Bioabsorbable Stents Market by Material (Polymer/Metal), Absorption Rate (Slow, Fast), Application (Coronary Artery Disease/CAD, Peripheral/PAD) & End User (Hospital, Cardiovascular Center) - Global Forecasts to 2022

Updated date -

[138 Slides Report] The global bioabsorbable stents market is expected to reach USD 417.2 million by 2022 from USD 242.4 million in 2017, at a CAGR of 11.5% during the forecast period. Market growth of bioresorbable stents is attributed to the growing aging population susceptible to coronary and peripheral artery diseases, rising PCI procedures, increasing focus of companies on clinical trials of bioresorbable stents, increasing adoption of these stents by physicians and patients, and patients’ preference for minimally invasive therapies.

Selected Market Dynamics in Bioabsorbable Stent Market

Strong product pipeline

Companies are increasingly focusing on developing stents that are efficient, can be fully absorbed into the body, and can naturally restore the movement of the artery while healing it. These stents are used for treating CAD and PAD.

This strong pipeline of highly advanced products is expected to play an important role in driving the growth of the bioresorbable stents market during the forecast period.

Presence of substitutes

Bioresorbable stents are a relatively novel technology that is expected to cannibalize the markets for bare-metal and drug-eluting stents in the coming years. However, at present, there are various other substitutes available for treating blocked arteries as well as CAD and PAD. For example, coronary artery bypass graft (CABG) is a therapy where blockages in the coronary artery are bypassed, and the blood is directed to flow through a different artery from the leg or the arms. According to the Centers for Disease Control and Prevention (CDC), around 395,000 CABG procedures are performed annually in the U.S. alone.

Another substitute—Xenograft—is used in procedures that require replacing damaged or blocked valves. Therapies such as laser ablation are also available, which use a catheter that has a metal or optic tube at the tip of the device to burn away plaque in the arteries.

In addition to these substitutes, patients also have the option to choose from a wide range of stents commercially available in the market. Many of these traditional stents are comparatively lower priced than bioresorbable stents. These substitutes and lower-priced alternatives pose a major challenge to the bioresorbable stents market.

The following are the major objectives of the study

- To define, describe, and forecast the bioabsorbable stents market on the basis of material, absorption rate, drug, end user, and application

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall bioabsorbable stents market

- To forecast the size of the market segments with respect to four main regions, namely, North America, Asia, Europe, and the Rest of the World (RoW)2

- To profile key players and comprehensively analyze their market shares and core competencies3

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions; new product developments, expansions; and research and development activities in the bioabsorbable stents market

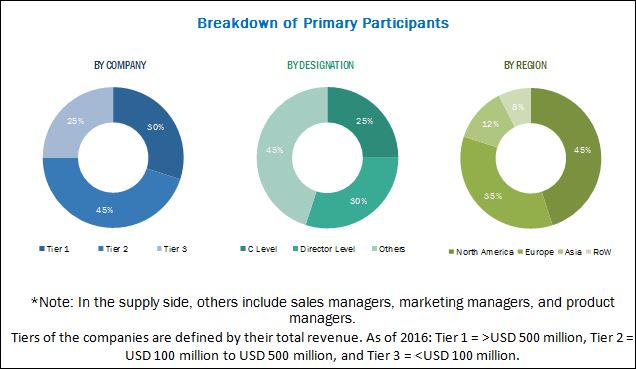

During this research study, major players operating in the bioabsorbable stents market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Some prominent players in the bioabsorbable stents market include Abbott (US), BIOTRONIK SE & Co. KG (Germany), REVA Medical, Inc. (US), Elixir Medical Corporation (US), Arterial Remodeling Technologies (France), and Kyoto Medical Planning Co., Ltd. (Japan).

Major Market Developments:

- In 2016, Abott received Received approval from the Ministry of Health, Labor and Welfare (MHLW) in Japan for its Absorb bioresorbable heart stent.

- In 2017, Reva Medical received CE approval for Fantom, a drug-eluting bioresorbable coronary scaffold

- In 2015, Abbott received CE mark approval for Absorb GT1, which is the world’s first fully bioresorbable stent system. This approval helped the company to market this product in Europe, thus expanding its customer base.

