road construction and playgrounds to drive marketTEXTILES- Reduction of environmental footprint to drive marketOTHER COMPOSITIONS- Glass- Foams

- 8.1 INTRODUCTION

-

8.2 OPTICAL SORTINGEFFICIENCY, ACCURACY, AND ENHANCED RECYCLING TO DRIVE MARKET

-

8.3 EDDY CURRENT SEPARATIONEFFICIENT EXTRACTION OF NON-FERROUS METALS TO DRIVE MARKET

-

8.4 MAGNETIC SEPARATIONHIGH-PURITY MAGNETIC FRACTION PROCESS TO DRIVE MARKET

-

8.5 AIR CLASSIFICATIONWIDE USE IN MINERAL PROCESSING INDUSTRY TO DRIVE MARKET

-

8.6 SCREENINGSINGLE-STREAM SORTING OF DIFFERENT MATERIALS TO DRIVE MARKET

-

8.7 OTHER TECHNOLOGIESNEAR-INFRARED (NIR) SPECTROSCOPY- Demand for quality control, process monitoring, and material characterization to drive marketSINK-FLOAT SEPARATION- Use in diverse industries to drive marketELECTROSTATIC SEPARATION- Sorting based on differences in electrical conductivity and surface charging to drive marketBALLISTIC SEPARATION- Separation based on shape and size to drive marketX-RAY SORTING- Sorting based on atomic composition and elemental density to drive marketLASER-INDUCED BREAKDOWN SPECTROSCOPY (LIBS)- Accurate identification and separation based on chemical composition to drive market

- 9.1 INTRODUCTION

- 9.2 LANDFILL

- 9.3 ENERGY RECOVERY

- 9.4 RECYCLING

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Growing environmental awareness and push for circular economy to drive marketCANADA- Government efforts toward sustainable development and demand for effective sorting technologies to drive marketMEXICO- Demand for technologies to manage waste from automobile industry and other plastic sources to drive market

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Major automotive industry coupled with large aerospace & defense sector to drive marketFRANCE- Growing automotive, pharmaceutical, and defense spending to lead to market growthITALY- Government initiatives and thriving automobile sector to drive marketUK- Robust automotive sector, circular economy initiative, and stringent environmental regulations to drive marketSPAIN- Well-established automobile sector and considerable strides in renewable energy industry to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Increasing waste due to industrialization and urbanization to drive marketJAPAN- Demand for efficient waste management and resource recovery to drive marketSOUTH KOREA- Commitment to environmental conservation and circular economy principles to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDIMPACT OF RECESSION ON REST OF THE WORLDBRAZIL- Automotive industry to be key driver for market growthSAUDI ARABIA- Circular Economy Vision to drive marketSOUTH AFRICA- Extraction of valuable materials from mixed waste streams to drive marketREST OF ROW

- 11.1 INTRODUCTION

-

11.2 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- TOMRA Systems ASA- Galloo- Sims Limited- MBA Polymers Inc.- Binder+Co.

-

11.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT

-

11.4 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

11.5 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSGALLOO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMBA POLYMERS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLANIC- Business overview- Products/Solutions/Services offered- MnM viewSIMS LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAXION LTD- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSRW METALFLOAT GMBH- Business overview- Products/Solutions/Services offered- MnM viewMACHINEX INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWENDT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBINDER+CO.- Business overview- Products/Solutions/Services offered- MnM viewCP MANUFACTURING INC.- Business overview- Products/Solutions/Services offered- MnM viewTOMRA SYSTEMS ASA- Business overview- Products/Solutions/Services offered- MnM viewBT-WOLFGANG BINDER GMBH (REDWAVE)- Business overview- Products/Solutions/Services offered- MnM viewAGILYX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTEINERT- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSERIEZ MANUFACTURING CO.BEZNERSESOTEC GMBHPICVISAFORNNAX TECHNOLOGY PRIVATE LIMITEDLINDNER WASHTECH

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 IMPACT OF PORTER’S FIVE FORCES ON AUTOMOTIVE SHREDDED RESIDUE MARKET

- TABLE 2 AUTOMOTIVE SHREDDED RESIDUE MARKET: ECOSYSTEM

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 GRANTED PATENTS ACCOUNTED FOR 36.4% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 9 LIST OF MAJOR PATENTS FOR POST SHREDDER TECHNOLOGY