Target Audience:

- Bioabsorbable stent manufacturing companies

- Pharmaceutical and medical devices manufacturing companies

- Healthcare institutions (hospitals and clinics)

- Stent distributors and suppliers

- Research institutes

- Venture capitalists

- Health insurance payers

- Market research and consulting firms

Scope of the Report

This report categorizes the global bioabsorbable stents market into following segments and subsegments.

By Material

- Bioresorbable polymer based stents

- Bioresorbable metallic stents

By Absorption Rate

- Slow- absorption stents

- Fast- absorption stents

By Applications

- Coronary Artery Diseases

- Peripheral Artery Diseases

By End User

- Hospitals

- Cardiac Centers

By Region

- North America

- Europe

- Asia

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional bioabsorbable stents market players (up to 5)

The global bioabsorbable stents market is expected to reach USD 417.2 million by 2022 from USD 242.4 million in 2017, at a CAGR of 11.5% during the forecast period. Market growth of bioresorbable stents is attributed to the growing aging population susceptible to coronary and peripheral artery diseases, rising PCI procedures, increasing focus of companies on clinical trials of bioresorbable stents, increasing adoption of these stents by physicians and patients, and patients’ preference for minimally invasive therapies. However, factors such as the increasing product withdrawals due to severe complications of these stents may hamper market growth.

Bioabsorbable stents or scaffolds are implanted within the artery for clearing the blockage caused due to the accumulation of plaque (cholesterol, fatty substances, cellular waste products, calcium, and fibrin). These devices dissolve within the body after eluting the drug within a certain period of time and are aimed at increasing the efficiency of the treatment by reducing the chances of thrombosis and dual anti-platelet therapy among patients.

Based on material, the bioabsorbable stents market is segmented into bioresorbable polymer-based stents and bioresorbable metallic stents. The bioresorbable polymer-based stents segment is expected to grow at the highest CAGR. The growth of this market is mainly attributed to companies’ increasing focus on developing polymeric stents and increasing approvals for polymer-based stents across various regions

Based on application, the market is segmented into coronary artery diseases and peripheral artery diseases. In 2017, coronary artery diseases accounted for the largest share of the market. The dominance of this segment is attributed to factors such as increasing aging population prone to coronary and the adoption of unhealthy lifestyle habits leading to increased risk of coronary artery diseases.

Based on end users, the bioabsorbable stents market is segmented into hospitals and cardiac centers. The hospitals segment is expected to dominate the market and grow at the highest CAGR during the forecast period. The high growth of this segment is attributed to increasing need of surgeries, growing risk of CAD and PAD, and improving reimbursement scenario for the hospitals.

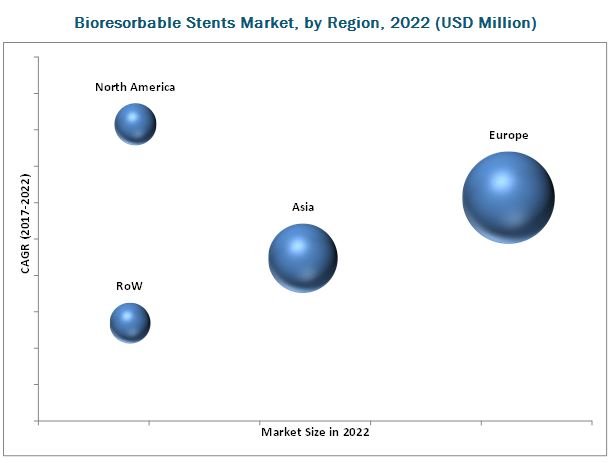

Geographically, the bioabsorbable stents market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). In 2017, Europe is expected to dominate the market, followed by Asia. The dominance of European region is majorly attributed to increasing regulatory approvals for stents which will facilitate their commercialization and rising research activities for development of bioresorbable stents. The market in North America is expected to grow at the highest CAGR during the forecast period. Factors such as increasing prevalence of CAD and PAD, patient preference for minimally invasive therapies, unhealthy lifestyle habits, and huge patient pool are enabling this market to grow in this region

Hospitals form the largest and fastest growing end user segment.

Hospitals

Hospitals are the largest and fastest growing end users of bioresorbable stents. The large share of this segment is primarily driven by the large number of treatment procedures carried out in hospitals for treating cardiac disorders and peripheral arterial disease (PAD). Hospitals are also expected to witness significant growth in this market mainly due to the rapidly increasing patient pool and the growing prevalence of CAD and PAD. In addition, initiatives and support programs to provide cost-effective and quality treatment make it easier for patients to afford various procedures that make extensive use of medical devices, such as bioresorbable stents.

Cardiac Centers

Cardiac centers are witnessing an increased patient inflow due to the high patient pool already being treated at hospitals. They are considered as key alternatives to hospitals as these centers focus specifically on cardiac care. Growth in this segment can primarily be attributed to the increasing prevalence of CAD, improving life expectancy of patients, and reduced cost of post-op cardiac care. In addition, the significant increase in the incidence of heart attacks and strokes is also expected to propel the demand for bioresorbable stents in cardiac centers.

Critical questions the report answers:

- Which of the end user bioabsorbable stents market will dominate in future?

- North America have immense opportunities for the growth of bioresorbable stents, will this scenario continue?

Bioresorbable stents are a relatively novel technology that is expected to cannibalize the markets for bare-metal and drug-eluting stents in the coming years. However, at present, there are various other substitutes available for treating blocked arteries as well as CAD and PAD. For example, coronary artery bypass graft (CABG) is a therapy where blockages in the coronary artery are bypassed, and the blood is directed to flow through a different artery from the leg or the arms. Another substitute—Xenograft—is used in procedures that require replacing damaged or blocked valves. Therapies such as laser ablation are also available, which use a catheter that has a metal or optic tube at the tip of the device to burn away plaque in the arteries.

Some prominent companies in the bioabsorbable stents market include Abbott (US), BIOTRONIK SE & Co. KG (Germany), REVA Medical, Inc. (US), Elixir Medical Corporation (US), and Kyoto Medical Planning Co., Ltd. (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Bioabsorbable Stents Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Approach

2.2 Secondary Data

2.3 Primary Data

2.4 Key Industry Insights

2.5 Bioabsorbable Stents Market Size Estimation

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Bioabsorbable Stents Market Overview

4.2 Market, By End User

4.3 Market, By Application

4.4 Market, By Material

4.5 Bioabsorbable Stents Market : Geographic Snapshot

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Bioabsorbable Stents Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapidly Growing Geriatric Population and Increased Risk of CAD and PAD in the Elderly

5.2.1.2 Strong Product Pipeline

5.2.2 Restraints

5.2.2.1 Presence of Substitutes

5.2.3 Opportunities

5.2.3.1 Emerging Markets to Offer High-Growth Opportunities for Market PartiCIPAnts

5.2.4 Challenges

5.2.4.1 Product Withdrawals and Failures

5.2.4.2 High Risk of Complications

6 Regulatory Scenario (Page No. - 38)

6.1 Introduction

6.2 FDA and Ce Approvals

6.3 PMA Approvals and Government Certificates

7 Bioabsorbable Stents Market , By Material (Page No. - 40)

7.1 Introduction

7.2 Bioresorbable Polymer-Based Stents

7.3 Bioresorbable Metallic Stents

8 Bioabsorbable Stents Market , By Absorption Rate (Page No. - 46)

8.1 Introduction

8.2 Slow-Absorption Stents

8.3 Fast-Absorption Stents

9 Bioabsorbable Stents Market , By Application (Page No. - 51)

9.1 Introduction

9.2 Coronary Artery Disease

9.3 Peripheral Artery Disease

10 Market, By End User (Page No. - 57)

10.1 Introduction

10.2 Hospitals

10.3 Cardiac Centers

11 Market, By Region (Page No. - 63)

11.1 Introduction

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 U.K.

11.2.4 Rest of Europe (RoE)

11.3 Asia

11.4 North America

11.4.1 U.S.

11.4.2 Canada

11.5 Rest of the World

12 Competitive Landscape (Page No. - 89)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Emerging Companies

12.3.4 Dynamic Differentiators

12.4 Competitive Benchmarking

12.4.1 Strength of the Product Portfolio

12.4.2 Business Strategy Excellence

Abbott, REVA Medical, Inc., Elixir Medical Corporation, KYOTO MEDICAL PLANNING Co., Ltd., BIOTRONIK, Amaranth Medical, Inc., Arterial Remodeling Technologies, Meril Life Sciences Pvt. Ltd., Arterius Limited, LEPU MEDICAL TECHNOLOGY CO., LTD., Boston Scientific Corporation, HangZhou HuaAn Biotechnology Co.,Ltd, S3V Vascular Technologies, QualiMed, SMT, TEPHA INC, Manli Cardiology Ltd., ORBUSNEICH, 480 Biomedical, Zorion Medical Inc, Lifetech Scientific (Shenzhen) Co., Ltd