- TABLE 10 MAJOR PATENTS FOR POST SHREDDER TECHNOLOGY

- TABLE 11 AVERAGE SELLING PRICE, BY REGION, 2020–2028 (USD/TON)

- TABLE 12 AVERAGE SELLING PRICE, BY APPLICATION, 2020–2028 (USD/TON)

- TABLE 13 AVERAGE SELLING PRICE, BY COMPOSITION, 2020–2028 (USD/TON)

- TABLE 14 AVERAGE SELLING PRICE, BY PLASTIC COMPOSITION, 2020–2028 (USD/TON)

- TABLE 15 TECHNOLOGIES OFFERED IN AUTOMOTIVE SHREDDED RESIDUE MARKET

- TABLE 16 AUTOMOTIVE SHREDDED RESIDUE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 17 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP FIVE INDUSTRIES

- TABLE 18 KEY BUYING CRITERIA FOR INDUSTRIES

- TABLE 19 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2028 (USD MILLION)

- TABLE 20 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 21 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (KILOTON)

- TABLE 22 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY PLASTIC COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 23 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY PLASTIC COMPOSITION, 2020–2028 (KILOTON)

- TABLE 24 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 25 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY TECHNOLOGY, 2020–2028 (KILOTON)

- TABLE 26 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 27 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 28 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 29 AUTOMOTIVE SHREDDED RESIDUE MARKET, BY REGION, 2020–2028 (KILOTON)

- TABLE 30 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 32 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (KILOTON)

- TABLE 34 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 36 US: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 37 US: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 38 CANADA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 39 CANADA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 40 MEXICO: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 41 MEXICO: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 42 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 43 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 44 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 45 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (KILOTON)

- TABLE 46 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 47 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 48 GERMANY: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 49 GERMANY: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 50 FRANCE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 51 FRANCE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 52 ITALY: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 53 ITALY: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 54 UK: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 55 UK: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 56 SPAIN: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 57 SPAIN: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 58 REST OF EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 59 REST OF EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 60 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 62 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (KILOTON)

- TABLE 64 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 66 CHINA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 67 CHINA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 68 JAPAN: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 69 JAPAN: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 70 SOUTH KOREA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 71 SOUTH KOREA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 74 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 75 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 76 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (USD MILLION)

- TABLE 77 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY COMPOSITION, 2020–2028 (KILOTON)

- TABLE 78 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 79 REST OF THE WORLD: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 80 BRAZIL: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 81 BRAZIL: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 82 SAUDI ARABIA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 83 SAUDI ARABIA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 84 SOUTH AFRICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 85 SOUTH AFRICA: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 86 REST OF ROW: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 87 REST OF ROW: AUTOMOTIVE SHREDDED RESIDUE MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 88 STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE SHREDDED RESIDUE MARKET

- TABLE 89 AUTOMOTIVE SHREDDED RESIDUE MARKET: DEGREE OF COMPETITION

- TABLE 90 AUTOMOTIVE SHREDDED RESIDUE MARKET: KEY COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 91 AUTOMOTIVE SHREDDED RESIDUE MARKET: KEY COMPANY PLASTIC TYPE FOOTPRINT

- TABLE 92 AUTOMOTIVE SHREDDED RESIDUE MARKET: KEY COMPANY EQUIPMENT TYPE FOOTPRINT

- TABLE 93 AUTOMOTIVE SHREDDED RESIDUE MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 94 AUTOMOTIVE SHREDDED RESIDUE MARKET: KEY STARTUPS/SMES

- TABLE 95 AUTOMOTIVE SHREDDED RESIDUE: PLASTIC TYPE FOOTPRINT OF SME PLAYERS

- TABLE 96 AUTOMOTIVE SHREDDED RESIDUE: EQUIPMENT TYPE FOOTPRINT OF SME PLAYERS

- TABLE 97 AUTOMOTIVE SHREDDED RESIDUE: END-USE INDUSTRY FOOTPRINT OF SME PLAYERS

- TABLE 98 AUTOMOTIVE SHREDDED RESIDUE MARKET: REGION FOOTPRINT OF SME PLAYERS

- TABLE 99 AUTOMOTIVE SHREDDED RESIDUE MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 100 AUTOMOTIVE SHREDDED RESIDUE MARKET: DEALS (2019–2023)

- TABLE 101 AUTOMOTIVE SHREDDED RESIDUE MARKET: OTHER DEVELOPMENTS (2019–2023)

- TABLE 102 GALLOO: COMPANY OVERVIEW

- TABLE 103 GALLOO: PRODUCT OFFERINGS

- TABLE 104 GALLOO: DEALS

- TABLE 105 MBA POLYMERS INC.: COMPANY OVERVIEW

- TABLE 106 MBA POLYMERS INC.: PRODUCT OFFERINGS

- TABLE 107 MBA POLYMERS INC.: PRODUCT LAUNCHES

- TABLE 108 MBA POLYMERS INC.: OTHERS

- TABLE 109 PLANIC: COMPANY OVERVIEW

- TABLE 110 PLANIC: PRODUCT OFFERINGS

- TABLE 111 SIMS LIMITED: COMPANY OVERVIEW

- TABLE 112 SIMS LIMITED: PRODUCT OFFERINGS

- TABLE 113 SIMS LIMITED: DEALS

- TABLE 114 AXION LTD: COMPANY OVERVIEW

- TABLE 115 AXION LTD: PRODUCT OFFERINGS

- TABLE 116 AXION LTD: OTHERS

- TABLE 117 SRW METALFLOAT GMBH: COMPANY OVERVIEW

- TABLE 118 SRW METALFLOAT GMBH: PRODUCT OFFERINGS

- TABLE 119 MACHINEX INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 120 MACHINEX INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 121 MACHINEX INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 122 MACHINEX INDUSTRIES, INC.: DEALS

- TABLE 123 MACHINEX INDUSTRIES, INC.: OTHERS

- TABLE 124 WENDT CORPORATION: COMPANY OVERVIEW

- TABLE 125 WENDT CORPORATION: PRODUCT OFFERINGS

- TABLE 126 WENDT CORPORATION: DEALS

- TABLE 127 WENDT CORPORATION: OTHERS

- TABLE 128 BINDER+CO.: COMPANY OVERVIEW

- TABLE 129 BINDER+CO.: PRODUCT OFFERINGS

- TABLE 130 CP MANUFACTURING INC.: COMPANY OVERVIEW

- TABLE 131 CP MANUFACTURING INC.: PRODUCT OFFERINGS

- TABLE 132 CP MANUFACTURING INC.: PRODUCT LAUNCHES

- TABLE 133 CP MANUFACTURING INC.: DEALS

- TABLE 134 TOMRA SYSTEMS ASA: COMPANY OVERVIEW

- TABLE 135 TOMRA SYSTEMS ASA: PRODUCT OFFERINGS

- TABLE 136 TOMRA SYSTEMS ASA: PRODUCT LAUNCHES

- TABLE 137 TOMRA SYSTEMS ASA: DEALS

- TABLE 138 TOMRA SYSTEMS ASA: OTHERS

- TABLE 139 BT-WOLFGANG BINDER GMBH: COMPANY OVERVIEW

- TABLE 140 BT-WOLFGANG BINDER GMBH: PRODUCT OFFERINGS

- TABLE 141 BT-WOLFGANG BINDER GMBH: PRODUCT LAUNCHES

- TABLE 142 BT-WOLFGANG BINDER GMBH: DEALS

- TABLE 143 BT-WOLFGANG BINDER GMBH: OTHERS

- TABLE 144 AGILYX: COMPANY OVERVIEW

- TABLE 145 AGILYX: PRODUCT OFFERINGS

- TABLE 146 AGILYX: DEALS

- TABLE 147 AGILYX: OTHERS

- TABLE 148 STEINERT: COMPANY OVERVIEW

- TABLE 149 STEINERT: PRODUCT OFFERINGS

- TABLE 150 STEINERT: PRODUCT LAUNCHES

- TABLE 151 STEINERT: DEALS

- TABLE 152 STEINERT: OTHERS

- TABLE 153 ERIEZ MANUFACTURING CO.: COMPANY OVERVIEW

- TABLE 154 BEZNER: COMPANY OVERVIEW

- TABLE 155 SESOTEC GMBH: COMPANY OVERVIEW

- TABLE 156 PICVISA: COMPANY OVERVIEW

- TABLE 157 FORNNAX TECHNOLOGY PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 158 LINDNER WASHTECH: COMPANY OVERVIEW