13 Company Profiles (Page No. - 94)

(Business Overview, Strength of Service Portfolio, Business Strategy Excellence, and Key Relationships)*

13.1 Abbott

13.2 REVA Medical, Inc.

13.3 Elixir Medical Corporation

13.4 KYOTO MEDICAL PLANNING Co., Ltd.

13.5 BIOTRONIK

13.6 Amaranth Medical, Inc.

13.7 Arterial Remodeling Technologies

13.8 Meril Life Sciences Pvt. Ltd.

13.9 Arterius Limited

13.10 LEPU MEDICAL TECHNOLOGY CO., LTD.

13.11 Boston Scientific Corporation

13.12 480 Biomedical

13.13 S3V Vascular Technologies Private Limited

13.14 Qualimed (Part of Q3 Medical Group)

13.15 ORBUSNEICH

*Details on Business Overview, Strength of Service Portfolio, Business Strategy Excellence, and Key Relationships Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 128)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (73 Tables)

Table 1 Pipeline Products in the Market

Table 2 List of the Approved Products

Table 3 Bioabsorbable Stents Market, By Material, 2015–2022 (USD Million)

Table 4 Bioresorbable Polymer-Based Stents Market, By Region, 2015–2022 (USD Million)

Table 5 North America: Bioresorbable Polymer-Based Stents Market, By Country, 2015–2022 (USD Million)

Table 6 Europe: Bioresorbable Polymer-Based Stents Market, By Country, 2015–2022 (USD Million)

Table 7 Bioresorbable Metallic Stents Market, By Region, 2017–2022 (USD Million)

Table 8 Europe: Bioresorbable Metallic Stents Market, By Country, 2017–2022 (USD Million)

Table 9 Market, By Absorption Rate, 2015–2022 (USD Million)

Table 10 Slow-Absorption Stents Market, By Region, 2015–2022 (USD Million)

Table 11 Europe: Slow-Absorption Stents Market, By Country, 2015–2022 (USD Million)

Table 12 North America: Slow-Absorption Stents Market, By Country, 2015–2022 (USD Million)

Table 13 Fast-Absorption Stents Market, By Region, 2015–2022 (USD Million)

Table 14 Europe: Fast-Absorption Stents Market, By Country, 2015–2022 (USD Million)

Table 15 North America: Fast-Absorption Stents Market, By Country, 2015–2022 (USD Million)

Table 16 Market, By Application, 2015–2022 (USD Million)

Table 17 Market for Coronary Artery Disease, By Region, 2015–2022 (USD Million)

Table 18 North America: Market for Coronary Artery Disease, By Country, 2015–2022 (USD Million)

Table 19 Europe: Market for Coronary Artery Disease, By Country, 2015–2022 (USD Million)

Table 20 Market for Peripheral Artery Disease, By Region, 2015–2022 (USD Million)

Table 21 Europe: Market for Peripheral Artery Disease, By Country, 2015–2022 (USD Million)

Table 22 Market, By End User, 2015–2022 (USD Million)

Table 23 Market for Hospitals, By Region, 2015–2022 (USD Million)

Table 24 North America: Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 25 Europe: Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 26 Market for Cardiac Centers, By Region, 2015–2022 (USD Million)

Table 27 North America: Market for Cardiac Centers, By Country, 2015–2022 (USD Million)

Table 28 Europe: Market for Cardiac Centers, By Country, 2015–2022 (USD Million)

Table 29 Market, By Region, 2015–2022 (USD Million)

Table 30 Bioabsorbable Stents Market, By Region, 2015–2022 (Units)

Table 31 Europe: Market , By Country, 2015–2022 (USD Million)

Table 32 Europe: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 33 Europe: Bioabsorbable Stents Market, By Absorption Rate, 2015–2022 (USD Million)

Table 34 Europe: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 35 Europe: Market , By End User, 2015–2022 (USD Million)

Table 36 Germany: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 37 Germany: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 38 Germany: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 39 Germany: Market, By End User, 2015–2022 (USD Million)