- FIGURE 1 AUTOMOTIVE SHREDDED RESIDUE MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE SHREDDED RESIDUE MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMOTIVE SHREDDED RESIDUE MARKET: DATA TRIANGULATION

- FIGURE 4 LANDFILL APPLICATION SEGMENT TO DOMINATE AUTOMOTIVE SHREDDED RESIDUE MARKET BETWEEN 2023 AND 2028

- FIGURE 5 PLASTICS COMPOSITION SEGMENT TO DOMINATE AUTOMOTIVE SHREDDED RESIDUE MARKET BETWEEN 2023 AND 2028

- FIGURE 6 PP PLASTIC COMPOSITION SEGMENT TO LEAD AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 7 MAGNETIC SEPARATION TECHNOLOGY SEGMENT TO LEAD AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO DOMINATE AUTOMOTIVE SHREDDED RESIDUE MARKET IN 2023

- FIGURE 9 GROWING PRESSURES FROM GOVERNMENT AND ENVIRONMENTAL AGENCIES TO DRIVE MARKET

- FIGURE 10 RECYCLING TO BE FASTEST-GROWING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 11 EUROPE TO BE FASTEST-GROWING REGION IN AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 12 PLASTICS TO BE FASTEST-GROWING COMPOSITION SEGMENT DURING FORECAST PERIOD

- FIGURE 13 PP PLASTIC COMPOSITION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 OPTICAL SORTING TECHNOLOGY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AUTOMOTIVE SHREDDED RESIDUE MARKET

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: AUTOMOTIVE SHREDDED RESIDUE MARKET

- FIGURE 18 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 19 REGIONAL ANALYSIS OF PATENTS GRANTED FOR POST SHREDDER TECHNOLOGY, 2023

- FIGURE 20 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FIVE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR INDUSTRIES

- FIGURE 23 IMPORT OF POST SHREDDER TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 24 EXPORT OF POST SHREDDER TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 25 REVENUE SHIFT OF AUTOMOTIVE SHREDDED RESIDUE MARKET

- FIGURE 26 PLASTICS COMPOSITION SEGMENT TO LEAD AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 27 POLYPROPYLENE PLASTIC COMPOSITION SEGMENT TO LEAD AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 28 MAGNETIC SEPARATION TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 LANDFILL APPLICATION SEGMENT TO LEAD AUTOMOTIVE SHREDDED RESIDUE MARKET DURING FORECAST PERIOD

- FIGURE 30 EUROPE TO BE FASTEST-GROWING AUTOMOTIVE SHREDDED RESIDUE MARKET

- FIGURE 31 NORTH AMERICA: AUTOMOTIVE SHREDDED RESIDUE MARKET SNAPSHOT

- FIGURE 32 EUROPE: AUTOMOTIVE SHREDDED RESIDUE MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: AUTOMOTIVE SHREDDED RESIDUE MARKET SNAPSHOT

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN AUTOMOTIVE SHREDDED RESIDUE MARKET, 2022

- FIGURE 35 AUTOMOTIVE SHREDDED RESIDUE MARKET: SHARE OF KEY PLAYERS

- FIGURE 36 AUTOMOTIVE SHREDDED RESIDUE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 AUTOMOTIVE SHREDDED RESIDUE MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 38 SIMS LIMITED: COMPANY SNAPSHOT