Table 40 France: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 41 France: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 42 France: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 43 France: Market, By End User, 2015–2022 (USD Million)

Table 44 U.K.: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 45 U.K.: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 46 U.K.: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 47 U.K.: Market, By End User, 2015–2022 (USD Million)

Table 48 RoE: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 49 RoE: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 50 RoE: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 51 RoE: Bioabsorbable Stents Market, By End User, 2015–2022 (USD Million)

Table 52 Asia: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 53 Asia: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 54 Asia: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 55 Asia: Market, By End User, 2015–2022 (USD Million)

Table 56 North America: Market, By Country, 2015–2022 (USD Million)

Table 57 North America: Bioresorbable Scaffold Market, By Material, 2015–2022 (USD Million)

Table 58 North America: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 59 North America: Bioresorbable Scaffold Market, By Application, 2015–2022 (USD Million)

Table 60 North America: Market, By End User, 2015–2022 (USD Million)

Table 61 U.S.: Market, By Material, 2015–2022 (USD Million)

Table 62 U.S.: Bioresorbable Scaffold Market, By Absorption Rate, 2015–2022 (USD Million)

Table 63 U.S.: Market, By Application, 2015–2022 (USD Million)

Table 64 U.S.: Bioresorbable Scaffold Market, By End User, 2015–2022 (USD Million)

Table 65 Canada: Market, By Material, 2015–2022 (USD Million)

Table 66 Canada: Market, By Absorption Rate, 2015–2022 (USD Million)

Table 67 Canada: Bioresorbable Scaffold Market, By Type, 2015–2022 (USD Million)

Table 68 Canada: Market, By End User, 2015–2022 (USD Million)

Table 69 RoW: Bioabsorbable Stents Market, By Material, 2015–2022 (USD Million)

Table 70 RoW: Bioresorbable Scaffold Market, By Absorption Rate, 2015–2022 (USD Million)

Table 71 RoW: Market, By Application, 2015–2022 (USD Million)

Table 72 RoW: Bioresorbable Scaffold Market, By End User, 2015–2022 (USD Million)

Table 73 Market Ranking Analysis, By Key Player, 2016

List of Figures (33 Figures)

Figure 1 Bioabsorbable Stents Market

Figure 2 Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Market Size Estimation: Bottom -Up Approach

Figure 6 Market Size Estimation: Top-Down Approach

Figure 7 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 8 Data Triangulation Methodology

Figure 9 Bioresorbable Polymer-Based Stents to Dominate the Market During the Forecast Period

Figure 10 Market, By Absorption Rate (2017 vs 2022)

Figure 11 Coronary Artery Disease to Register Highest Growth in the Bioresorbable Stents Application Market (2017-2022)

Figure 12 Hospitals to Offer Significant Growth Opportunities During the Forecast Period

Figure 13 North America is Expected to Witness the Highest Growth During the Forecast Period

Figure 14 Rising Geriatric Population and Increased Risk of CAD and PAD to Drive Market Growth During the Forecast Period

Figure 15 Hospitals Accounted for the Largest Market Share in 2017

Figure 16 Coronary Artery Diseases to Witness Highest Growth During the Forecast Period

Figure 17 Bioresorbable Polymer-Based Stents to Witness the Highest Growth During the Forecast Period

Figure 18 North America to Witness the Highest Growth in the Market During the Forecast Period

Figure 19 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Prevalence of CAD, By Age and Gender (2009–2012)

Figure 21 Bioabsorbable Stents Market, By Material (2017 vs 2022)

Figure 22 Slow Absorption Stents to Dominate the Market in 2017

Figure 23 Coronary Artery Disease to Dominate the Bioresorbable Stents Application Market in 2017

Figure 24 Hospitals to Register Highest Growth in the Bioresorbable Stents End-User Market in 2017

Figure 25 Europe to Dominate the Market in 2017

Figure 26 Europe: Market Snapshot

Figure 27 Asia: Bioabsorbable Stents Market Snapshot

Figure 28 North America: Market Snapshot

Figure 29 RoW Market Snapshot (2017)

Figure 30 Competitive Leadership Mapping

Figure 31 Abbott: Company Snapshot (2016)

Figure 32 REVA Medical, Inc.: Company Snapshot (2016)

Figure 33 Boston Scientific Corporation: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bioabsorbable Stents Market