- FIGURE 39 BINDER+CO.: COMPANY SNAPSHOT

- FIGURE 40 TOMRA SYSTEMS ASA: COMPANY SNAPSHOT

- FIGURE 41 AGILYX: COMPANY SNAPSHOT

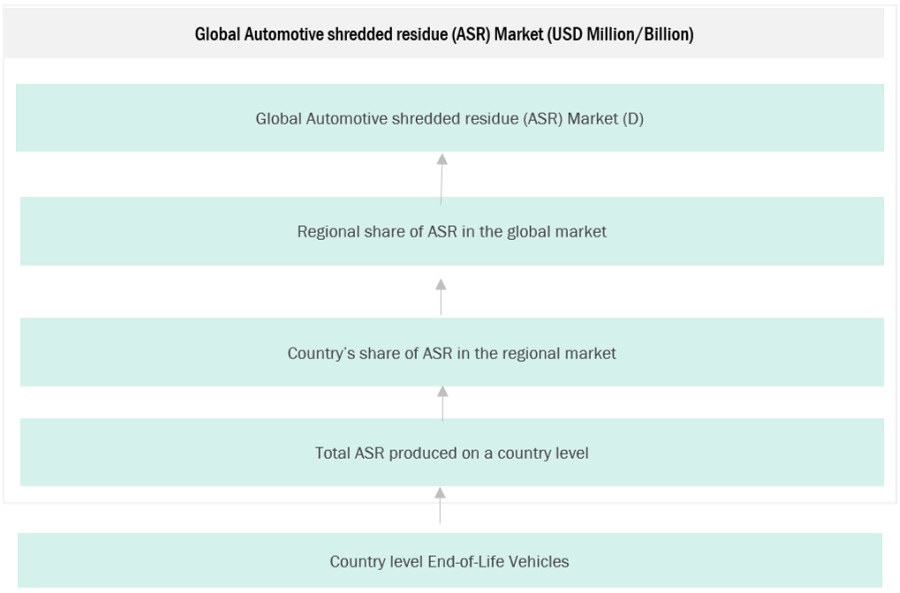

The study involved four major activities in estimating the market size of the automotive shredded residue (ASR) market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

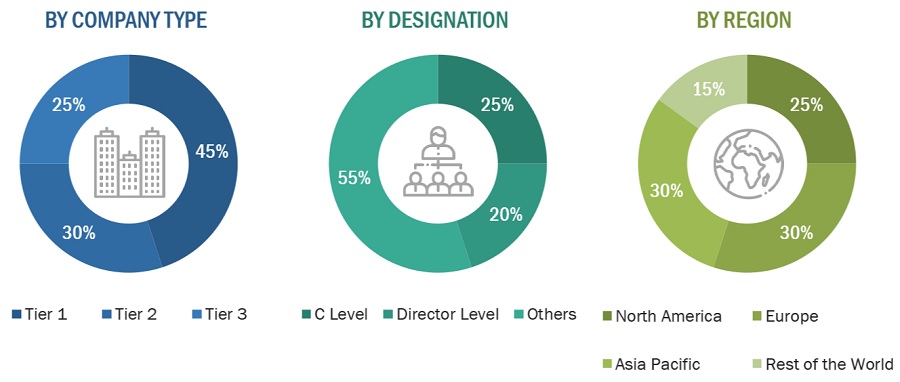

The automotive shredded residue (ASR) market comprises several stakeholders in the value chain, which include raw material suppliers, component manufacturers, distribution, and end-users. Various primary sources from the supply and demand sides of the automotive shredded residue (ASR) market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the post shredder technology industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of post shredder technology and the future outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

BT-Wolfgang Binder GmbH |

Individual Industry Expert |

|

Tomra Systems ASA |

Service Engineer |

|

Binder+Co. |

Director |

|

Ad Recycling Machines |

Sales Engineer |

|

MBA Polymers, Inc. |

R&D Manager |

Market Size Estimation

The top-down and bottom-up Approaches have been used to estimate and validate the size of the automotive shredded residue (ASR) market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Automotive Shredded Residue (ASR) Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Shredded Residue (ASR) Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Automotive shredded residue (ASR) refers to the heterogeneous mixture of materials left behind after the automotive recycling process involving the shredding and separation of end-of-life vehicles. ASR typically comprises various materials such as plastics, rubber, glass, textiles, foam, and metals that are difficult to separate and recycle using conventional methods. It represents a complex waste stream with environmental and economic implications, requiring specialized technologies and processes for efficient recovery of recyclables, energy generation, and responsible disposal, making it a distinctive and challenging segment within the automotive recycling and waste management industry.

Key Stakeholders

- Post shredder technology manufacturers.

- Raw material suppliers

- Post shredder technology equipment manufacturers.

- End-use companies.

- Automotive shredded residue traders, distributors, and suppliers.

- Research organizations.

- Industry associations

- Governments and research organizations

Report Objectives

- To define, describe, and forecast the size of the automotive shredded residue (ASR) market in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on application, composition, technology, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Rest of the world, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Automotive Shredded Residue (ASR) Market